Beruflich Dokumente

Kultur Dokumente

2011 Preqin Private Equity Report Sample Pages

Hochgeladen von

Michael GuoOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2011 Preqin Private Equity Report Sample Pages

Hochgeladen von

Michael GuoCopyright:

Verfügbare Formate

The 2011 Preqin Global Infrastructure Review - Sample Pages

2011 Global Private Equity Report

Contents

Editors Foreword Section One: The 2011 Preqin Global Private Equity Report Keynote Address - Moose Guen, CEO, MVision Section Two: Overview of the Private Equity Industry Introduction Deal-Driven Optimism - Simon Walker, Chief Executive, BVCA Proactively Engaging Legislation - Uli Fricke, Chairwoman, EVCA Challenges for the US Market - Doug Lowenstein, President, PEGCC The Rise of Emerging Markets - Sarah Alexander, President and CEO, EMPEA Section Three: Assets under Management, Dry Power, Employment and Compensation Assets under Management and Dry Powder Employment and Compensation Section Four: General Partners League Tables - Largest GPs Buyout GPs - Key Stats and Facts Distressed PE GPs - Key Stats and Facts Mezzanine GPs - Key Stats and Facts Natural Resources GPs - Key Stats and Facts Venture GPs - Key Stats and Facts Section Five: Fundraising An Insiders Guide to Fundraising in 2011 - Tripp Brower, Capstone Partners Evolution of Fundraising Market in 2010 Overview of Current Fundraising Market Fundraising Review - North America Fundraising Review - Europe Fundraising Review - Asia and Rest of World Fundraising Review - Buyout Fundraising Review - Distressed PE Fundraising Review - Mezzanine 27 28 31 32 33 34 35 36 37 Section Twelve: Fund Terms and Conditions Private Equity Fund Terms and Conditions 87 Section Eleven: Investment Consultants Investment Consultants in Private Equity 79 19 21 22 23 24 25 Section Ten: Investors in Private Equity Overview of the Limited Partner Universe Make-up of Investors in Recently Closed Funds Investor Appetite for Private Equity in 2011 December 2010 LP Survey Results League Tables of Biggest Investors by Region League Tables of Biggest Investors by Type Investors to Watch in 2010 67 71 75 76 77 78 13 15 7 8 9 10 11 Section Seven: Fund Administrators Fund Administrators Section Eight: Deals Relationships Really Matter Vineet Pruthi, Investment Professional, Lincolnshire Management Global Buyout Activity Section Nine: Private Equity Performance An Examination of Private Equity Performance Delivering Consistently High Private Equity Performance - Logan M. Cheek, III, Senior Managing Director, Pittsford Ventures Management Consistent Performers Private Equity Returns for Pension Funds Private Equity Benchmarks 51 52 45 43 5 3 Fundraising Review - Natural Resources Fundraising Review - Venture Section Six: Placement Agents Overview of Placement Agent Use in 2009 Prole of the Placement Agent Industry 41 42 38 39

46

53 57 60

The 2011 Preqin Global Infrastructure Review - Sample Pages

Section Fourteen: Private Equity Cleantech Energy Efciency Investments Lighting the Way - Michael ONeill, Associate, Climate Change Capital Private Equity Evolution of Fundraising Market in 2010 Cleantech Funds On the Road Overview of Private Equity Cleantech Managers Investors in Cleantech Section Fifteen: Funds of Funds Review of Private Equity Funds of Funds Funds of Funds GPs - Key Stats and Facts Fundraising Review - Funds of Funds Listed PE FoF 95 96 97 98 90

91 92 93 94

Section Sixteen: Secondaries Secondary Market Introduction Secondaries Pricing Analysis Investor Appetite for the Secondary Market in 2010 - LP Survey Results Secondaries Intermediaries Secondaries GPs - Key Stats and Facts Fundraising Review - Secondaries Section Seventeen: Order Forms Preqin Products 107 99 100 101 104 105 106

2011 Preqin Ltd. / www.preqin.com

The 2011 Preqin Global Infrastructure Review - Sample Pages

2. Overview of the Private Equity Industry

2011: A Year of Recovery?

- Tim Friedman, Preqin

2010 saw activity in the private equitybacked buyout market recovering to reach the kind of levels not seen since the onset of the nancial crisis. Q4 in particular represented a very strong quarter, with $64bn of new deals announced the highest since Q2 2008 and $72bn in exits the highest quarter of all time. 2011 is already continuing on a similar path, with highprole deals such as Thomas H. Lees buyout of Acosta and Advents buyout of The Priory Group in the pipeline, and a number of high prole IPOs and other exits also slated. The story in the fundraising market was less encouraging, with the $225bn raised over the course of the year being the lowest total since 2004. However, fundraising is to an extent a lagging indicator. Funds, especially in the current environment, take some time to raise, and the dearth of new vehicles achieving a nal close is more a reection of lacking institutional investor condence in 2009 than anything else. Although the 2009 fundraising gures are higher, a considerable amount of funds that held a nal close during that period gathered the majority of their commitments before Lehman Brothers went under in late 2008. With institutional investors remaining reluctant to commit new capital, the difculties seen in the fundraising market of 2009 led to many prominent fund managers delaying fundraising efforts until investor sentiment and cash ow became more positive. As a result, although the number of funds out there remained relatively high, many of the larger, more established rms were holding back, and the number of funds on road fell. The success stories of rms such as Inexion (raising 375mn within four months of launch), and Atlas Capital Holdings (closing nearly 50% above target on $365mn) show that for rms with strong past performance and a well-informed, strong investor base, fundraising was indeed possible, and in quick time at, or even above, targeted amounts. This is certainly encouraging news for a number of other rms planning to launch funds this year. The signicant pick-up in activity is leading to capital now being pulled through the private equity cash cycle once again, and as a result, it will be necessary for investors to make new investments if they wish to maintain their allocations to the asset class. In December 2010 we interviewed 100 leading LPs from around the world, revealing that not only do the majority of investors intend to at least maintain their exposure to private equity (96%), 37% actually expect to increase allocations in the longer term. In terms of their planned activity, 78% expect to match or exceed 2010 investment levels, with 45% expecting to commit more capital in 2011 compared with 2010. Of course, the other effect of the increase in investment activity is that many fund managers are now running low on dry powder, and will need to hit the road in order to gain the new commitments that will allow them to invest in new companies in the current cycle. We have already seen major rms such as BC Partners, Vestar Capital Management and Berkshire Partners initiating new fundraising activity, while other signicant rms including Providence Equity Partners are also primed to launch. In recent months the total number and value of funds on the road has increased following two years of slow decline, and this total is certain to increase further in 2011. Although there are more investor dollars out there, they are being spent with more care and consideration than ever before, and there are still nowhere near enough to satisfy the ambitions of the 1,600 rms seeking $600bn worldwide. Consolidation in the private equity industry is a long process, and it is only now that the total number of active private equity rms is starting to decline in certain sectors, as rms that last raised capital at the turn of the millennium reach the tail-end of their lifecycles and slowly close up shop, with not so many new rms being established to replace them. With the last major fundraising cycle being seen between 2005 and 2008, the majority of rms that are not able to raise new capital in the current market will still continue to operate for a number of years yet some coming back to market in the future while others only continuing to operate as long as they still hold an investment portfolio. For those that are able to communicate strong past performance and a compelling investment strategy for the current environment, they will nd fundraising to be possible, but those entering the market will nd an investor community which has changed signicantly since the bumper conditions of four years ago. Investors are looking to reduce the number of existing relationships they hold, and will be scrutinizing re-ups with great care. Nothing is guaranteed. Looking at geographies, Asia and other emerging markets such as Latin America will grow to represent a major part of the portfolio for a large number of institutions. European managers had a particularly challenging year in 2010, and with AIFM legislation serving to add additional burden to managers and investors alike, 2011 could again present difculties for the industry. US managers should see conditions steadily improving as certain institutions look to put capital to work for the rst time since 2008. In terms of strategy, mid-market funds, distressed vehicles, and growth and development capital funds will represent popular strategies, and we are also likely to see an uptick in secondaries activity as fund prices stabilize and specialist players such as Coller and Lexington raise additional capital to add to the signicant reserves gathered by other prominent rms in recent years. We have already seen an increase in the levels of capital being called up and distributed, and we expect such activity to remain at a relatively high level as rms put remaining dry powder from older vintages to work and exit some of the investments made during the previous cycle. The recovery in fund NAVs is expected to continue, and

