Beruflich Dokumente

Kultur Dokumente

Aims of FM

Hochgeladen von

Sarath KumarOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Aims of FM

Hochgeladen von

Sarath KumarCopyright:

Verfügbare Formate

ADI SHANKARA INSTITUTE

Of

ENGINEERING & TECHNOLOGY

KALADY - 683574

A S S I G N M E N T

Assignment No : 02

Subject : FINANCIAL NANAuENENT

Topic : AINS 0F FINANCIAL NANAuENENT

07-AUG-2009

FRIDAY

Submitted To, Submitted By,

Prof. S. SASIDHARAN MUHAMMED ASHRAF A.K.

Faculty, Roll No :29

Dept. of Management Studies SEM - II, MBA 2008-10

ASIET Kalady. ASIET Kalady.

AINS 0F FINANCIAL NANAuENENT

According to the Encyclopedia of Social Sciences, Corporation Finance or Financial

Management deals with the financial problems of of corporate enterprises.This problems in-

cludes the financial aspects of the promotion of new enterprise and their administration during

the early devolopment,the accounting problem connected with the distinction between capital

and income, the administrative questions created by growth and expansion and finally the fi-

nancial adjustments required for the bolstering up or rehablitation of a corporation which has

come into financial difficulties.

FINANCE F0NCTI0N

Financial Management reffers to that part of the mangement activity which is concerned

with the planning and controlling of firms financial resources.It deals with finding out various

sources for raising funds for the business.Hence this finance is the lifeblood of every business

Finance function is the most important of all busines function.

0B}ECTIvES 0F FINANCIAL NANAuENENT

Financial Management is concerned with the procurement and application of funds.Its

main aim is to use business funds in such away that the firms value or earnings are max-

imized.Financial Management provides a framework for selecting a proper course of action and

deciding a viable commercial strategy.The objectives of financial mangement can be achived by

the following ways :

Profit Maximisation

Wealth Maximisation

PROFIT MAXIMIZATION

Profit earning is the primary objectiv of every business activity.A business bieng an eco-

nomic institution must earn profit to cover its costs and provide funds for growth.No business

can survive without erning profit.Profit is the measure of efficiency of a business enter-

prise.Profits also serves as a protection against risks which cannot be ensured.Thus profit max-

iization is considered as the primary objective of a business.

However profit maximization objective has been criticised on many grounds.A firm pur-

sueing the objective of profit maximization starts exploiting workers and consumers.Hence it is

immoral and leads to a number of corrupt practice.It leads into colossal inequalities and lower

human values which are an essential part of an ideal social system.

Arguments in favour of Profit Maximization

01.When profit earning is the aim of the business the profit maximization will be the obivious

objective.

02.Profitablity is the barometer for measuring efficiency and economic prosperity of a business

enterprise thus profit maximization is justified in the grounds of rationality.

03.Economic and business conditions donot remain the same at all time.There may be adverse

business condition like recession,depression,severe competition etc.A business will be able to

survive under these unfavourable conditions only if it have some past earnings to rely

upon.Therefore a business should try to earn more and more when situation is favourable.

04.Profits are the main sources of finance for the growth of a business.So a business should aim

at profit maximization for enabling its growth and devolopment.

05.Profitablity is essential for fullfilment of social goals also, through socio-economic welfare

of a society.

Arguments against Profit Maximization

01.The term profit is vague and is not precisely defined.

02. Profit maximization objective ignores time value of moneyand does not consider the magni-

tude and timing of earnings.

03.It does not take into consideration the risk of the perspective earning stream.Means some

projects are risky than others.

04.The effect of divident policy on the market price is also not considered in the objective of

profit maximization.

WEALTH MAXIMIZATION

Wealth maximization is the appropriate objective of an enterpise.Financial theory

asses that wealth maximisation is the sing;e substitute for a stock holders utility.Whn the firm

maximize the stock holders wealth the individual stock holder can use this wealth for maximise

his individual utlity.It means that by maximising stockholders wealth the firm is operating con-

sistently towards maximising stockholders utility.

