Beruflich Dokumente

Kultur Dokumente

USA v. Richard Gray Sr.

Hochgeladen von

nphillips0304Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

USA v. Richard Gray Sr.

Hochgeladen von

nphillips0304Copyright:

Verfügbare Formate

Case: 4:12-cv-00006-RWS Doc.

#: 1

Filed: 01/03/12 Page: 1 of 11 PageID #: 1

United States District Court for the Eastern District of Missouri United States of America, Plaintiff, v. Richard Gray, Sr., Defendant. ) ) ) ) ) ) ) ) )

Case No.

Complaint The United States of America alleges against Richard Gray, Sr. (Gray), as follows: 1. This is a civil action brought by the United States under 7402(a), 7407, and 7408

of the Internal Revenue Code (26 U.S.C.) (I.R.C.) to enjoin Richard Gray, Sr., and anyone in active concert or participation with him, from directly or indirectly: (a) Acting as a federal tax return preparer or requesting, assisting in, or directing the preparation or filing of federal tax returns, amended returns, or other related documents or forms for other persons; Advising, assisting, counseling, or instructing anyone about the preparation of a federal tax return; Engaging in any other activity subject to penalty under I.R.C. 6694, 6695, 6701, or any other penalty provision in the I.R.C.; or Otherwise engaging in any conduct that substantially interferes with the proper administration and enforcement of the Internal Revenue laws. Jurisdiction and Venue 2. This action has been requested by the Chief Counsel of the Internal Revenue

(b)

(c)

(d)

Service, a delegate of the Secretary of the Treasury, and commenced at the direction of a delegate of the Attorney General, pursuant to the provisions of I.R.C. 7402(a), 7407, and 7408.

Case: 4:12-cv-00006-RWS Doc. #: 1

Filed: 01/03/12 Page: 2 of 11 PageID #: 2

3. 4.

Jurisdiction exists under 28 U.S.C. 1340 and 1345 and I.R.C. 7402(a). Venue is proper in this Court under 28 U.S.C. 1391(b)(1) and (b)(2). Grays Background

5.

Gray works on the production line at a Chrysler plant in Kokomo, Indiana. The

Chrysler plant experiences sporadic shutdowns due to production demand so Gray maintains a temporary residence in Kokomo where he stays when the plant is operational. Gray spends the remainder of the year at his home in St. Louis, Missouri. 6. Gray operates a tax return preparation business from his home in St. Louis.

His customers include family, friends, neighbors, and co-workers. He advertises his tax return preparation services by word of mouth. 7. Gray has no formal training in tax law or tax return preparation and prepares tax

returns for others using Turbo Tax computer software. Gray told an IRS agent that he relies on the questions asked by the Turbo Tax software when preparing returns. 8. 9. In 2009, 134 electronically-filed tax returns were traced to Grays IP address. Gray intends to prepare tax returns full-time when he retires from Chrysler. Grays Deceptive Conduct 10. 11. Gray generally receives between $20-$100 for preparing a tax return. Gray fails to report the income he earns from his tax return preparation business on

his own individual income tax returns. 12. Gray claims he accepts only gratuities for his return preparation services, and

therefore, he is not required to report the money he receives as income. This contradicts wellsettled law establishing that tips and/or gratuities constitute taxable income. Line 7 of the IRS -2-

Case: 4:12-cv-00006-RWS Doc. #: 1

Filed: 01/03/12 Page: 3 of 11 PageID #: 3

Form 1040 (Individual Income Tax Return) specifically requires taxpayers to list Wages, salaries, tips, etc. as income (emphasis added). 13. Gray does not sign the returns he prepares for others as the paid preparer to avoid

detection as the paid preparer. 14. In some cases, Gray instructs the IRS to deposit his customers refunds directly into

his own personal checking account, which he lists on lines 74b and 74d of the customers tax returns. Upon information and belief, Gray generally remits a portion of this money to his customers and keeps the remainder as a fee for his services. 15. One of Grays customers stated that she never received her 2006 refund despite

