Beruflich Dokumente

Kultur Dokumente

Bismillah 2011-12 Accounts Notes

Hochgeladen von

AMIN BUHARI ABDUL KHADERCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bismillah 2011-12 Accounts Notes

Hochgeladen von

AMIN BUHARI ABDUL KHADERCopyright:

Verfügbare Formate

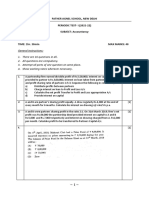

H.S.

C OMTEX CLASSES 9

TH

YEAR

1

BOOK KEEPING & ACCOUNTANCY

OMTEX CLASSES

8

th

years of success

BOOK KEEPING

AND

ACCOUNTANCY

NAME : - ______________________________

STANDARD: -S.Y.J.C (Second year junior college)

CLASSES : - OMTEX CLASSES

FOR PRIVATE CIRCULATION ONLY

You dont know what you can do until you try

IF YOU ARE SATISFIED WITH OUR TEACHING TELL TO OTHERS IF NOT TELL TO US

H.S.C OMTEX CLASSES 9

TH

YEAR

2

BOOK KEEPING & ACCOUNTANCY

Preface

It gives us great pleasure to present this thoroughly revised edition

of Omtex Book Keeping and Accountancy for Standard XII,

prepared according to the pattern prescribed by the board.

A thorough study and practice of this edition with the help of Omtex

guidance (teaching + coaching) will enable the students to pass the HSC

Examination with good marks.

Meticulous care has been taken to make this edition of Omtex

Book Keeping and Accountancy perfect and useful in every

respect. However, suggestions, if any, for its improvement are most

welcome.

- Omtex

Note: - No part of this book may be copied, adapted, abridged or translated, stored in any retrieval

system, computer system, photographic or other system or transmitted in any form or by any

means without a prior written permission of the Omtex classes.

H.S.C OMTEX CLASSES 9

TH

YEAR

3

BOOK KEEPING & ACCOUNTANCY

CH. 1. VALUATION OF GOODWILL [Q. 2 (A): 5 MARKS]

Note: - One practical problem on Valuation of Goodwill carrying 5 marks and one theory

question on Computer Awareness carrying 5 marks will be asked in Q. 2 of the Board Paper

in option to one practical problem on Depreciation carrying 10 marks. The students may

either attempt problem on Depreciation or Goodwill and theory question on Computer

Awareness.

Valuation of Goodwill: - As prescribed in the syllabus, the value of goodwill as on a

particular date is ascertained by using any one of the following methods:

i. The Average Profit Method and

ii. The Super Profit Method.

INTRODUCTION

Definition: Goodwill is an intangible (non visible) fixed asset having a realizable

(economic) value. It is the reputation of business. Valuation of goodwill is very

important in the case of admission, retirement and death of partners.

PROBLEMS

1. The profits of the firm for the last five years are 2002 Rs. 20,000; 2003 Rs. 16,000; 2004

Rs. 24,000; 2005 Rs. 8000; 2006 Rs. 12,000. Calculate the goodwill of the firm. [Ans.

Rs. 16,000]

2. Mona, Reena and Sona have been carrying on a partnership business and good will of their

firm is to be valued at three years purchase of the average profit for the last five years. The

profit and losses for the last five years have been. 1

st

Year Rs. 16,000, 2

nd

Year, 15,000, 3

rd

Year, 8,000(Loss), 4

th

Year, 7,000, 5

th

Year, 10,000. [Ans. Rs. 24,000]

3. Calculate the good will from the following information goodwill is valued at three years

purchase of average profit of the last six years. Profit and losses of the business in the last

six years are as follows, [Ans. Rs. 95,000]

1

st

year, Rs, 40,000(Profit)

2

nd

Year, Rs, 60,000(Profit)

3

rd

Year, Rs, 10,000(Loss)

4

th

Year, Rs, 50,000(Profit)

5

th

Year, Rs, 30,000 (Loss)

6

th

Year, Rs, 80,000(Profit)

4. Calculate the value of goodwill according to average profit method. Goodwill is valued at

three years purchase of last four year average profit. The profits and losses for the last four

years are. [Ans. Rs. 27,000]

1

st

Year Rs, 10,000(Profit)

2

nd

Year Rs, 12,000(Profit)

3

rd

Year Rs, 4,000(Loss)

4

th

Year Rs, 18,000(Profit)

H.S.C OMTEX CLASSES 9

TH

YEAR

4

BOOK KEEPING & ACCOUNTANCY

5. The profit of a firm for the four years from 1991 to 1994 where_ [Ans. Rs. 1, 02,000]

1991 Rs, 40,000

1992 Rs, 45,000

1993 Rs, 55,000

1994 Rs, 53,000

Calculate the goodwill of the firm at 2yrs. Purchase of the average profit for the last three

years.

6. Mr. X a businessperson has earned the following profits in the last five years.

1995 1, 05,800

1994 1, 02,600

1993 98,400

1992 96,800

1991 95,500

Value goodwill of Mr. X on the basis of three years purchase of average of the past five

years. [Ans. Rs. 2,99,460]

7. Good will is valued at three years purchase of last five years average profit. The profits for

the last five years are. [Ans. 0]

1

st

Year 4,800(p)

2

nd

Year 7,200(L)

3

rd

Year 10,000(L)

4

th

Year 3,000(P)

5

th

Year 5,000(L)

Note: - Since the companys average profit is negative. Therefore the firms goodwill is zero.

8. Compute the goodwill the following case good will is valued at three years purchase of

average profit of five years. The Profit of the five years were_ [Ans. Rs. 26,400]

1

st

Year 5,800

2

nd

Year 7,400

3

rd

Year 20,000

4

th

Year 3,500

5

th

Year 7,300

9. Sales of trader for 3years ended 30

th

June 1995 are as follows [Ans. Rs. 1, 22,680]

1995 Rs, 5, 50,000

1994 Rs, 5, 46,000

1993 Rs, 5, 25,000

The profit margin for the 3 years ended 30

th

June 1995 was 10%, 12%, 12% respectively. For

the purpose of selling the business of the trader, goodwill is to be valued at 2years purchase

of the average profit of the last 3years. Find the value of good will.

10. From the following particulars, value good will of 2yrs. Purchase of last 5 years. [Ans.

Rs. 70,326]

Year ended Turn over Net profit

31-12-1990

31-12-1991

31-12-1992

31-12-1993

31-12-1994

5,15,000

5,45,600

5,35,800

5,40,900

5,60,800

5%

6%

7%

7.5%

7%

H.S.C OMTEX CLASSES 9

TH

YEAR

5

BOOK KEEPING & ACCOUNTANCY

11. A firm with an average capital employed of Rs. 1, 60,000 is expected to earn Rs, 40,000

per annum in future. Calculate goodwill at three times the super profit taking the normal

rate of return as 15%. [Ans. Rs. 48,000]

12. Capital employed on 31

st

December, 1990 was Rs, 1, 00,000/-. The Profits earned by the

business for the last 5 years where. [Ans. Rs. 87,000]

1986 30,000

1987 40,000

1988 50,000

1989 40,000

1990 60,000

Normal rate of return is 15%. Good will is valued at 3 years purchase of the super profits of

the business. Find out the value of goodwill.

13. The books of a business showed that the capital employed on 31

st

December, 1992 was

Rs.1, 00,000/-. Profits for the last five years are_1988, 1989, 1990, 1991 & 1992 were Rs,

60,000, Rs, 55,000, Rs, 75,000, Rs, 85,000 & Rs, 65,000 respectively. Goodwill is valued

at 2 years purchase of the Super profit of the business. NRR is 10%. [Ans. Rs. 1, 16,000]

14. M/s XYZ partnership firm earned net profit during the last four years were Rs, 7,000. Rs,

13,000. Rs, 12,000 and Rs, 8,000. The capital investment made in the firm was Rs,

50,000. N.R.R on capital is 15%. The remuneration of the partners during the period is Rs,

500 p.a. Good will is valued at 2 Yrs purchase of Average super profit of the above

mentioned years. [Ans. Rs. 4,000]

15. M/s Vijay trading company earned net profit during the last four years was follows.

1

st

Year Rs, 57,000

2

nd

Year Rs, 44,000

3

rd

Year Rs, 61,000

4

th

Year Rs, 58,000

The capital investment made by the company is Rs, 1, 50,000. Normal Rate of return on

capital is 20%. The remuneration of the partners during this period is Rs, 500 p.m. Good

will is valued at 2years purchase of Average Super profit of above mentioned period.

