Beruflich Dokumente

Kultur Dokumente

Central Bank

Hochgeladen von

Ashraful IslamOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Central Bank

Hochgeladen von

Ashraful IslamCopyright:

Verfügbare Formate

Draft THE EMERGENT ROLE OF CENTRAL BANKS IN ADDRESSING RURAL FINANCE CHALLENGES THE GAMBIA EXPERIENCE

Presented During Africas Technical Workshop on Innovations in Addressing Rural Finance Challenges in Africa Date: 23rd - 28th November 2008 Venue: Dar es Salaam - Tanzania

BY

S. Bai Senghor Director Microfinance Department Central Bank of The Gambia Banjul, The Gambia

1.0

Introduction

The Government of the Gambia continues to give due attention to the growth and development of the Microfinance sub-sector as it has been recognized as one of the most effective tools to alleviate poverty as outlined in the PRSP II and Vision 2020. This is aimed at promoting and supporting access to financial services for the low income households and rural and urban poor not served by commercial banks. Our goal is to achieve inclusive finance for the entire populace to improve the livelihood of Gambians by enabling people to invest in better nutrition, housing, health and education for their children as well as coping with difficult times caused by crop failures, illness or other calamities. The sector has received and continues to receive enormous support from NGOs and Donor funded projects notably the Rural Finance Project (RFP) funded by IFAD, a follow up to the Rural Finance Community Initiative Project (RFCIP) and the Social Development Fund (SDF) funded by African Development Bank (AfDB). The Central Bank of the Gambia continues to play a pivotal role in the growth and development of microfinance institutions and has recently renewed the policy guidelines and drafted a Non-Bank Financial Institution (NBFI) Bill aimed at creating an enabling environment for building more vibrant and sustainable Microfinance Institutions (MFIs). The Bank is facilitating the linkage of the MFIs with the commercial banks to complement each other and enhance building inclusive finance as part of efforts to expand and deepen financial services for financial sector development and economic growth. Notwithstanding the above, the microfinance sector is still limited by the scale and depth of outreach especially in the rural areas. 1.1

Traditional Informal Finance System

Traditionally, rural finance has existed in a rather informal but cohesive group settings such as the USUSUs, which resemble rotating savings and credit associations (ROSCAs) and village kafos (community groups) based on 2

neighborhood ties, gender, age, kinship and ethnicity. The close ties among members of these groups and peer pressure have encouraged high repayment rates within grassroots institutions. The NGOs and government donor sponsored projects also came with mainly credit which was intended to lubricate the process of maximizing agricultural production and to play a significant role in promoting rural industrialization and the service sector.

1.2

Formal Financial System

The Gambia adopted an Economic Recovery program (ERP) as advised by the World Bank in 1985 with the aim of correcting macroeconomic and structural imbalances of the economy. In line with financial sector reforms, efforts were geared towards ensuring efficiency in the operations of financial institutions and the promotion of financial sector deepening. The reforms were basically:

i. Liberalisation and Deregulation liberalisation of the banking system mainly through the privatization of state-owned commercial banks and the elimination of key banking restrictions, De-regulation of interest rates to allow the forces of demand and supply to govern market outcomes.

Since these financial reforms, the number of private commercial banks have increased from two in the mid-80s to eleven currently. This invariably has opened up greater access to formal financial services albeit the exclusive financing of the bankable minority. This has also seen the rapid proliferation of NGOs offering credit as a means to provide limited access to finance to the unbanked segment of the population especially the rural sector. ii. At institutional level, initiatives to support financial sector development included:

The revision of the Financial Institutions Act (1992) to widen the intermediation base by making provision for NBFIs in the Act. The Act also mandated the Central Bank to take the lead role as the custodian of the financial system in formulating regulatory policies and supervising financial institutions.

Operating Rules and Guidelines for both Banking and NBFIs to ensure that prescribed standards are maintained by all financial institutions in line with the core functions of regulation: i. Protecting public deposits by enabling secure and sustainable internal management, including transparency in management and proper accounting and bookkeeping. ii. Ensuring the soundness of the financial system and to govern transactions between financial agents and institutions, iii. Ensuring competitive conditions.

Legal and Regulatory Framework for the classification and regulation and supervision of financial institutions (figure 1).

