Beruflich Dokumente

Kultur Dokumente

Gifted Interest and The Art of Banking

Hochgeladen von

Todd PratherOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Gifted Interest and The Art of Banking

Hochgeladen von

Todd PratherCopyright:

Verfügbare Formate

Honorable Exchange, Gifted Interest and the Art of Banking The following definitions given come from Black's

8th Dictionary. Along with the discussion herein, they are an attempt to show a pedantic construction of the meanings and types of 'money' and the substance thereof. It is shown that interest in a claim is, ultimately, the only money. And that honor is the only form payment. The importance of distinguishing between the form and trans-form-ation of the type of interest held is also discussed. The value of interest held in a liability versus the value held in an asset are of particular focus. The authors claim no authority in the matter other than the understanding of the definitions as given and otherwise common understanding of the terms used. Not all definitions are complete as given. fund. v. 1. To furnish money to (an individual, entity, or venture), esp. to finance a particular project. 2. To use resources in a manner that produces interest. 3. To convert (a debt, esp. an open account ) into a long-term debt that bears interest at a fixed rate. This definition of fund shows that using resources to create interest is the same as furnishing money. Money, defined in full below, is defined reciprocally as funds. fund, n. 1. A sum of money or other liquid assets established for a specific purpose <a fund reserved for unanticipated expenses>. 2. (usu. pl.) Money or other assets, such as stocks, bonds, or working capital, available to pay debts, expenses, and the like <Sue invested her funds in her sister's business> money. 1. The medium of exchange authorized or adopted by a government as part of its currency; esp. domestic currency <coins and currency are money>. UCC 1-201(b)(24). 2. Assets that can be easily converted to cash <demand deposits are money>. 3. Capital that is invested or traded as a commodity <the money market>. 4. (pl.) Funds; sums of money medium of exchange. Anything generally accepted as payment in a transaction and recognized as a standard of value <money is a medium of exchange>. currency. An item (such as a coin, government note, or banknote) that circulates as a medium of exchange. capital, n. 1. Money or assets invested, or available for investment, in a business. 2. The total assets of a business, esp. those that help generate profits. 3. The total amount or value of a corporation's stock; corporate equity. asset. 1. An item that is owned and has value. 2. (pl.) The entries on a balance sheet showing the items of property owned, including cash, inventory, equipment, real estate, accounts receivable, and goodwill. 3. (pl.) All the property of a person (esp. a bankrupt or deceased person) available for paying debts or for distribution. item. 1. A piece of a whole, not necessarily separated. 2. Commercial law. A negotiable instrument or a promise or order to pay money handled by a bank for collection or payment. The term does not include a payment order governed by division 11 of the UCC or a credit- or debitcard slip.

substance. 1. The essence of something; the essential quality of something, as opposed to its mere form <matter of substance>. Within the Federal Reserve System (Fed), consider what is the substance of funds where only interest or title therein can be held and redemption (i.e. gold, silver, goods, services) is not an option. That is, the Fed or Treasury cannot, by House Joint Resolution 192 of 1933, redeem money for gold, silver, goods or services. Goods or services being a 'particular type of currency' of the Treasury in this instance. All that is left is an interest holder's ability to perform in honor or dishonor. The substance is the ability to per-form, which is defined as the successful completion of a contractual duty. So, it can be said in the case of modern money mechanics that the only substance behind the value of money is honor. The acts and actions of the type of people using the Fed money is then what dictates it's value. So, any person with any citizenship has the choice to be either a creditor or debtor to the US government by his tendencies toward honorable or dishonorable behavior. honor, vb. 1. To accept or pay (a negotiable instrument) when presented. 2. To recognize, salute, or praise. Recognition is acceptance. Honor is recognition. Recognition is payment. recognition, n. 1. Confirmation that an act done by another person was authorized. See RATIFICATION. 2. The formal admission that a person, entity, or thing has a particular status; esp. a nation's act in formally acknowledging the existence of another nation or national government. 4. Tax. The act or an instance of accounting for a taxpayer's realized gain or loss for the purpose of income-tax reporting. 6. Int'l law. Official action by a country acknowledging, expressly or by implication, de jure or de facto, the existence of a government or a country, or a situation such as a change of territorial sovereignty. The simple act and form of honoring, then, affects the trans-form-ation of a person from debtor to creditor; of an item from payable to collectible. Honor is payment. Acknowledgment is payment. Authorization is payment. payment. 1. Performance of an obligation by the delivery of money or some other valuable thing accepted in partial or full discharge of the obligation. 2. The money or other valuable thing so delivered in satisfaction of an obligation. What is valuable? valuable, adj. Worth a good price; having financial or market value. price. The amount of money or other consideration asked for or given in exchange for something else; the cost at which something is bought or sold. other consideration. Additional things of value to be provided under the terms of a contract, usu. unspecified in the contract, deed, or bill of sale, because they are too numerous to conveniently list, or to avoid public knowledge of the total amount of consideration. -- Also termed other good and valuable consideration. Acceptance is payment.

