Beruflich Dokumente

Kultur Dokumente

BBPW3203 731101125021 Financial Management II

Hochgeladen von

Veronica SadomOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

BBPW3203 731101125021 Financial Management II

Hochgeladen von

Veronica SadomCopyright:

Verfügbare Formate

FACULTY OF BUSINESS AND MANAGEMENT JANUARY SEMESTER 2011

BBPW3203 FINANCIAL MANAGEMENT II

ASSIGNMENT

Name : Alexander Yang Yee Chuan @ Richard Matrix Number : 731102125021001 NRIC : 731101-12-5021 Telephone number : 013-8569072 E-mail address : sipitang@oum.edu.com.my Learning Centre: Keningau

Overview of Dividend policy Once a company makes a profit, they must decide on what to do with those profits. They could continue to retain the profits within the company, or they could pay out the profits to the owners of the firm in the form of dividends. Once the company decides on whether to pay dividends, they may establish a somewhat permanent dividend policy, which may in turn impact on investors and perceptions of the company in the financial markets. What they decide depends on the situation of the company now and in the future. It also depends on the preferences of investors and potential investors. A company's dividend policy is the company's usual practice when deciding how big a dividend payment to make. Dividend policy may be explicitly stated, or investors may infer it from the dividend payments a company has made in the past. If a company states a dividend policy it usually takes the form of a target pay-out ratio. If a company has not stated a dividend policy then investors will infer it. Assumptions that investors are likely to make are: * The DPS will be maintained at least the previous year's level (excluding special dividends) unless dividend cover is very low or the company has warned that a dividend cut is possible * If the payout ratio has been maintained at a roughly constant level in the past, the same will be done in the future * Any other pattern of dividend growth will continue as long as the cover does not fall too low. Companies do not normally increase dividends unless they are confident that the increase is sustainable. This means that increasing the dividend is a way in which the management of a company can signal investors that they are confident. A dividend is a usually distributed in cash form to stock holders of a corporation approved by the board of director. It may also include stock dividend or other forms of payment. A stock dividend represents a distribution of additional shares to common

stockholders. Dividends are only cash payments regularly made by corporations to their stockholders. There are two metrics which are commonly used to gauge the sustainability of a firm's dividend policy. Payout ratio is calculated by dividing the company's dividend by the earnings per share. A payout ratio of more than 1 means the company is paying out more in dividends for the year than it earned. Canada. Dividend cover is calculated by dividing the company's cash flow from operations by the dividend. This ratio is apparently popular with analysts of income trusts in

Literature Review The Relationship Between Dividend Policy and Value The question of whether dividend policy affects the value of the firm has puzzled researchers and corporate managers for many years. Dividend policy is one of the most widely researched topics in finance. Yet, researchers have different views about whether the percentage of earnings that a firm pays out in dividends materially affects its long-term share price. Some empirical studies appear to support Miller and Modigliani's (1961) classic dividend irrelevance proposition [e.g., Black and Scholes (1974), Miller and Scholes (1978), Jose and Stevens (1989)]; others do not [e.g., Long (1978), Sterk and Vandenberg (1990)]. In addition, survey research by Farrelly, Baker, and Edelman (1985) shows that corporate managers typically believe that dividend policy affects a firm's value and that an optimal level of dividend payout exists. In practice, most firms pay cash dividends, although paying dividends is costly in various ways. Thus, empirical evidence on whether dividend policy affects a firm's value offers contradictory advice to corporate managers. Today, many academicians and corporate managers still debate whether dividend policy matters.

