Beruflich Dokumente

Kultur Dokumente

Syllabus 030207

Hochgeladen von

Yesenia Lian Tan CadanoOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Syllabus 030207

Hochgeladen von

Yesenia Lian Tan CadanoCopyright:

Verfügbare Formate

10 January 07

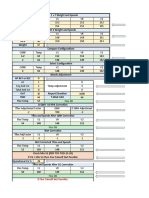

Yale Econ 485b Behavioral Economics Tentative Syllabus

Prof. Jernej Copic email: jernej.copic@yale.edu office: Room 6, 30 Hilhouse phone: 203 432 6158 REQUIRED TEXTBOOKS: Advances in Behavioral Economics, edited by Colin Camerer, George Loewenstein and Matthew Rabin, Princeton University Press, 2004. (available at Yale Book Store) Modeling Bounded Rationality, by Ariel Rubinstein, MIT Press, 1998 (available at Yale Book Store and online at http://arielrubinstein.tau.ac.il/book-br.html) Students will also be required to read a number of research articles, selected from a list (see partial list below). Yale, Spring 07 TIME AND LOCATION: TBA OFFICE HOURS: TBA

COURSE DESCRIPTION: The interface of psychology and economics has a long history. After all, psychologists study human behavior, and economists try to understand the implications of human behavior on economic life and institutions. While neoclassical economics assumes a simplified model of perfectly rational individuals, modern behavioral economics strives towards more realistic models of human behavior, taking into account known deviations from perfect rationality. These deviations have been documented empirically as well as experimentally. In order to understand economic consequences, economists have also proposed a number of formal behavioral models. In this course we will learn about empirical facts, we will learn and reproduce some basic experiments that demonstrate deviations from rationality, and we will learn how economists model such behaviors formally. We will try to understand the disagreements between the modeling approaches and we will have in-class debates, as well as paper presentations and discussions. Students are expected to learn to think critically and creatively and to form their own opinions about these topics. The seminar will cover the following topics: 1. Bounded Rationality and Behavioral Economics 2. Reference Dependence and Loss Aversion 3. Preferences over Risky and Uncertain Outcomes 4. Intertemporal Preferences 5. Fairness and Social Preferences 6. Neuroeconomics 7. Behavioral Finance 8. Memory and attention The seminar will be focused on discussing materials in class. There will be two debates. The topics in the class will be motivated either by apparent anomalies in our daily

economic life, or through in-class experiments. I will introduce the necessary methodologies used in approaching a specific topic. GRADING: -There will be a list of required readings (some of them selected from the two books, and some selected research articles) on which students will have to write short reports. -Students will be required to read weakly assignments. In class we will discuss the readings. -Students will be required to actively participate in discussion. There will be two debates in class. -Students will have a choice to write: (i) more readings reports and a short (10-15 page) research paper or (ii) fewer readings reports and a longer (20-25 page) research paper. I will be very available to help students with their research papers. -Grades will be based on class participation (30%), reports (20-30%), and the research paper (40-50%). TENTATIVE SCHEDULE: CLASS 1 Introduction: modeling principles and theories; empirical vs experimental evidence; is Economics a hard science? Theory and anomalies. New directions: neuroscience, psychology, computer science, evolutionary biology. Readings: **[Simon (QJE 1955), MBR: Intro (pp 1-6)], *ABE: Intro (pp 3-14). CLASS 2 Preferences over goods and gambles. Allais paradox. Reference dependence and loss aversion. Readings: **MBR Chapter 1 (pp 7-24), *Chen, Keith, Lakshminarayanan, Venkat, and Santos, Laurie. The Evolution of Our Preferences: Evidence from Capuchin-Monkey Trading Behavior. April 2006, *ABE Chapter 2 (pp 55-74), *ABE Chapter 5 . CLASS 3 Complexity of decisions. Case-based decision making. How preferences form. Evolutionary principles and genetic programming: Darwinian selection in Finance. Readings: **MBR Chapter 2 (pp 25-39), *ABE Chapter 25 (pp 659 -688), **Lensberg and Schenk-Hoppe (2006). CLASS 4 Intertemporal preference. Hyperbolic disconunting, dual-self model. Readings: *ABE Chapter 6 (pp 162 -222), *ABE Chapter 15 (pp 429-457), **Fudenberg and Levine (2005), **Strotz (1956). CLASS 5 Addiction, temptation, and self control. Readings: **Gul and Pesendorfer (2001), *Dela Vigna and Malmendier (2003),

