Beruflich Dokumente

Kultur Dokumente

Microequities Deep Value Microcap Fund May 2011 Update

Hochgeladen von

Microequities Pty LtdOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Microequities Deep Value Microcap Fund May 2011 Update

Hochgeladen von

Microequities Pty LtdCopyright:

Verfügbare Formate

MICROEQUITIES ASSET MANAGEMENT DEEP VALUE MICROCAP FUND UPDATE, MAY 2011 PERFORMANCE UPDATE

Dear Investor, Markets and economy nd We must be careful in not reading too much into Australias 2 quarter GDP number (-1.2%). it is a number that is completely distorted by one of the worst floods in history that affected a state that holds around 20% of the countrys population. The terrible Queensland floods brought the regions rich mining activity to a halt. The GDP figure is cluttered with the ill effects of that natural disaster. What is becoming evident however is that a new mantra of fiscal conservatism has taken place, not in government, but with our people. Australias household current savings ratio has climbed to just over 10%, its highest levels since the mid eighties. Why households have decided to increase their savings in the midst of a 20 year economic expansion and upon a labour market that enjoys one of the highest levels of employment in the Western World is difficult to explain. Perhaps our mindset is still reeling from the effects of the post GFC world. Whatever the reason might be, it is undoubtedly having effect on consumption. Retail consumption remains markedly weak, down 0.1% over the last quarter and flat YoY. The weakness is fueling notions of a two speed economy. Whilst we do not subscribe to that notion, it is admissible that one of the side effects of our resource boom, a record breaking Australian dollar, is placing pressure on our non commodity export businesses, some of which our Fund owns. This is however an addressable issue; capable management teams will modify their business operations to attain natural currency hedges. Microequities Deep Value Microcap Fund returned a negative -5.93% versus the All Ordinaries Accumulation Index negative 1.89% in May; this brings the total return net of fees to 102.37% for the Fund compared to 67.57% for the All Ords Accumulation since inception in March 2009. Though the market did decline our Deep Value Microcap Fund has experienced a poor month in May. A number of the Funds businesses, including our most heavily weighted position (approximately 15% of the fund) experienced price declines. Staying well clear of feeble justification, the profitability and growth of our businesses is sound. Our most heavily weighted position will attain strong double digit revenue and earnings growth in FY11. For FY12, it faces an even better growth outlook, and none of its significant clients will be up for renewal. Our businesses are strong, and in good shape. But I will be the first to admit that the patchy performance of the stock market over the last 12 months does not reconcile with the underlying growth in earnings. That breach in earnings growth and lack of price appreciation is not a constant, sooner or later money does gravitate towards the fundamentals. Written by Carlos Gil, Chief Investment Officer.

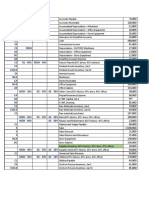

5.9%

4.3% 4.3% 7.9% 37.1%

Cash Software & Services Telecommunications Services Hotels Restaurants & Leisure Media Health Equipment & Services Metals & Mining

Latest Unit Price $1.9624

Latest Fund Performance as at May 31, 2011 1 Month -5.93% 3 Month -7.48% 6 Month -0.19% 12 Month +10.09% Inception +102.37%

(Returns are calculated after all fees and expenses and reinvestment of distributions)

15.6%

14.5%

4.3% 6.1%

st

Comercial Services & Supplies Diversified Financials

*Deep Value Portfolio as of 31 of May

Suite 702, 109 Pitt Street Sydney NSW 2000 Office: +61 2 9231 6169 Fax: +61 2 9475 1156 invest@microequities.com.au

Das könnte Ihnen auch gefallen

- Derivatives: Greeks and Black-Scholes: Call PutDokument7 SeitenDerivatives: Greeks and Black-Scholes: Call PutSAITEJA DASARINoch keine Bewertungen

- Capital Budgeting: Workshop Questions: Finance & Financial ManagementDokument12 SeitenCapital Budgeting: Workshop Questions: Finance & Financial ManagementJuan SanguinetiNoch keine Bewertungen

- GI Report January 2012Dokument3 SeitenGI Report January 2012Bill HallmanNoch keine Bewertungen

- The Signs Were There: The clues for investors that a company is heading for a fallVon EverandThe Signs Were There: The clues for investors that a company is heading for a fallBewertung: 4.5 von 5 Sternen4.5/5 (2)

- PMS Agreement SampleDokument9 SeitenPMS Agreement SamplesureshvgkNoch keine Bewertungen

- Microequities Deep Value Microcap Fund October 2011 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund October 2011 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund January 2012 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund January 2012 UpdateMicroequities Pty LtdNoch keine Bewertungen

