Beruflich Dokumente

Kultur Dokumente

Tax Declaration Form FY2011-2012

Hochgeladen von

nik_seaOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Tax Declaration Form FY2011-2012

Hochgeladen von

nik_seaCopyright:

Verfügbare Formate

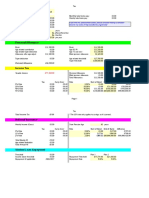

BOB Tech Solutions Pvt. Ltd.

Employee Declaration Form Tax Financial Year 1st April 2011 to 31st March 2012. Employee Tax Saving Investments / Expenditure Declaration Form Employee Name Employee No Department Designation PAN Gender

1. Rent payable by the employee towards residential accommodation Exemption under section 10(13A) Supporting Documents Month Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Amount (Rs) Month Oct-11 Nov-11 Dec-11 Jan-12 Feb-12 Mar-12 Amount (Rs)

2. Deductions from Gross Total Income: 2a.Deduction under chapter VIA: U/S 80C Particulars Contribution to PF Contribution to PPF NSC Contribution to Pension Fund Life Insurance Premium ULP of UTI / LIC Medical Reim U/S 80DD - Medical Treatment - physically handicapped dependent U/S 80 DDB - Medical Treatment for specified diseases 3. Details of Other sources of Income: 3 a. Income from House Property: (TO AVAIL THE TAX BENEFIT OF INTEREST PAYMENT TOWARDS FUNDS BORROWED FOR HOUSE CONSTRUCTION / ACQUISITION) Status of Property Self Occupied Let out property Deemed let out property Address of the property Date of capital borrowed Rent received (annual) If Let out Municipal Taxes Paid Interest paid for the current year Pre-construction interest paid details Amount (Rs) Supporting Documents must. Particulars House Loan repayment

PRINCIPAL AMOUNT ONLY

Amount (Rs)

Mutual Funds Infrastructure Bonds Child Education Fees Tuition fees only Any other investment

U/S 80 E - Education Loan Repayment U/S 80 G - Donations

U/S 80U - Physically Handicapped as specified

Address of the property TDS u/s 194I Enclose F.No. 16A, if TDS is Date of completion of acquisition / construction Please provide the aforesaid information in Form No. 12C 3b.Income from other sources: The details of any other income, if required to be considered by the employer for the purpose of withholding of taxes, to be provided in F.No.12B. Name and address of the previous employer Period of working Details of earnings & deductions I understand that the computation of total tax liability and the monthly withholding of taxes will be based on the completeness, accuracy of facts / information and the supporting documents made available by me. If any of the foregoing is not entirely complete/ inaccurate or not evidenced by adequate supportings, I hereby authorize my employer to proceed with further deduction of taxes as applicable under the provisions of the Income Tax Act and Rules. Further, I would be responsible for any tax / interest demand by the tax authorities, on account of improper / inadequate submissions of any information or documents.

Signature of the employee Place: Bangalore Date: To be filled in by the employer: The following facilities are provided to the employee Sl.No 1 Particulars of facility Company Leased Accommodation 1. Rent for premises 2. Rent for furniture & fixtures Motor car with / without driver 1.Cubic capacity of the car 2.Whether driver provided 3 Interest subsidy details 1.Eligibility as per Grade 2.The Interest payable by the employee Furniture & Fixtures at residence Club facility Credit card facility Any other facility Amount Supporting Documents

4 5 6 7

Das könnte Ihnen auch gefallen

- Bar Review Companion: Taxation: Anvil Law Books Series, #4Von EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Noch keine Bewertungen

- IT Declaration FormatDokument2 SeitenIT Declaration FormatKamal VermaNoch keine Bewertungen

- IT Declaration Form 2011-2012Dokument1 SeiteIT Declaration Form 2011-2012Shishir RoyNoch keine Bewertungen

- 1040 Exam Prep: Module II - Basic Tax ConceptsVon Everand1040 Exam Prep: Module II - Basic Tax ConceptsBewertung: 1.5 von 5 Sternen1.5/5 (2)

- A. General Guidance About The PTIN Application ProcessDokument7 SeitenA. General Guidance About The PTIN Application ProcessYanjing LiuNoch keine Bewertungen

- International Taxation In Nepal Tips To Foreign InvestorsVon EverandInternational Taxation In Nepal Tips To Foreign InvestorsNoch keine Bewertungen

