Beruflich Dokumente

Kultur Dokumente

Illinois Ventures

Hochgeladen von

malone17830Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Illinois Ventures

Hochgeladen von

malone17830Copyright:

Verfügbare Formate

RESEARCH | TEACHING | PUBLIC ENGAGEMENT | ECONOMIC DEVELOPMENT

ILLINOIS VENTURES

IllinoisVentures is a premier start-up and early-stage technology investment firm focused on researchderived companies in information technology, physical and life sciences, and cleantech. Conceived and launched as a public/private partnership by the University of Illinois, the firm starts and builds globally-competitive businesses based on work conducted at Midwest Universities, federal laboratories and other sources. Together with University Offices of Technology Management and the Research Park, IllinoisVentures completes a unique model that drives increased technology transfer, company formation and start-up success.

HISTORY In 2001, Illinois Legislature affirmed a fourth mission for the University Economic Development to strengthen Illinois and U.S. economies In turn, University Trustees created IllinoisVentures to catalyze the formation of Illinois and Midwest technology companies To augment its public evergreen fund, IllinoisVentures raised and deployed the Illinois Emerging Technology Funds, now totaling $50 million in privately-sourced venture capital Consistently recognized by Entrepreneur magazine and Innovosource as a leading research-based early-stage venture capital firm nationally

ABOUT ILLINOISVENTURES Total assets under management: $65 Million Stage: Origination and early-stage venture capital Focus: Research-derived investment opportunities Industries: Information technology, physical and life sciences, cleantech Geography: Illinois and the Midwest

BUILDING ON UNIVERSITY, STATE AND PRIVATE INVESTMENT Consultative interactions with over 2200 technologies since 2002 Invested over $40M in 60+ companies, often acting as co-founder Attracted $470M 3rd-party co-investment in holdings over 12:1 leverage Created more than 450 high-value jobs

A LEADING PROVIDER OF START-UP AND EARLY-STAGE CAPITAL IN THE MIDWEST

2-4%

National venture capital invested in Illinois companies: 2-4%

15-20%

Illinois-based venture capital invested in Illinois companies: 15-20%

90%

In comparison, IllinoisVentures companies: 90% have an operational presence in Illinois 70% have a majority of operations in Illinois

70%

PORTFOLIO HIGHLIGHTS

ShareThis

Cell measurement instrumentation First IllinoisVentures investment, sold to Sony of America, December 2009 Global digital media sharing network Reaches 450M consumers across 1M websites monthly

Produces low cost, high-concentration solar power modules Secured Siemens-led $45M funding, pilot plant live in mid-2012

Mini-chromosome gene stacking technology for agricultural and energy products Market-leading collaborations with Syngenta, Monsanto, Bayer, and Dow

Produces DNA biosensors to detect heavy metals in water Engaged with EPA, HF scientific, numerous major testing firms

Next-generation video conferencing Co-funded with AMD, leveraging emerging 3-D camera install-base

Repurposing of cannabinoids for treatment of sleep apnea Proof of concept trial completed, co-development underway

High-performance additives that render coatings selfhealing Collaborations underway with several leading coatings producers and specifiers

Office of the Vice President for Research 346 Henry Administration Building 506 South Wright Street Urbana, Illinois 61801 217.265.5440

Das könnte Ihnen auch gefallen

- iOS Provisioning: A How To' Guide For OTM Developers Using The Developer Program at AppleDokument82 SeiteniOS Provisioning: A How To' Guide For OTM Developers Using The Developer Program at Applemalone17830Noch keine Bewertungen

- Apple Developer Programs: A Visual Overview Guide For OTM On The Different iOS Developer ProgramsDokument44 SeitenApple Developer Programs: A Visual Overview Guide For OTM On The Different iOS Developer Programsmalone17830Noch keine Bewertungen

- iOS Provisioning: A How To' Guide For OTM Developers Using The Developer Program at AppleDokument82 SeiteniOS Provisioning: A How To' Guide For OTM Developers Using The Developer Program at Applemalone17830Noch keine Bewertungen

- iOS Provisioning: A How To' Guide For OTM Developers Using The Developer Program at AppleDokument82 SeiteniOS Provisioning: A How To' Guide For OTM Developers Using The Developer Program at Applemalone17830Noch keine Bewertungen

- University of Illinois Research ParkDokument2 SeitenUniversity of Illinois Research Parkmalone17830Noch keine Bewertungen

- Office of Technology Management 2012 Commercialization Analyst Intern FlyerDokument1 SeiteOffice of Technology Management 2012 Commercialization Analyst Intern Flyermalone17830Noch keine Bewertungen

- Apple Developer Programs: A Visual Overview Guide For OTM On The Different iOS Developer ProgramsDokument44 SeitenApple Developer Programs: A Visual Overview Guide For OTM On The Different iOS Developer Programsmalone17830Noch keine Bewertungen

- Innovations at The University of IllinoisDokument2 SeitenInnovations at The University of Illinoismalone17830Noch keine Bewertungen

- Illinois VenturesDokument2 SeitenIllinois Venturesmalone17830Noch keine Bewertungen

- Innovation at University of IllinoisDokument2 SeitenInnovation at University of Illinoismalone17830Noch keine Bewertungen

