Beruflich Dokumente

Kultur Dokumente

Kellogg Company and Subsidiaries

Hochgeladen von

Alejandra DiazOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Kellogg Company and Subsidiaries

Hochgeladen von

Alejandra DiazCopyright:

Verfügbare Formate

-6-

Kellogg Company and Subsidiaries

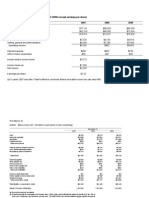

CONSOLIDATED STATEMENT OF INCOME (millions, except per share data) Quarter ended October 1, October 2, 2011 2010 $3,312 1,962 886 464 58 (9) 397 107 $290 $290 $.81 $.80 $.4300 360 363 $3,157 1,788 828 541 62 1 480 143 $337 (1) $338 $.91 $.90 $.4050 373 376 Year-to-date period ended October 1, October 2, 2011 2010 $10,183 5,969 2,635 1,579 178 (10) 1,391 394 $997 (2) $999 $2.75 $2.73 $1.2400 363 365 359 $9,537 5,438 2,438 1,661 188 9 1,482 427 $1,055 (3) $1,058 $2.80 $2.78 $1.1550 378 381 368

(Results are unaudited)

Net sales Cost of goods sold Selling, general and administrative expense Operating profit Interest expense Other income (expense), net Income before income taxes Income taxes Net income Net income (loss) attributable to noncontrolling interests Net income attributable to Kellogg Company Per share amounts: Basic Diluted Dividends per share Average shares outstanding: Basic Diluted Actual shares outstanding at period end

- more -

- 7Kellogg Company and Subsidiaries

SELECTED OPERATING SEGMENT DATA

(millions) (Results are unaudited) Net sales North America Europe Latin America Asia Pacific (a) Consolidated Segment operating profit North America (b) Europe Latin America Asia Pacific (a) Corporate (b) Consolidated (a) (b) Quarter ended October 1, October 2, 2011 2010 $2,217 585 274 236 $3,312 $2,130 564 247 216 $3,157 Year-to-date period ended October 1, October 2, 2011 2010 $6,812 1,840 816 715 $10,183 $6,469 1,730 709 629 $9,537

$357 84 43 23 (43) $464

$407 102 34 25 (27) $541

$1,203 287 152 79 (142) $1,579

$1,269 307 126 82 (123) $1,661

Includes Australia, Asia and South Africa. Research and Development expense totaling $3 million for the quarter ended October 2, 2010 and $8 million for the year-to-date period ended October 2, 2010 was reallocated to Corporate from North America.

- more -

-8Kellogg Company and Subsidiaries

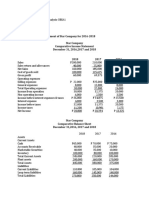

CONSOLIDATED STATEMENT OF CASH FLOWS (millions) Year-to-date period ended October 1, October 2, 2011 2010 $997 270 (2) 133 (187) 58 1,269 (392) 11 (381) 689 397 (946) 265 (693) (452) 10 (730) (20) 138 444 $582 $1,055 265 (53) 116 (45) (259) 1,079 (252) 2 (250) 547 (1) 178 (907) (435) 7 (611) 7 225 334 $559

(unaudited)

Operating activities Net income Adjustments to reconcile net income to operating cash flows: Depreciation and amortization Deferred income taxes Other Postretirement benefit plan contributions Changes in operating assets and liabilities Net cash provided by operating activities Investing activities Additions to properties Other Net cash used in investing activities Financing activities Net issuances of notes payable Issuances of long-term debt Reductions of long-term debt Net issuances of common stock Common stock repurchases Cash dividends Other Net cash used in financing activities Effect of exchange rate changes on cash and cash equivalents Increase in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period Supplemental financial data: Cash Flow (operating cash flow less property additions) (a)

$877

$827

(a) We use this non-GAAP measure of cash flow to focus management and investors on the amount of cash available for debt reduction, dividend distributions, acquisition opportunities, and share repurchase.

