Beruflich Dokumente

Kultur Dokumente

Article On HRA

Hochgeladen von

takne_007Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Article On HRA

Hochgeladen von

takne_007Copyright:

Verfügbare Formate

Invest | power

HYDERABAD SUNDAY 22 | JANUARY 2012 PHILLIP FISHER ROBERT G. ALLEN

PAGE

The stock market is filled with people who know the price of everything, but the value of nothing

How many do you know who have become rich by investing in savings accounts? I rest my case

MONEY

G-Securities are the safest

Melwyn O. Rego is the executive director IDBI Bank Ltd. Prior to this, he served as the CEO and MD of IDBI Homefinance Ltd. The bank has recently launched the sale of Government of India securities the safest investment option on its webportal. Mr Rego speaks to Olga Tellis to explain why an investor need to have government securities in his investment basket. Q Bonds are generally safe instruments. So what makes the government, securities (G-Sec) that you are selling through the IDBI Samriddhi G-Sec Portal special? If you evaluate the various investment opportunities you will find G-Sec totally safe because the government just cannot default ever on its bonds in any country. Another aspect is that it gives good returns on long maturity investments of about 10 years. All you need to have is a demat account and access to the internet. Q So, who would GSecs benefit? It would appeal to those who want decent returns in the long term. For example, if you look at it from the reward/risk point of view, there is zero-risk and good returns. The minimum investment level is `10,000. You can invest for 20 or 30 years. While you get your principal back at the end of tenure, the interest would be deposited in your Demat account every six months. The investor would have an option to reinvest the interest money in G-Sec. Q What is the rate of interest offered for GSecs? It depends on the tenure of the bond. But at an annualised rate, it comes to 9-10 per cent for a 30-year bond. We call it an SLR, which stands for safety, liquidity and returns. The government bonds are the most liquid and 100 per cent safe. Bank deposits are safe but they are for shorter duration. There is no other instrument that offers risk-free investment for over 10 years. Q What happens if the investor needs money urgently, does he have to sell his bonds? No. If he needs the money, we can give him an overdraft facility for the short term. Q What is the process of investing through the IDBI portal? You have to go to the Melwyn O. Rego IDBI Samriddhi G-Sec portal and put in your transaction and the next day you can make your payment through either an internal transfer, if you have a savings account with IDBI Bank, or through the RTGS or through NEFT. You will get your bonds in your Demat account the next day. There is not a single days delay even with the six-monthly interest payment. Q How are government securities different from corporate bonds? In the case of corporate bonds, you are not assured of the safety. Liquidty is very little, though the returns are higher than the government bonds because of the risks involved. Corporate paper usually has a tenure of just five years. In G-Secs, there is no tax deduction at source and so a person can do his tax planning independently. This facility is not available on any other instrument. Besides, there is also a nomination facility. Q How was the response to your G-Secs portal from investors? Our first customer interestingly was a software engineer from the small town of Vadakancherry in Trichur district in Tamil Nadu. Though it speaks of the response that we got, the bank plans to use its nearly 1,000 branches to spread awareness about these bonds. Around 200 people from investor associations from have attended our camp in Mumbai and this will have a multiplier effect. Our portal will play a key role in mobilising retail savings for government bonds. The RBI has been urging banks to have a portal to sell government bonds to retail investors and IDBI Bank decided to be the first to do so. In India, there is a huge scope in G-Sec market as the participation of retail investors in GSec market either directly or through mutual funds is very minimal.

MACRO QUOTE

Equity investors should scale down their expectations on returns

K.C. Chakrabarty, RBI deputy governor

news you can use

HRA puzzle

YOU LIVE IN YOUR OWN HOUSE:

You have taken a home loan and residing in the house purchased with it. Since you are residing in your own house, you will not be able to claim HRA. However, you will be able to claim tax benefits on both, the principal and interest repaid on the home loan.