*Bernheim and Rangel (2004). CLASS 6 Fairness and social preferences, group decision making. Readings: *ABE Chapter 9, **Shaked (2006), *Fehr and Schmidt (2006), *ABE Chapter 8, **MBR Chapter 6, **Sobel 2005. (1st draft of paper proposals due) CLASS 7 Attention and memory. Readings: **MBR Chapter 4, *Barber and Odean (2003), *Hirshleifer and Welch (2002), **Testafsion (2003), **Wilson (2006). (1 page proposals for papers due approved.) CLASS 8 Behavioral Game Theory. Readings: **MBR Chapter 7, *ABE Chapter 13, **McKelvey and Palfrey 1992, *CostaGomes et. al. (2003). CLASS 9 Behavioral Finance, Investor decisions. Readings: Barberis and Thaler (2006), ABE Chapter 23. CLASS 10 New directions: neuroeconomics. Readings: Gul and Pesendorfer (2006), Camerer et. al. (2005), Hsu et. al. (2005). CLASS 11 Field experiments. Readings: Harrison and List (2004), Duflo (2005), Bandiera et. al. (2006). CLASS 12 Debate 2: Behavioral economics vs Bounded rationality. Readings: Camerer (2005), Rubinstein (2005), MBR Chapter 11. Additional references: Introduction Simon, H. A. (1955). A Behavioral Model of Rational Choice. Quarterly Journal of Economics 69, 99-118.

Intertemporal choice

Angeletos, M. et. al. (2001) The Hyperbolic Consumption Model: Calibration, Simulation, and Empirical Evaluation, Journal of Economic Perspectives, August, 47-68 Fudenberg, Drew and Levine, David. A dual self model of impulse control. February 2005. http://post.economics.harvard.edu/faculty/fudenberg/papers/dual_self.pdf Della Vigna, Stefano and Ulrike Malmendier. Overestimating self-control: Evidence from the health club industry, Nov 2003. http://emlab.berkeley.edu/users/sdellavi/wp/self_control_nov03.pdf Fairness and social preferences Fehr and Gachter, Fairness and retaliation: The economics of reciprocity. J Ec Perspectives, 2000. and in ADVANCES. Rabin, M. (1993) Incorporating Fairness into Game Theory and Economics, American Economic Review, 83(5):1281-1302. (Monster paper; a recipe for how to do behavioral economics) Sobel, Joel. Social interdependent preferences and reciprocity, J Ec Lit June 2005, vol 43, 392-436. Neuroeconomics Hsu, Bhatt, Adolphs, Tranel, Camerer. A neural system for judging degrees of uncertainty. Science 2005. Camerer, Loewenstein & Prelec. Neuroeconomics: How neuroscience can inform economics. J Ec Perspectives, March 2005. Gul and Pesendorfer: The case for Mindless Economics (2006) Behavioral Finance Barberis and Thaler. A survey of behavioral finance. In Handbook of Economics & Finance, in press. (http://badger.som.yale.edu/faculty/ncb25/ch18-6.pdf) Game Tehory Costa-Gomes, M. et. al. (2003) Experimental studies of strategic sophistication and cognition in normal-form games, Econometrica, 69:1193-1235. (Masterpiece of careful interaction of theory and design) McKelvey and Palfrey, "An experimental study of the centipede game," Econometrica 1992.

Field Experiments Harrison and List, 2004. Field Experiments. J Economic Literature http://www.arec.umd.edu/fieldexperiments/fieldexperiments/Field%20Experiments.pdf Tanaka, Nguyen and Camerer. Field experiments in Vietnam. Duflo, Esther. 2005. Field experiments in development economics. World Congress paper, http://econ-www.mit.edu/faculty/download_pdf.php?id=1265 Bandiera, Barankay and Rasul. Social preferences and the response to incentives: Evidence from personnel data, 2006, Quarterly Journal of Economics vol. 120(3), pages 917-962. Behavioral Economics and Bounded Rationality Camerer (2005): Behavioral Economics Rubinstein (2005): Discussion of Behavioral Economics Memory and attention Barber, Brad and Terrance Odean. All that glitters, 2003. http://faculty.haas.berkeley.edu/odean/papers/Attention/All%20that%20Glitters.pdf Hirshleifer and Welch. An Economic Approach to the Psychology of Change: Amnesia, Inertia, and Impulsiveness. Journal of Economics and Management Strategy 11-3, Fall 2002, 379-421. Wilson, Andrea (2006). Bounded memory and biases in information processing. http://www.princeton.edu/~awilson/memorybiases.pdf Testafsion, Leigh. Agent-based computational economics. August 2003 http://www.econ.iastate.edu/tesfatsi/acewp1.pdf

