Beruflich Dokumente

Kultur Dokumente

PPSA

Hochgeladen von

chrislee81Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

PPSA

Hochgeladen von

chrislee81Copyright:

Verfügbare Formate

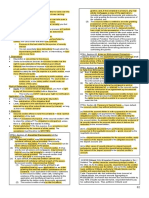

Personal Property Securities Act (PPSA)

Does your business: - Borrow or lend money? - Purchase or sell goods on agreement, assignment or credit? - Grow crops or raise livestock? - Own/lease machinery or vehicles? If so, the PPSA will affect you.

What is PPSA?

The PPSA is new legislation which will extensively change the way in which security interests in personal property are dealt with across Australia. The legislation will lead to the creation of an online Personal Property Securities Register (PPSR) in which any holder of a security interest in personal property must register to ensure they have a priority claim to that property. Legal title is no longer enough. This legislation overturns fundamental personal property law concepts. You need to understand how these changes affect the way in which you conduct your business. This legislation could have a significant impact on suppliers of retention of title (ROT) goods or other equipment where a security interest is required to be registered.

Why is this important?

The PPSA represents a fundamental change in securities law. The scope of PPSA is very broad and applies to: Interests in all property except land Interests granted by all entities (i.e. companies and individuals) Not only traditional securities, but ownership

Beware

If you do not comply with the requirements of the PPSA to perfect your security interest: 1. 2. Another security interest may take priority Another person may acquire an interest in the personal property free of your security interest Your security interest may not survive the grantors insolvency

Changes to the way in which security interests in personal property are dealt with across Australia

3.

In a worse case scenario, failure to perfect your interest may result in property to which you hold title being lost to another secured party.

What is a security interest?

Security interest means an interest in personal property provided for by a transaction that in substance secures payment or performance of an obligation (without regard to the form of the transaction or the identity of the person who has title to the property). Some examples of security interests are Charges; Mortgages (excluding a mortgage over land or water rights); Conditional Sale Agreements, including retention of title arrangements; Hire Purchase Agreements; Pledges; Trust Receipts; Leases of goods; Consignments; Assignments; Transfer of Title. In particular anyone who is a supplier of goods should pay close attention to the PPSA requirement to make sure their retention of title clause remains enforceable. The supplier or other beneficiaries of a retention of title clause will need to register their interest to ensure that the clause is enforceable and has its intended effect.

What is perfection?

Perfection means the requirements that need to be satisfied before a security interest is enforceable against third parties and in insolvency. Perfection is achieved by: Control; or Possession; or Registration.

that constitutes a security interest for the purposes of the PPSA must carefully consider their position. This will apply to all arrangements involving ROT, consignment, hire purchase and leases, charges and liens.

Commencement date

The PPSA was scheduled to commence on 31 October 2011 but has recently been deferred until January 30 2012.

What is priority?

As between perfected security interests, priority is determined by order of registration of financing statements. A perfected security interest takes priority over an unperfected security interest. As between unperfected security interests, priority is determined by the order of attachment.

Transitional period

Existing security interests (e.g. ASIC debentures) will be migrated to the PPSR. But any security interests which are not currently required to be registrable and are therefore unregistered cannot be migrated. So if you are the owners of ROT, leased or bailed goods and want to protect your interests you must register this interest during the proposed 2 year transition period.

Who will the PPSA affect?

It is not only companies and other commercial entities that will be affected by the PPSA. Any person who has been granted, or who may in the future be granted, an interest

Recommendation

We recommend that you review your position and contact us should you require advice. If this affects you, you need to decide your strategy now!

Contacts

National Contacts - Turnaround & Insolvency Canberra (02) 6247 5988 Melbourne (03) 9286 1800 Perth (08) 9261 9100 Sydney (02) 9233 8933 Wagga Wagga / Albury (02) 6921 9055

Turnaround & Insolvency

Frank Lo Pilato Glenn Crisp / Andrew Beck Mark Conlan / Neil Cribb / Greg Dudley Peter Marsden / David Kerr / Richard Stone Andrew Bowcher / Tim Gumbleton

www.rsmi.com.au

Liability limited by a scheme approved under Professional Standards Legislation All formal insolvency appointments are undertaken by RSM Bird Cameron Partners. The material contained in this communication is of the nature of general comment only. No reader should rely on it without seeking accounting or legal advice.

