Beruflich Dokumente

Kultur Dokumente

Microeconomics Group Assignment Report

Hochgeladen von

Meselu TegenieCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Microeconomics Group Assignment Report

Hochgeladen von

Meselu TegenieCopyright:

Verfügbare Formate

Hawassa University

Wondogenet collage of forestry and natural resources

Advanced Microeconomics (NrEp 521)

Solution to Assignment Problems

BY:

1. Teshome Sorato

2.Aster Abera(MSc/NRE/043/11)

3. Daniel W/Meskel

4. Meselu Tegenie (MSc/NRE/046/11)

Submitted to: Alemayehu Siyum (PHD)

December ,

2011

Wondogenet,

Ethiopia

1

1. Assume the commodity X has demand function

Q=150-5P

x

and supply function

SS=8+10P

x

a) Calculate the equilibrium quantity and price

b) Support your finding with graphical representation

Solution:

The market equilibrium quantity is reached when SS=Q=Q*

150-5P

x

=8+10P

x

142 15

x

P

15

142

*

x

P

The equilibrium price is

15

142

*

x

P

Then the equilibrium quantity is :

Q*=8+10(

15

142

)

The equilibrium quantity is

67 . 102 * Q

4. The n-goods Cobb-Douglass utility function is :

U(X)=Ax

1

1

x

2

2

x

3

3

x

n

n

Where A>0 and

n

i

i

1

1

2

67 . 102 * Q

P P

*

*

*

*

*

*

*

SS

DD

Q

Q

SS

P

P

*

*

*

*

*

*

*

a) Derive the Marshallian utility function

b) Derive the indirect utility function

c) Derive the expenditure function

d) Derive the Hicksian demand function

Solution:

a) Suppose the price of good x

i

be p

i

and the consumer income be M

Then the primal problem we consider here is:

Maximize U(X)=Ax

1

1

x

2

2

x

3

3

x

n

n

Where A>0 and

n

i

i

1

1

s.t

n

i

i i

M p x

1

Now setting the Lagrangian

) ( ....

1

2 1

2 1

+

n

i

i i n

p x M x x Ax L

n

Finding first order partial derivatives and setting up first order conditions we have

0

0 ....

......... .......... .......... .......... .......... ..........

0 ....

0 ....

0 ....

1

1

3 2

3

1

3 2 3

3

2 3

1

2 2

2

1 3 2

1

1

1

3 2 1

3 2 1

3 2 1

3 2 1

n

i

i i

n n n

n

n

n

n

p x M

L

p x x x x

x

L

p x x x x

x

L

p x x x x

x

L

p x x x x

x

L

n

n

n

n

Now

3

n

n n n n

p

x x x A

p

x x x A

p

x x x A

n n n

1

2 1

2

1

2 1 2

1

2

1

1 1

...

....

... ...

2 1 2 1 2 1

Equating the partial derivatives of the Lagrangian with respect to the x

1

and x

i

i=2, 3, 4,

., n we get the following

n i

p

x p

x

x p x p

x p

x x

x p

x x

p

x x

p

x x

n i

p

x x x x A

p

x x x x A

i

i

i

i i

i

i i

i i i

i

i i i

i

n i i n i

i i

i i

n i n i

,....., 4 , 3 , 2 ,

,.... 4 , 3 , 2 ,

. .. .. ..

1

1 1

1 1

1

1

1 1

1 1

1

1

1

1

1 1

1

2 1

1

2

1

1 1

1 1

1 1

2 1 2 1

Substituting these values of x

i

,i=2,3,4,.,n in to the equation

0

1

n

i

i i

p x M

we get

1

1

1

1 1

1 1

2 1

1 1

2 1

1 1

1 1

2 1

1 1

1 1

) (

)