- more -

-9-

Kellogg Company and Subsidiaries

CONSOLIDATED BALANCE SHEET (millions, except per share data) October 1, 2011 (unaudited) Current assets Cash and cash equivalents Accounts receivable, net Inventories: Raw materials and supplies Finished goods and materials in process Deferred income taxes Other prepaid assets Total current assets Property, net of accumulated depreciation of $4,858 and $4,690 Goodwill Other intangibles, net of accumulated amortization of $48 and $47 Pension Other assets Total assets Current liabilities Current maturities of long-term debt Notes payable Accounts payable Accrued advertising and promotion Accrued income taxes Accrued salaries and wages Other current liabilities Total current liabilities Long-term debt Deferred income taxes Pension liability Nonpension postretirement benefits Other liabilities Commitments and contingencies Equity Common stock, $.25 par value Capital in excess of par value Retained earnings Treasury stock, at cost Accumulated other comprehensive income (loss) Total Kellogg Company equity Noncontrolling interests Total equity Total liabilities and equity

* Condensed from audited financial statements.

January 1, 2011 * $444 1,190 224 832 110 115 2,915 3,128 3,628 1,456 333 387 $11,847

$582 1,302 252 761 159 122 3,178 3,193 3,622 1,455 480 335 $12,263

$737 1,200 446 18 239 461 3,101 5,300 790 195 191 401

$952 44 1,149 405 60 153 421 3,184 4,908 697 265 214 425

105 510 6,644 (3,050) (1,926) 2,283 2 2,285 $12,263

105 495 6,122 (2,650) (1,914) 2,158 (4) 2,154 $11,847

- more -

- 10 -

Kellogg Company and Subsidiaries

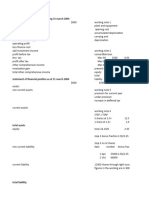

Analysis of net sales and operating profit performance Third quarter of 2011 versus 2010 (dollars in millions) 2011 net sales 2010 net sales % change - 2011 vs. 2010: Volume (tonnage) (b) Pricing/mix Subtotal - internal business Foreign currency impact Total change North America $ 2,217 $ 2,130 -.7% 4.4% 3.7% .4% 4.1% Europe $ 585 $ 564 -4.5% 2.9% -1.6% 5.2% 3.6% Latin Asia America Pacific (a) $ 274 $ 236 $ 247 $ 216 -3.0% 12.3% 9.3% 1.3% 10.6% -5.0% 7.0% 2.0% 7.8% 9.8% Corporate $ $ Consolidated $ 3,312 $ 3,157 -1.9% 5.0% 3.1% 1.8% 4.9%

(dollars in millions) 2011 operating profit 2010 operating profit % change - 2011 vs. 2010: Internal business Foreign currency impact Total change

(a) (b) (c) Includes Australia, Asia, and South Africa.

North America (c) $ 357 $ 407 -12.7% .5% -12.2%

Europe $ 84 $ 102 -20.9% 4.5% -16.4%

Latin America $ 43 $ 34 19.0% 2.8% 21.8%

Asia Pacific (a) $ 23 $ 25 -13.6% 4.5% -9.1%

ConsoliCorporate (c) dated $ (43) $ 464 $ (27) $ 541 -54.5% -54.5% -15.7% 1.6% -14.1%

We measure the volume impact (tonnage) on revenues based on the stated weight of our product shipments. Research and Development expense totaling $3 million for the quarter ended October 2, 2010 was reallocated to Corporate from North America.

- more -

- 11 -

Kellogg Company and Subsidiaries

Analysis of net sales and operating profit performance Year-to-date 2011 versus 2010 (dollars in millions) 2011 net sales 2010 net sales % change - 2011 vs. 2010: Volume (tonnage) (b) Pricing/mix Subtotal - internal business Foreign currency impact Total change North America Europe $ 6,812 $ 1,840 $ 6,469 $ 1,730 1.0% 3.8% 4.8% .5% 5.3% -2.7% 2.2% -.5% 6.8% 6.3% Latin Asia Pacific America (a) Corporate $ 816 $ 715 $ $ 709 $ 629 $ -% 8.8% 8.8% 6.3% 15.1% -% 2.6% 2.6% 11.1% 13.7% Consolidated $ 10,183 $ 9,537 .2% 3.8% 4.0% 2.8% 6.8%

(dollars in millions) 2011 operating profit 2010 operating profit % change - 2011 vs. 2010: Internal business Foreign currency impact Total change

(a) (b) (c) Includes Australia, Asia, and South Africa.

