Beruflich Dokumente

Kultur Dokumente

Wipro Result Updated

Hochgeladen von

Angel BrokingOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Wipro Result Updated

Hochgeladen von

Angel BrokingCopyright:

Verfügbare Formate

3QFY2012 Result Update | IT

January 20, 2012

Wipro

Performance Highlights

(` cr) Net revenue EBITDA EBITDA margin (%) PAT 3QFY12 9,997 1,984 19.8 1,456 2QFY12 9,095 1,740 19.1 1,301 % chg (qoq) 9.9 14.1 72bp 11.9 3QFY11 7,829 1,643 21.0 1,319 % chg (yoy) 27.7 20.8 (114)bp 10.4

NEUTRAL

CMP Target Price

Investment Period

Stock Info Sector Market Cap (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code IT 101,501 0.9 490/310 145,316 2 16,739 5,049 WIPR.BO WPRO@IN

`414 -

Source: Company, Angel Research

For 3QFY2012, Wipros results came in-line with our expectations. The major highlight of the result was the 2.9% and 2.3% qoq onsite and offshore pricing growth, respectively. However, the company disappointed on the volume front, which reported flat growth of merely 1.8% qoq. For 4QFY2012, management has given decent revenue guidance of 1-3% qoq growth in USD revenue. We maintain our Neutral view on the stock. Quarterly highlights: For 3QFY2012, Wipro registered 9.9% qoq growth in revenue to `9,997cr. Revenue from the IT services segment came in at US$1,505.5mn, up 2.2% qoq. Revenue from the consumer care and lighting segment grew strongly by 26.4% yoy, while the IT products segment reported merely 2.4% yoy revenue growth. EBIT margin of the IT services, IT products and consumer care and lighting business grew by 83bp, 77bp and 87bp qoq to 20.8%, 5.3% and 11.9%, respectively. Overall, EBITDA and EBIT margin of Wipro grew by 72bp and 88bp qoq to 19.8% and 17.2%, respectively. Outlook and valuation: For 4QFY2012, management has given a decent revenue guidance of US$1.520bn-1.550bn for the IT services segment, with qoq growth of 1-3%, which is slightly better than one of its peers, Infosys. Also, management maintained that the company will take another 1-2 quarters to grow at rates comparable to its peers. This implies poor annual growth for FY2012. Thus, we expect revenue CAGR for IT services (USD terms) to be muted at 12.8% over FY2011-13E. At the operating front, Wipro has limited tailwinds and headwinds such as wage inflation, integration impact of SAIC (lower EBIT margin at 13.5%) and moderate volume growth, which are expected to pull down margins. Thus, we expect EBIT margin of the IT services segment to slide down to 21.1% in FY2012 and 20.8% for FY2013. Also, the ~400bp increase in effective tax rate is expected to mar the companys net profitability further, and we expect a 14.0% CAGR in PAT over FY2011-13E. Thus, we value the company at 15.3x FY2013E EPS (15% discount to Infosys) of `27.8, which gives us a target price of `425. We maintain our Neutral rating on the stock.

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 79.2 3.6 5.7 11.5

Abs. (%) Sensex Wipro

3m 16.7

1yr

3yr 83.9

(1.2) (12.1)

(13.5) 202.6

Key financials (Consolidated, IFRS)

Y/E March (` cr) Net sales % chg Net profit % chg EBITDA margin (%) EPS (`) P/E (x) P/BV (x) RoE (%) RoCE (%) EV/Sales (x) EV/EBITDA (x) FY2009* 25,534 27.8 3,876 18.1 19.7 15.9 26.0 6.2 26.3 15.2 3.8 19.3 FY2010* 27,124 6.2 4,594 18.5 21.9 18.9 21.9 4.6 23.4 15.6 3.5 15.8 FY2011 31,099 14.7 5,297 15.3 21.2 21.7 19.1 4.2 22.0 15.5 3.0 14.0 FY2012E 38,004 22.2 5,656 6.8 19.8 23.1 17.9 3.6 20.2 15.4 2.4 12.3 FY2013E 43,949 15.6 6,810 20.4 19.7 27.8 14.9 3.1 20.5 15.3 2.0 10.0

Ankita Somani

+91 22 3935 7800 Ext: 6819 ankita.somani@angelbroking.com

Source: Company, Angel Research; Note: *Adjusted for 2:3 bonus

Please refer to important disclosures at the end of this report

Wipro | 3QFY2012 Result Update

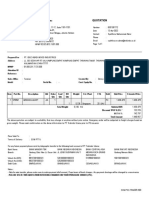

Exhibit 1: 3QFY2012 performance (Consolidated, IFRS)

