Beruflich Dokumente

Kultur Dokumente

MFM TRM Papr

Hochgeladen von

deepaknu2000Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

MFM TRM Papr

Hochgeladen von

deepaknu2000Copyright:

Verfügbare Formate

About Indian Banking Sector

The banking industry in India is sufficiently capitalized and regulated. The economic and financial conditions here are better than in any other country. Liquidity, credit, and market studies have proven Indian banks to be resilient. They have negotiated the downturn in the global economy well. The Reserve Bank of India (RBI) is the topmost body monitoring the Banking Industry. Any shortcomings or discrepancies are dealt with by the RBI. The banking industry in India is divided into scheduled and non-scheduled banks. 67,000 scheduled bank branches are located in India. They consist of cooperative banks and commercial banks. The PSBs (Public Sector Banks) form the base of this sector in India. They account for 78% of the assets in the banking sector. The Private Sector banking is making headway. They are leading in mobile banking, phone banking, ATMs, and Internet Banking sectors. Sectors of the banking industry include investment banking, retail, and private banking. Investment banking is a growing sector with more Indians looking to invest funds in mutual funds and stocks rather than the traditional fixed deposits and schemes. Retail banking is when the bank deals with individual customers rather than corporations. Services offered by these banks are normal savings, personal loans, checking accounts, and debit/credit cards amongst others. This is also a growing sector as the drive for cashless transactions is growing. More people are opting for debit and credit cards. Private banking is where the personalized financial services are provided to individuals or corporations of high worth. All these sectors are showing immense growth prospects. Internet banking is also gaining prominence. The phone banking sector is also gaining in popularity. Thus, the entire banking sector is growing and offers immense potential. FDI in this sector has been raised. 74% FDI via the automatic route is allowed in the private sector banks. This means that the aggregate foreign investment in any private bank considering all sources should be up to 74% of the paid-up capital. In the case of nationalized banks, the Portfolio and FDI investments maximum limit is 20%. This cap also applies to the investment in state banks and other associated ones. Even with the global recession, the investment in the banking industry is still prevalent though the volume may have been reduced. The FDI entries in the country grew by 145% between 2006 and 2007 and by 46.6% during 20072008. The FDI in 2009 was down to 18.6%. However, with the recession abating the investments are sure to rise. The government is also encouraging foreign investment in this sector, as the entry of foreign players will help the sector. FDI in Indian banking can lead to improved efficiency, better capitalization, and improved adaptability. So the government is attracting FDI, FII, and NRIs in this field. Overall, the Indian banking industry has immense potential for further growth and expansion.

Guidelines for FDI in Banking at a GlanceIn the private banking sector of India, FDI is allowed up to a maximum limit of 74 % of the paid-up capital of the bank. On the other hand, Foreign Direct Investment and Portfolio Investment in the public or nationalized banks in India are subjected to a limit of 20 % in totality. This ceiling is also applicable to the investments in the State Bank of India and its associate banks. FDI limits in the banking sector of India were increased with the aim to bring in more FDI inflows in the country along with the incorporation of advanced technology and management practices. The objective was to make the Indian banking sector more competitive. The Reserve Bank of India governs the investment matters in the banking sector.

Voting rights of foreign investors In terms of the statutory provisions under the various banking acts, the voting rights, when exercised, which are stipulated as under:

1. Private sector banks - [Section 12 (2) of Banking Regulation Act, 1949] No person holding shares, in respect of any share held by him, shall exercise voting rights on poll in excess of ten per cent of the total voting rights of all the share holders

2. Nationalized Banks - [Section 3(2E) of Banking Companies (Acquisition and Transfer of Undertakings) Acts,1970/80] No shareholder, other than the Central Government, shall be entitled to exercise voting rights in respect of any shares held by him in excess of one per cent of the total voting rights of all the share holders of the nationalized banks State Bank of India (SBI) (Section 11 of State Bank of India Act, 1955) No shareholder, other than RBI, shall be entitled to exercise voting rights in excess of ten per cent of the issued capital (Government, in consultation with RBI can raise the above voting rate to more than ten per cent).