Das könnte Ihnen auch gefallen

- Introduction to Behavioural EconomicsDokument7 SeitenIntroduction to Behavioural EconomicsInemi StephenNoch keine Bewertungen

- Experimental and Behavioral EconDokument15 SeitenExperimental and Behavioral Econbilllin12345Noch keine Bewertungen

- Experimental Economics SyllabusDokument11 SeitenExperimental Economics SyllabusUttara AnanthakrishnanNoch keine Bewertungen

- Macroeconomía I 2017Dokument3 SeitenMacroeconomía I 2017mauro monterosNoch keine Bewertungen

- Identification and Estimation of Causal Effects in Economics and Other Social SciencesDokument8 SeitenIdentification and Estimation of Causal Effects in Economics and Other Social SciencesStanislao MaldonadoNoch keine Bewertungen

- Psychology and Economics Evidence From The FieldDokument73 SeitenPsychology and Economics Evidence From The FieldFrancisco Garcia Dos SantosNoch keine Bewertungen

- 2015 Winter ECON 571 LECTURE B2Dokument12 Seiten2015 Winter ECON 571 LECTURE B2jgordon2Noch keine Bewertungen

- Okada Models17-18 SyllabusDokument3 SeitenOkada Models17-18 SyllabuscrazymoneyNoch keine Bewertungen

- Dellavigna 2009 Psychology and Economics Evidence From The FieldDokument135 SeitenDellavigna 2009 Psychology and Economics Evidence From The FieldЕкатерина КаплуноваNoch keine Bewertungen

- Imbens & Wooldridge, 2009Dokument105 SeitenImbens & Wooldridge, 2009toooNoch keine Bewertungen

- Workshop On Rational Choice Theories ICPDokument12 SeitenWorkshop On Rational Choice Theories ICPGjoko IvanoskiNoch keine Bewertungen

- Imbens & Wooldridge (2009) Recent Developments in The Econometrics of Program EvaluationDokument83 SeitenImbens & Wooldridge (2009) Recent Developments in The Econometrics of Program EvaluationElghafiky BimardhikaNoch keine Bewertungen

- SyllabusDokument8 SeitenSyllabuschetanaNoch keine Bewertungen

- Advancing Behavioral Economics Beyond "AdvancesDokument33 SeitenAdvancing Behavioral Economics Beyond "AdvancesNorbaNoch keine Bewertungen

- Economics, Psychology, and Interactive Decision Making - Will The Reign of Reason Rule On?Dokument38 SeitenEconomics, Psychology, and Interactive Decision Making - Will The Reign of Reason Rule On?blakmetalNoch keine Bewertungen

- Advanced Econometrics Course at DartmouthDokument5 SeitenAdvanced Econometrics Course at Dartmouthgs123@hotmail.comNoch keine Bewertungen

- Rajan Course Outline Asymmetric Information Ba865 - Syll2011Dokument8 SeitenRajan Course Outline Asymmetric Information Ba865 - Syll2011Adriana GarciaNoch keine Bewertungen

- IntroductionBoundedRationalityofEconomicMan PDFDokument9 SeitenIntroductionBoundedRationalityofEconomicMan PDFRafaelMontenegroNoch keine Bewertungen

- IntroductionBoundedRationalityofEconomicMan PDFDokument9 SeitenIntroductionBoundedRationalityofEconomicMan PDFRafaelMontenegroNoch keine Bewertungen

- Social Science Class 9 Sample Paper Term 2Dokument5 SeitenSocial Science Class 9 Sample Paper Term 2afmabkbhckmajg100% (1)