- The Outlook For Recovery in The U.S. EconomyDokument13 SeitenThe Outlook For Recovery in The U.S. EconomyZerohedgeNoch keine Bewertungen

- ANZ China in FocusDokument31 SeitenANZ China in FocusrguyNoch keine Bewertungen

- September 2012 NewsletterDokument2 SeitenSeptember 2012 NewslettermcphailandpartnersNoch keine Bewertungen

- Mosaic Special Situations FundDokument5 SeitenMosaic Special Situations Fundqweasd222Noch keine Bewertungen

- ICMAniacs Report Final (In Need of Finishing Touches)Dokument19 SeitenICMAniacs Report Final (In Need of Finishing Touches)George Stuart CottonNoch keine Bewertungen

- Microequities Deep Value Microcap Fund June 2011 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund June 2011 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Anz Research: Global Economics & StrategyDokument14 SeitenAnz Research: Global Economics & StrategyBelinda WinkelmanNoch keine Bewertungen

- Microequities Deep Value Microcap Fund December 2011 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund December 2011 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund September 2011 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund September 2011 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Kingdom Annual Audited Results Dec 2009Dokument11 SeitenKingdom Annual Audited Results Dec 2009Kristi DuranNoch keine Bewertungen

- U.S. Market Update August 12 2011Dokument6 SeitenU.S. Market Update August 12 2011dpbasicNoch keine Bewertungen

- UBS Weekly Guide: Help WantedDokument13 SeitenUBS Weekly Guide: Help Wantedshayanjalali44Noch keine Bewertungen

- Europe Revisited: or Are PIGS On The Road To Recovery?Dokument7 SeitenEurope Revisited: or Are PIGS On The Road To Recovery?Otavio FakhouryNoch keine Bewertungen

- John Abner T. Renolla Bsba FM 4A Activity 2 1. What Is Global Financial Recession. RecessionDokument3 SeitenJohn Abner T. Renolla Bsba FM 4A Activity 2 1. What Is Global Financial Recession. RecessionReb RenNoch keine Bewertungen

- Van Hoisington Letter, Q3 2011Dokument5 SeitenVan Hoisington Letter, Q3 2011Elliott WaveNoch keine Bewertungen

- PRDnationwide Quarterly Economic and Property Report Ed 2 2012Dokument28 SeitenPRDnationwide Quarterly Economic and Property Report Ed 2 2012ashd9410Noch keine Bewertungen

- Chap 1 Michael Pettus Strategic ManagementDokument4 SeitenChap 1 Michael Pettus Strategic ManagementSo PaNoch keine Bewertungen

- Globalisation, Financial Stability and EmploymentDokument10 SeitenGlobalisation, Financial Stability and EmploymentericaaliniNoch keine Bewertungen

- The Pensford Letter - 3.5.12Dokument4 SeitenThe Pensford Letter - 3.5.12Pensford FinancialNoch keine Bewertungen

- 2022 Fef Semi Annual LetterDokument8 Seiten2022 Fef Semi Annual LetterDavidNoch keine Bewertungen

- Is There A Double Dip Recession in The Making AC - FinalDokument2 SeitenIs There A Double Dip Recession in The Making AC - FinalPremal ThakkarNoch keine Bewertungen

- Einhorn Letter Q1 2021Dokument7 SeitenEinhorn Letter Q1 2021Zerohedge100% (4)

- International Monetary Fund: Hina Conomic UtlookDokument10 SeitenInternational Monetary Fund: Hina Conomic UtlooktoobaziNoch keine Bewertungen

- PHPZ FB L6 WDokument5 SeitenPHPZ FB L6 Wfred607Noch keine Bewertungen

- Annual Report: March 31, 2011Dokument23 SeitenAnnual Report: March 31, 2011VALUEWALK LLCNoch keine Bewertungen

- Microequities Deep Value Microcap Fund July 2011 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund July 2011 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Education Brief December 2011Dokument4 SeitenEducation Brief December 2011keatingcapitalNoch keine Bewertungen

- Strategy Radar - 2012 - 0601 XX An Australian MomentDokument4 SeitenStrategy Radar - 2012 - 0601 XX An Australian MomentStrategicInnovationNoch keine Bewertungen

- 8 Markets MythsDokument18 Seiten8 Markets MythsVicente Manuel Angulo GutiérrezNoch keine Bewertungen

- Market Outlook - Structural Transformation UnderwayDokument27 SeitenMarket Outlook - Structural Transformation Underwaysathiaseelans5356Noch keine Bewertungen

- Caught Between Armageddon and Irrational Exuberance: Stop Press ....Dokument4 SeitenCaught Between Armageddon and Irrational Exuberance: Stop Press ....FirstEquityLtdNoch keine Bewertungen

