Beruflich Dokumente

Kultur Dokumente

HEARING DATE AND TIME: January 27, 2012 at 10:00 A.M. (Eastern Time) OBJECTION DEADLINE: January 20, 2012 at 4:00 P.M. (Eastern Time)

Hochgeladen von

Melanie CohenOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

HEARING DATE AND TIME: January 27, 2012 at 10:00 A.M. (Eastern Time) OBJECTION DEADLINE: January 20, 2012 at 4:00 P.M. (Eastern Time)

Hochgeladen von

Melanie CohenCopyright:

Verfügbare Formate

11-15463-shl

Doc 543

Filed 01/06/12

Entered 01/06/12 16:28:16 Pg 1 of 53

Main Document

HEARING DATE AND TIME: January 27, 2012 at 10:00 a.m. (Eastern Time) OBJECTION DEADLINE: January 20, 2012 at 4:00 p.m. (Eastern Time)

Harvey R. Miller Stephen Karotkin Alfredo R. Prez Stephen A. Youngman WEIL, GOTSHAL & MANGES LLP 767 Fifth Avenue New York, New York 10153 Telephone: (212) 310-8000 Facsimile: (212) 310-8007 Attorneys for Debtors and Debtors in Possession UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK ---------------------------------------------------------------x : In re : : AMR CORPORATION, et al., : : Debtors. : : ---------------------------------------------------------------x

Chapter 11 Case No. 11-15463 (SHL) (Jointly Administered)

NOTICE OF HEARING ON APPLICATION OF AMERICAN EAGLE AIRLINES, INC. FOR ENTRY OF AN ORDER AUTHORIZING THE RETENTION AND EMPLOYMENT OF BAIN & COMPANY, INC. AS STRATEGIC CONSULTANTS NUNC PRO TUNC TO DECEMBER 14, 2011 PLEASE TAKE NOTICE that a hearing on the annexed application, dated January 6, 2012 (the Application), of American Eagle Airlines, Inc. (Eagle), will be held before the Honorable Sean H. Lane, United States Bankruptcy Judge, in Room 701 of the United States Bankruptcy Court for the Southern District of New York (the Bankruptcy Court), One Bowling Green, New York, New York 10004, on January 27, 2012 at 10:00 a.m. (Eastern Time), or as soon thereafter as counsel may be heard. PLEASE TAKE FURTHER NOTICE that any responses or objections to the Application (the Objections) must be in writing, shall conform to the Federal Rules of

US_ACTIVE:\43881053\07\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12

Entered 01/06/12 16:28:16 Pg 2 of 53

Main Document

Bankruptcy Procedure and the Local Bankruptcy Rules for the Southern District of New York, and shall be filed with the Bankruptcy Court (a) by registered users of the Bankruptcy Courts case filing system, electronically in accordance with General Order M-399 (which can be found at http://nysb.uscourts.gov) and (b) by all other parties in interest, on a 3.5 inch disk, in textsearchable portable document format (PDF) (with a hard copy delivered directly to Chambers), in accordance with the customary practices of the Bankruptcy Court and General Order M-399, to the extent applicable, and served in accordance with General Order M-399 and on (i) the attorneys for the Debtors, Weil, Gotshal & Manges LLP, 767 Fifth Avenue, New York, New York 10153 (Attn: Alfredo R. Prez, Esq.), (ii) American Eagle Airlines, Inc., c/o AMR Corporation, 4333 Amon Carter Boulevard, MD 5675, Fort Worth, Texas 76155 (Attn: Kathryn Koorenny, Esq.), (iii) the Office of the United States Trustee for the Southern District of New York, 33 Whitehall Street, 21st Floor, New York, New York 10004 (Attn: Brian Masumoto, Esq.), (iv) the attorneys for the statutory committee of unsecured creditors, Skadden, Arps, Slate, Meagher & Flom LLP, Four Times Square, New York, New York 10036 (Attn: John Wm. Butler, Jr., Esq. and Jay M. Goffman, Esq.), (v) Bain & Company, Inc., 131 Dartmouth Street, Boston, Massachusetts 02116 (Attn: Diane Fernandez, Esq.), and (vi) all entities that requested notice in these chapter 11 cases under Fed. R. Bankr. P. 2002 so as to be received no later than January 20, 2012 at 4:00 p.m. (Eastern Time) (the Objection Deadline).

US_ACTIVE:\43881053\07\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12

Entered 01/06/12 16:28:16 Pg 3 of 53

Main Document

PLEASE TAKE FURTHER NOTICE that if no Objections are timely filed and served with respect to the Application, the Debtors may, on or after the Objection Deadline, submit to the Bankruptcy Court an order substantially in the form of the proposed order annexed to the Motion, which order may be entered with no further notice or opportunity to be heard. Dated: New York, New York January 6, 2012 /s/ Alfredo R. Prez Harvey R. Miller Stephen Karotkin Alfredo R. Prez Stephen A. Youngman WEIL, GOTSHAL & MANGES LLP 767 Fifth Avenue New York, New York 10153 Telephone: (212) 310-8000 Facsimile: (212) 310-8007 Attorneys for Debtors and Debtors in Possession

US_ACTIVE:\43881053\08\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12

Entered 01/06/12 16:28:16 Pg 4 of 53

Main Document

HEARING DATE AND TIME: January 27, 2012 at 10:00 a.m. (Eastern Time) OBJECTION DEADLINE: January 20, 2012 at 4:00 p.m. (Eastern Time)

Harvey R. Miller Stephen Karotkin Alfredo R. Prez Stephen A. Youngman WEIL, GOTSHAL & MANGES LLP 767 Fifth Avenue New York, New York 10153 Telephone: (212) 310-8000 Facsimile: (212) 310-8007 Attorneys for Debtors and Debtors in Possession UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK ---------------------------------------------------------------x : In re : : AMR CORPORATION, et al., : : Debtors. : : ---------------------------------------------------------------x

Chapter 11 Case No. 11-15463 (SHL) (Jointly Administered)

APPLICATION OF AMERICAN EAGLE AIRLINES, INC. FOR ENTRY OF AN ORDER AUTHORIZING THE RETENTION AND EMPLOYMENT OF BAIN & COMPANY, INC. AS STRATEGIC CONSULTANTS NUNC PRO TUNC TO DECEMBER 14, 2011 TO THE HONORABLE SEAN H. LANE, UNITED STATES BANKRUPTCY JUDGE: American Eagle Airlines, Inc., (Eagle or the Debtor), as debtor and debtor in possession in the above-captioned chapter 11 cases respectfully represents: Background 1. On November 29, 2011 (the Commencement Date), Eagle, together

with its affiliated-debtors (collectively, the Debtors), commenced with this Court a voluntary case under chapter 11 of title 11, United States Code (the Bankruptcy Code). The Debtors are authorized to continue to operate their business and manage their properties as debtors in

US_ACTIVE:\43881053\07\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12

Entered 01/06/12 16:28:16 Pg 5 of 53

Main Document

possession pursuant to sections 1107(a) and 1108 of the Bankruptcy Code. No trustee or examiner has been appointed in these chapter 11 cases. 2. Information regarding the Debtors business, capital structure, and the

circumstances leading to the commencement of these chapter 11 cases is set forth in the Affidavit of Isabella D. Goren Pursuant to Rule 1007-2 of the Local Bankruptcy Rules of the Southern District of New York, sworn to on November 29, 2011. Jurisdiction 3. The Court has jurisdiction over this matter under 28 U.S.C. 157 and

1334. This is a core proceeding under 28 U.S.C. 157(b). Venue is proper in this district under 28 U.S.C. 1408 and 1409. Relief Requested 4. This application (the Application) requests entry of an order,

substantially in the form attached hereto as Exhibit A, pursuant to sections 327(a) and 328(a) of the Bankruptcy Code, Rules 2014(a) and 2016 of the Federal Rules of Bankruptcy Procedure (the Bankruptcy Rules), and Rules 2014-1 and 2016-1 of the Local Bankruptcy Rules for the Southern District of New York (the Local Bankruptcy Rules), authorizing Eagle to retain and employ Bain & Company, Inc. (Bain) as its strategic consultant in accordance with the terms and conditions set forth in the engagement letter, dated as of December 14, 2011 (including the exhibits annexed thereto, the Engagement Letter)1 nunc pro tunc to December 14, 2011. In support of this Application, Eagle submits the Declaration of William Wade, Vice President at Bain (the Wade Declaration), which is annexed hereto as Exhibit B.

