Beruflich Dokumente

Kultur Dokumente

Null

Hochgeladen von

d-fbuser-65596417Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Null

Hochgeladen von

d-fbuser-65596417Copyright:

Verfügbare Formate

Do You Know

Financial Statements are prepared : To know the profitability of the business and To know the financial position of the business

The Trading Account shows the results of buying and selling of goods, in preparing this account, the general establishment charges are ignored and only the transactions in goods are included. ----- Jamshed R. Batliboi

Tips and Tricks for the Students

Instead of learning and remembering the items of Trading account, Keep the following points in mind while preparing the Trading Account. Only following expenses are included in Trading Account : Expenses Related to Purchases Expenses Related to Manufacturing Expenses Related to Factory

Tips and Tricks

1. Wages and Salaries is Direct Expense but Salaries and Wages is Indirect Expense. 2. Closing Stock is valued at Market Price or Cost Price whichever is less. 3. Sales Tax should be Deducted from the Sale while preparing Trading A/c 4. Income Tax is treated as Drawing and will deducted from Capital in B/S.

5. All Inward expenses are Direct and All Outward expenses are Indirect expenses for example Carriage inward is direct expense but Carriage outward is Indirect expense.

6. Date Column is not prepared while preparing final accounts

7. Ledger folio column is not prepared because final accounts are not prepared from ledgers , Final accounts are prepared from the Trial Balance.

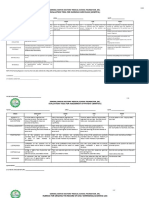

Particulars To Opening Stock To Purchases xxxx Less : Return xxxx To Wages To Manufacturing Exp. To Freight inward To Carriage inward To Factory Exp. To Gross Profit (Bal.Figure)

Amount xxxx

Particulars By Sales xxxx Less : Return xxxx

Amount xxxx

xxxx By Closing Stock xxxx xxxx xxxx xxxx xxxx xxxx By Gross Loss (Bal.figure) xxxx

All Factory Exp. Manufacturing & Production Expenses and expense on purchases should be debited

Particulars To Gross Loss b/d To Salaries To office Exp. To Administrative exp. To Carriage outward To Postage Exp. To Net Profit (Bal.Figure)

Amount xxxx xxxx xxxx xxxx xxxx Xxxx xxxx

Particulars By Gross Profit b/d By Rent Received By Interest Received By Commission Received By Net Loss (Bal. figure)

Amount xxxx xxxx xxxx xxxx xxxx

All Office Exp, Administrative Expenses and expense on Sales should be debited

Current liabilities Trade creditors Bill payable Outstanding expenses Unearned incomes Bank overdraft Short term loans Fixed liabilities Loans (long terms) Mortgages Capital (add) Net profit or (less) Net loss (less) Drawings Reserves

Current assets : Cash in hand Cash in bank Investments (short term) Bills receivable Sundry debtors Closing stock Raw material Work in progress Finished stock Prepaid expenses Accrued income FIXED ASSETS : Furniture and fittings Motor vehicles Plant and machinery Building Land Patents and trade marks Goodwill

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Structure of The Nazi Economy - Maxine Yaple SweezyDokument273 SeitenThe Structure of The Nazi Economy - Maxine Yaple Sweezygrljadus100% (2)

- Complete Cocker Spaniel Guide 009 PDFDokument119 SeitenComplete Cocker Spaniel Guide 009 PDFElmo RNoch keine Bewertungen

- The Crystalline Solid StateDokument58 SeitenThe Crystalline Solid Stated-fbuser-65596417Noch keine Bewertungen

- Roll No. I I I I I I I I Candidates Must Write The Code OnDokument6 SeitenRoll No. I I I I I I I I Candidates Must Write The Code Ond-fbuser-65596417Noch keine Bewertungen

- Biotechnology: Module - 5Dokument26 SeitenBiotechnology: Module - 5d-fbuser-65596417Noch keine Bewertungen

- Historical Places of IndiaDokument6 SeitenHistorical Places of Indiad-fbuser-65596417Noch keine Bewertungen

- ElectrochemistryDokument36 SeitenElectrochemistryd-fbuser-65596417Noch keine Bewertungen

- Reproduction in Plants: Module - 3Dokument31 SeitenReproduction in Plants: Module - 3d-fbuser-65596417Noch keine Bewertungen

- Incomes Which Do Not Form Part of Total Income: Section 64Dokument91 SeitenIncomes Which Do Not Form Part of Total Income: Section 64d-fbuser-65596417Noch keine Bewertungen

- The Presidents: By: Ainhoa Gutiérrez Rodríguez Jose Antonio Rodríguez PérezDokument49 SeitenThe Presidents: By: Ainhoa Gutiérrez Rodríguez Jose Antonio Rodríguez Pérezd-fbuser-65596417Noch keine Bewertungen