acceptance, n. 1. An offeree's assent, either by express act or by implication from conduct, to the terms of an offer in a manner authorized or requested by the offeror, so that a binding contract is formed. If an acceptance modifies the terms or adds new ones, it generally operates as a counteroffer. 3. The formal receipt of and agreement to pay a negotiable instrument. 4. A negotiable instrument, esp. a bill of exchange, that has been accepted for payment. assent, n. Agreement, approval, or permission; esp., verbal or nonverbal conduct reasonably interpreted as willingness. See CONSENT. -- assent, vb. The above definitions suggest that a counteroffer or conditional acceptance is also payment. Of course, this is an honorable act. The honorable actor: creditor. 1. One to whom a debt is owed; one who gives credit for money or goods. -- Also termed debtee. 2. A person or entity with a definite claim against another, esp. a claim that is capable of adjustment and liquidation. 3. Bankruptcy. A person or entity having a claim against the debtor predating the order for relief concerning the debtor. [Cases: Bankruptcy 2822. C.J.S. Bankruptcy 239, 241.] 4. Roman law. One to whom any obligation is owed, whether contractual or otherwise. Cf. DEBTOR. deposit, n. 1. The act of giving money or other property to another who promises to preserve it or to use it and return it in kind; esp., the act of placing money in a bank for safety and convenience. 2. The money or property so given. A depositor is exchanging his private asset in the form of a paper security, like checks and cash, for a like amount of interest in a legal obligation of his bank. Like arcade tokens, (dollars), the obligation is redeemable anywhere within the arcade (US jurisdiction). One's access to exchange private securities (checks and other drafts) for Fed tokens, or deposit, to the Fed is ultimately derived from the birth (berth) certificate issued by the US government as evidence of a cooperative partnership in the ventures of the nation. An invested shareholder of the US corporate venture, as represented by a citizen. A citizen being an artificial construct of government, like a corporation, to attach real people to various public obligations in exchange for privileges and benefits. token, n. 1. A sign or mark; a tangible evidence of the existence of a fact. 2. A sign or indication of an intention to do something, as when a buyer places a small order with a vendor to show good faith with a view toward later placing a larger order. 3. A coin or other legal tender. Although token most commonly refers to a piece of metal, the term may also denote a bill or other medium of exchange. Consider a man with a citizen-bond (birth certificate); a security interest in the US company, as an underwriter to the US company. His full faith and credit in the venture is expressed by his participation as a labor contributing partner therein, like sweatequity. As an investor or shareholder or creditor to the company, it's his prerogative to deduct the value of benefits, goods and services he received from his company from the interest amount he holds therein. Accepting this deduction from his shareholder expense account then decreases his company's liabilities. (Great! One less token for the company to redeem!) Accepting this value of the debt he owes for what he got from his US company can be

viewed as an act of refunding to his own company treasury. A withdrawal entry is made in his expense account with the company and a corresponding receivable of the company is marked paid. Zeros! Paid in full. It would continue to be in a shareholders best interest to return any tokens he has received from his company since holding tokens ultimately amounts to a debt to himself. For example, if this shareholder is paid by the company in company tokens then he would want to redeem the tokens for interest held in the company since the value of the tokens only exist within the company and have various restrictions (taxes) on their use therein. So, deposits with the Fed are liabilities of the Fed. When accepted for their value by a creditor to the Fed they are effectively replaced with non-taxable book entries since the tokens have effectively been returned to the Treasury. refund: 3. The act of refinancing, esp. by replacing outstanding securities with a new issue of securities. -- refund, vb. Conversely, the IRS issues a 'refund' by the issue of a Treasury security, or check, which is replacing the asset funds that are created by the tax paid out in liability funds. For example, taxes are deducted in Fed Notes from a paycheck and ultimately held on account at the Treasury as assets of the taxpayer as a creditor of the Treasury until a tax is assessed by him. Once the tax is asse(t)ssed then the difference in the pre-paid tax is 'refunded' by a Treasury liability/check, effectively replacing outstanding securities, (assets on account with Treasury), with a new issue of securities, (a Treasury check/liability). The act of accepting all Fed monies for value to charge back to the Treasury is a refund to Treasury for the interest held in those liability funds (dollars). All interest held in Fed Notes (a.k.a. dollars) is taxable since Fed Notes are a regulated privilege of the Treasury. Deposits can be accepted for value by a setoff from a taxpayer's social security trust acct. Inversely, the liability acct within the Fed is charged and held open by the social security asset acct which can also facilitate the acceptance and refund. Acceptance via the social security asset account effectively discharges the Fed funds' taxability meaning the balance held in the Fed account is effectively taxed and therefor discharged from any liability. So, securities (checks) issued from these non-taxable funds are all 'original issue'. Original issues can be reacquired then returned as security assets (govt bonds) by the re-venuing service to a TDA as directed via tax return affidavit. Deposits in liability accts might be reported abandoned since the endorsed check (asset) is traded for interest in liability funds or debt, effectively converting a positive value into a negative value. But can they be accepted for value and abandoned? Perhaps it's accepted for the positive asset value and abandoning the negative liability value? Original issue could then only be of asset securities that come into existence as an enforceable claim or right since interest in the asset funds is transferred by issuing securities against them like checks and authorized withdrawals. Interest in goods & services is traded for interest in these now asset funded securities that are almost always converted back into debt by endorsement and deposit by the recipient. The positive value of the asset is effectively abandoned by the act of endorsement and deposit into a bank in trade for interest in taxable liability funds. The issuer is then obliged to reacquire his gifted interest in the asset once the recipient signifies his satisfaction by endorsement of the security to affect release of, or cancel his title/interest as holder in due course. The recipient depositors bank returns the cancelled security to the issuing bank and title thereto is effectively transferred back and available for acquisition by the issuing account holder (banker) or otherwise assumed by the bank