records showing that her refund was deposited into Grays checking account. Gray Creates Bogus Schedule C Businesses and Claims False Deductions 16. Gray prepares federal income tax returns containing sham Schedule C businesses

and then reports bogus deductions on the Schedules C to create phony losses. Grays action result in the understatement of those customers tax liabilities. 17. On a customers 2005 and 2006 tax returns, Gray claimed bogus deductions for a

fictitious day care business. The customer told an IRS agent that she occasionally babysat for friends and family, but never considered herself the owner of a day care business. 18. On another customers 2006 return, Gray prepared a sham Schedule C for a fake

automotive repair business. Gray then generated a business loss by claiming false deductions on the Schedule C and used the loss to offset the taxpayers income, thereby improperly reducing the customers tax liability. During an audit, this customer told the IRS that he never told Gray he owned an automotive repair business. He only provided Gray with a Form W-2 for wage income.

-3-

Case: 4:12-cv-00006-RWS Doc. #: 1

Filed: 01/03/12 Page: 4 of 11 PageID #: 4

Gray Abuses the Earned Income Tax Credit 19. Gray commonly abuses the earned income tax credit (EITC) to obtain refunds for

his customers to which they are not entitled. 20. The EITC is a refundable tax credit available to certain low-income individuals.

The amount of the credit is based on the taxpayers income, filing status, and claimed number of dependents. The requirements for claiming the EITC are located in 26 U.S.C. 32. 21. Because the EITC is a refundable credit, claiming it can reduce a taxpayers

federal tax liability below zero, entitling the taxpayer to a refund from the U.S. Treasury. 22. Due to the method used to calculate the EITC, an individual can claim a larger

EITC by claiming multiple dependants. For certain income ranges, individuals with higher annual incomes are entitled to a larger credit than those with lower annual incomes. 23. Unscrupulous tax return preparers like Gray exploit the rules by claiming bogus

dependants on their customers returns and/or by minting phony Schedule C businesses to generate non-existent income. 24. 25. Gray knows that customers claiming more dependents are entitled to a larger EITC. Furthermore, Gray knows that once a taxpayer qualifies for the EITC, up until a

certain point, the more income the taxpayer has, the larger the EITC will be. 26. To maximize the EITC for one customer, Gray offered to sell her a random childs

social security number so that she could claim that child as a dependent on her tax return. 27. For another customer, Gray prepared a bogus Schedule C claiming the customer

earned income from an adult day care business, when in fact she did not. The income allowed the taxpayer to generate a larger refund on her return. -4-

Case: 4:12-cv-00006-RWS Doc. #: 1

Filed: 01/03/12 Page: 5 of 11 PageID #: 5

Harm Caused by Gray 28. Grays motive is to secure relatively large refunds for his customers in order to

attract, retain and grow his tax return preparation business. 29. Grays conduct harms the United States and the public fisc because his customers

under-report their correct tax liabilities and in many cases receiving unwarranted refunds. 30. 31. As stated above, Gray prepared at least 134 federal income tax returns in 2009. The IRS examined 20 returns prepared by Gray and found an average deficiency of

$3,800 per return. 32. Extending the average tax deficiency of $3,800 by the approximate 134 returns

prepared in 2009 results in a total tax loss of over $500,000 due to Grays misconduct. 33. Many of Grays customers who have been audited by the IRS have admitted that the

items claimed on their tax returns are not based upon any information they provided to Gray, nor did Gray ask for any documentation to support the information. 34. In many cases, Gray falsifies the information on his own volition and does not allow

the customer to review the return before he electronically files it with the IRS. 35. Grays customers have been harmed because they paid him substantial return

preparation fees (upwards of $100) and relied on him to prepare proper tax returns. 36. Instead, Gray prepares returns that substantially understate their correct tax

liabilities. Now, many customers may face large income tax deficiencies, including sizeable penalties and interest.