[Ans. Rs. 38,000]

16. The average net profit expected in the business by ABC firm is Rs, 36,000 per year. The

average capital employed in the business by the firm is Rs, 2, 00,000. The Rate of interest

expected from capital invested in the business is 10%. The remuneration of the partners is

estimated to Rs, 6,000 P.a. Calculate the value of goodwill based on 2years purchase of

super profit. [Ans. Rs. 20,000]

17. M/s Rajesh Trading company earned net profit during the last four years were Rs, 15,000,

Rs, 28,000, Rs, 30,000 & Rs, 40,000. The capital investment made by the company is 1,

00,000. Normal rate of return on capital is 15 %. The remuneration of the partners during

this period is Rs, 1,000p.a. Good will is valued at 2 years purchase of average super profit

of the above mentioned period. [Ans. Rs. 24,500]

H.S.C OMTEX CLASSES 9

TH

YEAR

6

BOOK KEEPING & ACCOUNTANCY

18.The present average net profit of Braful, Shobha partnership firm before detecting

partners remuneration is Rs, 27,000 p.a. The capital employed in the business by the

partner Braful Rs, 1, 00,000 & Shobha Rs, 50,000. The profit expected from the total

capital invested is 10% p.a. The total remuneration is estimated to be Rs, 6,000 per

annum. Find out the value of goodwill on the basis of 2 years purchase of super profit.

[Ans. Rs. 12,000]

19. The following balance sheet of Kantilal, Chandrakant.

Balance sheet as on 31

st

March, 1995

Liabilities Amount Assets Amount

Capital

Kantilal

Chandrakant

Reserve Fund

Creditors

90,000

70,000

44,000

38,000

Machinery

Building

Investments

Stock

Debtor

Bank

Profit/loss A/c

50,000

41,000

30,000

20,000

66,000

30,000

5,000

2,42,000 2,42,000

The net profits of the firm for the year ended 31

st

March, 1995 were Rs, 15,000 Rs, 25,000

Rs, 26,000. Ascertain the value of good will at 2 years purchase of the super profit of the

3years taking the normal rate of return on capital employed is 10%. [Ans. Rs. 4,200]

20. The following is the balance sheet of M/s Anna and Chunna as on 31

st

March 1995.

Balance sheet as on 31

st

march, 1995.

Liabilities Amount Assets Amount

Capital

Anna

Chunna

Creditors

Profit/ Loss A/c

1,64,000

40,000

35,000

3,040

Machinery

Building

Plant

Stock

Debtor

Bank

10,000

26,000

56,000

56,000

19,040

75,000

2, 42, 040 2, 42, 040

Net profits for the past 3years are 1

st

year Rs, 43,350, 2nd year Rs, 36870, 3rd year Rs,

32,280. Normal rate of return on capital employed is 10%. Calculate the value of goodwill

at 2years purchase of the average super profit. [Ans. Rs. 33,592]

21. Priti and Pritam are partners sharing profits and losses in the ratio of 3:2. They admit

Prasad for 1/6

th

share. For the purpose of admission of Prasad, goodwill of the firm should

be valued on the basis of 3 years purchase of the last 5 years average profit. The profits

were. [Ans. Rs. 1,20,000]

Year 1990 91 1991 92 1992 93 1993 94 1994 95

Profits Rs. 60,000 62,500 45,000(L) 42,500 80,000

H.S.C OMTEX CLASSES 9

TH

YEAR

7

BOOK KEEPING & ACCOUNTANCY

HOME WORK SECTION

1. Mahipati and Ganpati are partners sharing profits and losses in the ratio of 4:3. They

admitted in partnership Shripati for 1/8 share. For the purpose of admission of Shripati,

goodwill of the firm should be valued on the basis of 2 years purchase of the last 5 years

average profit. Calculate the goodwill of the firm. [Ans. Rs. 2,00,000]

1991 92

1992 93

1993 94

1994 95

1995 96

Rs. 75,000

Rs. 1,00,000

Rs. 1,25,000

Rs. 85,000

Rs. 1,15,000

2. Jaya and Maya are carrying on a business in partnership for last 12 years. Goodwill of the

firm is to be valued at 3 years purchase of the average profit of last 6 years.

2000-01

2001-02

2002-03

2003-04

2004-05

2005-06

2006-07

Rs. 2,20,000(Profit)

Rs. 1,20,000(Loss)

Rs. 2,60,000(Profit)

Rs. 1,80,000(Loss)

Rs. 2,90,000(Profit)

Rs. 3,20,000(Profit)

Rs. 2,10,000(Profit)

You are required to calculate the value of Goodwill of the firm. [Ans. Rs. 4,55,000]

[Note: - Last 6 years are to be counted in reverse order of years given. Therefore, profit given

for the year (2000 01) is to be ignored].

3. Vijay and Azim carrying on a business in partnership for last 5 years. Goodwill of the firm

is to be valued at 3 years purchases of the average profits of last 5 years. The profits and

losses for the last 5 years were:

1996-97

1997-98

1998-99

1999-2000

2000-01

(Profit) Rs. 32,000

(Profit) Rs. 30,000

(Loss) Rs. 16,000

(Profit) Rs. 14,000

(Profit) Rs. 20,000

You are required to calculate the value of goodwill of the firm. [Ans. Rs. 48,000]

4. The following is the Balance Sheet of Ashok and Nayan:

Balance Sheet as on 31

st

March 2007.

Liabilities Amount Assets Amount

Capital

Ashok

Nayan

General Reserve

Profit & Loss A/c

Sundry Creditors

1,00,000

1,20,000

78,000

56,000

36,000

Plant and Machinery

Furniture

Stock

Debtors

Bank

Prepaid Expenses

1,78,000

62,000

48,000

40,000

35,000

27,000

3,90,000 3,90,000

The trading result for the last four years was 2003 04: Rs. 65,000 (Profit), 2004 05: Rs.

5,000(loss), 2005 06: Rs. 78,000 (Profit) and 2006 07: Rs. 92,000 (Profit).

Calculate the value of goodwill of the firm at 2 years purchases of the super profit

considering the Normal rate of return on the capital employed is 13%. [Ans. Rs. 37,475]

H.S.C OMTEX CLASSES 9

TH

YEAR

8

BOOK KEEPING & ACCOUNTANCY

IMPORTANT POINTS TO REMEMBER

Any Number which is followed by the word Years Purchase / Times / Thrice /

Twice are considered as number of years purchase.

If Number of Years of purchase is not given then assume it as 1 years

purchase.

If there is a continuous loss in the Firm then the Good will of the Firm would

be Zero (0).

If the total Profits/ Loss are negative then also the goodwill will be Zero.

5. Calculate the value of goodwill of the firm from the following information:

i. Total capital employed in the business Rs. 4,00,000.

ii. Net profits of the firm or the past three years were Rs. 53,800, Rs. 45,350, Rs. 56,250.

iii. Normal rate of return at 10%.

iv. Goodwill is to be valued at three years purchase of super profit. [Ans. Rs. 35,400]

6. Following is the Balance Sheet of Mr. Atul as on 31

st

March, 1993:

Liabilities Amount Assets Amount

Capital

General Reserve

Creditors

Bills Payable

77,500

22,500

40,000

5,000

Fixed Assets

Current Assets

Prepaid Advertisement

85,000

50,000

10,000

1,45,000 1,45,000

The net profits for the last three years were Rs. 19,500; Rs. 22,500; Rs. 30,000.

Calculate the value of goodwill at two times of super profit, taking into consideration the

standard rate of return on the capital employed is 15%. [Ans. Rs. 21,000]

Note: Capital Employed = Partners Capital + General Reserve + Accumulated Profit

Unadjusted losses Expenses yet to be written off.

H.S.C OMTEX CLASSES 9

TH

YEAR

9

BOOK KEEPING & ACCOUNTANCY

CH. 2. COMPUTER AWARENESS [Q. 2 (B): 5 MARKS]

Answer the following questions

1. What is the computer hardware?

Ans. Computer hardware refers to physical components like input devices, central processing

unit and output devices of a computer system.