Y/E March (` cr) Net revenue Cost of revenue Gross profit SG&A expense EBITDA Dep. and amortisation EBIT Other income PBT Income tax PAT Minority interest Adj. PAT Diluted EPS (`) Gross margin (%) EBITDA margin (%) EBIT margin (%) PAT margin (%)

Source: Company, Angel Research

3QFY12 9,997 6,710 3,287 1,303 1,984 260 1,724 113 1,849 381 1,468 11 1,456 5.9 32.9 19.8 17.2 15.7

2QFY12 9,095 6,246 2,849 1,109 1,740 252 1,488 86 1,584 284 1,300 (1) 1,301 5.3 31.3 19.1 16.4 15.3

% chg (qoq) 9.9 7.4 15.4 17.5 14.1 3.3 15.9 16.7 34.1 12.9 (1,240.0) 11.9 11.3 156bp 72bp 88bp 45bp

3QFY11 7,829 5,145 2,684 1,041 1,643 208 1,435 132 1,584 258 1,326 7 1,319 5.4 34.3 21.0 18.3 16.9

% chg (yoy) 27.7 30.4 22.5 25.2 20.8 25.3 20.1 16.7 47.6 10.7 60.6 10.4 10.4 (140)bp (114)bp (109)bp (123)bp

9MFY12 27,656 18,724 8,932 3,478 5,453 746 4,707 343 5,082 975 4,108 15 4,092 16.7 32.3 19.7 17.0 16.0

9MFY11 22,796 14,952 7,844 2,964 4,881 593 4,288 323 4,662 711 3,951 29 3,922 16.1 34.4 21.4 18.8 18.6

% chg (yoy) 21.3 25.2 13.9 17.4 11.7 25.8 9.8 9.0 37.1 4.0 (46.5) 4.3 3.9 (212)bp (169)bp (179)bp (258)bp

Exhibit 2: 3QFY2012 Actual vs. Angel estimates

(` cr) Net revenue EBITDA margin (%) PAT

Source: Company, Angel Research

Actual 9,997 19.8 1,456

Estimate 9,829 20.6 1,487

Variation (%) 1.7 (76)bp (2.1)

Decent results

For 3QFY2012, Wipros IT services revenue came largely in-line with expectations at US$1,505.5mn, up 2.2% qoq, primarily led by pricing growth of 2.9% and 2.3% qoq (reported basis). In constant currency (CC) terms, pricing onsite and offshore grew by 4.3% and 3.6% qoq, respectively. Volume growth during the quarter was tepid at 1.8% qoq. Volume growth for the global IT business of the IT services segment came in at 1.8% qoq, led by 2.0% and 1.5% qoq growth in offshore and onsite volumes, respectively. In 3QFY2012, unfavorable cross-currency movement impacted Wipros IT services revenue by US$33mn, as USD appreciated against GBP, Euro and AUD on a qoq basis. In CC terms, the IT services segments revenue came in at US$1,539mn, up 4.5% qoq. In INR terms, revenue of the IT services segment came in at `7,608cr, up 11.4% qoq, aided by INR depreciation against USD.

January 20, 2012

Wipro | 3QFY2012 Result Update

Exhibit 3: Volume trend (Effort wise)

10 8 6

(%)

9.0

5.8 4.0 4.7 2.8 2.0 0.5 3QFY11 (0.4) 4QFY11 Onsite 0.2 1QFY12 2QFY12 Offshore 1.5 3QFY12

4 2 0 (2)

Source: Company, Angel Research

Exhibit 4: Pricing trend (Effort wise, CC basis)

6 4.3 4 2

(%)

2.5 3.6 0.9 0.4 (0.8) (1.7) (4.1) (1.2) (0.4)

0 (2) (4) (6) 3QFY11

4QFY11

1QFY12 Onsite Offshore

2QFY12

3QFY12

Source: Company, Angel Research

Service wise, Wipro witnessed modest revenue growth across almost all its services verticals. The companys anchor services line, business application services (contributed 30.8% to revenue) and application development and maintenance (ADM) (contributed 24.0% to revenue) posted 3.3% and 3.8% qoq growth in revenue, respectively. Other service verticals, R&D business, analytics and information management, product engineering and mobility and technology infrastructure services reported 3.1%, 2.7%, 2.6% and 0.4% qoq growth, respectively; however, the BPO segment again reported a qoq decline in its revenue during the quarter.