- Mobile Poster Final-ResizedDokument1 SeiteMobile Poster Final-Resizedmalone17830Noch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5782)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- UTM Grraduate StudentDokument11 SeitenUTM Grraduate StudentdhrghamNoch keine Bewertungen

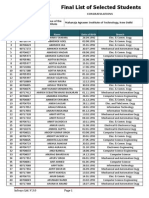

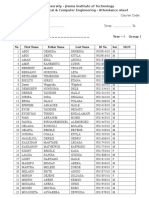

- Final List of Selected Students for Infosys PlacementDokument5 SeitenFinal List of Selected Students for Infosys PlacementHimanshu GuptaNoch keine Bewertungen

- Be 3 Sem Nov 2010Dokument21 SeitenBe 3 Sem Nov 2010Muhammad YâsirNoch keine Bewertungen

- Fundamentals of Geology: March 2012Dokument9 SeitenFundamentals of Geology: March 2012Gilang Cahyo WNoch keine Bewertungen

- ENS1154 Introduction to Engineering Unit OutlineDokument3 SeitenENS1154 Introduction to Engineering Unit OutlinegainchaudharyNoch keine Bewertungen

- At For 2ndsem 2018Dokument43 SeitenAt For 2ndsem 2018cudarunNoch keine Bewertungen

- April 2 3,2016, Chennai, IndiaDokument3 SeitenApril 2 3,2016, Chennai, IndiaCS & ITNoch keine Bewertungen

- Library RecordsDokument9 SeitenLibrary RecordsDr-Atul Kumar DwivediNoch keine Bewertungen

- APRCET 2021Dokument5 SeitenAPRCET 2021Eswara SaiNoch keine Bewertungen

- Jawaharlal Nehru Technological University Kakinada: College Name: Chebrolu Engg College, Chebrolu, Guntur:HuDokument6 SeitenJawaharlal Nehru Technological University Kakinada: College Name: Chebrolu Engg College, Chebrolu, Guntur:HuShaik AbdulwahabNoch keine Bewertungen

- Engineering Design Mcas ReviewDokument9 SeitenEngineering Design Mcas Reviewapi-319102793Noch keine Bewertungen

- Tamara Bojanic ResumeDokument2 SeitenTamara Bojanic Resumeapi-273439711Noch keine Bewertungen

- Mobile: 9121343031 E-mail: gopimallela337@gmail.comDokument3 SeitenMobile: 9121343031 E-mail: gopimallela337@gmail.comgopi 30Noch keine Bewertungen

- CN Lab 17ECL68 (Even Sem 2019-20)Dokument2 SeitenCN Lab 17ECL68 (Even Sem 2019-20)Pallavi JayramNoch keine Bewertungen

- SAEP-135 - Process Automation Systems Obsolescence EvaluationDokument15 SeitenSAEP-135 - Process Automation Systems Obsolescence EvaluationQA QCNoch keine Bewertungen

- CV Paul Krot - Mechanical and Control EngineerDokument5 SeitenCV Paul Krot - Mechanical and Control EngineerPavel KrotNoch keine Bewertungen

- Petroleum Engineering PDFDokument173 SeitenPetroleum Engineering PDFKeeran Daniel Ramanujam100% (1)

- 2013-9-30-Chemical Engineering Road Map 2013Dokument1 Seite2013-9-30-Chemical Engineering Road Map 2013saadqaNoch keine Bewertungen

- Telco Trends Webinar InsightsDokument2 SeitenTelco Trends Webinar InsightsCarmela FranciscoNoch keine Bewertungen

- Booklets CDI Jan Sept 2013Dokument96 SeitenBooklets CDI Jan Sept 2013Cosimo BettiniNoch keine Bewertungen

- Lab ProformaDokument5 SeitenLab ProformasaravkiruNoch keine Bewertungen

- JB Vaught Resume MDokument1 SeiteJB Vaught Resume Mapi-316044072Noch keine Bewertungen

- List of Coordinators at Member Institutions 9 Fundamental FieldsDokument14 SeitenList of Coordinators at Member Institutions 9 Fundamental FieldsHendrii SubagioNoch keine Bewertungen

- Revised AdvertisementDokument15 SeitenRevised Advertisementsahilkoul2007Noch keine Bewertungen

- Mohammad Abu Shattal July2017Dokument3 SeitenMohammad Abu Shattal July2017Mohammad Abu ShattalNoch keine Bewertungen

- 2011 Monsoon Second TestDokument2 Seiten2011 Monsoon Second TestK Nagarjunan ReddyNoch keine Bewertungen

- Why Romanian Journal of Food ScienceDokument2 SeitenWhy Romanian Journal of Food ScienceAna Vitelariu - RaduNoch keine Bewertungen

- Resume Aditya Agarwal IndiaDokument1 SeiteResume Aditya Agarwal IndiaAditya AgarwalNoch keine Bewertungen

- Kumaraguru College of TechnologyDokument2 SeitenKumaraguru College of TechnologyArihara SudhanNoch keine Bewertungen

- Experience: DirectorDokument5 SeitenExperience: DirectorShahid MahmudNoch keine Bewertungen