2. Explain about the components of computer hardware?

Ans. The computer hardware comprises of the following components.

i. Input devices: - The data is required to be transmitted to computer for processing. It

is done with the help of input devices like punch card reader, paper tape reader, mark

and character reader, keyboard, speech recognizer etc.

ii. Central processing Unit: - This unit processes raw data according to the

instructions given to the computer. It has mainly three parts. Control unit, Arithmetic /

Logic unit and memory unit.

iii. Output devices: - The processed data is to be made available to the user in the form

required by him. For this purpose the following devices are used. Printers, visual display unit

etc. This is necessary to provide back up storage. It may be in the form magnetic tapes,

magnetic dises, floppies, C.D.s etc.

3. Write a short note on second generation computers.

Ans. The computers of the second generation: - We are initially characterized by either

magnetic drum or magnetic core storage later on they used transistors in place of vacuum

tubes the transistors being small in size occupied lesser space and power. They were less

expensive and generated less heat as compared to the vacuum tubes. The computer became

compact. These computers were also applied in other field such as scientific and mathematical

application in addition to application in the fields of business and industry. The United states

of America had more than 5000 computers. Some of the important second generation

computers are IBM 1620, IBM 1401, IBM 7094, CDC 1604, CDC 3600, RCA 501 and

UNIVAC 1108 of these the most popular model of the second generation was IBM 1401.

4. Write short notes on Third Generation Computers (1965 71)

Ans. In the early sixties integrated circuits were developed which were later on used in

computers. Integrated circuits (I.C.) improved secondary stage devices, new input output

devices such as Visual Display Unit (V.D.U) and high speed printers. These computers came to

be known as Mini computers. I.C.s were more efficient and they were having much higher

speed than transistors. Because of the I.C.s it became possible to have lot of functions from

computers. They had a very large memory. Also many computer languages were introduced.

5. Write short note on Fourth Generation of Computers (1971 85)

Ans. In 1971, Intel corporation developed and I.C. which was a revolutionary in a computer

world. Later in 1974, another breed of computer known as Micro computers came into

existence and which became popular during the fourth phase. The computer which used large

H.S.C OMTEX CLASSES 9

TH

YEAR

10

BOOK KEEPING & ACCOUNTANCY

scale integrated circuits used micro processor chips like 8080, 8085, 8086, 6800, 68000 of

this 8086 and 68000 are 16 Bit chips and rest are 8 Bit chips. It reduced the size and

increased the number of functions. Secondary devices are further developed. These computers

left no field in human life uncovered. Some of the important models of fourth generation are

Intel 4004, Apple I & II, DCM Spectrum, 2X Spectrum, BBCs ACCOM, IBM Compatibles

etc. and sinclairs ZX 81.

6. Write short notes on First generation Computers.

Ans. The first generation computers were voluminous computers in which electronic valves

were used. They were built by using vacuum tube. As the vacuum tubes were used as an

electronic component, the computers were very large in size. ENIAC was the first computer of

this category. Thus, the computer from ANIAC to IBM 650 belongs to this generation. The

data manipulation capacity of ENIAC was thirty times more than the previous computers

vacuum tubes were replaced by the transistors. Transistors were very small in size and weighs

as compared to vacuum tubes and consumed very low power.

7. Write short notes on Central Procession Unit.

Ans. It is popularly known as the heart, Brain and Nervous system of the computer. It provides

central control of the operation of the whole computing machine. The CPU is known as a part

of the computer system. The CPU consists of a memory unit, control unit and An Arithmetic

and logic unit.

i. Memory unit: - A memory unit of the central processing unit is a place where the

computer program and data are stored during processing. A memory unit is a random

access storage device comprising number of storage locations. The data which is to be

stored in the memory unit for processing are fixed by the computer program. The main

or internal memory is called as primary storage. It normally consists of the program to

be executed and the data required by the program.

ii. The Control Unit: - All the operations carried out by the computer are directed by

the control unit. A control unit is called as the nerve centre of the computer since it

controls and co ordinates all hardware operations. The program and data are

transferred from the input device into the memory as directed by the control unit

during the execution of the program each instruction is retrieved in turn from the

memory and interpreted. A control unit informs the Arithmetic logic unit as to how

precisely the operation to be preformed. It directs the transfer to the Arithmetic logic

unit of any item of data that is required for operation.

iii. The Arithmetic Logic Unit (ALU): - The arithmetic logic unit comprises a number

of accumulators and registers. Accumulator means a register and associated

equipment in the arithmetic unit of the computer where arithmetic and logical

operations are performed. A register is a hardware device for holding data to be

operated upon. The ALU obtains the data from the main memory as per the direction

given by the controlling unit based on the program given to it. This data is loaded into

accumulators in the ALU. The ALU operates on the data which is available in the main

memory. The ALU after processing the data sent to output device.

H.S.C OMTEX CLASSES 9

TH

YEAR

11

BOOK KEEPING & ACCOUNTANCY

8. EXPLAIN THE IMPORTANCE OF COMPUTER IN MODERN AGE.

Today computers are put to a variety of uses. They have been designed with highly improved

performances. Computers can be used to process voluminous data at a high speed. As regards

its application in the field of accounting, a computer should be able to deal with routine

accounting. It means all normal accounting processes such as financial transactions should be

dealt with the use of a computer. All cash and bank transactions, handling of accounts of

debtors and creditors and calculation of wages and salaries etc should be handled with the use

of computer. In addition, computers can be put to other popular uses such as production,

programming and control, flexible budgetary control, variance analysis, sales and forward

trends etc.

Following points explain the importance of computer in modern age.

Speed: - In the modern world, the desire of a man to complete tasks within the stipulated time

limits has been, to a large extent, fulfilled by using a computer. Computers enable us to do

arithmetical computations with a high degree of speed and ease. It has enables us to do things,

which would have been almost impossible earlier. The speed which computers functions are

measured in Pico seconds (1/1000 of Nano second). Thus, computers are capable of

making millions of computations per second. Hence, a powerful computer is capable of

completing the tasks in less than an hour, which could have taken a year for a group of people

to compute.

Accuracy: - Computers are not only fast in completing a job at a great speed, but it is also

performed with a high degree of accuracy. Sometimes, it is common to say that there is a

Computer error. As a matter of fact, it is Human error and not a Computer error since a

computer carries out the instructions efficiently given by the programmer. As such, if the

instructions are faulty, the errors creep in the computers output. Therefore, if the computer is

provided with accurate data and instructions, there will be no error in the output given by a

computer. Thus, a computer offers the greatest advantage of achieving high degree of accuracy

in accounting processes.

Diligence: - By doing similar job continuously, human beings get tired which results into some

mistakes. As against this, a computer is capable of doing the same job continuously error free.

A computer takes the same time to complete the first calculation as well as the 10000

th

calculation. Thus, the degree of diligence possessed by a computer is impossible in case the

same job is done by human beings.

Storage: - Another advantage offered by a computer is that of its enormous capability to store

data. A computer is capable of storing data along with the instructions given by the

programmer in the primary (main) memory. In case, the primary memory is not sufficient it

can be stored in its secondary (auxiliary) memory. There are various devices used for storing

the secondary memory. Some of the common devices used in secondary memory are Compact

Disks, Tapes, Drums, pen Drives etc. Having large capacity to store data.

Versatility: - A computer possesses great versatility, which is capable of performing arithmetic

calculations, logic operation of comparison and moving data within different sections of the

computer and in input and output operations. Although, a computer lacks a brain of its own, it

can be put to a varied uses such as preparation of mark lists, financial accounting, share

analysis etc. Further, a computer can produce results almost in whatever form it is most

suitable.

Miscellaneous: - In addition to the above mentioned advantages, a computer can offer

economies in the form of effective managerial control, saving in labour cost because it is fully

automatic.

H.S.C OMTEX CLASSES 9

TH

YEAR

12

BOOK KEEPING & ACCOUNTANCY

9. EXPLAIN THE ROLE OF COMPUTER IN ACCOUNTING.

Ans. The role of computer in accounting is explained as follows.

1. For various reasons, every business organization is required to prepare and maintain

various books of account. The computer is used by many business organizations to carry

out accounting operations at a greater speed and accuracy.

2. The computer is useful for classifying, processing, analyzing, tabulating, recording and

interpreting the accounting data for various purposes.

3. It is useful for improving the financial system of the organization.

4. With the help of the computer, accountants can easily, accurately and speedily prepare

the different source documents like voucher, invoice, quotation, receipt, etc.