1

1 (

0

0

p

M

x

M

p x

M p x

x p

p x M

p

x p p

p x M

n

i

i

n

i

i

n

i

i

n

i i

i i

+

+

+

Substituting this value of x

1

in

n i

p

x p

x

i

i

i

,...., 3 , 2 ,

1

1 1

We get the Marshallian demand functions

4

n i

p

M

x

n i

p

M

p

p

x

i

i

i

i

i

i

,.... 3 , 2 . 1 ,

,...., 3 , 2 ,

1

1

1

1

1

]

1

The Marshallian demand function for each good x

i

is given by:

n i

p

M

x

i

i

i

,.... 3 , 2 . 1 ,

b) The indirect utility function is found by substituting the Marshallian demand

expressions of each good X

i

in to the direct utility function

1

]

1

n

i

i

i

i

A M p V

p

M

i

1

) , (

c) The expenditure function e is the dual of the utility function and is given by:

n

i

i i i i

p x p x e

1

) ( ) , (

and the total expenditure for the maximized utility is

n

i i

i

i i

M

p

M

p p M e

1

)) ( ( ) , (

d) Derive the Hicksian demand function

Hicksian demand function is the solution of the dual problem to the direct utility

maximization problem set as shown below

Minimize

n

i

i i i i

p x p x e

1

) ( ) , (

Subject to:

U x x Ax

n

n

....

2 1

2 1

where U is the fixed utility to be achieved

Now setting the Lagrangian and the first order necessary conditions we have

5

0 ....

0 ....

...... .......... .......... .......... .......... ..........

0 ....

0 ....

) .... (

2 1

2 1

2 1

2 1

2 1

2 1

1

2 1

1

2 1 2 2

2

2

1

1 1 1

1

2 1

1

n

n

n

n

n

n

n

n n n

n

n

n

n

n

i

i i

x x Ax U

x

L

x x x A p

x

L

x x x A p

x

L

x x x A p

x

L

x x Ax U p x L

Solving for we get the following

1

1

1

1

2 1 2

1

1 1

1

1

2 1

1

2 1 2

2

2

1

1 1

1

,....... 4 , 3 , 2 ,

... ... ... ...

...

....

... ...

2 1 2 1

2 1 2 1 2 1

x

p

p

x

n i

x x x x A

p

x x x x A

p

x x x A

p

x x x A

p

x x x A

p

i

i

i

n i i

i

n i

n n

n

n n

n i n i

n n n

Substituting this values of x

i

in 0 ....

2 1

2 1

n

n

x x Ax U

We get

A

U p p p

p

x

p p p

p

A

U

x

p

p

p

p

p

p

A

U

x

U x

p

p

p

p

x

p

p

Ax

n

n

n

n

n

n

n

n

n

n

n

n

) ....( ) ( ) (

) ....( ) ( ) (

) ....( ) ( ) (

) ....( ) ( ) (

3 2

1

3 2

1

3 2

3 2 1

3

3

2

2

1

1

1

1

3

3

2

2

1

1

1

1

1

1

3 1

1 3

2 1

1 2

1

1

1

1

3 1

1 3

1

2 1

1 2

1

,

_

,

_

Then substituting this value of x

1

we get the

Hicksian demand function of each

good

6

n i

A

U p p p

p p

p

P U x

n

n

n

i

i

i

,... 3 , 2 , 1 , ) ....( ) ( ) ( ) , (

3 2

1

3

3

2

2

1

1

1

1

1

,

_

7. Duopolists produce substitute goods Q

1

and Q

2

they face inverse demand function

P

1

= 20 +

2

1

P

2

-Q

1

P

2

= 20+

2

1

P

1

-Q

2

Each firm has constant marginal cost MC= 20 and no fixed costs and each firm is a

Cournot competitor in price not in quantity. Compute the Cournot equilibriums in this

market giving the equilibrium price and output of each good?

