Beruflich Dokumente

Kultur Dokumente

2011AT&T T Mobile Merger Report

Hochgeladen von

dreadnought111Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2011AT&T T Mobile Merger Report

Hochgeladen von

dreadnought111Copyright:

Verfügbare Formate

August 2011

AT&T/T-Mobile Merger: More Market Concentration, Less Choice, Higher Prices

by Gigi Wang, Chief Research Officer, gwang@yankeegroup.com and Carl Howe, Director, chowe@yankeegroup.com

The Bottom Line

From a spectrum perspective, the merger of AT&T and T-Mobile appears to expand network coverage and improve performance for AT&T customers. From a market perspective, Yankee Group believes the merger will increase market concentration, reduce consumer choice, and open the door for price increases in the most heavily populated U.S. wireless markets.

Todays US Wireless Market: Verizon, AT&T and Everyone Else

Will the merger of AT&T and T-Mobile be good for mobile users? At the time the merger was announced, Yankee Group thought the combined spectrum made possible by such a merger could bring better coverage and higher performance to customers (see the March 2011 Yankee Group Report AT&T/T-Mobile to Verizon: Can You Hear ME Now?). However, while a single company with combined spectrum promises better coverage, that technical solution ignores the market effects created by such a merger. This report is intended to raise our concern about the potential market and competitive implications of this merger on the U.S. wireless marketplace. Since the March announcement, Yankee Group has analyzed its wireless industry and consumer data to understand the effects such a merger would have on the U.S. market, consumers and businesses. These results dash cold water on the mergers promise of benefiting consumers and competition; instead, we see this merger resulting in less choice and higher prices for T-Mobiles consumer and business customers. According to Yankee Groups North America Mobile Carrier Monitor, June 2011, AT&T and Verizon each reported having almost a third of all U.S. subscribers at the end of March 2011 (see Exhibit 1). AT&T reported having 97.5 million or nearly 32 percent, while Verizon reported 95 million or just over 31 percent. Other mobile operators, including Sprint (about 51 million subscribers), T-Mobile (33.6 million) and other smaller carriers, offer alternative wireless services that serve 105.4 million, or roughly the other third of the U.S. 298 million subscribers. This market share picture at the national level appears to provide consumers with a wealth of choices.

But Market Share in Local Markets Varies Significantly

However, what Exhibit 1 ignores is the local competitive landscape. When the U.S. FCC created the licensing rules for the cellular market in 1982, it divided the U.S. into 734 cellular market areas (CMAs) to ensure no one carrier dominated in each of those local markets. Yankee Group analyzed more than 15,000 responses from its US Consumer Survey - Wave 1-12, 2010 to understand how those market shares changed at the local level. Exhibit 1: Wireless Service Provider Market Share in the Top U.S. Cellular Market Areas

Source: Yankee Groups North America Mobile Carrier Monitor, June 2011

1.9% 2.5% 2.9% 2%

11%

31.9% 31.1%

16.7%

AT&T Verizon Sprint T-Mobile U.S. Cellular Leap/Cricket MetroPCS Other

Note: Data includes Q1 2011 reports from all U.S. mobile operators.

Copyright 2011. Yankee Group Research, Inc. All rights reserved.

AT&T/ T-Mobile Merger: More Market Concentration, Less Choice, Higher Prices

Exhibit 2 shows the results of that analysis for 27 of the most populous CMAs. Today, AT&T has 33 percent or more of the subscribers in nine of those CMAs. The proposed merger would give AT&T more than 33 percent of the market in 20 of those 27 markets. In fact, the merger with T-Mobile would give AT&T a full 50 percent market share or more in five of the most populous CMAs.

Department of Justice Metrics Imply This Merger Would Concentrate Market Power

Market share numbers dont provide the complete picture of how concentrated a market is. The U.S. Department of Justice (DoJ) uses a more sophisticated metric, the Herfindahl-Hirschman Index (HHI), to assess market concentration. (Details on calculating and interpreting the HHI are available in the DOJs 2010 guidelines for mergers, which can be found at http://www.justice.gov/atr/public/guidelines/hmg-2010.html).