A copy of the Engagement Letter is attached as an exhibit to the proposed order.

US_ACTIVE:\43881053\07\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12

Entered 01/06/12 16:28:16 Pg 6 of 53

Main Document

Bains Qualifications 5. Eagle seeks to retain Bain as its strategic consultant because, among other

things, Bain has extensive experience in, and an excellent reputation for, providing high-quality consulting services to companies, including companies undergoing restructuring. Bain has provided business consulting services to over 4,600 major corporations from every economic sector and region of the world since its founding in 1973. 6. Bain professionals have substantial expertise and extensive experience in

the airline industry, where Bain has played a major role in the successful transformation of several leading airlines. During these assignments, Bain worked on most of the major strategic and operational issues faced by these airlines. Bain developed comprehensive turnaround plans as well as plans to address specific issues, including labor strategy, routing and scheduling, capacity planning, distribution strategy, fleet management, yield management, pricing and regional jet strategy, as well as cost reduction in airport services, maintenance, overhead and purchasing. 7. In addition, Bain has worked with Eagle on three major assignments over

the past five years and is very familiar with company operations, strategy and stakeholders. These assignments have covered similar issues to those outlined in the Engagement Letter, providing Bain with a unique ability to rapidly perform the needed analysis, work productively with both union and management stakeholders, and effectively advise Eagle during its restructuring process. 8. Broadly speaking, Bain will assist in labor-cost assessment and

negotiations. Bain has previously served as a strategic consultant to Eagle in its evaluation of labor matters. In the most recent engagement between Eagle and Bain, which ran between October 2010 and September 2011, Bain performed a cost-benchmarking analysis across

US_ACTIVE:\43881053\07\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12

Entered 01/06/12 16:28:16 Pg 7 of 53

Main Document

employee groups, a deeper cost-benchmarking analysis for the pilot group, and assisted Eagle in developing solutions for and negotiating with its pilot group. 9. In providing prepetition professional services to Eagle, Bain has become

familiar with Eagle and its business, including Eagles operations, employee groups, cost structures and related matters. Having worked with Eagles management and its other advisors, Bain has developed relevant experience and expertise regarding Eagle that will assist it in providing effective and efficient services in these chapter 11 cases. Accordingly, Bain is both well qualified and uniquely able to assist Eagle during these chapter 11 cases in an efficient and timely manner. Proposed Services2 10. The terms and the conditions of the Engagement Letter were negotiated

between Eagle and Bain and reflect the parties mutual agreement as to the substantial efforts that will be required in this engagement. Subject to further order of this Court, Bain will develop a benchmarking analysis that identifies Eagles relative cost position by employee group and calculates the degree of cost advantage or disadvantage. The assessed employee groups will include management, pilots, flight attendants, maintenance, fleet service clerks, dispatch and agents, and, to the extent that data is available, the analysis will cover the major cost drivers of wages and benefits, productivity and seniority. The analysis will develop both top-down (overall cost position) and bottom-up (by employee group) views of the data reviewed by Bain. 11. As part of this process, Bain will also help Eagle identify and structure

potential labor solutions as part of the restructuring process. Bain will provide analytic support, strategic advice, and advice on best practices during labor negotiations, and will otherwise work

2

The summaries of the Engagement Letter contained in this Application are provided for purposes of convenience only. In the event of any inconsistency between the summaries contained herein and the terms and provisions of the Engagement Letter, the terms of the Engagement Letter shall control.

US_ACTIVE:\43881053\07\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12

Entered 01/06/12 16:28:16 Pg 8 of 53

Main Document

with both management and union stakeholders as needed. Bain will also assist in the ongoing development of Eagle business strategy, including issues such as competitive dynamics, relationships with various stakeholders and market positioning. Bain professionals will be able to execute an in-depth study of Eagles employee groups in more depth and with greater speed than Eagles management could using available staff. Accordingly, Eagle requires the services of a capable and experienced consultant such as Bain to maximize the value of its estate. 12. Bains services for Eagle do not overlap with any other services provided by

professionals to the other Debtors. Eagles employees belong to different unions and are covered by different collective bargaining agreements than employees of the other Debtors, and, accordingly, Eagles review of its labor costs will involve assessment of a different set of facts and questions than the review of labor matters for any of the other Debtors. Nonetheless, all of the services that Bain will provide to Eagle will be undertaken at the request of Eagle and will be appropriately directed by Eagle so as to avoid duplicative efforts among the professionals retained in these chapter 11 cases. Eagle will also use reasonable efforts to coordinate Bains service with those services provided by Eagles other retained professionals to ensure that there is no unnecessary duplication of services. Professional Compensation 13. Bain intends to apply for compensation of a monthly fee plus direct

expenses for professional services rendered in connection with these cases, subject to approval of the Court and in compliance with any applicable provisions of the Bankruptcy Code. Eagle will compensate Bain in accordance with the terms and conditions of the Engagement Letter, which provides a compensation structure (the Fee and Expense Structure) in relevant part as follows: (a) Monthly Fee: Eagle will pay Bain a monthly professional fee equal to $525,000 per month (the Monthly Fee) as described in the Engagement Letter. The 5

US_ACTIVE:\43881053\07\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12

Entered 01/06/12 16:28:16 Pg 9 of 53

Main Document

Monthly Fee will be paid in advance on each monthly anniversary of the Commencement Date, provided that the first payment shall be made upon approval of the engagement by the Court and will be in respect of the period from the Commencement Date through the monthly anniversary of the Commencement Date that immediate follows the date such payment is made. (b) Expenses: Eagle will reimburse Bain for expenses reasonably incurred in connection with and directly related to the provision of Bains Services as described in the Engagement Letter. Such expenses may include, but are not limited to, travel expenses, postage, express mail and messenger charges, external market research charges and expenses for working meals. Bain will invoice expenses in arrears and such expense invoices will be due and payable within 30 days of Eagles receipt. Such expenses include fees and expenses of Bains outside counsel incurred in connection with preparation of the Engagement Letter and approval of Bains retention and any fee applications. All expenses charged by Bain are subject to interim and final approval by the Court. Testimony: In the event of a hearing or other court or administrative proceeding under Section 1113 of the Bankruptcy Code, Bain agrees that it will produce a Vice-President level employee to testify or otherwise provide reasonable assistance to Eagle in preparing for testimony. There will be no additional charge for providing such testimony if such testimony occurs during the term of Bains Engagement. If testimony is required after the termination of Bains Engagement, Eagle will pay Bain additional compensation for the time expended by Bain in testifying at such proceedings and related preparation at the rate of $8,720 per day for a Vice-President level employee. In addition, Eagle will reimburse Bain for its reasonable fees and expenses incurred in connection therewith (including without limitation the fees and expenses of Bains outside counsel). Similarly, if Bain is requested by Eagle or required by subpoena or similar legal process to produce Bains materials or personnel with respect to its engagement for Eagle, and Bain is not a party to such proceeding, Eagle will reimburse Bain for its professional time and expenses, together with the fees and expenses of Bains counsel incurred in responding to such a request. 14. The Fee and Expense Structure is comparable to compensation generally

(c)

charged by other firms of similar stature to Bain for comparable engagements, both in and out of bankruptcy, which do not bill their clients on an hourly basis and generally are compensated on a transactional basis. Further, the Fee and Expense Structure represents Bains standard fee structure. Bain charged Eagle $500,000 per month during its most recent engagement for Eagle, which concluded in September 2011. Bain and Eagle believe that the foregoing compensation arrangements are both reasonable and market-based and consistent with Bains normal and

US_ACTIVE:\43881053\07\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 10 of 53

Main Document

customary billing practices for comparably sized and complex cases, both in and out-of-court, involving the services to be provided in the chapter 11 cases. 15. Eagle believes that the ultimate benefit of Bains services hereunder

cannot be measured by reference to the number of hours to be expended by Bains professionals in the performance of such services. Indeed, Eagle and Bain have agreed upon the Fee and Expense Structure in anticipation that a substantial commitment of professional time and effort will be required of Bain and its professionals hereunder, that such commitment may foreclose other opportunities for Bain, and that the actual time and commitment required of Bain and its professionals to perform its services hereunder may vary substantially from week to week or month to month. 16. Eagle submits that Bain has obtained valuable institutional knowledge of