North America Europe (c) $ 1,203 $ 287 $ 1,269 $ 307 -5.7% .5% -5.2% -12.8% 6.4% -6.4%

Latin Asia Pacific ConsoliCorporate (c) America (a) dated $ 152 $ 79 $ (142) $ 1,579 $ 126 $ 82 $ (123) $ 1,661 12.6% 7.5% 20.1% -13.7% 9.9% -3.8% -14.9% -14.9% -7.6% 2.7% -4.9%

We measure the volume impact (tonnage) on revenues based on the stated weight of our product shipments. Research and Development expense totaling $8 million for the year-to-date period ended October 2, 2010 was reallocated to Corporate from North America.

- more -

- 12 -

Kellogg Company and Subsidiaries

Up-Front Costs*

$ millions Quarter ended October 1, 2011 Cost of goods sold (a) 2011 North America Europe Latin America Asia Pacific Corporate Total $ 3 4 7 Selling, general and administrative expense $ 9 9 $ Year-to-date period ended October 1, 2011 Cost of goods sold (a) 12 4 16 $ 14 12 2 28 Selling, general and administrative expense $ 19 1 20 $

Total

Total 33 12 1 2 48

Quarter ended October 2, 2010 Cost of goods sold 2010 North America Europe Latin America Asia Pacific Corporate Total $ 3 1 1 5 Selling, general and administrative expense $ 9 1 1 11 $

Year-to-date period ended October 2, 2010 Cost of goods sold 9 4 1 1 1 16 $ 13 11 2 2 28 Selling, general and administrative expense $ 18 1 2 3 24 $

Total

Total 31 12 2 4 3 52

2011 Variance - better(worse) than 2010 North America $ Europe Latin America Asia Pacific Corporate Total $

(3) $ (1) 1 1 (2) $

1 1 2

(3) 1 1 1 -

(1) $ (1) 2 - $

(1) $ 1 (1) 2 3 4 $

(2) 1 2 3 4

* Up-front costs are charges incurred by the Company which will result in future cash savings and/or reduced depreciation. They also include expense associated with capital projects across our supply chain network. (a) Includes expense associated with capital projects across our supply chain network incurred primarily in North America totaling $4 million and $16 million for the quarter and year-to-date periods ended October 1, 2011, respectively.

###

Das könnte Ihnen auch gefallen

- Miscellaneous Investment Pools & Funds Revenues World Summary: Market Values & Financials by CountryVon EverandMiscellaneous Investment Pools & Funds Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- 494.Hk 2011 AnnReportDokument29 Seiten494.Hk 2011 AnnReportHenry KwongNoch keine Bewertungen

- Cash Flow Statement - Common Size - RatiosDokument15 SeitenCash Flow Statement - Common Size - RatiosAnshul GargNoch keine Bewertungen

- SMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011Dokument18 SeitenSMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011nicholasyeoNoch keine Bewertungen

- Financial ReportDokument35 SeitenFinancial ReportDaniela Denisse Anthawer LunaNoch keine Bewertungen

- CH 6 Model 14 Free Cash Flow CalculationDokument12 SeitenCH 6 Model 14 Free Cash Flow CalculationrealitNoch keine Bewertungen

- Flash Memory Inc Student Spreadsheet SupplementDokument5 SeitenFlash Memory Inc Student Spreadsheet Supplementjamn1979Noch keine Bewertungen

- Colgate Palmolive Edos. Financieros 2009 A 2011Dokument11 SeitenColgate Palmolive Edos. Financieros 2009 A 2011manzanita_2412Noch keine Bewertungen

- For The Interim Six Month Period Ended June 30, 2011 (In United States Dollars)Dokument32 SeitenFor The Interim Six Month Period Ended June 30, 2011 (In United States Dollars)alexandercuongNoch keine Bewertungen

- Net Sales: January 28, 2012 January 29, 2011Dokument9 SeitenNet Sales: January 28, 2012 January 29, 2011장대헌Noch keine Bewertungen