Solving

By Adhil Shetty

Money talk

YOU HAVE A HOUSE WHICH IS READY FOR OCCUPATION BUT YOU CANT RESIDE IN IT:

You have bought a house in Delhi taking a home loan and now you arent residing in it but are living in a rented apartment in the same city for genuine reasons the house that you have bought is far away from your office. In such cases, the Income-Tax Act permits the individual to claim HRA and home loan benefits, which includes both principal and interest repaid on the home loan. Also, please note that if your house remains vacant, then you will still need to pay tax on a notional rent income.

INVESTORS RUSH TO EQUITY LINKED SAVINGS PLANS

The introduction of the Direct Taxes Code from next year will, among other things, end the tax-saving provisions of several instruments, such as Ulips and equity linked savings schemes (ELSS). This is making many investors rush to ELSS funds this year. They are also encouraged by the fact that the markets are at attractively low levels and are poised to give good returns over the next two to three years. ELSS funds are said to work well because the funds are locked for three years at least and the manager thus has the comfort of knowing that he can invest for the long term. This does not always workthe last year or so has been among the worst in recent memory. But the tax incentive is a big bonus, so fund managers are bracing for a good influx of money in the next few weeks.

Income-Tax Act allows claiming HRA and home loan deductions

jit Kumar is a salaried person, who stays in a rented apartment in Mumbai. But he has bought himself a property in Chennai, which is partly funded by a home loan. He finds himself in a dilemma while filing tax returns as to whether he can claim both HRA and home loan benefits. This seems to be a confusing factor for many tax payers, who have invested in a property but do not live in it and instead live in a rented property. When Ajit pays rent, under the Income-Tax Act, he is definitely allowed to claim both HRA and home loan benefits (interest payment and principal repayment). Let us evaluate various possible situations an individual can find himself in and understand what the Income-Tax Act permits him to do.

YOU OWN A HOUSE IN ANOTHER CITY:

This situation was the one faced by Ajit. He stays in Mumbai but had bought an apartment in Chennai with the help of a home loan. Ajit will be entitled to HRA exemption and tax benefits on both, the principal and interest repaid on the home loan.

REALTY BUYERS LIKELY TO GET GOOD DEALS

The crunch faced by builders and developers is finally beginning to bite. For months, even while liquidity was becoming tight and buyers were staying away, builders, especially the big ones held on to their rates, refusing to lower them. Buyers too were nervous about the high interest rates. Now things are easing up. Dont expect outright discounts, but when you are ready to commit you might get a few freebies such as free or discounted parking. It depends from city to city, but in hot markets like the national capital region and Mumbai, where built up inventory has shot up, good deals are now possible.

YOUR HOUSE CANNOT BE OCCUPIED AT THIS POINT:

You have bought a house in Mumbai taking a home loan and you are currently living in the same city in a rented apartment because the house is under construction. In such a case, you are eligible to claim HRA. In the case of tax breaks on the home loan, you can claim tax benefits only for your principal before the completion of your house. Once your house is completed, you can claim tax benefits on the total interest paid up to the date of completion in five equal instalments in five years beginning from the year of completion.

YOU HAVE RENTED YOUR HOUSE AND STAYING IN A RENTED HOUSE:

You took a home loan and your house is now ready for occupation. You have rented the same out while you reside in a rented house. The Income-Tax Act allows you to claim both HRA and home loan benefits. However, in such a case, since you are the recipient of rent because you have let out your own house, that income is taxable at your hands.

The Income-Tax Act treats HRA and home loan deductions under separate sections independently. The two are not interconnected to each other. HRA is dealt with in section 10(13A) Rule 2A while home loans are entitled for tax benefits under section 80C (tax benefit on principal repayment) and Section 24 (tax benefit on interest payment) of the Income Tax Act. Hence, figure out where you stand to avail both tax benefits accordingly.