2011 RSM Bird Cameron

Our one-firm structure enables us to provide strong connections and a focus on client relationships. Clients can readily connect to our national and international expertise and networks, our extensive understanding of Australian business and to our directors and senior advisors. With RSM Bird Cameron you really are ... Connected for Success.

Das könnte Ihnen auch gefallen

- PPSA Supplemental ReviewerDokument13 SeitenPPSA Supplemental ReviewerJohn Paul100% (3)

- Personal Property Security Act From Scratch 1Dokument18 SeitenPersonal Property Security Act From Scratch 1Ralph Ronald CatipayNoch keine Bewertungen

- PPSA HandoutsDokument11 SeitenPPSA HandoutsGerard Relucio Oro67% (6)

- Ppsa 4Dokument1 SeitePpsa 4queenNoch keine Bewertungen

- Property Security Act", Sec. 4)Dokument29 SeitenProperty Security Act", Sec. 4)Rion Margate60% (5)

- Beda MemAid PPSADokument5 SeitenBeda MemAid PPSAJeremiah Ruaro100% (3)

- Personal Property Security Act (R.A. 11057) Part 2: Priority (Preference) of Security Interests by Atty. JavierDokument2 SeitenPersonal Property Security Act (R.A. 11057) Part 2: Priority (Preference) of Security Interests by Atty. Javierrocky dominusNoch keine Bewertungen

- Notes Ra 11057Dokument2 SeitenNotes Ra 11057Jillian Roy100% (1)

- Ra 11057Dokument16 SeitenRa 11057Rio Sanchez100% (9)

- Revised PPSA V. Chattel Mortgage, Pledge, Preference of CreditDokument8 SeitenRevised PPSA V. Chattel Mortgage, Pledge, Preference of CreditJj Jumalon67% (3)

- RA 11057 vs. Repealed LawsDokument2 SeitenRA 11057 vs. Repealed LawsSage Rainelle LingatongNoch keine Bewertungen

- PPSA V CIVIL CODE & CHATTEL MORTGAGE LAWDokument7 SeitenPPSA V CIVIL CODE & CHATTEL MORTGAGE LAWElaizza Concepcion100% (1)

- PPSA NotesDokument3 SeitenPPSA NotesKing Badong100% (1)

- Notes From Dean Salaos Lecture On Personal Property Security ActDokument9 SeitenNotes From Dean Salaos Lecture On Personal Property Security ActCassie GacottNoch keine Bewertungen

- PPSA SummaryDokument9 SeitenPPSA Summarykarl100% (17)

- Personal Property Security Act: Republic Act No. 11057 Section 2. Declaration of PolicyDokument21 SeitenPersonal Property Security Act: Republic Act No. 11057 Section 2. Declaration of PolicyRikka Reyes100% (4)

- Personal Property Security ActDokument18 SeitenPersonal Property Security Actsun100% (3)

- (Intangible Assets) Intermediate Securities Or: Provided, That A Security That Is Not RegisteredDokument2 Seiten(Intangible Assets) Intermediate Securities Or: Provided, That A Security That Is Not RegisteredYya LadignonNoch keine Bewertungen

- Cred Trans - PpsaDokument10 SeitenCred Trans - PpsaJane Galicia100% (3)

- PpsaDokument19 SeitenPpsaRabelais Medina100% (1)

- RA 11057 Personal Property Security Act20181024-5466-60b906Dokument17 SeitenRA 11057 Personal Property Security Act20181024-5466-60b906denbar15Noch keine Bewertungen

- Zarah VillanuevaDokument9 SeitenZarah VillanuevaEdione CueNoch keine Bewertungen

- Negotiable Instruments Law Memory AidDokument9 SeitenNegotiable Instruments Law Memory AidMichael C. PayumoNoch keine Bewertungen

- Credit Transactions - Bar Question 1990Dokument15 SeitenCredit Transactions - Bar Question 1990Queng ArroyoNoch keine Bewertungen

- Understanding RA 11057 and Its Effect With NCC and Prior LawsDokument2 SeitenUnderstanding RA 11057 and Its Effect With NCC and Prior LawsKym Algarme100% (2)