- Epsf FormDokument1 SeiteEpsf Formpawanrai5982Noch keine Bewertungen

- Employee Proof Submission Form - 2011-12Dokument5 SeitenEmployee Proof Submission Form - 2011-12aby_000Noch keine Bewertungen

- Saving Form-Income Tax 12-13Dokument9 SeitenSaving Form-Income Tax 12-13khaleel887Noch keine Bewertungen

- Income Tax Declaration Form 2012-13Dokument2 SeitenIncome Tax Declaration Form 2012-13asfsadfSNoch keine Bewertungen

- Declaration For Proposed Tax Saving Investment and Expenditures For F.Y. 2011 12Dokument11 SeitenDeclaration For Proposed Tax Saving Investment and Expenditures For F.Y. 2011 12nikhiljain17Noch keine Bewertungen

- Proforma of ApplicationDokument3 SeitenProforma of ApplicationJeshiNoch keine Bewertungen

- CIR v. Yumex PhilippinesDokument3 SeitenCIR v. Yumex PhilippinesFrancis PunoNoch keine Bewertungen

- Pension Joint Declaration FormDokument2 SeitenPension Joint Declaration Formredminote7s098Noch keine Bewertungen

- Pension Proposal FormatDokument11 SeitenPension Proposal Formatmdeivem100% (1)

- Application Format - Dda Instl LandDokument11 SeitenApplication Format - Dda Instl Landsourabhmunjal0112Noch keine Bewertungen

- Form of Application For Final Payment of General Provident Fund BalanceDokument6 SeitenForm of Application For Final Payment of General Provident Fund BalanceSurampudi Adivenkata RamanaNoch keine Bewertungen

- Office of The Principal Accountant General (A&E) Himachal Pradesh Shimla-171003 (Dos & Donts For GPF Final Withdrawal Claim)Dokument3 SeitenOffice of The Principal Accountant General (A&E) Himachal Pradesh Shimla-171003 (Dos & Donts For GPF Final Withdrawal Claim)Chandan SainiNoch keine Bewertungen

- Epsf FormDokument1 SeiteEpsf FormSavio MenezesNoch keine Bewertungen

- Annexure VIIDokument2 SeitenAnnexure VIIpenpremNoch keine Bewertungen

- EPF Book PDFDokument47 SeitenEPF Book PDFKrishnarao MadhurakaviNoch keine Bewertungen

- Rti ApplicationDokument2 SeitenRti ApplicationGautam Jayasurya0% (1)

- Fin - e - 321 - 2019 - Pensiom GODokument32 SeitenFin - e - 321 - 2019 - Pensiom GORytham Puni100% (2)

- Arrina Education Services Pvt. LTD.: Investment Declaration Form (FY 2012-2013)Dokument2 SeitenArrina Education Services Pvt. LTD.: Investment Declaration Form (FY 2012-2013)JITEN2050Noch keine Bewertungen

- Augusta Mews Lease Application FormDokument3 SeitenAugusta Mews Lease Application FormNyasha SvondoNoch keine Bewertungen

- 2 Employee Proof Submission (EPS) Form-TemplateDokument13 Seiten2 Employee Proof Submission (EPS) Form-TemplateAnil GanduriNoch keine Bewertungen

- New Pension FormDokument29 SeitenNew Pension FormMayil VananNoch keine Bewertungen

- GST Reg ChecklistDokument35 SeitenGST Reg ChecklistShaik MastanvaliNoch keine Bewertungen

- 9AKIHKTQ FATCAIndividualZerodhapdfDokument2 Seiten9AKIHKTQ FATCAIndividualZerodhapdfSHOBHA VERMANoch keine Bewertungen

- 230 Short Sale Packet - BayviewDokument16 Seiten230 Short Sale Packet - BayviewrapiddocsNoch keine Bewertungen

- Bhupender Singh RawatDokument3 SeitenBhupender Singh RawatPrince Dada100% (2)

- Acceptance Payment Form: Tax Amnesty On DelinquenciesDokument1 SeiteAcceptance Payment Form: Tax Amnesty On DelinquenciesJennyMariedeLeonNoch keine Bewertungen

- Professional Skilled Form 03 Master Employment ContractDokument3 SeitenProfessional Skilled Form 03 Master Employment Contractcarmina villarealNoch keine Bewertungen

- Loan (Solar) Application Form - SidbiDokument5 SeitenLoan (Solar) Application Form - SidbiPalaniswamy KNoch keine Bewertungen

