Beruflich Dokumente

Kultur Dokumente

Aaaco1111l Form16a 2011-12 Q3

Hochgeladen von

Pradnesh KulkarniOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Aaaco1111l Form16a 2011-12 Q3

Hochgeladen von

Pradnesh KulkarniCopyright:

Verfügbare Formate

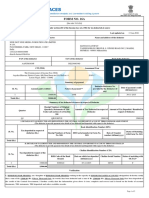

Tax Information Network of Income Tax Department

Certificate No.: FFFVWW Last Updated 17/01/2011

FORM NO.16A

[See rule 31(1)(b)] Certificate under section 203 of the Income-tax Act, 1961 for Tax deducted at source Name and address of the Deductor ABC LIMITED 7th FLOOR TRADE CENTRE, BIKAJI CAMA PLACE, NEW DELHI DELHI 110005 PAN of the Deductor AAAAA1111A CIT (TDS) The Commissioner of Income Tax (TDS) Aayakar Bhawan District Centre, 6th Floor Room no 610 Hall no. 4, Luxmi Nagar Delhi 110092 Summary of Payment Amount paid/credited ( ) 9,92,700.00 Nature of payment 194J - Fees for Professional or Technical Services Date of payment/credit (dd/mm/yyyy) 30/12/2010 Status of Booking MATCHED Name and address of the Deductee ABC CONSULTANCY SERVICES PRIVATE LIMITED 1ST FLOOR WORLD TRADE CENTER, LOWER PAREL, MUMBAI MAHARASHTRA 400021 TAN of the Deductor DELA01216E Assessment Year From 2011-12 01/10/2010 31/12/2010 PAN of the Deductee AAACO1111L Period To

Summary of tax deducted at source in respect of deductee Quarter Receipt Numbers of original quarterly statements of TDS under sub-section (3) of section 200 BSTXBQVB Amount of tax deducted in respect of the deductee ( ) 99,270.00 Amount of tax deposited/ remitted in respect of the deductee ( ) 99,270.00

Q3

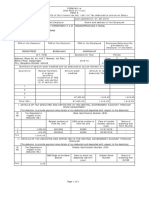

I. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee) S. No. Tax Deposited in respect of the deductee ( ) ) N.A. Book Identification number (BIN) Receipt numbers of Form No. 24G DDO sequence Number in the Book Adjustment Mini Statement N.A. Date on which tax deposited (dd/mm/yyyy) Status of Booking

Total (

II. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN (The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee S. No. Tax Deposited in respect of the deductee ( ) 99,270.00 ) 99,270.00 Verification I, Baidyanath Sahoo, son/daughter of Bholanath Sahoo working in the capacity of Assistant Manager (designation) do hereby certify that a sum of ( ) 99,270.00 [Rupees Ninety Nine Thousand Two Hundred Seventy only] has been deducted and a sum of ( ) 99,270.00 [Rupees Ninety Nine Thousand Two Hundred Seventy only] has been deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the books of account, documents, TDS statements, TDS deposited and other available records. Place Date Mumbai 20/06/2011 Signature of person responsible for deduction of tax Challan Identification number (CIN) BSR Code of the Bank Branch 6910333 Date on which tax deposited (dd/mm/yyyy) 07/01/2011 Challan Serial Number 58063 Status of Booking

1 Total (

MATCHED

Notes: 1. Government deductors to fill information in item I if tax is paid without production of an Income-tax challan and in item II if tax is paid accompanied by an income-tax challan. 2. Non-Government deductors to fill information in item II. 3. In item I and II, in the column for TDS, give total amount for TDS, Surcharge (if applicable) and education cess. 4. The deductor shall furnish the address of the Commissioner of Income-tax (TDS) having jurisdiction as regards TDS statements of the assessee. 5. This Form shall be applicable only in respect of tax deducted on or after 1st day of April, 2010.

