Beruflich Dokumente

Kultur Dokumente

Risk & Value Magt in Banks

Hochgeladen von

rk7570Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Risk & Value Magt in Banks

Hochgeladen von

rk7570Copyright:

Verfügbare Formate

Banking and Finance

Risk & Value Management in Banks

This article highlights the scope and objectives of risk management system in banks and the steps involved in transforming risk management from the traditional control oriented process into a value adding function. It also stresses the significance of integrated risk management in achieving the value addition and the role of capital as cushion for risk taking as pronounced by the recent Basel capital accord. The conclusions drawn are significant for banks in India as they are going to implement the Basel capital standards.

he business of banking today is synonymous with active risk management than it was ever before. The success and failure of a banking institution heavily depends on the strength of the risk management system in the current environment. This is true as the very business of banking is risk-taking as an intermediary, i.e. interposing between savers (depositor) on one hand and the borrower on the other hand, thereby accepting the risks of intermediation. With the rapid development of public capital markets worldwide, there has been a steady reduction in the dependence of borrowers on the banking system for funding their activities. This disintermediation, not only by the borrowers but also by the bank depositors directly investing their funds in capital market instruments, has caused a significant change in the business of banking. To arrest the fall in customer business and base owing to disintermediation, banks have entered into a host of fee-based services such as cash management, funds transfer, etc., capital market activities such as merchant banking, public issue management, private placement of issues and advisory services to diversify from fund-based to fee-based activities. Another outcome of disintermediation is the rapid growth in the size of investment portfolio of banks over a period

- Dr. V. Subramanian

of time at the cost of advances portfolio, which can be attributed to various other reasons apart from disintermediation, thereby changing the complexion of banking risks. Over a period of time, the return from the businesses of lending, investments and fee- based services have come down due to competition both from within and outside the industry. To counter this, the latest in the array of new products is the provision of specialised services by structuring products to meet the unique requirements of corporate customers and also to high net worth individual clients for improving fee income. The scope of the business of structuring products has widened to a significant level with the introduction of derivative products in the markets. The net result of all the above developments is a metamorphic change in the risk and return profile compared to the past.

Risk Management: Meaning and Scope

Though the term risk has got different connotations from different angles, it can be defined as the potential that events, expected or unexpected, may have an adverse impact on a banks earnings or capital or both. It is useful to recall at this stage that risk and expected return are positively related; higher the risk, higher the expected return and vice versa. The scope of risk management function in any organisation is to ensure that systems and processes are set up and they function in accordance with the risk management policy of the institution.

(The author is Principal Consultant Risk Management, Misys International Financial Systems, Bangalore. He can be reached at subbuv2005@gmail.com)

July 2006 The Chartered Accountant

123

Banking and Finance

Objectives of Risk Management

The very basic objective of risk management system is to put in place and operate a systematic process to give a reasonable degree of assurance to the top management that the ultimate corporate goals that are vigorously pursued by it would be achieved in the most efficient manner. In this way, all the risks that come in the way of the institution achieving the goals it has set for itself would be managed properly by the risk management system. In the absence of such a system, no institution can exist in the long run without being able to fulfil the objectives for which it was set up.

trading day in accordance with global best practice, losses in the trading book translate into losses in P&L on a daily basis.

l

Liquidity Risk is the risk of being unable to meet the commitments to pay as they arise. This inability could be due to difficulty experienced in selling the securities in the trading book or drying up of sources of finance in times of need or both. Liquidity risk is intricately related to credit, interest rate and market risks. Operational Risk is non-financial risk arising out of operations, deployment of technology, people, systems, etc. Defining precisely operational risk is important but difficult as it is caused by multiple factors ranging from weak internal control system to natural disaster. Operational risk is caused both by high probability, low impact events and low probability, high impact events. While the former are day-to-day events such as data entry error leading to minor losses and are more predictable, the latter are events such as 9/11, threatening the very survival and are the most difficult ones to predict. Operational risk is related to other risks in a very complex manner making it very difficult to decipher.

Categories of Risks

l

Credit Risk is risk of non-performance by borrower or counter-party to a trade or any other transaction. Though it is well known to banks, formal measurement at individual and portfolio level require dependable data on counter-party default in the past and recovery made in the event of such default. The degree to which default by one borrower is related to default by other borrowers in the loan portfolio is the most important input for portfolio level modelling of credit risk.