The 2011 Preqin Global Infrastructure Review - Sample Pages

2. Overview of the Private Equity Industry

Deal-Driven Optimism

- Simon Walker, Chief Executive, BVCA

As the private equity industry limbers up for a fresh bout of fundraising, its worth taking a moment over how far the industry has come over the last 12 months. At the tail end of 2008, Boston Consulting Group made the muchpublicised prediction that up to 50% of all companies backed by private equity funds would default on their debts, and as many as 40% of buyout rms would cease to exist. The reality, clearly, has failed to be quite so apocalyptic. Certainly there have been failures, both at portfolio company and fund level, but the degree to which our industry, in general, was able to withstand the worst that the economic storm threw at us deserves to be recognised. Private equity leaves the recession looking quite different to how it went in. Debt to equity multiples are probably the most obvious indications that todays buyout market is not all about enormous leverage, but there are other, more subtle signs. In particular, the increasingly hands-on role private equity funds now take in their portfolio companies. A result of the economic pressures of the last three plus years, it has become imperative for buyout rms to actively get involved in the operations of their portfolio investments by setting out business plans, establishing nancial targets and ensuring interests are aligned between the management team and the private equity rm. And as 2010 drew to a close, such a strategy started to reap rewards with a huge surge in divestments. There were over US$70bn of private equity exits globally in the nal quarter of the year, the highest quarterly gure on record. Investments are also on the up, with European deal ow in Q4 almost 40% higher than the same period last year. The opening few weeks of 2011 have demonstrated a similar resurgence with a number of deals nalised or announced. It is against such a backdrop of increased activity that private equity professionals are allowing themselves a degree of optimism for the year ahead. Cautious optimism of course, but there is now a real sense that the worst is behind us and all are eager to get investing, owning and building businesses. This is not to say there will not be challenges ahead. Banks are still reluctant to loan, and although debt prices have edged down, it is still expensive. Trade buyers are slowly coming back into the market, and they are expected to do so signicantly in 2011 and 2012, but it is likely to be more of a trickle than a wave for the short term. And of course the public markets. Certainly no friend to private equity in 2010, it is hoped IPOs will prove a more viable alternative for divesting buyout houses than they have been for the last three years. In the face of an unwelcoming public market and a paucity of trade buyers, private equity rms turned to each other to exit. Secondary buyouts came to dominate the exit statistics last year and they are likely to remain a signicant source of deal ow for some time to come. And so they should. A number of secondary buyouts occur between funds that operate at different levels in the market Bridgepoint selling Pets at Home to KKR is probably the most high-prole example where the original investor has taken the business as far as it can and it requires funding levels and an international exposure that only a global buyout house can bring. Exposure was something European regulators were especially keen on in 2010. The single most important piece of legislation to directly affect our industry was ratied last year, but whilst many of the worst aspects of the Alternative Investment Fund Managers (AIFM) Directive were mitigated, there are still areas of concern and the road between political approval and legal implementation is likely to be a long and difcult one. The process now enters its second stage, which is concerned with translating the Directive into national law, something which could take up to two years. The BVCA, along with its European counterparts the EVCA, will dedicate much of its time to a forensic involvement in the critical implementation phase of this exercise. The other big challenge for the year ahead will be fundraising, as I alluded to at the beginning. With the next cycle set to kick off any minute now, it will be a real test of investor commitment. There is no doubt that some funds will struggle. But I am supremely condent the industry will continue to thrive and not, as our dear friends in Boston predicted, fall by the wayside.

2011 Preqin Ltd. / www.preqin.com

The 2011 Preqin Global Infrastructure Review - Sample Pages

3. AUM, Dry Powder, Employment and Compensation

Fig. 3.3: Estimated Private Equity Employment by City

Number of Employees at Private Equity Firms by City Fig. 3.3 shows the estimated employment at private equity rms by city. New York tops the list, with more than 11,000 people employed by rms headquartered in the city. London is second, with an estimated 7,000 private equity professionals. Four out of the top ve cities are in the US, with San Francisco, Boston and Los Angeles following London in the list. Number of Employees at Private Equity Firms by Firm Type Fig. 3.4 shows estimated employment at private equity rms for each of the main private equity strategies. Buyout and venture rms employ the largest numbers of people, with each rm type having a total of more than 20,000 employees. Real estate is the next largest, with an estimated 12,200 people employed at real estate rms. Private equity fund of funds managers have an estimated 5,300 employees worldwide. Average Number of Employees at Private Equity Firms by Assets under Management The number of staff employed by a private equity rm varies signicantly with assets under management, as shown in Fig. 3.5. Firms with less than $250mn in assets under management have an average of 10.4 employees, while rms with $10bn or more in total assets employ an average of 194.6 people. There are signicant economies of scale to be enjoyed by the larger private equity rms, and such rms typically have fewer staff per $1bn in assets

City* New York London San Francisco** Boston Los Angeles Paris Chicago Washington Hong Kong Dallas

Estimated Total Employment 11,500 7,000 4,000 3,000 2,300 2,200 1,900 1,400 1,100 1,000

under management than their smaller counterparts. Fig. 3.5 shows that rms with less than $250mn in assets under management employ, on average, the equivalent of 92.3 members of staff per $1bn in assets, i.e. $10.8mn managed per employee. For rms with $10bn or more in total assets, this falls to just 9.3 employees per $1bn, or one employee for every $107.5mn managed. Since the management fees that private equity rms collect are usually calculated as a percentage of total investor commitments to a rms funds, one would expect that the percentage rates charged by rms managing the largest funds would be less than those charged by rms managing smaller funds. This is generally the case, but the slightly lower fees only partially reect the economies of scale that the larger rms benet from. As a result, the operating economics of the largest funds are very favourable and the management fees earned by these vehicles have become a signicant source of income for their managers. Share of Total Private Equity Employment by Assets under Management Fig. 3.6 gives a breakdown of total employment at buyout and venture rms by rm assets under management. Four-fths of venture employees work for venture rms with less than $1bn in assets under management, a much higher proportion than the gure for buyouts rms. Just over a third of all buyout rm employees work for rms with less than $1bn in assets under management, while a signicant 40% work for rms with $5bn or more in total assets.