Support your answer with graph

Solution

Given

P

1

= 20 +

2

1

P

2

-Q

1

P

2

= 20+

2

1

P

1

-Q

2

and MC=20 the direct demand functions are

Q

1

= 20 +

2

1

P

2

-p

1

(demand function for firm 1)

Q

2

= 20 +

2

1

P

1

-p

2

(demand function for firm 2)

1 2

1

2

2

1 1 2 1

1 2 1 2 1 1 1 1

2

2

1

40

10 400

2

1

40

)

2

1

20 ( 20 )

2

1

20 ( 20

p p

p

p p p p p

p p p p p Q p Q

+

+

+ +

Setting this partial derivative to zero

7

We get

2 1

4

1

20 p p +

. (1) (the reaction function of firm 1 to firm 2)

Similarly the reaction function of firm 2 to firm 1 is

1 2

4

1

20 p p +

(2)

Substituting (2) in (1) we get the Cournot equilibrium prices

3

80

) 1

4

1

20 (

4

1

20

1

1

+ +

p

p p

And

3

80

)

3

80

(

4

1

20

2

+ p

The Cournot equilibrium quantities

Can be calculated by substituting Cournot prices in to the demand functions

Q

1

= 20 +

2

1

p

2

-p

1

3

20

3

20

3

80

3

80

*

2

1

20

2

1

20

1

1 2

1

+ +

c

c

Q

p p Q

Q

2

= 20+

2

1

p

1

-p

2

3

20

3

20

3

80

3

80

*

2

1

20

2

1

20

2

2 1

2

+ +

c

c

Q

p p Q

8

10. Explain Pareto efficient allocation in consumption and production.

Answer

An economic situation is Pareto efficient if there is no way to make some group of people better

off without making some other group of people worse off.

So an economic situation is Pareto efficient in consumption when each group or individual in

the economy system is maximizing its consumption without undermining the consumption of

other groups in the system. Similarly an economic system is Pareto efficient in production if each

firm or individual is maximizing its output without making the production of other firms in the

economic system worse off.

13. A consumer has A utility function U(x, y)=xy and the budget line M = P

x

x + P

y

y

A) Formulate the Lagrange for and drive the first order condition

y p x p M

L

p x

y

L

p y

x

L

y p x p M xy L

y x

y

x

y x

+

+ +

)) ( (

9

The first order conditions are

0 0

0 0

0 0

+

y p x p M

L

p x

y

L

p y

x

L

y x

y

x

B) From the first order condition find expression from the demand of commodity x and y

(good x and y)

Solving the first order conditions simultaneously we get

Expressions for the demands of good x and y as follows

y y

x

x

x

y

x

y x

y

x

x y

p

M

p

p

p

M

y

p

M

x

p

xp

p x p M

p

xp

y

p

y

p

x

2

*

2

,

2

0

C) Find out the dual form of the U(x, y)=xy function

The dual form of

Maximize U(x, y)=xy

s.t

M = P

x

x + P

y

y

Is

Minimize e(x,y)= P

x

x + P

y

y

s.t.

xy=U where U is fixed level of utility and e(x,y) is expenditure for goods x and y

10

D) Calculate the expression (X and Y) from the dual function

Solution

x

y

y

x

y

x

x

y

y

x

y

x

y

x

y

x

y x

p

p U

p

p

p

xp

y

p

p U

x

p

xp

x U

p

xp

y

x

p

y

p

xy U

L

x p

y

L

y p

x

L

xy U y p x p L

+ +

,

0

0

0

0

) (

11

13. Suppose Duopolists have the following demand curve; P = 30 - Q; MC

1

= 0 and MC

2

= 0

and total quantity: Q = Q

1

+ Q

2

.

Find the reaction curve of both firms

Assume the firm collude, find the new price p and profit at Cournot equilibrium.