3. SBI Associates - [Section 19(1)&(2) of SBI (Subsidiary Bank) Act, 1959] No person shall be registered as a shareholder in respect of any shares held by him in excess of two hundred shares. No shareholder, other than SBI, shall be entitled to exercise voting rights in excess of one per cent of the issued capital of the subsidiary bank concerned.

According to the guidelines for FDI in the banking sector, Indian operations by foreign banks can be executed by any one of the following three channels

y y y

Branches in India Wholly owned subsidiaries. Other subsidiaries.

In case of wholly owned subsidiaries (WOS), the guidelines for FDI in the banking sector specified that the WOS must involve a capital of minimum ` 300 crores and should ensure proper corporate governance.

Approval of RBI and reporting requirements 1.

Under extant instructions, transfer of shares of 5 per cent and more of the paid-up capital of a private sector banking company, requires prior acknowledgments of RBI. For FDI of 5 per cent and more of the paid-up capital, the private sector banking company has to apply in the prescribed form to the Department of Banking Operations and Department in the Regional office of RBI, where the bank's Head Office is located. 2. Under the provisions of FEMA 1999, any fresh issue of shares of a banking company, either through the automatic route or with the specific approval of FIPB, does not require further approval of Exchange Control Department (ECD) of RBI from the exchange control angle. The Indian banking company is only required to undertake 2-stage reporting to the ECD as follows: a. In the first stage, the Indian company has to submit a report within 30 days of the date of receipt of amount of consideration indicating the name and address of foreign investors, date of receipt of funds and their rupee equivalent, name of bank through whom funds were received and details of Government approval, if any. b. In the second stage, the Indian banking company is required to file within 30 days from the date of issueof shares, a report in form FC-GPR together with a certificate from the Company Secretary of the concerned company certifying that various regulations have been complied with. A certificate will also accompany the report from a Chartered Accountant indicating the manner of arriving at the price of the shares issued.

Conformity with SEBI Regulations and Companies Act provisions wherever applicable, FDI in banking companies should conform to the provisions regarding shareholding and share transfer, etc as stipulated by SEBI, Companies Act, Etc. y Disinvestments by Foreign Investors in terms of regulation 10 and 11 of RBI Notification No. FEMA/20/2000-RB dated May 3, 2000 issued under FEMA 1999; disinvestments by foreign investors would be governed by the following: 1. Sale of shares by non-residents on a stock exchange and remittance of the proceeds thereof through an authorized dealer does not require RBI approval. 2. Sale of shares by private arrangement requires RBIs prior approval. RBI grants permission for sale of shares at a price that is market related and is arrived at in terms of guidelines indicated in Regulation 10 above. y All commercial banks, which either have foreign investments or intending to have foreign investments, need to observe the above guidelines.

Problems faced by the Indian Banking SectorFDI in Indian banking sector resolves the following problems often faced by various banks in the country:

y y y y y y y

Inefficiency in management Instability in financial matters Innovativeness in financial products or schemes Technical developments happening across various foreign markets Non-performing areas or properties Poor marketing strategies Changing financial market condition

Benefits of FDI in Banking sector in Indiay y y y

Transfer of technology from overseas countries to the domestic market Ensure better and improved risk management in the banking sector Assures better capitalization Offers financial stability in the banking sector in India

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Nepal submits TFA ratification documents to WTODokument1 SeiteNepal submits TFA ratification documents to WTOrajendrakumarNoch keine Bewertungen

- Weimar Republic Model AnswersDokument5 SeitenWeimar Republic Model AnswersFathima KaneezNoch keine Bewertungen

- Shoppers Paradise Realty & Development Corporation, vs. Efren P. RoqueDokument1 SeiteShoppers Paradise Realty & Development Corporation, vs. Efren P. RoqueEmi SicatNoch keine Bewertungen