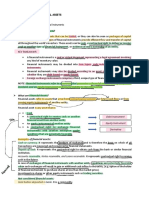

Interest Rate Risk is risk of interest rate Steps in Risk Management fluctuation in case of assets and liabilities in the banking book. As interest rates change 1. Risk Identification: It is crucial that all the risks have to be identified first. The in an unexpected manner, fluctuations methodology normally followed is the risk in interest income and interest expenses matrix approach which appears as under: cause the net interest income (NII), to be volatile. As NII is the top line, NII Risk Matrix (Indicative) volatility would be translated into volatility in net profit and Products Credit Interest Market Liquidity Operational Risk Rate Risk Risk Risk Risk other measures of earnings YES YES NO YES YES performance. Volatility in Loans & Advances NII captures only the short- Investments YES YES YES YES YES term impact of interest rate Cash Management & NO NO NO NO YES Payment Services changes. Market Risk is risk of adverse Deposits movement in prices of assets and liabilities in the trading book. As trading book is required to be valued on each

NO YES NO YES YES

The matrix above has been prepared for main products. The matrix can be detailed to go

124 The Chartered Accountant July 2006

Banking and Finance

down to individual product level risks for better identification of the risks present. 2. Risk Measurement: This step is the most crucial step of all. Having identified the risks, tools for measurement of each one of the risks need to be put in place to measure each one of the risks quantitatively. The most challenging task is the selection of an appropriate tool or measure for quantification of risks. The measures of quantification range from very simple to highly complex. What is important is to use an appropriate quantification method or tool suitable for the bank. 3. Risk Control & Monitoring: It deals with setting up of limits to each one of the risks and monitoring to ensure that the actual exposure to each one of the risks defined is within the limits prescribed in the risk management policy. Any violation of limits needs to be thoroughly investigated to ascertain the reasons for violation and to avoid such violations in future. The traditional control based risk management ends with the above-mentioned steps. The modern risk management, which strives to align risk management with overall corporate objectives and strategies, involves two additional steps in the form of capital allocation and risk adjusted performance measurement.

called as SWM measures, consider both the return and risk in its framework and are superior to the accounting measures in a number of ways. The following description explains the relationship between the expected return, actual return and addition to shareholder wealth in a given time period:

l l l

AR > ER: Addition to existing wealth of shareholders AR < ER: Destruction of existing wealth of shareholders AR = ER: Maintenance of existing wealth of shareholders Where

AR = Actual Rate of Return on Shareholders Capital ER = Expected Rate of Return on Shareholders Capital As it can be seen, wealth maximisation takes place only when the actual return is higher than the expected return. Actual return for this purpose is an economic measure, not an accounting measure. The term expected return denotes the rate of return expected by the shareholders for the level of risk they are exposed to in their investment. There are a number of approaches to estimating the expected return such as Capital Asset Pricing Model (CAPM), Arbitrage Pricing Theory (APT), etc. There has been a shift gradually from accounting based measures to SWM measures in many industries. Banking industry is not an exception to this. The most popular SWM measure in the banking industry is Risk Adjusted Return On Capital (RAROC) and its variants. RAROC has in its numerator the return earned and capital allocated in its denominator. Given the importance of SWM measures, the traditional control oriented risk management system should pave the way for value based risk management system. In order to achieve this, the following two steps need to be added to the

From Risk Management to Value Management

The subject of finance suggests that the ultimate objective of any commercially oriented enterprise is shareholder wealth maximisation. This means that all the decisions should be towards maximising the market value of equity shares traded in the market in the long run. Accounting measures of performance evaluation such as Net Profit Margin, Return on Assets, Return on Equity, Earnings per Share, etc. are at best useless as they are only return measures. They do not consider the actual risk taken to earn the return earned. The measures of shareholder wealth maximisation, broadly

July 2006 The Chartered Accountant

125

Banking and Finance

existing list of steps in risk management: 1. Capital Allocation: Under this step, activities of a bank would be broken down to various major businesses, such as retail banking, corporate banking, government business, proprietary trading, etc. Each one can be viewed as a Strategic Business Unit (SBU) with targets of return performance. Each one of the SBUs is allocated a portion of the banks equity capital. The allocation of capital is based on the contribution of each SBU to various risks of the bank. Higher the contribution of an SBU to the risk of the bank, higher will be the capital allocated. 2. Risk-adjusted Performance Measurement: Having allocated capital to each SBU commensurate with its contribution to the overall risk of the bank, a target return on the capital allocated needs to be set. The question of whether the target return to be achieved by each SBU is the same bank level target or is different for each SBU dependent upon risk contribution is the most contentious issue occupying the attention of the risk management community.

stocks when wrong allotments were made due to errors in the software used by the registrar of the issue. When risks are interrelated strongly, managing each one of them under a silo approach can lead to losing the focus on interrelationship as each one of the risk management functions would be concentrating only on a particular risk. To prevent this leakage, the RBI has suggested that banks should move towards an integrated risk management system in which the mentioned interrelationships are analysed prior to ascertaining the impact of risks. The current risk management

In the Basel AccordII, sweeping changes have been suggested for the computation of capital adequacy as Basel AccordI miserably failed to achieve its objective of promoting safety and soundness of the financial system.

practices under the silo approach do not pave the way for identifying such a tool. This means that there is a need for a thorough overhauling of the entire risk management system rather than merely making cosmetic changes to the existing system.