Eagles businesses, financial affairs and labor groups as a result of providing services to Eagle before the Commencement Date and that Bain is both well qualified and uniquely able to perform these services and assist Eagle in these chapter 11 cases. Moreover, Eagle believes that Bains services will assist Eagle in achieving a successful outcome for these chapter 11 cases. Eagle is advised by Bain that it is not Bains general practice to keep detailed time records similar to those customarily kept by attorneys. Accordingly, Bain does not intend to file detailed time records, but it will otherwise file interim and final fee applications for the allowance of compensation for services rendered and reimbursement of expenses incurred in accordance with applicable provisions of the Bankruptcy Code, the Guidelines, the Bankruptcy Rules and any applicable orders of this Court. Such applications will include a general description of the services rendered during the period under review, the names of the Bain professionals rendering such services, and, notwithstanding that Bain will not charge for its services on an hourly basis, the total number of hours expended by such professionals in rendering such services as well as

US_ACTIVE:\43881053\07\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 11 of 53

Main Document

an itemized list of any actual and necessary costs and expenses for which Bain seeks reimbursement. 17. In light of the foregoing, the importance of Bains expertise and assistance

in Eagles reorganization effort, Bains commitment to the variable level of time and effort necessary to complete an in-depth analysis for Eagle expeditiously, and the market prices for Bains services for engagements of this nature both out-of-court and in a chapter 11 context, Eagle believes that the Fee and Expense Structure is market-based and fair and reasonable under the standards set forth in section 328(a) of the Bankruptcy Code. Accordingly, as more fully described below, Eagle believes that the Court should approve Bains retention subject to the standard of review set forth in section 328(a) of the Bankruptcy Code. 18. Bain has not shared or agreed to share any of its compensation from Eagle

with any other person, other than as permitted by section 504 of the Bankruptcy Code. Indemnification and Contribution Provisions 19. As part of the overall compensation payable to Bain under the terms of the

Engagement Letter, Eagle has agreed to certain indemnification and contribution obligations as described in the Engagement Letter and Exhibit B annexed thereto (the Indemnification Obligations). The Indemnification Obligations provide that Eagle will indemnify and hold harmless Bain (including its affiliates) and the directors, officers, stockholders, agents and employees of Bain (and such affiliates) (collectively, the Indemnified Parties) against liabilities arising out of or in connection with its retention by Eagle, except for any liabilities finally judicially determined by a court of competent jurisdiction to have resulted primarily from the gross negligence, willful misconduct, or bad faith of any of Bain or the other indemnified parties. In addition, if indemnification or reimbursement obligations are held to be unavailable by any court (other than circumstances where a court determines that liability is primarily from

US_ACTIVE:\43881053\07\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 12 of 53

Main Document

the gross negligence or intentional misconduct of the indemnified party), the Engagement Letter allocates contribution obligations based on the relative benefits and faults of Bain and Eagle, subject to a limitation on Bains aggregate liability in the amount of its fees received under the Engagement Letter. The indemnification provisions reflected in the Engagement Letter are customary and reasonable terms of consideration for advisors such as Bain for proceedings both out of court and in chapter 11. 20. The terms of the Engagement Letter, including the Indemnification

Provisions, were fully negotiated between Eagle and Bain at arms length, and Eagle respectfully submits that the Indemnification Provisions, as modified by the order requested herein, are reasonable and in the best interests of Eagle, its estate and creditors. Accordingly, as part of this Application, Eagle requests that this Court approve the Indemnification Provisions, as may be modified by Eagles proposed order. Bains Disinterestedness 21. As set forth in the Wade Declaration, Bain has concluded a computerized

search of potential significant parties in the Debtors chapter 11 cases. Upon review of its client database, Bain has learned that it has business relationships with certain creditors of the Debtors and other parties in interest, as more fully discussed in the Wade Declaration. The relationships and work conducted by Bain for those parties in no way involves matters upon which Bain is to be engaged and should not disqualify Bain from working for Eagle. 22. Bain has also learned that it is an indirect minority shareholder of certain

of the Debtors creditors and parties in interest, as more fully described in the Wade Declaration. Bain and its professionals do not actively manage these investments or exercise control over the operations of the portfolio companies, and the size of the holdings are of a de minimis (less than

US_ACTIVE:\43881053\07\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 13 of 53

Main Document

one percent) size. Thus, these holdings in no way create a conflict which would in any way disqualify Bain from working for Eagle. 23. To the best of Eagles knowledge and except to the extent disclosed herein

and in the Wade Declaration: (a) Bain is a disinterested person within the meaning of section 101(14) of the Bankruptcy Code, as required by section 327(a) of the Bankruptcy Code and does not hold or represent an interest adverse to Eagles estate; and (b) Bain has no connection to Eagle, its creditors or their related parties except as may be disclosed in the Wade Declaration. To the extent that any new relevant facts or relationships bearing on the matters described herein during the period of Bains retention are discovered or arise, Bain will use reasonable efforts to file promptly a supplemental declaration, as required by Bankruptcy Rule 2014(a). 24. In the six months prior to the Commencement Date, pursuant to a separate

engagement letter, Eagle paid Bain $1,125,000 in professional services fees. This amount was paid over three payments as follows: $500,000 paid July 25, 2011; $375,000 paid August 25, 2011; and $250,000 paid October 31, 2011. As of the Commencement Date, Bain asserts a prepetition claim against Eagle arising from its previous engagement in the amount of $1,925,000, which the Debtors have not reviewed or assessed. Bain will waive this claim upon entry of an order approving this application. 25. Bain will conduct an ongoing review of its files to ensure that no conflicts

or other disqualifying circumstances exist or arise. If any new material facts or relationships are discovered or arise, Bain will inform this Court. Basis for Relief 26. Eagle seeks authority to employ and retain Bain as its strategic consultant

under section 327 of the Bankruptcy Code, which provides that a debtor is authorized to employ professional persons that do not hold or represent an interest adverse to the estate, and that are

US_ACTIVE:\43881053\07\14013.0138

10

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 14 of 53

Main Document

disinterested persons, to represent or assist the [Debtor] in carrying out the [Debtors] duties under this title. 11 U.S.C. 327(a). Section 1107(b) of the Bankruptcy Code elaborates upon sections 101(14) and 327(a) of the Bankruptcy Code in cases under chapter 11 of the Bankruptcy Code and provides that a person is not disqualified for employment under section 327 of [the Bankruptcy Code] by a debtor in possession solely because of such persons employment by or representation of the debtor before the commencement of the case. 11 U.S.C. 1107(b). 27. Eagle seeks approval of the Fee and Expense Structure and the

Engagement Letter (including the indemnification provisions) pursuant to section 328(a) of the Bankruptcy Code, which provides, in relevant part, that Eagle with the courts approval, may employ or authorize the employment of a professional person under section 327 . . . on any reasonable terms and conditions of employment, including on a retainer, on an hourly basis, on a fixed or percentage fee basis, or on a contingent fee basis. 11 U.S.C. 328(a). Accordingly, section 328 of the Bankruptcy Code permits the compensation of professionals, including consultants, on flexible terms that reflect the nature of their services and market conditions. Thus, section 328 is a significant departure from prior bankruptcy practice relating to the compensation of professionals. Indeed, as the United States Court of Appeals for the Fifth Circuit recognized in Donaldson Lufkin & Jenrette Securities Corp. v. National Gypsum (In re National Gypsum Co.), 123 F.3d 861, 862 (5th Cir. 1997): Prior to 1978 the most able professionals were often unwilling to work for bankruptcy estates where their compensation would be subject to the uncertainties of what a judge thought the work was worth after it had been done. That uncertainty continues under the present 330 of the Bankruptcy Code, which provides that the court award to professional consultants reasonable compensation based on relevant factors of time and comparable costs, etc. Under present 328 the professional may avoid that uncertainty by obtaining court approval of compensation agreed to with the trustee (or debtor or committee) (internal citations omitted).

US_ACTIVE:\43881053\07\14013.0138

11

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 15 of 53

Main Document

28.