*Based upon location of head ofce for each rm ** Includes Menlo Park, Palo Alto and San Mateo

Fig. 3.4: Estimated Private Equity Employment by Firm Type

Firm Type* Buyout Venture Real Estate Private Equity Fund of Funds Distressed Private Equity Infrastructure Mezzanine Other Total

Estimated Total Employment 22,500 21,500 12,200 5,300 3,700 2,700 2,100 3,000 73,000

*Based upon main rm strategy

Fig. 3.5: Average Number of Employees by Firm Assets under Management

250 200 150 100 50 10.4 0

$10bn or More $1-4.9bn $250499mn $500999mn $5-10bn Less than $250mn

Fig. 3.6: Share of Total Industry Employees for Buyout and Venture Firms by Firm Assets under Management

100% 90% 2% 18% 40% $5bn or More $14.9bn 80% Less than $1bn

194.6

Proportion of Firms

Average No. of Staff

80% 70% 60% 50% 40% 30% 20% 10% 0%

92.3 39.9 14.2

107.3 Average No. of Staff per $1bn AUM

25%

27.8 33.9 19.2 18.7

15.6

9.3

35%

Buyout

Venture

The 2011 Preqin Global Infrastructure Review - Sample Pages

4. General Partners

Fig. 4.3: Annual Private Equity Capital Raised: New vs. Existing GPs

100%

Proportion of Total Annual Capital Raised

90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 2003 2004 2005 2006 2007 2008 2009 18% 14% 12% 13% 14% 12% 11% PE Capital Raised by New GPs 82% 86% 88% 87% 86% 88% 89% PE Capital Raised by Existing GPs 92%

8% 2010

Fig. 4.4: Buyout - 20 Largest GPs by Total Funds Raised in the Last 10 Years

Total Funds Raised Last 10 Years ($bn) 46.7 46.5 41.7 40.6 37.0 30.6 29.1 28.8 24.8 21.7 20.7 18.0 16.4 14.4 14.1 13.1 12.8 12.6 10.9 10.3

Fig. 4.5: Buyout - 20 Largest GPs by Estimated Dry Powder

Estimated Dry Powder ($bn) 18.2 16.6 15.2 15.2 13.4 10.4 10.1 9.6 9.3 8.9 8.0 6.5 5.8 5.6 4.8 4.7 4.3 4.1 4.0 4.0

Rank 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20

Firm Name Kohlberg Kravis Roberts TPG Blackstone Group Carlyle Group CVC Capital Partners Apollo Global Management Bain Capital Goldman Sachs Merchant Banking Division Apax Partners Advent International Hellman & Friedman Permira Providence Equity Partners JC Flowers & Co Silver Lake Charterhouse Capital Partners Bridgepoint Capital Cinven EQT Partners Madison Dearborn Partners

GP Location US US US US UK US US US UK US US UK US US US UK UK UK Sweden US

Rank 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20

Firm Name TPG Carlyle Group CVC Capital Partners Blackstone Group Goldman Sachs Merchant Banking Division Bain Capital Hellman & Friedman Advent International Kohlberg Kravis Roberts Apollo Global Management Charterhouse Capital Partners Apax Partners Bridgepoint Capital Silver Lake JC Flowers & Co TA Associates Lindsay Goldberg Kelso & Company Thomas H Lee Partners Golden Gate Capital

GP Location US US UK US US US US US US US UK UK UK US US US US US US US

2011 Preqin Ltd. / www.preqin.com

The 2011 Preqin Global Infrastructure Review - Sample Pages

4. General Partners

Mezzanine GPs

Key Stats and Facts

Fig. 4.22: Breakdown of Mezzanine Firms by Number of Funds Raised Fig. 4.23: Number of Firms Actively Managing Mezzanine Funds by Country

GP Location US UK France Canada Italy

No. of Firms 120 14 11 8 4

Fig. 4.24: Mezzanine Firms Industry Preferences for Underlying Investments

60% 53% 46% 42% 46% 41% 34% 24% 18% 17% 4%

Consumer Discretionary Information Technology Business Services Food and Agriculture Health Care Materials Telecoms, Media and Communications Industrials Energy and Utilities Real Estate

Proportion of Firms

50% 40% 30% 20% 10% 0%

Fig. 4.25: 10 Largest Mezzanine Funds Raised of All Time

Fund GS Mezzanine Partners V GS Mezzanine Partners 2006 TCW / Crescent Mezzanine V TCW Energy Fund XIV GS Mezzanine Partners III GSO Capital Opportunities Fund ICG European Fund 2006 TCW / Crescent Mezzanine IV Tower Square Capital Partners III DLJ Investment Partners III

Firm Name Goldman Sachs Merchant Banking Division Goldman Sachs Merchant Banking Division TCW Group TCW Group Goldman Sachs Merchant Banking Division Blackstone Group Intermediate Capital Group TCW Group Babson Capital Management Credit Suisse Customized Fund Investment Group

Year Raised 2008 2006 2008 2008 2003 2008 2007 2006 2008 2007

Amount Closed (bn) 13.0 USD 5.3 USD 2.9 USD 2.6 USD 2.0 USD 2.0 USD 1.3 EUR 1.6 USD 1.6 USD 1.5 USD