Another possible reason for paying dividends is the use of dividend policy to communicate information about a firm's future prospects to investors. Miller and Modigliani (1961) realize that in the real world a change in the market price often follows a change in the dividend rate. According to the information content of dividends or signaling explanation, cash dividends announcements convey valuable information about management's assessment of a firm's future profitability that other means cannot fully communicate. Information asymmetry suggests that corporate managers have an information advantage over outside investors. If managers have information that investors do not have, managers may use a change in dividends as a way to signal this private information and thus reduce information asymmetry. In turn, investors may use dividend announcements as information to assess a firm's stock price. On balance, much empirical evidence supports the view of dividends as a signaling device. Several empirical studies provide support for the agency explanation for dividends. For example, Rozeff (1982) finds support for the role of dividends in resolving agency costs in minority-manager-controlled

firms. His analysis shows a negative relationship between dividend payout and the percentage of insiders. Given a lower percentage of outsiders, less need exists to pay dividends to reduce agency costs. Crutchley and Hansen (1989) and Moh'd, Perry, and Rimbey (1995) conclude that managers make financial policy tradeoffs such as paying dividends to control agency costs. Dividend policy issues Clientele Effect: Investors needing current income will be drawn to firms with high payout ratios. Investors preferring to avoid taxes will be drawn to firms with lower payout ratios. (i.e., firms draw a given clientele, given their stated dividend policy). Therefore, firms should avoid making drastic changes in their dividend policy. Information Content: Changes in dividend policy may be signals concerning the firms financial condition. A dividend increase may signal good future earnings. A dividend decrease may signal poor future earnings.

Dividend payment history of firms listed on the Bursa Malaysia 1. KFC Holdings (Malaysia) Berhad - Dividend History

This Report provides Dividends history for KFC Holdings (Malaysia) Berhad. Tabular results include up to a four-year history of dividend payout from 2007 to 2011. KFC Holdings (Malaysia) Bhd is a Malaysia-based investment holding company. Through its subsidiaries, the Company operates in three segments, namely restaurants, integrated poultry and ancillary. Its integrated poultry operations include breeder farms and hatchery, feed mills, poultry farms, contract broiler farming, and processing and further processing plants. Its ancillary support system encompasses sauce manufacturing, as well as bakery and commissary operations. As of December 31, 2009, the Company operated 475 restaurants across Malaysia, 77 stores in Singapore, nine restaurants in Brunei and 72 restaurants in India. In 2009, the Company had a total of 43 RasaMas restaurants in Malaysia and Brunei and 35 Kedai Ayamas stores across Malaysia. On December 15, 2009, the Company had acquired the entire issued and paid-up capital of Rasamas Terminal Larkin Sdn Bhd and Rasamas Melaka Sdn Bhd. Prices Date Sep 8, 2010 Sep 7, 2010 May 4, 2010 Sep 9, 2009 May 5, 2009 Sep 17, 2008 May 5, 2008 Sep 13, 2007 Jun 14, 2007

Open

Low Close Volume 2: 1 Stock Split 0.10 Dividend 0.16 Dividend 0.08 Dividend 0.14 Dividend 0.08 Dividend 0.12 Dividend 0.08 Dividend 0.14 Dividend * Close price adjusted for dividends and splits.

High

Adj Close*

2.

Gamuda Berhad Dividend History

This Report provides Dividends history for KFC Holdings (Malaysia) Berhad. Tabular results include up to a four-year history of dividend payout from 2007 to 2011.

Gamuda Berhad is a Malaysia-based investment holding company engaged in civil engineering construction. The Company operates in three business segments: engineering and construction, which is engaged in the construction of highways and bridges, airfield facilities, railway, water treatment plants, dams and general and trading services related to construction activities; property development and club operations, which is engaged in the development of residential and commercial properties and club operations, and water and expressway concessions, which is engaged in the management of water supply and the management and tolling of highway operations. Its subsidiaries include Gammau Construction Sdn. Bhd. and Gamuda Engineering Sdn. Bhd. The Company operates in Malaysia, Taiwan, Republic of China, Mauritius, Qatar, Bahrain and Vietnam. Prices Date Aug 4, 2010 Jan 26, 2010 Aug 4, 2009 Jan 13, 2009 Jul 16, 2008 Jan 14, 2008 Jul 17, 2007 Apr 17, 2007

Open

Close Volume 0.06 Dividend 0.06 Dividend 0.04 Dividend 0.04 Dividend 0.125 Dividend 0.125 Dividend 0.23 Dividend 0.23 Dividend * Close price adjusted for dividends and splits.