The Fee and Expense Structure appropriately reflects the nature and scope

of services to be provided by Bain, Bains substantial experience with respect to strategic consulting services, and the fee and expense structures typically utilized by Bain and other leading consultants that do not bill their clients on an hourly basis. 29. Furthermore, the Bankruptcy Abuse Prevention and Consumer Protection

Act of 2005 amended section 328(a) of the Bankruptcy Code as follows: The trustee, or a committee appointed under section 1102 of this title, with the courts approval, may employ or authorize the employment of a professional person under section 327 or 1103 of this title, as the case may be, on any reasonable terms and conditions of employment, including on a retainer, on an hourly basis, on a fixed or percentage fee basis, or on a contingent fee basis. 11 U.S.C. 328(a) (emphasis added). This change makes clear that debtors may retain a professional on a fixed fee basis with Court approval, such as the Fee and Expense Structure for Bain in the Engagement Letter. 30. Eagle believes that the Fee and Expense Structure set forth in the

Engagement Letter sets forth reasonable terms and conditions of employment and should be approved under section 328(a) of the Bankruptcy Code. The Fee and Expense Structure adequately reflects: (a) the nature of the services to be provided by Bain; and (b) fee and expense structures and indemnification provisions typically utilized by Bain and other leading strategic consulting firms, which do not bill their time on an hourly basis and generally are compensated on a transactional basis. Moreover, Bains substantial experience with respect to the consulting services, coupled with the nature and scope of work already performed by Bain before the Commencement Date, further suggest the reasonableness of the Fee and Expense Structure.

US_ACTIVE:\43881053\07\14013.0138

12

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 16 of 53

Main Document

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 17 of 53

Main Document

EXHIBIT A Proposed Order

US_ACTIVE:\43881053\07\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 18 of 53

Main Document

UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK ---------------------------------------------------------------x : In re : : AMR CORPORATION, et al., : : Debtors. : : ---------------------------------------------------------------x

Chapter 11 Case No. 11-15463 (SHL) (Jointly Administered)

ORDER AUTHORIZING THE EMPLOYMENT AND RETENTION OF BAIN & COMPANY, INC. AS STRATEGIC CONSULTANTS TO AMERICAN EAGLE AIRLINES, INC. NUNC PRO TUNC TO DECEMBER 14, 2011 Upon the Application, dated January 6, 2012 (the Application),1 of American Eagle Airlines, Inc. (Eagle or the Debtor), for entry of an order authorizing Eagle to employ and retain Bain & Company, Inc. (Bain) as its strategic consultant effective as of December 14, 2011, pursuant to sections 327(a) and 328(a) of title 11 of the United States Code (the Bankruptcy Code), Rules 2014(a) and 2016 of the Federal Rules of Bankruptcy Procedure (the Bankruptcy Rules), and Rules 2014-1 and 2016-1 of the Local Bankruptcy Rules for the United States Bankruptcy Court for the Southern District of New York (the Local Bankruptcy Rules); and upon the Declaration of William Wade, Vice President at Bain, in support of the Application (the Wade Declaration); and the Court having jurisdiction to consider the Application and the relief requested therein in accordance with 28 U.S.C. 157 and 1334 and the Standing Order M-61 Referring to Bankruptcy Judges for the Southern District of New York any and all Proceedings Under Title 11, dated July 10, 1984 (Ward, Acting C.J.); and consideration of the Application and the relief requested therein being a core proceeding

Capitalized terms used herein and not otherwise defined herein shall have the meanings ascribed to such terms in the Application.

US_ACTIVE:\43881053\07\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 19 of 53

Main Document

pursuant to 28 U.S.C. 157(b); and venue being proper before this Court pursuant to 28 U.S.C. 1408 and 1409; and due and proper notice of the Application having been provided, and it appearing that no other or further notice need be provided; and a hearing having been held to consider the relief requested in the Application (the Hearing); and upon the record of the Hearing and all of the proceedings had before the Court; and the Court having found and determined that the relief sought in the Application is in the best interest of Eagle, its estate, creditors, and all parties in interest, and that the legal and factual bases set forth in the Application establish just cause for the relief granted herein; and after due deliberation and sufficient cause appearing therefor, it is ORDERED that the Application is granted as provided herein; and it is further ORDERED that Eagle is authorized pursuant to sections 327(a) and 328(a) of the Bankruptcy Code, Bankruptcy Rules 2014(a) and 2016 and Local Bankruptcy Rules 2014-1 and 2016-1 to employ and retain Bain as its strategic consultant in accordance with the terms and conditions set forth in the Engagement Letter annexed hereto as Exhibit 1, effective nunc pro tunc to December 14, 2011, and to pay fees and reimburse expenses to Bain on the terms and at the times specified in the Engagement Letter; and it is further ORDERED that the Services set forth in the Wade Declaration are incorporated herein by reference, and, notwithstanding anything to the contrary in the Engagement Letter, the Application or the Wade Declaration, to the extent that Eagle requests Bain to perform any services other than those detailed in the Engagement Letter, Eagle shall seek further application for an order of approval by the Court for a supplement to the retention and any related modifications to the Engagement Letter and such application shall set forth, in addition to the additional services to be performed, the additional fees sought to be paid; and it is further

US_ACTIVE:\43881053\07\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 20 of 53

Main Document

ORDERED that Bain shall file interim and final fee applications for the allowance of compensation for services rendered and reimbursement of expenses incurred in accordance with applicable provisions of the Bankruptcy Code, the Bankruptcy Rules, the Local Bankruptcy Rules, any applicable orders of this Court and the Guidelines, as modified by the terms of this Order; provided, however, Eagle is authorized to pay Bain in accordance with the payment schedule defined in the Engagement Letter, including by making payments to Bain before it has submitted a fee application for the applicable time period to the Bankruptcy Court, but payments made to Bain must be returned to Eagle to the extent that they are not approved by the Court following submission of a fee application by Bain; and it is further ORDERED that notwithstanding anything to the contrary contained herein, the U.S. Trustee retains all rights to respond or object to Bain interim and final applications for compensation and reimbursement of expenses on all grounds including, but not limited to, reasonableness pursuant to section 330 of the Bankruptcy Code; and, in the event the U.S. Trustee objects, the Court retains the right to review the interim and final applications pursuant to section 330 of the Bankruptcy Code; provided, however, that Bains professionals will not be required to keep detailed time-records in one-tenth hour increments, but will instead furnish time records described in the following paragraph; and it is further ORDERED that Bain shall include in its fee applications, among other things, an itemized list of any actual and necessary costs and expenses for which Bain seeks reimbursement and time records describing generally the services rendered, the names of the Bain professionals rendering such services, and the total number of hours expended by such professionals in rendering such services; and it is further ORDERED that pursuant to the terms of the Engagement Letter, Bain is entitled to reimbursement by Eagle for reasonable expenses incurred in connection with the performance

US_ACTIVE:\43881053\07\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 21 of 53

Main Document

of its engagement under the Engagement Letter, including, without limitation, the fees, disbursements and other charges of Bains counsel relating to Bains retention and fee applications, and relating to any indemnification, testimony, or responses to subpoenas or similar legal process, in connection with these chapter 11 cases (which counsel shall not be required to be retained pursuant to section 327 of the Bankruptcy Code or otherwise); ORDERED that the Engagement Letter, including, without limitation, the Indemnification Obligations, is incorporated herein by reference and approved in all respects except as otherwise set forth herein; and it is further ORDERED, that Eagles indemnity of the affiliates of Bain and the other Indemnified Parties shall apply only to the extent that any claims against affiliates arise from acts or omissions of Bain during the pendency of Eagles chapter 11 case; and it is further ORDERED that all requests by Indemnified Parties for the payment of indemnification, contribution or otherwise as set forth in the Engagement Letter shall be made by means of an application to the Court and shall be subject to review by the Court to ensure that payment of such indemnity conforms to the terms of the Engagement Letter and is reasonable under the circumstances of the litigation or settlement in respect of which indemnity is sought; provided, however, that in no event shall any Indemnified Party be indemnified in the case of its own bad faith, self-dealing, breach of fiduciary duty (if any), gross negligence, willful misconduct or fraud; and it is further ORDERED that in no event shall Indemnified Parties be indemnified if Eagle or a representative of the estate, assert a claim for, and a court determines by final order that such claim arose out of, Bains own bad faith, self-dealing, breach of fiduciary duty (if any), gross negligence, willful misconduct or fraud; and it is further