- India Inc's Baby Steps On Long Road To Normalcy: HE Conomic ImesDokument12 SeitenIndia Inc's Baby Steps On Long Road To Normalcy: HE Conomic ImesShobhashree PandaNoch keine Bewertungen

- Business PeoplesDokument2 SeitenBusiness PeoplesPriya Selvaraj100% (1)

- Mintwise Regular Commemorative Coins of Republic IndiaDokument4 SeitenMintwise Regular Commemorative Coins of Republic IndiaChopade HospitalNoch keine Bewertungen

- Pengiriman Paket Menggunakan Grab Expres 354574f4 PDFDokument24 SeitenPengiriman Paket Menggunakan Grab Expres 354574f4 PDFAku Belum mandiNoch keine Bewertungen

- Marico Over The Wall Operations Case StudyDokument4 SeitenMarico Over The Wall Operations Case StudyMohit AssudaniNoch keine Bewertungen

- Bahasa Inggris SMK Kur 2013Dokument13 SeitenBahasa Inggris SMK Kur 2013Jung Eunhee100% (2)

- Practical IFRSDokument282 SeitenPractical IFRSahmadqasqas100% (1)

- Equity vs. EqualityDokument5 SeitenEquity vs. Equalityapi-242298926Noch keine Bewertungen

- Pi MorchemDokument1 SeitePi MorchemMd Kamruzzaman MonirNoch keine Bewertungen

- Department of Labor: Ncentral07Dokument70 SeitenDepartment of Labor: Ncentral07USA_DepartmentOfLaborNoch keine Bewertungen

- JVA JuryDokument22 SeitenJVA JuryYogesh SharmaNoch keine Bewertungen

- FPO Application GuideDokument33 SeitenFPO Application GuideIsrael Miranda Zamarca100% (1)

- Daily LogDokument14 SeitenDaily Logdempe24Noch keine Bewertungen

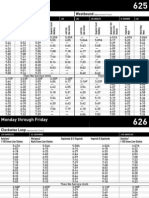

- LA Metro - 625-626Dokument4 SeitenLA Metro - 625-626cartographicaNoch keine Bewertungen

- Rent Agreement - (Name of The Landlord) S/o - (Father's Name of TheDokument2 SeitenRent Agreement - (Name of The Landlord) S/o - (Father's Name of TheAshish kumarNoch keine Bewertungen

- DBBL (Rasel Vai)Dokument1 SeiteDBBL (Rasel Vai)anik1116jNoch keine Bewertungen

- Environment PollutionDokument6 SeitenEnvironment PollutionNikko Andrey GambalanNoch keine Bewertungen

- Ch-3 Financial Market in BangladeshDokument8 SeitenCh-3 Financial Market in Bangladeshlabonno350% (1)

- Lic Plans at A GlanceDokument3 SeitenLic Plans at A GlanceTarun GoyalNoch keine Bewertungen

- Building Economics Complete NotesDokument20 SeitenBuilding Economics Complete NotesManish MishraNoch keine Bewertungen

- Rapaport Diamond ReportDokument2 SeitenRapaport Diamond ReportMorries100% (1)

- ProjectDokument17 SeitenProjectfirman tri ajie75% (4)

- Inflation Title: Price Stability Definition, Causes, EffectsDokument20 SeitenInflation Title: Price Stability Definition, Causes, EffectsSadj GHorbyNoch keine Bewertungen

- Study of Supply Chain at Big BasketDokument10 SeitenStudy of Supply Chain at Big BasketPratul Batra100% (1)

- IGPSA PresentationDokument11 SeitenIGPSA Presentationisrael espinozaNoch keine Bewertungen

- Chapter 15 Investment, Time, and Capital Markets: Teaching NotesDokument65 SeitenChapter 15 Investment, Time, and Capital Markets: Teaching NotesMohit ChetwaniNoch keine Bewertungen

- COA - M2017-014 Cost of Audit Services Rendered To Water DistrictsDokument5 SeitenCOA - M2017-014 Cost of Audit Services Rendered To Water DistrictsJuan Luis Lusong67% (3)