- University of Wales and Mdis: Introduction To Accounting (Hk004)Dokument11 SeitenUniversity of Wales and Mdis: Introduction To Accounting (Hk004)Muhd RizdwanNoch keine Bewertungen

- Non-GAAP Financial MeasuresDokument1 SeiteNon-GAAP Financial MeasuresAlok ChitnisNoch keine Bewertungen

- BallCorporation 10Q 20130506Dokument57 SeitenBallCorporation 10Q 20130506doug119Noch keine Bewertungen

- Online Presentation 11-1-11Dokument18 SeitenOnline Presentation 11-1-11Hari HaranNoch keine Bewertungen

- ADPT Corp: Quarterly Report Pursuant To Sections 13 or 15 (D) Filed On 08/09/2011 Filed Period 07/01/2011Dokument76 SeitenADPT Corp: Quarterly Report Pursuant To Sections 13 or 15 (D) Filed On 08/09/2011 Filed Period 07/01/2011llMarsIINoch keine Bewertungen

- CCFM, CH 02, ProblemDokument4 SeitenCCFM, CH 02, ProblemKhizer SikanderNoch keine Bewertungen

- 22 22 YHOO Merger Model Transaction Summary AfterDokument101 Seiten22 22 YHOO Merger Model Transaction Summary Aftercfang_2005Noch keine Bewertungen

- Parent, Inc Actual Financial Statements For 2012 and OlsenDokument23 SeitenParent, Inc Actual Financial Statements For 2012 and OlsenManal ElkhoshkhanyNoch keine Bewertungen

- Comperative BALANCE SHEETS-Horizontal ANALIYIS: (Expressed in Thousands of United States Dollars)Dokument9 SeitenComperative BALANCE SHEETS-Horizontal ANALIYIS: (Expressed in Thousands of United States Dollars)jopa77Noch keine Bewertungen

- Answers For Quantitative Questions (Exam 3)Dokument3 SeitenAnswers For Quantitative Questions (Exam 3)Tsentso NaNoch keine Bewertungen

- Fin Model Practice 1Dokument17 SeitenFin Model Practice 1elangelang99Noch keine Bewertungen

- Hill Country SnackDokument8 SeitenHill Country Snackkiller dramaNoch keine Bewertungen

- 2010 Ibm StatementsDokument6 Seiten2010 Ibm StatementsElsa MersiniNoch keine Bewertungen

- United States Securities and Exchange Commission FORM 10-QDokument71 SeitenUnited States Securities and Exchange Commission FORM 10-QWai LonnNoch keine Bewertungen

- FY14 HPQ Salient Points 20141125Dokument2 SeitenFY14 HPQ Salient Points 20141125Amit RakeshNoch keine Bewertungen

- Flash Memory CaseDokument6 SeitenFlash Memory Casechitu199233% (3)

- Flash MemoryDokument8 SeitenFlash Memoryranjitd07Noch keine Bewertungen

- Chapter 4 AnswersDokument4 SeitenChapter 4 Answerscialee100% (2)

- Analysis of Financial StatementDokument9 SeitenAnalysis of Financial StatementSums Zubair MoushumNoch keine Bewertungen

- Laquayas Research Paper - NetflixDokument18 SeitenLaquayas Research Paper - Netflixapi-547930687Noch keine Bewertungen

- Accounting Text & Cases Ed 13th Case 6-3Dokument1 SeiteAccounting Text & Cases Ed 13th Case 6-3Ki UmbaraNoch keine Bewertungen

- Semester-End Examination Model QuestionDokument9 SeitenSemester-End Examination Model QuestionSarose ThapaNoch keine Bewertungen

- 4Q11 Earnings Presentation Final 1.13.12Dokument23 Seiten4Q11 Earnings Presentation Final 1.13.12sushil2005Noch keine Bewertungen

- Macys 2011 10kDokument39 SeitenMacys 2011 10kapb5223Noch keine Bewertungen

- Ch03 P15 Build A ModelDokument2 SeitenCh03 P15 Build A ModelHeena Sudra77% (13)

