Beruflich Dokumente

Kultur Dokumente

pdIC vs. CA - CivPro

Hochgeladen von

cmv mendozaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

pdIC vs. CA - CivPro

Hochgeladen von

cmv mendozaCopyright:

Verfügbare Formate

PDIC V CA (ABAD) 00 SCRA 00 CARPIO-MORALES; April 30, 2003

FACTS - Prior to May 22, 1987 Respondents (Jose Abad, Leonor Abad, Sabina Abad, Josie Beata Abad-Orlina, Cecilia Abad, Pio Abad, Dominic Abad, and Teodora Abad) had, individually or jointly with each other, 71 certificates of time deposits denominated as Golden Time Deposits (GTD) with an aggregate face value of P1,115,889.96 in Manila Banking Corp (MBC). - May 22, 1987 - a Friday, the Monetary Board (MB) of the Central Bank of the Philippines (now BSP) issued Resolution 505 prohibiting MBC to do business in the Philippines, and placing its assets and affairs under receivership. The Resolution, however, was not served on MBC until Tuesday the following week, or on May 26, 1987, when the designated Receiver took over. - May 25, 1987 - The next banking day following the issuance of the MB Resolution, Jose Abad was at the MBC at 9 AM for the purpose of pre-terminating the 71 aforementioned GTDs and re-depositing the fund represented thereby into 28 new GTDs in denominations of P40,000.00 or less under the names of herein respondents individually or jointly with each other. Of the 28 new GTDs, Jose Abad preterminated 8 and withdrew the value thereof in the total amount of P320,000.00. The Abads then filed their claims for the payment of the remaining 20 GTDs. - February 11, 1988 - PDIC paid respondents the value of 3 claims in the total amount of P120,000.00. PDIC, however, withheld payment of the 17 remaining claims after Washington Solidum, Deputy Receiver of MBC-Iloilo, submitted a report to the PDIC that there was massive conversion and substitution of trust and deposit accounts on May 25, 1987 at MBC-Iloilo. According to the report, MBC-Iloilo was found to have recorded an unusually heavy movements in terms of volume and amount for all types of deposits and trust accounts. Apparently the impending receivership of MBC appeared to have been known already to many depositors on account of the massive withdrawals paid on this day which practically wiped out the branch's entire cash position. - Because of the said report, PDIC entertained serious reservation in recognizing the Abads GTDs as deposit liabilities of MBC-Iloilo. - August 30, 1991, PDIC filed a petition for declaratory relief against respondents with the Iloilo City RTC for a judicial declaration determination of the insurability of respondents' GTDs at MBC-Iloilo. - Respondents set up a counterclaim against PDIC whereby they asked for payment of their insured deposits. - February 22, 1994 - The Iloilo RTC declared the 20 GTDs of respondents to be deposit liabilities of MBC, hence, are liabilities of PDIC as statutory insurer. The RTC ordered PDIC to pay the Abads the value of said 20 GTDs less the value of 3 GTDs it paid on February 11, 1988. The CA affirmed the RTC decision. - PDICs arguments are as follows: - Under its charter, PDIC is liable only for deposits received by a bank "in the usual

course of business." Convinced that the questioned bank transactions were so massive, hence, irregular, PDIC essentially seeks a judicial declaration that such transactions were not made "in the usual course of business" and, therefore, it cannot be made liable for deposits subject thereof. - PDIC posits that there was no consideration for the 20 GTDs subject of respondents' claim. Because when the 20 GTDs were made, MBC had been experiencing liquidity problems. Hence, even if respondents had wanted to convert the face amounts of the GTDs to cash, MBC could not have complied with it. - PDIC argues that the trial court erred in ordering it to pay the balance of the deposit insurance to respondents, maintaining that the instant petition stemmed from a petition for declaratory relief which does not essentially entail an executory process, and the only relief that should have been granted by the trial court is a declaration of the parties' rights and duties. As such no order of payment may arise from the case as this is beyond the office of declaratory relief proceedings. ISSUE WON the trial court erred in ordering PDIC to pay the balance of the deposit insurance to respondents: a) based on the factual backdrop b) based on the fact that the petition stemmed from a petition for declaratory relief HELD NO Reasoning a) Factual aspect - While the MB issued Resolution 505 on May 22, 1987, a copy thereof was served on MBC only on May 26, 1987. MBC and its clients could be given the benefit of the doubt that they were not aware that the MB resolution had been passed, given the necessity of confidentiality of placing a banking institution under receivership. Mere conjectures that MBC had actual knowledge of its impending closure do not suffice. The MB resolution could not thus have nullified respondents' transactions which occurred prior to May 26, 1987. b) Procedural aspect: - There is nothing in the nature of a special civil action for declaratory relief that proscribes the filing of a counterclaim based on the same transaction, deed or contract subject of the complaint. - A special civil action is after all not essentially different from an ordinary civil action, which is generally governed by Rules 1 to 56 of the Rules of Court, except that the former deals with a special subject matter which makes necessary some special regulation. - But the identity between their fundamental nature is such that the same rules governing ordinary civil suits may and do apply to special civil actions if not inconsistent with or if they may serve to supplement the provisions of the peculiar rules governing special