US_ACTIVE:\43881053\07\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 22 of 53

Main Document

ORDERED that to the extent that there may be any inconsistency between the terms of the Application, the Engagement Letter, the Wade Declaration, and this Order, the terms of this Order shall govern; and it is further ORDERED that Eagle may terminate the Engagement Letter at any time and Bain may terminate the engagement at any time provided that such termination is approved by the Court; and it is further ORDERED that if, upon the expiration of the Engagement Letter, the parties wish to extend the Engagement Letter, they may agree to extend the Engagement Letter for an additional term, without further application for an order of approval of the Court, provided such extension will be subject to terms of the Engagement Letter and this Order; and it is further ORDERED that Eagle is authorized to take all actions necessary to effectuate the relief granted pursuant to this Order in accordance with the Application; and it is further ORDERED that notice of the Application as provided therein shall be deemed good and sufficient notice of such motion and the requirements of the local rules of the Court are satisfied by such notice; and it is further ORDERED that the terms and conditions of this Order shall be immediately effective and enforceable upon its entry; and it is further ORDERED that the relief granted herein shall be binding upon any chapter 11 trustee appointed in these chapter 11 cases, or upon any chapter 7 trustee appointed in the event of a subsequent conversion of these chapter 11 cases to cases under chapter 7; and it is further

US_ACTIVE:\43881053\07\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 23 of 53

Main Document

ORDERED that this Court retains jurisdiction with respect to all matters arising from or related to the implementation of this Order.

Dated: New York, New York [_________], 2012

United States Bankruptcy Judge

US_ACTIVE:\43881053\07\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 24 of 53

Main Document

EXHIBIT 1 Engagement Letter

US_ACTIVE:\43881053\07\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 25 of 53

Main Document

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 26 of 53

Main Document

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 27 of 53

Main Document

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 28 of 53

Main Document

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 29 of 53

Main Document

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 30 of 53

Main Document

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 31 of 53

Main Document

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 32 of 53

Main Document

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 33 of 53

Main Document

EXHIBIT B Declaration of William Wade

US_ACTIVE:\43881053\07\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 34 of 53

Main Document

UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK ---------------------------------------------------------------x : In re : : AMR CORPORATION, et al., : : Debtors. : : ---------------------------------------------------------------x

Chapter 11 Case No. 11-15463 (SHL) (Jointly Administered)

DECLARATION OF WILLIAM WADE IN SUPPORT OF THE EMPLOYMENT AND RETENTION OF BAIN & COMPANY, INC. AS STRATEGIC CONSULTANTS TO AMERICAN EAGLE AIRLINES, INC. NUNC PRO TUNC TO DECEMBER 14, 2011 I, William Wade, under penalty of perjury, declare as follows: 1. I am a Vice President at Bain & Company, Inc. (Bain), a consulting

services firm, which has offices located at 5215 North OConnor Boulevard, Suite 500, Irving, Texas 75039. I am duly authorized to make this Declaration on behalf of Bain in support of the application (the Application)1 of American Eagle Airlines, Inc. (Eagle or the Debtor) for entry of an order authorizing the employment and retention of Bain as strategic consultant, nunc pro tunc to December 14, 2011, under the terms and conditions set forth in the Engagement Letter, annexed hereto as Exhibit 1. I submit this Declaration in accordance with sections 327(a) and 328(a) of title 11 of the United States Code (the Bankruptcy Code), Rules 2014(a), 2016 and 5002 of the Federal Rules of Bankruptcy Procedure (the Bankruptcy Rules) and Rules 2014-1 and 2016-1 of the Local Bankruptcy Rules for the United States Bankruptcy Court for the Southern District of New York (the Local Bankruptcy Rules). Except as otherwise noted, I have personal knowledge of the matters set forth herein.

All capitalized terms used but otherwise not defined herein shall have the meanings set forth in the Application or the Engagement Letter, as appropriate.

US_ACTIVE:\43881053\07\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 35 of 53

Main Document

A.

Bains Qualifications 2. Bain has provided business consulting services to over 4,600 major

corporations from every economic sector and region of the world since its founding in 1973. 3. Bain professionals have substantial expertise and extensive experience in

the airline industry, where Bain has played a major role in the successful transformation of several leading airlines. During these assignments, Bain worked on most of the major strategic and operational issues faced by these airlines. Bain developed comprehensive turnaround plans as well as plans to address specific issues, including labor strategy, routing and scheduling, capacity planning, distribution strategy, fleet management, yield management, pricing and regional jet strategy, as well as cost reduction in airport services, maintenance, overhead and purchasing. 4. In addition, Bain has worked with Eagle on three major assignments over

the past five years and is very familiar with company operations, strategy and stakeholders. These assignments have covered similar issues to those outlined in the Engagement Letter, providing Bain with a unique ability to rapidly perform the needed analysis, work productively with both union and management stakeholders, and effectively advise Eagle during its restructuring process. 5. Broadly speaking, Bain will assist in labor-cost assessment and

negotiations. Bain has previously served as a strategic consultant to Eagle in its evaluation of labor matters. In the most recent engagement between Eagle and Bain, which ran between October 2010 and September 2011, Bain performed a cost-benchmarking analysis across employee groups, a deeper cost-benchmarking analysis for the pilot group, and assisted Eagle in developing solutions for and negotiating with its pilot group.

US_ACTIVE:\43881053\07\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 36 of 53

Main Document

6.

In providing prepetition professional services to Eagle, Bain has become

familiar with Eagle and its business, including Eagles operations, employee groups, cost structures and related matters. Having worked with Eagles management and its other advisors, Bain has developed relevant experience and expertise regarding Eagle that will assist it in providing effective and efficient services in these chapter 11 cases. Accordingly, Bain is both well qualified and uniquely able to assist Eagle during these chapter 11 cases in an efficient and timely manner. B. Proposed Services2 7. As described in the Engagement Agreement, the services that Bain will

provide to Eagle (the Services) include, but are not limited to, the following: (1) Labor cost assessment. Develop benchmarking that identifies American Eagles relative cost position by employee group and calculates the degree of cost advantage or disadvantage. The employee groups to be assessed include management, pilots, flight attendants, maintenance, fleet service clerks, dispatch and agents. This analysis will cover the major cost drivers of wages & benefits, productivity and seniority to the extent that data is available. Both tops-down (overall cost position) and bottom-up (by employee group) views will be developed. (2) Labor solutions & negotiations support. Help identify and structure potential labor solutions as part of the restructuring process. Provide analytic support, best practices and strategic advice during the labor negotiations. Work with management and union stakeholders as needed. (3) Strategy Support. Assist in the ongoing development of Eagle business strategy, including issues such as competitive dynamics, relationships with various stakeholders and market positioning. C. Compensation 8. Bain intends to apply for compensation of a monthly fee plus direct

expenses for professional services rendered in connection with these cases, subject to approval of

The summaries of the Engagement Letter contained in this declaration are provided for purposes of convenience only. In the event of any inconsistency between the summaries contained herein and the terms and provisions of the Engagement Letter, the terms of the Engagement Letter shall control.

