Beruflich Dokumente

Kultur Dokumente

Assignment 2 M Eco F

Hochgeladen von

RazaRanaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Assignment 2 M Eco F

Hochgeladen von

RazaRanaCopyright:

Verfügbare Formate

UNIVERSITY OF CENTRAL PUNJAB, Lahore.

MBA, Fall 2011

Assignment#2

Resource Person: Syeda Hameeda Batool Name: Due Date: 5th Jan 12 ID#

Managerial Eoconomics Section F

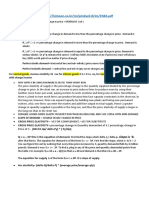

COST / Production ANALYSIS In the accompanying table, we list cost figures for a hypothetical firm. We assume that the firm is selling in a perfectly competitive market. Fill in all the blanks. Output (units) Fixed Cost Average Variable Average Cost Variabl Fixed e Cost Cost (AFC) (AVC) $100 $40 $40 50 35 70 33.33 25 20 60.67 180 250 330 120 40 45 50 55 Total Cost Average Total Costs (ATC) $140 85 73.33 70 70 71.67 Marginal Cost (MC) $ 30 50 60 70 80

1 2 3 4 5 6

A.

100 100 100 100 100 100

$ 140 170 220 280 350 430

How low would the market price of its output have to go before the firm would shutdown in the short run? The price is not gives so taking Q = 6, Avc = 55. Putting 6 = 100 / P 55 P = 71.66

B. If the price of its output were $76, what rate of output would the firm produce, and how much profit would it earn? Q = 100 / 76 55 Q = 4.76 Profit

Q = (TFC + Profit) / P AVC 4.76 = (100 profit) / 76 55 Profit = - 0.04 (which is a loss) C. What is the price of its output at which the firm would just break even in the short run? (This is the same price below which the firm would go out of business in the longrun.) What output would the firm produce at that price? Breakeven actually come where AVC is greater than price but here price is greater than AVC, it means that firms output covers some cost so breakeven quantity is 4.76 and price is 76. Mr. Ahmed, manager of university caf, is contemplate keeping open his caf until 11:00pm. In order to do so, he would have to hire additional workers. He estimates the following total output. If the price of each unit of output is Rs.10 and each worker must be paid Rs. 40 per day, how many workers should Mr. Ahmed hire? Workers Total Output MP P MRP(L) MR(C) Hire 0 0 0 10 0 0 1 12 12 10 120 40 2 22 10 10 100 40 3 30 8 10 80 40 4 36 6 10 60 40 5 40 4 10 40 40 6 42 2 10 20 40

Based on the following table, Outpu Price Total Costs t 0 $10 $30 1 10 40 2 10 45 3 10 48 4 10 55 5 10 65 6 10 80 7 10 100 8 10 140 9 10 220 10 10 340

TR 0 10 20 30 40 50 60 70 80 90 100

MR 0 10 10 10 10 10 10 10 10 10 10

MC 30 10 5 3 7 10 15 20 40 80 120

a) What is the profit-maximizing output? Profit maximization where MR = MC but here at 2 places where MR = MC, at output 1 & 5, now we can see where cost and loss is minimum at Q1 and TR is 10, but TC is 40, it means loss is 30, but at Q 5 TR = 50 and TC = 65, here 15 is loss. So output 5 is over profit is maximizing output. b) How would your answer change if, in response to an increase in demand, the price of the good increased to $15? Now the price of good increase 15 $ / unit so at this price what is our profit maximize output

A firm's cost curves are given by the following table: Q TC 0 $100 1 130 2 152 3 160 4 172 5 185 6 210 7 240 8 280 9 330 10 390 Complete the table TFC $100 100 100 100 100 100 100 100 100 100 100 VC 0 30 52 60 72 85 110 140 180 230 290 AVC 0 30 26 20 18 17 18.3 20 22.5 25.5 29 ATC 0 130 76 53.3 43 37 35 34.2 35 36.6 39 MC 0 30 22 8 12 13 25 30 40 50 60

a) Graph AVC, ATC and MC on the same graph. What is the relationship between the MC curve and ATC?

b) Suppose that market price is $ 30. How much will the firm produce in the short run? How much are total profits? Show them on graph. Price is 30 AVC = 20, where Q is 3 Q = 100 \ 30 20 Q = 10 So profit is 0 c) Suppose that market price is $50. How much will the firm produce in the short run? What are total profits? Show them on the graph. AVC = 30 Q=1 TFC = 100 SO Q = 100 \ 50 30 Q=5 Profit = 0 d) Suppose that market price is $10 and AVC is 5. How much would the firm produce in the short run? What are total profits? Show them on the graph. P = 10 AVC = 5 TFC = 100 Q = 100 \ 10 5 Q = 20 Profit = 0 Here the firm faces loss, not profit.