High

Low

Adj Close*

The sectors chosen:Aviation Sector AirAsia Versus Malaysia Airlines (1 Quarter 2008) Malaysia Airlines (MAS) and AirAsia released contrasting financial results for the fourth quarter and full year ended 31-Dec-08. The full service carrier shrunk its operation to record its tenth consecutive quarterly net profit, while the LCC continued its aggressive expansion, but notched

up its second consecutive quarterly net loss. However, AirAsia's quarterly operating result was outstanding. Free of the hedging contracts that weighed down the second half of 2008, AirAsia appears set to soar. MAS cut its capacity by 1.3% in 4Q08, while AirAsia grew its ASKs by 17% (its slowest pace all year). Malaysia Airlines and AirAsia passenger numbers growth comparison: 1Q08 to 4Q08

MAS reported a 5% increase in RASK (including fuel surcharges and admin fees) to MYR 21.5 sen, which was outdone by AirAsia's 13% increase in RASK to MYR 16.75 sen. While MAS has been eking out small net profits, AirAsia lost heavily in the final two quarters of 2008, as it unwound its fuel hedging programme and some of its interest rate swaps. Malaysia Airlines and AirAsia passenger net profit margin comparison: 1Q08 to 4Q08

But the core operating margins are a better guide of the relative strengths of the two businesses, and AirAsia's margins exploded in the final quarter. The carrier's fourth quarter operating profit of MYR194 million was three times higher than Malaysia Airlines' result for the same period and double AirAsia's result for the same time last year. AirAsias Dividend Policy AirAsia does not pay dividends nor do we foresee paying dividends in the near future. The business is in the early stages of development and capital is required to be reinvested for the futures well being. We believe this will ultimately yield the most beneficial returns when viewed on a long-term basis. No dividend has been paid or declared by the Company since the end of the previous financial period. The Directors do not recommend the payment of any dividend for the financial year ended 31 December 2008.

Budget airline AirAsia Bhd said it has successfully placed out 380 million new shares at RM1.33 per share, raising gross proceeds of RM505.4 million

STOCKCODE NAME 5099 AirAsia

REF. 1.380

HIGH 1.390

LOW 1.370

LAST 1.370

CHANGE -0.010

VOLUME(00) 18442

Changes in substantial shareholders interest : October 3 2009

Circumstances by reason of which Change has occurred Nature of interest Direct(units) Direct(%) Indirect/deemed interest (units) Indirect/deemed interest (%) : : : : : : Sale of equity, Purchase of share Direct and Indirect 302246900 10.96 21278300 0.77

MASs Dividend Policies

Food and beverage Sector Campbell Soup versus Starbucks 1) Campbell Soup Company Dec-04 259 56 315 2.44% 43.5% Dec-03 259 24 283 2.60% 54.5% Dec-02 286 5 291 3.14% 57.6% Dec-01 374 681 992 2.85% 53.8% Dec-00 384 394 778 3.08% 53.3%

Dividend Paid Stock Buyback Total Cash to Shareholders Dividend Yield % Dividend Payout %

Averages: Dividend Yield = 2.91% Dividend Payout = 41.34%

2)

Starbucks Company Dec-04 203.4 203.4 0% 0% Dec-03 75.7 75.7 0% 0% Dec-02 52.2 52.2 0% 0% Dec-01 49.7 49.7 0% 0% Dec-00 203.4 203.4 0% 0%

Dividend Paid Stock Buyback Total Cash to Shareholders Dividend Yield % Dividend Payout %

Averages: Dividend Yield = 0.00% Dividend Payout = 0.00% Affordable Dividend - Free Cash Flow to Equity (FCFE) and Dividends/Stock Buybacks Company Campbell Average FCFE 560.67 Ave. dividend and stocks buyback 531.80 difference 28.87 Dividend + buyback / FCFE 60.52%

Starbucks

152.5

76.2

76.3

50%

We determined the amount that our selected companies could have paid in dividends by first calculating the average Free Cash Flow to Equity (FCFE) for each company as follows: Net Income - (Cap Ex Depreciation)*(1-Debt Ratio) - Change in Working Capital * (1-Debt Ratio) Free Cash Flow to Equity (FCFE) As a second step, we compared the average FCFE for each company to the cash returned to stockholders (over the last 5 years), either through dividends, or stock buybacks, or both. Campbell Soup Dividend Yield (D/Y) % Average Industry Average D/Y Dividend Payout (D/P)* % Average Industry Average D/P 2.44% 0.73% 43.50% 20.34% Starbucks 0% 0.21% 35.04% 11.88%