2

US_ACTIVE:\43881053\07\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 37 of 53

Main Document

the Court and in compliance with any applicable provisions of the Bankruptcy Code. Eagle will compensate Bain in accordance with the terms and conditions of the Engagement Letter, which provides a compensation structure (the Fee and Expense Structure) in relevant part as follows: (a) Monthly Fee: Eagle will pay Bain a monthly professional fee equal to $525,000 per month (the Monthly Fee) as described in the Engagement Letter. The Monthly Fee will be paid in advance on each monthly anniversary of the Commencement Date, provided that the first payment shall be made upon approval of the engagement by the Court and will be in respect of the period from the Commencement Date through the monthly anniversary of the Commencement Date that immediate follows the date such payment is made. Expenses: Eagle will reimburse Bain for expenses reasonably incurred in connection with and directly related to the provision of Bains Services as described in the Engagement Letter. Such expenses may include, but are not limited to, travel expenses, postage, express mail and messenger charges, external market research charges and expenses for working meals. Bain will invoice expenses in arrears and such expense invoices will be due and payable within 30 days of Eagles receipt. Such expenses include fees and expenses of Bains outside counsel incurred in connection with preparation of the Engagement Letter and approval of Bains retention and any fee applications. All expenses charged by Bain are subject to interim and final approval by the Court. Testimony: In the event of a hearing or other court or administrative proceeding under Section 1113 of the Bankruptcy Code, Bain agrees that it will produce a Vice-President level employee to testify or otherwise provide reasonable assistance to Eagle in preparing for testimony. There will be no additional charge for providing such testimony if such testimony occurs during the term of Bains Engagement. If testimony is required after the termination of Bains Engagement, Eagle will pay Bain additional compensation for the time expended by Bain in testifying at such proceedings and related preparation at the rate of $8,720 per day for a Vice-President level employee. In addition, Eagle will reimburse Bain for its reasonable fees and expenses incurred in connection therewith (including without limitation the fees and expenses of Bains outside counsel). Similarly, if Bain is requested by Eagle or required by subpoena or similar legal process to produce Bains materials or personnel with respect to its engagement for Eagle, and Bain is not a party to such proceeding, Eagle will reimburse Bain for its professional time and expenses, together with the fees and expenses of Bains counsel incurred in responding to such a request. 9. The Fee and Expense Structure is comparable to compensation generally

(b)

(c)

charged by other firms of similar stature to Bain for comparable engagements, both in and out of

US_ACTIVE:\43881053\07\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 38 of 53

Main Document

bankruptcy, which do not bill their clients on an hourly basis and generally are compensated on a transactional basis. Further, the Fee and Expense Structure represents Bains standard fee structure. Bain charged Eagle $500,000 per month during its most recent engagement for Eagle, which concluded in September 2011. 10. Bain has obtained valuable institutional knowledge of Eagles businesses,

financial affairs and labor groups as a result of providing services to Eagle before the Commencement Date and is both well qualified and uniquely able to perform these services and assist Eagle in these chapter 11 cases. It is not Bains general practice to keep detailed time records similar to those customarily kept by attorneys. Accordingly, Bain does not intend to file detailed time records, but it will otherwise file interim and final fee applications for the allowance of compensation for services rendered and reimbursement of expenses incurred in accordance with applicable provisions of the Bankruptcy Code, the Guidelines, the Bankruptcy Rules and any applicable orders of this Court. Such applications will include a general description of the services rendered during the period under review, the names of the Bain professionals rendering such services and, notwithstanding that Bain will not charge for its services on an hourly basis, the total number of hours expended by such professionals in rendering such services as well as an itemized list of any actual and necessary costs and expenses for which Bain seeks reimbursement. 11. In light of the foregoing, the importance of Bains expertise and assistance

in Eagles reorganization effort, Bains commitment to the variable level of time and effort necessary to complete an in-depth analysis for Eagle expeditiously, and the market prices for Bains services for engagements of this nature both out-of-court and in a chapter 11 context, Bain believes the Fee and Expense Structure is market-based and fair and reasonable.

US_ACTIVE:\43881053\07\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 39 of 53

Main Document

12. with any other person. D.

Bain has not shared or agreed to share any of its compensation from Eagle

Bains Disinterestedness 13. Eagle and the other Debtors have numerous creditors, equity holders and

other parties with whom they maintain business relationships. In connection with its proposed retention by Eagle in these chapter 11 cases, Bain undertook to determine whether it had any conflicts or other relationships that might cause it not to be disinterested or to hold or represent an interest adverse to Eagle. Bain obtained from Eagle and/or its representatives a conflicts checklist with the names of individuals and entities that may be parties in interest in these chapter 11 cases (Potential Parties in Interest). A categorized summary of the conflicts checklist is provided on Exhibit 2 annexed hereto. Bain conducted a computerized search of potential significant parties in the Debtors chapter 11 cases. Specifically Bain searched the list of Potential Parties in Interest against a list of Bains current clients and vendors and clients and vendors to Bain during the 12 months preceding the search. 14. To the best of my knowledge and belief, Bain has not represented any

Potential Parties in Interest in connection with matters relating to these chapter 11 cases. 15. In the six months prior to the Commencement Date, pursuant to a separate

engagement letter, Eagle paid Bain $1,125,000 in professional services fees. This amount was paid over three payments as follows: $500,000 paid July 25, 2011; $375,000 paid August 25, 2011; and $250,000 paid October 31, 2011. As of the Commencement Date, Bain asserts a prepetition claim against Eagle arising from its previous engagement in the amount of $1,925,000. Bain will waive this claim upon entry of an order approving its retention. In addition, as of the Commencement Date, a subsidiary of Bain has a prepetition claim against

US_ACTIVE:\43881053\07\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 40 of 53

Main Document

American Airlines, Inc., but will waive this claim upon entry of an order approving Bains retention. 16. To the best of my knowledge and belief, insofar as I have been able to

ascertain after reasonable inquiry, neither I, nor Bain, nor any of its professional employees has any connection with the Debtors, their creditors, the U.S. Trustee or any other Potential Parties in Interest in the chapter 11 cases or their respective attorneys or accounts, except as follows: (a) Before the Commencement Date, Bain rendered prepetition services to Eagle for which fees and expenses remain outstanding. Upon entry of the order approving this Application, Bain will waive its claim for such amounts in excess of amounts paid to Bain prepetition. Before the Commencement Date, a wholly-owned subsidiary of Bain rendered prepetition services to American Airlines for which fees or expenses remain outstanding. Upon entry of the order approving this Application, Bain and such subsidiary will waive their claim for such amounts in excess of amounts paid to such subsidiary prepetition. Bain has provided and is currently providing services to a creditor of the Debtors. Bain is helping this creditor grow the joint marketing program under which they purchase frequent flier points and customer marketing access from one of the Debtors. As such engagement is subject to confidentiality provisions, Bain is currently restricted from providing any further detail with respect to such engagement. To the best of my knowledge, information and belief, Bains services to such creditor were and are wholly unrelated to these chapter 11 cases and such representation does not constitute an interest materially adverse to the Debtors herein in matters upon which Bain is to be engaged. Bain is a large consulting firm and it and its affiliates have provided and are currently providing consulting services to various Potential Parties in Interest. To the best of my knowledge, information and belief, Bains services to these parties were and are wholly unrelated to the Debtors, their estates or these chapter 11 cases. Bain is an indirect minority shareholder of certain of the non-Debtor Potential Parties in Interest. Bain and its professionals do not actively manage these investments or exercise control over the operations of the portfolio companies, and the size of the holdings are of a de minimis (less than one percent) size. To the best of my knowledge, information and belief, these holdings in no way create a conflict which would in any way disqualify Bain from working for Eagle.

(b)

(c)

(d)

(e)

US_ACTIVE:\43881053\07\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 41 of 53

Main Document

(f)

Bain has, in the ordinary course of its business, purchased and is expected to continue to purchase, goods and services and has banking, insurance and other commercial relationships with various organizations, including professionals, on the list of Potential Parties in Interest. To the best of my knowledge, information and belief, these relationships in no way create a conflict which would in any way disqualify Bain from working for Eagle. As part of its practice, Bain and its affiliates provide services in connection with numerous cases, proceedings, and transactions unrelated to these chapter 11 cases. These unrelated matters involve many different professionals, including Weil, Gotshal & Manges LLP (the Debtors proposed counsel), some of which may be claimants or parties in interest in these cases or may represent claimants and parties in interest in these cases. Furthermore, Bain has in the past and will likely in the future be working with or against other professionals involved in these cases in matters unrelated to these cases. Based on my current knowledge of the professionals involved, and to the best of my knowledge and information, none of these business relationships represents an interest materially adverse to the Debtors herein in matters upon which Bain is to be engaged. 17. To the best of my knowledge, information and belief, insofar as I have

(g)

been able to ascertain after reasonable inquiry, Bain has not been retained to assist any entity or person other than Eagle on matters relating to, or in direct connection with, the chapter 11 cases. If Bains proposed retention by Eagle is approved by this Court, Bain will not accept any engagement or perform any service for any entity or person other than Eagle in these chapter 11 cases. Bain will, however, continue to provide professional services to entities or persons that may be creditors of the Debtors or parties in interest in the chapter 11 cases, provided that such services do not relate to, or have any direct connection with, the chapter 11 cases. 18. I am not related or connected to and, to the best of my knowledge after

reasonable inquiry, no other professional of Bain who will work on this engagement is related or connected to, any United States Bankruptcy Judge for the Southern District of New York, any of the District Judges for the Southern District of New York, the U.S. Trustee for the Southern District of New York or any employee in the Office of the U.S. Trustee for the Southern District of New York.