Figure 1:

Classification of The Gambias Financial System

Financial Institutions Act (FIA 1992)

Rules and Guidelines (NBFIs)

Category A Institutions

Commercial Banks Insurance Companies Foreign Exchange Bureaus

Category B Institutions

Deposit-taking NBFls NGO MFIs Private Sector-owned MFIs Grassroots Community-owned MFIs Cooperative Credit Unions

The focus of the supervisory effort is on the health and stability of the entire finance system and for the protection of the consumer. Hence the Central Bank continues to improve monetary policy and tighten prudential regulation which has helped minimize risks associated with savings services provision for the poor, thus protecting clients against faulty or fraudulent banking practices.

1.3

The Rural Financial System (Microfinance)

Availability of adequate and efficient financial services to the rural community is an indispensable requirement in the economic development of The Gambia and accordingly financial institutions shall endeavour to extend financial services in different forms directly or otherwise to the sector. These policy rules and guidelines are intended to enhance the development of viable and stable rural financial institutions and thereby strengthen their effectiveness and the quality of the financial services required to meet this development objective. Table 2: The Classification of MFIs Category Types Category A: Category B: Category C : Fiduciary Financial Institutions Savings and Credit Companies /Cooperatives Savings and Credit Associations (SACAs)/Credit Unions

The recent review of the policy guidelines catered for only three categories of MFIs in the legal and regulatory framework of Non-Bank Financial Institutions (NBFIs) in The Gambia. The hitherto 5 categories would be phased out except the Fiduciary Financial Institutions (FFI), Finance Companies (FCs) and the VISACAs. Fiduciary Financial Institutions, also referred to as Trust Institutions may manage or hold funds for the benefit of microfinance institutions or act as a link between such institutions on one part and a donor or a bank on the other.

The minimum paid-up capital contributed by the trust partners shall not be less than D1.0 million. Although a FFI shall charge market interest rate on loans, unless authorized by the Central Bank to do so, they shall not mobilize savings directly from the general public. Presently no institution have been licensed as a FFI, however plans are under way to transform the SDF into a fully fledged FFI. The former are the highest category with large capital base of over D5.0 million with varied financial services offered, while the latter constitute the lowest category promoted by NGOs but owned, managed and controlled by rural or grass-roots community or cooperative. The VISACAs have proven to be the best opportunity to expand formal financial services in rural areas, and have been expanding with various degrees of success to form a comprehensive rural financial system. Rural MFIs in the Gambia provide financial services to both farm and off-farm individuals, households and micro-enterprises in both rural and urban areas. The rural financial market has it characteristics which make the supply of financial services more costly. These include the management of large number of small loans which involve substantial costs associated with issuing and monitoring the loans, sparsely population communities spread over large areas, and poor roads which lead to substantial travel time and costs. Financial services affect performance of micro-enterprises and living conditions of households. It is however, difficult to asses their effects since they depend on many factors including type of services offered, repayment periods, and flexibility in reimbursement and to whom the loan was given in the household. Unlike the real sector, rural financial markets in the Gambia are inherently imperfect in the sense that there is no certainty about the completion of a credit transaction. Financial innovations must therefore contribute to reduce transaction costs and risks in order to reinforce the process of sustainable economic development. The ultimate tests of any MFI is not whether it sustains itself but whether it manages to promote the economic development of the region, a sector or a commodity chain.

In the Gambia, experience has shown that in order for savings services to be successful, they have to respond to the level and patterns of savings by the poor. The poor households are likely to set aside some small amounts of savings to cover emergencies and other unexpected expenditures. For such savings, liquidity and safety of deposits are of principal concern to the household. Hence the important factors for designing successful savings products for such clients are, flexibility in deposits and withdrawals and assurance of safe, prompt and reliable services. It is however important to realize that for larger amounts of savings, in case of agricultural households which tend to be seasonal, such amounts are invested with an eye on both liquidity and returns. Such investment may be kept in the form of food stuff, livestock, and jewellery amongst other valuables. MFIs therefore need to provide competitive returns in order to attract such savings. Providing safe, reliable and flexible savings services on small scales of operations implies high transaction costs. Hence, fresh institutional approaches are required if such services are to cover costs fully. The Central Bank over the years has prescribed the following considerations for MFIs to uphold by the creation or improvement of customer confidence, and secondly provision of cost effective services. The former could be achieved by improved general transparency of MFI operations, inclusion of local representation, proper internal controls, pooling of risks of individual MFIs through second-tier organizations (creation of VISACA Apexes) and shareholders participation in governance and management functions. While the latter could also be realised by putting in place an efficient management system and effective internal and external control mechanisms, that establish strong linkage systems between other MFIs and formal banking sector, plus compatible incentives systems for employees. The Central Bank continues to improve monetary policy and tighten prudential regulation which has helped minimize risks associated with savings services provision for the poor, thus protecting clients against faulty or fraudulent banking practices.