Campbell Soups had high and fairly steady earnings, and the projects it has undertaken have been within their core businesses. Consequently, this company could afford to pay high dividends. In fact, Campbell Soup has utilized debt to pay higher dividends, which has helped it increase its debt ratio. It may be mentioned that it has a debt ratio of less than 10% while its optimal debt ratio is 40%. Starbucks need financial flexibility for future growth and therefore should ideally have a low financial leverage. Indeed, this company needs flexibility to invest in new projects and products that have an extremely high variability in terms of success or failure. In that regard, the companies should be careful with its dividend policy so as to have cash available to continue investing in good projects.

Finally, stock prices have traditionally not been affected by the firms dividend policies, but rather by macroeconomic trends. Stockholder expectations on the firms are driven by expectations of future growth from investments rather than by the dividend policies of the companies in this sector. Similarly, future cash flows to the firms are more related to expectations of investment in good projects. Consequently, dividend policy is not always the means used to signal financial markets. At the same time, initiation of dividend payout can at times signal that the company no longer has good investment projects on its plate and hence future growth is expected to slow down. That may be taken as a negative signal by the stock markets.

Automobiles Sector Proton Berhad Investor Ratios There are several ratios commonly used by investors to assess the performance of a business as an investment: Year 2001,2002, 2003, 2004, 2005 Dividend per share 0.06, 0.14, 0.16, 0.17, 0.25 Dividend payout ratio10.99% ,6.7%, 7.93%, 18.28%, 16.95% Dividend yield ratio------1.88%, 3.2% Earnings per share(EPS) ---- 0.52., 162.0, 20.93, 1.47 Price earnings(P/E) ratio------9.6, 5.3

Dividend per share:

The dividend per share is depending on the dividends announced during a period to the number of shares on issue during that period. In essence, the ratio reflect an investor receive cash from holding share in the company. It is influencing by profit available for distribution, future investments of company and shareholder's expectation regarding dividends. The figure from 2001 to 2005 almost base on the same dividends announced during a period, it represents a increase trend, therefore, it will have be a expectant future in PROTON. Dividend payout ratio: The dividend payout ratio measures the proportion of earning that a company pays out to shareholders in the form of dividends. This ratio influences by net profit in annual, it is showing in the form, from 10.99% in 2001 decrease to 6.7% in 2002,then a little increase to 7.93% in 2003,after that, it enhance most in 2004 to 18.28%,finally,it fallen slightly in 2005.It depends on net profit and dividends announced for that year. From this figure, a higher proportion of earning was paid out as dividends year by year. Dividend yield ratio: Dividends are most important to some shareholder, but a secondary factor to others. Some stockholder invests primarily to receive regular cash income, while others invest in stocks principally with the expectation of rising market prices. It indicates the cash return from a share to its current market value or a measure of cash return on investor's investment. In this form, it show the dividend yield ratio is increase from 1.88% to 3.2% in 2005.Hence, the cash return is higher in 2005, it cause of more dividend per share in 2005, it is a good information for the investors who hold the share of PROTON. Earning per share (EPS): This is, perhaps, the fundamental investor ratio: EPS measures the overall profit generated for each share in existence over a particular period. PROTON EPS has increased by 1.66 ringgit in 2002 but decrease 0.14 ringgit in 2003, and continue decrease to 0.93 ringgit in 2004, at least, it enhances to 1.47 ringgit. An increase of 0.54 ringgit in 2005 because of higher profit generated in 2005. Price - Earnings Ratio (P/E Ratio):

P/E ratio of a stock is used to measure how cheap or expensive share prices are. For PROTON, the current P/E ratio is 5.3. This means that we are paying RM 5.3 for RM1 of earnings which is quite high and overvalued. One perspective is that 1/5.3 is only about 18.87% return on money, so if the risk-free interest rate is at or above this level there is little point in investing in a stock at a 5.3 P/E. Conversely, however, under the new management, PROTON has some future growth potential.

