Beruflich Dokumente

Kultur Dokumente

Karen Malhotra..Case Study

Hochgeladen von

Dimple Pankaj DesaiOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Karen Malhotra..Case Study

Hochgeladen von

Dimple Pankaj DesaiCopyright:

Verfügbare Formate

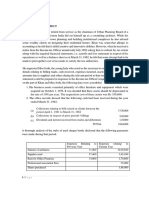

MONEYWISE (FINAL ROUND) Case study Karan Malhotra, aged 31 years, is working with a Multi-National Company since December

2004. He has approached you, for preparing his Financial Plan. He is staying in his own house at Ahmedabad. His wife Karen, aged 30 years, is a fashion designer. She has earned a net profit of Rs. 4 Lakh in FY 2008-09. They have a son, Suraj of age 4 years (born on 12.02.2006), and a daughter, Kavita(born on of 23.09.2009). Karan is also supporting his parents staying in their own house at Surat to whom he sends Rs. 10,000 p.m. His monthly house hold expenses are Rs. 30,000 p.m. (excludes his investments, payment of premium and EMIs ) Karan Malhotras monthly Post tax salary: Rs. 62,000 Couples Current Assets & Liabilities Assets: House : Rs. 35.00 lakh Car : Rs. 3.50 lakh (Depreciated value) PPF (maturity on 1st April 2017) : Rs. 2.90 lakh Gold ornaments : Rs. 4.50 lakh Equity Mutual Fund scheme : Rs. 4.85 lakh Portfolio of Equity Shares : Rs. 3.95 lakh Bank fixed deposit : Rs. 2.50 lakh Cash/Bank Balance : Rs. 0.75 lakh Liabilities: Home loan : Rs. 12.97 lakh Car Loan : Rs. 2.93 lakh Goals: 1. To provide for higher education of Suraj and Kavita. 2. Marriage expenses for each child at their respective age of 25 years. 3. Adequate Retirement corpus 4. A Bigger house . Assumptions: A. Regarding long-term pre-tax returns on various asset classes: 1. Equity & Equity MF schemes /Index ETFs : 11.00% p.a. 2. Balanced MF schemes : 9.00% p.a.

MONEYWISE (FINAL ROUND) 3. Bonds/Govt. Securities/Debt MF schemes : 7.00% p.a. 4. Liquid MF schemes : 5.50% p.a. 5. Gold & Gold ETF : 7.50% p.a. B. Regarding economic factors: 1. Inflation : 5.50% p.a. 2. Risk free rate : 6.50% p.a. 3. Real Estate appreciation : 8.00% p.a.

On the basis of the above information, answer the following queries:

Q1) In order to provide for higher education of Suraj and Kavita, Karan is confused whether he should invest in SIPs or lump sum in equities markets. What would you advise him? Q2) On his birthday Suraj Received Rs 5lacs from his grandfather as gift. Where should Karan & Karen invest this amount? Q3) On the basis of the couples current asset allocation, is there any change required? Justify. Q4) As Karan has invested some portion of money into equity mutual funds, he doesnt know the implication of entry & exit loads. Does it affect his returns? Q5) Karan wants to invest in ULIP, but he wants to be cautious before entering a long period of contract. As Per IRDA Guidelines on ULIP, if he wants to return the policy within 15 days free look period. What amount would be refunded to him? A. He would get the prevailing fund value subject to deduction of expenses towards medical examination, stamp duty and proportionate risk premium for the period of cover. B. He would get the refund of full premium paid. C. He would get the refund of premium less commission paid to the intermediary. D. He would get the prevailing fund value less commission paid to the intermediary.

Das könnte Ihnen auch gefallen

- Financial Analysis and Planning PDFDokument80 SeitenFinancial Analysis and Planning PDFDimple Pankaj DesaiNoch keine Bewertungen

- Types of FinancingDokument30 SeitenTypes of FinancingIIMnotesNoch keine Bewertungen

- Extra Jurisdiction - Essential Information Checklist OCT2013Dokument35 SeitenExtra Jurisdiction - Essential Information Checklist OCT2013Dimple Pankaj DesaiNoch keine Bewertungen

- Financial Analysis and Planning PDFDokument80 SeitenFinancial Analysis and Planning PDFDimple Pankaj DesaiNoch keine Bewertungen