Exhibit 2: AT&T/T-Mobile Merger Would Give AT&T More Than a 50 Percent Share in Five Major Markets

Source: Yankee Groups US Consumer Survey - Wave 1-12, 2010

Market Shares Before Merger

35% 21% 22% 33% 17% 40% 21% 19% 14% 32% 19% 22% 32% 39% 37% 15% 43% 24% 32% 26% 21% 25% 36% 44% 29% 40% 14%

Market Shares After Merger

Atlanta (n=166) Baltimore (n=188) Boston (n=234) Chicago (n=424) Cleveland (n=124) Dallas (n=168) Denver - Boulder (n=127) Detroit (n=236) Gila County, Arizona (n=139) Houston (n=209) Kansas City (n=114) Kent County, Maryland (n=103) Los Angeles (n=833) Miami (n=233) Milwaukee (n=103) Minneapolis (n=131) Navarro County, Texas (n=209) New York (n=876) Orlando (n=126) Philadelphia (n=290) Portland (n=123) San Antonio (n=100) San Diego (n=155) San Francisco (n=203) Seattle (n=146) St. Louis (n=124) Tampa (n=118)

28% 32% 46% 38% 46% 39% 35% 39% 43% 52% 49% 50% 25% 45% 53% 41% 25% 27% 50% 43% 24% 54% 40% 26% 35% 47% 46%

Cellular Market Area (CMA)

20

40

60

80

20

40

60

80

Percent Cellular Market Share

Note: Includes CMAs in which the number of survey respondents is greater than 100.

Carrier

Percent Cellular Market Share

AT&T Leap/Cricket

MetroPCS Other

Sprint T-Mobile

U.S. Cellular Verizon

Copyright 2011. Yankee Group Research, Inc. All rights reserved.

August 2011

Those guidelines identify numeric HHI breakpoints for analyzing mergers: Post-merger HHI below 1,500. The DoJ regards markets in this category to be unconcentrated. Mergers resulting in unconcentrated markets are unlikely to have adverse competitive effects and ordinarily require no further analysis. Post-merger HHI between 1,500 and 2,500. The agency regards markets in this category to be moderately concentrated. Mergers producing an increase in the HHI of more than 100 points in moderately concentrated markets post-merger potentially raise significant competitive concerns depending on the factors set forth in Sections 2-5 of the guidelines. Exhibit 3: AT&T/T-Mobile Merger Results in the Number of Highly Concentrated Top 27 CMAs Growing From 1 to 17

Source: DoJ HHI 2010 Guidelines and Yankee Groups US Consumer Survey - Wave 1-12, 2010

Post-merger HHI above 2,500. The agency regards markets in this category to be highly concentrated. Where the postmerger HHI exceeds 1,800, it presumes that mergers producing an increase in the HHI of more than 200 points are likely to create or enhance market power or facilitate its exercise. Using data from our 2010 US Consumer Survey, we computed HHIs for the same largest CMAs listed in Exhibit 2. We find that before the AT&T/T-Mobile merger, only one of the top 27 CMAs is highly concentrated. If the merger proceeds, however, 17or 63 percentof the top 27 markets would be considered highly concentrated (see Exhibit 3).

Pre-Merger HHI

1,983 2,186 2,241 1,770 2,493 2,343 1,571 1,795 1,815 1,900 1,692 2,403 2,096 2,147 2,165 1,649 2,461 1,991 1,774 2,042 1,791 1,718 2,478 2,631 2,100 2,263 1,920

Post-Merger HHI

Atlanta (n=166) Baltimore (n=188) Boston (n=234) Chicago (n=424) Cleveland (n=124) Dallas (n=168) Denver - Boulder (n=127) Detroit (n=236) Gila County, Arizona (n=139) Houston (n=209) Kansas City (n=114) Kent County, Maryland (n=103) Los Angeles (n=833) Miami (n=233) Milwaukee (n=103) Minneapolis (n=131) Navarro County, Texas (n=209) New York (n=876) Orlando (n=126) Philadelphia (n=290) Portland (n=123) San Antonio (n=100) San Diego (n=155) San Francisco (n=203) Seattle (n=146) St. Louis (n=124) Tampa (n=118)

2,310 2,162 2,698 2,657 2,681 2,702 2,375 2,418 2,991 3,322 3,270 3,091 2,375 2,047 2,167 3,079 2,606 2,536 2,911 3,231 2,452 2,783 2,367 2,791 2,698 2,738 3,436

Cellular Market Area (CMA)

0

Note: Includes CMAs in which the number of survey respondents is greater than 100.

1,000

2,000

3,000

0

Concentration Level Highly Concentrated

1,000

2,000

3,000

HerfindahlHerschman Index (HHI) of Market Concentration

Moderately Concentrated

HerfindahlHerschman Index (HHI) of Market Concentration

Copyright 2011. Yankee Group Research, Inc. All rights reserved.