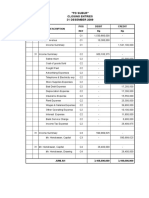

UMW Holding Berhad Dividends Amount 2005 RM000 In respect of the financial year ended 31 December 2003 - Final dividend of 9.0% less 28% taxation In respect of the financial year ended 31 December 2004 - Interim dividend of 11.0% less 28% taxation - Final dividend of 10.0% less 28% taxation In respect of the financial year ended 31 December 2005 - Interim dividend of 12.5% less 28% taxation - Special Interim dividend 45,626 9.0 36,468 37,663 7.2 7.9 30,733 6.5 2004 RM000 Net Dividend Per Share 2005 RM000 2004 RM000

of 5.0% less 28% taxation

18,251 100,345

68,396

3.6 19.8

14.4

Amount Net Dividend Per Share At the forthcoming Annual General Meeting, a final dividend in respect of the current financial year ended 31 December 2005, of 20.5%, less 28% taxation, amounting to a total net dividend of approximately RM74,830,000 (14.8 sen net per share) will be proposed for shareholders' approval. The financial statements for the current financial year do not reflect this proposed dividend. Such dividend, if approved by the shareholders, will be accounted for in the shareholders' equity as an appropriation of retained profits in the next financial year ending 31 December 2006.

(3144 words)

References 1. Wikipedia. (2007). Dividends. Available: http://en.wikipedia.org/wiki/Dividend. Last accessed 18 October 2007. 2. Miller, Merton H. and Franco Modigliani (1961), Dividend Policy, Growth, and the valuation of shares, the Journal of Business, 34, 411-433. 3. Malaysia Airline, Returns & Profits. (2010).

http://www.eturbonews.com/1442/malaysian-airline-returns-profit-2007-exceeds Accessed: 22 Feb 2011. 4. 5. http://en.wikipedia.org/wiki/Dividend "What Are Dividends?". New York Life.

http://www.newyorklife.com/cda/0,3254,10542,00.html. 6. Easterbrook, F. H. (1984). Two agency-cost explanations of dividends. American Economic Review. September, 650-659. 7. Baker, H. K. and Smith, D. M. (2006). In search of a residual dividend policy. Review of Financial Economics, 15(1), 1-18.

8.

Annuar, M. N. & Shamsher, M. (1993). Earnings and Dividend Behaviour. of Social Science and Humanities 1 (2): 171177.

Journal

Das könnte Ihnen auch gefallen

- Assignment BBPW3203 Financial Management IIDokument10 SeitenAssignment BBPW3203 Financial Management IIafif120750% (2)

- Financial Management II Assignment CompleteDokument25 SeitenFinancial Management II Assignment Completeharmeet kaur100% (1)

- Financial Management II Assignment CompleteDokument25 SeitenFinancial Management II Assignment CompletenirupaNoch keine Bewertungen

- Matriculation No: Identity Card No.: Telephone No.: E-Mail: Learning CentreDokument22 SeitenMatriculation No: Identity Card No.: Telephone No.: E-Mail: Learning CentrekerttanaNoch keine Bewertungen

- Contoh Asgn FMDokument21 SeitenContoh Asgn FMnira_110Noch keine Bewertungen

- ProfitabilityDokument25 SeitenProfitabilitynira_11050% (2)

- Bbpw3103 Financial Management 1Dokument25 SeitenBbpw3103 Financial Management 1neiyaayien100% (5)

- Sample Assignment AnswerBBPW3203 May 2012Dokument21 SeitenSample Assignment AnswerBBPW3203 May 2012nutanayaNoch keine Bewertungen

- BBCP4103 - Career Planning and DevelopmentDokument10 SeitenBBCP4103 - Career Planning and Developmentmermaidaira92Noch keine Bewertungen

- Finalize Aisyah IbDokument16 SeitenFinalize Aisyah IbAisya S. ShaariNoch keine Bewertungen