- Net Income Attributable To Noncontrolling Interest Net Income (Loss) Attributable To VerizonDokument9 SeitenNet Income Attributable To Noncontrolling Interest Net Income (Loss) Attributable To VerizonvenkeeeeeNoch keine Bewertungen

- Asahi Glass 2009-10Dokument29 SeitenAsahi Glass 2009-10Divya SharmaNoch keine Bewertungen

- Chapter 13 - Build A Model SpreadsheetDokument6 SeitenChapter 13 - Build A Model Spreadsheetdunno2952Noch keine Bewertungen

- Financial Analysis Project Segement 1and 2.edited Final 2Dokument15 SeitenFinancial Analysis Project Segement 1and 2.edited Final 2chris waltersNoch keine Bewertungen

- Sewanee Manufacturing Inc. Summary Historical Operating and Balance Sheet ($ in Millions, Fiscal Year Ending December 31)Dokument6 SeitenSewanee Manufacturing Inc. Summary Historical Operating and Balance Sheet ($ in Millions, Fiscal Year Ending December 31)Tran LyNoch keine Bewertungen

- CH 01 Review and Discussion Problems SolutionsDokument11 SeitenCH 01 Review and Discussion Problems SolutionsArman BeiramiNoch keine Bewertungen

- Bmo 8.1.13 PDFDokument7 SeitenBmo 8.1.13 PDFChad Thayer VNoch keine Bewertungen

- 2010 Financial Highlights: Year-End 2010 2009 % B/ (W) ChangeDokument6 Seiten2010 Financial Highlights: Year-End 2010 2009 % B/ (W) ChangeahmedNoch keine Bewertungen

- Colcom Press Results Dec2011Dokument1 SeiteColcom Press Results Dec2011Kristi DuranNoch keine Bewertungen

- Investment VI FINC 404 Company ValuationDokument52 SeitenInvestment VI FINC 404 Company ValuationMohamed MadyNoch keine Bewertungen

- Assign 1 - Sem II 12-13Dokument8 SeitenAssign 1 - Sem II 12-13Anisha ShafikhaNoch keine Bewertungen

- Financial Statements and Financial AnalysisDokument42 SeitenFinancial Statements and Financial AnalysisAhmad Ridhuwan AbdullahNoch keine Bewertungen

- 70 XTO Financial StatementsDokument5 Seiten70 XTO Financial Statementsredraider4404Noch keine Bewertungen

- Ebix, Inc.: FORM 10-QDokument39 SeitenEbix, Inc.: FORM 10-QalexandercuongNoch keine Bewertungen

- Butterfield Reports 2011 Net Income of $40.5 Million: For Immediate ReleaseDokument10 SeitenButterfield Reports 2011 Net Income of $40.5 Million: For Immediate Releasepatburchall6278Noch keine Bewertungen

- 2010-10-22 003512 Yan 8Dokument19 Seiten2010-10-22 003512 Yan 8Natsu DragneelNoch keine Bewertungen

- 61 JPM Financial StatementsDokument4 Seiten61 JPM Financial StatementsOladipupo Mayowa PaulNoch keine Bewertungen

- The Goodyear Tire & Rubber Company: FORM 10-QDokument62 SeitenThe Goodyear Tire & Rubber Company: FORM 10-Qavinashtiwari201745Noch keine Bewertungen

- Mod 1 Historical Financial StatementsDokument14 SeitenMod 1 Historical Financial StatementsMahesh ChippaNoch keine Bewertungen

- Exhibit 99.1 Message To ShareholdersDokument8 SeitenExhibit 99.1 Message To ShareholdersWilliam HarrisNoch keine Bewertungen

- Bob's Bicycles - Master Budget 2010Dokument28 SeitenBob's Bicycles - Master Budget 2010Jonathan Slonim100% (2)

- RMCF 10-Q 20110831Dokument22 SeitenRMCF 10-Q 20110831mtn3077Noch keine Bewertungen

- Consolidated First Page To 11.2 Property and EquipmentDokument18 SeitenConsolidated First Page To 11.2 Property and EquipmentAsif_Ali_1564Noch keine Bewertungen

- Financial Statement SolutionDokument21 SeitenFinancial Statement SolutionYousaf BhuttaNoch keine Bewertungen