AT&T/ T-Mobile Merger: More Market Concentration, Less Choice, Higher Prices

The shift in market concentration among the top CMAs is striking. Not only would 17 of the top 27 CMAs become highly concentrated, but the HHIs would jump dramatically. The DoJs 2010 guidelines state that any HHI increase of 200 points or more is considered significant. In our analysis, not only did 25 of the 27 CMAs see HHI increases over 200, but four of the CMAs had HHI increases of over 1,000 (see Exhibit 4). There is no question the merger would result in significantly more concentrated markets.

Market Concentration Leads to Reduced Price Competition, Higher Prices Over Time

In these more concentrated markets, consumers and businesses will have fewer choices for wireless carriers. This in turn reduces price competition among wireless carriers, which over time leaves every consumer in these markets with higher prices. This basic dynamic is present in other markets, such as the airlines, where cities served by multiple national carriers offer lower fares than cities served by a single national carrier.

Exhibit 4: Post-Merger Market Concentration Increases Markedly in Top 27 CMAs

Source: DoJ HHI 2010 Guidelines and Yankee Groups US Consumer Survey - Wave 1-12, 2010

Atlanta (n=166) Baltimore (n=188) Boston (n=234) Chicago (n=424) Cleveland (n=124) Dallas (n=168) Denver - Boulder (n=127) Detroit (n=236) Gila County, Arizona (n=139)

252 352 245 181

800 550 928 1,093 804

Cellular Market Area (CMA)

Houston (n=209) Kansas City (n=114) Kent County, Maryland (n=103) Los Angeles (n=833) Miami (n=233) Milwaukee (n=103) Minneapolis (n=131) Navarro County, Texas (n=209) New York (n=876) Orlando (n=126) Philadelphia (n=290) Portland (n=123) San Antonio (n=100) San Diego (n=155) San Francisco (n=203) Seattle (n=146) St. Louis (n=124) Tampa (n=118)

237 584 700 513 691 287 513 390 666 133

1,179 914 815 1,084

907 660

1,170 828

0

Note: Includes CMAs in which the number of survey respondents is greater than 100.

1,000

2,000

3,000

Difference in Pre- and Post-Merger HHI

Copyright 2011. Yankee Group Research, Inc. All rights reserved.

August 2011

The open question is what effect this market concentration will have on wireless service prices for consumers and businesses. To understand the consumer impact, we return to Yankee Groups 2010 US Consumer Survey to examine the prices consumers say they pay for mobile phone service. These are not unit prices, nor are they actual customer bills. While we know these prices provided by consumers are not completely accurate compared with actual carrier bills, we dont believe the errors in consumer responses differ significantly from carrier to carrier. Therefore, we believe these consumer-reported mobile prices can provide us with some guidance of how prices may change, even if the absolute prices arent completely accurate. The first step in our calculation is to estimate how much of the T-Mobile subscriber base is made up of current T-Mobile customers versus new customers (consumers moving from another carrier to AT&T/T-Mobile). This distinction is important, as AT&T has publicly stated that it will allow these existing customers to keep their lower T-Mobile rates. In our analysis, we applied T-Mobiles published churn rate to determine the mix of existing customers who will be grandfathered in with current T-Mobile pricing and new customers who switch to AT&T/T-Mobile from other carriers. Exhibit 5 shows that over half of T-Mobiles existing subscriber base will churn in the next three years.

Although it is not possible to know what pricing AT&T will offer T-Mobile subscribers if the merger takes place, it can reasonably be assumed that pricing for T-Mobiles 33.6 million subscribers will approach the higher rates paid by AT&Ts existing 97.5 million customers over time. Based on a January 2012 completion date for the merger, T-Mobiles nearly 34 million subscribers will decline to fewer than 10 million by January 2015. We believe that new customers acquired by the merged AT&T/T-Mobile after January 2012 will be paying AT&T rates. To estimate the pricing effect this changing mix of old and new subscribers would have, we applied these churn figures to nine of the largest CMAs and estimated how the migration of subscribers to AT&T rate plans would change prices in January 2015 (see Exhibit 6 on the next page). Assuming that both AT&Ts and T-Mobiles average payments stayed constant over the intervening three years, we find that: Two CMAs would see small declines in prices. Consumers in Chicago and Denver/Boulder today spend less with AT&T on average than consumers who subscribe to T-Mobile. As a result, when T-Mobile subscribers begin paying AT&T average prices, the overall bill average in these two markets declines slightly. Other large markets would see increases. Customers in Boston, Dallas, Los Angeles, Miami and New York would see mean increases in mobile phone bills of less than $5 a month. Customers in Houston and Seattle would see increases of more than $5.