- Commercial Law Review - Zara Notes Chattel MortgageDokument4 SeitenCommercial Law Review - Zara Notes Chattel MortgageMiko Caralde Dela CruzNoch keine Bewertungen

- Commercial Law Review: Maria Zarah Villanueva - CastroDokument3 SeitenCommercial Law Review: Maria Zarah Villanueva - CastroTinn ApNoch keine Bewertungen

- IRR - Personal Property Security Act (PPSA)Dokument38 SeitenIRR - Personal Property Security Act (PPSA)acolumnofsmoke33% (3)

- GUILLERMO-Tabular Comparison of PPSA As Against Pledge, Chatel Mortgage and Preference of CreditsDokument2 SeitenGUILLERMO-Tabular Comparison of PPSA As Against Pledge, Chatel Mortgage and Preference of CreditsPATRICIA MAE GUILLERMONoch keine Bewertungen

- Digest Manila Insurance v. Sps AmuraoDokument3 SeitenDigest Manila Insurance v. Sps AmuraoYsa UbanaNoch keine Bewertungen

- PPSA SummaryDokument18 SeitenPPSA SummaryJane100% (1)

- Digest Aug 10 CreditDokument23 SeitenDigest Aug 10 CreditCesyl Patricia BallesterosNoch keine Bewertungen

- Warehouse and Trust Receipt LawDokument10 SeitenWarehouse and Trust Receipt Lawmccm92Noch keine Bewertungen

- Union Bank VDokument5 SeitenUnion Bank VGlyza Kaye Zorilla PatiagNoch keine Bewertungen

- Syndicated Loan Agreement: PartiesDokument10 SeitenSyndicated Loan Agreement: PartiesAleezah Gertrude RaymundoNoch keine Bewertungen

- Hizon Notes - Negotiable InstrumentsDokument86 SeitenHizon Notes - Negotiable Instrumentsdnel13Noch keine Bewertungen

- RA 11057 or The Personal Property Security ActDokument14 SeitenRA 11057 or The Personal Property Security ActLaughLy ReuyanNoch keine Bewertungen

- Securing Obligations With Movable AssetsDokument3 SeitenSecuring Obligations With Movable AssetsLester AgoncilloNoch keine Bewertungen

- CREDIT TRANSACTIONS - Escarez Reviewer - Part IIIDokument9 SeitenCREDIT TRANSACTIONS - Escarez Reviewer - Part IIIPaul Aaron Esguerra EscarezNoch keine Bewertungen

- Trust Receipts LawDokument5 SeitenTrust Receipts LawAlverastine AnNoch keine Bewertungen

- PPSA Handouts PDFDokument11 SeitenPPSA Handouts PDFNikkandra MarceloNoch keine Bewertungen

- Antichresis (ARTICLES 2132-2139) : Writing OtherwiseDokument4 SeitenAntichresis (ARTICLES 2132-2139) : Writing OtherwiseLisa Bautista100% (1)

- Ppsa IrrDokument32 SeitenPpsa IrrNiel DabuetNoch keine Bewertungen

- CDDokument32 SeitenCDAdrian HilarioNoch keine Bewertungen

- Guide Questions No. 4Dokument8 SeitenGuide Questions No. 4carlota ann lafuenteNoch keine Bewertungen

- Antichresis HandoutDokument3 SeitenAntichresis HandoutKC ManglapusNoch keine Bewertungen

- Secured Transactions Bar Review NotesDokument51 SeitenSecured Transactions Bar Review NotesCJVNoch keine Bewertungen

- Personal Property Securities Act RA 11057Dokument77 SeitenPersonal Property Securities Act RA 11057Ann QuirimitNoch keine Bewertungen

- Negotiable Instruments Case Digest 6 PDF FreeDokument50 SeitenNegotiable Instruments Case Digest 6 PDF FreeJr MateoNoch keine Bewertungen

- Negotiable Instruments LawDokument13 SeitenNegotiable Instruments LawApple MarieNoch keine Bewertungen

- Negotiable Instruments Law Case DigestDokument12 SeitenNegotiable Instruments Law Case DigestSSNoch keine Bewertungen

