Beruflich Dokumente

Kultur Dokumente

Norateloanmod Mortgagerewards

Hochgeladen von

Matthew HoffmanOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Norateloanmod Mortgagerewards

Hochgeladen von

Matthew HoffmanCopyright:

Verfügbare Formate

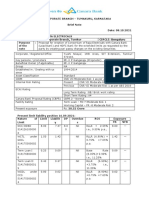

"No-Fee" Rate Modification Disclosure for First Mortgage Loans Thank you for selecting Bank of America for

your home financing needs. We are committed to deliver to you a quality experience. In conjunction with that commitment, effective with loans closing beginning September 25, 2006, we are pleased to offer to any customer that closes a first mortgage loan under this special purchase program a future "No-Pee" rate modification option*. This is a fast and easy way for you to manage your loan and take advantage of current lending rates based on your current financial needs. Subject to the following criteria and restrictions, by just contacting the Customer Service Call Center to request a loan

modification at 1.800.285.6000, you may request to modify

Rate only, OR

Rate and monthly payment.

The following criteria will apply:

Your loan must be closed under the criteria of this special program to be eligible for this no-fee rate modification option. There is a 3 month waiting period after the closing date of the original loan before you exercise the rate modification. The option is available for the life of the loan*. You can exercise the option 1 time every 12 months (you must wait 12 months between each exercise of the option).

'There are no fees charged to you to exercise this option.

Options will be evaluated based on the current market rate and standard risk adjustments will apply. The loan can be approved for modification if you are and have been current for the past 90 days.

This option is available in selected states, unless state regulatory requirements prohibit or restrict the transaction. Please consult your Account Representative for availability in your state. The option is available only on owner-occupied primary residence and second homes. (Investment properties are not allowed.) There is no maximum or minimum principal balance required (not allowed if loan has been paid in full). No minimum change in rate is required. All first mortgage products currently available under this special program will be eligible for a "No-Pee" rate modification.

modification information.

Note:

*Please note: Loans with an adjustable rate (ARM) (fully amortized and initial interest-only) are only eligible for rate modification during the fixed or interest-only period of the loan. If you modify an ARM loan, the modification will only be for the remaining months of the fixed or interest only period. The eventual ARM adjustment will be based on the scheduled ARM information and not on the

At time of rate modification, an amortization schedule is run to ensure that the loan amortizes out correctly. If you request to modify the rate down to a lower rate only and do not adjust the payment, the term will change, it will decrease. You will always be able to pay additional amounts towards your loan at any time without modification of the rate.

Restrictions:

No additional funds can be made available as a result of the rate modification. No term extensions. No changes that would require the payment to increase.

No title changesproperties. No addition or removal of borrower(s) to the loan/Note or the deed (title) are allowed. are allowed: No investment

This option is only applicable toand HELOCs). ^ for home equity loan products (HELOANs first mortgage loans only, and is not applicable ^ f

'This offer is available only in conjunction with the Mortgage Rewards or its successor program.

BA506IVIP (06061

MP06 12/26/06 12:01 PM 3305747275

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- FNAN 321: (COMPANY NAME) (Company Address)Dokument7 SeitenFNAN 321: (COMPANY NAME) (Company Address)Shehryaar AhmedNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Anggaran Yuran Universiti MalayaDokument2 SeitenAnggaran Yuran Universiti MalayaIzhh RazaaNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Anandham CaseDokument17 SeitenAnandham Casekarthick raj100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Octane Service StationDokument3 SeitenOctane Service StationAkanksha Vaish0% (2)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Basic Financial Statements Analysis DoneDokument17 SeitenBasic Financial Statements Analysis DoneAjmal SalamNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Components of Indian Financial SystemDokument10 SeitenComponents of Indian Financial Systemvikas1only100% (2)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Final Internship Report On Summit BankDokument48 SeitenFinal Internship Report On Summit BankMohsen Shoukat0% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- UBS Lesson 1Dokument4 SeitenUBS Lesson 1Yau Xiang YingNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Pershing Square GSE Complaint (Claims Court)Dokument39 SeitenPershing Square GSE Complaint (Claims Court)CapForumNoch keine Bewertungen

- Quiz 5Dokument115 SeitenQuiz 5LEKHAN GAVINoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Mercury Athletic FootwearDokument9 SeitenMercury Athletic FootwearJon BoNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Homework Chapter 7Dokument12 SeitenHomework Chapter 7Trung Kiên NguyễnNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Lending Process: Step-By-Step Name of Client: - Days To Complete Date Completed Identification of New CustomersDokument3 SeitenThe Lending Process: Step-By-Step Name of Client: - Days To Complete Date Completed Identification of New CustomersShubham ParmarNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- DemonetizationDokument27 SeitenDemonetizationSuman PoudelNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Objective Type CPT LawDokument51 SeitenObjective Type CPT LawRaghvendra JoshiNoch keine Bewertungen

- 43 - Insurance - Arce v. Capital Insurance and Surety Co.Dokument1 Seite43 - Insurance - Arce v. Capital Insurance and Surety Co.perlitainocencioNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Collection Application Form: Financial Process ExchangeDokument2 SeitenCollection Application Form: Financial Process ExchangeMohd Rafie HashimNoch keine Bewertungen

- Acc CH 4Dokument16 SeitenAcc CH 4Tajudin Abba RagooNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Emancipation PatentDokument11 SeitenEmancipation PatentEdmond Lorenzo100% (1)

- Raja Electricals Consortium Brief Note 08 10 2021Dokument3 SeitenRaja Electricals Consortium Brief Note 08 10 2021MSME SULABH TUMAKURUNoch keine Bewertungen

- Paper Code MB0035Dokument8 SeitenPaper Code MB0035Hossam M.shareifNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Mark XDokument10 SeitenMark XJennifer Ayers0% (2)

- Taxation Law Discussions by Professor ORTEGADokument15 SeitenTaxation Law Discussions by Professor ORTEGAKring de VeraNoch keine Bewertungen

- GOVERNMENT SERVICE INSURANCE SYSTEM vs. COURT OF APPEALS & MR. AND MRS. ISABELO R. RACHODokument2 SeitenGOVERNMENT SERVICE INSURANCE SYSTEM vs. COURT OF APPEALS & MR. AND MRS. ISABELO R. RACHOTrudgeOnNoch keine Bewertungen

- Invoice 120289103981Dokument1 SeiteInvoice 120289103981Nuhu Ibrahim MaigariNoch keine Bewertungen

- A U D I T I N G P R o B L e M S Finals Set ADokument7 SeitenA U D I T I N G P R o B L e M S Finals Set AJerico MamaradloNoch keine Bewertungen

- A Project Report On Working Capital Management Nirani Sugars LTDDokument95 SeitenA Project Report On Working Capital Management Nirani Sugars LTDBabasab Patil (Karrisatte)100% (4)

- Topic 5-MID TERM ASSIGNMENT 2 - FWS 201 REVISEDDokument12 SeitenTopic 5-MID TERM ASSIGNMENT 2 - FWS 201 REVISEDYousef Al HashemiNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Statement of Changes in Equity - Practice ExercisesDokument2 SeitenStatement of Changes in Equity - Practice ExercisesEvangeline Gicale25% (8)

- Penman and Yehuda, 2004, The Pricing of Earnings and Cash FlowsDokument50 SeitenPenman and Yehuda, 2004, The Pricing of Earnings and Cash FlowsAbdul KaderNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)