GP Location US US US US US US UK US US US

The 2011 Preqin Global Infrastructure Review - Sample Pages

5. Fundraising

European

Fundraising

Overview Fundraising for Europe-focused funds was challenging in 2010, with 122 funds raising an aggregate $50bn, down from $82bn raised by 189 funds in 2009. Breakdown by Type of Funds Europe-focused private equity fundraising was led by buyout funds, with 28 buyout vehicles raising over $16bn and accounting for nearly a third of capital raised by funds focusing on the region in 2010. Aggregate capital commitments to Europe-focused buyout funds fell by nearly 40% from the previous year, although the number of funds raised has seen only a marginal decrease. Venture funds focusing on the region saw the highest number of nal closes of the fund types in 2010. Despite the number of nal closes dropping from 49 in 2009 to 29 in 2010, venture funds still accounted for 24% of all private equity funds primarily targeting Europe. In terms of aggregate capital, venture vehicles raised over $5bn in 2010, a slight decrease from just over $6bn raised in 2009. Not as abundant as venture funds, but holding a larger share in terms of capital raised, were infrastructure funds. The number of Europe-focused infrastructure vehicles closing increased signicantly from four in 2009 to 13 in 2010, and the aggregate capital raised by the funds increased from $2.6bn to $8bn. Fund Size Breakdown The average size of private equity funds targeting Europe in 2010 was $436mn, a decrease on the average size in 2009 of $487mn. In 2010 there were 13 funds primarily focusing on Europe that recorded a nal close of $1bn or more, accounting for nearly 50% of the aggregate capital raised by funds focused on Europe. The largest fund was Pantheon Global Secondary Fund IV, which closed on just over 2.3bn and accounted for 6% of the capital raised by all Europe focused funds in 2010. Predictions for 2011 Europe-focused fundraising generally decreased over the four quarters of 2010, from over $19.5bn raised in the rst quarter to approximately $6.5bn in the fourth quarter. Despite the unfavourable fundraising climate over the past two years, there are signs there could be an upturn in 2011. There are currently 391 European-focused funds on the road seeking nearly $147bn in capital and nearly half of these have already had at least one interim close, indicating a certain level of momentum in the market.

Fig. 5.15: Annual Europe-Focused Fundraising, 2005 - 2010

400 350 300 250 200 150 100 50 0 2005 2006 2007 2008 2009 2010 107.6 82.3 50.2 135.5 249 189 164.4 122 Aggregate Commitments ($bn) 347 373 333 No. Funds Raised

Fig. 5.14: 10 Largest Europe-Focused Funds Closed in 2010

Amount Closed (mn)

Fund

Fund Type

165.1

Pantheon Global Secondary Fund IV Triton Fund III HgCapital 6 Apollo European Principal Finance Fund 3i Growth Capital Fund Macquarie European Infrastructure Fund III Antin Infrastructure Fund Cube Infrastructure Fund ATP Private Equity Partners IV Crown Global Secondaries II

Secondaries Buyout Buyout Distressed Debt Growth Infrastructure Infrastructure Infrastructure Fund of Funds Secondaries

2,311 2,250 2,180 1,400 1,200 1,200 1,100 1,080 1,000 954

2011 Preqin Ltd. / www.preqin.com

The 2011 Preqin Global Infrastructure Review - Sample Pages

9. Performance

Private Equity

Benchmarks

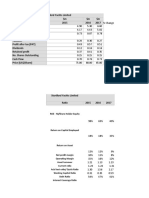

Fund Type: Buyout Geographic Focus: All Regions Vintage 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 No. Funds 14 20 54 68 65 75 36 26 26 30 63 47 56 43 25 28 32 20 19 11 23 Called (%) 13.2 16.2 31.2 49.9 77.3 88.7 91.4 92.5 95.4 95.8 97.0 97.4 99.7 100.0 99.4 100.0 100.0 100.0 100.0 100.0 100.0 Median Fund Dist (%) DPI 0.0 0.0 1.0 0.7 5.4 25.2 43.1 78.1 111.7 163.3 142.2 135.9 130.8 148.7 134.2 150.0 197.2 196.0 192.0 221.8 207.2 Value (%) RVPI 87.0 85.3 92.0 94.8 86.7 83.6 83.3 70.7 36.3 36.9 34.9 9.1 4.5 0.0 0.2 0.0 0.0 0.0 0.0 0.0 0.0 Benchmark Type: Median As At: 30 Jun 10 Mutliple Quartiles (X) Q1 0.92 1.04 1.09 1.16 1.11 1.44 1.74 2.00 2.07 2.64 2.20 1.89 1.78 2.12 2.06 2.19 2.47 2.63 2.39 3.17 2.72 Median 0.87 0.88 0.98 0.99 0.97 1.17 1.37 1.66 1.62 2.00 1.79 1.52 1.47 1.56 1.54 1.56 1.97 2.02 1.93 2.22 2.07 Q3 0.13 0.80 0.80 0.86 0.81 1.02 1.15 1.37 1.35 1.50 1.45 1.12 0.95 1.14 1.07 1.14 1.53 1.61 1.30 2.09 1.54 IRR Quartiles (%) Q1 n/m n/m 8.4 7.4 4.5 13.0 25.0 30.1 33.5 40.0 24.6 17.0 14.4 19.9 23.3 25.4 37.4 25.3 29.6 30.6 26.0 Median n/m n/m -1.5 -0.1 -1.9 5.9 13.5 17.0 17.6 28.1 20.5 8.7 8.0 9.6 9.6 10.7 22.6 17.8 21.2 25.0 15.4 Q3 n/m n/m -20.6 -7.1 -9.8 0.8 5.6 11.2 8.8 13.2 12.0 5.0 -2.4 2.7 0.9 2.7 12.8 10.2 7.9 21.7 7.9 IRR Max/Min (%) Max Min n/m n/m n/m n/m 45.8 -62.2 22.6 -42.6 33.0 -64.7 76.9 -17.7 85.9 -5.7 91.0 -16.2 51.9 -34.3 95.4 9.0 57.5 -8.9 27.0 -25.1 31.3 -100.0 84.5 -11.2 147.4 -16.2 59.9 -15.5 92.2 -1.1 58.0 0.8 58.1 -49.9 54.7 -0.5 70.0 2.4

Fund Type: Buyout by Fund Size Geographic Focus: All Regions

Benchmark Type: Median

Mega Buyout Large Buyout Median Weighted Median Weighted Vintage Multiple IRR Multiple IRR Multiple IRR Multiple IRR (X) (%) (X) (%) (X) (%) (X) (%) 2010 n/m n/m 0.00 n/m 0.46 n/m 0.55 n/m 2009 n/m n/m 0.94 n/m 0.85 n/m 0.85 n/m 2008 0.82 -8.1 0.97 -4.7 1.02 2.9 1.03 6.1 2007 0.97 -1.3 0.90 -3.7 1.00 0.0 0.98 -2.8 2006 0.88 -5.9 0.86 -7.3 0.97 -1.7 0.92 -4.5 2005 1.30 8.8 1.31 7.6 1.02 0.7 1.13 8.6 2004 1.37 8.7 1.47 14.9 1.26 13.5 1.32 21.8 2003 1.72 23.1 1.87 26.5 1.75 17.6 1.80 29.3 2002 1.83 34.1 1.79 28.6 1.75 22.5 1.73 19.6 2001 2.32 33.6 2.38 32.7 1.65 21.1 2.06 23.9 2000 1.81 18.1 1.90 16.9 1.62 14.2 1.61 14.7 1999 1.64 12.0 1.59 9.7 1.38 -0.8 1.42 -0.5 1998 1.38 8.0 1.41 5.4 1.39 9.3 1.35 3.5 1997 1.58 9.9 1.36 5.5 1.64 9.0 1.75 18.2 1996 1.40 8.3 1.50 10.3 1995 1.58 10.7 1.74 16.5 1994 1.72 36.3 1.86 37.5 Denitions used for mega, large, mid-market, and small buyout funds: Vintage 92-96 Vintage 97-04 Vintage 05-10