January 20, 2012

Wipro | 3QFY2012 Result Update

Exhibit 5: Revenue growth (Service wise)

Service verticals Technology infrastructure services Analytics and information management Business application services BPO Product engineering and mobility ADM R&D business Consulting

Source: Company, Angel Research

% to revenue 21.7 6.6 30.8 8.5 8.4 24.0 12.6 3.0

% growth (qoq) % growth (yoy) 0.4 2.7 3.3 (1.7) 2.6 3.8 3.1 (4.2) 13.1 25.0 15.8 2.6 11.8 7.1 4.4 7.0

Industry wise, Wipros growth was led by healthcare, life sciences and services (contributed 10.0% to revenue), which reported 6.9% qoq growth (CC terms). Revenue from the companys anchor vertical, financial services (contributed 27.3% to revenue), reported 4.6% qoq growth. Revenue from energy and utilities, manufacturing and hitech, global media and telecom, and retail and transportation grew by 1.7%, 4.2%, 4.8%, 5.4% and 1.7% qoq (CC terms), respectively. Management indicated that in the telecom industry, the equipment manufacturers space is still challenged in terms of IT spend; service providers are looking into new opportunities, which might kick in some amount of IT spending from the telecom industry.

Exhibit 6: Revenue growth (Service wise CC basis)

% to revenue Global media and telecom Financial solutions Manufacturing and hi-tech Healthcare, life sciences and services Retail and transportation Energy and utilities

Source: Company, Angel Research

% growth (qoq) 4.8 4.6 4.2 6.9 5.4 1.7

% growth (yoy) 5.6 13.1 7.5 10.5 9.5 52.0

15.4 27.3 19.0 10.0 14.9 13.4

Geography wise, Wipro reported revenue growth across all geographies to which it caters to. Revenue from India and Middle East and Japan posted whopping 10.9% and 9.6% qoq (CC terms) growth, respectively. Revenue from developed geographies America and Europe grew by 4.0% and 2.7% qoq (CC terms), respectively.

January 20, 2012

Wipro | 3QFY2012 Result Update

Exhibit 7: Revenue growth (Geography wise, CC basis)

% to revenue America Europe Japan India and Middle East APAC and other emerging markets

Source: Company, Angel Research

% growth (qoq) 4.0 2.7 9.6 10.9 5.7

% growth (yoy) 8.5 12.2 (2.1) 31.4 41.0

52.5 28.2 1.3 9.1 8.9

Segmental performance

During the quarter, the IT services segments revenue came in at US$1,505.5mn, up 2.2% qoq, with global IT business being the major growth driver, posting 4.3% qoq growth. Revenue from India and Middle East business and BPO came in at US$236mn and US$128mn, down 5.0% and 1.2% qoq, respectively.

Exhibit 8: IT services Revenue growth (qoq)

16 12 8

(%)

14.1 9.8 5.6 7.7 2.7 0.2 4.2 2.3 0.5 4QFY11 1QFY12 (4.6) (4.4) Global IT India and Middle East BPO (1.0) 2QFY12 7.5 4.7 4.6 4.3 2.2 (1.2) 3QFY12 (5.0) IT services

4.5 4 0

3QFY11 (4) (8)

Source: Company, Angel Research

Exhibit 9: Global IT services revenue trend

7 6 5

(%)

6.0 5.6

4.2 4.6 1.9 1.8 0.5 2.2

4 3 2 1 0 3QFY11 4QFY11 1QFY12 1.5

1.8

2QFY12

3QFY12

Global IT volume growth

Source: Company, Angel Research

IT services revenue growth (in USD)

January 20, 2012

Wipro | 3QFY2012 Result Update

The IT products segment reported merely 2.4% yoy growth in revenue to `900cr during the quarter. The consumer care and lighting segment posted 26.4% yoy growth in revenue to `879cr, with brands like Yardley, Santoor and Chandrika bolstering growth. In the lighting business, Wipro is gaining traction in its eco-energy business, which involves managing energy through use of renewable products.

Exhibit 10: IT products Revenue growth (yoy)

1,200 20.9 1,100 15 1,000

(` cr)

25

1,006 879 911 2.3

1,001 2.4 900 (6.4)

(%) (%)

900 800 700 (13.1) 600 3QFY11

(5)

(15) 4QFY11 IT products 1QFY12 2QFY12 yoy growth (%) 3QFY12

Source: Company, Angel Research

Exhibit 11: Consumer care and lighting Revenue growth (yoy)

900 850 800

(` cr)

29 879 26.4 800 21.0 695 724 19.1 17.6 755 20.3 27 25 23 21 19 17 15 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12 Consumer care and lightening yoy growth (%)

750 700 650 600 550 500

Source: Company, Angel Research

On a consolidated level, Wipros revenue came in at `9,997cr, up 9.9% qoq.

Hiring and utilization

Net additions during the quarter were strong at 5,004 employees, taking the companys total employee base to 136,734. Voluntary attritions (annualized) in global IT declined significantly to 14.2% in 3QFY2012 from 18.5% in 2QFY2012. Also, attrition rate (quarterly) in BPO declined to 13.9% in 3QFY2012 from 14.1% in 2QFY2012.