Integration of Risks Leading to EWRM System

Each one of the risks is interrelated to the other. It has been observed that one type of risk can transform itself into some other type, if not managed properly thereby causing losses to the bank. For example, it has been generally observed that when interest rates go up in the economy, the credit risk also increases as increase in the interest rates on loan increases the burden of the borrower, thereby impacting adversely the ability of the borrower to pay. Similarly, the market risk and liquidity risk are highly interrelated. It has been witnessed that when the markets crash, the liquidity of the traded securities in the markets dries up drastically. The recent example in the Indian market highlighting the interrelationship between operational risk and market risk (of adverse price change) was the fall in market value of ONGC

126 The Chartered Accountant July 2006

Requirements for An Effective Risk Management System

The Basel Committee on Banking Supervision has set out the requirements for an effective risk management system as under:

l l l l l

Well-informed Board of Directors and Oversight of Board Capable management Adequate risk management policies and processes High quality MIS for risk management and Appropriate staffing of the risk management function The job of the board is to establish banks

Banking and Finance

strategic direction and define risk tolerances for various types of risk. The risk management policies and standards need to be approved by the board. The senior management of the bank is responsible for implementation, integrity and maintenance of the risk management system.

to develop their own approach to measuring risks, are validating the internal approach and ensuring consistency across banks. Pillar 2: Supervisory Review Process: This puts responsibility on the bank supervisors to ensure that banks follow rigorous processes, measure their risk exposures correctly and maintain capital in accordance with risk exposure. The recent initiatives of the RBI in the introduction of Risk Based Supervision and Risk Based Internal Audit are in conformity with this pillar. Pillar 3: Market Discipline: This aims to strengthen the safety and soundness of the banking system through better disclosure of risk exposures and capital maintained. This is expected to help the market participants to better assess the position of banks.

Banking Risks & Capital Accords

The extent of risk taken by a bank and the amount of capital required to be maintained by the bank for such risk-taking is all about capital adequacy standards. Prior to the implementation of the Basels first capital accord in the beginning of the 1990s, there was no relationship between capital and risk taking. Banking business, being one of the highly levered businesses, is significantly prone to shocks. Moreover, banking business is the business of public confidence. If public confidence erodes, it becomes difficult for a bank to be in business. Basel Committee, with a view to protecting banks from vulnerabilities and to maintain financial stability, recommended a minimum capital to risk-weighted assets ratio, thereby limiting the risk exposure to availability of capital. Initially, the capital accord recognised only credit risk. Subsequently, the market risk was also brought under the capital accord. Recently in the Basel AccordII, sweeping changes have been suggested for the computation of capital adequacy as Basel AccordI miserably failed to achieve its objective of promoting safety and soundness of the financial system. Apart from credit and market risks, the operational risk would also require minimum capital to be maintained under Basel AccordII. To achieve the objectives above, Basel Committee proposed a three-pillared framework as under: Pillar 1: Minimum Capital Requirements: Under this, as in the current accord, a minimum capital has been prescribed to be maintained. To arrive at the capital for various types of risks, a number of approaches, widely classified as standardised approach and internal approach, have been prescribed. The critical issues in the internal approach in which the banks are free

Conclusion

Risk management is a crucial function in todays environment of heightened volatility. It reduces the cost of distress and aims at strengthening the decision making process for an optimum risk-return trade-off. Risk management does not prevent taking risks. Taking risks consciously is the only way to improve the expected returns to the shareholders. The accounting measures of performance are at best useless from the perspective of risk management. As a number of risks are highly interrelated to each other, a compartmentalised approach to risk management would be a disaster. What is required is an enterprise-wide risk management system leading to capital allocation to the businesses within the bank and risk adjusted performance measurement both at bank level and at lower levels such as business units within the bank. This would enable the transformation of risk management function from a merely control oriented one to that of adding value to the business of banks. Indian banks have to take a cue from these developments as they would be implementing the Basel accord in the near future. They must strive for improving capital efficiency rather than merely fulfilling the regulatory requirement of capital adequacy. r

July 2006 The Chartered Accountant 127

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Fiscal ConsolidationDokument30 SeitenFiscal ConsolidationKapil ChoudharyNoch keine Bewertungen