5. The computer is useful for recording accounting entries in the journal and posting such

entries in the ledger. It is also used to prepare trial balance, final account, accounting

statements like Balance sheet, etc.

********************************************************************************

H.S.C OMTEX CLASSES 9

TH

YEAR

13

BOOK KEEPING & ACCOUNTANCY

CH. 3. BILLS OF EXCHANGE [Q.3: 17 MARKS]

Note: - In Q.3 of the Board paper, one problem on Renewal of bills of exchange and another

problem on dealing of multiple bills by a drawer (one drawer and multiple drawees) will be asked.

Students are required to attempt any one out of these two.

DEFINITION:-

BILLS OF EXCHANGE: - A Bills of Exchange is a Negotiable (exchangeable) Instrument,

containing an unconditional order signed by the maker (drawer) directing a certain person

(drawee) to pay a certain sum of money only to the bearer of the Instrument.

THERE ARE THREE PARTIES IN THE BILL OF EXCHANGE.

DRAWER: - The drawer is the person or the party who draws the bill. He is the creditor and he

has to receive the money from other person.

DRAWEE: - The drawee is the person or the party on whom the bill is drawn. He is a debtor

and he has to pay the amount to the drawer. Once he accepts the bill he becomes an Acceptor.

PAYEE: - The payee is the person or the party to whom the bill is made payable. If the bill is

made payable to the drawer himself, the drawer and the payee are the same person.

TERM OF THE BILL: -A bill of exchange is subject to certain terms and conditions. Such terms

and conditions include period of the bill, place of payment, amount of the bill, etc.

GRACE DAYS/ DAYS OF GRACE: - While calculating the due date of any time bill, three extra

days knows as days of grace should be added to the specified period mentioned in the bill. For

example, a bill drawn on 15

th

January, 2007 for two month will become due on 18

th

March,

2007.

DUE DATES / MATURITY DATES: - The date on which the Bill is ready for the payment is

known as due date or maturity date of that Bill.

If the due date falls on Sunday or any other public holiday the payment of the bill should be

made on the immediately preceding working day. If a bill falls due for payment on 15

th

August,

it must be paid on 14

th

August. If a bill falls due on 26

th

January, it must be paid on 25

th

January. In case 25

th

January is Sunday the payment must be made on 24

th

January.

HONOUR OF THE BILL: - When the bill is paid on the due date is known as honour of the Bill.

DISHONOUR OF THE BILL: - When the Bill is not paid on the due date then it is known as dishonour

of the bill.

RETIREMENT OF THE BILL: - When the Bill is paid before the due date then it is known as

retirement of the Bill.

HUN DIES: - When the subject matter of the Bill is in Indian language say Tamil, Telungu,

Guajarati, Hindi etc. then it is known as hundies.

ACCEPTANCE OF THE BILL: - When the drawee puts the signature on the bill then it is known

as acceptance of the bill.

THERE ARE TWO TYPES OF ACCEPTANCE

GENERAL ACCEPTANCE: - When the bill is accepted without any terms and conditions then it

is known as general acceptance.

H.S.C OMTEX CLASSES 9

TH

YEAR

14

BOOK KEEPING & ACCOUNTANCY

QUALIFIED ACCEPTANCE: - When the bill is accepted with certain terms and conditions then

it is known as qualified acceptance.

DRAFT: - Before the acceptance of the bill, it is known as draft.

ENDORSEMENT OF BILL: - When the ownership of the bill is transferred then it is known as

endorsement of Bill. There are two parties in the endorsement of Bill.

ENDORSER: - A person who transfers the ownership of the bill is known as endorser.

ENDORSEE: - A person on whom the bill has been transferred is known as endorsee.

TYPES OF BILL: - There are two types of Bill

INLAND BILL: - A bill which is drawn & made payable in the same country, it is known as

Inland bill.

FOREIGN BILL: - A bill which is drawn in one country & made payable in another country

then it is known as foreign bill.

NOTING CHARGES: - It is a fee charged by the Notary Public, In case of dishonour of Inland

bill. Notary Public is a government officer who is appointed to register the dishonour bill.

PROTESTING: - It is also a fee charged by the government in case of foreign bill.

H.S.C OMTEX CLASSES 9

TH

YEAR

15

BOOK KEEPING & ACCOUNTANCY

Pro Forma of a bill of exchange

Notes: -

1. If the question includes Prepare a demand bill or if the term is On demand,

or if the period is not given at all, the wording will be: On demand, pay

2. If the term given in 45 days after acceptance/sight, the wording will be: Forty

five days after acceptance / sight, pay

3. If instead of the term, the due date itself is given the wording will be: On such

and such a date, pay

BILL OF EXCHANGE

________________

________________

(Drawers Name &

Address)

_______________

(Date of Bill drawn)

______________ after date, pay __________________________________________________

_________________________ or his / her order, the sum of Rupees _____________________

_______________________________________________ only for value received.

Sd /-

_______________

(Drawers Name)

To

___________________

(Drawees Name)

___________________

___________________

(Drawees Address)

STAMP

Rs. ______________/-

Accepted

Sd/-

_______________

(Drawees name)

_______________

(Date of acceptance)

H.S.C OMTEX CLASSES 9

TH

YEAR

16

BOOK KEEPING & ACCOUNTANCY

PREPARE A BILL OF EXCHANGE FROM THE FOLLOWING

DETAILS. [Q. 1. (F) - 5 Marks]

1. Drawer : Soundariya, Neelam Bhawan, Kalyan

Drawee : Sugandi, Dastur Nagar, Amaravati

Payee : Umesh , Deogad

Period : 90 days

Amount : Rs. 7,555

Date of bill : 15

th

March 1995

Accepted on : 20

th

March 1995

2. On 10

th

March, 1995 Rajesh Bhoyar, Gandhinagar, Nagpur draws a 2 months bill for Rs. 3,000 on

Samir Choudhary, Main Road, and Belapur. Samir Choudhary accepted the bill on 15

th

March 1995

3. Drawer : Vilas Patil, 20, M.G. Road, Pune.

Drawee: Vikas Pawar, 31, S.V. Road, Nashik

Payee: Viraj Potade, 41, A.B. Road, Sholapur,

Period, 3 months

Amount Rs. 7500

Date of Bill, 1

st

January, 2007

Date of Acceptance: - 3

rd

January, 2007

4. Drawer : Shri Narayandas Kela, Gandhi Chauk, Dhamangaon

Drawee : Shri Atul Khatke, Mandrup Road, Solapur

Payee : Shri Ranjeet Chavan, Ambajogi

Amount : Rs. 5,000

Period : 90 days.

Date of Bill : 15

th

March, 1995

Accepted on : 20

th

March, 1995

5. Drawee : K . Prabhakar, Nehur Road, Solapur.

Drawer : M. Sudhakaran, Shivaji Nagar, Nanded.

Period : 3 Months.

Date of Bill : 5

th

February,1996

Amount of the Bill : Rs. 4000/-

Accepted On : 9

th

February,1996

6. Drawer : Vilas Ptil, 44, M.G. Road, Nanded.

Drawee : Pankaj Pawar, 70, Bhavani Galli, Solapur.

Payee : Ramchandra Rampure, Rampur.

Period : 60 days.

Date of Bill : 28

th

January, 1995

Date of Acceptance : 29

th

January, 1995

Amount of the Bill : Rs. 2,800/-

H.S.C OMTEX CLASSES 9

TH

YEAR

17

BOOK KEEPING & ACCOUNTANCY

7. Drawer : Rekha, Main Road, Jalgaon.

Drawee : Basant, Sandesh, Nandura.

Payee : Uma Chandak, Khamgaon.

Amount : Rs. 2500/-

Period : 2 months.

Date of Bill : 21

st

January, 1995

Date of Acceptance: 25

th

January, 1995

8. Drawer : Shekhar Desai, Shastri Road, Mahad.

Drawee : Sharad Verma, Narayanpeth, Pune

Payee : Mukund Pande, Panel.

Amount : Rs. 3,500/-

Period : 3months.

Date of Bill : 21

st

June, 1995

Bill accepted : for 3,000 on 25

th

June, 1995.

9. Drawer : Vijay Bhat, Main Road, Nagpur.

Drawee : Ashok Kulkarni, M.G. Road, Nagpur.

Payee : Anil Jadhav, Pune.

Amount : Rs. 6,950.

Period : 80 days.