AINS 0F FINANCIAL NANAuENENT

The primary aim of financial management is to arrange as much funds for the business as

are required from time to time.This function have the following aims :

AQ0IRINu S0FFICIENT F0NBS

R0ER 0TLIZATI0N 0F F0NBS

INCREASINu R0FITABLITY

NAXINISINu FIRNS vAL0E

AQ0IRINu S0FFICIENT F0NBS

Tha main aim of finance function is to assess the financial needs of an orgniztion and

then findout suitable source for raising them.The sources should commensurate with the need of

the business.If the funds are needed for longer periods then long term sources like

shares,debentures,long term loans etc must be explored.

R0ER 0TLIZATI0N 0F F0NBS

Through raising of funds is important but their effective utlization is more important.The

funds should be used in such a way that maximum benefit is derived from them.The return from

their use must be more than their cost.It should be ensure that funds are not remain idle at any

point of time.The funds commited to various operations should be effectively utlized.Those

projects should be preffered which are benefitial to the business.

INCREASINu R0FITABLITY

The planning and control of finance function aims at only profit maximization.It is true

that money generates money.To this profit maximization proper funds must be invested.Here

financial management is so planned that the concern neither suffers from inadequency nor

wastes more funds than required.

NAXINISINu FIRNS vAL0E

Finance function also aims at maximising the value of the firm.It is generally said that a

concerns value is linked with its profitablity.Even though profitablity influences the firms val-

ue but it is not all.Besides that, sources of finance,market conditions etc are also some factors

influence the value of firm.

Das könnte Ihnen auch gefallen

- Chapter-1 Industry Profile: What Is Finance?Dokument59 SeitenChapter-1 Industry Profile: What Is Finance?Ravi ShankarNoch keine Bewertungen

- Unit 1 FMDokument4 SeitenUnit 1 FMAbhishek SoniNoch keine Bewertungen

- Financial ManagementDokument7 SeitenFinancial ManagementSarah SarahNoch keine Bewertungen

- Financial ManagementDokument12 SeitenFinancial ManagementHarshitha Angel.B100% (1)

- Finance:: Unit - IDokument16 SeitenFinance:: Unit - ISantuNoch keine Bewertungen

- COURSE: MS 100: Entrepreneurship and Innovation I TOPIC FOUR: Financial Management For Entrepreneurial VenturesDokument87 SeitenCOURSE: MS 100: Entrepreneurship and Innovation I TOPIC FOUR: Financial Management For Entrepreneurial VenturesGd novsyNoch keine Bewertungen

- Corporate Finance Assignment: Submitted byDokument8 SeitenCorporate Finance Assignment: Submitted byRidhi KumariNoch keine Bewertungen

- Project TopicDokument8 SeitenProject TopicKrishna kumarNoch keine Bewertungen

- MB0029 Financial ManagementDokument14 SeitenMB0029 Financial ManagementR. SidharthNoch keine Bewertungen

- Komal Lalwani FinalDokument43 SeitenKomal Lalwani Finalsauravv7Noch keine Bewertungen

- Wipro ProjectDokument91 SeitenWipro ProjectDeepak DineshNoch keine Bewertungen

- Financial ManagementDokument8 SeitenFinancial Managementmandeep_kaur20Noch keine Bewertungen

- Manajemen Keuangan/ Financial Management: Endang Etty MerawatiDokument41 SeitenManajemen Keuangan/ Financial Management: Endang Etty MerawatiilaNoch keine Bewertungen

- Cash Flow Statement@ NCLDokument95 SeitenCash Flow Statement@ NCLsureshNoch keine Bewertungen

- Chapter 1 Introduction - Chapter 2 Industrial ProfileDokument74 SeitenChapter 1 Introduction - Chapter 2 Industrial Profilebalki123Noch keine Bewertungen