HOUSE RENT ALLOWANCE CALCULATION

House Rent Allowance (HRA) is given by the employer to the employee to meet the expenses in connection with rent of the accommodation. HRA is exempt under Section 10(13A) to the extent of the minimum of the following three amounts : Actual house rent allowance received by the employee Excess of rent paid for the accommodation occupied by him over 10 per cent of the salary. 50 per cent of salary, where the taxpayer stays in Mumbai, Calkata, Delhi or Chennai and 40 per cent of the salary, if the taxpayer resides at any other place.

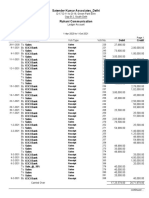

FIXED DEPOSIT INTEREST RATES (UP TO `15 LAKH AS ON OCTOBER 20, 2011)

BANKS 6 MONTHS - < 1 YR 1 < 2 YEAR 2 < 3 YEAR 3 < 5 YEAR 5 YEARS & ABOVE

Corporation Bank IDBI Bank OBC Union Bank of India Central Bank of India Axis Bank Dhanlaxmi Bank Canara Bank Dena Bank Bank of India Syndicate Bank Vijaya Bank Indian Overseas Bank Kotak Mahindra Bank HDFC Bank State Bank of India The Federal Bank ICICI Bank Bank of Baroda Bank of Maharashtra DCB IndusInd Bank

9.25% 9.00% - 9.25% 9.00% 8.60-8.75% 8.50% 7.50% 8.50% 8.10% 8.00% 8.00% 8.00% - 9.55% 8.00% 8.00% - 8.50% 7.75% - 9.00% 7.25% - 8.00% 7.00% - 7.75% 7.00% - 9.50% 7.00% - 7.75% 7.00% - 7.75% 7.00% - 8.80% 6.75% 6.50% - 8.50%

9.5% - 9.65% 9.25% - 9.50% 9.75% 9.25% 9.25% - 9.30% 9.30% - 9.40% 8.75% - 9.75% 9.25% 9.50% - 9.60% 9.00% - 9.25% 9.35% 9.25% 9.50% 9.40% - 9.50% 7.25% - 9.25% 9.25% 9.50%-9.75% 8.25% - 9.25% 9.25% - 9.35% 9.30% 8.00% - 10.00% 9.00% - 9.50%

9.25% 9.50% 9.25% 9.25% 9.30% 9.30% 8.75% - 9.00% 9.25% 9.50% 9.00% 9.35% 9.35% 9.25% 9.25% 8.50% - 9.25% 9.25% 9.50% 8.50% - 9.25% 9.25% 9.30% 8.00% - 9.50% 8.75% - 9.50%

9.25% 9.50% 9.25% 9.25% 9.25% 8.50% 8.75% - 10.10% 9.25% 9.30% 8.50% - 9.00% 9.25% 9.00% 9.25% 9.25% 8.25% - 8.50% 9.25% 9.25% 8.75% 9.00% 9.00% - 9.35% 8.00% - 9.30% 8.75%

9.00% - 9.25% 9.50% 9.25% 8.50% - 9.40% 9.09% 8.50% 9.00% - 10.10% 9.00% 8.75% 8.75% 9.25% 8.75% 9.00% 9.25% 8.25% 9.25% 9.25% 8.75% 8.50% 9.00% 8.00% - 9.30% 8.75%

CELEB TAKE: HANSIKA MOTWANI

I prefer long-term investments only

Hansika Motwani is a seasoned actress. She has worked in Hindi, Tamil, Telugu and Kannada films. Q Are you a big investor? Where do you invest? I began to earn from the age of 10 and I have been a professional investor. I would like to stay invested in gold, properties and mutual funds. Q Who advises you on your investment strategy? I want to safeguard each paisa that I earn. So I seek the help of my mother as well as investment experts. Q What is the investment mantra you follow? I believe in long-term investments of 10 years and above and also prefer quick liquidity in cash investments. Q Do you prefer fixed deposits, property, mutual funds or something else? Of course I invest a small portion of my money in fixed deposits and equities for the sake of liquidity. Q Would you define yourself as a conservative or a risk taker? I am a conservative investor as I dislike taking risks. Q How often do you track business news, stocks and financial newspapers? Frankly, I dont have the time to browse newspapers and channels. So my mother, who is a doctor, helps me out along with investment bankers.