Date of Bill : 7

th

March, 1996.

Accepted on : 10

th

March, 1996. For 90 days.

10. Drawer : Namdev Tukaram, Paithan.

Drawee : Nivruti Sopan, Dehu.

Payee : Vitthal Pandurang, Pandharpur.

Amount : Rs. 5,111

Period : 3 months

Date of Bill : 17

th

August, 1995

Date of Acceptance : 20

th

August, 1995

11. Drawer : Priti Chavan, Chandika Road, Malvan.

Drawee : Snehlata Patil, Prashant Nagar, Ambajogai

Payee : Archana Ghime, Amaravati

Amount of Bill : Rs, 10,000/-

Period : 2 months.

Date of Bill : 1

st

January, 1996

Date of Acceptance : 5

th

January, 1996

12. Drawer : Shri Ravindra Patil, Housing Society, Ambajogai

Drawee : Shri Bhaurao Deshmukh, Bazar Chauk, Dhamangaon

Payee : Shri Prasad Shendage, Malvan

Amount : Rs. 7,500/-

Period : 3 months

Date of Bill : 1

st

January, 1995

Date of Acceptance : 5

th

January, 1995

H.S.C OMTEX CLASSES 9

TH

YEAR

18

BOOK KEEPING & ACCOUNTANCY

13. Drawer : Abhijit Patil, Vikram nagar, Patna.

Drawee : Tejas Kapare, Kothrud, Pune.

Payee : Amey Patki, Nagpur.

Amount : Rs. 7500

Period : 60 days

Term : After sight

Date of Bill Drawn : 1

st

June 2006

Date of Acceptance : 11

th

June 2006

Accepted bill for Rs. : 7000 only.

14. Drawer: Yamini Gupta, Sarvapriya Vihar, Delhi

Drawee Kamini Sharma, Raj baug, Agra.

Period 100 days.

Term After acceptance

Date of Bill 1

st

January, 2007

Amount Rs. 10,500/-

Date of Acceptance 3

rd

January, 2007

H.S.C OMTEX CLASSES 9

TH

YEAR

19

BOOK KEEPING & ACCOUNTANCY

TRADE BILLS {IN THE BOOKS OF DRAWER & DRAWEE}

1. Anand brought goods worth Rs. 4,500 from Samant on August 1, 2006. On the same day, Anand

accepted the bill for Rs. 4,500 at 3 months drawn by Samant. Samant got the bill discounted with

his bank at 4%. Before the due date, Anand informed Samant about his inability to pay the amount

of bill. He further requested him to accept Rs. 2,500 in cash and immediately draw upon him a new

bill for the remaining amount at 2 months together with interest at 8% p.a. Samant agreed. The

second bill was duly paid on maturity. Give journal entries in the books of Samant and Anand.

Note: - Here 1

st

part payment is made and then the interest is charged.

2. On 1

st

March, Ramchandra sold goods to Raman worth Rs. 8,000/- and Raman accepted the Bill for

Rs. 8,000/- at 3 months drawn by Ramchandra. Ramchandra discounted the bill with his bank @

6% p.a. On due date the bill was dishonoured and Raman requested Ramchandra to accept Rs.

4,000/- immediately and draw upon him a new bill for the remaining amount at 3 months together

with an interest at 10% p.a. Ramchandra agreed. The second Bill was duly honoured. Give Journal

entries in the books of Ramchandra.

Note: - Here 1

st

part payment is made and then the interest is charged.

3. Premlal sold goods to Sunderlal worth Rs. 10,000/- and Sunderlal accepted the bill for Rs. 10,000/-

at 3 months drawn by Premlal. Premlal Discounted the bill with his bank @ 6 % p.a. on due date the

bill was dishonoured and Sunderlal requested Premlal to accept Rs. 4,000 immediately and draw

upon him a new bill for the remaining amount at 3months together with an interest at 10% p.a.

Premlal agreed and the second bill was duly honoured. Give the Journal entries in the books of

Premlal. Note: - Here 1

st

part payment is made and then the interest is charged.

4. Archana purchased goods from Babita on Credit for Rs. 20,000. On next day Archana paid Rs.

10,000 to Babita and accepted a bill drawn by Babita for the balance amount for four months.

Babita discounted the bill with her bank for Rs. 9600/- Before the due date Archana approached

Babita with a request to renew the Bill Babita agreed with the condition that Archana should pay

Rs. 6000 with interest of Rs. 120 and accept a new bill for the balance. The arrangement was duly

carried out. New bill is met on the due date. Pass journal entries in the books of Babita.

Note: - Here 1

st

interest is charged and then the part payment is made.

5. Baloo owes Kaloo Rs.8000. Kaloo then draws a bill for Rs. 8000 on Baloo for a period of three

months. Baloo accepts and return it to Kaloo. Kaloo discounted the bill with his bank at 12 % p.a.

On due date, the bill was dishonoured noting charges amount to Rs. 30. Kaloo then draws a bill for

the balance plus interest of Rs. 170. Before the due date of this bill Baloo pays the amount at a

discount of Rs. 40 to retire the bill. Pass Journal Entries in the books of Kaloo.

Note: - Here only the interest is charged and there is no part payment occurs.

6. Minal draws a bill on Usha for Rs. 5,000 at 3 months. Usha accepts the bill and return to Minal.

Minal discounted the bill @ 12 % p.a. with the bank. On Maturity Usha finds herself unable to make

payment of the bill and requested Minal to renew the bill. Minal accepts the proposal on the

condition that Usha should Pay Rs. 2,000 in cash and accept a new bill at one month along with

interest at 10% p.a. These arrangements were carried through. Usha retires the bill by paying Rs.

3015/- Pass Journal Entries in the books of Minal. Note: - Here 1

st

part payment is made and

then the interest is charged.

MISCELLANEOUS PROBLEM

7. Rupali accepted a bill for Rs. 2,000/- drawn by Deepali at three months. Deepali got the bill

discounted with her bank for Rs. 1,900. Before the due date Rupali approached Deepali for renewal

of the bill. Deepali agreed on the condition that Rs. 1,000/- be paid immediately together with

interest on the remaining amount at 6% p.a. For balance Rupali should accept a new bill for three

months. These arrangements were carried through but afterwards, Rupali become Insolvent and

only 40 % of the amount could be recovered from her estate. Give journal entries in the books of

Deepali.

8. Chanda accepted a bill for Rs. 6,000 drawn by Nanda at three months. Nanda got the bill

discounted with his bank for Rs. 5,700. Before the due date, Chanda approached Nanda for renewal

of the Bill. Nanda agreed on the condition that Rs. 3,000 is paid immediately together with an

interest on remaining amount at 18% p.a. for four months and for the balance Chanda should

H.S.C OMTEX CLASSES 9

TH

YEAR

20

BOOK KEEPING & ACCOUNTANCY

accept a new bill. But afterwards Chanda become insolvent and only 25% of the amount could be

recovered from her estate. Pass journal entries in the books of Nanda.

9. Pankaj draws a bill on Anil worth Rs. 8,000 for three months which was accepted by Anil. On the

same date Pankaj discounted the bill with his bank @ 10 % p.a. On the due date Anil dishonoured

his acceptance. Anil paid Rs. 4,000/- to Pankaj and accepted a fresh bill for two months for the

balance including interest of Rs. 40. Anil became insolvent before the maturity of the bill and 50

paise in a rupee was received at first and final dividend from his estate. Give Journal entries in the

books of Pankaj.

10. Bhagwan sold goods to Deo for Rs. 3,000. On the same date Deo accepted a bill for 2 months.

Bhagwan endorsed the bill to Ishwar. On the due date of the bill, Ishwar informed that the bill is

dishonoured and the noting Charges were Rs. 20. Bhagwan drew a new bill on Deo for the amount

due including noting charges and an interest of Rs. 130. Before the due date of the second bill Deo

become bankrupt and 20 paise in a rupee was received from his estate as first and final dividend.

Pass the necessary journal entries in the books of Bhagwan.

11. Mahendra sold goods to Ravindra worth Rs. 6000 and for that Ravindra accepted a bill drawn by

Mahendra for 3 months. After a month Mahendra discounted the bill with his bank at 10 % p.a. On

the due date Ravindra dishonoured his acceptance. Ravindra paid Rs.3, 000 to Mahendra and

accepted a fresh bill for 3 months for the balance including interest @ 8% p.a. Before Maturity of

the Bill Ravindra become insolvent and 50 paise in a rupee was discovered from his estate as first

and final dividend. Give Journal entries in the books of Mahendra and Ravindra.