Signature Not Verified

Page 1 of 1

Digitally signed by Demo1 Date: 2011.06.22 20:47:03 IST

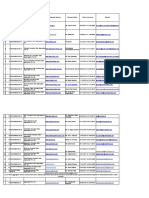

Das könnte Ihnen auch gefallen

- EstoppelDokument2 SeitenEstoppelmalasunder100% (2)

- Form16Dokument5 SeitenForm16er_ved06Noch keine Bewertungen

- Applied Statistics in Business and Economics 5th Edition Doane Solutions ManualDokument26 SeitenApplied Statistics in Business and Economics 5th Edition Doane Solutions ManualSharonMartinezfdzp100% (43)

- FORM 16 TITLEDokument5 SeitenFORM 16 TITLEPunitBeriNoch keine Bewertungen

- 1040 Exam Prep: Module I: The Form 1040 FormulaVon Everand1040 Exam Prep: Module I: The Form 1040 FormulaBewertung: 1 von 5 Sternen1/5 (3)

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionVon EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNoch keine Bewertungen

- Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDokument2 SeitenForm No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceAnonymous glyBR9Noch keine Bewertungen

- Agc Shortform Subcontractor Agreement FormDokument3 SeitenAgc Shortform Subcontractor Agreement Formapi-324291104Noch keine Bewertungen

- 1040 Exam Prep: Module II - Basic Tax ConceptsVon Everand1040 Exam Prep: Module II - Basic Tax ConceptsBewertung: 1.5 von 5 Sternen1.5/5 (2)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4Von EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Noch keine Bewertungen

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Dokument4 SeitenForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Kamlesh PatelNoch keine Bewertungen

- Kaushik Sarkar Form 16 DynProDokument5 SeitenKaushik Sarkar Form 16 DynProKaushik SarkarNoch keine Bewertungen

- Samsung India Electronics Pvt. LTD.: Signature Not VerifiedDokument7 SeitenSamsung India Electronics Pvt. LTD.: Signature Not VerifiedGajendra Singh RaghavNoch keine Bewertungen

- CONTRACTS Past Paper QuestionsDokument3 SeitenCONTRACTS Past Paper QuestionsKerine Williams-FigaroNoch keine Bewertungen

- Form 16Dokument2 SeitenForm 16Mithun KumarNoch keine Bewertungen

- Equitable Banking Corporation V NLRCDokument3 SeitenEquitable Banking Corporation V NLRCAnonymous hS0s2moNoch keine Bewertungen

- Form 16Dokument2 SeitenForm 16SIVA100% (1)

- Charbhuja v. Ambience WSDokument23 SeitenCharbhuja v. Ambience WSAmbience LegalNoch keine Bewertungen

- Interpleader Dispute Over Ownership of Central Bank BillsDokument35 SeitenInterpleader Dispute Over Ownership of Central Bank BillsAnton Fortich0% (1)

- Southeast Mindanao Gold Mining Corporation vs. Balite Portal Mining CooperativeDokument2 SeitenSoutheast Mindanao Gold Mining Corporation vs. Balite Portal Mining CooperativeLee100% (3)

- MR4 - Franchise Agreement - Train - Rolling Stock Module - Publication Version PDFDokument156 SeitenMR4 - Franchise Agreement - Train - Rolling Stock Module - Publication Version PDFAnand Raj DoraisingamNoch keine Bewertungen

- NPC V Ein Chemical Corp and Phil. International Surety Co.Dokument1 SeiteNPC V Ein Chemical Corp and Phil. International Surety Co.Eiffel Usman Marrack100% (1)

- Special Power of Attorney DocDokument3 SeitenSpecial Power of Attorney DocgerrymanderingNoch keine Bewertungen

- Rlic App Ecommunication Pdfrecieptgenerator Mail PDF Files TDSC STMT 2011-12 q3 Ablpi5301a Form16a 2012-13 q3Dokument2 SeitenRlic App Ecommunication Pdfrecieptgenerator Mail PDF Files TDSC STMT 2011-12 q3 Ablpi5301a Form16a 2012-13 q3143688Noch keine Bewertungen

- Form 16A TDS Certificate DetailsDokument2 SeitenForm 16A TDS Certificate DetailsKovidh GoyalNoch keine Bewertungen

- Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDokument2 SeitenForm No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceAkshay DhawanNoch keine Bewertungen

- Form 16A: Summary of Tax Deducted at Source in Respect of DeducteeDokument1 SeiteForm 16A: Summary of Tax Deducted at Source in Respect of DeducteeVinayak BadagiNoch keine Bewertungen

- Form No.16A: Tax Information Network of Income Tax Department Certificate No.: GVVIPLDokument2 SeitenForm No.16A: Tax Information Network of Income Tax Department Certificate No.: GVVIPLcool_rdNoch keine Bewertungen

