Beruflich Dokumente

Kultur Dokumente

Managing Risk and Innovation: The Challenge For Smaller Businesses

Hochgeladen von

Kamran KhanOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Managing Risk and Innovation: The Challenge For Smaller Businesses

Hochgeladen von

Kamran KhanCopyright:

Verfügbare Formate

University of Warwick Risk Initiative Briefing

Managing Risk and Innovation: the Challenge for Smaller Businesses

Successful innovation is in large measure an issue of identifying and controlling risk. The smaller the business, the more likely it is that survival will depend on effective risk management. Small and medium sized enterprises (SMEs) are caught in a double bind. As competitive pressures mount and customers press for higher quality standards, tighter cost control and faster response times from suppliers, SMEs find it increasingly vital to accelerate process and product innovation. At the same time, the attendant risks of innovation are higher for a small firm than a large one: usually, the smaller firm will have fewer technical and managerial competences, more limited finance, and more limited access to information than a larger organisation. The risk of getting it wrong comes into sharp focus for those firms where one major unsuccessful product or process development may threaten the survival of the enterprise and possibly the entrepreneur's personal assets. The consequence is a characteristic and understandable risk aversion. But this does not mean one can look solely to the large firm sector for innovation. Innovation has to be seen in the context of a supply chain, the continued competitiveness of the whole being dependent on the innovativeness of all links in the chain. Indeed, in industries such as engineering responsibility for aspects of technological development is being pushed further up the chain towards smaller supplier firms. Then there is the tomorrow as well as today problem: the need for suppliers to demonstrate to their end customers not only the production of a competitive, quality product today, but also a commitment to developing the skills, resources and agility to remain a competitive supplier into the future. The processes of innovation in most SMEs (in contrast to those in large firms and in the high tech minority of SMEs) are poorly understood. This is sometimes reflected in the view that information provision is all that is needed - that is, that SMEs will see the risks associated with innovation as acceptable if only they can be provided with information about scientific, technological and market developments. The reality is more complex, which is one reason why attempts to provide small firms with information through linkages to the public sector science base, universities, etc., seldom prove as effective as their proponents hope. Another fallacy is that large-company models of innovative behaviour can be readily applied to SMEs. In practice, the methods used for managing portfolios of R&D and new product introduction in a large centralised organisation has little real application in an SME context - for example, the ability of a big firm to spread the risk over several parallel product developments with a range of risk/reward ratios is rarely available to an SME. Moreover, SMEs are far from homogeneous: large companies all work on the basis of maximising share holder value, but in an SME there can be a wide variety of owner/entrepreneur aspirations. These will affect attitudes to risk and influence the appropriateness of using public resources to encourage innovation in the firm.

The lack of understanding of innovation in small firms is also reflected in the financing arena, where technological proposals are characteristically assessed more pessimistically in terms of financial risk by financial institutions than the statistics warrant. In fact, technological business opportunities are more likely, not less, to be successful than the generality of businesses of similar size. To overcome some of these issues a variety of tools and approaches are available for use by policy makers, business support organisations and individual firms. Many of the approaches are being used already by the more successful SMEs, often without knowing it: the challenge here is to codify good practice and enshrine it in well designed, SME-specific tools and methodologies which can be applied in a rapid, reproducible way by firms and their advisors. All this is all the more widely relevant when one considers that many large organisations now resemble federations of SMEs much more than traditional highly centralised large companies. Increasingly, innovation decisions are taken not at the corporate centre but at operating business level where, if not the survival of the business unit, then perhaps the managing directors career prospects, may be prejudiced by one unsuccessful new development.

The Internal Perspective

What then are the tools available to manage innovation risks in smaller firms? A simple self-assessment procedure can be an extremely valuable experience for an SME. A capable facilitator can add value by forcing issues out into the open, promoting wide staff involvement, ensuring that everyone takes the exercise seriously, interpreting findings and arriving at an action plan. Many diagnostic, audit and benchmarking frameworks are available, though most are empirically based while those which are not tend to be built on large-company models of good practice. A second approach is concerned with adjusting the culture of the firm itself. This can range from organisational change - characteristically, greater delegation from the owner/entrepreneur to the next level - to wider dissemination of financial data, greater emphasis on training, and an involvement of staff at all levels in suggesting and implementing improvements. There is a close link here with TQM, the creation of a culture of continuous improvement, and programmes such as Investors in People. At a UK manufacturer of gauging systems, a subsidiary of a US corporation, an energetic site operations director used participation in clubs and networks to garner ideas and create a continuous improvement culture within the firm. Improved materials control and cellular manufacturing were introduced, junior staff were sent to exhibitions to pick up ideas, performance measures were charted and the results displayed. Cellular telephone linkages were implemented to improve utilisation of the firms fleet of service vans and record information and parts used. As time went on, participation in competitions proved a useful way of stimulating continued commitment, involvement and improvement. As a result, while turnover increased by 44%, stock and work in progress fell from 1.3 million to 360,000, space occupancy by 35% and delivery times from eight weeks to 2 days. A further group of approaches focuses on aspects of product and process development. One aspect of big company thinking which is, qualitatively at least relevant to small firms is that