12. Prakash drew a bill for Rs. 4,000 on Anand on 1

st

May, 1976 for three months. This was for the

amount which Anand owed to Prakash. Anand accepts the same and return it to Prakash who

discounted at his bank for Rs. 3,900. On 1

st

Aug, 1976 Anand requested Prakash to renew the bill

and Prakash agreed on the condition that Rs. 1,000 is paid immediately and Anand should accept

the new bill for 3 months for the balance payable plus interest of Rs. 45. These arrangements were

carried through. However, on 1

st

October, 1976, Anand retired his acceptance for Rs. 3, 035. Pass

journal entries in the books of Prakash and Anand.

13. On 1

st

January, 1988 Vandana drew a bill for Rs. 6,000 for 2 months periods on Lata. Lata duly

accepted the bill. On 4

th

January 1988 Vandana discounted the bill with her bank for Rs. 5850.

However, on the due date the bill was dishonoured. Lata agreed to accept a new bill with an interest

of Rs. 100 for a period of one month. The bill was duly met on the due date. Give the journal entries

in the books of Vandana and show Vandanas account in the books of Lata.

14. Mukund owes (be obligated) Prakash Rs. 4000 for which Prakash draws a bill for 2 months on 1

st

February, 1989. Mukund accepts it and returns it to Prakash. On 4

th

March, 1989, Mukund

approaches Prakash and request him to accept Rs. 1000 in cash and draw a fresh bill for 3 months

for the balance plus interest @ 10% p.a. Prakash accepts the request and draw a bill accordingly

which is accepted by Mukund. On 1

st

June 1989 Mukund retired his acceptance under discount of

Rs. 30/-. Pass journal entries in the books of Prakash and prepare Prakash account in the ledger of

Mukund.

15. Abhay draws a bill on Ajay for Rs. 1,400 at 3 months. Ajay accepts the bill and returns it to Abhay.

The bill is sent to the bank for collection. On maturity Ajay finds he unable to make payment of

the bill and request Abhay to renew it. Abhay accepts the Proposal on the condition that Abhay

should pay Rs. 700 in cash along with noting charges of Rs. 10 and draw a renew bill for one

months for the balance. These arrangements were carried through. Afterwards Ajay retired the bill

by paying Rs. 695. Give journal entries in the books of Abhay and Ajay.

16. Krishna accepted a bill for three months drawn by Rama for Rs. 4000. Rama discounted the bill

with the bank at Rs. 3900. On the date of maturity, the bill was dishonoured. Rama paid noting

charges for Rs. 20 Krishna paid half the mount for the bill and full amount of the noting charges

and accepted a bill for the balance including interest of Rs. 50. The second bill was duly honoured.

Pass necessary journal entries in the books of Rama and show Krishnas account.

H.S.C OMTEX CLASSES 9

TH

YEAR

21

BOOK KEEPING & ACCOUNTANCY

17. Jain purchased goods worth Rs. 3,000 from Sharma on 1

st

June 1977 and gave him acceptance on

3

rd

June for a period of three months. On 15

th

June Sharma discounted the bill for Rs. 2980. On 6

th

September, when the bill was presented for payment. Jain dishonoured the same. Rs. 20 was paid

as noting charges. Pass journal entries in the books of Sharma and Sharmas account in the books of

Jain.

18. Sagar owes Sindhu Rs. 8000 Sagar accepted a bill for 3 months by Sindhu for Rs. 8000. Sindhu

discounted the bill with bank at Rs. 7800. On the due date, the bill was dishonoured. Noting

charges amounted to Rs. 20. Sagar Paid half the amount of the bill and full amount of the noting

charges including interest of Rs. 100. Pass journal entries in the books of Sindhu and show the

account of Sagar.

19. On 1

st

January, 1982 Shri Jameersheth of Jalgaon sold goods to Shri Nanchand of Nanded for Rs.

80,000. On the same date Shri Jameersheth drew a bill on Shri Nanchand for the same amount for

three months. Shri Nanchand accepted the bill and returned the same to Shri Jameersheth on 4

th

January, 1982. Shri Jameersheth discounted the bill with the banker at 10 % p.a. On the due date

bank informed that the bill was dishonoured and Shri Nanchand requested Shri Jameersheth to

accept Rs. 40000 immediately and draw upon him the new bill for the remaining amount for two

months together and interest at 12% p.a. Shri Jameersheth agreed and the second bill was duly

honoured. Pass the necessary Journal entries in the books of Shri Jameersheth of Jalgaon and show

Shri Jameersheths account in the books of Shri Nanchand of Nagpur.

20. Ameet draws a bill for Rs. 7500 on Tushar for four months. Ameet discounts the bill with the

bank at 8%p.a. On the due date Tushar requested Ameet to accept Rs. 4,700 (including Rs. 200

for interest) and to draw a bill for the balance of three months. Ameet agrees this proposal. Before

the due date of the new bill Tushar retires the bill for Rs. 2960. Pass the journal entries in the books

of Tushar and open Tushars account in the books of Ameet.

21. Akbar owed to Barbar Rs. 6,000. Akbar accepted the bill drawn by Barbar for the amount at four

months. Barbar discounted the bill with his bank for Rs. 5850. Before the Due date, Akbar

approaches Barbar with the request for renewal of the bill. Barbar agreed on the condition that Rs.

4,000 is paid immediately in cash together with an interest on the remaining amount at 12%p.a. for

three months and for the balance Akbar should accept a new bill at three months. These

arrangements were carried through. Barbar endorsed the new bill to Kadar. Akbar met the bill on

due date. Give the transaction in the books of Akbar and prepare Akbars account in the books of

Barbar.

22. Sonia draws a bill on Moni for Rs. 6,000 at 4 months. Moni accepts the bill and returns it to Sonia

who discounts the bill with the bank at a discount of 8%p.a. Before the due date of Bill Moni

requested Sonia to accept Rs. 4000 in cash and draw a bill for the balance plus interest at 12%p.a.

for two months. Sonia draws a bill as the request is agreed. The bill is sent to bank for collection. On

the due date the bill was honoured. Pass the necessary journal entries in the books of Sonia and

Moni.

23. Journalize the following transactions in the books of Kamesh:

a. Nanda informs Kamesh that Shantis acceptance for Rs. 4,000 endorsed to Nanda has been

dishonoured and noting charges have been Rs. 100

b. Ashok renews his acceptance to Kamesh for Rs. 2400 by paying Rs. 800 in cash and accepting a

new bill for the balance plus interest @ 12 p.a. for 3 months.

c. Devas acceptance to Kamesh Rs. 12,000 is retired one month before its due date at a discount of

12% p.a.

d. The bank informs Kamesh that Sudhakars acceptance for Rs. 4,000 has been dishonoured and it

has paid noting charges Rs. 80.

24. Journalise the following transactions in the books of Kailash.

a. Sandeep informs Kailash that Vilas acceptance for Rs. 8,000 endorsed to Sandeep has been

dishonoured. Noting Charges amounted to Rs. 200.

b. Kalpana renews her acceptance to Kailash for Rs. 7,500 by paying Rs. 3,500 in cash and accepting a

fresh bill for the balance plus interest at 10% p.a. for 3 months.

c. Uma retired her acceptance to Kailash for Rs. 3,000 by paying Rs. 2,900 in cash.

H.S.C OMTEX CLASSES 9

TH

YEAR

22

BOOK KEEPING & ACCOUNTANCY

d. Kailash sent a bill of Anita for Rs. 6,000 to bank for collection. But Bank informed that the bill has

been dishonoured by Anita.

25. Journalise the following transactions in the books of Rahul.

a. Pradeep informed Rahul that, Vijays acceptance for Rs. 1,000 endorsed to Pradeep has been

dishonoured. Noting charges amounted to Rs. 50.

b. Nilesh renews his acceptance to Rahul for Rs. 600 by paying Rs. 200 in cash and accepting a fresh

bill for balance plus interest at 12% p.a. for 3 months.

c. Prashants acceptance to Rahul for Rs. 3,000 retired one month before due date at a discount of

12% p.a.

d. Bank informs Rahul as to the dishonour of Avirajs acceptance for Rs. 1,000 to Rahul, discounted

with the bank. Noting charges are Rs. 20.

