Beruflich Dokumente

Kultur Dokumente

Stock Audit Check List

Hochgeladen von

syraju09Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Stock Audit Check List

Hochgeladen von

syraju09Copyright:

Verfügbare Formate

Stock and Debtors Audit 1 2 3 4 5 6 7

8 9 # # # # # # # # # #

# # # #

Stock and Debtors Audit Utilization of Bank finance/end use of Bank's fund for the puppose of client's business. Percentage coverag (which would be preferably by 100%) of physical stocks (raw materials, work-in-progress, finished goods, consumable stores, spares & parts etc.,). Identification of slow moving/ non - moving/ obselet stocks segregated including verification of stock/ un - saleable stock. Shortfall/ surplus of physical stock with reference to books of accounts. Whether stock register/ purchase register/ sales register item - wise ledger and other book of accounts are maintained on daily basis and made upto-date. Monthly production and sale (both quantity & value) for the last six months. Basis of valuation of stock, work-in- progress, fininshed goods including whether stock has been computed on the basis of the principle of "stock at market price or cost price whichever is lower" against proportionate appropriation for fininshed and semi - finished goods. Paid and unpaid stocks would preferably be segrageted item - wise and in calculation of the drawing power, the value of unpaind stock, trade creditors to be exclude alongwith the exclusio nof slow moving/ non - moving/ Age -wise classification of book debt on the date of stock audit and the reasons for outstanding over six months, and also the amount of advance payment received/ adjustable in respect of book debts. Age -wise outstanding of trade creditors as on the date of verification. Utilization of fund and/ or coverage of adhoc sanction released recently. List of outstanding dues and dues for moer than three months and six months as is shown seperately. Drawing power as on the date of verification alongwith monthly DP during the period of last stock audi and upto the date of present audit. In case of calculation of DP, please ensure particularly whether the pre-shipment packing credit is well covered by physical stock at your godown/ possession. Whether the irreovocable power of attorney furnished to the Bank has been registered with all the customers of the borrower for ensuring the payment of the bills/ book debts through the borrower's cash credit accounts with It is also to be ascertained whether the borrower is maintaining any account with branch(es) with our/ other banks and is so the statement for the last one year for such maintenance of account with item. Whether the stocks are covered by adequate comprehensive insurance policies with appropriate bank clause against all sorts of foreseeable risks and the validity of the polcicies. Whether all the items, specified in the sanction letter for the computation fo drawing power are covered by the policy e.g. stock of raw materials, work-in-progress, finished goods, stores, packing materials, etc. Item wise value as shown in the periodical stock statement submitted to the financial institutions by the borrower i.e. stock of raw materials, work-in-progress, finished goods, stores, packing materials etc. is to be compared with the item wise value of risks covered by the policy. If it is observed that the item wise stock value appearing in the said periodical stock statement exceeds the value of risks covered by the policy, it is to be identified as 'underinsured' and will attract 'avarage clause' for the purpose of settlement of claim, if any. Address of the insured godown as specified in the policy must be same as mentioned in the periodical stock statement and the terms of the sanction of the credit facility availed by the borrower. Ensure that the 'Bank clause" has been specified in the policy in favour of the concerned financial institutuion. Risk covering period specified in the concerned policy has not expired. Any other particlurs/ information necceray for the purpose of credit arrangement.

un - saleable stock.

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5782)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Marketing BreifDokument6 SeitenMarketing Breifmohamed abd el khalekNoch keine Bewertungen

- Price SkimmingDokument3 SeitenPrice SkimmingleighannNoch keine Bewertungen

- T.Y.Baf Cost Accounting Sem Vi (Regular) Apr 2021: Option A Option B Option C Option DDokument5 SeitenT.Y.Baf Cost Accounting Sem Vi (Regular) Apr 2021: Option A Option B Option C Option DAditya DeodharNoch keine Bewertungen

- Configure accrual schemes in Dynamics 365 FinanceDokument4 SeitenConfigure accrual schemes in Dynamics 365 FinanceAndrew PackNoch keine Bewertungen