- Unit 1-Financial ManagementDokument66 SeitenUnit 1-Financial ManagementAshwini shenolkarNoch keine Bewertungen

- Financial Management: Legal AccountingDokument8 SeitenFinancial Management: Legal AccountingRizwana BegumNoch keine Bewertungen

- Financial Management: For EntrepreneursDokument26 SeitenFinancial Management: For EntrepreneursWadson Ushemakota100% (1)

- FINANCIAL MANAGEMENT Study PaperDokument102 SeitenFINANCIAL MANAGEMENT Study PaperPriyank TripathyNoch keine Bewertungen

- Financial Mgt.Dokument16 SeitenFinancial Mgt.Naman LadhaNoch keine Bewertungen

- Financial Management DBA1654Dokument130 SeitenFinancial Management DBA1654Anbuoli ParthasarathyNoch keine Bewertungen

- Mba Ii Sem Finacial ManagementDokument11 SeitenMba Ii Sem Finacial ManagementningegowdaNoch keine Bewertungen

- Financial ManagementDokument17 SeitenFinancial ManagementJake SullyNoch keine Bewertungen

- Scope of Financial ManagementDokument6 SeitenScope of Financial ManagementMy thoughtNoch keine Bewertungen

- Unit I - Financial ManagementDokument5 SeitenUnit I - Financial ManagementAnsh JainNoch keine Bewertungen

- Financial ManagementDokument4 SeitenFinancial ManagementAkshay Pratap Singh ShekhawatNoch keine Bewertungen

- Financial ManagementDokument11 SeitenFinancial ManagementTina KalitaNoch keine Bewertungen

- According To Phillipatus, "Financial Management Is Concerned With The Managerial Decisions ThatDokument26 SeitenAccording To Phillipatus, "Financial Management Is Concerned With The Managerial Decisions Thataneesh arvindhanNoch keine Bewertungen

- Main Project Srinu ModifidDokument58 SeitenMain Project Srinu ModifidVamsi SakhamuriNoch keine Bewertungen

- INTRODUCTION To FMDokument9 SeitenINTRODUCTION To FMRobi MatiNoch keine Bewertungen

- Loans and AdvancesDokument64 SeitenLoans and AdvancesShams SNoch keine Bewertungen

- Financial Managment m1-2010Dokument29 SeitenFinancial Managment m1-2010pavithragowtham100% (1)

- Financial Management Financing Decision Investment Decision Dividend DecisionDokument5 SeitenFinancial Management Financing Decision Investment Decision Dividend Decisionjagdish makwanaNoch keine Bewertungen

- Financial ManagementDokument111 SeitenFinancial ManagementManisha Lade75% (4)

- Skill Based Training: Assignment On Introduction To Financial ManagementDokument8 SeitenSkill Based Training: Assignment On Introduction To Financial ManagementTinu Burmi AnandNoch keine Bewertungen

- A COMPARATIVE STUDY ON FINANCIAL PERFORMANCE OF SELECT AUTOMOBILE INDUSTRIES IN INDIA Four Wheelers PDFDokument104 SeitenA COMPARATIVE STUDY ON FINANCIAL PERFORMANCE OF SELECT AUTOMOBILE INDUSTRIES IN INDIA Four Wheelers PDFNidhi Maheshwari100% (1)

- MMPC 14 Ebooks FinalDokument59 SeitenMMPC 14 Ebooks Finalvinoth kumar SanthanamNoch keine Bewertungen

- BCH-503-SM03 FM IntroDokument28 SeitenBCH-503-SM03 FM Introsugandh bajajNoch keine Bewertungen

- Dynamic Finance - Final ReportDokument90 SeitenDynamic Finance - Final Reportalkanm750Noch keine Bewertungen

- ShahanDokument84 SeitenShahanDhanush47Noch keine Bewertungen

- Financial Management One CH OneDokument33 SeitenFinancial Management One CH Oneabdussemd2019Noch keine Bewertungen