civil actions. - A petition for declaratory relief does not essentially entail an executory process. There is nothing in its nature, however, that prohibits a counterclaim from being set-up in the same action. Disposition WHEREFORE, the assailed decision of the Court of Appeals is hereby AFFIRMED.

Das könnte Ihnen auch gefallen

- RMC No 17-2018Dokument6 SeitenRMC No 17-2018fatmaaleahNoch keine Bewertungen

- Ricardo Verino Y Pingol V. People of The Philippines G.R. No. 225710 - June 19, 2019 - Third Division - LEONEN, JDokument2 SeitenRicardo Verino Y Pingol V. People of The Philippines G.R. No. 225710 - June 19, 2019 - Third Division - LEONEN, JAlvin MotillaNoch keine Bewertungen

- Africa V Pcgg. GR 83831. Jan 9, 1992. 205 Scra 39Dokument12 SeitenAfrica V Pcgg. GR 83831. Jan 9, 1992. 205 Scra 39Charles DumasiNoch keine Bewertungen

- Cleofas Vs ST Peter Memorial ParkDokument9 SeitenCleofas Vs ST Peter Memorial ParkEKANGNoch keine Bewertungen

- Judge CasesDokument19 SeitenJudge CasesJas Em BejNoch keine Bewertungen

- Vicente Chuidian v. Sandiganbayan and The RepublicDokument4 SeitenVicente Chuidian v. Sandiganbayan and The RepublicArmando MataNoch keine Bewertungen

- 35 Philippine Dream Company Inc. V.20210424-12-1jxqs4iDokument11 Seiten35 Philippine Dream Company Inc. V.20210424-12-1jxqs4iervingabralagbonNoch keine Bewertungen

- Sumifru (Philippines) Corporation, Petitioner, vs. Spouses Danilo Cereño and Cerina Cereño, Respondents. ResolutionDokument30 SeitenSumifru (Philippines) Corporation, Petitioner, vs. Spouses Danilo Cereño and Cerina Cereño, Respondents. ResolutionJohn GenobiagonNoch keine Bewertungen

- fflmtiln: Upreme LourtDokument11 Seitenfflmtiln: Upreme LourtJesryl 8point8 TeamNoch keine Bewertungen

- Pentagon Steel Corporation vs. CA (GR No. 174141, June 26, 2009)Dokument2 SeitenPentagon Steel Corporation vs. CA (GR No. 174141, June 26, 2009)jovani emaNoch keine Bewertungen

- TaxationBarQ26A TaxRemediesDokument32 SeitenTaxationBarQ26A TaxRemediesjuneson agustinNoch keine Bewertungen

- 001 Chan Vs Chan 702 Scra 76Dokument10 Seiten001 Chan Vs Chan 702 Scra 76Maria Jeminah TurarayNoch keine Bewertungen

- Syllabus Evidence 2015Dokument4 SeitenSyllabus Evidence 2015Kristian CaumeranNoch keine Bewertungen

- All Jrdoss No Crsrxs or Court Op: (La Ïp Studr2Vt PractjcrjDokument16 SeitenAll Jrdoss No Crsrxs or Court Op: (La Ïp Studr2Vt PractjcrjJan Erik Manigque100% (1)