January 20, 2012

Wipro | 3QFY2012 Result Update

Exhibit 12: Employee pyramid

Employee pyramid Utilization Global IT (%) Attrition (%) Global IT BPO Net additions

Source: Company, Angel Research

3QFY11 68.6 21.7 14.2 3,591

4QFY11 68.9 20.9 15.5 2,894

1QFY12 69.7 23.2 15.3 4,105

2QFY12 69.3 18.5 14.1 5,240

3QFY12 67.1 14.2 13.9 5,004

Utilization rate of the global IT business decreased by 220bp qoq to 67.1%. As per management, of the total hiring to be done in FY2012, 70% would be freshers, which in turn would not give utilization level much headroom to scale up from current levels in the next couple of quarters.

Margins enhance

EBIT margin for IT services increased by 83bp qoq to 20.8% due to a steep qoq INR depreciation against USD. EBIT margin for the consumer care and lighting segment, which was showing a declining trend since 1QFY2011, finally rebounded during the quarter and grew by 87bp qoq to 11.9%. EBIT margin of the IT products business also increased by 77bp qoq to 5.3%. On a consolidated level, Wipros EBITDA and EBIT margins expanded by 72bp and 88bp qoq to 19.8% and 17.2%, respectively.

Exhibit 13: Segment-wise EBIT margin trend

25 20 15

(%)

22.2 18.3 12.3

22.1

22.0 20.0 17.8 17.5 11.9 16.4 11.0

20.8 17.2 11.9 5.3

12.0

10 5 0 3QFY11 IT services 4QFY11 IT products 1QFY12 2QFY12 3QFY12 Consolidated 4.6 3.6 4.2 4.5

Consumer care and lightening

Source: Company, Angel Research

Client pyramid

Wipro added 39 new clients in 3QFY2012, with its active client base standing at 953. The companys client pyramid witnessed qualitative improvement, with one client getting added in the US$100mn plus revenue bracket and two clients in the US$20mn-50mn revenue bracket. Few clients from the US$1mn-3mn revenue bracket moved to the higher revenue brackets.

January 20, 2012

Wipro | 3QFY2012 Result Update

Exhibit 14: Client metrics

Particulars US$100mn plus US$75mn$100mn US$50mn$75mn US$20mn$50mn US$10mn$20mn US$5mn$10mn US$3mn$5mn US$1mn$3mn New clients Active customers

Source: Company, Angel Research

3QFY11 1 9 11 43 49 63 78 179 36 880

4QFY11 3 9 10 46 49 63 75 174 68 904

1QFY12 4 8 12 45 49 77 63 180 49 937

2QFY12 5 8 11 46 50 72 75 195 44 930

3QFY12 6 8 11 48 48 76 87 178 39 953

Outlook and valuation

Management has given a decent revenue guidance of US$1.52bn-1.55bn for 4QFY2012 for the IT services segment, with qoq growth of 1-2%, which is slightly better than one of its peers, Infosys. Also, management maintained that the company will take another 1-2 quarters to grow at rates comparable to its peers. This implies poor annual growth for FY2012. Thus, we expect revenue CAGR for IT services (USD terms) to be muted at 12.8% over FY2011-13E, underperforming not only tier-I IT companies but also tier-II IT companies such as Hexaware Technologies, Mahindra Satyam and MindTree. At the operating front, Wipro has limited tailwinds and headwinds such as wage inflation, integration impact of SAIC (lower EBIT margin at 13.5%) and moderate volume growth, which are expected to pull down margins. Utilization, the companys margin lever, is expected to be partially capped as the company targets to have ~70% of its gross hires as freshers. Also, the company plans to continue making investments in S&M. Thus, we expect EBIT margin of the IT services segment to slide down to 21.1% in FY2012 and 20.8% for FY2013. Also, the ~400bp increase in effective tax rate is expected to mar the companys net profitability further, and we expect a 14.0% CAGR in PAT over FY2011-13E. Thus, we value the company at 15.3x FY2013E EPS (15% discount to Infosys) of `27.8, which gives us a target price of `425. We maintain our Neutral recommendation on the stock.

Exhibit 15: Key assumptions

FY2012 Revenue growth IT services (USD) USD-INR rate (realized) Revenue growth Consolidated (`) EBITDA margin (%) Tax rate (%) EPS growth (%)

Source: Company, Angel Research

FY2013 12.2 50.0 15.6 19.7 20.0 13.1

13.5 48.4 22.2 19.8 19.1 6.4

January 20, 2012

Wipro | 3QFY2012 Result Update

Exhibit 16: Change in estimates

FY2012E Parameter (` cr) Net revenue EBITDA Other income PBT Tax PAT Earlier estimates 37,495 7,552 395 6,972 1,304 5,656 Revised estimates 38,004 7,521 476 7,018 1,342 5,656 Variation (%) 1.4 (0.4) 20.5 0.7 2.9 (0.0) Earlier estimates 42,338 8,498 1,130 8,566 1,713 6,836 FY2013E Revised estimates 43,949 8,661 973 8,533 1,707 6,810 Variation (%) 3.8 1.9 (13.9) (0.4) (0.4) (0.4)