- ECON6000 Economics Principles and Decision Making: TitleDokument13 SeitenECON6000 Economics Principles and Decision Making: TitleShubham AgarwalNoch keine Bewertungen

- Poloz Remarks 190613Dokument6 SeitenPoloz Remarks 190613ericaaliniNoch keine Bewertungen

- Fiscal Policy: Adapted From: Belinda P. Ato Prepared By: Daphne MagtibayDokument29 SeitenFiscal Policy: Adapted From: Belinda P. Ato Prepared By: Daphne MagtibayTee MendozaNoch keine Bewertungen

- Schroder Wholesale Australian Equity Fund: July 2012Dokument2 SeitenSchroder Wholesale Australian Equity Fund: July 2012qweasd222Noch keine Bewertungen

- DBS 200818 - Insights - SG - Financial - Wellness PDFDokument40 SeitenDBS 200818 - Insights - SG - Financial - Wellness PDFhhNoch keine Bewertungen

- Monthly Economic Outlook 06082011Dokument6 SeitenMonthly Economic Outlook 06082011jws_listNoch keine Bewertungen

- Frontline Defense of The Economy: Annual ReportDokument40 SeitenFrontline Defense of The Economy: Annual ReportJayroy VillagraciaNoch keine Bewertungen

- Equity Research: Earnings TrackerDokument5 SeitenEquity Research: Earnings Trackertrend2trader2169Noch keine Bewertungen

- March 2013 NewsletterDokument2 SeitenMarch 2013 NewslettermcphailandpartnersNoch keine Bewertungen

- Broyhill Letter (Q2-08)Dokument3 SeitenBroyhill Letter (Q2-08)Broyhill Asset ManagementNoch keine Bewertungen

- Home Capital Group Initiating Coverage (HCG-T)Dokument68 SeitenHome Capital Group Initiating Coverage (HCG-T)Zee MaqsoodNoch keine Bewertungen

- Report - Introduction and MicroDokument2 SeitenReport - Introduction and Microed900Noch keine Bewertungen

- GI Report February 2012Dokument3 SeitenGI Report February 2012Bill HallmanNoch keine Bewertungen

- 5f0b44cdc10751fbb7009cf3 - McLain Capital Q2 2020 Investor LetterDokument19 Seiten5f0b44cdc10751fbb7009cf3 - McLain Capital Q2 2020 Investor LetterAndy HuffNoch keine Bewertungen

- Global Recession and Its Impact On Indian EconomyDokument4 SeitenGlobal Recession and Its Impact On Indian EconomyPankaj DograNoch keine Bewertungen

- Weekly Report 7-11 JanDokument2 SeitenWeekly Report 7-11 JanFEPFinanceClubNoch keine Bewertungen

- State of The Financial Services Industry Report 2015Dokument24 SeitenState of The Financial Services Industry Report 2015Aditi KohliNoch keine Bewertungen

- The Economy Grew 2.8% in Q4, But That Doesn't Tell The Whole StoryDokument2 SeitenThe Economy Grew 2.8% in Q4, But That Doesn't Tell The Whole Storyapi-118535366Noch keine Bewertungen

- Economics Macro IADokument5 SeitenEconomics Macro IAQuang Nguyễn Nhựt Lâm0% (1)

- ABNL Annual Report 2011-12Dokument222 SeitenABNL Annual Report 2011-12Gundeep Singh KapoorNoch keine Bewertungen

- The Outlook For The US Economy: White PaperDokument8 SeitenThe Outlook For The US Economy: White PaperJustin FungNoch keine Bewertungen

- Stocks To Buy: NewslettersDokument17 SeitenStocks To Buy: Newslettersfrank valenzuelaNoch keine Bewertungen

- Microequities Deep Value Microcap Fund April 2012 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund April 2012 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities High Income Value Microcap Fund May 2012 UpdateDokument1 SeiteMicroequities High Income Value Microcap Fund May 2012 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities High Income Value Microcap Fund April 2012 UpdateDokument1 SeiteMicroequities High Income Value Microcap Fund April 2012 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund April 2012 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund April 2012 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities High Income Value Microcap Fund July 2012 UpdateDokument1 SeiteMicroequities High Income Value Microcap Fund July 2012 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund December 2011 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund December 2011 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund April 2011 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund April 2011 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund June 2011 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund June 2011 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund July 2011 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund July 2011 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund IMDokument28 SeitenMicroequities Deep Value Microcap Fund IMMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund September 2011 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund September 2011 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund March 2011 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund March 2011 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund February 2011 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund February 2011 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund January 2011 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund January 2011 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund August 2010 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund August 2010 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund September 2010 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund September 2010 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund December 2010 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund December 2010 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund July 2010 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund July 2010 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Cash Converters International at Microequities 2010 Rising Stars Microcap ConferenceDokument35 SeitenCash Converters International at Microequities 2010 Rising Stars Microcap ConferenceMicroequities Pty LtdNoch keine Bewertungen