- Warehouse Receipts LawDokument8 SeitenWarehouse Receipts LawChris T NaNoch keine Bewertungen

- Personal Property Security Act: Section 2. Declaration of PolicyDokument20 SeitenPersonal Property Security Act: Section 2. Declaration of PolicyRikka Reyes100% (4)

- Outline in Negotiable Instruments Law1Dokument17 SeitenOutline in Negotiable Instruments Law1Arvin AbyadangNoch keine Bewertungen

- Credit TransactionsDokument46 SeitenCredit TransactionsSui0% (1)

- Commercial Law ReviewDokument3 SeitenCommercial Law ReviewElijahBactolNoch keine Bewertungen

- Heldlawyersnewsletterjune 2012Dokument2 SeitenHeldlawyersnewsletterjune 2012api-284203178Noch keine Bewertungen

- Heldlawyersnewslettermay 2012Dokument2 SeitenHeldlawyersnewslettermay 2012api-284203178Noch keine Bewertungen

- Held Lawyers: Law MattersDokument2 SeitenHeld Lawyers: Law Mattersapi-284203178Noch keine Bewertungen

- PPSADokument2 SeitenPPSAreception2999Noch keine Bewertungen

- Cariaga Bir Lease Contract (Kamias)Dokument8 SeitenCariaga Bir Lease Contract (Kamias)florelee de leonNoch keine Bewertungen

- 9 Royal Plains View, Inc. vs. MejiaDokument2 Seiten9 Royal Plains View, Inc. vs. MejiaJem100% (3)

- Marcelina Edroso, Vs - Pablo and Basilio Sablan FactsDokument19 SeitenMarcelina Edroso, Vs - Pablo and Basilio Sablan Factsbebs CachoNoch keine Bewertungen

- New Mexico Month To Month Rental AgreementDokument7 SeitenNew Mexico Month To Month Rental AgreementWalter ThompsonNoch keine Bewertungen

- Article 774-782Dokument6 SeitenArticle 774-782ALee BudNoch keine Bewertungen

- FRANCHISE-AGREEMENT-Ismael ParasDokument4 SeitenFRANCHISE-AGREEMENT-Ismael ParasMae Francesca Alcid Garcia - Gumaru67% (12)

- may17-SPS - CANNU-v-SPS - GALANG and MALABANAN-v-CADokument2 Seitenmay17-SPS - CANNU-v-SPS - GALANG and MALABANAN-v-CAcassandra leeNoch keine Bewertungen

- Legal Position of The Promoters - Situation CasesDokument3 SeitenLegal Position of The Promoters - Situation CasesNAMAN SHAHNoch keine Bewertungen

- Real Property TaxDokument6 SeitenReal Property TaxLiliNoch keine Bewertungen

- Credit Transactions - Full OutlineDokument8 SeitenCredit Transactions - Full OutlineJas FherNoch keine Bewertungen

- CORAZON KO v. VIRGINIA DY ARAMBURO GR No. 190995, Aug 09, 2017 Co-Ownership, Sale, Void vs. Voidable Sale, Prescription - PINAY JURISTDokument6 SeitenCORAZON KO v. VIRGINIA DY ARAMBURO GR No. 190995, Aug 09, 2017 Co-Ownership, Sale, Void vs. Voidable Sale, Prescription - PINAY JURISTDJ MikeNoch keine Bewertungen

- Whether It Is The General Rule or The Exception That Is Followed, The Legitime of Compulsory Heirs Must Never Be ImpairedDokument3 SeitenWhether It Is The General Rule or The Exception That Is Followed, The Legitime of Compulsory Heirs Must Never Be ImpairedLouem GarceniegoNoch keine Bewertungen

- Orola V PontevedraDokument9 SeitenOrola V PontevedraJayNoch keine Bewertungen

- 2y Property Case Digests 2aDokument333 Seiten2y Property Case Digests 2aYzah Joy ParaynoNoch keine Bewertungen

- Licensing Contract For Commercial Use of ImagesDokument2 SeitenLicensing Contract For Commercial Use of ImagesKazi UdhoyNoch keine Bewertungen

- Classification or Types of ContractDokument3 SeitenClassification or Types of ContractAdan HassanNoch keine Bewertungen