it is almost always more risky to move both into new products and into new markets than to sell new products to existing customers or to sell essentially the existing range to new clients. The case below illustrates how even in a very small company, it is possible to separate in time new market development and new product development. Paraid, a small UK engineering company, reduced innovation risk by licensing products from overseas and developing UK markets prior to considering taking on manufacturing rights. This enabled them to get to new customers first, before worrying about manufacturing. Secondly, when the company did wish to expand its product range it did so by developing add-ons for the licensed products - for example, adapters to fit German ambulance trolley cots to UK specification vehicles. This enabled them to sell further products to customers they already knew and understood. Thirdly, increased funding derived from this expanded activity was recycled into a modest product development capability led by a senior staff member who was able to devote much of his attention to new developments and prototyping.

The external perspective

A simple SWOT (strengths, weaknesses, opportunities, threats) analysis can be very potent in linking a firm's internal competencies and capabilities into the opportunities and threats presented by the external environment. Again the use of a suitable facilitator adds immensely to the exercise, which would extend to looking at new market developments and the current and likely future state of competition. Paraids move into emergency evacuation equipment from its earlier business in disability aids was prompted by intelligent observation of regulatory changes. The requirement for disabled access to the upper floors of buildings was seen as creating a requirement for equipment which would permit the rapid evacuation of the disabled in the event of fire or other emergency. Paraid secured distribution, sales and manufacturing rights in the EU for such a device from its American inventor. Equally, technology watch is a key requirement for most firms. In a large organisation systematic scanning of new intellectual property etc. across a wide technology range can be appropriate, but a small firm can do the technology watch quite effectively by simple expedients such as reading the appropriate trade periodicals and attending relevant exhibitions. The evidence is that these channels are among the most effective methods of channelling information to SMEs. Thirdly, regular and systematic benchmarking is invaluable. The level of sophistication should suit the firm and need not be high, but there is a standard sequence: benchmark against peers in one's own industry benchmark against exemplars of best practice for specific functions (e.g. for distribution, one might benchmark against a successful retailer) benchmark against a holistic model of good practice.

The benchmarking will include looking at how other firms make decisions about new products and processes, how projects are planned and managed, and to what extent "what if" analysis is carried and contingency measures planned. It is useful to have an objective good practice standard to refer to, and the model used for the European Quality Award (EQA) is a widely used example. Again however there is a need

for research to establish how the thinking on which it is based might need modification for small firms.

Using External Help Wisely

The value of an external facilitator in a firm's internal and external assessment process is clear. This is essentially process consultancy, and it should have a continuing rle through a consultant acting as a sounding board for the entrepreneur and giving him an opportunity to discuss/debate innovation decisions. The second standard form of consultancy, technical expert consultancy, is valuable too, to address issues identified by (for example) a benchmarking exercise and to play a mentoring rle. For example, regular visits by an expert can encourage and guide skills development among SME technical personnel and accomplish much more than classroom training alone. In addition, the value of corporate mentoring is being recognised. Where it is not appropriate for large end customers to provide support directly, they can initiate a programme for a supply chain. A good example of this is provided by the Society of Motor Manufacturers and Traders in the UK, which promotes an assessment using an EQA based model followed by access to a tool kit of techniques and assistance in whichever of several action areas is identified as the priority. In a similar way, groups of firms within the same industry can come together to improve their handling of innovation and enhance performance without the relationship breaking down through competitive pressures. In the Making It Pay initiative by the Department of Trade and Industry (UK), customer surveys are used as the basis for identifying and prioritising improvements in component suppliers. The initiative was piloted in a group of eight forging companies, who were then able to target their improvement efforts at those aspects of performance viewed as most significant by customers and where the greatest discrepancies between desired and achieved performance were found. Interaction between firms is even more valuable if it is sustained over time and local networking, perhaps with the facilitation of a third party, is one of the most powerful means of spreading good practice and passing on new ideas. In the FRAM scheme in Norway, microenterprises are encouraged to join in local networks for mutual support, advice and problem solving. The initiative was based on Norways successful BUNT (Business Development Using New Technology), programme, but was targeted specifically at very small firms for who most innovation management techniques remain unsuitable. The initiative was particularly valuable in areas remote from conventional business support services.

Where do we go from here?

The need now is to make tools and approaches such as the above more widely known and used by sharing good practice. At the same time there is an urgent need to interpret their operation not merely empirically but in terms of well understood processes of innovation in small firms. The analogy with a machine is a good one: if the machine squeaks, we want to understand which part is in need of lubrication and oil just that bit. Without a sound understanding of innovation management, outside assistance is at best the equivalent of spraying the machine randomly with oil and hoping some of it reaches the right place. If the challenges of innovation and risk can be met, the competitiveness of small firms and the

supply chains of which they form part can benefit considerably.