Solution

Given P=30-Q, Q=Q

1

+Q

2

and MC

1

=MC

2

=0

TR

1

=PQ

1

=(30-Q

1

-Q

2

)Q

1

TR

2

=PQ

2

=(30-Q

1

-Q

2

)Q

2

2 1 2 1

2

2

1 2 2 1

1

1

2 30 0 2 30

2 30 0 2 30

Q Q Q Q

Q

TR

Q Q Q Q

Q

TR

If the firms collude they maximize their profit at MC=MR

15

15 30

15

0 2 30

Q

TR

Q)Q - 30 (

2 1

+

p

P

Q

Q

PQ TR TR TR

12

P1

P

2

P

1

F

12

=reaction

curve of firm1

to 2

F

21

=reaction curve

of firm 2to 1

Collusion point

Q

2

Q

1

F

12

=reaction

curve of firm1

to 2

F

21

=reaction curve

of firm 2to 1

Collusion point

Das könnte Ihnen auch gefallen

- A-level Maths Revision: Cheeky Revision ShortcutsVon EverandA-level Maths Revision: Cheeky Revision ShortcutsBewertung: 3.5 von 5 Sternen3.5/5 (8)

- Exercises Mid 07Dokument6 SeitenExercises Mid 07100111Noch keine Bewertungen

- Answers To Some Selected Exercises To Consumer Theory: R Finger Advanced Microeconomics ECH-32306 September 2012Dokument8 SeitenAnswers To Some Selected Exercises To Consumer Theory: R Finger Advanced Microeconomics ECH-32306 September 2012Irina AlexandraNoch keine Bewertungen

- Consumer ChoiceDokument26 SeitenConsumer ChoicexcscscscscscscsNoch keine Bewertungen

- Economics Solution Book PDFDokument368 SeitenEconomics Solution Book PDFgoutam1235100% (3)

- Lecture 02-2005Dokument40 SeitenLecture 02-2005Nidhi ZinzuvadiaNoch keine Bewertungen

- Tutorial 2 Questions With SolutionDokument4 SeitenTutorial 2 Questions With SolutionVictoria Wang100% (1)

- HW1 2014Dokument6 SeitenHW1 2014Anonymous ewKJI4xUNoch keine Bewertungen

- Questions Section 4, OptimisationDokument20 SeitenQuestions Section 4, Optimisationagonza70Noch keine Bewertungen

- Intr Econometric SDokument23 SeitenIntr Econometric Sfrancisco20047129Noch keine Bewertungen

- 9 Two Variable OptimizationDokument10 Seiten9 Two Variable OptimizationBella NovitasariNoch keine Bewertungen

- Answers To Some Selected Exercises To Consumer Theory: R Finger Advanced Microeconomics ECH-32306 September 2012Dokument8 SeitenAnswers To Some Selected Exercises To Consumer Theory: R Finger Advanced Microeconomics ECH-32306 September 2012Irina AlexandraNoch keine Bewertungen

- Notes LagrangeDokument8 SeitenNotes LagrangeLennard PangNoch keine Bewertungen

- Mathematical Applications in Economics ECON 262 Practice Set 1Dokument4 SeitenMathematical Applications in Economics ECON 262 Practice Set 1Salman FarooqNoch keine Bewertungen

- IntegrationDokument23 SeitenIntegrationnikowawaNoch keine Bewertungen

- Microeconomics I - MidtermDokument6 SeitenMicroeconomics I - Midtermcrod123456Noch keine Bewertungen

- 5.integral Calculus Objectives:: DX DyDokument16 Seiten5.integral Calculus Objectives:: DX DyAndyMavia100% (1)

- Math 105 Practice Exam 3 SolutionsDokument3 SeitenMath 105 Practice Exam 3 SolutionsexamkillerNoch keine Bewertungen

- Notes Chapter 6 7Dokument20 SeitenNotes Chapter 6 7awa_caemNoch keine Bewertungen

- Math Study Guide Notes For Final Exam MCR3U Grade 11 FunctionsDokument31 SeitenMath Study Guide Notes For Final Exam MCR3U Grade 11 FunctionsSujith NimalarajNoch keine Bewertungen

- Gra 65161 - 201820 - 16.11.2018 - EgDokument12 SeitenGra 65161 - 201820 - 16.11.2018 - EgHien NgoNoch keine Bewertungen