- Rental, Somasundar K To NGACHONYO ZINGYO, Pointed, 04 Nov 23Dokument4 SeitenRental, Somasundar K To NGACHONYO ZINGYO, Pointed, 04 Nov 23Vinayak UpadhyayaNoch keine Bewertungen

- 44 - Olympia Housing Inc Vs Panasiatic Travel Corporation (2003)Dokument2 Seiten44 - Olympia Housing Inc Vs Panasiatic Travel Corporation (2003)Johnny EnglishNoch keine Bewertungen

- National Grains Authority vs. IacDokument4 SeitenNational Grains Authority vs. IacMhaliNoch keine Bewertungen

- List of Mandatory Documentary Requirements and Procedure (RD Extrajudicial Settlement)Dokument4 SeitenList of Mandatory Documentary Requirements and Procedure (RD Extrajudicial Settlement)punditninjaNoch keine Bewertungen

- Standard Oil CoDokument2 SeitenStandard Oil CoLady MAy SabanalNoch keine Bewertungen

- Franchise AgreementDokument18 SeitenFranchise AgreementSandeep ManikireddyNoch keine Bewertungen

- PREMPTIONDokument33 SeitenPREMPTIONgunjanjha11Noch keine Bewertungen

- Mortgage and Its Types 56Dokument3 SeitenMortgage and Its Types 56sonam1991Noch keine Bewertungen

- LW3902 - Tutorial Questions Wk2Dokument4 SeitenLW3902 - Tutorial Questions Wk2Daisy LeungNoch keine Bewertungen

- Form 0009-Deed of Absolute Sale of Untitled LandDokument2 SeitenForm 0009-Deed of Absolute Sale of Untitled LandPaula Jane EscasinasNoch keine Bewertungen

- RDO No. 84 - Tagbilaran CityDokument295 SeitenRDO No. 84 - Tagbilaran CitySeth Raven83% (6)

- Declaration of Land Patent Bill of Conveyance - Torres State Society of Christopher NationDokument2 SeitenDeclaration of Land Patent Bill of Conveyance - Torres State Society of Christopher NationMegan Ryan TorresNoch keine Bewertungen

- Seller Closing Statement - When Buyer Gets FinancingDokument2 SeitenSeller Closing Statement - When Buyer Gets FinancingJo Jemison EnglandNoch keine Bewertungen

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorVon EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorBewertung: 4.5 von 5 Sternen4.5/5 (132)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingVon EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingBewertung: 4.5 von 5 Sternen4.5/5 (97)

- The SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsVon EverandThe SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsNoch keine Bewertungen

- Ben & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooVon EverandBen & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooBewertung: 5 von 5 Sternen5/5 (2)

- Public Finance: Legal Aspects: Collective monographVon EverandPublic Finance: Legal Aspects: Collective monographNoch keine Bewertungen

- Introduction to Negotiable Instruments: As per Indian LawsVon EverandIntroduction to Negotiable Instruments: As per Indian LawsBewertung: 5 von 5 Sternen5/5 (1)

- AI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersVon EverandAI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersNoch keine Bewertungen

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorVon EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorBewertung: 4.5 von 5 Sternen4.5/5 (63)

- Contract Law in America: A Social and Economic Case StudyVon EverandContract Law in America: A Social and Economic Case StudyNoch keine Bewertungen

- The Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseVon EverandThe Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseNoch keine Bewertungen

- Indian Polity with Indian Constitution & Parliamentary AffairsVon EverandIndian Polity with Indian Constitution & Parliamentary AffairsNoch keine Bewertungen

- The Streetwise Guide to Going Broke without Losing your ShirtVon EverandThe Streetwise Guide to Going Broke without Losing your ShirtNoch keine Bewertungen

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsVon EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsBewertung: 5 von 5 Sternen5/5 (24)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementVon EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementBewertung: 4.5 von 5 Sternen4.5/5 (20)

- International Business Law: Cases and MaterialsVon EverandInternational Business Law: Cases and MaterialsBewertung: 5 von 5 Sternen5/5 (1)

- The Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersVon EverandThe Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersNoch keine Bewertungen

- LLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessVon EverandLLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessBewertung: 5 von 5 Sternen5/5 (1)

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseVon EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseNoch keine Bewertungen