- Bbgo4103 Organisatonal BehaviourDokument13 SeitenBbgo4103 Organisatonal BehavioureugeneNoch keine Bewertungen

- Bbgo 4103Dokument22 SeitenBbgo 4103Bernice TanNoch keine Bewertungen

- Assignment Final FinanceDokument17 SeitenAssignment Final FinanceTamil Arasu100% (1)

- Bbun 2103Dokument7 SeitenBbun 2103YOGESWARI A/P SUBRAMANIAN STUDENTNoch keine Bewertungen

- Financial Management 1 (Bbpw3103) : May Semester 2021Dokument17 SeitenFinancial Management 1 (Bbpw3103) : May Semester 2021Freshlynero JonalNoch keine Bewertungen

- International BusinessDokument18 SeitenInternational Businesscikgu_ishmaelNoch keine Bewertungen

- BBCP4103 Career Planning and DevelopmentDokument14 SeitenBBCP4103 Career Planning and DevelopmentKhai WenNoch keine Bewertungen

- Startegy Management 1 DesktopDokument16 SeitenStartegy Management 1 DesktopMariammah Suprumaniam100% (1)

- Assigment FINANCIAL MANAGEMENT IIDokument14 SeitenAssigment FINANCIAL MANAGEMENT IILoyai BaimNoch keine Bewertungen

- Faculty of Information Technology & Multimedia CommunicationDokument12 SeitenFaculty of Information Technology & Multimedia CommunicationDiLip SinghNoch keine Bewertungen

- CBMS4303 Management of Information System September 2017Dokument14 SeitenCBMS4303 Management of Information System September 2017Mon LuffyNoch keine Bewertungen

- Faculty of Business and Management: Sample of Good AssignmentDokument35 SeitenFaculty of Business and Management: Sample of Good AssignmentSashiNoch keine Bewertungen

- Bachelor of Human Resource Management (Sbst1303)Dokument13 SeitenBachelor of Human Resource Management (Sbst1303)Jamuna RaniNoch keine Bewertungen

- Assignment/ TugasanDokument4 SeitenAssignment/ Tugasanapplelind weeNoch keine Bewertungen

- BBEK 4303 - PRINCIPLES OF MACROECONOMICS - AssignmentDokument15 SeitenBBEK 4303 - PRINCIPLES OF MACROECONOMICS - AssignmentChen WoonNoch keine Bewertungen

- 2.strategic Management 1Dokument15 Seiten2.strategic Management 1stepmal0% (1)

- BBAW2103 Financial AccountingDokument14 SeitenBBAW2103 Financial AccountingAttenuator James100% (1)

- Education and Social Sciences Bachelor of Teaching (Primary Education) With HonoursDokument13 SeitenEducation and Social Sciences Bachelor of Teaching (Primary Education) With Honoursvickycool7686Noch keine Bewertungen

- BBPW3103Dokument35 SeitenBBPW3103zu67% (3)

- Faculty Science and Technology: Matriculation No: Identity Card No.: Telephone No.: E-Mail: Learning CentreDokument31 SeitenFaculty Science and Technology: Matriculation No: Identity Card No.: Telephone No.: E-Mail: Learning Centresobhiee88100% (1)

- BBPS 4103 Strategic Management 2Dokument17 SeitenBBPS 4103 Strategic Management 2Thalhah Bin UbaidillahNoch keine Bewertungen

- Bbpw3103 Financial Management IDokument7 SeitenBbpw3103 Financial Management Isayang_diriNoch keine Bewertungen

- Assignment Answer1Dokument10 SeitenAssignment Answer1Che TaNoch keine Bewertungen

- FIDMDokument23 SeitenFIDMAiyoo JessyNoch keine Bewertungen

- BBPS4103 Assignment Jan2008Dokument9 SeitenBBPS4103 Assignment Jan2008pprpd_bdetgraNoch keine Bewertungen

- ABCR2103 Principles of Corporate Communication - Digi CompanyDokument9 SeitenABCR2103 Principles of Corporate Communication - Digi Companymuhd100% (1)