- Quantum Mechanics - Homework Assignment 3: Alejandro G Omez Espinosa October 8, 2012Dokument7 SeitenQuantum Mechanics - Homework Assignment 3: Alejandro G Omez Espinosa October 8, 2012Ale GomezNoch keine Bewertungen

- Solutions Jehle RanyDokument5 SeitenSolutions Jehle Ranypatipet275378% (9)

- PS1Dokument3 SeitenPS1Joseph ShaulNoch keine Bewertungen

- Definition and Properties of The Production FunctionDokument40 SeitenDefinition and Properties of The Production FunctionHimesh AroraNoch keine Bewertungen

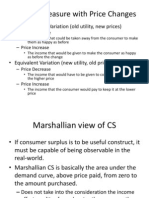

- Welfare Measure With Price Changes: - Compensating Variation (Old Utility, New Prices)Dokument20 SeitenWelfare Measure With Price Changes: - Compensating Variation (Old Utility, New Prices)Bella NovitasariNoch keine Bewertungen

- 5 - Question Bank - Advanced Engineering MAthematics-II - 21MTB41Dokument7 Seiten5 - Question Bank - Advanced Engineering MAthematics-II - 21MTB41G59 Satwik AIML-2021-25Noch keine Bewertungen

- Lecture # 3 Derivative of Polynomials and Exponential Functions Dr. Ghada AbdelhadyDokument32 SeitenLecture # 3 Derivative of Polynomials and Exponential Functions Dr. Ghada AbdelhadyEsraa AhmadNoch keine Bewertungen

- 3 The Utility Maximization ProblemDokument10 Seiten3 The Utility Maximization ProblemDaniel Lee Eisenberg JacobsNoch keine Bewertungen

- Lagrange EconDokument6 SeitenLagrange EconUjjwal Kumar DasNoch keine Bewertungen

- (Tang C.) Solutions Manual. Fundamentals of OrgDokument65 Seiten(Tang C.) Solutions Manual. Fundamentals of OrgMehdi Torabi GoodarziNoch keine Bewertungen

- Mathematics For Microeconomics: 6y y U, 8x X UDokument8 SeitenMathematics For Microeconomics: 6y y U, 8x X UAsia ButtNoch keine Bewertungen

- Numerical Optimization: Unit 9: Penalty Method and Interior Point Method Unit 10: Filter Method and The Maratos EffectDokument24 SeitenNumerical Optimization: Unit 9: Penalty Method and Interior Point Method Unit 10: Filter Method and The Maratos EffectkahvumidragaispeciNoch keine Bewertungen

- Chapter 4 - Part - BDokument48 SeitenChapter 4 - Part - BamoyalopNoch keine Bewertungen

- Unofficial Solutions Manual To R.A Gibbon's A Primer in Game TheoryDokument36 SeitenUnofficial Solutions Manual To R.A Gibbon's A Primer in Game TheorySumit Sharma83% (23)

- Lecture 11 - Business and Economics Optimization Problems and Asymptotes PDFDokument9 SeitenLecture 11 - Business and Economics Optimization Problems and Asymptotes PDFpupu_putraNoch keine Bewertungen

- Chapter Nine: Buying and SellingDokument45 SeitenChapter Nine: Buying and SellinganirbanmbeNoch keine Bewertungen

- Assignment 3: 1 Find The First Order and Second Order of Derivatives of The Following FunctionsDokument2 SeitenAssignment 3: 1 Find The First Order and Second Order of Derivatives of The Following FunctionsNooxay PhoomsuwanNoch keine Bewertungen

- CournotDokument66 SeitenCournotsooguyNoch keine Bewertungen

- Microeconomic Theory - Review For Final ExamDokument6 SeitenMicroeconomic Theory - Review For Final ExamKhanh LuuNoch keine Bewertungen

- Homework 1 KeyDokument7 SeitenHomework 1 KeyNafiz AhmedNoch keine Bewertungen

- Deriving Demand Functions ExamplesDokument8 SeitenDeriving Demand Functions ExamplesKanika MahajanNoch keine Bewertungen