Mid-Market Buyout Small Buyout Median Weighted Median Weighted Multiple IRR Multiple IRR Multiple IRR Multiple IRR (X) (%) (X) (%) (X) (%) (X) (%) 0.21 n/m 0.43 n/m 0.15 n/m 0.44 n/m 0.89 n/m 0.80 n/m 1.03 n/m 0.73 n/m 0.89 -10.8 0.86 -13.2 0.99 -0.5 0.94 -2.5 1.04 4.2 1.02 -1.2 0.95 0.2 0.94 -1.2 0.96 -1.0 0.94 -3.0 1.01 -0.6 0.99 -3.9 1.12 5.7 1.16 6.5 1.33 12.1 1.28 13.1 1.41 13.3 1.59 19.9 1.24 9.1 1.51 12.1 1.68 16.6 1.72 21.0 1.44 10.2 1.55 11.4 1.61 15.3 1.58 16.8 1.54 18.6 1.71 21.5 1.92 28.0 2.07 27.6 2.42 31.2 2.16 25.9 1.91 21.3 1.84 20.6 2.01 18.5 1.83 16.4 1.51 9.1 1.55 10.6 1.38 12.8 1.36 10.0 1.37 7.5 1.38 1.8 1.65 9.7 1.73 11.2 1.05 1.3 1.10 2.8 1.58 9.3 1.47 7.8 1.49 9.3 1.49 12.3 1.80 15.2 1.75 15.8 1.31 -1.5 1.51 3.4 1.56 17.6 1.93 19.4 1.95 25.1 2.27 28.1 1.92 19.0 2.01 19.3 Mid $201-500mn $301-750mn $501-1,500mn Large > $500mn $751-2,000mn $1,501-4,500mn Mega > $2,000mn > $4,500mn

Small $200mn $300mn $500mn

The 2011 Preqin Global Infrastructure Review - Sample Pages

10. Investors

Investor Appetite

for Private Equity in 2011

December 2010 LP Survey Results The onset of the nancial crisis saw private equity fundraising become a much more challenging prospect for fund managers. Many institutional investors that had previously been active in the asset class placed their investments on hold and GPs struggled to raise capital for new vehicles. Fundraising remained extremely difcult in 2010with $225bn raised in the year, less than the $296bn raised in the same period the year before. To gain an indication of what can be expected in terms of fundraising in 2011, Preqin interviewed a global sample of 100 institutional investors in private equity in December 2010 in order to assess their current attitudes to the market and their plans for future investments in the asset class. Low Levels of Activity in 2010 Last years survey, conducted in December 2009, found that 40% of LPs had opted not to make any new commitments to private equity funds over the course of that year. Little changed in 2010; 42% of respondents to our December 2010 survey told us they had not made a single commitment to a fund during 2010. The vast majority of investors are currently at or above their target allocations to private equity. As Fig. 10.11 shows, 13% of investors are exceeding their target allocations. The proportion of LPs that have yet to reach their target allocations has fallen by 12 percentage points from 45% in December 2009 to 33% in December 2010 and more LPs are nding themselves at their targeted level of exposure to the asset class. When the responses from LPs in different regions are compared, a considerable 18% of North American LPs are exceeding their target allocations, signicantly more than the 10% of European respondents and 11% of Asia and Rest of World respondents

90% 80% 78% 71% 70% Exceeded Expectations

Fig. 10.11: Proportion of Investors Currently At, Above or Below Their Target Allocations to Private Equity

100% 90% 13% 5%

13%

Above Target Allocation

Proportion of Respondents

80% 70% 60% 50% 40% 30% 20% 10% 0% Dec-09 Jun-10 Dec-10 45% 33% 54% 40% 42% 54%

At Target Allocation

Below Target Allocation

Fig. 10.12: Proportion of Investors That Feel Their Private Equity Fund Investments Have Lived Up to Expectations

Proportion of Respondents

74%

70% 60% 50%

Met Expectations 40% 30% 20% 10% 2% 0% Dec-07 Dec-08 Dec-09 Dec-10 7% 7% 10% 13%

24%

22%

23%

Fallen Short of Expectations

that are also over-allocated to private equity. 40% of European investors are in fact below their target allocations. LPs Returns Expectations Over the past couple of years, LPs have seen the valuations of many of their private equity fund investments

fall signicantly. Despite this, the vast majority feel their private equity investments have met or exceeded their expectations. Fig. 10.12 shows how investors levels of satisfaction with their private equity investments have changed over the past few years. In December 2007, 24% of LPs felt their private equity investments had exceeded their expectations. In

10

2011 Preqin Ltd. / www.preqin.com

2011 Preqin Global Alternatives Reports

alternative assets. intelligent data.

The 2011 Preqin Global Alternatives Reports are the most comprehensive reviews of the alternatives investment industry ever undertaken, and are a must have for anyone seeking to understand the latest developments in the private equity, real estate and infrastructure markets.

Key content includes:

2011 Preqin Global Infrastructure Report

Interviews and articles from the most important people in the industry today; Detailed analysis on every aspect of the industry with a review of 2010, and predictions for the coming year; Comprehensive source of stats - including fundraising, performance, deals, GPs, secondaries, fund terms, investors, placement agents, advisors, law rms; Numerous reference guides for different aspects of the industry - Who is the biggest? Where are the centres of activity? How much has been raised? Where is the capital going? Who is investing? What are the biggest deals? What is the outlook for the industry?

ISBN: 978-1-907012-17-4 $175 / 95 / 115 www.preqin.com

2011 Preqin Global Private Equity Report

2011 Preqin Global Real Estate Report

ISBN: 978-1-907012-17-4 $175 / 95 / 115 www.preqin.com

ISBN: 978-1-907012-17-4 $175 / 95 / 115 www.preqin.com

For more information visit: www.preqin.com/gper

I would like to purchase:

2 Copies (10% saving) $315/170/205 $315/170/205 $315/170/205 $630/340/410 5 Copies (25% saving) $655/355/430 $655/355/430 $655/355/430 $1,310/710/860 10 Copies (35% saving) $1,135/620/750 $1,135/620/750 $1,135/620/750 $2,270/1,240/1,500 Data Pack* (Please Tick)

Name Private Equity Real Estate Infrastructure All Titles (33% Saving!)