Source: Company, Angel Research

Exhibit 17: One-year forward PE chart

950 800 650

(`)

500 350 200 50

Oct-06

Oct-07

Oct-08

Oct-09

Oct-10

Price

Source: Company, Angel Research

34x

28x

21x

14x

Exhibit 18: Recommendation summary

Company HCL Tech Hexaware Infosys Infotech Enterprises KPIT Cummins Mahindra Satyam MindTree Mphasis NIIT Persistent TCS Tech Mahindra Wipro Reco. Buy Buy Buy Neutral Accumulate Buy Accumulate Accumulate Buy Neutral Buy Accumulate Neutral CMP (`) 417 80 2,584 135 143 71 445 345 44 316 1,079 602 414 Tgt. price (`) 520 96 3,047 134 163 82 502 368 55 324 1,262 666 Upside (%) 24.6 20.3 17.9 (0.7) 13.7 15.5 12.8 6.6 26.4 2.5 17.0 10.6 Target P/E (x) 13.0 11.0 18.0 8.5 10.0 11.0 10.0 11.5 6.5 9.0 19.5 9.0 15.3 FY2013E EBITDA (%) 17.5 18.7 32.0 16.0 15.4 14.8 14.7 16.6 16.4 22.4 29.9 16.8 19.7 FY2013E P/E (x) 10.4 9.2 15.3 8.6 8.8 9.6 8.9 9.4 5.2 9.3 16.7 7.2 14.9 FY2011-13E EPS CAGR (%) 22.1 74.1 18.9 11.9 19.9 33.0 42.1 (3.1) 22.7 (1.1) 20.6 29.9 13.1 FY2013E RoCE (%) 20.9 21.4 25.8 16.1 19.5 11.7 20.3 14.0 12.5 20.0 32.1 14.6 15.3 FY2013E RoE (%) 23.1 19.8 23.8 13.0 16.9 13.8 17.4 14.2 18.2 14.0 33.3 20.0 20.5

Source: Company, Angel Research

January 20, 2012

Oct-11

7x

Apr-06

Apr-07

Apr-08

Apr-09

Apr-10

Apr-11

Wipro | 3QFY2012 Result Update

Profit & Loss account (Consolidated, IFRS)

Y/E March (` cr) Net revenue Cost of revenues Gross profit % of net sales Selling and mktg exp. % of net sales General and admin exp. % of net sales Depreciation and amortization % of net sales EBIT % of net sales Other income, net Share in profits of eq. acc. ass. Profit before tax Provision for tax % of PBT PAT Share in earnings of associate Minority interest Adj. PAT Diluted EPS (`)

Note: *Adjusted for 2:3 bonus

FY2009* 25,534 18,022 7,512 29.4 1,737 6.8 1,445 5.7 695 2.7 4,330 17.0 123 36.2 4,490 604 13.4 3,886 10 3,876 15.9

FY2010* 27,124 18,630 8,494 31.3 1,861 6.9 1,482 5.5 783 2.9 5,151 19.0 337 53 5,541 929 16.8 4,612 18 4,594 18.9

FY2011 31,099 21,285 9,814 31.6 2,218 7.1 1,829 5.9 821 2.6 5,767 18.5 472 64.8 6,303 971 15.4 5,332 35 5,297 21.7

FY2012E 38,004 26,701 11,303 29.7 2,781 7.3 2,027 5.3 1,026 2.7 6,495 17.1 476 46.6 7,018 1,342 19.1 5,675 19 5,656 23.1

FY2013E 43,949 30,785 13,165 30.0 3,271 7.4 2,389 5.4 1,156 2.6 7,504 17.1 973 56 8,533 1,707 20.0 6,826 16 6,810 27.8

January 20, 2012

10

Wipro | 3QFY2012 Result Update

Balance sheet (Consolidated, IFRS)

Y/E March ( cr) Assets Goodwill Intangible assets Property, plant & equipment Invstment in equ. acc. investees Derivative assets Non-current tax assets Deferred tax assets Other non-current assets Total non-current assets Inventories Trade receivables Other current assets Unbilled revenues Available for sale investments Current tax assets Derivative assets Cash and cash equivalents Total current assets Total assets Equity Share capital Share premium Retained earnings Share based payment reserve Other components of equity Shares held by controlled trust Equity attrib. to shareholders of Co. Minority interest Total equity Liabilities Long term loans and borrowings Deferred tax liability Derivative liabilities Non-current tax liability Other non-current liabilities Provisions Total non-current liabilities Loans and bank overdraft Trade payables Unearned revenues Current tax liabilities Derivative liabilities Other current liabilities Provisions Total current liabilities Total liabilities Total equity and liabilities