- Mactan v. LozadaDokument1 SeiteMactan v. Lozadagrego centillasNoch keine Bewertungen

- Dugs Palabrica NotesDokument22 SeitenDugs Palabrica NotesFrancisNoch keine Bewertungen

- Macasaet vs. Macasaet, 439 SCRA 625, September 30, 2004Dokument11 SeitenMacasaet vs. Macasaet, 439 SCRA 625, September 30, 2004Jane BandojaNoch keine Bewertungen

- Mison Vs NatividadDokument1 SeiteMison Vs NatividadOlivia FelNoch keine Bewertungen

- Decisions Penned by Justice Prisbeterio Velasco.Dokument17 SeitenDecisions Penned by Justice Prisbeterio Velasco.Xing Keet LuNoch keine Bewertungen

- Platon Notes Civil Procedure QuiambaoDokument64 SeitenPlaton Notes Civil Procedure QuiambaoYoan Baclig BuenoNoch keine Bewertungen

- Rule 42, Section 1-4 - MAGNODokument38 SeitenRule 42, Section 1-4 - MAGNOMay RMNoch keine Bewertungen

- CIR V Puregold Duty FreeDokument4 SeitenCIR V Puregold Duty FreeCelina Marie Panaligan0% (1)

- Requirement For Provisional RemedyDokument5 SeitenRequirement For Provisional RemedyEdsel Ian S. FuentesNoch keine Bewertungen

- Makati Tuscany Condominium Corp V CADokument3 SeitenMakati Tuscany Condominium Corp V CACheezy ChinNoch keine Bewertungen

- Tacay V RTC of TagumDokument2 SeitenTacay V RTC of TagumKiana AbellaNoch keine Bewertungen

- Carlos Superdrug Corp Vs CirDokument2 SeitenCarlos Superdrug Corp Vs CirFrances Abigail BubanNoch keine Bewertungen

- TORTS Midterm CasesDokument38 SeitenTORTS Midterm CasesConnie BebNoch keine Bewertungen

- Sample Judicial AffidavitDokument3 SeitenSample Judicial AffidavitRoland Bon IntudNoch keine Bewertungen

- 2009 Bar Question1Dokument4 Seiten2009 Bar Question1Joyce Somorostro Ozaraga100% (1)

- BPI LetterDokument1 SeiteBPI Letterchiqui_soNoch keine Bewertungen

- Flow Chart of Readmission To The BarDokument1 SeiteFlow Chart of Readmission To The BarJason MergalNoch keine Bewertungen

- Republic of The Philippines Regional Trial CourtDokument2 SeitenRepublic of The Philippines Regional Trial CourtMarcus GilmoreNoch keine Bewertungen

- William Gemperle vs. Helen Scheneker 19 SCRA 45Dokument2 SeitenWilliam Gemperle vs. Helen Scheneker 19 SCRA 45FranzMordenoNoch keine Bewertungen

- COCOFED v. Republic, 805 SCRA 1 (2016)Dokument93 SeitenCOCOFED v. Republic, 805 SCRA 1 (2016)Nicole IbayNoch keine Bewertungen

- LEDDA V BPI Case DigestDokument1 SeiteLEDDA V BPI Case DigestKatrina Ysobelle Aspi HernandezNoch keine Bewertungen

- 78 Phil LJ1Dokument26 Seiten78 Phil LJ1IAN ANGELO BUTASLACNoch keine Bewertungen

- Asia Trust Devt Bank Vs First Aikka Devt Inc PDFDokument3 SeitenAsia Trust Devt Bank Vs First Aikka Devt Inc PDFArvinNoch keine Bewertungen

- Evidence Column Compiled Essay Bar Qs 2006 2019Dokument22 SeitenEvidence Column Compiled Essay Bar Qs 2006 2019Olivia JaneNoch keine Bewertungen

- Vera Vs Fernandez - Tax1Dokument5 SeitenVera Vs Fernandez - Tax1Rap BaguioNoch keine Bewertungen

- Leading Questions 1. State V. Scott (Apg)Dokument52 SeitenLeading Questions 1. State V. Scott (Apg)bobbyrickyNoch keine Bewertungen