-5-

Case: 4:12-cv-00006-RWS Doc. #: 1

Filed: 01/03/12 Page: 6 of 11 PageID #: 6

37.

Gray further harms the United States because the IRS must devote limited resources

to identifying Grays customers, ascertaining their correct tax liabilities, recovering any refunds erroneously issued, and collecting any additional taxes and penalties. 38. Grays activities also undermine public confidence in the administration of the

federal tax system and encourage noncompliance with tax laws. Count I Injunction Under 7407 for Conduct Subject to Penalty Under 6694 and 6695 39. 40. Plaintiff incorporates by reference the allegations in paragraphs 1 through 38. Section 7407 of the Code authorizes the United States to seek an injunction against

any tax preparer who, among other things, has engaged in any conduct subject to penalty under I.R.C. 6694 and 6695. 41. If a return preparers conduct is continual and/or repeated and the Court finds that a

narrower injunction (i.e., prohibiting specific enumerated conduct) would not be sufficient to prevent the preparers interference with the proper administration of federal tax laws, the Court may enjoin the person from acting as a return preparer. 42. Section 6694(b) of the Code penalizes a tax return preparer who prepares a return

or claim for refund with respect to which any part of an understatement of liability is due to: a. a willful attempt to understate the liability for tax on the return or claim or b. a reckless or intentional disregard of rules or regulations. 43. As demonstrated in the examples above, by preparing sham Schedules C and

promoting the use of bogus dependents, Gray willfully understates his customers proper tax liabilities and shows an utter and intentional disregard of the internal revenue laws. -6-

Case: 4:12-cv-00006-RWS Doc. #: 1

Filed: 01/03/12 Page: 7 of 11 PageID #: 7

44.

Injunctive relief is necessary to prevent Grays continued misconduct because

absent an injunction Gray intends prepare tax returns full-time after retiring from Chrysler. 45. Allowing Gray to continue prepare tax returns will enable his customers to receive

greater refunds than what they are legitimately entitled, thereby diminishing the public fisc. 46. Section 6695(b) of the Code penalizes a tax return preparer for failing to sign a

return. Gray never signs the returns he prepares for others as their paid preparer. As a result, the IRS must spend considerable resources just to ascertain the scope of Grays return preparation business. 47. Gray should be permanently enjoined under 26 U.S.C. 7407 from acting as a

tax return preparer because a more limited injunction would be insufficient to stop his interference with the proper administration of the tax laws or to deter his penalty conduct. Penalties and other administrative measures are insufficient to deter his conduct. Only the threat of criminal contempt will deter Grays conduct. Count II Injunction under I.R.C. 7408 for Conduct Subject to Penalty Under 6701 48. 49. Plaintiff incorporates by reference the allegations in paragraphs 1 through 47. Section 7408 of the Code authorizes a district court to enjoin any person from

engaging in conduct subject to penalty under either I.R.C. 6701 if injunctive relief is appropriate to prevent recurrence of such conduct. 50. Section 6701(a) of the Code penalizes any person who aids or assists in, procures,

or advises with respect to the preparation or presentation of a federal tax return, refund claim, or other document knowing (or having reason to believe) that it will be used in connection with any -7-

Case: 4:12-cv-00006-RWS Doc. #: 1

Filed: 01/03/12 Page: 8 of 11 PageID #: 8

material matter arising under the internal revenue laws and knowing that if it is so used it will result in an understatement of another persons tax liability. 51. Gray prepares tax returns containing sham Schedule C businesses and uses these