Das könnte Ihnen auch gefallen

- Managerial Economics Michael Baye Chapter 8 AnswersDokument6 SeitenManagerial Economics Michael Baye Chapter 8 Answersneeebbbsy8980% (10)

- Chapter 6.questions & SolutionsDokument36 SeitenChapter 6.questions & Solutionshizkel hermNoch keine Bewertungen

- ECON 301 Homework Chapter 5 1. A Firm Can Manufacture A Product According To The Production FunctionDokument8 SeitenECON 301 Homework Chapter 5 1. A Firm Can Manufacture A Product According To The Production FunctionFachrizal AnshoriNoch keine Bewertungen

- 281 Winter 2015 Final Exam With Key PDFDokument15 Seiten281 Winter 2015 Final Exam With Key PDFAlex HoNoch keine Bewertungen

- Activity On Short Run Costs and Output DecisionDokument5 SeitenActivity On Short Run Costs and Output DecisionJane ButterfieldNoch keine Bewertungen

- BMME5103 - Assignment - Oct 2011 211111Dokument6 SeitenBMME5103 - Assignment - Oct 2011 211111maiphuong200708Noch keine Bewertungen

- ECON3400 Optional AS6 F12 Sol FullDokument17 SeitenECON3400 Optional AS6 F12 Sol FullSurya Atmaja MrbNoch keine Bewertungen

- Problem Set 3 SolutionDokument2 SeitenProblem Set 3 SolutionMadina SuleimenovaNoch keine Bewertungen

- Theory of Cost and ProfitDokument11 SeitenTheory of Cost and ProfitCenniel Bautista100% (4)

- Managerial Economics 12th Edition Hirschey Test BankDokument50 SeitenManagerial Economics 12th Edition Hirschey Test BankHeatherJohnsonwnesd100% (15)

- Data Interpretation Guide For All Competitive and Admission ExamsVon EverandData Interpretation Guide For All Competitive and Admission ExamsBewertung: 2.5 von 5 Sternen2.5/5 (6)

- Chapter 12Dokument11 SeitenChapter 12Kim Patrice NavarraNoch keine Bewertungen

- Dealer Management System v2.3.Xlsx - GetacoderDokument19 SeitenDealer Management System v2.3.Xlsx - Getacoderapsantos_spNoch keine Bewertungen

- CPADokument98 SeitenCPAPavan Kumar100% (1)

- BBA Unit IIIDokument9 SeitenBBA Unit IIIPriya NandhakumarNoch keine Bewertungen

- L6B Profit MaximizationDokument42 SeitenL6B Profit Maximizationkurumitokisaki967Noch keine Bewertungen

- Answers Homework4Dokument3 SeitenAnswers Homework4anishNoch keine Bewertungen

- PcsDokument4 SeitenPcsOntheissues Dot OrgNoch keine Bewertungen

- Assignment Micro 2Dokument13 SeitenAssignment Micro 2Nguyên BảoNoch keine Bewertungen

- Problem Set - Perfect Competition AnswersDokument3 SeitenProblem Set - Perfect Competition AnswersKhushi GuptaNoch keine Bewertungen

- Unit 7 Revenue and Cost and Break EvenDokument13 SeitenUnit 7 Revenue and Cost and Break Evenafreen khanNoch keine Bewertungen

- EXERCISE Before FinalDokument15 SeitenEXERCISE Before FinalNursakinah Nadhirah Md AsranNoch keine Bewertungen

- Rolando Final ProjectDokument15 SeitenRolando Final Projectapi-242856546Noch keine Bewertungen

- Q F (K, L) K L: (Please Show Complete Solution.)Dokument4 SeitenQ F (K, L) K L: (Please Show Complete Solution.)Karl Simone EsmillaNoch keine Bewertungen

- Managerial Economics 2015 AssignmentDokument3 SeitenManagerial Economics 2015 Assignmentgasararoba99Noch keine Bewertungen

- Practice Exercise CH 9 BECN 150 (F-21) STDokument13 SeitenPractice Exercise CH 9 BECN 150 (F-21) STbrinthaNoch keine Bewertungen

- Cost-Output RelationshipDokument16 SeitenCost-Output RelationshipJohn Hipona100% (2)

- Solution-BECO575-Worksheet 3 (8 And10 - Market Structures) PDFDokument10 SeitenSolution-BECO575-Worksheet 3 (8 And10 - Market Structures) PDFSara HalabiNoch keine Bewertungen

- Eportfolio MicroeconomicsDokument16 SeitenEportfolio Microeconomicsapi-241510748Noch keine Bewertungen