- Mathematical Economics Notes - III For V Sem: A. Diagram Discussion Economic RelationshipDokument6 SeitenMathematical Economics Notes - III For V Sem: A. Diagram Discussion Economic RelationshipAngad 2K19-PE-012Noch keine Bewertungen

- Micro EconomicsDokument4 SeitenMicro EconomicsUWIZERA MoniqueNoch keine Bewertungen

- Math Camp Sample Problems F 2016Dokument3 SeitenMath Camp Sample Problems F 2016Nam Giang HàNoch keine Bewertungen

- Statistics 100A Homework 6 Solutions: Ryan RosarioDokument13 SeitenStatistics 100A Homework 6 Solutions: Ryan RosarioDeepak PandeyNoch keine Bewertungen

- A New Predictor-Corrector Method For Optimal Power FlowDokument5 SeitenA New Predictor-Corrector Method For Optimal Power FlowfpttmmNoch keine Bewertungen

- Exame Micro ImpDokument8 SeitenExame Micro ImpSabin SadafNoch keine Bewertungen

- Concave ProgrammingDokument10 SeitenConcave Programmingcharles luisNoch keine Bewertungen

- Green's Functions For The Stretched String Problem: D. R. Wilton ECE DeptDokument34 SeitenGreen's Functions For The Stretched String Problem: D. R. Wilton ECE DeptSri Nivas ChandrasekaranNoch keine Bewertungen

- Differentiation of Exponential FunctionsDokument20 SeitenDifferentiation of Exponential FunctionsPrya Suthan SathiananthanNoch keine Bewertungen

- Mathematics For Microeconomics: Maximization of A Function of One VariableDokument35 SeitenMathematics For Microeconomics: Maximization of A Function of One VariableYbnias GrijalvaNoch keine Bewertungen

- Sem 2 Final Exam ReviewDokument21 SeitenSem 2 Final Exam ReviewaprileverlastingNoch keine Bewertungen

- Application of Derivatives Tangents and Normals (Calculus) Mathematics E-Book For Public ExamsVon EverandApplication of Derivatives Tangents and Normals (Calculus) Mathematics E-Book For Public ExamsBewertung: 5 von 5 Sternen5/5 (1)

- Ten-Decimal Tables of the Logarithms of Complex Numbers and for the Transformation from Cartesian to Polar Coordinates: Volume 33 in Mathematical Tables SeriesVon EverandTen-Decimal Tables of the Logarithms of Complex Numbers and for the Transformation from Cartesian to Polar Coordinates: Volume 33 in Mathematical Tables SeriesNoch keine Bewertungen

- Mathematics 1St First Order Linear Differential Equations 2Nd Second Order Linear Differential Equations Laplace Fourier Bessel MathematicsVon EverandMathematics 1St First Order Linear Differential Equations 2Nd Second Order Linear Differential Equations Laplace Fourier Bessel MathematicsNoch keine Bewertungen

- Kodak IMCDokument2 SeitenKodak IMCYash BhatiaNoch keine Bewertungen

- Hot Money:: Hot Money Is A Term That Is Most Commonly Used in Financial Markets To Refer To The Flow of Funds (OrDokument3 SeitenHot Money:: Hot Money Is A Term That Is Most Commonly Used in Financial Markets To Refer To The Flow of Funds (OrPratik RambhiaNoch keine Bewertungen

- Study Material Economics: Course InformationDokument13 SeitenStudy Material Economics: Course InformationParamartha BanerjeeNoch keine Bewertungen

- Guidelines in Writing The IMC Plan: Part 1: Situation AnalysisDokument3 SeitenGuidelines in Writing The IMC Plan: Part 1: Situation AnalysisKevin MoranNoch keine Bewertungen

- Multiple Choice Questions Distrubution Logistic PDFDokument14 SeitenMultiple Choice Questions Distrubution Logistic PDFYogesh Bantanur50% (2)