Exhibit 5: T-Mobiles 34 Million Subscribers Will Decline to Fewer Than 10 Million by 2015

Source: Yankee Group estimates based on T-Mobile published churn rate, August 2011

100%

T-Mobile Customers Switching to Other Plans

75%

Exhibit 5: T-Mobile Subscriber Base: New Customers Move to AT&T/T-Mobile as Old Customers Churn Away

Source: Yankee Group estimates based on T-Mobile published churn rate, August 2011

50%

T-Mobile Customers Paying Pre-Merger Rates

25%

0%

2012

2013

2014

2015

Copyright 2011. Yankee Group Research, Inc. All rights reserved.

AT&T/ T-Mobile Merger: More Market Concentration, Less Choice, Higher Prices

Exhibit 6: Chicago and Denver Would See Average Bills Decline PostMerger, While Seven Other CMAs Would See Increases

Source: Yankee Groups US Consumer Survey - Wave 1-12, 2010

Boston (n=234)

Chicago (n=424)

Dallas (n=168)

Degree of Bill Change Decrease

Cellular Market Area (CMA)

Denver - Boulder (n=127)

Less Than $5 More Than $5

Houston (n=209)

Los Angeles (n=833)

Miami (n=233)

New York (n=876)

Seattle (n=146)

Mean Mobile Bill Increase

Note: Includes CMAs in which the number of survey respondents is greater than 100.

Summary

In summary, Yankee Group believes that while the combined spectrum of the proposed merger should bring better coverage and performance to customers, we are concerned about the mergers effect on consumer pricing. Our analysis shows the AT&T/T-Mobile merger would solidify AT&Ts leading market position in a majority of CMAs. We believe this market concentration by a company already serving a third of U.S. wireless subscribers will reduce choice for consumers and, more importantly, leave little incentive for AT&T to offer competitive pricing for unbundled mobile services. And while our analysis is based on consumer data, we do not expect its effects to be limited to consumers; businesses would also see more concentrated markets and likely higher prices.

Conclusions and Recommendations

The proposed AT&T/T-Mobile merger comes only three years after Verizons 2008 acquisition of Alltel, and it is only the latest in a long series of consolidating moves in the U.S. wireless market. We do not believe it will be the last. Once this merger goes through and AT&T serves 132 million subscribers, its only a matter of time before Verizon purchases Sprint and adds Sprints 51 million subscribers to its 95 million, thereby creating a national duopoly. Yankee Group believes reducing competition in the most heavily populated markets will extend duopolystyle pricing to the national level, resulting in less choice for consumers and limiting competition.

Copyright 2011. Yankee Group Research, Inc. All rights reserved.

August 2011

Yankee Group believes the merger of AT&T and T-Mobile will have a negative impact on consumers and competition in the U.S. wireless marketplace. To counteract this negative impact, and to increase competition in moderately and highly concentrated markets, we recommend the FCC not allow this merger to proceed unless it is also prepared to maintain a stronger regulatory stance to avoid domination by the two largest carriers. Such a stance might include actions such as: Thinking creatively about divesture remedies. Regulators typically require merging companies to divest properties to conform with anti-trust regulations. However, remedying the market concentration caused by the AT&T/TMobile merger wont be easy because no other national GSM networks exist and few regional GSM service providers are big enough to serve the divested AT&T/T-Mobile subscribers. To reintroduce competition in highly concentrated markets such as Dallas, Miami and Seattle, the DoJ and FCC may have to consider creating a new mobile service provider from smaller competitors or requiring the merged companies to cede a portion of their customers to a mobile virtual network operator (MVNO) such as TracFone or Tru operating on their network. Enforcing mandatory, reasonable data roaming rates to facilitate competition. National carriers must offer reasonable roaming rates for voice calls. Similar requirements for reasonable roaming rates for data went into effect in June 2011 (see FCC document WT Docket No. 05-265), and both Verizon and AT&T are protesting the decision. If those dominant carriers are not required to provide reasonable data roaming