itself after a 3 year testing period where no acquisition has been made. liability, n. 1. The quality or state of being legally obligated or accountable; legal responsibility to another or to society, enforceable by civil remedy or criminal punishment <liability for injuries caused by negligence>. -- Also termed legal liability; responsibility; subjection. 2. (often pl.) A financial or pecuniary obligation; DEBT <tax liability> <assets and liabilities>. "The term 'liability' is one of at least double signification. In one sense it is the synonym of duty, the correlative of right; in this sense it is the opposite of privilege or liberty. If a duty rests upon a party, society is now commanding performance by him and threatening penalties. In a second sense, the term 'liability' is the correlative of power and the opposite of immunity. In this case society is not yet commanding performance, but it will so command if the possessor of the power does some operative act. If one has a power, the other has a liability. It would be wise to adopt the second sense exclusively. Accurate legal thinking is difficult when the fundamental terms have shifting senses." William R. Anson, Principles of the Law of Contract 9 (Arthur L. Corbin ed., 3d Am. ed. 1919). debt. 1. Liability on a claim; a specific sum of money due by agreement or otherwise <the debt amounted to $2,500>. 2. The aggregate of all existing claims against a person, entity, or state <the bank denied the loan application after analyzing the applicant's outstanding debt>. 3. A nonmonetary thing that one person owes another, such as goods or services <her debt was to supply him with 20 international first-class tickets on the airline of his choice>. 4. A common-law writ by which a court adjudicates claims involving fixed sums of money <he brought suit in debt>. -- Also termed (in sense 4) writ of debt. immunity. 1. Any exemption from a duty, liability, or service of process; esp., such an exemption granted to a public official. (Perhaps synonymous with 'creditor?) bank, vb. 1. To keep money at <he banks at the downtown branch>. 2. To deposit (funds) in a bank <she banked the prize money yesterday>. 3. Slang. To loan money to facilitate (a transaction) <who banked the deal?>. The lender's consideration usu. consists of a fee or an interest in the property involved in the transaction. Am I a bank? Yes, I am issuing securities for deposit; a depositor. bank. n. 1. A financial establishment for the deposit, loan, exchange, or issue of money and for the transmission of funds; esp., a member of the Federal Reserve System. Under securities law, a bank includes any banking institution, whether or not incorporated, doing business under federal or state law, if a substantial portion of the institution's business consists of receiving deposits or exercising fiduciary powers similar to those permitted to national banks and if the institution is supervised and examined by a state or federal banking authority; or a receiver, conservator, or other liquidating agent of any of the above institutions.

national bank. A bank incorporated under federal law and governed by a charter approved by the Comptroller of the Currency. A national bank is permitted to use the abbreviation N.A. (national association) as part of its name. financial institution. A business, organization, or other entity that manages money, credit, or capital, such as a bank, credit union, savings-and-loan association, securities broker or dealer, pawnbroker, or investment company. entity. An organization (such as a business or a governmental unit) that has a legal identity apart from its members. identity. 2. Evidence. The authenticity of a person or thing. organization. 1. A body of persons (such as a union or corporation) formed for a common purpose. body. 3. An artificial person created by a legal authority. See CORPORATION. banker. A person who engages in the business of banking. banking. The business carried on by or with a bank. (the act of depositing -Tp) investment. 1. An expenditure to acquire property or assets to produce revenue; a capital outlay. 2. The asset acquired or the sum invested. expenditure. 1. The act or process of paying out; disbursement. 2. A sum paid out.