- Types of BudgetsDokument10 SeitenTypes of BudgetsDimple Pankaj DesaiNoch keine Bewertungen

- Budget Imp..Dokument5 SeitenBudget Imp..lavanya2401Noch keine Bewertungen

- Financial Decision PDFDokument72 SeitenFinancial Decision PDFDimple Pankaj Desai100% (1)

- Foreign Exchange MarketDokument5 SeitenForeign Exchange MarketDimple Pankaj DesaiNoch keine Bewertungen

- World War I To World War II 1918 - 1939: Great DepressionDokument29 SeitenWorld War I To World War II 1918 - 1939: Great DepressionDimple Pankaj DesaiNoch keine Bewertungen

- Mastrategicissuesindiversification 120403060425 Phpapp01Dokument14 SeitenMastrategicissuesindiversification 120403060425 Phpapp01Dimple Pankaj DesaiNoch keine Bewertungen

- The Foreign Exchange MarketDokument18 SeitenThe Foreign Exchange MarketDimple Pankaj DesaiNoch keine Bewertungen

- Chapter6report2 130409192656 Phpapp02Dokument40 SeitenChapter6report2 130409192656 Phpapp02Dimple Pankaj DesaiNoch keine Bewertungen

- WTO N GATTDokument37 SeitenWTO N GATTJeetendra KhilnaniNoch keine Bewertungen

- DiversificationDokument3 SeitenDiversificationDimple Pankaj DesaiNoch keine Bewertungen

- DiversificationDokument33 SeitenDiversificationDimple Pankaj DesaiNoch keine Bewertungen

- Finance: Homework HelpDokument4 SeitenFinance: Homework HelpDimple Pankaj DesaiNoch keine Bewertungen

- Business Model - Diversification Strategy For Electronic Media ConglomerateDokument7 SeitenBusiness Model - Diversification Strategy For Electronic Media ConglomerateFawad Ahmad Khan NiaziNoch keine Bewertungen

- DiversificationDokument51 SeitenDiversificationDimple Pankaj DesaiNoch keine Bewertungen

- Market Expansion Via Product Diversification: Training On Expansion Strategies September 13, 2011 RBAP BLDG, IntramurosDokument13 SeitenMarket Expansion Via Product Diversification: Training On Expansion Strategies September 13, 2011 RBAP BLDG, IntramurosUdayan DattaNoch keine Bewertungen

- Corporate Diversification503Dokument23 SeitenCorporate Diversification503Anggi Gayatri SetiawanNoch keine Bewertungen

- Codeofconduct 121118135557 Phpapp01Dokument31 SeitenCodeofconduct 121118135557 Phpapp01Dimple Pankaj DesaiNoch keine Bewertungen

- Diversification: Presented By: Anushree GuptaDokument9 SeitenDiversification: Presented By: Anushree GuptaAnushree Harshaj GoelNoch keine Bewertungen

- DiversificationDokument18 SeitenDiversificationRohit RajNoch keine Bewertungen

- Diversificationstrategyofadityabirlagroup 120109235357 Phpapp02Dokument6 SeitenDiversificationstrategyofadityabirlagroup 120109235357 Phpapp02Dimple Pankaj DesaiNoch keine Bewertungen

- DiversificationDokument56 SeitenDiversificationvarsha27k4586Noch keine Bewertungen

- DiversificationDokument51 SeitenDiversificationDimple Pankaj DesaiNoch keine Bewertungen

- Mpo Group5 Bmwsportfoliodiversification 121229085329 Phpapp01Dokument14 SeitenMpo Group5 Bmwsportfoliodiversification 121229085329 Phpapp01Dimple Pankaj DesaiNoch keine Bewertungen

- Tatta 120930095119 Phpapp02Dokument20 SeitenTatta 120930095119 Phpapp02Dimple Pankaj DesaiNoch keine Bewertungen

- DiversificationDokument13 SeitenDiversificationAlisa Aryana PratiwiNoch keine Bewertungen

- Mpo Group5 Bmwsportfoliodiversification 121229085329 Phpapp01Dokument14 SeitenMpo Group5 Bmwsportfoliodiversification 121229085329 Phpapp01Dimple Pankaj DesaiNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Power Sector Moving Towards DeregulationDokument88 SeitenPower Sector Moving Towards DeregulationsachinNoch keine Bewertungen

- Nota Principle of CorporateDokument145 SeitenNota Principle of CorporateAhmad MustapaNoch keine Bewertungen