- Bar Examination 2004: TaxationDokument8 SeitenBar Examination 2004: TaxationbubblingbrookNoch keine Bewertungen

- Chapter Vii TaxationDokument15 SeitenChapter Vii Taxationkimberly milagNoch keine Bewertungen

- Purisima, Jr. V PurisimaDokument2 SeitenPurisima, Jr. V PurisimaAriel Christen EbradaNoch keine Bewertungen

- 2018 MOCK BAR-mercantileDokument4 Seiten2018 MOCK BAR-mercantileememNoch keine Bewertungen

- GHJDokument6 SeitenGHJJilyan SiobalNoch keine Bewertungen

- Full Text Evidence. Module 1 CasesDokument102 SeitenFull Text Evidence. Module 1 CasesCarla CariagaNoch keine Bewertungen

- Tabuada vs. Tabuada (Full Text, Word Version)Dokument10 SeitenTabuada vs. Tabuada (Full Text, Word Version)Emir MendozaNoch keine Bewertungen

- Silkair (Singapore) Pte., Ltd. vs. Commissioner of Internal Revenue (February 6, 2008 November 14, 2008 and January 20, 2012)Dokument3 SeitenSilkair (Singapore) Pte., Ltd. vs. Commissioner of Internal Revenue (February 6, 2008 November 14, 2008 and January 20, 2012)Vince LeidoNoch keine Bewertungen

- McBurnie v. GanzonDokument22 SeitenMcBurnie v. GanzonMaria AndresNoch keine Bewertungen

- TaxDokument21 SeitenTaxAnna Dela VegaNoch keine Bewertungen

- TaxRev Finals Coverage Last Edit May 16Dokument57 SeitenTaxRev Finals Coverage Last Edit May 16UsixhzkaBNoch keine Bewertungen

- 4F Banking Abella Notes PDFDokument54 Seiten4F Banking Abella Notes PDFRoger Montero Jr.Noch keine Bewertungen

- Gregory v. Helvering, 293 U.S. 465 (1935)Dokument3 SeitenGregory v. Helvering, 293 U.S. 465 (1935)Scribd Government DocsNoch keine Bewertungen

- People vs. CoderesDokument3 SeitenPeople vs. CoderesNoo NooooNoch keine Bewertungen

- Calma vs. SantosDokument20 SeitenCalma vs. SantosAmerigo VespucciNoch keine Bewertungen

- American Home Assurance v. Tantuco Scire LicetDokument2 SeitenAmerican Home Assurance v. Tantuco Scire LicetJetJuárezNoch keine Bewertungen

- Rule 16 To Rule 19Dokument65 SeitenRule 16 To Rule 19Jaime PinuguNoch keine Bewertungen

- Unfair Labor PracticeDokument2 SeitenUnfair Labor PracticejeandpmdNoch keine Bewertungen

- PDIC v. CA, G.R. No. 126911, April 30, 2003Dokument3 SeitenPDIC v. CA, G.R. No. 126911, April 30, 2003MICHELLE JUEVESNoch keine Bewertungen

- 119285-2003-Philippine Deposit Insurance Corp. v. CourtDokument7 Seiten119285-2003-Philippine Deposit Insurance Corp. v. CourtChristian VillarNoch keine Bewertungen

- Umali vs. EstanislaoDokument8 SeitenUmali vs. Estanislaocmv mendozaNoch keine Bewertungen

- Roxas vs. RaffertyDokument6 SeitenRoxas vs. Raffertycmv mendozaNoch keine Bewertungen

- BIR Revenue Memorandum Order 10-2014Dokument17 SeitenBIR Revenue Memorandum Order 10-2014PortCalls100% (4)

- Wage Computation TableDokument1 SeiteWage Computation Tablecmv mendozaNoch keine Bewertungen

- DOJ Circular No. 18, 18 June 2014Dokument2 SeitenDOJ Circular No. 18, 18 June 2014cmv mendozaNoch keine Bewertungen

- PNP Manual PDFDokument114 SeitenPNP Manual PDFIrish PD100% (9)

- Taganito vs. Commissioner (1995)Dokument2 SeitenTaganito vs. Commissioner (1995)cmv mendozaNoch keine Bewertungen