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Republic of The Philippines: Liezel Dannud, PlaintiffDokument56 SeitenRepublic of The Philippines: Liezel Dannud, PlaintiffAmboy Villanueva SilvaNoch keine Bewertungen

- List of Forms of Government - RationalWikiDokument3 SeitenList of Forms of Government - RationalWikiprosenNoch keine Bewertungen

- Practicum V Portfolio: Legal InternDokument10 SeitenPracticum V Portfolio: Legal InternJannina Pinson RanceNoch keine Bewertungen

- Uy V Ca - 314 Scra 69Dokument11 SeitenUy V Ca - 314 Scra 69Krista YntigNoch keine Bewertungen

- Sample EO For LYDODokument2 SeitenSample EO For LYDOgulp_burpNoch keine Bewertungen

- People Vs Tangan GR No. 103613 - Mitigating CircumstanceDokument7 SeitenPeople Vs Tangan GR No. 103613 - Mitigating CircumstanceLourd CellNoch keine Bewertungen

- B. Institution of HeirsDokument4 SeitenB. Institution of HeirsHannah PlopinioNoch keine Bewertungen

- Zuellig Pharma Corp V Alice Sibal Et. AlDokument4 SeitenZuellig Pharma Corp V Alice Sibal Et. AlFrank Gernale GolpoNoch keine Bewertungen

- Maneka Gandhi CasenoteDokument5 SeitenManeka Gandhi Casenotesorti nortiNoch keine Bewertungen

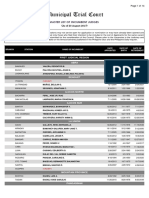

- MTCDokument14 SeitenMTCciryajamNoch keine Bewertungen

- Iloilo City Regulation Ordinance 2006-020Dokument5 SeitenIloilo City Regulation Ordinance 2006-020Iloilo City Council100% (1)

- CIR Vs Liquigaz - Case DigestDokument2 SeitenCIR Vs Liquigaz - Case DigestKaren Mae ServanNoch keine Bewertungen

- ComplaintDokument17 SeitenComplaintMichaelPatrickMcSweeney100% (1)

- Rough DraftDokument5 SeitenRough Draftapi-242353543Noch keine Bewertungen

- GR No. 3962 US V. LING SU FANDokument14 SeitenGR No. 3962 US V. LING SU FANClaire SalcedaNoch keine Bewertungen

- Kyc - AmlaDokument15 SeitenKyc - AmlaBay Ariel Sto TomasNoch keine Bewertungen

- Writ of Kalikasan - AgcaoiliDokument15 SeitenWrit of Kalikasan - Agcaoilimabandes dironNoch keine Bewertungen

- Notification Slip For Pre-Arrival Registration For Indian NationalsDokument1 SeiteNotification Slip For Pre-Arrival Registration For Indian NationalsAmit VermaNoch keine Bewertungen

- Interim Report of Raju Ramachandran On Gujarat RiotsDokument13 SeitenInterim Report of Raju Ramachandran On Gujarat RiotsCanary TrapNoch keine Bewertungen

- Duty of Care of SchoolsDokument12 SeitenDuty of Care of SchoolsDonn Tantuan100% (1)

- Aff of Undertaking Floor PlanDokument2 SeitenAff of Undertaking Floor PlanTet LegaspiNoch keine Bewertungen

- Executive Order No. 180: CoverageDokument3 SeitenExecutive Order No. 180: CoverageJesh RadazaNoch keine Bewertungen

- de Castro vs. EcharriDokument3 Seitende Castro vs. EcharriLance Christian ZoletaNoch keine Bewertungen

- Criminal Procedure Rule 110 113Dokument41 SeitenCriminal Procedure Rule 110 113mrgry sbndlNoch keine Bewertungen

- RAFAEL H. GALVEZ Et Al. Vs CADokument2 SeitenRAFAEL H. GALVEZ Et Al. Vs CAAnsai CaluganNoch keine Bewertungen

- All You Need To Know About Domestic Violence ActDokument6 SeitenAll You Need To Know About Domestic Violence ActGopi JampaniNoch keine Bewertungen

- Shelvi COnfirm Partner Visa Subclass 820 Grant NotificationDokument3 SeitenShelvi COnfirm Partner Visa Subclass 820 Grant NotificationShelvi Su'aNoch keine Bewertungen

- Islamic Will Template (ISNA)Dokument11 SeitenIslamic Will Template (ISNA)chkamiNoch keine Bewertungen

- Augmentis Recruiting Services Agreement v2Dokument4 SeitenAugmentis Recruiting Services Agreement v2Noriega LaneeNoch keine Bewertungen

- Chapter 9 - Documentary Evidence: 9.1 Primary and Secondary EvidenceDokument49 SeitenChapter 9 - Documentary Evidence: 9.1 Primary and Secondary EvidenceAnis FirdausNoch keine Bewertungen