- Amir Bin Tompong (Cross Cultural Management)Dokument17 SeitenAmir Bin Tompong (Cross Cultural Management)kiranaomomNoch keine Bewertungen

- Task 4 ABCC1103 Prakash V SubramaniamDokument4 SeitenTask 4 ABCC1103 Prakash V SubramaniamARVIN ARSENAL100% (1)

- Faculty of Oum Business School: Semester: January 2020Dokument24 SeitenFaculty of Oum Business School: Semester: January 2020sharmin TASNoch keine Bewertungen

- Career Planning and DevelopmentDokument13 SeitenCareer Planning and DevelopmentBen AzarelNoch keine Bewertungen

- International BussinessDokument7 SeitenInternational BussinessshaliniNoch keine Bewertungen

- Abcr 2103 AssignmentDokument15 SeitenAbcr 2103 AssignmentMadhu SudhanNoch keine Bewertungen

- Management Information SystemDokument11 SeitenManagement Information SystemShariful islamNoch keine Bewertungen

- BBPS4103Dokument13 SeitenBBPS4103Milly Hafizah Mohd KanafiaNoch keine Bewertungen

- BBUI3103Dokument8 SeitenBBUI3103sthiyaguNoch keine Bewertungen

- Assignment Islamic Financial Management Sept 2018Dokument5 SeitenAssignment Islamic Financial Management Sept 2018Siti Salwa Abdul AzizNoch keine Bewertungen

- Financial MGMTDokument13 SeitenFinancial MGMTBen AzarelNoch keine Bewertungen

- Assignment Bdoe4103Dokument14 SeitenAssignment Bdoe4103Shar KhanNoch keine Bewertungen

- Bbim 4103Dokument16 SeitenBbim 4103Sharifah Md IbrahimNoch keine Bewertungen

- International Business PDFDokument16 SeitenInternational Business PDFShariful islamNoch keine Bewertungen

- Assignment / Tugasan - Relationship MarketingDokument6 SeitenAssignment / Tugasan - Relationship Marketinglya natasyaNoch keine Bewertungen

- Carrer Planning AssignmentDokument7 SeitenCarrer Planning AssignmentDevi KannanNoch keine Bewertungen

- Business Law BBUN2103Dokument13 SeitenBusiness Law BBUN2103E'daiyah Azam100% (3)

- Bbui3103 FDokument11 SeitenBbui3103 Fsthiyagu0% (1)

- OUMM3203 - Vadivookarassi MammaranDokument16 SeitenOUMM3203 - Vadivookarassi MammaranVadivookarassi ManimaranNoch keine Bewertungen

- Bachelor of Human Resource Management: Matriculation No: Identity Card No.: Telephone No.: E-Mail: Learning CentreDokument17 SeitenBachelor of Human Resource Management: Matriculation No: Identity Card No.: Telephone No.: E-Mail: Learning CentreThenmalar SubramaniamNoch keine Bewertungen

- Contrat LawDokument16 SeitenContrat LawJiana Nasir100% (1)

- Company LawDokument23 SeitenCompany Lawmialoves160579100% (1)

- BBPW3203 Financial Management IIDokument20 SeitenBBPW3203 Financial Management IIAllison Chan100% (1)

- Dividend Policy AfmDokument10 SeitenDividend Policy AfmPooja NagNoch keine Bewertungen

- Module 1 Compensation N RewardDokument52 SeitenModule 1 Compensation N RewardAnshul PandeyNoch keine Bewertungen

- Daily Equity Market Report - 11.05.2022Dokument1 SeiteDaily Equity Market Report - 11.05.2022Fuaad DodooNoch keine Bewertungen

- CPM of PepsiDokument3 SeitenCPM of PepsiIdrees Akbar RajputNoch keine Bewertungen

- Basic Points 2007Dokument455 SeitenBasic Points 2007bschwartzieNoch keine Bewertungen

- Types of Foreign Exchange Exposure: Changes in Exchange Rates Can Effect Firm Value ThroughDokument8 SeitenTypes of Foreign Exchange Exposure: Changes in Exchange Rates Can Effect Firm Value ThroughFatim Zohra EssaafNoch keine Bewertungen