Source : Apna Paisa Research Bureau

Opt for individual health cover, not family floater

I owe `1.5 lakh towards a personal loan and a credit card. Because of this, banks are refusing to sanction a home loan to buy a flat. Please suggest how to manage my dues and avail the housing loan. If you have an overdue amount of `1.5 lakh on your existing personal loans and credit card, you will find it difficult to get a home loan from anybody. If this amount is just an outstanding and you are regular in paying your instalments, then you get a loan, but it will be reduced to that extent. If I am already paying fees to the institute, can I get an education loan from any bank? This is possible only by the way of refinancing within one months time. However, you can check with your bank regarding the terms of refinancing. What is the ideal health insurance coverage? The sum assured can be decided based on the number of family members that you want to cover under the policy and their age. You need to estimate the cost that you expect on the treatment in case of any hospitalisation and also the amount of premium that you are willing to pay. While calculating the cost of hospitalisation, you should keep in my mind the city you are staying in the hospital you would like the that you should preferably go in for individual cover for each family member and not a family floater. What should be the basis for selecting the policy term for life insurance? Should it be till ones retirement or earning age? The term for life insurance policy should be till earning age. Obviously, if you are very young (say 25 years old) and if your retirement age is 65 years, then you may opt for the maximum available tenure as a 40-year policy tenure may not be available. You can buy another policy with a higher tenure after a few years to cover the leftover years.

Q&A

Harsh Roongta

treatment to happen in and various other factors. Given the rise in hospitalisation costs, it is essential to have a cover of at least `3 lakh for each member in the family. My advice is

Last year, I had purchased a life insurance policy. Recently, I approached the insurer for a loan against it. But I was told that the policy is not eligible for loan until three premiums are paid. Can I pay two premiums in advance and become eligible for the loan? Most policies do not acquire a surrender value till they have completed three years (even if the premiums are paid in advance). So the answer to the question is no. You are not likely to get a loan on a one-year-old policy, even if you pay the premiums in advance. Secondly, pure insurance (term insurance) has no

surrender value and hence a loan against a term policy is not possible. Thirdly, banks lend only around 40-50 per cent of the value of an equity fund (in a Ulip) and even for that the specific fund needs to be approved by the bank. Most banks would normally approve the equity funds of their own groups insurance company. Fourthly unless the first years premium has appreciated dramatically I cant see the rationale of taking a loan when you have the ability to pay two more premiums in advance. Harsh Roongta is the CEO of Apnapaisa.com. Y ou can send in your queries to movingmoney@deccanmail.com

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Sffli®: IlftsfDokument136 SeitenSffli®: Ilftsftakne_007Noch keine Bewertungen

- Qdoc - Tips - Sankaran Element of HomeopathyDokument546 SeitenQdoc - Tips - Sankaran Element of Homeopathytakne_007Noch keine Bewertungen

- A Case OF Cervical Spine InjuryDokument127 SeitenA Case OF Cervical Spine Injurytakne_007Noch keine Bewertungen

- Repertorization of The Totality of The SymptomsDokument3 SeitenRepertorization of The Totality of The Symptomstakne_007Noch keine Bewertungen

- Messages To AspirantsDokument123 SeitenMessages To Aspirantstakne_007Noch keine Bewertungen

- Venous Ulcer and Stasis Dermatitis Case SeriesDokument11 SeitenVenous Ulcer and Stasis Dermatitis Case Seriestakne_007Noch keine Bewertungen

- Nature: The " Electronic Reactions of Abrams."Dokument2 SeitenNature: The " Electronic Reactions of Abrams."takne_007Noch keine Bewertungen

- Mahatma Letters Volume IDokument213 SeitenMahatma Letters Volume Itakne_007Noch keine Bewertungen