1 Copy $175/95/115 $175/95/115 $175/95/115 $350/190/230

If you would like to order more than 10 copies of one title, please contact us for special rates * Data Pack Costs: $300/180/185 for single publication

Completed Order Forms:

Post (to Preqin): One Grand Central Place, 60 E 42nd Street, Suite 2544, New York NY 10165 Equitable House, 47 King William Street, London, EC4R 9AF Asia Square Tower 1 #07-04 8 Marina View Singapore 018960 Fax: +44 (0)87 0330 5892 +1 440 445 9595 +65 6407 1001 Email: info@preqin.com Telephone: +44 (0)20 7645 8888 +1 212 350 0100 +65 6407 1011

Payment Details:

Cheque enclosed (please make cheque payable to Preqin) Credit Card Visa Amex Please invoice me Mastercard

Shipping Details:

Name: Firm: Job Title: Address:

Card Number: Name on Card: Expiration Date: City: Security Code: Post/Zip: Country: Telephone: Email:

American Express, four digit code printed on the front of the card. Visa and Mastercard, last three digits printed on the signature strip.

Das könnte Ihnen auch gefallen

- The Well-Timed Strategy (Review and Analysis of Navarro's Book)Von EverandThe Well-Timed Strategy (Review and Analysis of Navarro's Book)Noch keine Bewertungen

- Preqin Private Equity Venture Report Oct2010Dokument11 SeitenPreqin Private Equity Venture Report Oct2010http://besthedgefund.blogspot.comNoch keine Bewertungen

- Investing in Junk Bonds: Inside the High Yield Debt MarketVon EverandInvesting in Junk Bonds: Inside the High Yield Debt MarketBewertung: 3 von 5 Sternen3/5 (1)

- Pe-Backed Ipos See Record Deals Sizes in Q1 2011Dokument4 SeitenPe-Backed Ipos See Record Deals Sizes in Q1 2011Pushpak Reddy GattupalliNoch keine Bewertungen

- Takaful Investment Portfolios: A Study of the Composition of Takaful Funds in the GCC and MalaysiaVon EverandTakaful Investment Portfolios: A Study of the Composition of Takaful Funds in the GCC and MalaysiaNoch keine Bewertungen

- Venture Investing After The Bubble: A Decade of EvolutionDokument10 SeitenVenture Investing After The Bubble: A Decade of Evolutionsweber7079Noch keine Bewertungen

- Ey A New Equilibrium ReportDokument20 SeitenEy A New Equilibrium ReportfadNoch keine Bewertungen

- Sharing Deal Insight: European Financial Services M&A News and Views From PWCDokument5 SeitenSharing Deal Insight: European Financial Services M&A News and Views From PWCvm7489Noch keine Bewertungen

- JPM Cap Intro 2011Dokument32 SeitenJPM Cap Intro 2011mdorneanuNoch keine Bewertungen

- Fun of FundsDokument21 SeitenFun of FundsGregor SakovičNoch keine Bewertungen

- PWC Shariah ReportDokument14 SeitenPWC Shariah ReportTan Chay LingNoch keine Bewertungen

- Guide To Privae Equity Fund of FundsDokument19 SeitenGuide To Privae Equity Fund of FundslentinieNoch keine Bewertungen

- Deal Forum: DigestDokument12 SeitenDeal Forum: DigestAnonymous Feglbx5Noch keine Bewertungen

- 2020.Q4 Massif Investor Client LetterDokument10 Seiten2020.Q4 Massif Investor Client LetterKan ZhouNoch keine Bewertungen

- The Top 100 Networked VentureDokument4 SeitenThe Top 100 Networked VentureJobin GeorgeNoch keine Bewertungen

- Third Point May 2021Dokument10 SeitenThird Point May 2021Owm Close CorporationNoch keine Bewertungen

- Preqin Private Equity Spotlight December 2012Dokument20 SeitenPreqin Private Equity Spotlight December 2012richard_dalaudNoch keine Bewertungen

- Alternative Investments Become Part of MainstreamDokument1 SeiteAlternative Investments Become Part of MainstreamGanesh KumarNoch keine Bewertungen

- Global Trends in Investment Operations OutsourcingDokument9 SeitenGlobal Trends in Investment Operations OutsourcingCognizantNoch keine Bewertungen

- Top of Form: Search inDokument5 SeitenTop of Form: Search inrashmiearoraNoch keine Bewertungen

- Private Debt Investor Special ReportDokument7 SeitenPrivate Debt Investor Special ReportB.C. MoonNoch keine Bewertungen

- Alex Navab - Overview of Private EquityDokument21 SeitenAlex Navab - Overview of Private EquityAlyson Davis100% (16)

- Preqin Compensation and Employment Outlook Private Equity December 2011Dokument9 SeitenPreqin Compensation and Employment Outlook Private Equity December 2011klaushanNoch keine Bewertungen

- Deleveraging Investing Optimizing Capital StructurDokument42 SeitenDeleveraging Investing Optimizing Capital StructurDanaero SethNoch keine Bewertungen

- PEVC Club - 101Dokument26 SeitenPEVC Club - 101tevfik_erenNoch keine Bewertungen

- Goldman Sachs Presentation To The Sanford Bernstein Strategic Decisions Conference Comments by Gary Cohn, President & COODokument7 SeitenGoldman Sachs Presentation To The Sanford Bernstein Strategic Decisions Conference Comments by Gary Cohn, President & COOapi-102917753Noch keine Bewertungen

- Chapter 9 Private Equity and VentureDokument53 SeitenChapter 9 Private Equity and VenturestephaniNoch keine Bewertungen

- HCP 1Q-2010 LetterDokument6 SeitenHCP 1Q-2010 LetterkevinobNoch keine Bewertungen

- Brenner West - 2010 Fourth Quarter LetterDokument4 SeitenBrenner West - 2010 Fourth Quarter LettergatzbpNoch keine Bewertungen

- Ernst & Young Islamic Funds & Investments Report 2011Dokument50 SeitenErnst & Young Islamic Funds & Investments Report 2011The_Banker100% (1)

- Bank Loans: Market Dynamics Poised To Deliver Attractive Risk-Adjusted ReturnsDokument6 SeitenBank Loans: Market Dynamics Poised To Deliver Attractive Risk-Adjusted ReturnsSabin NiculaeNoch keine Bewertungen

- A Decade of Developments in The VC Industry June 2022Dokument6 SeitenA Decade of Developments in The VC Industry June 2022Rahul RameshNoch keine Bewertungen

- Macroeconomics 12th Edition Michael Parkin Solutions Manual Full Chapter PDFDokument31 SeitenMacroeconomics 12th Edition Michael Parkin Solutions Manual Full Chapter PDFJosephWebbemwiy100% (12)

- Third Point Q3 Investor LetterDokument8 SeitenThird Point Q3 Investor Lettersuperinvestorbulleti100% (1)

