Beruflich Dokumente

Kultur Dokumente

CIPA Information

Hochgeladen von

Sayed SalehOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

CIPA Information

Hochgeladen von

Sayed SalehCopyright:

Verfügbare Formate

Certified Islamic Professional Accountant (CIPA) Program 2010

Scope of CIPA program Scope of the CIPA program has been expanded to cover all existing AAOIFI Accounting standards and Auditing standards as well as selected Shari'a standards and Governances standards. Candidates are expected to have good understanding of the standards concerned. The list of AAOIFI Accounting standards and Auditing standards as well as selected Shari'a standards and Governances standards is as follows: AAOIFI Accounting Standards Financial Accounting Statements

1. Objectives of Financial Accounting for Islamic Banks and Financial Institutions 2. Concepts of Financial Accounting for Islamic Banks and Financial Institutions

Financial Accounting Standards

1. General Presentation and Disclosure in the Financial Statements of Islamic Banks and Financial Institutions 2. Murabaha and Murabaha to the Purchase Orderer 3. Mudaraba Financing 4. Musharaka Financing 5. Disclosure of Bases for Profit Allocation Between Owners Equity and Investment Account Holders 6. Equity of Investment Account Holders and Their Equivalent 7. Salam and Parallel Salam 8. Ijarah and Ijarah Muntahia Bittamleek 9. Zakah 10. Istisnaa and Parallel Istisnaa 11. Provisions and Reserves 12. General Presentation and Disclosure in the Financial Statements of Islamic Insurance Companies 13. Disclosure of Bases for Determining and Allocating Surplus or Deficit in Islamic Insurance Companies 14. Investment Funds

__________________________________________________________________________________________ AAOIFI, P.O. Box 1176, Manama, Kingdom of Bahrain Tel: +973 1724 4496 Fax: +973 1725 0194 www.aaoifi.com

15. Provisions and Reserves in Islamic Insurance Companies 16. Foreign Currency Transactions and Foreign Operations 17. Investments 18. Islamic Financial Services offered by Conventional Financial Institutions 19. Contributions in Islamic Insurance Companies 20. Deferred Payment Sale 21. Disclosure on Transfer of Assets 22. Segment Reporting 23. Consolidation 24. Investments in Associates AAOIFI Auditing Standards

1. Objective and Principles of Auditing 2. The Auditors Report 3. Terms of Audit Engagement 4. Testing for Compliance with Shari'a Rules and Principles by an External Auditor by External Auditor 5. The Auditors Responsibility to Consider Fraud and Error in an Audit of Financial Statements Selected AAOIFI Governance Standards 1. Sharia Supervisory Board: Appointment, Composition and Report 2. Sharia Review 3. Internal Sharia Review 4. Audit & Governance Committe for Islamic Financial Institutions 5. Independence of Sharia Supervisory Board Selected AAOIFI Sharia Standards 5 8 9

Guarantees Murabaha to the Purchase Orderer Ijarah and Ijarah Muntahia Bittamleek

__________________________________________________________________________________________ AAOIFI, P.O. Box 1176, Manama, Kingdom of Bahrain Tel: +973 1724 4496 Fax: +973 1725 0194 www.aaoifi.com

10 11 12 13 17

Salam and Parallel Salam Istisnaa and Parallel Istisnaa Sharika (Musharaka) and Modern Corporations Mudaraba Investment Sukuk

Candidates should also be familiar with Islamic banking and finance in general and have good understanding of accounting and accountancy.

For Option 1 candidates, training will be carried out in Bahrain (venue to be confirmed). The training will cover some but not all of all the standards that are included in the scope of CIPA program and exam.

__________________________________________________________________________________________ AAOIFI, P.O. Box 1176, Manama, Kingdom of Bahrain Tel: +973 1724 4496 Fax: +973 1725 0194 www.aaoifi.com

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Scientology: The Truth Rundown by Joe Childs and Thomas C. TobinDokument40 SeitenScientology: The Truth Rundown by Joe Childs and Thomas C. Tobinsirjsslut100% (2)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Gaas and SQCDokument5 SeitenGaas and SQCemc2_mcv100% (1)

- PMT 10507Dokument21 SeitenPMT 10507cvg ertdNoch keine Bewertungen

- Nebosh Igc Openbook Students Answer December 2020Dokument7 SeitenNebosh Igc Openbook Students Answer December 2020Nathan Tankwal86% (7)