- Pecson vs. CADokument4 SeitenPecson vs. CAcmv mendozaNoch keine Bewertungen

- Osmena vs. OrbosDokument9 SeitenOsmena vs. Orboscmv mendozaNoch keine Bewertungen

- Court of Tax Appeals: Republic of The PhilippinesDokument28 SeitenCourt of Tax Appeals: Republic of The Philippinescmv mendozaNoch keine Bewertungen

- 1 - Conwi vs. CTA DigestDokument2 Seiten1 - Conwi vs. CTA Digestcmv mendozaNoch keine Bewertungen

- IRR of RA 9480Dokument7 SeitenIRR of RA 9480cmv mendozaNoch keine Bewertungen

- Tax NotesDokument10 SeitenTax Notescmv mendozaNoch keine Bewertungen

- Tax 1 - TereDokument57 SeitenTax 1 - Terecmv mendoza100% (1)

- Republic Bank V EbradaDokument9 SeitenRepublic Bank V Ebradacmv mendozaNoch keine Bewertungen

- Republic Bank V EbradaDokument9 SeitenRepublic Bank V Ebradacmv mendozaNoch keine Bewertungen

- Misamis Oriental Assn vs. Dept of FinanceDokument6 SeitenMisamis Oriental Assn vs. Dept of Financecmv mendozaNoch keine Bewertungen

- Ra 9480Dokument6 SeitenRa 9480cmv mendozaNoch keine Bewertungen

- BIR Form No. 0618 Download: (Zipped Excel) PDFDokument6 SeitenBIR Form No. 0618 Download: (Zipped Excel) PDFcmv mendozaNoch keine Bewertungen

- Commissioner vs. PalancaDokument6 SeitenCommissioner vs. Palancacmv mendozaNoch keine Bewertungen

- Conwi vs. CTADokument10 SeitenConwi vs. CTAcmv mendozaNoch keine Bewertungen

- Primer On The Tax Amnesty Act of 2007Dokument8 SeitenPrimer On The Tax Amnesty Act of 2007cmv mendozaNoch keine Bewertungen

- 9 - Commissioner vs. PalancaDokument1 Seite9 - Commissioner vs. Palancacmv mendozaNoch keine Bewertungen

- Appellants Brief Tutuban CaseDokument4 SeitenAppellants Brief Tutuban Casecmv mendozaNoch keine Bewertungen

- Remedies Under NIRCDokument14 SeitenRemedies Under NIRCcmv mendoza100% (3)

- Tax Alert - 2006 - OctDokument8 SeitenTax Alert - 2006 - Octcmv mendozaNoch keine Bewertungen

- Tax 2 Finals ReviewerDokument19 SeitenTax 2 Finals Reviewerapi-3837022100% (2)

- Taxation - 8 Tax Remedies Under NIRCDokument34 SeitenTaxation - 8 Tax Remedies Under NIRCcmv mendoza100% (3)

- Taxation - 7 Tax Remedies Under LGCDokument3 SeitenTaxation - 7 Tax Remedies Under LGCcmv mendozaNoch keine Bewertungen

- Remedies Under Local Government CodeDokument15 SeitenRemedies Under Local Government Codecmv mendoza100% (3)

- N I Act EsaayDokument55 SeitenN I Act Esaayynarsale100% (2)

- Notice To Vacate To Tenants of Rented PremisesDokument12 SeitenNotice To Vacate To Tenants of Rented PremisesAndrewMihelakisNoch keine Bewertungen

- Motion For HDODokument3 SeitenMotion For HDOInean Tolentino100% (1)

- Customs Brokers Desiring To Engage in Customs Brokers Practice."Dokument5 SeitenCustoms Brokers Desiring To Engage in Customs Brokers Practice."Jonah FlorendoNoch keine Bewertungen

- Juvenile Justice System Acm NotesDokument4 SeitenJuvenile Justice System Acm NotesAerylle GuraNoch keine Bewertungen

- Sample Deed NovationDokument7 SeitenSample Deed NovationFatima PascuaNoch keine Bewertungen

- 069-Islamic Directorate of The Philippines vs. CA 272 Scra 454Dokument9 Seiten069-Islamic Directorate of The Philippines vs. CA 272 Scra 454wewNoch keine Bewertungen