US_ACTIVE:\43881053\07\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 42 of 53

Main Document

19.

To the best of my knowledge and belief, insofar as I have been able to

ascertain after reasonable inquiry, none of the employees of Bain working on this engagement on Eagles behalf has had, or will have in the future, direct contact concerning the chapter 11 cases with the Debtors creditors, other parties in interest, the U.S. Trustee or anyone employed in the Office of the U.S. Trustee other than in connection with performing consulting services on behalf of Eagle. 20. To the best of my knowledge, Bain has no agreement with any other entity

to share with such entity any compensation received by Bain in connection with Eagles bankruptcy case. 21. Accordingly, except as otherwise set forth herein, and insofar as I have

been able to determine after reasonable inquiry, none of Bain, I, nor any employee of Bain who will work on this engagement holds or represents any interest adverse to Eagle or its estate, and Bain is a disinterested person as that term is defined in section 101(14) of the Bankruptcy Code, as modified by section 1107(b) of the Bankruptcy Code, in that Bain, its professionals and employees: (a) (b) (c) are not creditors, equity security holders or insiders of Eagle; were not, within two years before the date of filing of Eagles chapter 11 petitions, a director, officer or employee of Eagle; and do not have an interest materially adverse to Eagle, its estate or any class of creditors or equity security holders by reason of any direct or indirect relationship to, connection with, or interest in Eagle, or for any other reason.

US_ACTIVE:\43881053\07\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 43 of 53

Main Document

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 44 of 53

Main Document

Exhibit 1 to the Declaration Engagement Letter

US_ACTIVE:\43881053\07\14013.0138

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 45 of 53

Main Document

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 46 of 53

Main Document

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 47 of 53

Main Document

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 48 of 53

Main Document

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 49 of 53

Main Document

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 50 of 53

Main Document

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 51 of 53

Main Document

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 52 of 53

Main Document

11-15463-shl

Doc 543

Filed 01/06/12 Entered 01/06/12 16:28:16 Pg 53 of 53

Main Document

Exhibit 2 to the Declaration Retention Checklist Debtors Debtors Trade Names Debtors Affiliates Top 50 Unsecured Creditors Largest Unsecured Funded Debt Creditors Top 100 Trade Creditors Top 5 Secured Creditors Current Members of Board of Directors Former Members of Board of Directors (past 3 years) Current Officers Former Officers (past 3 years) Affiliations of Current Members of Board of Directors Affiliations of Current Officers Current Significant Shareholders (top 5%) Unions Financial Institutions Aircraft Lenders and Lessors Financial Derivative Counterparties Landlords Major Competitors Bankruptcy Judges for the United States Bankruptcy Court for the S.D.N.Y. United States Trustees for the S.D.N.Y. Known Bondholders Major Litigation Claimants Insurance Providers Taxing Authorities Utility Companies Professionals

US_ACTIVE:\43881053\07\14013.0138

Das könnte Ihnen auch gefallen

- Liberi V Taitz Plaintiffs Request For Judicial Notice Doc 466Dokument107 SeitenLiberi V Taitz Plaintiffs Request For Judicial Notice Doc 466nocompromisewtruthNoch keine Bewertungen

- AMR OpinionDokument20 SeitenAMR OpinionChapter 11 DocketsNoch keine Bewertungen

- Lehman Brothers' MotionDokument128 SeitenLehman Brothers' MotionDealBookNoch keine Bewertungen

- Attorneys For Debtor and Debtor in PossessionDokument17 SeitenAttorneys For Debtor and Debtor in PossessionChapter 11 DocketsNoch keine Bewertungen

- Notice of Motion For:: L . .SUANTDokument16 SeitenNotice of Motion For:: L . .SUANTChapter 11 DocketsNoch keine Bewertungen

- Affidavit of ServiceDokument435 SeitenAffidavit of ServiceDr Luis e Valdez rico0% (1)

- (Admitted Pro Vice) : - @A Tfox - Co .Mafk@areDokument10 Seiten(Admitted Pro Vice) : - @A Tfox - Co .Mafk@areChapter 11 DocketsNoch keine Bewertungen

- AMR EETC RefinancingDokument1.106 SeitenAMR EETC RefinancingDistressedDebtInvest100% (1)

- Proposed Hearing Date: March 23, 2011 at 11:00 A.M. Eastern Time Proposed Objections Deadline: March 18, 2011 at 4:00 P.M. Eastern TimeDokument27 SeitenProposed Hearing Date: March 23, 2011 at 11:00 A.M. Eastern Time Proposed Objections Deadline: March 18, 2011 at 4:00 P.M. Eastern TimeChapter 11 DocketsNoch keine Bewertungen

- 10000005126Dokument687 Seiten10000005126Chapter 11 DocketsNoch keine Bewertungen

- 10000004307Dokument48 Seiten10000004307Chapter 11 DocketsNoch keine Bewertungen

- The Last Four Digits of The Debtor's Federal Tax Identification Number Are (8739) - The Debtor's Address Is: 3251 East Imperial Highway, Brea, CA 92821Dokument12 SeitenThe Last Four Digits of The Debtor's Federal Tax Identification Number Are (8739) - The Debtor's Address Is: 3251 East Imperial Highway, Brea, CA 92821Chapter 11 DocketsNoch keine Bewertungen

- United States Bankruptcy Court Southern District of New YorkDokument40 SeitenUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNoch keine Bewertungen

- United States Bankruptcy Court Southern District of New YorkDokument24 SeitenUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNoch keine Bewertungen

- Lamco Docket 7578Dokument176 SeitenLamco Docket 7578Troy UhlmanNoch keine Bewertungen

- Lehman's Motion On Insurance Payments of Legal BillsDokument20 SeitenLehman's Motion On Insurance Payments of Legal BillsDealBookNoch keine Bewertungen

- United States Bankruptcy Court District of Nevada: E-File: June 19, 2009Dokument11 SeitenUnited States Bankruptcy Court District of Nevada: E-File: June 19, 2009Chapter 11 DocketsNoch keine Bewertungen

- Washington Mutual (WMI) - Motion of Shareholder William Duke To Allow Certain Documents and InformationDokument148 SeitenWashington Mutual (WMI) - Motion of Shareholder William Duke To Allow Certain Documents and InformationmeischerNoch keine Bewertungen

- 10000000610Dokument78 Seiten10000000610Chapter 11 DocketsNoch keine Bewertungen

- Dre DeathrowDokument30 SeitenDre DeathrowEriq GardnerNoch keine Bewertungen

- United States Bankruptcy Court Central District of California Santa Ana DivisionDokument5 SeitenUnited States Bankruptcy Court Central District of California Santa Ana DivisionChapter 11 DocketsNoch keine Bewertungen

- United States Bankruptcy Court Central District of California (Santa Ana Division)Dokument6 SeitenUnited States Bankruptcy Court Central District of California (Santa Ana Division)Chapter 11 DocketsNoch keine Bewertungen

- Filed & Entered: Clerk U.S. Bankruptcy Court Central District of California by Deputy ClerkDokument7 SeitenFiled & Entered: Clerk U.S. Bankruptcy Court Central District of California by Deputy ClerkChapter 11 DocketsNoch keine Bewertungen

- Attorneys For The Christian Brothers' Institute, Et Al. Debtors and Debtors-in-PossessionDokument17 SeitenAttorneys For The Christian Brothers' Institute, Et Al. Debtors and Debtors-in-PossessionChapter 11 DocketsNoch keine Bewertungen

- Lehman Brothers Motion To Pay SettlementDokument123 SeitenLehman Brothers Motion To Pay SettlementDealBookNoch keine Bewertungen

- Presentment Date and Time: June 13, 2011 at 10:00 A.M. (ET) Objection Deadline: June 10, 2011at 12:00 Noon (ET)Dokument25 SeitenPresentment Date and Time: June 13, 2011 at 10:00 A.M. (ET) Objection Deadline: June 10, 2011at 12:00 Noon (ET)Chapter 11 DocketsNoch keine Bewertungen