- Chelidonim VS NuxvomDokument3 SeitenChelidonim VS Nuxvomtakne_007Noch keine Bewertungen

- StaphylococcinumDokument11 SeitenStaphylococcinumtakne_007Noch keine Bewertungen

- AyurvedaDokument67 SeitenAyurvedatakne_007Noch keine Bewertungen

- Advanced Case Taking in HomeopathyDokument11 SeitenAdvanced Case Taking in Homeopathytakne_007Noch keine Bewertungen

- Ayurvedamlo Sulabha Chickitsalu by DR GV PurnachanduDokument119 SeitenAyurvedamlo Sulabha Chickitsalu by DR GV Purnachandutakne_007Noch keine Bewertungen

- Quarterly Homoeopathic Digest Vol - Iii No - 3 September 1986 1. 2. 3Dokument17 SeitenQuarterly Homoeopathic Digest Vol - Iii No - 3 September 1986 1. 2. 3takne_007Noch keine Bewertungen

- Elia Kim - Organon OutlineDokument16 SeitenElia Kim - Organon Outlinetakne_007Noch keine Bewertungen

- Quarterly Homoeopathic DigestDokument15 SeitenQuarterly Homoeopathic Digesttakne_007Noch keine Bewertungen

- How Can Healthier Children Be BornDokument9 SeitenHow Can Healthier Children Be Borntakne_007Noch keine Bewertungen

- Dunham Taking The CaseDokument18 SeitenDunham Taking The Casetakne_007Noch keine Bewertungen

- Lung Exam DetailsDokument3 SeitenLung Exam Detailsdidutza91Noch keine Bewertungen

- Quarterly Homeopathic JournalDokument16 SeitenQuarterly Homeopathic Journaltakne_007100% (1)

- Registration1 PDFDokument1 SeiteRegistration1 PDFtakne_007Noch keine Bewertungen

- Geukens A. - 5000 Repertory Additions For SynthesisDokument9 SeitenGeukens A. - 5000 Repertory Additions For Synthesistakne_007Noch keine Bewertungen

- RADAR 10.x Update To 10.0.012Dokument6 SeitenRADAR 10.x Update To 10.0.012takne_007Noch keine Bewertungen

- Occult Significance HypnosisDokument53 SeitenOccult Significance Hypnosispresttige100% (4)

- Bonsai For Part Shade: Japanese Cedar. This Conifer Has TightDokument2 SeitenBonsai For Part Shade: Japanese Cedar. This Conifer Has Tighttakne_007Noch keine Bewertungen

- Mcgee-Vodou and Voodoo in SR PDFDokument28 SeitenMcgee-Vodou and Voodoo in SR PDFtakne_007Noch keine Bewertungen

- Ayurveda Panchakarma Keraleeya Panchakarmapdf PDFDokument9 SeitenAyurveda Panchakarma Keraleeya Panchakarmapdf PDFtakne_007Noch keine Bewertungen

- Bonsai by Brent WaltsonDokument5 SeitenBonsai by Brent WaltsonartlinefoxNoch keine Bewertungen

- Bonsai Winter Care in New EnglandDokument2 SeitenBonsai Winter Care in New Englandtakne_007Noch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Risk Latte - RAROC of A Corporate Loan - "Back of The Envelope" CalculationsDokument3 SeitenRisk Latte - RAROC of A Corporate Loan - "Back of The Envelope" CalculationsAshley JomyNoch keine Bewertungen

- HRM Strategies of SCBDokument52 SeitenHRM Strategies of SCBajish808Noch keine Bewertungen

- Monetary Policy & Its ImpactDokument23 SeitenMonetary Policy & Its ImpactHrishikesh DargeNoch keine Bewertungen

- Ferro Scrap Nigam LimitedDokument46 SeitenFerro Scrap Nigam LimitedIyyappadasan SubramanianNoch keine Bewertungen