- Lesson 2: (Philippine Politics and Governance)Dokument43 SeitenLesson 2: (Philippine Politics and Governance)Dee Cyree RusiaNoch keine Bewertungen

- REYES, Petitioner, v. ASUNCION, RespondentDokument2 SeitenREYES, Petitioner, v. ASUNCION, RespondentKatrina Ysobelle Aspi HernandezNoch keine Bewertungen

- Cesario Ursua Case DigestDokument2 SeitenCesario Ursua Case DigestellochocoNoch keine Bewertungen

- Shariah Under Bol - AttysalendabDokument18 SeitenShariah Under Bol - AttysalendabAyla Herazade SalendabNoch keine Bewertungen

- A Review of Child Sexual Abuse in Pakistan Based On Data From "Sahil" OrganizationDokument7 SeitenA Review of Child Sexual Abuse in Pakistan Based On Data From "Sahil" OrganizationshinesheryNoch keine Bewertungen

- One Hundred (100) Multiple Choice Questions: TopicDokument3 SeitenOne Hundred (100) Multiple Choice Questions: TopicZeus GamoNoch keine Bewertungen

- Marc II Marketing, Inc. vs. Alfredo M. JosonDokument1 SeiteMarc II Marketing, Inc. vs. Alfredo M. JosonDirect LukeNoch keine Bewertungen

- Child Protection 2019 TemplateDokument14 SeitenChild Protection 2019 TemplateGlenda Manalo CochingNoch keine Bewertungen

- Karvy Itt ProjectDokument8 SeitenKarvy Itt Projectdeepti ranjan sahooNoch keine Bewertungen

- Ethics ExercisesDokument3 SeitenEthics ExercisesArnould MalayaoNoch keine Bewertungen

- Publish United States Court of Appeals For The Tenth CircuitDokument51 SeitenPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNoch keine Bewertungen

- P 634Dokument29 SeitenP 634Rachna YadavNoch keine Bewertungen

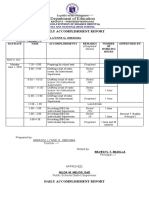

- Department of Education: Daily Accomplishment ReportDokument10 SeitenDepartment of Education: Daily Accomplishment ReportMirasolLynneCenabre-QuilangObsiomaNoch keine Bewertungen

- Family Code of The Republic of MoldovaDokument3 SeitenFamily Code of The Republic of MoldovaStefania SpeianuNoch keine Bewertungen

- 085 Lawandyou Law PDFDokument4 Seiten085 Lawandyou Law PDFKhuvindra Kevin MataiNoch keine Bewertungen

- Partnership - Chapter 1 and 2Dokument15 SeitenPartnership - Chapter 1 and 2Jill Ann JoseNoch keine Bewertungen

- Audience Solutions Agreement: Powered byDokument2 SeitenAudience Solutions Agreement: Powered byleeroopNoch keine Bewertungen

- Complaint: Republic of The Philippines Fourth Judicial Region Municipal Trial Court BRANCH - Rosario, BatangasDokument6 SeitenComplaint: Republic of The Philippines Fourth Judicial Region Municipal Trial Court BRANCH - Rosario, BatangasaldehNoch keine Bewertungen

- National Development Company Vs Cebu CityDokument2 SeitenNational Development Company Vs Cebu CityHappy Kid100% (1)

- The Institution of The Ombudsman in Africa With Special Reference To ZimbabweDokument19 SeitenThe Institution of The Ombudsman in Africa With Special Reference To ZimbabweHemantVerma100% (1)

- B.H Berkenkotter Vs Cu UnjiengDokument2 SeitenB.H Berkenkotter Vs Cu UnjiengDenDenciio Barćelona100% (1)

- 5 Years Program Detailed Curriculum 2014 PDFDokument106 Seiten5 Years Program Detailed Curriculum 2014 PDFInder singhNoch keine Bewertungen

- Perez vs. LPG Refillers Association of The Philippines, Inc.Dokument6 SeitenPerez vs. LPG Refillers Association of The Philippines, Inc.acolumnofsmokeNoch keine Bewertungen