- IntroductionBoundedRationalityofEconomicMan PDFDokument9 SeitenIntroductionBoundedRationalityofEconomicMan PDFDiana LisethNoch keine Bewertungen

- IntroductionBoundedRationalityofEconomicMan PDFDokument9 SeitenIntroductionBoundedRationalityofEconomicMan PDFJESSICA MARCELA LADINO FERNANDEZNoch keine Bewertungen

- Bernard Sp11 SyllabusDokument9 SeitenBernard Sp11 SyllabusDongbo WangNoch keine Bewertungen

- Camerer - Rules For ExperimentingDokument15 SeitenCamerer - Rules For ExperimentingViata DeadolescentNoch keine Bewertungen

- Spring 2022 Syllabus for Behavioral Economics CourseDokument6 SeitenSpring 2022 Syllabus for Behavioral Economics Coursezauri zauriNoch keine Bewertungen

- Case Study Research MethodsDokument12 SeitenCase Study Research MethodsCristina NunesNoch keine Bewertungen

- Introduction: Bounded Rationality of Economic Man: New Frontiers in Evolutionary Psychology and BioeconomicsDokument2 SeitenIntroduction: Bounded Rationality of Economic Man: New Frontiers in Evolutionary Psychology and BioeconomicsMiguel A SequeraNoch keine Bewertungen

- UT Dallas Syllabus For Fin7335.001.08f Taught by Yexiao Xu (Yexiaoxu)Dokument10 SeitenUT Dallas Syllabus For Fin7335.001.08f Taught by Yexiao Xu (Yexiaoxu)UT Dallas Provost's Technology GroupNoch keine Bewertungen

- Microeconomics and PsichologyDokument16 SeitenMicroeconomics and PsichologyMartín PuyoNoch keine Bewertungen

- GVcef - Teixeira. Behind Behavioral Economic ManDokument24 SeitenGVcef - Teixeira. Behind Behavioral Economic ManAndres E. LopezNoch keine Bewertungen

- Answer Key ResDokument7 SeitenAnswer Key ResMae Francine Kinkito CaminadeNoch keine Bewertungen

- Disciplines and Ideas in Social SciencesDokument11 SeitenDisciplines and Ideas in Social SciencesArjane Grace SullanoNoch keine Bewertungen

- 708-Kaido Class NotesDokument6 Seiten708-Kaido Class Noteshimanshoo panwarNoch keine Bewertungen

- MKTG6153 Course OutlineDokument8 SeitenMKTG6153 Course OutlineJieteng ChenNoch keine Bewertungen

- UT Dallas Syllabus For Psci6325.001 06f Taught by Patrick Brandt (pxb054000)Dokument14 SeitenUT Dallas Syllabus For Psci6325.001 06f Taught by Patrick Brandt (pxb054000)UT Dallas Provost's Technology GroupNoch keine Bewertungen

- Research MethodologyDokument58 SeitenResearch MethodologyRab Nawaz100% (2)

- George G. Judge, William E. Griffiths, R. Carter Hill, Helmut Lütkepohl, Tsoung-Chao Lee-The Theory and Practice of Econometrics (Wiley Series in Probability and Statistics) - Wiley (1985)Dokument1.033 SeitenGeorge G. Judge, William E. Griffiths, R. Carter Hill, Helmut Lütkepohl, Tsoung-Chao Lee-The Theory and Practice of Econometrics (Wiley Series in Probability and Statistics) - Wiley (1985)agressive60% (5)

- Mace+2010+ +Translational+Research+in+BA+Dokument20 SeitenMace+2010+ +Translational+Research+in+BA+6ybczp6t9bNoch keine Bewertungen

- MSC Psychology Dissertation ExamplesDokument6 SeitenMSC Psychology Dissertation ExamplesWritingContentNewYork100% (1)

- Econophysics: Background and Applications in Economics, Finance, and SociophysicsVon EverandEconophysics: Background and Applications in Economics, Finance, and SociophysicsGheorghe SavoiuBewertung: 2 von 5 Sternen2/5 (1)

- Psychology and Economics Evidence from Field Surveys Three Classes of DeviationsDokument58 SeitenPsychology and Economics Evidence from Field Surveys Three Classes of DeviationsRoberto PaezNoch keine Bewertungen