Schedules C to claim improper deductions in order to generate refunds for customers beyond which they are legitimately entitled. 52. Gray willingly aids and assists customers in filing tax returns with sham Schedule C

businesses knowing this will result in customers understating their tax liability and receiving unwarranted refunds. 53. If the Court does not enjoin Gray, he will likely to continue to engage in conduct

subject to penalty under I.R.C. 6701. 54. Injunctive relief is therefore appropriate under I.R.C. 7408. Count III Injunction under I.R.C. 7402(a) Necessary to Enforce the Internal Revenue Laws 55. 56. Plaintiff incorporates by reference the allegations in paragraphs 1 through 54. Section 7402 of the Code authorizes a district court to issue orders of injunction as

may be necessary or appropriate for the enforcement of the internal revenue laws. 57. Gray, through the actions described above, has engaged in conduct that substantially

interferes with the enforcement of the internal revenue laws. 58. Unless enjoined, Gray is likely to continue to engage in such improper conduct and

interfere with the enforcement of the internal revenue laws. If Gray is not enjoined from engaging in this fraudulent and deceptive conduct, the United States will suffer irreparable injury by wrongfully issuing tax refunds in amounts beyond which his customers are legitimately entitled. -8-

Case: 4:12-cv-00006-RWS Doc. #: 1

Filed: 01/03/12 Page: 9 of 11 PageID #: 9

59.

Enjoining Gray is in the public interest because an injunction, backed by the Courts

contempt powers if needed, will stop Grays illegal conduct and the harm it causes the United States and his customers, current and prospective. 60. The Court should impose injunctive relief under 26 U.S.C. 7402(a).

WHEREFORE, the United States of America prays for the following: A. That the Court find that Richard Gray, Sr., has continually and repeatedly engaged

in conduct subject to penalty under I.R.C. 6694 and 6695, and has continually and repeatedly engaged in other fraudulent or deceptive conduct that substantially interferes with the administration of the tax laws, and that a narrower injunction prohibiting only this specific misconduct would be insufficient; B. That the Court, pursuant to I.R.C. 7407, enter a permanent injunction prohibiting

Richard Gray, Sr., from acting as a federal tax return preparer; C. That the Court find that Richard Gray, Sr., has engaged in conduct subject to a

penalty under I.R.C. 6701, and that injunctive relief under I.R.C. 7408 is appropriate to prevent a recurrence of that conduct. D. That the Court find that Richard Gray, Sr., has engaged in conduct that interferes

with the enforcement of the internal revenue laws, and that injunctive relief is appropriate to prevent the recurrence of that conduct pursuant to the Courts inherent equity powers and I.R.C. 7402(a);

-9-

Case: 4:12-cv-00006-RWS Doc. #: 1

Filed: 01/03/12 Page: 10 of 11 PageID #: 10

E.

That the Court, pursuant to I.R.C. 7402(a), 7407, and 7408, enter a permanent

injunction prohibiting Richard Gray, Sr., and all those in active concert or participation with him, from: (1) Acting as a federal tax return preparer or requesting, assisting in, or directing the preparation or filing of federal tax returns, amended returns, or other related documents or forms for any person or entity other than himself; Advising, assisting, counseling, or instructing anyone about the preparation of a federal tax return; Engaging in any other activity subject to penalty under I.R.C. 6694, 6701, or any other penalty provision in the I.R.C.; or Otherwise engaging in any conduct that substantially interferes with the proper administration and enforcement of the Internal Revenue laws.

(2)

(3)

(4)

F.

That the Court require Gray, within 60 days of the date of the Courts Order, to mail

an executed copy of the Stipulated Final Judgment of Permanent Injunction to all persons for whom he has prepared a federal tax return or form since January 1, 2009. The mailing shall include a cover letter in a form agreed to by counsel for the United States or approved by the Court, and shall not include any other documents or enclosures except those specifically mentioned herein. G. That the Court require Gray, to produce to counsel for the United States, within 45

days of the Courts Order, a list that identifies by name, social security number, address, e-mail address, and telephone number and tax period(s) all persons for whom he has prepared a federal tax return or form since January 1, 2009;

- 10 -

Case: 4:12-cv-00006-RWS Doc. #: 1

Filed: 01/03/12 Page: 11 of 11 PageID #: 11

H.