- Ahrpv0731f 2013-14Dokument2 SeitenAhrpv0731f 2013-14Shiva KumarNoch keine Bewertungen

- Form 16 and Salary DetailsDokument22 SeitenForm 16 and Salary DetailsAjay Chowdary Ajay ChowdaryNoch keine Bewertungen

- Form 16: Wipro LimitedDokument5 SeitenForm 16: Wipro Limiteddeepak9976Noch keine Bewertungen

- FKMPS9021Q Q3 2016-17Dokument2 SeitenFKMPS9021Q Q3 2016-17Hannan SatopayNoch keine Bewertungen

- Tax Applicable (Tick One) 2 8 1Dokument7 SeitenTax Applicable (Tick One) 2 8 1Gaurav BajajNoch keine Bewertungen

- Form 16 ADokument2 SeitenForm 16 Asatyampandey7986659533Noch keine Bewertungen

- ViewDokument2 SeitenViewVenkat JvsraoNoch keine Bewertungen

- FORM 16 TAX DEDUCTION CERTIFICATEDokument3 SeitenFORM 16 TAX DEDUCTION CERTIFICATEdugdugdugdugiNoch keine Bewertungen

- Form 16 Salary CertificateDokument2 SeitenForm 16 Salary CertificateGopal TrivediNoch keine Bewertungen

- Shashank Kantheti Hyd 12 13Dokument5 SeitenShashank Kantheti Hyd 12 13kshashankNoch keine Bewertungen

- LetterDokument2 SeitenLetterShiv Kiran SademNoch keine Bewertungen

- BIR FormDokument4 SeitenBIR FormfyeahNoch keine Bewertungen

- Printed From WWW - Incometaxindia.gov - in Page 1 of 4Dokument4 SeitenPrinted From WWW - Incometaxindia.gov - in Page 1 of 4Thil ThilNoch keine Bewertungen

- TDS certificateDokument2 SeitenTDS certificateMohammed MohieNoch keine Bewertungen

- 2551QDokument2 Seiten2551QCris David Moreno79% (14)

- Form16fy10 11Dokument3 SeitenForm16fy10 11atishroyNoch keine Bewertungen

- ADRPD2454Dokument2 SeitenADRPD2454ravibhartia1978Noch keine Bewertungen

- Anspg5953f 2018-19Dokument3 SeitenAnspg5953f 2018-19virajv1Noch keine Bewertungen

- Form27d Applicable From 01.04Dokument2 SeitenForm27d Applicable From 01.04sudhrengeNoch keine Bewertungen

- Nidhi Form 16 UpdateDokument3 SeitenNidhi Form 16 UpdateAbhinav NigamNoch keine Bewertungen

- Indian Income Tax Return Verification FormDokument1 SeiteIndian Income Tax Return Verification FormSanjeev BansalNoch keine Bewertungen

- Form VAT ReturnDokument3 SeitenForm VAT ReturnYf WoonNoch keine Bewertungen

- PrintTax14 PDFDokument2 SeitenPrintTax14 PDFarnieanuNoch keine Bewertungen

- P.P.T On Duties - Responsibilities of DDO For GSTDokument30 SeitenP.P.T On Duties - Responsibilities of DDO For GSTBilal A BarbhuiyaNoch keine Bewertungen

- (See Rule 37D) : Cit (TDS) Address City Pin Code . .Dokument2 Seiten(See Rule 37D) : Cit (TDS) Address City Pin Code . .Akshay RuikarNoch keine Bewertungen

- Form 16 TDS CertificateDokument4 SeitenForm 16 TDS CertificateKesava KesNoch keine Bewertungen

- Form 16 TDS CertificateDokument3 SeitenForm 16 TDS CertificateBijay TiwariNoch keine Bewertungen

- TDS Certificate Form 16 SummaryDokument3 SeitenTDS Certificate Form 16 SummarySvsSridharNoch keine Bewertungen

- Form ITR-VDokument2 SeitenForm ITR-VSumit ManglaniNoch keine Bewertungen

- TDS certificate details for employeeDokument2 SeitenTDS certificate details for employeeravibhartia1978Noch keine Bewertungen

- TdsDokument4 SeitenTdsSahil SheikhNoch keine Bewertungen

- TDS Certificate Form 16 SummaryDokument3 SeitenTDS Certificate Form 16 Summarydingle2Noch keine Bewertungen