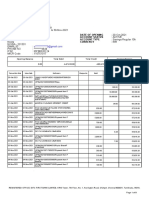

Table 4:

Performance of VISACAs and Credit Unions Clients Loans 138.2 93.3 80.7 63.4 Deposits 134.8 116.9 91.1 75.8

(Million Dalasi) (Million Dalasi) Dec 2007 Dec 2006 Dec 2005 Dec 2004 63,597 66,676 63,764 56,608

2.2

Finance Companies

Currently, there are 5(five) licensed finance companies operating in the Gambia; namely GAWFA, NACCUG, GAMSAVINGS, BAYBA and Reliance Financial Services.

Table 5: Summary of Total Savings, Loans, Assets and membership of Finance Companies

Parameter Savings Loans Assets Membership

Dec-05 20.3m 23.1m 59.7m 9724

Dec-06 33.7m 30.5m 69.7m 21862

Dec-07 120.7m 94.9m 197.4m 65347

3.0 Innovations in Rural Finance

Innovations in rural finance is now known as changes in the technology, the type of financial services offered, the strategic behaviour of institutions, the institutional arrangements, and the structure of incentives that result in improved viability. These innovations should contribute towards the reduction of the risks of service provision as well as the per unit transaction costs associated with financial intermediation in order to impact on small agricultural enterprises. In line with poverty reduction, these strategies must also be properly designed and targeted to impact on the identified poor and vulnerable of the population. Consequently, policies that promote access to financial services must enable the following segments of the society. i. ii. iii. iv. the rural population where poverty is most acute poor households with high dependency ratios agricultural workers especially groundnut farmers women and the vulnerable engaged in small informal income generating activities (own account workers and family helpers) For the vast majority of MFIs, five categories of innovations have been identified in the area of rural/agricultural finance namely: The Central Bank is also encouraging financial institutions to modernize their information systems, increase the range of products they offer and provide better quality services to their customers. Thus the Central Bank has encouraged the introduction of ATMs, Point of Sale systems and debit/credit card technology. The Central Bank prescribed rules and guidelines has helped to strengthen the MFIs by enhancing and or improving customer confidence, and secondly provision of cost effective services. The former could be achieved by improved general transparency of MFI operations, inclusion of local representation, proper

internal controls, pooling of risks of individual MFIs through second-tier organizations (creation of VISACA Apexes) and shareholders participation in governance and management functions. It will also facilitate the linkage of the MFIs with the commercial banks to complement each other and enhance building inclusive finance as part of efforts to expand and deepen financial services for financial sector development and economic growth. Outreach MFIs therefore serve a limited number of people and yet one of the principles of micro finance is serving a large number of clients which is necessary for both financial viability and developmental impact. Studies have shown that the poor are bankable; they can save, invest and repay loans. Therefore to enhance production and for employment creation and income generation, the poor need access to a range of micro-finance services, in particular, savings-deposit activities, credit and insurance. Many reasons such as inappropriate lending and savings technologies, management capacity, cultural structures and set-up or an enabling legal and regulatory framework account for the low outreach. MFIs must come up with a solution to this predicament for micro finance to develop. The ultimate test of any microfinance institution is not whether it sustains itself, but whether it manages to promote the economic development of its target market - be it a region, a sector or a commodity chain. A new set of strategies have been developed and applied by specialized MFIs in the Gambia, such as GAWFA, NACCUG, GAMSAVING, BAYBA and RELIANCE FINANCIAL SERVICES. Even though there are variations in approaches, three basic strategies have been identified as being successful. These include: Knowing the market in which they operate 10

Using special techniques to reduce administrative costs, and Using special techniques to innovate timely payments.