services, customers of regional carriers such as U.S. Cellular (CDMA) and Cincinnati Bell (GSM), both in Ohio, have no access to data when they are outside their regional networks. With data-hungry smartphones making up the majority of new phone purchases and national network carriers reluctant to provide access to their networks, the FCC must ensure that smaller regional carriers can compete in concentrated markets by enforcing these mandatory reasonable data roaming fees, just as it did with voice roaming. Regulating unbundled wireless tariffs. Both Verizon and AT&T have land-line telephony, pay TV and broadband Internet businesses that are struggling to grow, while wireless subscriptions are booming. In highly concentrated markets, its likely these duopoly carriers will try to extend their market power to those lower growth offerings by making unbundled wireless much less attractive than bundles that pile on these other services. The FCC should regulate the maximum rate carriers can charge for unbundled wireless services; otherwise, the duopoly holders can easily extend their market concentration in wireless to broadband Internet and pay TV.

Copyright 2011. Yankee Group Research, Inc. All rights reserved.

Yankee Groupthe global connectivity experts

The people of Yankee Group are the global connectivity expertsthe leading source of insight and counsel trusted by builders, operators and drivers of connectivity solutions for 40 years. We are uniquely focused on the evolution of Anywhere, and chart the pace of technology change and its effect on networks, consumers and enterprises. For more information, visit http://www.yankeegroup.com

Gigi Wang, Chief Research Officer

As Chief Research Officer, Gigi Wang leads Yankee Groups team of analysts in defining the overall direction of research content for the firm. Wang works closely with analysts to track the evolving demands of connected users and the products and services that drive them, and she guides the delivery of data and insights to clients and the broader Yankee Group community.

Carl Howe, Director

Carl Howe is a director for Yankee Groups Consumer Research group. In this role, he examines how the Anywhere Network transforms consumer work, life and play. Carls contributions to Yankee Groups Anywhere vision include reports such as Best of the Anywhere Web 2009, Forecasting the Mobile App Gold Rush and The Anywhere Economy. Carls current research agenda includes research on digital applications and media, mobile Web sites and their evolution, and digital advertising.

ead H

t uar

ers

Copyright 2011. Yankee Group Research, Inc. Yankee Group published this content for the sole use of Yankee Group subscribers. It may not be duplicated, reproduced or retransmitted in whole or in part without the express permission of Yankee Group, One Liberty Square, 7th Floor, Boston, MA 02109. All rights reserved. All opinions and estimates herein constitute our judgment as of this date and are subject to change without notice.

Corporate

One Liberty Square 7th Floor BOSTON, MASSACHUSETTS 617-598-7200 phone 617-598-7400 fax

European

30 Artillery Lane LONDON E17LS UNITED KINGDOM 44-20-7426-1050 phone 44-20-7426-1051 fax

Das könnte Ihnen auch gefallen

- Read Play of Consciousness: A Spiritual Autobiography - Download FileDokument1 SeiteRead Play of Consciousness: A Spiritual Autobiography - Download Fileमयंक पाराशर20% (5)

- THE EVOLUTION OF ANTITRUST IN THE DIGITAL ERA - Vol. TwoVon EverandTHE EVOLUTION OF ANTITRUST IN THE DIGITAL ERA - Vol. TwoNoch keine Bewertungen

- Media Markets and Competition Law: Multinational PerspectivesVon EverandMedia Markets and Competition Law: Multinational PerspectivesBewertung: 3 von 5 Sternen3/5 (1)

- Guppa - Se Ultra300x Servicemanual PDFDokument560 SeitenGuppa - Se Ultra300x Servicemanual PDFPatrik Benjaro100% (1)

- THE EVOLUTION OF ANTITRUST IN THE DIGITAL ERA: Essays on Competition PolicyVon EverandTHE EVOLUTION OF ANTITRUST IN THE DIGITAL ERA: Essays on Competition PolicyNoch keine Bewertungen

- Managing Business Finance AssignmentDokument21 SeitenManaging Business Finance Assignmentjerrygmathew100% (1)

- Sprint Rebuts AT&T and T-Mobile MergerDokument299 SeitenSprint Rebuts AT&T and T-Mobile MergerJonathan Fingas100% (1)

- Marketing Plan ATTDokument17 SeitenMarketing Plan ATTDora Wan100% (1)

- Strapack I-10 Instruction-Parts Manual MBDokument26 SeitenStrapack I-10 Instruction-Parts Manual MBJesus PempengcoNoch keine Bewertungen

- Porter's Five Forces On Us Telecom IndustryDokument5 SeitenPorter's Five Forces On Us Telecom IndustrySagar MallikNoch keine Bewertungen