- EMP101 eDokument7 SeitenEMP101 eNozipho MpofuNoch keine Bewertungen

- Flr-13-1-Feb10-En-Fil 1Dokument10 SeitenFlr-13-1-Feb10-En-Fil 1api-269986153Noch keine Bewertungen

- 1601 C CompensationDokument2 Seiten1601 C Compensationjon_cpaNoch keine Bewertungen

- Reference Check FormDokument2 SeitenReference Check FormDavid ThomasNoch keine Bewertungen

- Application Form PNB 1166 Upto 1 Crore MsmeDokument7 SeitenApplication Form PNB 1166 Upto 1 Crore MsmeChristopher GarrettNoch keine Bewertungen

- Power of Attorney and Declaration of RepresentativeDokument2 SeitenPower of Attorney and Declaration of Representativepreston_402003Noch keine Bewertungen

- Trust Withdrawal FormatDokument8 SeitenTrust Withdrawal FormatJackiee1983100% (1)

- Form No.16: Part ADokument3 SeitenForm No.16: Part AYogesh DhekaleNoch keine Bewertungen

- PPP Loan Forgiveness Application (Revised 6.16.2020)Dokument5 SeitenPPP Loan Forgiveness Application (Revised 6.16.2020)LaurenNoch keine Bewertungen

- Taxpayer Registration Form TRF 01 For STRNNTNDokument8 SeitenTaxpayer Registration Form TRF 01 For STRNNTNHammad Nazir MalikNoch keine Bewertungen

- New Pension Proposal With Example PDFDokument13 SeitenNew Pension Proposal With Example PDFPavan Kumar100% (2)

- PrintTax14 PDFDokument2 SeitenPrintTax14 PDFarnieanuNoch keine Bewertungen

- Request For Copy of Tax Return or Tax Account Information/Transcript SC4506Dokument2 SeitenRequest For Copy of Tax Return or Tax Account Information/Transcript SC4506AsjsjsjsNoch keine Bewertungen

- 1604-CFDokument8 Seiten1604-CFmamasita25Noch keine Bewertungen

- Investment Declaration Form F.Y. 2016-17Dokument2 SeitenInvestment Declaration Form F.Y. 2016-17Sanjeev Kumar50% (2)

- 2848 - Arnold Part 2Dokument2 Seiten2848 - Arnold Part 2Arnissia Dior100% (5)

- Identification of Account Holder: PARTDokument2 SeitenIdentification of Account Holder: PARTMuhammad HarisNoch keine Bewertungen

- Individual Tax Residency Self-Certification FormDokument2 SeitenIndividual Tax Residency Self-Certification FormEmadNoch keine Bewertungen

- BCC BR 107 338 Mudra-1-1Dokument20 SeitenBCC BR 107 338 Mudra-1-1Arun GuptaNoch keine Bewertungen

- 10d FormDokument7 Seiten10d FormNitesh JadhavNoch keine Bewertungen

- Occupational Tax and Registration Return For Wagering: Type or PrintDokument6 SeitenOccupational Tax and Registration Return For Wagering: Type or Printrobertledoux2Noch keine Bewertungen

- SSS Employer Data Change Request Form R-8Dokument2 SeitenSSS Employer Data Change Request Form R-8Jolas E. Brutas50% (2)

- 2016finms214 Subscription Business Model PensionDokument8 Seiten2016finms214 Subscription Business Model Pensioncp3y2000-scribdNoch keine Bewertungen

- Building International Bridges BIB Articles of Incorporation Page 19 BY LAWSDokument32 SeitenBuilding International Bridges BIB Articles of Incorporation Page 19 BY LAWSJk McCreaNoch keine Bewertungen

- Employees' Provident Fund OrganisationDokument2 SeitenEmployees' Provident Fund OrganisationMuthiah ManiNoch keine Bewertungen

- Preview of Chapter 6: Intermediate Accounting IFRS 2nd Edition Kieso, Weygandt, and WarfieldDokument84 SeitenPreview of Chapter 6: Intermediate Accounting IFRS 2nd Edition Kieso, Weygandt, and WarfieldLong TranNoch keine Bewertungen

- Individual Income Tax Return Guide: The Information in This Guide Is Based On Current Tax Laws at The Time of PrintingDokument60 SeitenIndividual Income Tax Return Guide: The Information in This Guide Is Based On Current Tax Laws at The Time of PrintingCaleb JNoch keine Bewertungen