- FM FullDokument114 SeitenFM Fullsabha5121021Noch keine Bewertungen

- Objectives FM & Area of F.decisionDokument10 SeitenObjectives FM & Area of F.decisionKashyapNoch keine Bewertungen

- Synopsis - 01-IntroductionDokument7 SeitenSynopsis - 01-IntroductionleyaketjnuNoch keine Bewertungen

- 2022 Notes Fin. Man.Dokument74 Seiten2022 Notes Fin. Man.kundai machipisaNoch keine Bewertungen

- Financial Management Full NotesDokument30 SeitenFinancial Management Full Notessaadsaaid0% (1)

- FM Bba Iv SemDokument84 SeitenFM Bba Iv SemShreya GoyalNoch keine Bewertungen

- Financial ManagementDokument34 SeitenFinancial Managementma carol fabraoNoch keine Bewertungen

- Scope of Financial ManagementDokument4 SeitenScope of Financial Managementgosaye desalegnNoch keine Bewertungen

- Introduction To Financial Management: Business Finance Unit 1Dokument9 SeitenIntroduction To Financial Management: Business Finance Unit 1RoxieNoch keine Bewertungen

- Working Capital Dodly DairyDokument90 SeitenWorking Capital Dodly DairyRAKESHNoch keine Bewertungen

- Financial ManagementDokument22 SeitenFinancial ManagementRk BainsNoch keine Bewertungen

- Project On HondaDokument68 SeitenProject On HondaPraveen Kumar Hc50% (2)

- AaaaaaaaaaDokument3 SeitenAaaaaaaaaaAszad RazaNoch keine Bewertungen

- Financial ManagementDokument18 SeitenFinancial ManagementsreelakshmisureshNoch keine Bewertungen

- Module-1 Introduction To Finanaical ManagementDokument79 SeitenModule-1 Introduction To Finanaical ManagementRevathi RevathiNoch keine Bewertungen

- Chapter - I 1.1 Introduction To The StudyDokument91 SeitenChapter - I 1.1 Introduction To The StudyNaresh KumarNoch keine Bewertungen

- Financial Literacy for Entrepreneurs: Understanding the Numbers Behind Your BusinessVon EverandFinancial Literacy for Entrepreneurs: Understanding the Numbers Behind Your BusinessNoch keine Bewertungen

- Buried PipelinesDokument93 SeitenBuried PipelinesVasant Kumar VarmaNoch keine Bewertungen

- Siemens Make Motor Manual PDFDokument10 SeitenSiemens Make Motor Manual PDFArindam SamantaNoch keine Bewertungen

- UntitledDokument216 SeitenUntitledMONICA SIERRA VICENTENoch keine Bewertungen

- Reported SpeechDokument6 SeitenReported SpeechRizal rindawunaNoch keine Bewertungen

- Application Form InnofundDokument13 SeitenApplication Form InnofundharavinthanNoch keine Bewertungen

- Amount of Casien in Diff Samples of Milk (U)Dokument15 SeitenAmount of Casien in Diff Samples of Milk (U)VijayNoch keine Bewertungen

- 8051 NotesDokument61 Seiten8051 Notessubramanyam62Noch keine Bewertungen

- Continue Practice Exam Test Questions Part 1 of The SeriesDokument7 SeitenContinue Practice Exam Test Questions Part 1 of The SeriesKenn Earl Bringino VillanuevaNoch keine Bewertungen

- Chapter - I Introduction and Design of The StudyDokument72 SeitenChapter - I Introduction and Design of The StudyramNoch keine Bewertungen

- Epson Stylus Pro 7900/9900: Printer GuideDokument208 SeitenEpson Stylus Pro 7900/9900: Printer GuideJamesNoch keine Bewertungen