- ECONOMICS Problem SetDokument8 SeitenECONOMICS Problem SetnbvnvnvNoch keine Bewertungen

- Costs of ProductionDokument30 SeitenCosts of ProductionANIKNoch keine Bewertungen

- PQs 5 ADokument4 SeitenPQs 5 Aalex-bookNoch keine Bewertungen

- Answer ALL Questions (15 Marks) : BEB1033 Microeconomics AssignmentDokument3 SeitenAnswer ALL Questions (15 Marks) : BEB1033 Microeconomics AssignmentKevin PirabuNoch keine Bewertungen

- Chap 13Dokument7 SeitenChap 13Lê Trung AnhNoch keine Bewertungen

- Final Assignment Course: BUS525 (Managerial Economics)Dokument8 SeitenFinal Assignment Course: BUS525 (Managerial Economics)MushfiqNoch keine Bewertungen

- Assignment 8:: Exercise 1Dokument5 SeitenAssignment 8:: Exercise 1Ngọcc LannNoch keine Bewertungen

- MarketDokument26 SeitenMarketTushar BallabhNoch keine Bewertungen

- Managerial Economics AssignmentDokument2 SeitenManagerial Economics Assignmentharshit2010pmbNoch keine Bewertungen

- Costs and Revenue of Tarangelic Riz:: Production & Cost Case StudyDokument3 SeitenCosts and Revenue of Tarangelic Riz:: Production & Cost Case StudyVicky Kuroi BaraNoch keine Bewertungen

- UYGULAMA DERSÝ SORU VE CEVAPLARI (Practice Q & A)Dokument5 SeitenUYGULAMA DERSÝ SORU VE CEVAPLARI (Practice Q & A)Wail Fouaad Maa'ni MohammedNoch keine Bewertungen

- Economics All CH NotesDokument6 SeitenEconomics All CH NotesNishtha GargNoch keine Bewertungen

- Tutorial Set 5 - Microeconomics UGBS 201-2Dokument7 SeitenTutorial Set 5 - Microeconomics UGBS 201-2FrizzleNoch keine Bewertungen

- Topic 3 Solution of Short Answer QuestionsDokument7 SeitenTopic 3 Solution of Short Answer QuestionsTy VoNoch keine Bewertungen

- Not For Quotation: Theory of Cost and ProfitDokument8 SeitenNot For Quotation: Theory of Cost and ProfitFrancis Thomas LimNoch keine Bewertungen

- Seminar 10.1Dokument6 SeitenSeminar 10.1Haqeemy Fakhrizzakie Mohd YusriNoch keine Bewertungen

- Total Cost StudyDokument36 SeitenTotal Cost StudyUb UsoroNoch keine Bewertungen

- ME Chap - 3 Cost AnalDokument11 SeitenME Chap - 3 Cost Analgeneralpurpose1729Noch keine Bewertungen

- Amna Lall 10721 Assignment EcoDokument5 SeitenAmna Lall 10721 Assignment EcoGohar AfshanNoch keine Bewertungen

- Practice Multiple-Choice Questions For The Final Exam (Fall 2020)Dokument21 SeitenPractice Multiple-Choice Questions For The Final Exam (Fall 2020)GustaveNoch keine Bewertungen

- Homework 5 - Gabriella Caryn Nanda - 1906285320Dokument9 SeitenHomework 5 - Gabriella Caryn Nanda - 1906285320Cyril HadrianNoch keine Bewertungen

- Market TypesDokument32 SeitenMarket TypesJintu Moni BarmanNoch keine Bewertungen

- Principles of Economics (Microeconomics) Homework With AnswersDokument3 SeitenPrinciples of Economics (Microeconomics) Homework With AnswersAndriyNoch keine Bewertungen

- Economics Notes Unit 3Dokument12 SeitenEconomics Notes Unit 3Prothom UzzamanNoch keine Bewertungen

- Theory of Cost and ProfitDokument20 SeitenTheory of Cost and ProfitCrystal De GuzmanNoch keine Bewertungen

- PS - 6 - Sol MicroeconomyDokument4 SeitenPS - 6 - Sol MicroeconomytunaugurNoch keine Bewertungen

- Tutorial Questions On AccountingDokument6 SeitenTutorial Questions On AccountingEve PomeNoch keine Bewertungen

- Group Assignment Presentation 7.2: Exercise 1: The Following Data Is For A Firm Which Operates in A Perfectly CompetitiveDokument5 SeitenGroup Assignment Presentation 7.2: Exercise 1: The Following Data Is For A Firm Which Operates in A Perfectly CompetitiveNguyễn Hoàngg100% (1)