- Analysis of IPO As An Exit Strategy For Private Equity Firms in The Present ScenarioDokument10 SeitenAnalysis of IPO As An Exit Strategy For Private Equity Firms in The Present ScenarioPushpak Reddy GattupalliNoch keine Bewertungen

- Thesis Version 1Dokument80 SeitenThesis Version 1deosa villamonteNoch keine Bewertungen

- Pere May 2012 Pere30Dokument13 SeitenPere May 2012 Pere30tritrantranNoch keine Bewertungen

- Anne Simpson Corporate Governance PDFDokument15 SeitenAnne Simpson Corporate Governance PDFSunil ShawNoch keine Bewertungen

- MAN GROUP (Done by Ummal)Dokument17 SeitenMAN GROUP (Done by Ummal)sunnymanoNoch keine Bewertungen

- BodyDokument83 SeitenBodydeosa villamonteNoch keine Bewertungen

- Brookfield Asset Management q2 2013 Letter To ShareholdersDokument6 SeitenBrookfield Asset Management q2 2013 Letter To ShareholdersCanadianValueNoch keine Bewertungen

- Plugin-2009 CFO Forum Exec SummDokument6 SeitenPlugin-2009 CFO Forum Exec SummmosshoiNoch keine Bewertungen

- Mfi 0516Dokument48 SeitenMfi 0516StephNoch keine Bewertungen

- Difficult TimesDokument18 SeitenDifficult TimesMichael Iliste von RoopNoch keine Bewertungen

- Accenture - Why M&A PDFDokument16 SeitenAccenture - Why M&A PDFAbhishek DaiyaNoch keine Bewertungen

- Lbo MSC Slides 2017Dokument257 SeitenLbo MSC Slides 2017Chris MiguelvivasNoch keine Bewertungen

- Investment Banking Investment Banking2122Dokument16 SeitenInvestment Banking Investment Banking2122vishal13889100% (2)

- Vietnam Deals Review 2011: High Capital Inflows From Japanese CorporationsDokument53 SeitenVietnam Deals Review 2011: High Capital Inflows From Japanese CorporationsManh Cuong Nguyen TuNoch keine Bewertungen

- Mckinsey PDFDokument36 SeitenMckinsey PDFMohammed Abdul HadyNoch keine Bewertungen

- Financing A New Venture Trough and Initial Public Offering (IPO)Dokument32 SeitenFinancing A New Venture Trough and Initial Public Offering (IPO)Manthan LalanNoch keine Bewertungen

- Back To Basics For Equity MarketsDokument20 SeitenBack To Basics For Equity MarketshelfossNoch keine Bewertungen

- Z-Ben Executive Briefing (March 2012)Dokument2 SeitenZ-Ben Executive Briefing (March 2012)David QuahNoch keine Bewertungen

- 2011 Mid-Year Shareholder Activism UpdateDokument10 Seiten2011 Mid-Year Shareholder Activism UpdatesachhyamNoch keine Bewertungen

- 10 Key Trends Changing Inv MGMTDokument50 Seiten10 Key Trends Changing Inv MGMTcaitlynharveyNoch keine Bewertungen

- Bam q2 2015 LTR To ShareholdersDokument6 SeitenBam q2 2015 LTR To ShareholdersDan-S. ErmicioiNoch keine Bewertungen

- Artko Capital 2019 Q3 LetterDokument10 SeitenArtko Capital 2019 Q3 LetterSmitty WNoch keine Bewertungen

- Is There A Silver Lining?: The Indian Mutual Fund IndustryDokument28 SeitenIs There A Silver Lining?: The Indian Mutual Fund IndustryUtsav LokeshNoch keine Bewertungen

- The Case For Emerging Markets Private Equity: V.10 May 2012Dokument33 SeitenThe Case For Emerging Markets Private Equity: V.10 May 2012Bryan LiNoch keine Bewertungen

- 2014BankingIndustryOutlook DeloitteDokument20 Seiten2014BankingIndustryOutlook DeloittelapogkNoch keine Bewertungen

- Persistent Losses Prompt Ctas To Improvise: June 18, 2014Dokument12 SeitenPersistent Losses Prompt Ctas To Improvise: June 18, 2014Allen FuchsNoch keine Bewertungen

- ABM - BF12 IIIb 8Dokument4 SeitenABM - BF12 IIIb 8Raffy Jade SalazarNoch keine Bewertungen

- Apple Matrik SpaceDokument25 SeitenApple Matrik SpaceChandra SusiloNoch keine Bewertungen

- Business Unit 4 Revision NotesDokument21 SeitenBusiness Unit 4 Revision NotesAlicia KunteNoch keine Bewertungen

- Chapter 4 Financial PerformanceDokument19 SeitenChapter 4 Financial Performancejoann121887Noch keine Bewertungen

- CBT PPT BK NC IiiDokument34 SeitenCBT PPT BK NC IiiJacqueline DelrosarioNoch keine Bewertungen

- Ce 8 Sem Construction Economics and Finance Summer 2016Dokument2 SeitenCe 8 Sem Construction Economics and Finance Summer 2016Panna KurmiNoch keine Bewertungen

- Groups 7 Changes in Group StructureDokument10 SeitenGroups 7 Changes in Group StructureSharmaine Rivera MiguelNoch keine Bewertungen

- Rashmi Class Rough WorkDokument10 SeitenRashmi Class Rough WorkTejas Suhas MuleyNoch keine Bewertungen

- Shahi Export FY 21 PDFDokument327 SeitenShahi Export FY 21 PDFArun Kumar DasNoch keine Bewertungen

- CHAP - 5 - Measuring and Evaluating The Performance of BanksDokument7 SeitenCHAP - 5 - Measuring and Evaluating The Performance of BanksNgoc AnhNoch keine Bewertungen

- Amalgamation Revision NotesDokument9 SeitenAmalgamation Revision NotesghsjgjNoch keine Bewertungen

- Accounting 1101 Midterm Examination 100 PointsDokument7 SeitenAccounting 1101 Midterm Examination 100 PointsRhaizel HernandezNoch keine Bewertungen

- Isssue of Shares and Debentures MCQDokument42 SeitenIsssue of Shares and Debentures MCQlolNoch keine Bewertungen

- Questions On AccountancyDokument34 SeitenQuestions On AccountancyAshwin ChoudharyNoch keine Bewertungen

- Ultimate Sample Paper 2Dokument21 SeitenUltimate Sample Paper 2Senthilkumar KNoch keine Bewertungen

- Finance Management Individual AssDokument33 SeitenFinance Management Individual AssDevan MoroganNoch keine Bewertungen

- Full Download Financial Reporting Financial Statement Analysis and Valuation 9th Edition Wahlen Test BankDokument36 SeitenFull Download Financial Reporting Financial Statement Analysis and Valuation 9th Edition Wahlen Test Bankjulianwellsueiy100% (30)