- Economic Order QuantityDokument3 SeitenEconomic Order QuantitySudhakar DoijadNoch keine Bewertungen

- The Tenuous Case For Derivataves ClearinghousesDokument24 SeitenThe Tenuous Case For Derivataves ClearinghousesRicharnellia-RichieRichBattiest-CollinsNoch keine Bewertungen

- Mine Zeynep Senses Practice Problem Set – Lecture 5 SolutionsDokument2 SeitenMine Zeynep Senses Practice Problem Set – Lecture 5 SolutionsKaterina VakhulaNoch keine Bewertungen

- Study Break - 17Dokument3 SeitenStudy Break - 17Chacha YanuariskaNoch keine Bewertungen

- Performance Measurement Chp11Dokument30 SeitenPerformance Measurement Chp11jitendra sahNoch keine Bewertungen

- Consulting Frameworks For Case InterviewsDokument47 SeitenConsulting Frameworks For Case InterviewsRaman Deep S Arora0% (1)

- Revised Corporation Code MCQDokument25 SeitenRevised Corporation Code MCQNiña Yna Franchesca PantallaNoch keine Bewertungen

- MC PlanningDokument21 SeitenMC Planningrizardsaji78% (27)

- Audit of Inventories PSPDokument5 SeitenAudit of Inventories PSPMarriel Fate CullanoNoch keine Bewertungen

- Netflix Business Model Canvas Highlights Key StrategiesDokument1 SeiteNetflix Business Model Canvas Highlights Key StrategiesNemo SecretNoch keine Bewertungen

- Economics Reviewer 1Dokument3 SeitenEconomics Reviewer 1Lorrianne RosanaNoch keine Bewertungen

- CRM Strategy for Maximizing Customer Lifetime ValueDokument21 SeitenCRM Strategy for Maximizing Customer Lifetime ValuesidNoch keine Bewertungen

- Sample Final Solutions PDFDokument10 SeitenSample Final Solutions PDFrealdmanNoch keine Bewertungen

- Types of E-Commerce Explained in DetailDokument18 SeitenTypes of E-Commerce Explained in DetailZyaffNoch keine Bewertungen

- Heineken Global BrandDokument3 SeitenHeineken Global BrandmcdesignnyNoch keine Bewertungen

- Gregory Enterprises overhead cost allocationDokument2 SeitenGregory Enterprises overhead cost allocationMandy KhouryNoch keine Bewertungen

- Michelin Fleet Solutions: From Selling Tires to Selling KilometersDokument15 SeitenMichelin Fleet Solutions: From Selling Tires to Selling KilometersHoàng Đức ThuậnNoch keine Bewertungen

- Sap Fico Tcode ListDokument25 SeitenSap Fico Tcode ListKalyan KakustamNoch keine Bewertungen

- 5082-Risk Management PoliciesDokument27 Seiten5082-Risk Management Policiesnasir_m68100% (1)

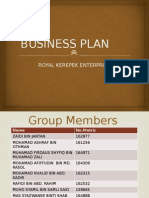

- 1.royal KerepekDokument48 Seiten1.royal KerepekKathss Rinea Cheria0% (1)

- Executive Summary Period 1Dokument2 SeitenExecutive Summary Period 1Огнян ГеоргиевNoch keine Bewertungen

- Reviewer Intangible Assets PDF FreeDokument7 SeitenReviewer Intangible Assets PDF FreeMike Lester EboraNoch keine Bewertungen

- BL Econ Week 1 To 20Dokument48 SeitenBL Econ Week 1 To 20Christine Mae Cahayon67% (3)

- Cash Flow Analysis, Target Cost, Variable Cost PDFDokument29 SeitenCash Flow Analysis, Target Cost, Variable Cost PDFitsmenatoyNoch keine Bewertungen

- PWC Divestment Services eDokument3 SeitenPWC Divestment Services ep10souravnNoch keine Bewertungen

- Paper 7 - Financial MarketsDokument52 SeitenPaper 7 - Financial MarketsBogey PrettyNoch keine Bewertungen