Note: *Adjusted for 2:3 bonus

FY2009* FY2010* FY2011 FY2012E FY2013E 5,614 349 4,979 167 437 808 12,355 759 4,865 1,494 1,411 1,654 983 4,912 16,078 28,433 293 2,728 12,665 375 (1,292) (54) 14,714 24 14,738 1,968 47 311 877 167 3370.2 3,721 4,165 873 649 326 590 10,324 13,695 28,433 5,380 401 5,346 235 120 346 169 878 12,875 793 5,093 2,111 1,671 3,042 660 262 6,488 20,118 32,993 294 2,919 16,579 314 (440) (54) 19,611 44 19,655 1,811 38 288 307 323 10 2776.7 4,440 3,875 746 485 138 650 227 10,561 13,338 32,993 5,482 355 5,509 299 298 924 147 898 13,913 971 6,163 1,974 2,415 4,928 496 171 6,114 23,231 37,144 491 3,012 20,325 136 58 (54) 23,968 69 24,037 1,976 30 259 502 271 8 3045.3 3,304 4,405 660 734 136 591 232 10,062 13,107 37,144 6,050 500 5,484 400 440 1,161 250 1,200 15,484 1,197 8,017 2,857 2,603 6,093 692 210 4,985 26,654 42,139 491 3,100 24,258 80 50 (54) 27,925 70 27,995 2,025 50 290 580 330 12 3287 3,691 5,121 600 650 100 545 150 10,857 14,144 42,139 6,050 500 5,327 400 500 1,188 300 1,400 15,666 1,325 8,790 2,509 2,890 9,293 780 247 7,603 33,436 49,102 491 3,150 29,346 100 60 (54) 33,093 80 33,173 2,025 70 350 700 400 16 3561 3,978 5,904 700 765 105 700 216 12,368 15,929 49,102

January 20, 2012

11

Wipro | 3QFY2012 Result Update

Cash flow statement (Consolidated, IFRS)

Y/E March (` cr) Pre tax profit from operations Depreciation Expenses (deferred)/written off Pre tax cash from operations Other income/prior period ad Net cash from operations Tax Cash profits (Inc)/dec in current assets Inc/(dec) in current liab. Net trade working capital Cashflow from oper. actv. (Inc)/dec in fixed assets (Inc)/dec in intangibles (Inc)/dec in investments (Inc)/dec in net def. tax assets (Inc)/dec in derivative assets (Inc)/dec in non-current tax asset (Inc)/dec in minority interest Inc/(dec) in other non-current liab (Inc)/dec in other non-current ast. Cashflow from investing activities Inc/(dec) in debt Inc/(dec) in equity/premium Dividends Cashflow from financing activities Cash generated/(utilised) Cash at start of the year Cash at end of the year

Note: *Adjusted for 2:3 bonus

FY2009* 4,366 695 (10) 5,051 123 5,174 (604) 4,571 (3,510) 1,633 (1,877) 2,694 (1,726) (1,514) (162) (437) 12 1,128 730 (1,969) 1,968 (1,023) (686) 260 985 3,927 4,912

FY2010* FY2011 5,204 783 (18) 5,969 337 6,306 (929) 5,377 (1,076) 237 (840) 4,537 (1,150) 182 (1,455) 268 (120) (346) 20 (436) (70) (3,107) (157) 982 (679) 146 1,576 4,912 6,488 5,832 821 (35) 6,618 472 7,090 (971) 6,119 (1,601) (499) (2,101) 4,018 (985) (56) (1,951) 22 (178) (578) 25 103 (20) (3,616) 165 617 (1,558) (775) (374) 6,488 6,114

FY2012E 6,542 1,026 (19) 7,548 476 8,024 (1,342) 6,682 (3,388) 795 (2,593) 4,089 (1,000) (713) (1,265) (103) (142) (237) 1 193 (302) (3,568) 49 24 (1,723) (1,650) (1,129) 6,114 4,985

FY2013E 7,560 1,156 (16) 8,701 973 9,673 (1,707) 7,967 (963) 1,511 548 8,515 (1,000) (3,200) (50) (60) (28) 10 274 (200) (4,254) 80 (1,723) (1,643) 2,618 4,985 7,603