- IBPS QuantitativeDokument44 SeitenIBPS QuantitativeRam ChandranNoch keine Bewertungen

- (Chapter 9) : Water: A Confluence On Replenishable But Depletable ResourcesDokument17 Seiten(Chapter 9) : Water: A Confluence On Replenishable But Depletable Resourcesii muNoch keine Bewertungen

- Aggregate Demand and Aggregate SupplyDokument8 SeitenAggregate Demand and Aggregate Supplytasleem1Noch keine Bewertungen

- Managerial Economics PPT at Mba 2009Dokument31 SeitenManagerial Economics PPT at Mba 2009Babasab Patil (Karrisatte)Noch keine Bewertungen

- Group 2 NestleINDDokument11 SeitenGroup 2 NestleINDYash BafnaNoch keine Bewertungen

- Kunci Jawaban Siklus Akuntansi (P1)Dokument30 SeitenKunci Jawaban Siklus Akuntansi (P1)Zulkarnain Zoel67% (3)

- Employee RemunerationDokument22 SeitenEmployee RemunerationJagruti Bhansali100% (3)

- Wage Order No. Rbiii-23: Wage Rationalization Act", To Periodically Assess Wage Rates and ConductDokument5 SeitenWage Order No. Rbiii-23: Wage Rationalization Act", To Periodically Assess Wage Rates and ConductECMH ACCOUNTING AND CONSULTANCY SERVICESNoch keine Bewertungen

- Unit 4 Operations Management Categorised Past Papers: WWW - Igcsebusiness.co - UkDokument44 SeitenUnit 4 Operations Management Categorised Past Papers: WWW - Igcsebusiness.co - UkArtsy & TartsyNoch keine Bewertungen

- Strategy FormulationDokument38 SeitenStrategy FormulationRobin Bhagat100% (1)

- Answer in BudgetingDokument9 SeitenAnswer in BudgetingkheymiNoch keine Bewertungen

- Contract, Specification & Quantity SurveyDokument60 SeitenContract, Specification & Quantity Surveybulcha100% (1)

- 5 6107116501871886934Dokument38 Seiten5 6107116501871886934Harsha VardhanNoch keine Bewertungen

- Inco TermsDokument1 SeiteInco TermscharlesanNoch keine Bewertungen

- B&D Case MMUGMDokument8 SeitenB&D Case MMUGMrobbyapr100% (4)

- Caribbean Utilities Company Request For Expressions of Interest For Renewable Energy Generation in The Cayman IslandsDokument3 SeitenCaribbean Utilities Company Request For Expressions of Interest For Renewable Energy Generation in The Cayman Islandstherese7990Noch keine Bewertungen

- The Ultimate Guide To Trading OptionsDokument68 SeitenThe Ultimate Guide To Trading Optionsjose HernandezNoch keine Bewertungen

- Busmt - w16 - QP - 2 SLDokument7 SeitenBusmt - w16 - QP - 2 SLDivyaNoch keine Bewertungen

- Employee Share Schemes: Group Sharesave Scheme (SAYE)Dokument4 SeitenEmployee Share Schemes: Group Sharesave Scheme (SAYE)Steve MedhurstNoch keine Bewertungen

- Best Styles - Harvesting Risk Premium in Equity InvestingDokument8 SeitenBest Styles - Harvesting Risk Premium in Equity InvestingIra ArtmanNoch keine Bewertungen

- SiaHuatCatalogue2017 2018Dokument350 SeitenSiaHuatCatalogue2017 2018Chin TecsonNoch keine Bewertungen

- Questions (Fun With Economics)Dokument7 SeitenQuestions (Fun With Economics)Bhoomi SinghNoch keine Bewertungen

- 118.2 - Illustrative Examples - IFRS15 Part 1Dokument3 Seiten118.2 - Illustrative Examples - IFRS15 Part 1Ian De DiosNoch keine Bewertungen

- Export PricingDokument21 SeitenExport PricingSushant KaushalNoch keine Bewertungen

- Monetary PolicyDokument8 SeitenMonetary PolicyLyubov KushnirNoch keine Bewertungen