- Solved Suppose The Formerly Competing Firms in Question 3 Form AnDokument1 SeiteSolved Suppose The Formerly Competing Firms in Question 3 Form AnM Bilal SaleemNoch keine Bewertungen

- Principles of Macroeconomics 8th Edition Mankiw Solutions Manual 1Dokument7 SeitenPrinciples of Macroeconomics 8th Edition Mankiw Solutions Manual 1cynthiasheltondegsypokmj100% (26)

- Managerial Economics Assignment Question Spring 21Dokument1 SeiteManagerial Economics Assignment Question Spring 21farhan Momen100% (2)

- Selected Answer: C.: 10 Out of 10 PointsDokument75 SeitenSelected Answer: C.: 10 Out of 10 PointsPelin CanikliNoch keine Bewertungen

- Assgn1 Part 1 Florists Industry AnalysisDokument6 SeitenAssgn1 Part 1 Florists Industry AnalysisbrdpdrsnNoch keine Bewertungen

- Resume For Mary IannielloDokument1 SeiteResume For Mary Iannielloapi-352787809Noch keine Bewertungen

- 3 4-+Common+Factors PDFDokument2 Seiten3 4-+Common+Factors PDFLodhi IsmailNoch keine Bewertungen

- Group6 Deetey SalonDokument17 SeitenGroup6 Deetey SalonRachel Jane TanNoch keine Bewertungen

- Lectura - CAPM - 2Dokument11 SeitenLectura - CAPM - 2Isabella QuinteroNoch keine Bewertungen

- Mcom Sem 4 Advertising NotesDokument100 SeitenMcom Sem 4 Advertising Notesprathamesh gadgilNoch keine Bewertungen

- Nielsen TradePromo Ebook 2017Dokument28 SeitenNielsen TradePromo Ebook 2017Инна ЛобынцеваNoch keine Bewertungen

- Final Exam Revision - Econ 111-02-2011Dokument19 SeitenFinal Exam Revision - Econ 111-02-2011Natalie KaruNoch keine Bewertungen

- The Five Marketing ConceptsDokument4 SeitenThe Five Marketing ConceptsBidyut Bhusan PandaNoch keine Bewertungen

- SPSC Lecturer Test CommerceDokument3 SeitenSPSC Lecturer Test CommerceDildar Raza100% (1)

- Fin33 2nd NewDokument2 SeitenFin33 2nd NewRonieOlarteNoch keine Bewertungen

- Fifo Lifo WAC EgDokument1 SeiteFifo Lifo WAC EgKapil NagpalNoch keine Bewertungen

- International Business: An Asian PerspectiveDokument36 SeitenInternational Business: An Asian PerspectiveNur AddninNoch keine Bewertungen

- Test Bank Microeconomics 9th Edition Parkin CompressDokument30 SeitenTest Bank Microeconomics 9th Edition Parkin Compressمركز التعلم ُedu-centerNoch keine Bewertungen

- Icici ProjectDokument42 SeitenIcici ProjectAshish SoodNoch keine Bewertungen

- Intertemporal Choice, Time AllocationDokument9 SeitenIntertemporal Choice, Time AllocationhishamsaukNoch keine Bewertungen

- PS2Dokument2 SeitenPS2fego2008100% (1)

- ECON1268 Price Theory - Lecture 4-2Dokument71 SeitenECON1268 Price Theory - Lecture 4-2Giang HoangNoch keine Bewertungen

- Chapter 1 Managing Profitable Customer RelationshipsDokument13 SeitenChapter 1 Managing Profitable Customer RelationshipswhateveroilNoch keine Bewertungen

- FINAL EXAM Financial Markets PDFDokument3 SeitenFINAL EXAM Financial Markets PDFAdithiya Iyappan0% (1)

- LECTURE NUMBER ONE Nature and Scope of Economics - Definition and Scope of Engineering EconomicsDokument61 SeitenLECTURE NUMBER ONE Nature and Scope of Economics - Definition and Scope of Engineering Economicsnickokinyunyu11Noch keine Bewertungen