26. Journalize the following transactions in the books of Maharaja.

a. Ayub informs Maharaja that Sadashivs acceptance for Rs. 2,000 endorsed to Ayub has been

dishonoured, noting charges amounted to Rs. 150

b. Pankaj renews his acceptance to Maharaja for Rs. 1200 by paying Rs. 400 in cash and accepting

a fresh bill for the balance plus interest at 12% p.a. for 3 months.

c. Vaibhavs acceptance to Maharaja for Rs. 6000 retired one month before the due date at a

discount of 12%p.a.

d. Bank informs Maharaja as to the dishonour of Kasams acceptance for Rs. 2000 to Maharaja

discounted with Bank noting charges Rs. 200.

27. Journalise the following transactions in the books of Mr. Ashok Agrawal.

y The bank informed Mr. Ashok Agrawal that Kamleshs acceptance for Rs. 12,000 sent to bank

for collection had been honoured and bank charges debited were Rs. 60.

y Discharged Dr. Ashok Agrawals acceptance to Mahesh for Rs. 15,250 by endorsing Prakashs

acceptance to Mr. Ashok Agrawal for Rs. 15,100.

y Vishal renewed his acceptance to Mr. Ashok AGrawal for Rs. 11,200 by paying Rs. 6000 in cash

and accepting a fresh bill for the balance plus interest @ 12% p.a. for three months.

y Dinesh who had accepted Mr. Ashok Agrawals bill of Rs. 14,000 was declared bankrupt and

only 45% of the amount due could be recovered from his estate.

28.Journalise the following transactions in the books of Ashwin.

y Bank informed that Sachins acceptance for Rs. 5,750 sent to bank for collection had been

honoured and bank charges debited were Rs. 50.

y Nitin renewed his acceptance for Rs. 7,200 by paying Rs. 2,200 in cash and accepting a new bill

for the balance plus interest @8% p.a. for 3 months.

y Discharged our acceptance to Pravin for Rs. 4,250 by endorsing Bhavins acceptance to us for

Rs. 4,000.

y Jatin who had accepted Ashwins bill of Rs. 8,500 was declared insolvent and only 40% of the

amount due could be recovered from his estate.

29. Journalise the following transactions in the books of Kamalakar.

y Nisha informs Kamalakar that Shantis acceptance for Rs. 14,000 endorsed to Nisha has been

dishonoured and noting charges have been paid Rs. 200.

y Asha renews hare acceptance to Kamalakar for Rs. 12400 by paying Rs. 6000 in cash and

accepting a new bill for the balance plus interest @ 12% p.a. for 3 months.

y Devikas acceptance to Kamalakar for Rs. 42000 is retired one month before its due date at a

discount of 12% p.a.

y The bank informs Kamalakar that Sindhus acceptance for Rs. 15000 has been dishonoured and

it has paid noting charges Rs. 100.

y Bank informs Kamalakar that Sangitas acceptance for Rs. 12000 which was sent to bank for

collection has been dishonoured.

H.S.C OMTEX CLASSES 9

TH

YEAR

23

BOOK KEEPING & ACCOUNTANCY

30. Journalise the following transactions in the books of Ranbir.

y Sonam informs Ranbir that Salmans acceptance for Rs. 3200 endorsed to Sonam has been

dishonoured and the noting charges amounted to Rs. 80.

y Ravindra renews his acceptance to Ranbir for Rs. 4,800 by paying Rs. 1800 in cash and

accepted a fresh bill for the balance, plus interest @ 12% p.a for 2 months.

y Dilips acceptance to Ranbir for Rs 8000 is retired one moth before the due date at a discount

of 12% p.a.

The bank inform Ranbir that Shirins acceptance for Rs 5500 to Ranbir discounted with the bank earlier

has been dishounred and the noting charges Rs. 100.

H.S.C OMTEX CLASSES 9

TH

YEAR

24

BOOK KEEPING & ACCOUNTANCY

CH. 4. DEPRECIATION [Q. 2 : 10 MARKS]

Note: - As per the syllabus a Standard XII (SYJC), the students are required to study the following

two methods of depreciation only, viz.

i. Fixed Installment Method / Original Cost Method / Straight Lime Method / Equal

Installment method.

ii. Reducing Balance Method / Written Down Value Method / Diminishing Balance

Method.

PROBLEMS

1. M/s Modern company purchased Machinery worth Rs. 2, 00,000 on 1

st

April, 2006.

Accounting year of the Company closes on 31

st

March every year. Company provides

depreciation at 10% p.a. on the original cost. On 31

st

March, 2008 the machinery was sold

for Rs. 1, 20,000. Give the machinery Account and depreciation account for two years.

[F.I.M]

2. M/s Classic company purchased Machinery worth Rs. 1, 00,000 on 1

st

April, 2006.

Accounting year of the Company closes on 31

st

March every year. Company provides

depreciation at 10% p.a. on the original cost. On 31

st

March, 2008 the machinery was sold

for Rs. 20,000. Give the machinery Account and Depreciation account for two years

3. Shri Yuvraj and company, Kolhapur, purchased furniture for Rs. 60,000 on 1.4.2007. On

1.10.2009 the company sold out a part of the furniture for Rs. 6000, the original cost of

which on 1.4.2007 was Rs. 12,000. The company charges depreciation at the rate of 10%

p.a. on Original Cost method. The financial year of the company ends on 31

st

March, every

year. Prepare: Furniture account and depreciation account for the years 2007 2008-,

2008 2009, 2009-2010. [F.I.M]

4. M/s. Deepali International bought furniture worth Rs. 24,000 on 1 4 1977 and

additional furniture on 1 10 1977 worth Rs. 16,000. They charged depreciation at 15%

p.a. on Fixed Instalment basis. On 1 10 1979 they sold out one cupboard for Rs. 2,200

original cost of which on 1-4-1977 was 4,000. On the same date a new cupboard was

purchased for Rs. 8,000. Show the furniture account and depreciation account for the year

1977-78, 1978-79 and 1979-80 assuming that the financial year closes on 31

st

March every

year. [F.I.M]

5. Janab Hasansab of Hyderabad made furniture for his own office on 1

st

October 1975. For

this he had spent Rs. 36,000 on materials and Rs. 16,000 on wages. He estimated he life of

the furniture to be 10years. He also estimated that its expected scrap value at the end of its

life would be Rs. 12,000. He closed his books of accounts on 31

st

March every year. He sold

the entire furniture for Rs. 40,000 on 1

st

October 1978. Show the furniture account and

depreciation account for the year ended 31

st

March, 1976, 31

st

March 1977, 31

st

March 1978

and 31

st

March 1979. [F.I.M]

6. The company purchased machinery worth Rs. 36,000 on 1-4-1987 and spent Rs. 4,000

towards installation charges. The company depreciates the machinery at the rate of 10%

p.a. on original cost. On 1-10-1989 the company sold out a part machinery for Rs. 3,200.

The original cost of the sold machinery on 1-4-1987 was Rs. 6,000. On 1-10-89 the

company purchased machinery for Rs. 10,000. As the company closes the financial year

H.S.C OMTEX CLASSES 9

TH

YEAR

25

BOOK KEEPING & ACCOUNTANCY

31

st

March every year. Prepare Machinery account and the deprecation account for the

years 1987-88, 1988-89 and 1989-90. [F.I.M]

7. Shirish Enterprises purchased a machinery costing Rs. 36,000 on 1-4-1989 and was

installed on the same date. The installation expenses amounted to Rs. 4,000. The firm

decided to charge depreciation at 10% p.a. on straight line method. On 1-10-91 a part of

machinery with an original price of Rs. 6,000/- (including the installation charges) was

sold for Rs. 3,200 and a new machinery costing Rs. 10,000 was purchased on the same

date. The firm closes its books of accounts on 31

st

March every year. Prepare Machinery

account and Depreciation account for the year 1989-90, 1990-91 and 1991-92 in the books

of the firm. [F.I.M]

8. S. Narayan from Mumbai purchased Furniture for his office costing Rs. 1,04,000 on 1

st

July 1987. Estimated life of the Furniture is 10 years and scrap value Rs. 24,000. The

Furniture was sold on 31

st

December 1990 for Rs. 70,000. The accounts are closed on 31

st

March every year. From the above information prepare Furniture account and

Depreciation account for the years 1987, 1988, 1989 and 1990, by charging depreciation

under Fixed Instalment Method. [F.I.M]

9. M/s J.K. Company, Maroda, purchased machinery for Rs. 80,000 on 1

st

April 2002.