- Homework For Chapter 8Dokument6 SeitenHomework For Chapter 8Pramit Singh0% (1)

- Astral LTD Finance ProjectDokument55 SeitenAstral LTD Finance Projectshubhamkumar.bhagat.23mbNoch keine Bewertungen

- Fabm2 DlaDokument100 SeitenFabm2 DlaCathlyn San LuisNoch keine Bewertungen

- Comparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018Dokument5 SeitenComparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018JonellNoch keine Bewertungen

- ARDokument2 SeitenARTk KimNoch keine Bewertungen

- XtolDokument2 SeitenXtolsujal JainNoch keine Bewertungen

- Wrap Up Part 2 - Financial Accounting and ReportingDokument14 SeitenWrap Up Part 2 - Financial Accounting and ReportingShaimer Cinto100% (1)

- AdjustmentsDokument16 SeitenAdjustmentsScouter SejatiNoch keine Bewertungen

- FinMan Planning Master-BudgetDokument3 SeitenFinMan Planning Master-Budgetjim malajatNoch keine Bewertungen

- Assignment/ TugasanDokument21 SeitenAssignment/ Tugasanhafiz azuanNoch keine Bewertungen

- SBR Current IssueDokument61 SeitenSBR Current IssueJony SaifulNoch keine Bewertungen

- Dwnload Full Financial Accounting 17th Edition Williams Test Bank PDFDokument35 SeitenDwnload Full Financial Accounting 17th Edition Williams Test Bank PDFboredomake0ahb100% (14)

- Answer Keys Assignment IDokument3 SeitenAnswer Keys Assignment IAshutosh SinghNoch keine Bewertungen

- Comparable Companies CompletedDokument8 SeitenComparable Companies Completeduclabruin220Noch keine Bewertungen

- Tab 5 Goentzel Working Capital CCCDokument11 SeitenTab 5 Goentzel Working Capital CCCits4krishna3776Noch keine Bewertungen

- Seatwork 11.1 TaliteDokument10 SeitenSeatwork 11.1 Taliteandrea taliteNoch keine Bewertungen

- Chapter 4 Branch AccountingDokument17 SeitenChapter 4 Branch Accountingkefyalew TNoch keine Bewertungen

- Adjusting Entries and Worksheet PreparationDokument16 SeitenAdjusting Entries and Worksheet Preparationcarlo bundalianNoch keine Bewertungen

- Analisis Keuangan PershDokument8 SeitenAnalisis Keuangan PershMeilinda AryantoNoch keine Bewertungen

- Vinati Organics - ResearchDokument10 SeitenVinati Organics - ResearchjackkapuparaNoch keine Bewertungen

- ACF 103 Tutorial 6 Solns Updated 2015Dokument18 SeitenACF 103 Tutorial 6 Solns Updated 2015Carolina SuNoch keine Bewertungen

- M 202Dokument2 SeitenM 202Rafael Capunpon VallejosNoch keine Bewertungen

- Cash & Cash EquivalentsDokument10 SeitenCash & Cash EquivalentsKristine Valerie BonghanoyNoch keine Bewertungen

- 7110 s05 QP 1Dokument12 Seiten7110 s05 QP 1kaviraj1006Noch keine Bewertungen

- CHEMALITEDokument1 SeiteCHEMALITEPurva TamhankarNoch keine Bewertungen

- P1-2B 6081901141Dokument3 SeitenP1-2B 6081901141Mentari Anggari67% (3)

- WAC11 2016 Oct AS QPDokument12 SeitenWAC11 2016 Oct AS QPFarbeen Satira MirzaNoch keine Bewertungen

- Practice Paper Pre-Board Xii Acc 2023-24Dokument13 SeitenPractice Paper Pre-Board Xii Acc 2023-24Pratiksha Suryavanshi100% (1)

- PracticeProblems Set1withAnswersDokument5 SeitenPracticeProblems Set1withAnswersRoselle Jane LanabanNoch keine Bewertungen

- College of Accountancy: Midterm Examination in Financial Accounting and ReportingDokument6 SeitenCollege of Accountancy: Midterm Examination in Financial Accounting and ReportingALMA MORENANoch keine Bewertungen