- Justice 2011b - Suing AT&TDokument3 SeitenJustice 2011b - Suing AT&Tsam_f3rencNoch keine Bewertungen

- ATT T Mobile Benefits To WorkersDokument3 SeitenATT T Mobile Benefits To WorkersSeaLinc2Noch keine Bewertungen

- OligopolyDokument2 SeitenOligopolyjasmine722Noch keine Bewertungen

- AT&T NegotiationDokument29 SeitenAT&T NegotiationEbube Anizor100% (5)

- Econex Researchnote 4Dokument4 SeitenEconex Researchnote 4Sizakele Portia MbeleNoch keine Bewertungen

- Marketing Paper FinalDokument35 SeitenMarketing Paper Finalapi-301743370Noch keine Bewertungen

- MPRA Paper 2517Dokument18 SeitenMPRA Paper 2517Tehrani SanazNoch keine Bewertungen

- Impact of PrivatizationDokument42 SeitenImpact of PrivatizationAlex CurtoisNoch keine Bewertungen

- Telecommunications Final PaperDokument41 SeitenTelecommunications Final PaperJessieHaNoch keine Bewertungen

- Project Report CellularDokument28 SeitenProject Report CellularrhldxmNoch keine Bewertungen

- Regulation in The US Telecommunication Sector and Its Impact On RiskDokument37 SeitenRegulation in The US Telecommunication Sector and Its Impact On RiskCristian Fernando ArNoch keine Bewertungen

- Final Wireless Telecommunications Industry PaperDokument19 SeitenFinal Wireless Telecommunications Industry Papervp_zarateNoch keine Bewertungen

- Global Telecom Update - 2013: Market Research Reports, Inc. +91-8762746600 15192 Coastal Highway, Lewes, DE 19958, USADokument25 SeitenGlobal Telecom Update - 2013: Market Research Reports, Inc. +91-8762746600 15192 Coastal Highway, Lewes, DE 19958, USAfcgertNoch keine Bewertungen

- Impact of Mobile1Dokument25 SeitenImpact of Mobile1Pankaj KotwaniNoch keine Bewertungen

- Forecasting Bussiness DemandDokument12 SeitenForecasting Bussiness DemandzackyzzNoch keine Bewertungen

- 2008 Conceptual TelecomDokument4 Seiten2008 Conceptual Telecomabsekhar797Noch keine Bewertungen

- Direct To Home (DTH) Market in India 2012Dokument1 SeiteDirect To Home (DTH) Market in India 2012pop_pop12121Noch keine Bewertungen

- Before The F C C WASHINGTON, D.C. 20554: Ederal Ommunications OmmissionDokument11 SeitenBefore The F C C WASHINGTON, D.C. 20554: Ederal Ommunications OmmissionCompetitive Enterprise InstituteNoch keine Bewertungen

- M&a Telecom IndustryDokument39 SeitenM&a Telecom IndustryMuhammad AshrafNoch keine Bewertungen

- AT&T Buys T-Mobile USADokument3 SeitenAT&T Buys T-Mobile USAslobodanbuljugicNoch keine Bewertungen

- Telecommunications Etfs: Market Capitalization Capitalization Market ValueDokument4 SeitenTelecommunications Etfs: Market Capitalization Capitalization Market ValueMorning古莫宁Noch keine Bewertungen

- China:: M-Commerce in World's Largest Mobile MarketDokument16 SeitenChina:: M-Commerce in World's Largest Mobile MarketRoman ŠakirovskiNoch keine Bewertungen

- Common Carrier Regulation-The Silent CrisisDokument31 SeitenCommon Carrier Regulation-The Silent CrisisjudymeandyouNoch keine Bewertungen

- EY Metrics Transformation in Telecommunications PDFDokument20 SeitenEY Metrics Transformation in Telecommunications PDFPallavi ReddyNoch keine Bewertungen

- User Satisfaction With Mobile Services in Canada: AbstractDokument21 SeitenUser Satisfaction With Mobile Services in Canada: Abstractsanjay2907Noch keine Bewertungen

- The Evolution of Voip: A Look Into How Voip Has Proliferated Into The Global Dominant Platform It Is TodayDokument48 SeitenThe Evolution of Voip: A Look Into How Voip Has Proliferated Into The Global Dominant Platform It Is TodayBradley SusserNoch keine Bewertungen