- CIR V Traders Royal Bank, GR No. 167134, Mar 18, 2015Dokument3 SeitenCIR V Traders Royal Bank, GR No. 167134, Mar 18, 2015SophiaFrancescaEspinosaNoch keine Bewertungen

- Standard Operating Procedure For Energy AuditDokument12 SeitenStandard Operating Procedure For Energy AuditMuhammad Nur Iqbal Razemi100% (1)

- Test Bank Ifa Part 3 2015 EditiondocxDokument287 SeitenTest Bank Ifa Part 3 2015 EditiondocxRaca DesuNoch keine Bewertungen

- Training EMSDokument34 SeitenTraining EMSNavneet Singh100% (1)

- Flexituff Ventures International Ltd. Project Report On Finance and AccountsDokument49 SeitenFlexituff Ventures International Ltd. Project Report On Finance and AccountsJanak Gupta100% (1)

- luật asm2Dokument5 Seitenluật asm2hoattkbh01255Noch keine Bewertungen

- 5 Published Company AccountsDokument27 Seiten5 Published Company Accountsking brothersNoch keine Bewertungen

- LESSON 1 Introduction To Accounting LectureDokument3 SeitenLESSON 1 Introduction To Accounting LectureACCOUNTING STRESSNoch keine Bewertungen

- CAM-Accounting For Income Taxes - Nike 2020 10KDokument1 SeiteCAM-Accounting For Income Taxes - Nike 2020 10KnofeNoch keine Bewertungen

- OJT Scope of WorkDokument4 SeitenOJT Scope of WorkSheena Marie OuanoNoch keine Bewertungen

- Certifed Internal Auditors of Pakistan - Benefits of CIAPDokument3 SeitenCertifed Internal Auditors of Pakistan - Benefits of CIAPZeeshan AliNoch keine Bewertungen

- FIFA Garcia Report, Russia ReportDokument39 SeitenFIFA Garcia Report, Russia ReportsilkdieselNoch keine Bewertungen

- CostingDokument33 SeitenCostingVishwajeet Srivastav100% (2)

- CASE: IS Auditng: RequiredDokument1 SeiteCASE: IS Auditng: Requiredevel streetNoch keine Bewertungen

- Research Paper On Bid Rigging & Cash LappingDokument10 SeitenResearch Paper On Bid Rigging & Cash Lappingrajaarunca100% (3)

- May 2024 RTPDokument98 SeitenMay 2024 RTPLooney ApacheNoch keine Bewertungen

- 2017 Pto Isabela Annual Report of AccomplishmentDokument37 Seiten2017 Pto Isabela Annual Report of AccomplishmentAngelica Aquino GasmenNoch keine Bewertungen

- 38 Executive SummaryDokument2 Seiten38 Executive SummaryJill SandersNoch keine Bewertungen

- ĐỀ-kiểm tra tacn2 hvtc Học viện tài chínhDokument7 SeitenĐỀ-kiểm tra tacn2 hvtc Học viện tài chínhMinh Anh NguyenNoch keine Bewertungen

- GEIJMRDokument10 SeitenGEIJMRRahul BarnwalNoch keine Bewertungen

- Infosys Annual Report 2016 Available Online For ADS Holders (Company Update)Dokument200 SeitenInfosys Annual Report 2016 Available Online For ADS Holders (Company Update)Shyam SunderNoch keine Bewertungen

- Acc 205 L2 300720Dokument31 SeitenAcc 205 L2 300720Shubham Saurav SSNoch keine Bewertungen

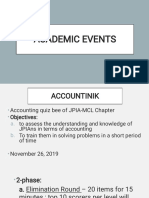

- JPIA-MCL Academic-EventsDokument17 SeitenJPIA-MCL Academic-EventsJana BercasioNoch keine Bewertungen

- Oracle Purchasing - & - Inventory - Standard - ReportsDokument19 SeitenOracle Purchasing - & - Inventory - Standard - Reportsfarhanahmed01Noch keine Bewertungen

- Assessment of Internal Auditing Practice in Dashen Bank Jimma BranchDokument41 SeitenAssessment of Internal Auditing Practice in Dashen Bank Jimma BranchabceritreaNoch keine Bewertungen

- Amida Daboh Nafisatu Mba 2018Dokument75 SeitenAmida Daboh Nafisatu Mba 2018Waafi LiveNoch keine Bewertungen