- 2551MDokument3 Seiten2551MButch Pogi100% (2)

- Certificate of Creditable Tax Withheld at Source: Sharp (Phils) CorporationDokument17 SeitenCertificate of Creditable Tax Withheld at Source: Sharp (Phils) CorporationromnickNoch keine Bewertungen

- Form 15G/15H ReceiptsDokument6 SeitenForm 15G/15H ReceiptspriyaradhiNoch keine Bewertungen

- Skyreign Travel & Tours Corp. - 03312021Dokument1 SeiteSkyreign Travel & Tours Corp. - 03312021Lhynette JoseNoch keine Bewertungen

- Form 16, Tax Deduction at Source... Income Tax of IndiaDokument2 SeitenForm 16, Tax Deduction at Source... Income Tax of IndiaDrAnilkesar GohilNoch keine Bewertungen

- 14374752Dokument2 Seiten14374752Anshul MehtaNoch keine Bewertungen

- TDS Provisions for FY 2010-11Dokument3 SeitenTDS Provisions for FY 2010-11Abhishek GuptaNoch keine Bewertungen

- Form No.16: Part ADokument3 SeitenForm No.16: Part AYogesh DhekaleNoch keine Bewertungen

- FH 2307 Generator (Updated Version)Dokument124 SeitenFH 2307 Generator (Updated Version)lyrene silvederioNoch keine Bewertungen

- ITR62 Form 15 CADokument5 SeitenITR62 Form 15 CAMohit47Noch keine Bewertungen

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesVon EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNoch keine Bewertungen

- Republic V SayoDokument2 SeitenRepublic V Sayobai malyanah a salman100% (1)

- List of Web Aggregators On IRDAIDokument2 SeitenList of Web Aggregators On IRDAIGeniusly MemberNoch keine Bewertungen

- Business Law Exam TipsDokument3 SeitenBusiness Law Exam TipsJave MontevirgenNoch keine Bewertungen

- Mary Ann Vernatter v. Allstate Insurance Company, An Illinois Corporation, 362 F.2d 403, 4th Cir. (1966)Dokument6 SeitenMary Ann Vernatter v. Allstate Insurance Company, An Illinois Corporation, 362 F.2d 403, 4th Cir. (1966)Scribd Government DocsNoch keine Bewertungen

- Agreement Between Client and ArchitectDokument8 SeitenAgreement Between Client and ArchitectAkanksha bhavsarNoch keine Bewertungen

- Landlords treat roommates as one personDokument6 SeitenLandlords treat roommates as one personhayesbyrdjrNoch keine Bewertungen

- Bough Vs Cantiveros DigestDokument2 SeitenBough Vs Cantiveros DigestErik SorianoNoch keine Bewertungen

- Seniority RulesDokument3 SeitenSeniority RulesAnup DeyNoch keine Bewertungen

- 4th Final B.Ed Merit List 2023Dokument3 Seiten4th Final B.Ed Merit List 2023Deep jyoti Dutta.Noch keine Bewertungen

- Legal Documents for DesignersDokument5 SeitenLegal Documents for DesignersKumarNoch keine Bewertungen

- GDokument20 SeitenGCesNoch keine Bewertungen

- ArtDokument2 SeitenArtAlfred GarciaNoch keine Bewertungen

- Holtzman v. Cirgadyne - Notice of Demurrer and Demurrer To ComplaintDokument10 SeitenHoltzman v. Cirgadyne - Notice of Demurrer and Demurrer To ComplaintLDuquid100% (1)

- Apo Fruits Vs CA DigestDokument3 SeitenApo Fruits Vs CA Digestkatie graceNoch keine Bewertungen

- GCS 1Dokument1 SeiteGCS 1Luthfi AnandhikaNoch keine Bewertungen

- IOC Recruitment Faculty Nursing PositionsDokument2 SeitenIOC Recruitment Faculty Nursing PositionsBhaskargrNoch keine Bewertungen

- Pre Bid Meeting Under PB 21 046 2Dokument6 SeitenPre Bid Meeting Under PB 21 046 2quantum fireNoch keine Bewertungen

- Tenancy Agreement 1Dokument3 SeitenTenancy Agreement 1Teoh Wen DeeNoch keine Bewertungen

- Societies Registration ChecklistDokument16 SeitenSocieties Registration ChecklistAbhijit BobadeNoch keine Bewertungen