- ComTech Telecom SummaryDokument3 SeitenComTech Telecom Summarysommer_ronald5741Noch keine Bewertungen

- Mock CAT - 01.pdfDokument45 SeitenMock CAT - 01.pdfSarvagya GuptaNoch keine Bewertungen

- Power and Utilities M&A: Focus On North AmericaDokument5 SeitenPower and Utilities M&A: Focus On North AmericasenniNoch keine Bewertungen

- The Impact of Privatization On Organizational Information NeedsDokument10 SeitenThe Impact of Privatization On Organizational Information NeedsIrfan KhanNoch keine Bewertungen

- Alternative Paths For The Growth of E-CommerceDokument17 SeitenAlternative Paths For The Growth of E-CommercekarahandevrimNoch keine Bewertungen

- Before The Federal Communications Commission Washington, D.C. 20554Dokument15 SeitenBefore The Federal Communications Commission Washington, D.C. 20554rnclarkeNoch keine Bewertungen

- Economics Analysis Paper Three - 2Dokument12 SeitenEconomics Analysis Paper Three - 2INNOBUNo7Noch keine Bewertungen

- Coaxial Cable Market - North America Industry Analysis, Size, Share, Growth, Trends and Forecast, 2012 - 2018Dokument8 SeitenCoaxial Cable Market - North America Industry Analysis, Size, Share, Growth, Trends and Forecast, 2012 - 2018api-247970851Noch keine Bewertungen

- Mgt232 Video Project SummaryDokument2 SeitenMgt232 Video Project SummaryRahim PirachaNoch keine Bewertungen

- Chapter1 PDFDokument5 SeitenChapter1 PDFDARK SUNNoch keine Bewertungen

- Prce Cap TelecomsDokument16 SeitenPrce Cap TelecomsMario A. CampaNoch keine Bewertungen

- Oligopolistic Nature and Competition in The Telecom SectorDokument9 SeitenOligopolistic Nature and Competition in The Telecom SectorErikaNoch keine Bewertungen

- Asignación Gerencia EstrategicaDokument2 SeitenAsignación Gerencia EstrategicaJoaquin Higuera GaitanNoch keine Bewertungen

- Statement of Chairman Ajit PaiDokument2 SeitenStatement of Chairman Ajit PaisffNoch keine Bewertungen

- Current Telecom Developments October 28 2011Dokument4 SeitenCurrent Telecom Developments October 28 2011Kim HedumNoch keine Bewertungen

- Pricing Issues in TelecommunicationsDokument9 SeitenPricing Issues in TelecommunicationsMoustaphe SyNoch keine Bewertungen

- Analysis of Vodafone Essar IndiaDokument34 SeitenAnalysis of Vodafone Essar IndiaSantosh SamNoch keine Bewertungen

- Chapter-1 (To Industry, Company & Topic)Dokument69 SeitenChapter-1 (To Industry, Company & Topic)pmcmbharat264Noch keine Bewertungen

- Regulating Communication Services in Developing CountriesDokument16 SeitenRegulating Communication Services in Developing CountriesWondale KebedeNoch keine Bewertungen

- AT&T Acquisition of NCR - Lys&VincentDokument26 SeitenAT&T Acquisition of NCR - Lys&VincentAfiq Fozi100% (1)

- Straregic ManagementDokument57 SeitenStraregic ManagementNisha KambleNoch keine Bewertungen

- Telecommunicationsactof 2015Dokument2 SeitenTelecommunicationsactof 2015api-305551792Noch keine Bewertungen

- Can The Telecom Industry Welcome The New Entrants? Ms. Ambika Rathi, Mr. Rajesh VermaDokument8 SeitenCan The Telecom Industry Welcome The New Entrants? Ms. Ambika Rathi, Mr. Rajesh VermaPijush Kanti DolaiNoch keine Bewertungen

- Dewenter Et Al. 2007Dokument10 SeitenDewenter Et Al. 2007Razbir RayhanNoch keine Bewertungen

- Content Page Introduction of TopicDokument47 SeitenContent Page Introduction of TopicMeenu RaniNoch keine Bewertungen

- McKinsey Telecoms. RECALL No. 11, 2010 - Mature MarketsDokument66 SeitenMcKinsey Telecoms. RECALL No. 11, 2010 - Mature MarketskentselveNoch keine Bewertungen

- Module 6B Regression - Modelling PossibilitiesDokument62 SeitenModule 6B Regression - Modelling Possibilitiescarolinelouise.bagsik.acctNoch keine Bewertungen