- Economic Principles - Tutorial 4 Semester 1 AnswersDokument19 SeitenEconomic Principles - Tutorial 4 Semester 1 Answersmad EYESNoch keine Bewertungen

- SSC CGL Preparatory Guide -Mathematics (Part 2)Von EverandSSC CGL Preparatory Guide -Mathematics (Part 2)Bewertung: 4 von 5 Sternen4/5 (1)

- SQL Server Functions and tutorials 50 examplesVon EverandSQL Server Functions and tutorials 50 examplesBewertung: 1 von 5 Sternen1/5 (1)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsVon EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNoch keine Bewertungen

- Project Review and Administrative AspectsDokument22 SeitenProject Review and Administrative Aspectsamit861595% (19)

- Trắc nghiệm tieng anhDokument2 SeitenTrắc nghiệm tieng anhMinh HoàngNoch keine Bewertungen

- Document 1083870621Dokument5 SeitenDocument 1083870621Okan AladağNoch keine Bewertungen

- Deemed Export BenefitDokument37 SeitenDeemed Export BenefitSamNoch keine Bewertungen

- 06 Rajashree Foods AAR OrderDokument6 Seiten06 Rajashree Foods AAR OrderanupNoch keine Bewertungen

- Module 7 2nd Quarter EntrepDokument17 SeitenModule 7 2nd Quarter EntrepRonnie Ginez75% (4)

- Notice For MemberDokument5 SeitenNotice For MemberDEEPAK KUMARNoch keine Bewertungen

- Sandesh Stores AuditedDokument7 SeitenSandesh Stores AuditedManoj gurungNoch keine Bewertungen

- AREOPA - Principles of IC AccountingDokument39 SeitenAREOPA - Principles of IC AccountingJoris g. ClaeysNoch keine Bewertungen

- Mahindra Case StudyDokument10 SeitenMahindra Case StudySahil AroraNoch keine Bewertungen

- Capital Expenditure Review - Work ProgramDokument8 SeitenCapital Expenditure Review - Work Programmarikb79Noch keine Bewertungen

- Verana Exhibit and SchedsDokument45 SeitenVerana Exhibit and SchedsPrincess Dianne MaitelNoch keine Bewertungen

- 2 Ac4Dokument2 Seiten2 Ac4Rafols AnnabelleNoch keine Bewertungen

- Bloomberg Top Hedge Funds 2010Dokument14 SeitenBloomberg Top Hedge Funds 2010jackefeller100% (1)

- Search Results For "Certification" - Wikimedia Foundation Governance Wiki PDFDokument2 SeitenSearch Results For "Certification" - Wikimedia Foundation Governance Wiki PDFAdriza LagramadaNoch keine Bewertungen

- Final Prentation of ProjectDokument17 SeitenFinal Prentation of ProjectnilphadtareNoch keine Bewertungen

- FHFA Housing ProjectionDokument13 SeitenFHFA Housing Projectionooo5770Noch keine Bewertungen

- 12th Commerce - 1st Revision Question Paper - English Medium PDF DownloadDokument6 Seiten12th Commerce - 1st Revision Question Paper - English Medium PDF DownloadAřúń .jřNoch keine Bewertungen

- 4 - 5882075308076565519Fx Traders HandbookDokument71 Seiten4 - 5882075308076565519Fx Traders HandbookDaniel ObaraNoch keine Bewertungen

- Entries For Various Dilutive Securities The Stockholders Equi PDFDokument1 SeiteEntries For Various Dilutive Securities The Stockholders Equi PDFAnbu jaromiaNoch keine Bewertungen

- Bai Tap Chuong 7Dokument19 SeitenBai Tap Chuong 7Nguyen Quang PhuongNoch keine Bewertungen

- Oracle General Ledger Process 315817574.doc Effective Mm/dd/yy Page 1 of 28 Rev 1Dokument28 SeitenOracle General Ledger Process 315817574.doc Effective Mm/dd/yy Page 1 of 28 Rev 1kashinath09Noch keine Bewertungen

- Rockefeller File, TheDokument150 SeitenRockefeller File, TheElFinDelFinNoch keine Bewertungen

- Encasa BrochureDokument12 SeitenEncasa Brochuremanoj_dalalNoch keine Bewertungen

- Segmentation PDFDokument24 SeitenSegmentation PDFRiya SachanNoch keine Bewertungen

- Summer Internship Programme 2018-19: National Aluminum Company Limited NalcoDokument59 SeitenSummer Internship Programme 2018-19: National Aluminum Company Limited Nalcoanon_849519161Noch keine Bewertungen

- Deed PropertyDokument8 SeitenDeed PropertyUtkarsa GuptaNoch keine Bewertungen