- ResearchesDokument29 SeitenResearchesGani AnosaNoch keine Bewertungen

- What Is Talent ManagementDokument8 SeitenWhat Is Talent ManagementarturoceledonNoch keine Bewertungen

- Annual Barangay Youth Investment Program Monitoring FormDokument3 SeitenAnnual Barangay Youth Investment Program Monitoring FormJaimeh AnnabelleNoch keine Bewertungen

- 000 Citibank Client Services 040 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. ADokument4 Seiten000 Citibank Client Services 040 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. AMónica M. RodríguezNoch keine Bewertungen

- The Channel Tunnel An Ex Post Economic Evaluation PDFDokument37 SeitenThe Channel Tunnel An Ex Post Economic Evaluation PDFpirotte0% (1)

- RHDdqokooufm I1 EeDokument14 SeitenRHDdqokooufm I1 Eedeshdeepak srivastavaNoch keine Bewertungen

- 1 Handbook of Business PlanningDokument326 Seiten1 Handbook of Business PlanningjddarreNoch keine Bewertungen

- UTS Bahasa Inggris Nanda Pratama Nor R 202210100087Dokument4 SeitenUTS Bahasa Inggris Nanda Pratama Nor R 202210100087Nanda Pratama Nor RochimNoch keine Bewertungen

- Bahasa Indonesia RidhoDokument3 SeitenBahasa Indonesia RidhoRidho FirdausmanNoch keine Bewertungen

- Noise Flair BillDokument2 SeitenNoise Flair BillShrinivethika BalasubramanianNoch keine Bewertungen

- Shareholders Agreement Free SampleDokument4 SeitenShareholders Agreement Free Sampleapi-235666177100% (1)

- BCLTE Points To ReviewDokument4 SeitenBCLTE Points To Review•Kat Kat's Lifeu•Noch keine Bewertungen

- Enquiries and Offers Seminar 03Dokument17 SeitenEnquiries and Offers Seminar 03lenkaNoch keine Bewertungen

- Darden Case Book 2019-2020 PDFDokument155 SeitenDarden Case Book 2019-2020 PDFJwalant MehtaNoch keine Bewertungen

- Unethical Practice of BankDokument14 SeitenUnethical Practice of BankNasrin786Noch keine Bewertungen

- Dreamforce 2019 - Justifying Your Salesforce InvestmentDokument21 SeitenDreamforce 2019 - Justifying Your Salesforce InvestmentPattyNoch keine Bewertungen

- Topic 2 - Ias 16Dokument46 SeitenTopic 2 - Ias 16jpatrickNoch keine Bewertungen

- PepsicoDokument20 SeitenPepsicoUmang MehraNoch keine Bewertungen

- Accounting For Labor CostDokument28 SeitenAccounting For Labor CostStp100% (1)

- Unit 3Dokument328 SeitenUnit 35pkw48m27cNoch keine Bewertungen

- Transferable Letters of CreditDokument12 SeitenTransferable Letters of CreditSudershan ThaibaNoch keine Bewertungen

- Motorcycle To Car Ownership The Role of Road Mobility Accessibility and Income InequalityDokument8 SeitenMotorcycle To Car Ownership The Role of Road Mobility Accessibility and Income Inequalitymèo blinksNoch keine Bewertungen

- Latif Khan PDFDokument2 SeitenLatif Khan PDFGaurav AroraNoch keine Bewertungen

- Labor Cost Per Bell Will Be Rs. 1 Variable Overheads 100% of Labor CostDokument3 SeitenLabor Cost Per Bell Will Be Rs. 1 Variable Overheads 100% of Labor CostanushkaNoch keine Bewertungen

- Tugas Ke 5 Ade Hidayat Kelas 1a MMDokument4 SeitenTugas Ke 5 Ade Hidayat Kelas 1a MMadeNoch keine Bewertungen

- Memorandum by Virgin Atlantic Airways: Executive SummaryDokument5 SeitenMemorandum by Virgin Atlantic Airways: Executive Summaryroman181Noch keine Bewertungen

- Standard Project Execution Plan PEP TemplateDokument35 SeitenStandard Project Execution Plan PEP TemplateecaterinaNoch keine Bewertungen

- Quess CorpDokument22 SeitenQuess CorpdcoolsamNoch keine Bewertungen