- Ratio Case Study - Standfornd Yard Mon Sec Summer 2021Dokument8 SeitenRatio Case Study - Standfornd Yard Mon Sec Summer 2021Muhammad Ali SamarNoch keine Bewertungen

- CH06Dokument26 SeitenCH06Will TrầnNoch keine Bewertungen

- Ikea in IndiaDokument85 SeitenIkea in Indiahn30103_40569026100% (2)

- 4 Audit of Investments Docx Accounting Examination PDF Copy DownloadedDokument12 Seiten4 Audit of Investments Docx Accounting Examination PDF Copy DownloadedJANISCHAJEAN RECTONoch keine Bewertungen

- Final Genentech ReportDokument14 SeitenFinal Genentech Reportromagoyal09100% (2)

- Ownershio Structure Pre and Post IPO and Operating Performance of Jasdaq CompDokument19 SeitenOwnershio Structure Pre and Post IPO and Operating Performance of Jasdaq CompMandala Sigit WibowoNoch keine Bewertungen

- Fin Man Case Study On Fs AnalysisDokument6 SeitenFin Man Case Study On Fs AnalysisRechelleNoch keine Bewertungen

- Solution To Ch02 P14 Build A ModelDokument4 SeitenSolution To Ch02 P14 Build A Modeljcurt8283% (6)

- Welcome To First ReviewDokument17 SeitenWelcome To First Reviewkarthy143Noch keine Bewertungen

- Dublin LTDDokument4 SeitenDublin LTDXianFa WongNoch keine Bewertungen

- Khajuria Final TranscriptDokument22 SeitenKhajuria Final Transcriptmlieb737Noch keine Bewertungen

- Financial Accounting The Impact On Decision Makers 10Th Edition Porter Test Bank Full Chapter PDFDokument68 SeitenFinancial Accounting The Impact On Decision Makers 10Th Edition Porter Test Bank Full Chapter PDFchristinecohenceyamrgpkj100% (10)

- Scary Smart: The Future of Artificial Intelligence and How You Can Save Our WorldVon EverandScary Smart: The Future of Artificial Intelligence and How You Can Save Our WorldBewertung: 4.5 von 5 Sternen4.5/5 (55)

- System Error: Where Big Tech Went Wrong and How We Can RebootVon EverandSystem Error: Where Big Tech Went Wrong and How We Can RebootNoch keine Bewertungen

- Generative AI: The Insights You Need from Harvard Business ReviewVon EverandGenerative AI: The Insights You Need from Harvard Business ReviewBewertung: 4.5 von 5 Sternen4.5/5 (2)

- Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyVon EverandDigital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyBewertung: 4 von 5 Sternen4/5 (51)

- AI Superpowers: China, Silicon Valley, and the New World OrderVon EverandAI Superpowers: China, Silicon Valley, and the New World OrderBewertung: 4.5 von 5 Sternen4.5/5 (399)

- 100M Offers Made Easy: Create Your Own Irresistible Offers by Turning ChatGPT into Alex HormoziVon Everand100M Offers Made Easy: Create Your Own Irresistible Offers by Turning ChatGPT into Alex HormoziNoch keine Bewertungen

- The Master Algorithm: How the Quest for the Ultimate Learning Machine Will Remake Our WorldVon EverandThe Master Algorithm: How the Quest for the Ultimate Learning Machine Will Remake Our WorldBewertung: 4.5 von 5 Sternen4.5/5 (107)

- Four Battlegrounds: Power in the Age of Artificial IntelligenceVon EverandFour Battlegrounds: Power in the Age of Artificial IntelligenceBewertung: 5 von 5 Sternen5/5 (5)

- Artificial Intelligence: A Guide for Thinking HumansVon EverandArtificial Intelligence: A Guide for Thinking HumansBewertung: 4.5 von 5 Sternen4.5/5 (30)

- The Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyVon EverandThe Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyNoch keine Bewertungen

- The Bitcoin Standard: The Decentralized Alternative to Central BankingVon EverandThe Bitcoin Standard: The Decentralized Alternative to Central BankingBewertung: 4.5 von 5 Sternen4.5/5 (41)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andVon EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andBewertung: 4.5 von 5 Sternen4.5/5 (709)

- YouTube Secrets: The Ultimate Guide on How to Start and Grow Your Own YouTube Channel, Learn the Tricks To Make a Successful and Profitable YouTube ChannelVon EverandYouTube Secrets: The Ultimate Guide on How to Start and Grow Your Own YouTube Channel, Learn the Tricks To Make a Successful and Profitable YouTube ChannelBewertung: 4.5 von 5 Sternen4.5/5 (48)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumVon EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumBewertung: 3 von 5 Sternen3/5 (12)

- Artificial Intelligence: The Insights You Need from Harvard Business ReviewVon EverandArtificial Intelligence: The Insights You Need from Harvard Business ReviewBewertung: 4.5 von 5 Sternen4.5/5 (104)

- HBR's 10 Must Reads on AI, Analytics, and the New Machine AgeVon EverandHBR's 10 Must Reads on AI, Analytics, and the New Machine AgeBewertung: 4.5 von 5 Sternen4.5/5 (69)

- Eric Ries’ The Lean Startup How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses SummaryVon EverandEric Ries’ The Lean Startup How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses SummaryBewertung: 4.5 von 5 Sternen4.5/5 (11)

- The World's Most Dangerous Geek: And More True Hacking StoriesVon EverandThe World's Most Dangerous Geek: And More True Hacking StoriesBewertung: 4 von 5 Sternen4/5 (50)

- Binary Option Trading: Introduction to Binary Option TradingVon EverandBinary Option Trading: Introduction to Binary Option TradingNoch keine Bewertungen

- Your AI Survival Guide: Scraped Knees, Bruised Elbows, and Lessons Learned from Real-World AI DeploymentsVon EverandYour AI Survival Guide: Scraped Knees, Bruised Elbows, and Lessons Learned from Real-World AI DeploymentsNoch keine Bewertungen

- The AI Advantage: How to Put the Artificial Intelligence Revolution to WorkVon EverandThe AI Advantage: How to Put the Artificial Intelligence Revolution to WorkBewertung: 4 von 5 Sternen4/5 (7)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNVon Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNBewertung: 4.5 von 5 Sternen4.5/5 (3)

- Who's Afraid of AI?: Fear and Promise in the Age of Thinking MachinesVon EverandWho's Afraid of AI?: Fear and Promise in the Age of Thinking MachinesBewertung: 4.5 von 5 Sternen4.5/5 (13)

- T-Minus AI: Humanity's Countdown to Artificial Intelligence and the New Pursuit of Global PowerVon EverandT-Minus AI: Humanity's Countdown to Artificial Intelligence and the New Pursuit of Global PowerBewertung: 4 von 5 Sternen4/5 (4)