- More Details About The Books (Summary, Tables of Contents or Keywords) OnDokument12 SeitenMore Details About The Books (Summary, Tables of Contents or Keywords) OnLaura RomanNoch keine Bewertungen

- 2004 - Decision Analysis in Management ScienceDokument15 Seiten2004 - Decision Analysis in Management SciencevlobosgNoch keine Bewertungen

- The University of Chicago Press Journal of Political EconomyDokument11 SeitenThe University of Chicago Press Journal of Political EconomyStefanAndreiNoch keine Bewertungen

- Revised M.Phil Syllabus in Economics: Semester Course No. Name of The Course Contact Hours CreditDokument9 SeitenRevised M.Phil Syllabus in Economics: Semester Course No. Name of The Course Contact Hours CreditMradul Yadav100% (1)

- Stigler-Becker Versus Myers-Briggs: Why Preference-Based Explanations Are Scientifically Meaningful and Empirically ImportantDokument15 SeitenStigler-Becker Versus Myers-Briggs: Why Preference-Based Explanations Are Scientifically Meaningful and Empirically ImportantradenpatahNoch keine Bewertungen

- Summers 1991Dokument21 SeitenSummers 1991FedericoGlusteinNoch keine Bewertungen

- ABM Applied Economics Module 1 Differentiate Economics As Social Science and Applied Science in Terms of Nature and ScopeDokument36 SeitenABM Applied Economics Module 1 Differentiate Economics As Social Science and Applied Science in Terms of Nature and ScopeNamra MesomìäNoch keine Bewertungen

- Goertz Mahoney 2006 WDokument23 SeitenGoertz Mahoney 2006 WKrokupper Acrata100% (1)

- Amitai Etzioni Behavioural EconomicsDokument12 SeitenAmitai Etzioni Behavioural Economicsejmc74juNoch keine Bewertungen

- Syllabus - Corporate Finance - PHD CourseDokument10 SeitenSyllabus - Corporate Finance - PHD CoursePranav Pratap SinghNoch keine Bewertungen

- Social Exchange Theory Research PaperDokument6 SeitenSocial Exchange Theory Research Papergz3ezhjc100% (1)

- Syllabus Fall 2023 0Dokument8 SeitenSyllabus Fall 2023 0rribeiro70Noch keine Bewertungen

- Lecture1 2Dokument40 SeitenLecture1 2boteeNoch keine Bewertungen

- Teaching Heterodox Economics ConceptsDokument40 SeitenTeaching Heterodox Economics ConceptsПетър Димитров100% (1)

- An Evolutionary Theory of Economic Change.Dokument20 SeitenAn Evolutionary Theory of Economic Change.Cláudio Haupt VieiraNoch keine Bewertungen

- Case Study Research Quality in ManagementDokument35 SeitenCase Study Research Quality in ManagementSiva Sankara Narayanan SubramanianNoch keine Bewertungen

- Behavioral Economics and Public Policy - A Pragmatic PerspectiveDokument34 SeitenBehavioral Economics and Public Policy - A Pragmatic PerspectiveRain PanNoch keine Bewertungen

- Deception FinalJEBODokument12 SeitenDeception FinalJEBOPatty LinNoch keine Bewertungen

- Behavioural Economics: Psychology, neuroscience, and the human side of economicsVon EverandBehavioural Economics: Psychology, neuroscience, and the human side of economicsNoch keine Bewertungen

- Telescopic sight basics and reticle typesDokument18 SeitenTelescopic sight basics and reticle typesKoala LumpurNoch keine Bewertungen

- Regulation of AlternatorDokument6 SeitenRegulation of Alternatorkudupudinagesh100% (1)

- Textbook List for Sri Kanchi Mahaswami Vidya Mandir 2020-21Dokument13 SeitenTextbook List for Sri Kanchi Mahaswami Vidya Mandir 2020-21drsubramanianNoch keine Bewertungen

- TAURI User ManualDokument23 SeitenTAURI User ManualChris Sad LHNoch keine Bewertungen

- Mahusay Module 4 Acc3110Dokument2 SeitenMahusay Module 4 Acc3110Jeth MahusayNoch keine Bewertungen