That the Court require Gray, within 65 days of the date of the Court's Order, to file

with the Court a sworn certificate stating that he has complied with the requirements set forth in Paragraphs F and G. I. That the Court retain jurisdiction over Gray, and over this action, to enforce any

permanent injunction entered against him; J. That the United States be entitled to conduct discovery to monitor Grays

compliance with the terms of any permanent injunction entered against him; and K. That the Court grant the United States such other and further relief, including costs,

as is just and reasonable. Dated: January 3, 2012 Respectfully submitted, RICHARD G. CALLAHAN United States Attorney s/ Mark C. Milton MARK C. MILTON Missouri Bar No. 63101 Trial Attorney, Tax Division U.S. Department of Justice P.O. Box 7238, Ben Franklin Station Washington, D.C. 20044 Telephone: (202) 616-2904 Fax: (202) 514-6770 Email: Mark.C.Milton@usdoj.gov

- 11 -

Das könnte Ihnen auch gefallen

- Stanley Schell V Ste Genevieve CountyDokument10 SeitenStanley Schell V Ste Genevieve CountysamtlevinNoch keine Bewertungen

- Dunard Morris IndictmentDokument13 SeitenDunard Morris Indictmentnphillips0304100% (1)

- Western Appellate District On George Allen Habeas CorpusDokument51 SeitenWestern Appellate District On George Allen Habeas Corpusnphillips0304Noch keine Bewertungen

- Wheels of Soul Superseding IndictmentDokument39 SeitenWheels of Soul Superseding Indictmentnphillips0304Noch keine Bewertungen

- OBrien MTN Stay Pending AppealDokument21 SeitenOBrien MTN Stay Pending Appealnphillips0304Noch keine Bewertungen

- Boy Racer v. John Doe in Eastern MissouriDokument12 SeitenBoy Racer v. John Doe in Eastern Missourinphillips0304Noch keine Bewertungen

- Bailey v. Jeff Co DeputiesDokument15 SeitenBailey v. Jeff Co Deputiesnphillips0304Noch keine Bewertungen

- North Face MTN For Contempt 8-3-12Dokument5 SeitenNorth Face MTN For Contempt 8-3-12Nicholas PhillipsNoch keine Bewertungen

- Judge Jackson 8-17-2012 Order in Henrietta Arnold LawsuitDokument21 SeitenJudge Jackson 8-17-2012 Order in Henrietta Arnold Lawsuitnphillips0304Noch keine Bewertungen

- Roger Fidler DeclarationDokument6 SeitenRoger Fidler Declarationnphillips0304Noch keine Bewertungen

- Reade Denies Sigillito MTN For New TrialDokument31 SeitenReade Denies Sigillito MTN For New Trialnphillips0304Noch keine Bewertungen

- Hansen V CiarraDokument9 SeitenHansen V Ciarranphillips0304Noch keine Bewertungen

- Sigillito Moves For New TrialDokument9 SeitenSigillito Moves For New Trialnphillips0304Noch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- 191752Dokument135 Seiten191752Aiman HassanNoch keine Bewertungen

- CUSTOMS LAW MANUAL - NotesDokument10 SeitenCUSTOMS LAW MANUAL - NotesChetanya KapoorNoch keine Bewertungen

- Shayan - VIth Sem (R) - Roll 57 - Tax LAwDokument21 SeitenShayan - VIth Sem (R) - Roll 57 - Tax LAwShayan ZafarNoch keine Bewertungen

- Tax DigestDokument6 SeitenTax DigestJo-Al GealonNoch keine Bewertungen

- Service Charges in Commercial Property Second EditionDokument88 SeitenService Charges in Commercial Property Second EditionChris Gonzales100% (1)

- Application For Registration: Taxpayer Identification Number (TIN)Dokument4 SeitenApplication For Registration: Taxpayer Identification Number (TIN)Bernadette LeaNoch keine Bewertungen

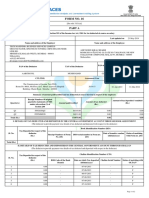

- Form No. 16: Part ADokument2 SeitenForm No. 16: Part AasifNoch keine Bewertungen