- Solution Manual Financial Institution Management 3rd Edition by Helen Lange SLM1085Dokument8 SeitenSolution Manual Financial Institution Management 3rd Edition by Helen Lange SLM1085thar adelei100% (1)

- Retail Banking: by Prof Santosh KumarDokument30 SeitenRetail Banking: by Prof Santosh KumarSuraj KumarNoch keine Bewertungen

- Icici Bank Noc FormatDokument1 SeiteIcici Bank Noc Formatguiness_joe915463% (8)

- Contract To Sell Revised Feb 2022Dokument9 SeitenContract To Sell Revised Feb 2022Darwin LasinNoch keine Bewertungen

- New SFS Marketing Presentation SlidesDokument20 SeitenNew SFS Marketing Presentation SlidessarahNoch keine Bewertungen

- Cap 8Dokument26 SeitenCap 8Uver Jhon Terrones LeonNoch keine Bewertungen

- Anti-Money Laundering ActDokument8 SeitenAnti-Money Laundering ActKriztel CuñadoNoch keine Bewertungen

- Investigation Report TP017356Dokument41 SeitenInvestigation Report TP017356Bk Charles Ruppy100% (1)

- Barbara Etzel - Webster's Finance and Investment Dictionary-Wiley (2003)Dokument388 SeitenBarbara Etzel - Webster's Finance and Investment Dictionary-Wiley (2003)wayawid760Noch keine Bewertungen

- Administered Interest Rates in IndiaDokument17 SeitenAdministered Interest Rates in IndiatNoch keine Bewertungen

- Satender Kumar Associates - DelhiDokument7 SeitenSatender Kumar Associates - DelhiAVS & AssociatesNoch keine Bewertungen

- Materi Binal 6 The Global Capital MarketDokument27 SeitenMateri Binal 6 The Global Capital MarketNicholas ZiaNoch keine Bewertungen

- KOFAX - Five Case Studies To Inspire Your Intelligent Automation StrategyDokument22 SeitenKOFAX - Five Case Studies To Inspire Your Intelligent Automation StrategyShirinda PradeeptiNoch keine Bewertungen

- TD Bank Payment ContracDokument2 SeitenTD Bank Payment Contracshafa anisa ramadhaniNoch keine Bewertungen

- Cryptoassets: The Financial MetaverseDokument125 SeitenCryptoassets: The Financial MetaverseTom ChoiNoch keine Bewertungen

- Conceptual Frame WorkDokument62 SeitenConceptual Frame WorkKavyaNoch keine Bewertungen

- Q&aDokument70 SeitenQ&apaulosejgNoch keine Bewertungen

- Lapu-Lapu Foundation V CADokument2 SeitenLapu-Lapu Foundation V CAjasminealmiraNoch keine Bewertungen

- Gmail - Contact The BankDokument1 SeiteGmail - Contact The BankFira tubeNoch keine Bewertungen

- Artifact 5a - Guidelines For Filling PF Withdrawal Form TCS PDFDokument3 SeitenArtifact 5a - Guidelines For Filling PF Withdrawal Form TCS PDFDebmalya DuttaNoch keine Bewertungen

- 2021 Global Islamic Fintech Report 2021Dokument56 Seiten2021 Global Islamic Fintech Report 2021Slamet PrayitnoNoch keine Bewertungen

- PDFDokument386 SeitenPDFVic CajuraoNoch keine Bewertungen

- PS FSCM TablesDokument17 SeitenPS FSCM TablessivanblNoch keine Bewertungen

- Jesus TambuntingDokument5 SeitenJesus TambuntingheinzteinNoch keine Bewertungen

- Financial Acctg & Reporting 1 - CASE ANALYSIS SUMMARYDokument23 SeitenFinancial Acctg & Reporting 1 - CASE ANALYSIS SUMMARYJaquelyn ClataNoch keine Bewertungen

- Call Money Market in IndiaDokument37 SeitenCall Money Market in IndiaDivya71% (7)