David Brown1 / Warwick Risk Initiative 1997 Further information: David Brown 01223 420024 / Professor Henry Wynn 01203 523625

Now at: Arthur D. Little Ltd, Science Park, Milton Road, Cambridge CB4 4DW, UK

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Diesel Engines For Vehicles D2066 D2676Dokument6 SeitenDiesel Engines For Vehicles D2066 D2676Branislava Savic63% (16)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The DIRKS Methodology: A User GuideDokument285 SeitenThe DIRKS Methodology: A User GuideJesus Frontera100% (2)

- Method Statement FINALDokument61 SeitenMethod Statement FINALshareyhou67% (3)

- Ppap - 2556 PDFDokument7 SeitenPpap - 2556 PDFMohamed ElmakkyNoch keine Bewertungen

- SCIENCE 11 WEEK 6c - Endogenic ProcessDokument57 SeitenSCIENCE 11 WEEK 6c - Endogenic ProcessChristine CayosaNoch keine Bewertungen

- Advanced Oil Gas Accounting International Petroleum Accounting International Petroleum Operations MSC Postgraduate Diploma Intensive Full TimeDokument70 SeitenAdvanced Oil Gas Accounting International Petroleum Accounting International Petroleum Operations MSC Postgraduate Diploma Intensive Full TimeMoheieldeen SamehNoch keine Bewertungen

- BSRM Ultima BrochureDokument2 SeitenBSRM Ultima BrochuresaifuzzamanNoch keine Bewertungen

- ABBindustrialdrives Modules en RevBDokument2 SeitenABBindustrialdrives Modules en RevBMaitry ShahNoch keine Bewertungen

- Assessing Apical PulseDokument5 SeitenAssessing Apical PulseMatthew Ryan100% (1)

- Punches and Kicks Are Tools To Kill The Ego.Dokument1 SeitePunches and Kicks Are Tools To Kill The Ego.arunpandey1686Noch keine Bewertungen

- Ubicomp PracticalDokument27 SeitenUbicomp Practicalvikrant sharmaNoch keine Bewertungen

- Unit 1 Bearer PlantsDokument2 SeitenUnit 1 Bearer PlantsEmzNoch keine Bewertungen

- Guidelines For Doing Business in Grenada & OECSDokument14 SeitenGuidelines For Doing Business in Grenada & OECSCharcoals Caribbean GrillNoch keine Bewertungen

- Quotation - 1Dokument4 SeitenQuotation - 1haszirul ameerNoch keine Bewertungen

- Lab Science of Materis ReportDokument22 SeitenLab Science of Materis ReportKarl ToddNoch keine Bewertungen

- Addendum ESIA Oct 2019Dokument246 SeitenAddendum ESIA Oct 2019melkamuNoch keine Bewertungen

- Creating A Research Space (C.A.R.S.) ModelDokument5 SeitenCreating A Research Space (C.A.R.S.) ModelNazwa MustikaNoch keine Bewertungen

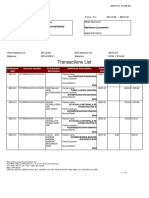

- Transactions List: Marilena Constantin RO75BRDE445SV93146784450 RON Marilena ConstantinDokument12 SeitenTransactions List: Marilena Constantin RO75BRDE445SV93146784450 RON Marilena ConstantinConstantin MarilenaNoch keine Bewertungen

- DBM Uv W ChartDokument2 SeitenDBM Uv W ChartEddie FastNoch keine Bewertungen

- How To Change Front Suspension Strut On Citroen Xsara Coupe n0 Replacement GuideDokument25 SeitenHow To Change Front Suspension Strut On Citroen Xsara Coupe n0 Replacement Guidematej89Noch keine Bewertungen

- Blackbook 2Dokument94 SeitenBlackbook 2yogesh kumbharNoch keine Bewertungen

- TransistorsDokument21 SeitenTransistorsAhmad AzriNoch keine Bewertungen

- Worksheet in Bio 102: Microbiology and Parasitology (WEEK 17)Dokument3 SeitenWorksheet in Bio 102: Microbiology and Parasitology (WEEK 17)DELOS SANTOS JESSIECAHNoch keine Bewertungen

- Req Equip Material Devlopment Power SectorDokument57 SeitenReq Equip Material Devlopment Power Sectorayadav_196953Noch keine Bewertungen

- Documentos de ExportaçãoDokument17 SeitenDocumentos de ExportaçãoZineNoch keine Bewertungen

- SY22-23+Annual+Report FinalDokument47 SeitenSY22-23+Annual+Report FinalNorus LizaNoch keine Bewertungen

- Prediction of CBR From Index Properties of Cohesive Soils: Magdi ZumrawiDokument1 SeitePrediction of CBR From Index Properties of Cohesive Soils: Magdi Zumrawidruwid6Noch keine Bewertungen

- 5045.CHUYÊN ĐỀDokument8 Seiten5045.CHUYÊN ĐỀThanh HuyềnNoch keine Bewertungen

- 1572 - Anantha Narayanan FFS CalculationDokument1 Seite1572 - Anantha Narayanan FFS CalculationAnantha NarayananNoch keine Bewertungen

- Payment of Wages 1936Dokument4 SeitenPayment of Wages 1936Anand ReddyNoch keine Bewertungen