- Cloud ProfileDokument11 SeitenCloud ProfilePeter RupinaeNoch keine Bewertungen

- MBA MCQsDokument42 SeitenMBA MCQsSyed Muazzam Ali Naqvi100% (2)

- Rubio Vs CIRDokument3 SeitenRubio Vs CIRJoovs JoovhoNoch keine Bewertungen

- Budget Its CoverageDokument36 SeitenBudget Its CoveragenicahNoch keine Bewertungen

- Foundations - Tax Exempt Foundations Their Impact On Our Economy US Gov 1962 140pgs PDFDokument140 SeitenFoundations - Tax Exempt Foundations Their Impact On Our Economy US Gov 1962 140pgs PDFjulianbreNoch keine Bewertungen

- Term Paper On IbblDokument37 SeitenTerm Paper On Ibblreza786Noch keine Bewertungen

- Factors That Influence The Performance of Micro and Small Business Enterprises (A Case Study in Arbegona Town)Dokument53 SeitenFactors That Influence The Performance of Micro and Small Business Enterprises (A Case Study in Arbegona Town)Gadisa Gudina100% (1)

- The Collector of Internal Revenue vs. Suyoc Consolidated Mining Company, Et AlDokument3 SeitenThe Collector of Internal Revenue vs. Suyoc Consolidated Mining Company, Et AlDaLe AparejadoNoch keine Bewertungen

- G.R. No. L-75697 June 18, 1987 Valentin Tio vs. Videogram Regulatory BoardDokument3 SeitenG.R. No. L-75697 June 18, 1987 Valentin Tio vs. Videogram Regulatory BoardMary.Rose RosalesNoch keine Bewertungen

- Taxguru - In-Joint Development Agreement With Land Owners To Construct Residential Complex Attracts Service TaxDokument13 SeitenTaxguru - In-Joint Development Agreement With Land Owners To Construct Residential Complex Attracts Service TaxnivasshaanNoch keine Bewertungen

- Proforma Invoice 110 V1-Moh13994-NBDokument1 SeiteProforma Invoice 110 V1-Moh13994-NBTALAL TRADESNoch keine Bewertungen

- Application Form Validated: Registration DataDokument12 SeitenApplication Form Validated: Registration DataClaudiaIonitaNoch keine Bewertungen

- Quiz QuestionsDokument13 SeitenQuiz QuestionsInesNoch keine Bewertungen

- Abfrl: BirlaDokument37 SeitenAbfrl: Birlakrishna_buntyNoch keine Bewertungen

- Commission: 979197/895-HS Talha Ahmed ButtDokument1 SeiteCommission: 979197/895-HS Talha Ahmed ButtGooglo FanNoch keine Bewertungen

- Tax Invoice: KONE Elevator India Private LimitedDokument1 SeiteTax Invoice: KONE Elevator India Private LimitedSameer PatilNoch keine Bewertungen

- Hector SDokument3 SeitenHector SFerrer Benedick50% (2)

- Shell Pakistan Limited Financial Statements For The Year Ended December 31, 2010Dokument60 SeitenShell Pakistan Limited Financial Statements For The Year Ended December 31, 2010popatiaNoch keine Bewertungen

- Steve BuchheitDokument4 SeitenSteve BuchheitCulverhouse InteractiveNoch keine Bewertungen

- Guide+to+Importing+and+Exporting +Breaking+Down+the+BarriersDokument77 SeitenGuide+to+Importing+and+Exporting +Breaking+Down+the+BarriersGrand-Master-FlashNoch keine Bewertungen

- DT 0108a Employer Annual Tax Deduction Schedule v1 2Dokument1 SeiteDT 0108a Employer Annual Tax Deduction Schedule v1 2joseph borketeyNoch keine Bewertungen

- Property Case Digest IVDokument57 SeitenProperty Case Digest IVJasmin CuliananNoch keine Bewertungen

- U.S. vs. Tommy CryerDokument7 SeitenU.S. vs. Tommy CryerBetty TaylorNoch keine Bewertungen