They have applied the following financial technologies in achieving varied successes: Demand-Oriented Savings and Credit Products with the following features Low minimum deposit and/or credit balances, good product mix with liquid savings product, positive and competitive savings and credit interest rates, loan terms taking into account the activities of clients. Low Transaction Costs Resulting from ensuring access and convenience by locating offices close to business centers and markets. This has been manifested in quick services to clients and at times that are convenient to them including extending services hours and the provision of mobile banking services amongst others. Non-Traditional Loan Appraisal and Collateral Loan appraisal techniques that take into account borrowers reputation and character have also proved to be very successful in the Gambia. Cash flow based on household analysis, using income stream of all economic activities of the household, and the use of livestock, jewellery and appliances have also manifested considerable success among MFIs in the country. Peer-lending Use of self-selected groups in which members guarantee each other (i.e. peer pressure and peer monitoring). This strategy is typical of GAWFA which is mainly using the group lending methodology widely known here as a Kafo. Borrower groups often handle much of the loan processing burden. success with GAWFA and the Social Development Fund (SDF). Their collaboration with credit officers to issue and manage loans has registered much

11

Incentive Mechanisms for Timely Repayment Access to repetitive loans with increasing loan size and longer term. classification systems that rate borrowers accordingly. This mechanism has been used by MFIs to prepare record-based borrower

4.0 Challenges Faced by Microfinance Institutions

Considering the potential role expected of microfinance in poverty reduction and the level of support to the sub-sector, the performance of MFIs is rather mixed. The task of building microfinance institutional capacity and financial strength remains the key challenges to expanding the scale of microfinance operations to meet the gap between the supply and demand for such services. Other challenges faced by the sub-sector include the following: Some new institutions have not been able to attract capable management

talent, leaving them to vulnerable inexperienced managers who find it difficult to manage growth and create new products, services and methodologies. MFIs have been faced with risk where many clients come from one geographical area or segment that is vulnerable to common distortions with the growing microfinance industry. Some MFIs in the Gambia especially GAWFA, puts more emphasis on achieving social objective rather than financial performance, and sufficient financial depth. Such MFIs may be able to raise the required capital from their founding shareholders but many lack financial depth and the flexibility to raise additional capital. Management risk resulting from decentralized and often manual or spreadsheet operating system by most of the MFIs are subjected to fraudulent practices where internal controls are not adequate. Untimely and inaccurate management information has also affected management performance in some growing MFIs in the country.

12

5.0

Conclusions and Way Forward

Increased Outreach remains one of the most pertinent goals of

microfinance. Two strategies have been suggested first, developing the supply services to rural groups as replicable business models, and second, examining how advanced MFI service providers can lower their transactions costs of supply by adopting their methodologies and incentive structures for working with grassroots-owned and managed rural groups. Given the scales of the problem of rural financial service delivery, donor policy/institutional support can no longer neglect grassroots institutions services as the bottom-up spike of a two-pronged approach to extending outreach into rural areas of the Gambia. Formation and use of Apex Institutions as second-tier or wholesale organizations that channels funding (grants, loans and guarantees) to multiple microfinance institutions (MFIs) countrywide or in a specific region. Funding may be provided with or without supporting technical services. Creating an apex body for the VISACAs just like NACCUG was formed by the Credit Unions. Savings and Credit with education programme is an integrated financial and education delivery system. Here, non-formal education on the formation of savings and credit associations, institutional strengthening, savings mobilization and marketing focus, credit administration, safety and soundness and short-term technical assistance. Cooperative branding strategy is another innovative way of small-scale

agricultural finance practiced in Asia, America and some parts of Africa. It has given a big boost to the objective of maintaining the soundness of the financial coordination of the cooperative, thereby generating trust and confidence in their operations. approach (i) Emphasis of savings mobilization and 13 Two things however stand out in this

(ii)

Strict credit discipline and adherence to performance standards. Linking these village-based institutions with the countrys banking system,

to complement and further deepen the financial system. Currently a good number of MFIs deposits their excess liquid funds in the commercial banks and in return benefit from soft loans and overdrafts. In conclusion, trends in microfinance service delivery in the Gambia have increasingly focused on the commercialization of services, the broadening of institutional categories and their linkage for sustainable operations. With the recent review of our microfinance policy, it is hoped that the linkages and take over of some VISACAs will add value and further ensure sustainable financial service delivery at all corners of the country. The new capital requirements, we believe will enable MFIs to have adequate funding to finance operations for the sake of viability and sustainability.