- NFA To DFA Conversion: Rabin and Scott (1959)Dokument14 SeitenNFA To DFA Conversion: Rabin and Scott (1959)Rahul SinghNoch keine Bewertungen

- Rules of the Occult UndergroundDokument247 SeitenRules of the Occult UndergroundIsaak HillNoch keine Bewertungen

- Report CategoryWiseSECCVerification 315700301009 08 2019Dokument2 SeitenReport CategoryWiseSECCVerification 315700301009 08 2019Sandeep ChauhanNoch keine Bewertungen

- WHLP G9 ESolomon Nov 23-27Dokument4 SeitenWHLP G9 ESolomon Nov 23-27Ericha SolomonNoch keine Bewertungen

- Katsina Polytechnic Lecture Notes on History and Philosophy of Science, Technology and MathematicsDokument33 SeitenKatsina Polytechnic Lecture Notes on History and Philosophy of Science, Technology and MathematicsHamisu TafashiyaNoch keine Bewertungen

- Mains Junior Assistant GSMA - 232021Dokument81 SeitenMains Junior Assistant GSMA - 232021RaghuNoch keine Bewertungen

- Industrial Applications of Olefin MetathesisDokument7 SeitenIndustrial Applications of Olefin Metathesisdogmanstar100% (1)

- E02-E02 Rev 3 Jun 2017 Selection of Elec Equip in Hazardous AreaDokument6 SeitenE02-E02 Rev 3 Jun 2017 Selection of Elec Equip in Hazardous AreaSALMANNoch keine Bewertungen

- A320 Flex CalculationDokument10 SeitenA320 Flex CalculationMansour TaoualiNoch keine Bewertungen

- Audit ComplianceDokument1 SeiteAudit ComplianceAbhijit JanaNoch keine Bewertungen

- Doping Effects of Zinc On LiFePO4 Cathode MaterialDokument5 SeitenDoping Effects of Zinc On LiFePO4 Cathode MaterialMarco Miranda RodríguezNoch keine Bewertungen

- Phil of DepressDokument11 SeitenPhil of DepressPriyo DjatmikoNoch keine Bewertungen

- Planets Classification Malefic and BeneficDokument3 SeitenPlanets Classification Malefic and Beneficmadhu77Noch keine Bewertungen

- #C C C$ C%C& C' C (CDokument4 Seiten#C C C$ C%C& C' C (CThong Chee WheiNoch keine Bewertungen

- Risk in Clean RoomDokument9 SeitenRisk in Clean RoomABEERNoch keine Bewertungen

- What Is The Procedure For Graceful Shutdown and Power Up of A Storage System During Scheduled Power OutageDokument5 SeitenWhat Is The Procedure For Graceful Shutdown and Power Up of A Storage System During Scheduled Power OutageNiraj MistryNoch keine Bewertungen

- 38-13-10 Rev 2Dokument128 Seiten38-13-10 Rev 2Gdb HasseneNoch keine Bewertungen

- A Data-Based Reliability Analysis of ESPDokument19 SeitenA Data-Based Reliability Analysis of ESPfunwithcubingNoch keine Bewertungen

- Barco High Performance MonitorsDokument34 SeitenBarco High Performance Monitorskishore13Noch keine Bewertungen

- Ausa 300-RH - en Parts ManualDokument93 SeitenAusa 300-RH - en Parts ManualandrewhNoch keine Bewertungen

- Coal Gasification, Liquid Fuel Conversion (CTL), and CogenerationDokument66 SeitenCoal Gasification, Liquid Fuel Conversion (CTL), and CogenerationVăn Đại - BKHNNoch keine Bewertungen

- Caso de Estudio 14.1, 14.2 y 14.3Dokument6 SeitenCaso de Estudio 14.1, 14.2 y 14.3Rodolfo G. Espinosa RodriguezNoch keine Bewertungen

- Accomplishment Report - English (Sy 2020-2021)Dokument7 SeitenAccomplishment Report - English (Sy 2020-2021)Erika Ikang WayawayNoch keine Bewertungen

- Mobile Phone Addiction 12 CDokument9 SeitenMobile Phone Addiction 12 Cvedang agarwalNoch keine Bewertungen

- Follow The Directions - GR 1 - 3 PDFDokument80 SeitenFollow The Directions - GR 1 - 3 PDFUmmiIndia100% (2)