- Health Post - Exploring The Intersection of Work and Well-Being - A Guide To Occupational Health PsychologyDokument3 SeitenHealth Post - Exploring The Intersection of Work and Well-Being - A Guide To Occupational Health PsychologyihealthmailboxNoch keine Bewertungen

- AMULDokument11 SeitenAMULkeshav956Noch keine Bewertungen

- Sociology As A Form of Consciousness - 20231206 - 013840 - 0000Dokument4 SeitenSociology As A Form of Consciousness - 20231206 - 013840 - 0000Gargi sharmaNoch keine Bewertungen

- Caspar Hirschi - The Origins of Nationalism - An Alternative History From Ancient Rome To Early Modern Germany-Cambridge University Press (2012)Dokument255 SeitenCaspar Hirschi - The Origins of Nationalism - An Alternative History From Ancient Rome To Early Modern Germany-Cambridge University Press (2012)Roc SolàNoch keine Bewertungen

- FIRST SUMMATIVE EXAMINATION IN ORAL COMMUNICATION IN CONTEXT EditedDokument3 SeitenFIRST SUMMATIVE EXAMINATION IN ORAL COMMUNICATION IN CONTEXT EditedRodylie C. CalimlimNoch keine Bewertungen

- Z-Purlins: Technical DocumentationDokument11 SeitenZ-Purlins: Technical Documentationardit bedhiaNoch keine Bewertungen

- Model 255 Aerosol Generator (Metone)Dokument20 SeitenModel 255 Aerosol Generator (Metone)Ali RizviNoch keine Bewertungen

- Jakub - BaZi CalculatorDokument3 SeitenJakub - BaZi Calculatorpedro restinxNoch keine Bewertungen

- Out PDFDokument211 SeitenOut PDFAbraham RojasNoch keine Bewertungen

- Perancangan Crushing Plant Batu Andesit Di PT Nurmuda Cahaya Desa Batujajar Timur Kecamatan Batujajar Kabupaten Bandung Barat Provinsi Jawa BaratDokument8 SeitenPerancangan Crushing Plant Batu Andesit Di PT Nurmuda Cahaya Desa Batujajar Timur Kecamatan Batujajar Kabupaten Bandung Barat Provinsi Jawa BaratSutan AdityaNoch keine Bewertungen

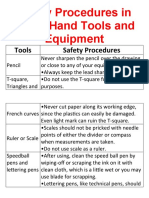

- Safety Procedures in Using Hand Tools and EquipmentDokument12 SeitenSafety Procedures in Using Hand Tools and EquipmentJan IcejimenezNoch keine Bewertungen

- Aleutia Solar Container ClassroomDokument67 SeitenAleutia Solar Container ClassroomaleutiaNoch keine Bewertungen

- Kazon Greater Predator MothershipDokument1 SeiteKazon Greater Predator MothershipknavealphaNoch keine Bewertungen

- CV Augusto Brasil Ocampo MedinaDokument4 SeitenCV Augusto Brasil Ocampo MedinaAugusto Brasil Ocampo MedinaNoch keine Bewertungen

- ISO 27001 Introduction Course (05 IT01)Dokument56 SeitenISO 27001 Introduction Course (05 IT01)Sheik MohaideenNoch keine Bewertungen

- Anatomy of the pulp cavity กย 2562-1Dokument84 SeitenAnatomy of the pulp cavity กย 2562-1IlincaVasilescuNoch keine Bewertungen

- Man As God Created Him, ThemDokument3 SeitenMan As God Created Him, ThemBOEN YATORNoch keine Bewertungen

- ChatGpt PDFDokument19 SeitenChatGpt PDFsanx2014100% (1)

- National Anthems of Selected Countries: Country: United States of America Country: CanadaDokument6 SeitenNational Anthems of Selected Countries: Country: United States of America Country: CanadaHappyNoch keine Bewertungen

- Summary of Bill of Quantities ChurchDokument52 SeitenSummary of Bill of Quantities ChurchBiniamNoch keine Bewertungen