14

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Question Paper Investment Banking and Financial Services-I (261) : October 2005Dokument22 SeitenQuestion Paper Investment Banking and Financial Services-I (261) : October 2005api-27548664Noch keine Bewertungen

- IDFCFIRSTBankstatement 10078387878 130042647Dokument8 SeitenIDFCFIRSTBankstatement 10078387878 130042647Nikhil Visa ServicesNoch keine Bewertungen

- As Level Accounting Notes.Dokument75 SeitenAs Level Accounting Notes.SameerNoch keine Bewertungen

- Swot Analysis of HDFC BankDokument1 SeiteSwot Analysis of HDFC BankRishabh KumarNoch keine Bewertungen

- Solution - Problems 1-8 Cash and Cash EquivalentsDokument3 SeitenSolution - Problems 1-8 Cash and Cash Equivalentsanon_965241988Noch keine Bewertungen

- Dwnload Full Auditing and Assurance Services A Systematic Approach 9th Edition Messier Solutions Manual PDFDokument36 SeitenDwnload Full Auditing and Assurance Services A Systematic Approach 9th Edition Messier Solutions Manual PDFpetrorichelle501100% (15)

- Eastern Bank Limited: Name: ID: American International University of Bangladesh Course Name: Faculty Name: Due DateDokument6 SeitenEastern Bank Limited: Name: ID: American International University of Bangladesh Course Name: Faculty Name: Due DateTasheen MahabubNoch keine Bewertungen

- SuperstarDokument5 SeitenSuperstarAntora HoqueNoch keine Bewertungen

- CA Related Syllabus For 2024 - 2025Dokument4 SeitenCA Related Syllabus For 2024 - 2025loganathanNoch keine Bewertungen

- Reserve Bank of IndiaDokument84 SeitenReserve Bank of IndiaSunil ColacoNoch keine Bewertungen

- Importance of Life InsuranceDokument3 SeitenImportance of Life InsuranceManya NagpalNoch keine Bewertungen

- Day 1 Financial ManagementDokument7 SeitenDay 1 Financial ManagementEricka DeguzmanNoch keine Bewertungen

- 2.4. E-Commerce Payment Systems and Security IssuesDokument68 Seiten2.4. E-Commerce Payment Systems and Security IssuesNency ThummarNoch keine Bewertungen

- Developing The Philippines's Parametric and Crop Insurance IndustryDokument14 SeitenDeveloping The Philippines's Parametric and Crop Insurance IndustryKarloAdrianoNoch keine Bewertungen

- Comparative Study of Financial Report of Three Indian Banks (IIMT) Project FileDokument95 SeitenComparative Study of Financial Report of Three Indian Banks (IIMT) Project Filedeepak GuptaNoch keine Bewertungen

- Assignment - Funds and Other InvestmentsDokument2 SeitenAssignment - Funds and Other InvestmentsJane DizonNoch keine Bewertungen

- Marilou B. Franco San Francisco, Agusan Del Sur: (In Philippine Pesos)Dokument6 SeitenMarilou B. Franco San Francisco, Agusan Del Sur: (In Philippine Pesos)ATRIYO ENTERPRISESNoch keine Bewertungen

- TD Bank Statement MAR 2019Dokument1 SeiteTD Bank Statement MAR 2019jessiNoch keine Bewertungen

- Final Report KasbDokument70 SeitenFinal Report KasbtrueliarerNoch keine Bewertungen

- FABM2 12 Quarter1 Week7Dokument10 SeitenFABM2 12 Quarter1 Week7Princess DuquezaNoch keine Bewertungen

- Last Assignment December 2022Dokument77 SeitenLast Assignment December 2022DavidNoch keine Bewertungen

- 1.5-Case StudyDokument11 Seiten1.5-Case StudyPradeep Raj100% (1)

- Audit Process - Control Risk AssessmentDokument25 SeitenAudit Process - Control Risk Assessment[Naz]wa BintangNoch keine Bewertungen

- Partnership Class BookDokument52 SeitenPartnership Class BookBharat NotnaniNoch keine Bewertungen

- Acc3 Intermediate Acctg 1aDokument9 SeitenAcc3 Intermediate Acctg 1aKaren UmaliNoch keine Bewertungen

- Westpac Feb4Dokument2 SeitenWestpac Feb4რაქსშ საჰა100% (1)

- Reliance BP Mobility LimitedDokument63 SeitenReliance BP Mobility LimitedMaheshNoch keine Bewertungen

- International Accounting Standard CommitteeDokument2 SeitenInternational Accounting Standard Committeeshamrat ronyNoch keine Bewertungen

- Banking Ass - KPMG Study - Bank MarginsDokument58 SeitenBanking Ass - KPMG Study - Bank MarginscommercestudentNoch keine Bewertungen

- CA1 Introduction To Cost Accounting and ControlDokument8 SeitenCA1 Introduction To Cost Accounting and ControlhellokittysaranghaeNoch keine Bewertungen