January 20, 2012

12

Wipro | 3QFY2012 Result Update

Key Ratios

Y/E March Valuation ratio(x) P/E (on FDEPS) P/CEPS P/BVPS Dividend yield (%) EV/Sales EV/EBITDA EV/Total assets Per share data (`) EPS (Fully diluted) Cash EPS Dividend Book value DuPont analysis Tax retention ratio (PAT/PBT) Cost of debt (PBT/EBIT) EBIT margin (EBIT/Sales) Asset turnover ratio (Sales/Assets) Leverage ratio (Assets/Equity) Operating ROE Return ratios (%) RoCE (pre-tax) Angel RoIC RoE Turnover ratios (x) Asset turnover(fixed assets) Receivables days Payable days

Note: *Adjusted for 2:3 bonus

FY2009* 26.0 11.1 6.2 1.0 3.8 19.3 3.4 15.9 37.3 4.0 67.0 0.9 6.5 0.0 0.9 1.9 26.4 15.2 26.6 26.3 1.0 64 71

FY2010* 21.9 9.3 4.6 1.0 3.5 15.8 2.8 18.9 44.3 4.0 89.3 0.8 7.1 0.0 0.8 1.7 23.5 15.6 28.5 23.4 0.9 67 79

FY2011 19.1 9.2 4.2 1.5 3.0 14.0 2.5 21.7 45.1 6.0 98.0 0.8 7.7 0.0 0.8 1.5 22.2 15.5 28.0 22.0 0.9 66 71

FY2012E 17.9 8.4 3.6 1.5 2.4 12.3 2.2 23.1 49.5 6.0 114.1 0.8 6.8 0.0 0.9 1.5 20.3 15.4 26.0 20.2 1.0 68 65

FY2013E 14.9 7.1 3.1 1.5 2.0 10.0 1.8 27.8 58.3 6.0 135.2 0.8 7.4 0.0 0.9 1.5 20.6 15.3 28.7 20.5 1.0 70 65

January 20, 2012

13

Wipro | 3QFY2012 Result Update

Research Team Tel: 022 - 3935 7800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

Wipro No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

January 20, 2012

14

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDokument4 SeitenRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNoch keine Bewertungen

- Technical & Derivative Analysis Weekly-14092013Dokument6 SeitenTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- WPIInflation August2013Dokument5 SeitenWPIInflation August2013Angel BrokingNoch keine Bewertungen

- Special Technical Report On NCDEX Oct SoyabeanDokument2 SeitenSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report November 12Dokument2 SeitenMetal and Energy Tech Report November 12Angel BrokingNoch keine Bewertungen

- International Commodities Evening Update September 16 2013Dokument3 SeitenInternational Commodities Evening Update September 16 2013Angel BrokingNoch keine Bewertungen

- Oilseeds and Edible Oil UpdateDokument9 SeitenOilseeds and Edible Oil UpdateAngel BrokingNoch keine Bewertungen

- Commodities Weekly Tracker 16th Sept 2013Dokument23 SeitenCommodities Weekly Tracker 16th Sept 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 8th JanDokument3 SeitenDerivatives Report 8th JanAngel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 14 2013Dokument2 SeitenDaily Agri Tech Report September 14 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 16 2013Dokument9 SeitenDaily Agri Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 16 2013Dokument2 SeitenDaily Agri Tech Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Metals and Energy Report September 16 2013Dokument6 SeitenDaily Metals and Energy Report September 16 2013Angel BrokingNoch keine Bewertungen

- Commodities Weekly Outlook 16-09-13 To 20-09-13Dokument6 SeitenCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNoch keine Bewertungen

- Currency Daily Report September 16 2013Dokument4 SeitenCurrency Daily Report September 16 2013Angel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Dokument4 SeitenDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNoch keine Bewertungen

- Technical Report 13.09.2013Dokument4 SeitenTechnical Report 13.09.2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 16 Sept 2013Dokument3 SeitenDerivatives Report 16 Sept 2013Angel BrokingNoch keine Bewertungen

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDokument1 SeitePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNoch keine Bewertungen

- Market Outlook 13-09-2013Dokument12 SeitenMarket Outlook 13-09-2013Angel BrokingNoch keine Bewertungen

- Sugar Update Sepetmber 2013Dokument7 SeitenSugar Update Sepetmber 2013Angel BrokingNoch keine Bewertungen

- IIP CPIDataReleaseDokument5 SeitenIIP CPIDataReleaseAngel BrokingNoch keine Bewertungen

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDokument6 SeitenTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNoch keine Bewertungen

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDokument4 SeitenJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNoch keine Bewertungen

- MetalSectorUpdate September2013Dokument10 SeitenMetalSectorUpdate September2013Angel BrokingNoch keine Bewertungen

- TechMahindra CompanyUpdateDokument4 SeitenTechMahindra CompanyUpdateAngel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report Sept 13Dokument2 SeitenMetal and Energy Tech Report Sept 13Angel BrokingNoch keine Bewertungen