- Form No. 12B Form For Furnishing Details of Income Under Section 192 (2) For The Year Ending 31st MarchDokument3 SeitenForm No. 12B Form For Furnishing Details of Income Under Section 192 (2) For The Year Ending 31st MarchkawoNoch keine Bewertungen

- La Consolacion College Pacucoa Accredited Level IiDokument4 SeitenLa Consolacion College Pacucoa Accredited Level IiitsmenatoyNoch keine Bewertungen

- 2 GO (P) No 208 2013 FinDokument2 Seiten2 GO (P) No 208 2013 FinHarish NetguyNoch keine Bewertungen

- Brochure HDFC NPSDokument2 SeitenBrochure HDFC NPSkonupoddarNoch keine Bewertungen

- FPSB India - Financial Plan..Dokument20 SeitenFPSB India - Financial Plan..komurojuNoch keine Bewertungen

- Gen Annuity NolianDokument26 SeitenGen Annuity NolianCarlLacambra80% (5)

- November 8, 2019 Strathmore TimesDokument16 SeitenNovember 8, 2019 Strathmore TimesStrathmore TimesNoch keine Bewertungen

- Nature of Pension TrustsDokument30 SeitenNature of Pension TrustsAntony KiarahuNoch keine Bewertungen

- Pay Period 01.03.2022 To 31.03.2022: Income Tax ComputationDokument3 SeitenPay Period 01.03.2022 To 31.03.2022: Income Tax ComputationParveen SainiNoch keine Bewertungen

- 25 Years Incentive Fin e 390 2012Dokument4 Seiten25 Years Incentive Fin e 390 2012Palanichamy Muthu0% (1)

- BSA 4125 - Actuarial Liability Management - September 2021Dokument4 SeitenBSA 4125 - Actuarial Liability Management - September 2021Peris WanjikuNoch keine Bewertungen

- Raj Kumar ExemptionDokument5 SeitenRaj Kumar ExemptionJashwanthNoch keine Bewertungen

- 2021 Turbo Tax ReturnDokument4 Seiten2021 Turbo Tax ReturnEmonee WellsNoch keine Bewertungen

- Annuities: CertainDokument33 SeitenAnnuities: Certainbarkon desieNoch keine Bewertungen

- Perquisite Results - Attachment ADokument1 SeitePerquisite Results - Attachment AWXYZ-TV Channel 7 DetroitNoch keine Bewertungen

- Income From Salary: Sharif Ud Din Khilji Chief Executive Khilji & Co. Chartered AccountantsDokument85 SeitenIncome From Salary: Sharif Ud Din Khilji Chief Executive Khilji & Co. Chartered AccountantsTayyaba YounasNoch keine Bewertungen

- Zambia: Doing Business in ZambiaDokument4 SeitenZambia: Doing Business in ZambiaKajal N Jignesh PatelNoch keine Bewertungen

- Richard Lobo Senior Vice President - HRDDokument8 SeitenRichard Lobo Senior Vice President - HRDAmberNoch keine Bewertungen

- Declaration Form (22-23)Dokument4 SeitenDeclaration Form (22-23)vasavi kNoch keine Bewertungen

- ITP2 InformationDokument3 SeitenITP2 Informationn_costiqueNoch keine Bewertungen

- W6-Module Concept of Income-Part 1Dokument14 SeitenW6-Module Concept of Income-Part 1Danica VetuzNoch keine Bewertungen

- Retirement Age Triggers of Sworn Members of The Queensland Police ServiceDokument275 SeitenRetirement Age Triggers of Sworn Members of The Queensland Police ServiceAnonymous j9lsM2RBaINoch keine Bewertungen

- IELTS Writing Task 2 - Ageing Population PDFDokument3 SeitenIELTS Writing Task 2 - Ageing Population PDFmaniNoch keine Bewertungen

- Part A: Personal InformationDokument2 SeitenPart A: Personal InformationpreethishNoch keine Bewertungen

- Rajasthan Service RulesDokument62 SeitenRajasthan Service RulesAnonymous 1b3ih8zg9Noch keine Bewertungen

- Paper Code 138Dokument23 SeitenPaper Code 138Jaganmohan Medisetty100% (1)

- Lund Lawsuit PDFDokument66 SeitenLund Lawsuit PDFHelen BennettNoch keine Bewertungen

- Ukpaye-2017-2018 - 18500Dokument2 SeitenUkpaye-2017-2018 - 18500Anonymous jEmTt5o6Noch keine Bewertungen