- Enter The DateDokument27 SeitenEnter The Dated-fbuser-65596417Noch keine Bewertungen

- Bhagat Singh: ShaheedDokument13 SeitenBhagat Singh: Shaheedd-fbuser-65596417Noch keine Bewertungen

- The No.1 CBSE Mathematics Website in The World: Lines and AnglesDokument2 SeitenThe No.1 CBSE Mathematics Website in The World: Lines and Anglesd-fbuser-65596417Noch keine Bewertungen

- Prime Ministers of India: Pt. Jawaharlal NehruDokument15 SeitenPrime Ministers of India: Pt. Jawaharlal Nehrud-fbuser-65596417Noch keine Bewertungen

- Evolution of Designed Industrial Symbiosis Networks in The Ulsan Eco-Industrial Park - Research and Development Into Business ADokument10 SeitenEvolution of Designed Industrial Symbiosis Networks in The Ulsan Eco-Industrial Park - Research and Development Into Business Asanyukta sinhaNoch keine Bewertungen

- NURS FPX 6021 Assessment 1 Concept MapDokument7 SeitenNURS FPX 6021 Assessment 1 Concept MapCarolyn HarkerNoch keine Bewertungen

- Value Chain AnalaysisDokument100 SeitenValue Chain AnalaysisDaguale Melaku AyeleNoch keine Bewertungen

- Project Report Devki Nandan Sharma AmulDokument79 SeitenProject Report Devki Nandan Sharma AmulAvaneesh KaushikNoch keine Bewertungen

- FACT SHEET KidZaniaDokument4 SeitenFACT SHEET KidZaniaKiara MpNoch keine Bewertungen

- Types of Vegetation in Western EuropeDokument12 SeitenTypes of Vegetation in Western EuropeChemutai EzekielNoch keine Bewertungen

- Project CharterDokument10 SeitenProject CharterAdnan AhmedNoch keine Bewertungen

- Surefire Hellfighter Power Cord QuestionDokument3 SeitenSurefire Hellfighter Power Cord QuestionPedro VianaNoch keine Bewertungen

- Exam Questions AZ-304: Microsoft Azure Architect Design (Beta)Dokument9 SeitenExam Questions AZ-304: Microsoft Azure Architect Design (Beta)Deepa R NairNoch keine Bewertungen

- March FOMC: Tighter Credit Conditions Substituting For Rate HikesDokument8 SeitenMarch FOMC: Tighter Credit Conditions Substituting For Rate HikeshaginileNoch keine Bewertungen

- FFT SlidesDokument11 SeitenFFT Slidessafu_117Noch keine Bewertungen

- PEDIA OPD RubricsDokument11 SeitenPEDIA OPD RubricsKylle AlimosaNoch keine Bewertungen

- RPS Manajemen Keuangan IIDokument2 SeitenRPS Manajemen Keuangan IIaulia endiniNoch keine Bewertungen

- Pudlo CWP TDS 2Dokument4 SeitenPudlo CWP TDS 2azharNoch keine Bewertungen

- ViTrox 20230728 HLIBDokument4 SeitenViTrox 20230728 HLIBkim heeNoch keine Bewertungen

- Tim Horton's Case StudyDokument8 SeitenTim Horton's Case Studyhiba harizNoch keine Bewertungen

- Anti Dump ch-84Dokument36 SeitenAnti Dump ch-84Tanwar KeshavNoch keine Bewertungen

- A Comparison of Practitioner and Student WritingDokument28 SeitenA Comparison of Practitioner and Student WritingMichael Sniper WuNoch keine Bewertungen

- Kerjaya JuruterbangDokument11 SeitenKerjaya JuruterbangAqil NazriNoch keine Bewertungen

- Ancient Egyptian TimelineDokument5 SeitenAncient Egyptian TimelineMariz Miho100% (2)

- Budget ProposalDokument1 SeiteBudget ProposalXean miNoch keine Bewertungen

- Succession CasesDokument17 SeitenSuccession CasesAmbisyosa PormanesNoch keine Bewertungen

- Astm C1898 20Dokument3 SeitenAstm C1898 20Shaik HussainNoch keine Bewertungen

- Adobe Scan Sep 06, 2023Dokument1 SeiteAdobe Scan Sep 06, 2023ANkit Singh MaanNoch keine Bewertungen

- Governance Whitepaper 3Dokument29 SeitenGovernance Whitepaper 3Geraldo Geraldo Jr.Noch keine Bewertungen

- 7 кмжDokument6 Seiten7 кмжGulzhaina KhabibovnaNoch keine Bewertungen

- Lyndhurst OPRA Request FormDokument4 SeitenLyndhurst OPRA Request FormThe Citizens CampaignNoch keine Bewertungen

- Filipino Chicken Cordon BleuDokument7 SeitenFilipino Chicken Cordon BleuHazel Castro Valentin-VillamorNoch keine Bewertungen