- MarketStrategy September2013Dokument4 SeitenMarketStrategy September2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 06 2013Dokument2 SeitenDaily Agri Tech Report September 06 2013Angel BrokingNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Essays UOLs FIDokument34 SeitenEssays UOLs FIAnna KucherukNoch keine Bewertungen

- Invoice For Portable Toilets - Nuggets ParadeDokument1 SeiteInvoice For Portable Toilets - Nuggets Parade9newsNoch keine Bewertungen

- Exchange Rate in NigeriaDokument12 SeitenExchange Rate in NigeriaJoel ChineduNoch keine Bewertungen

- Idec 8301381772Dokument1 SeiteIdec 8301381772denny palimbungaNoch keine Bewertungen

- Assignment On MoneybhaiDokument7 SeitenAssignment On MoneybhaiKritibandhu SwainNoch keine Bewertungen

- Bpo 102 Part 1Dokument30 SeitenBpo 102 Part 1Mary Lynn Dela PeñaNoch keine Bewertungen

- Step 1 Step 2: Notice of AssessmentDokument1 SeiteStep 1 Step 2: Notice of Assessmentabinash manandharNoch keine Bewertungen

- Advanced AccountingDokument4 SeitenAdvanced Accountinggisela gilbertaNoch keine Bewertungen

- Additional Bank Recon QuestionsDokument4 SeitenAdditional Bank Recon QuestionsDebbie DebzNoch keine Bewertungen

- Risk Capital Management 31 Dec 2011Dokument181 SeitenRisk Capital Management 31 Dec 2011G117Noch keine Bewertungen

- BILTIR Fact Sheet 2019 PDFDokument2 SeitenBILTIR Fact Sheet 2019 PDFBernewsAdminNoch keine Bewertungen

- Business Balance Sheet TemplateDokument5 SeitenBusiness Balance Sheet TemplateAMIT PRAJAPATI100% (1)

- Citi Card Pay PDFDokument1 SeiteCiti Card Pay PDFShamim KhanNoch keine Bewertungen

- Model Asset and Liability Affidavit D. VDokument12 SeitenModel Asset and Liability Affidavit D. VsavagecommentorNoch keine Bewertungen

- Report in BM 222Dokument5 SeitenReport in BM 222Neil Dela Cruz AmmenNoch keine Bewertungen

- MBA 662 Financial Institutions and Investment ManagementDokument4 SeitenMBA 662 Financial Institutions and Investment ManagementAli MohammedNoch keine Bewertungen

- Bank Baroda Project.Dokument106 SeitenBank Baroda Project.Ketul SahuNoch keine Bewertungen

- Sherry Hunt Case - Team CDokument4 SeitenSherry Hunt Case - Team CMariano BonillaNoch keine Bewertungen

- Annexure-B: Format - Daily Margin Statement To Be Issued To Clients Client Code: Clientname: ExchangeDokument1 SeiteAnnexure-B: Format - Daily Margin Statement To Be Issued To Clients Client Code: Clientname: ExchangeenamsribdNoch keine Bewertungen

- Issues and Challenges of Insurance Industry in IndiaDokument3 SeitenIssues and Challenges of Insurance Industry in Indianishant b100% (1)

- Tax PresentationDokument40 SeitenTax PresentationAshrafulIslamNoch keine Bewertungen

- Company Name: Starting Date Cash Balance Alert MinimumDokument3 SeitenCompany Name: Starting Date Cash Balance Alert MinimumdantevariasNoch keine Bewertungen

- Receivable ManagementDokument39 SeitenReceivable ManagementIquesh Gupta100% (1)

- Closing America's Infrastructure Gap:: The Role of Public-Private PartnershDokument42 SeitenClosing America's Infrastructure Gap:: The Role of Public-Private PartnershrodrigobmmNoch keine Bewertungen

- International Trade and Finance (Derivatives)Dokument52 SeitenInternational Trade and Finance (Derivatives)NikhilChainani100% (1)

- FIN2004 - 2704 Week 2 SlidesDokument60 SeitenFIN2004 - 2704 Week 2 SlidesJalen GohNoch keine Bewertungen

- Bangladesh BankDokument35 SeitenBangladesh Bankihshourov60% (5)

- SECTION 4.1 Payment or PerformanceDokument6 SeitenSECTION 4.1 Payment or PerformanceMars TubalinalNoch keine Bewertungen

- Review Questions: by Kailashinie ThiranagamaDokument9 SeitenReview Questions: by Kailashinie ThiranagamarkailashinieNoch keine Bewertungen

- Houzit Pty LTD: 1st Quarter Ended Sept - 2012 Actual Results Budget Q1 Actual Q1 $ VarianceDokument4 SeitenHouzit Pty LTD: 1st Quarter Ended Sept - 2012 Actual Results Budget Q1 Actual Q1 $ VarianceHamza Anees100% (1)