- TraceDokument318 SeitenTraceJonathan EvilaNoch keine Bewertungen

- Chapter 2 Conceptualized InteractionDokument32 SeitenChapter 2 Conceptualized InteractionnancyNoch keine Bewertungen

- Deep LearningDokument34 SeitenDeep Learningtheepi murugesanNoch keine Bewertungen

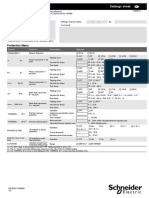

- VIP400 Settings Sheet NRJED311208ENDokument2 SeitenVIP400 Settings Sheet NRJED311208ENVăn NguyễnNoch keine Bewertungen

- Chapters 1 - 6: - Chapter 6Dokument51 SeitenChapters 1 - 6: - Chapter 6Delasdriana WiharjaNoch keine Bewertungen

- Bosch Mems Inertial Sensor Smi700 Product Info SheetDokument2 SeitenBosch Mems Inertial Sensor Smi700 Product Info SheetDarío Gabriel LipicarNoch keine Bewertungen

- HRS Funding Opportunities BulletinSeptember222017Dokument24 SeitenHRS Funding Opportunities BulletinSeptember222017SyedNoch keine Bewertungen

- RFQ 10406475 - RWSCM00015F-Rev05-RequestforQuotationSupplyandDelivery - 20230929112300.955 - X 23 October 2023TDokument11 SeitenRFQ 10406475 - RWSCM00015F-Rev05-RequestforQuotationSupplyandDelivery - 20230929112300.955 - X 23 October 2023TPfunzo MammbaNoch keine Bewertungen

- Rechargeable Laptop Battery User ManualDokument1 SeiteRechargeable Laptop Battery User ManualVintonius Raffaele PRIMUSNoch keine Bewertungen

- Subject: Technical and Cost Proposal of Online Manpower Management System IntegratedDokument12 SeitenSubject: Technical and Cost Proposal of Online Manpower Management System IntegratedMainuddin BhuiyanNoch keine Bewertungen

- Pass Leader DumpsDokument30 SeitenPass Leader DumpsHyder BasetNoch keine Bewertungen

- 2006 - Pew Future of The Internet 2Dokument9 Seiten2006 - Pew Future of The Internet 2_sdpNoch keine Bewertungen

- c20 Dcaie Artificial Intelligence 6thoctober2021Dokument345 Seitenc20 Dcaie Artificial Intelligence 6thoctober2021Mr KalyanNoch keine Bewertungen

- SokkiaioDokument24 SeitenSokkiaioUlisesRiveraUrbanoNoch keine Bewertungen

- Using IComparer IComparable For Sorting in WPFDokument6 SeitenUsing IComparer IComparable For Sorting in WPFAbhiNoch keine Bewertungen

- Knowledge Management in Engineering Through ICT-2. DR K Dhamodharan Scopus PaperDokument25 SeitenKnowledge Management in Engineering Through ICT-2. DR K Dhamodharan Scopus PaperDR K DHAMODHARANNoch keine Bewertungen

- AMDE Brochure-Mine Safety Accountability Integrated SystemDokument1 SeiteAMDE Brochure-Mine Safety Accountability Integrated SystemHakimNoch keine Bewertungen

- DX DiagDokument34 SeitenDX DiagHaryo RuNoch keine Bewertungen

- MOCK Exams Submission TestDokument7 SeitenMOCK Exams Submission TestPam MshweshweNoch keine Bewertungen

- Visual Foxpro Bsamt3aDokument32 SeitenVisual Foxpro Bsamt3aJherald NarcisoNoch keine Bewertungen

- Designing A 3D Jewelry ModelDokument4 SeitenDesigning A 3D Jewelry ModelAbdulrahman JradiNoch keine Bewertungen

- Cubase 7 Quick Start GuideDokument95 SeitenCubase 7 Quick Start Guidenin_rufaNoch keine Bewertungen

- Aspire Company Profile:, Aspire Exam Cracking KITDokument17 SeitenAspire Company Profile:, Aspire Exam Cracking KITChandrasekhar Uchiha100% (1)

- ControlMaestro 2010Dokument2 SeitenControlMaestro 2010lettolimaNoch keine Bewertungen

- Architecture of Industrial Automation Systems: Unit-1 ECE361Dokument20 SeitenArchitecture of Industrial Automation Systems: Unit-1 ECE361anuj jainNoch keine Bewertungen