- Data Mining: A Competitive Tool in The Banking and Retail IndustriesDokument7 SeitenData Mining: A Competitive Tool in The Banking and Retail Industriesrk7570Noch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Forward Contract 6Dokument5 SeitenForward Contract 6rk7570Noch keine Bewertungen

- Chapter 7 Special Purpose Vehicle: 7.1 ConceptDokument13 SeitenChapter 7 Special Purpose Vehicle: 7.1 Conceptsimple_aniNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Price Elasticity of Demand (PED) : Price. PED (Of A Product) % Change in Quantity Demanded / % Change in PriceDokument4 SeitenPrice Elasticity of Demand (PED) : Price. PED (Of A Product) % Change in Quantity Demanded / % Change in PriceHmzaa Omer PuriNoch keine Bewertungen

- Karvy ReportDokument51 SeitenKarvy ReportAbhishek rajNoch keine Bewertungen

- Foreign Exchange & Its ParticipantsDokument2 SeitenForeign Exchange & Its ParticipantsSK Lashari100% (1)

- ALFM Peso Bond FundDokument2 SeitenALFM Peso Bond FundkimencinaNoch keine Bewertungen

- Finance QuizDokument2 SeitenFinance QuizSatyajitNoch keine Bewertungen

- A Study On Performance Evaluation of MutDokument5 SeitenA Study On Performance Evaluation of MutAvanthika DeyNoch keine Bewertungen

- International Finance - Interest Rate ParityDokument17 SeitenInternational Finance - Interest Rate ParityMileth Xiomara Ramirez GomezNoch keine Bewertungen

- Financial Statement AnalysisDokument24 SeitenFinancial Statement AnalysisDawn Zoleta100% (1)

- Event Driven Investing PDFDokument2 SeitenEvent Driven Investing PDFBartNoch keine Bewertungen

- Hilega Milega TradingDokument8 SeitenHilega Milega Tradingmaurya.vikas11111Noch keine Bewertungen

- JPMorgan BearStearns QuestionsDokument2 SeitenJPMorgan BearStearns QuestionsShubham KumarNoch keine Bewertungen

- Entrepreneurial FinancialDokument11 SeitenEntrepreneurial FinancialTya NwsNoch keine Bewertungen

- Valuation of Merger ProposalDokument21 SeitenValuation of Merger ProposalKARISHMAATA2100% (2)

- History and Definition of ENGRO RUPIYADokument10 SeitenHistory and Definition of ENGRO RUPIYAZeeshan MehdiNoch keine Bewertungen

- Gaurav AgarwalDokument37 SeitenGaurav AgarwalShashankPandeyNoch keine Bewertungen

- Seventeenth Edition: Implementing Strategies: Finance and Accounting IssuesDokument22 SeitenSeventeenth Edition: Implementing Strategies: Finance and Accounting IssuesGrace GunawanNoch keine Bewertungen

- Books-Investing in Stock MarketsDokument2 SeitenBooks-Investing in Stock MarketsRitesh TiwariNoch keine Bewertungen

- ICTSI: Terms of Share IssuanceDokument3 SeitenICTSI: Terms of Share IssuanceBusinessWorldNoch keine Bewertungen

- Collection of Pitch Decks From Venture Capital Funded StartupsDokument22 SeitenCollection of Pitch Decks From Venture Capital Funded StartupsAlan Petzold50% (2)

- StrategiesDokument4 SeitenStrategiesRajaNoch keine Bewertungen

- Intoduction To Financial Assets and Financial Assets at Fair ValueDokument11 SeitenIntoduction To Financial Assets and Financial Assets at Fair ValueKin Lee100% (2)

- Fundamental Equity Analysis & Analyst Recommendations - STOXX Europe Mid 200 Index ComponentsDokument401 SeitenFundamental Equity Analysis & Analyst Recommendations - STOXX Europe Mid 200 Index ComponentsQ.M.S Advisors LLCNoch keine Bewertungen

- Credit RatingDokument18 SeitenCredit Ratingrameshmba100% (10)

- VC Fund With An Accelerator - Key TermsDokument4 SeitenVC Fund With An Accelerator - Key TermsAnte MaricNoch keine Bewertungen

- Test 1 W AnswersDokument8 SeitenTest 1 W AnswersVaniamarie VasquezNoch keine Bewertungen

- Audit of Shareholders EquityDokument5 SeitenAudit of Shareholders EquityAldwin LlevaNoch keine Bewertungen

- Internal Audit of DPDokument9 SeitenInternal Audit of DPAlpa ShahNoch keine Bewertungen

- PolandDokument4 SeitenPolandiwanowskaksenia16Noch keine Bewertungen

- Chap 12 - Cost of Capital - EditedDokument17 SeitenChap 12 - Cost of Capital - EditedRusselle Therese Daitol100% (1)