- Principle MaterialDokument35 SeitenPrinciple MaterialHay JirenyaaNoch keine Bewertungen

- Maharashtra Natural Gas LTD.: PNG Connection Bearing BP No . & Meter No .Dokument1 SeiteMaharashtra Natural Gas LTD.: PNG Connection Bearing BP No . & Meter No .Madhup KhandelwalNoch keine Bewertungen

- Business Accounting PDFDokument1.108 SeitenBusiness Accounting PDFFabiola Henry100% (2)

- USA CMA Part 1 2021 Syllabus in DetailDokument4 SeitenUSA CMA Part 1 2021 Syllabus in DetailHimanshu TalwarNoch keine Bewertungen

- Chapter 2 Lesson 1Dokument12 SeitenChapter 2 Lesson 1April BumanglagNoch keine Bewertungen

- Foreign Currency TransactionsDokument4 SeitenForeign Currency TransactionsDeo CoronaNoch keine Bewertungen

- Hype Cycle For Supply Chain Management, 2009Dokument65 SeitenHype Cycle For Supply Chain Management, 2009ramapvkNoch keine Bewertungen

- Case 25-27Dokument4 SeitenCase 25-27Alyk Tumayan CalionNoch keine Bewertungen

- ACTBFAR Exercise Set #1 - Ex 5 - FS ClassificationsDokument1 SeiteACTBFAR Exercise Set #1 - Ex 5 - FS ClassificationsNikko Bowie PascualNoch keine Bewertungen

- Powerponit Presentation of Mr. Dolce RamirezDokument65 SeitenPowerponit Presentation of Mr. Dolce RamirezCharisse Ann MonsaleNoch keine Bewertungen

- Notes For Audit by ChaptersDokument7 SeitenNotes For Audit by ChaptersFarah KhattabNoch keine Bewertungen

- Registration of Corporations Stock Corporation Basic RequirementsDokument27 SeitenRegistration of Corporations Stock Corporation Basic RequirementsRhyz Taruc-ConsorteNoch keine Bewertungen

- Agricultural & Applied Economics AssociationDokument10 SeitenAgricultural & Applied Economics AssociationfenderaddNoch keine Bewertungen

- Icai TenderDokument29 SeitenIcai TenderRamnish MishraNoch keine Bewertungen

- Sainsburry Ratio Analysis Year 2021Dokument20 SeitenSainsburry Ratio Analysis Year 2021aditya majiNoch keine Bewertungen

- The Voice: Message From SFAA National President - Ms. Quallyna Nini PorteDokument10 SeitenThe Voice: Message From SFAA National President - Ms. Quallyna Nini PortesnorwlorNoch keine Bewertungen

- Zain Annual Report 2016 EnglishDokument76 SeitenZain Annual Report 2016 EnglishAnonymous gtP37gHO100% (1)

- Sol. Man. - Chapter 4 Provisions, Cont. Liabs. & Cont. AssetsDokument10 SeitenSol. Man. - Chapter 4 Provisions, Cont. Liabs. & Cont. AssetsMiguel Amihan100% (1)

- Mco-7 emDokument8 SeitenMco-7 emKhundrakpam Satyabarta100% (3)

- Mathoot Finanace ProjectsDokument32 SeitenMathoot Finanace ProjectsMayank Jain NeerNoch keine Bewertungen

- 1) in Tally There Are - Predefined Ledger Ans: 2: 2) - Key Is Used To Print A ReportDokument6 Seiten1) in Tally There Are - Predefined Ledger Ans: 2: 2) - Key Is Used To Print A ReportjeeadvanceNoch keine Bewertungen

- Auditing & Cost AccountingDokument10 SeitenAuditing & Cost AccountingSachin MoreNoch keine Bewertungen

- NUREC Finance ManualDokument148 SeitenNUREC Finance ManualRatna PrasadNoch keine Bewertungen

- APB Live Banks PDFDokument14 SeitenAPB Live Banks PDFHarish KotharuNoch keine Bewertungen

- 6Dokument10 Seiten6ampfcNoch keine Bewertungen

- Money and Banking: Chapter - 8Dokument32 SeitenMoney and Banking: Chapter - 8Kaushik NarayananNoch keine Bewertungen

- Property Notes Fall 2013Dokument108 SeitenProperty Notes Fall 2013achrys13Noch keine Bewertungen