- United States Bankruptcy Court Southern District of New YorkDokument26 SeitenUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNoch keine Bewertungen

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokument33 SeitenIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNoch keine Bewertungen

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokument20 SeitenIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNoch keine Bewertungen

- The Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Dokument7 SeitenThe Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Chapter 11 DocketsNoch keine Bewertungen

- 10000004161Dokument16 Seiten10000004161Chapter 11 DocketsNoch keine Bewertungen

- United States Bankruptcy Court Southern District of New YorkDokument24 SeitenUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNoch keine Bewertungen

- 10000005218Dokument23 Seiten10000005218Chapter 11 DocketsNoch keine Bewertungen

- United States Bankruptcy Court District of Nevada: 73203-001/DOCS - SF:68647.1Dokument16 SeitenUnited States Bankruptcy Court District of Nevada: 73203-001/DOCS - SF:68647.1Chapter 11 DocketsNoch keine Bewertungen

- Certificate of NoticeDokument8 SeitenCertificate of NoticeChapter 11 DocketsNoch keine Bewertungen

- Hearing Date: May 10, 2011 at 10:00 A.M. (ET) Objection Deadline: May 6, 2011 at 4:00 P.M. (ET)Dokument75 SeitenHearing Date: May 10, 2011 at 10:00 A.M. (ET) Objection Deadline: May 6, 2011 at 4:00 P.M. (ET)Chapter 11 DocketsNoch keine Bewertungen

- Attorneys For Debtor and Debtor-in-PossessionDokument22 SeitenAttorneys For Debtor and Debtor-in-PossessionChapter 11 DocketsNoch keine Bewertungen

- Hearing Date: March 23, 2011 at 11:00 A.M. Eastern Time Objections Due: March 18, 2011 at 4:00 P.M. Eastern TimeDokument22 SeitenHearing Date: March 23, 2011 at 11:00 A.M. Eastern Time Objections Due: March 18, 2011 at 4:00 P.M. Eastern TimeChapter 11 DocketsNoch keine Bewertungen

- Motion On Lehman's Directors and Officers InsuranceDokument16 SeitenMotion On Lehman's Directors and Officers InsuranceDealBookNoch keine Bewertungen

- Filed & EnteredDokument6 SeitenFiled & EnteredChapter 11 DocketsNoch keine Bewertungen

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokument8 SeitenIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNoch keine Bewertungen

- United States Bankruptcy Court Southern District of New YorkDokument17 SeitenUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNoch keine Bewertungen

- WWW Nysb Uscourts GovDokument9 SeitenWWW Nysb Uscourts GovChapter 11 DocketsNoch keine Bewertungen

- United States Bankruptcy Court Southern District of New YorkDokument7 SeitenUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNoch keine Bewertungen

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokument32 SeitenIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNoch keine Bewertungen

- United States Bankruptcy Court Southern District of New YorkDokument39 SeitenUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNoch keine Bewertungen

- United States Bankruptcy Court Central District of California, Santa Ana DivisionDokument3 SeitenUnited States Bankruptcy Court Central District of California, Santa Ana DivisionChapter 11 DocketsNoch keine Bewertungen

- The Last Four Digits of The Debtor's Federal Tax Identification Number Are (8739) - The Debtor's Address Is: 3251 East Imperial Highway, Brea, CA 92821Dokument137 SeitenThe Last Four Digits of The Debtor's Federal Tax Identification Number Are (8739) - The Debtor's Address Is: 3251 East Imperial Highway, Brea, CA 92821Chapter 11 DocketsNoch keine Bewertungen

- United States Bankruptcy Court Southern District of New YorkDokument9 SeitenUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNoch keine Bewertungen

- Por7 Omnibus Response 0812229120213000000000027Dokument80 SeitenPor7 Omnibus Response 0812229120213000000000027joeMcoolNoch keine Bewertungen

- NRE ASE O BK Hapter Elta Roduce Ointly Dministered EbtorDokument38 SeitenNRE ASE O BK Hapter Elta Roduce Ointly Dministered EbtorChapter 11 DocketsNoch keine Bewertungen

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokument43 SeitenIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNoch keine Bewertungen

- Inc.'s Response To Debtors' Eighth Omnibus Objection To Claims (The "Stipulation")Dokument8 SeitenInc.'s Response To Debtors' Eighth Omnibus Objection To Claims (The "Stipulation")Chapter 11 DocketsNoch keine Bewertungen

- Filed & Entered: Clerk U.S. Bankruptcy Court Central District of California by Deputy ClerkDokument7 SeitenFiled & Entered: Clerk U.S. Bankruptcy Court Central District of California by Deputy ClerkChapter 11 DocketsNoch keine Bewertungen

- Filed & Entered: Lead Case No. 8:10-bk-16743-TADokument7 SeitenFiled & Entered: Lead Case No. 8:10-bk-16743-TAChapter 11 DocketsNoch keine Bewertungen

- Filed & Entered: United States Bankruptcy Court Central District of California (Santa Ana Division)Dokument7 SeitenFiled & Entered: United States Bankruptcy Court Central District of California (Santa Ana Division)Chapter 11 DocketsNoch keine Bewertungen

- United States Bankruptcy Court Southern District of New YorkDokument19 SeitenUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNoch keine Bewertungen

- 1284 4 PDFDokument8 Seiten1284 4 PDFlonghorn4lif100% (1)

- United States Bankruptcy Court Southern District of New YorkDokument4 SeitenUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNoch keine Bewertungen

- Bar Review Companion: Remedial Law: Anvil Law Books Series, #2Von EverandBar Review Companion: Remedial Law: Anvil Law Books Series, #2Bewertung: 3 von 5 Sternen3/5 (2)

- Dna Secures The Use of 280 Broadway Through October 14Dokument2 SeitenDna Secures The Use of 280 Broadway Through October 14Melanie CohenNoch keine Bewertungen

- 916 Dna OrderDokument5 Seiten916 Dna OrderMelanie CohenNoch keine Bewertungen

- Harrisburg Strong PlanDokument357 SeitenHarrisburg Strong PlanPennLiveNoch keine Bewertungen

- Detroit PetitionDokument16 SeitenDetroit PetitionMelanie CohenNoch keine Bewertungen

- SEC AnchorDokument17 SeitenSEC AnchorMelanie CohenNoch keine Bewertungen

- Born This WayDokument18 SeitenBorn This WayMelanie CohenNoch keine Bewertungen

- U S B C Southern District of New York Voluntary Petition: Nited Tates Ankruptcy OurtDokument19 SeitenU S B C Southern District of New York Voluntary Petition: Nited Tates Ankruptcy OurtMelanie CohenNoch keine Bewertungen

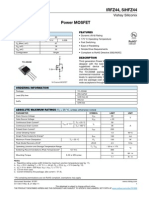

- IRFZ44 Data SheetDokument9 SeitenIRFZ44 Data SheetColossus RhodesNoch keine Bewertungen

- Notice of Claim Final 3132012Dokument4 SeitenNotice of Claim Final 3132012Rachel E. Stassen-BergerNoch keine Bewertungen

- Loadstar Shipping Co., Inc., Petitioner, vs. Court of Appeals and THE MANILA INSURANCE CO., INC., RespondentsDokument5 SeitenLoadstar Shipping Co., Inc., Petitioner, vs. Court of Appeals and THE MANILA INSURANCE CO., INC., RespondentsKiz AndersonNoch keine Bewertungen

- Due Diligence Check ListDokument10 SeitenDue Diligence Check ListRai Hasni LatuconsinaNoch keine Bewertungen

- 1 North Sea Continental Shelf CasesDokument9 Seiten1 North Sea Continental Shelf CasesLourd MantaringNoch keine Bewertungen

- Perla v. BaringDokument2 SeitenPerla v. BaringChedeng KumaNoch keine Bewertungen

- 3 Punzalan Vs Municipal Board of ManilaDokument1 Seite3 Punzalan Vs Municipal Board of ManilaTan JunNoch keine Bewertungen

- Legal Ethics and Judicial RegulationDokument2 SeitenLegal Ethics and Judicial RegulationJacinth DelosSantos DelaCerna100% (1)

- Everything You Need to Know About Intellectual Property LawsDokument88 SeitenEverything You Need to Know About Intellectual Property LawsRam SinghNoch keine Bewertungen