Company purchased additional machinery for Rs. 36,000 on 1

st

October, 2003. The

company charges depreciation @10% p.a. on the original cost. The financial year of the

Company ends on 31

st

March every year. On 30

th

September, 2004 a part of the machinery,

original cost of which was Rs. 30,000 on 1

st

April, 2002 was sold by the Company for Rs.

22,000. Prepare Machinery account for 3 years and give journal entries for the year 2002

2003. [F.I.M] [MARCH 2009].

10. M/s Dolphin, New Delhi, showed a debit balance of Rs. 32,000 to the Machinery A/c

on 1

st

April, 2001(Original cost of the Machinery was Rs. 40,000). On 1

st

October, 2001 the

Mill bought additional Machinery for Rs. 15,000 and spent Rs. 1,000 for its installation.

One more machinery costing Rs. 20,000 was purchased on 31

st

March, 2003. Depreciation

is charged on 31

st

March, every year at 10% p.a. under the straight line method. On 31

st

March, 2004, the machinery which was purchased on 1

st

October, 2001 was sold for Rs.

12000. Prepare Machinery A/c and Depreciation A/c for the years 2001 2001, 2002

2003 and 2003 2004. [F.I.M]

11. M/s Philips company purchased Machinery worth Rs. 2, 00,000 on 1

st

April, 2006.

Accounting year of the Company closes on 31

st

March every year. Company provides

depreciation at 10% p.a. on the written down value. On 31

st

March, 2008 the machinery

was sold for Rs. 1, 20,000. Give the machinery Account and depreciation Account for two

years. [W.D.V.]

12. M/s View Sonic company purchased Machinery worth Rs. 1, 00,000 on 1

st

April, 2006.

Accounting year of the Company closes on 31

st

March every year. Company provides

depreciation at 10% p.a. on the Diminishing balance method. On 31

st

March, 2008 the

machinery was sold for Rs. 20,000. Give the machinery Account and Depreciation account

for two years. [W.D.V.]

13. Aurangabadkar purchased furniture worth Rs. 20,000 on 1-4-73. He charges depreciation

at the rate of 10% on the Reducing Balance method. On 1 7 75, he sold out a part of the

Furniture for Rs. 2,000, the original cost of which on 1 4 73 was Rs. 4,000. The

financial year of Aurangabadkar ends on 31

st

March every year. You are required to

prepare his furniture account for the first four years, and to pass journal entries for the

transactions of the third year. [W.D.V.]

H.S.C OMTEX CLASSES 9

TH

YEAR

26

BOOK KEEPING & ACCOUNTANCY

14. On 1

st

July, 1992, Ajanta Traders, Pune, acquired a building for Rs. 8,00,000. On 1

st

April,

1993, an extension was made to the above building by spending Rs. 4,00,000. On 1

st

October 1994, half of the building was sold through a broker for Rs. 5,60,000 and

brokerage at 2% of the selling price was paid. Depreciation is charged on 31

st

March every

year at 10% p.a. under the Diminishing Balance Method. Prepare the Building Account and

the Depreciation account for three years. [W.D.V.]

15. M/s Jalaram Mill, Mulund, showed a debit balance of Rs. 32,000 to the Machinery A/c on

1

st

April, 2001(Original cost of the Machinery was Rs. 40,000). On 1

st

October, 2001 the

Mill bought additional Machinery for Rs. 15,000 and spent Rs. 1,000 for its installation.

One more machinery costing Rs. 20,000 was purchased on 31

st

March, 2003. Depreciation

is charged on 31

st

March, every year at 10% p.a. under the Diminishing Balanced Method.

On 31

st

March, 2004, the machinery which was purchased on 1

st

October, 2001 was sold for

Rs. 12000. Prepare Machinery A/c and Depreciation A/c for the years 2001 2001, 2002

2003 and 2003 2004. (February, 2008) [W.D.V.]

16. On 1

st

April, 2004 Saikripa enterprises purchased two computers of Rs. 40,000 each. On

1

st

October, 2004 they purchased one more computer for Rs. 40,000. On 1

st

October, 2006

they sold one computer, which was purchased on 1

st

April, 2004 for Rs. 18,780.

Depreciation on computers was provided @ 10% p.a. on diminishing balance method and

the financial year closes on 31

st

March every year. Prepare computer A/c depreciation A/c

for years 2004 05, 2005 06 and 2006 07. (September. 2008) [W.D.V.]

17. Shri Yashraj and company, Kolhapur, purchased furniture for Rs. 60,000 on 1.4.2007. On

1.10.2009 the company sold out a part of the furniture for Rs. 6000, the original cost of

which on 1.4.2007 was Rs. 12,000. The company charges depreciation at the rate of 10%

p.a. on Reducing balance method. The financial year of the company ends on 31

st

March,

every year. Prepare: Furniture account and depreciation account for the years 2007

2008-, 2008 2009, 2009-2010. [W.D.V] FEBRUARY 2011.

18.M/s J.K. Company, Maroda, purchased machinery for Rs. 80,000 on 1

st

April 2002.

Company purchased additional machinery for Rs. 36,000 on 1

st

October, 2003. The

company charges depreciation @10% p.a. on the diminishing balance. The financial year of

the Company ends on 31

st

March every year. On 30

th

September, 2004 a part of the

machinery, original cost of which was Rs. 30,000 on 1

st

April, 2002 was sold by the

Company for Rs. 22,000. Prepare Machinery account for 3 years and give journal entries

for the year 2002 2003. [W.D.V.]

H.S.C OMTEX CLASSES 9

TH

YEAR

27

BOOK KEEPING & ACCOUNTANCY

CH. 5. JOINT VENTURE ACCOUNTS [Q. 4: 12 MARKS]

Method I When Separate set of Books is maintained.

1. Dimple and Simple entered into a joint venture. They agreed to share profits and

losses in the proportion of their initial contributions to the joint venture. They opened a

joint Bank A/c. and deposited Rs. 60,000 and Rs. 40,000 respectively as initial

contributions. They made cash purchases of Rs. 70,000. They also paid Rs. 4,500 for

insurance and freight and Rs. 1,750 for sundry expenses. At the end of the venture, the

sales amounted to Rs. 1, 10,000/- There was unsold stock of goods worth Rs. 5000. Simple

took over the unsold stock. The Joint Venture was closed. You are asked to prepare Joint

Venture A/c. Joint Bank A/c and Co ventures A/c. Also pass journal entries.

2. A and B entered in to Joint Venture to construct a building for X enterprises limited.

The contract price was Rs. 2, 50,000. They opened joint bank account and deposited Rs.

1,20,000 and Rs. 60,000 respectively and agreed to share profits and losses in the ratio 3 :

2. The following transactions were made from Joint Bank A/c: Wages Rs. 70,000 and

Material purchases Rs. 1,25,000. Apart from this A supplied material of Rs. 12,000 and

B paid the architect fees of Rs. 2,500 on completion of construction. X enterprises Ltd.

paid the full amount and unsold stock was taken over by B at an agreed value of Rs.

15,000. Prepare Joint venture A/c, Joint Bank A/c and Co venturers A/c. Also pass

journal entries.

3. Suresh and Ramesh entered into a joint venture to construct a building at a contract

price of Rs. 7,00,000. They agreed to share profits and losses in the ratio of 2:1. Suresh

deposited Rs. 5,00,000 and Ramesh Rs. 1,00,000 into joint bank. The transactions were

as follows.

y Purchase of materials Rs. 3,50,000

y Tools and equipment Rs. 1,00,000.

y Wages Rs. 1,20,000

y Architect fees Rs. 25,000

y Besides these, Suresh supplied material worth Rs. 15,000 and Ramesh supplied

material worth Rs. 13,500. Building was ready and contract price received. Prepare

Joint venture A/c, Joint Bank A/c & Co Venturers A/c. Also pass journal entries.

4. Ashok, Kishor & Anup undertook the construction of an office building at a contract

price of Rs. 10,00,000. Receivable in cash Rs. 6,00,000 and Rs, 4,00,000 in shares. They

agreed to share profits and losses equally. They opened the joint bank a/c and contributed

the following amount. Ashok Rs. 3,00,000, Kishor - Rs. 3,00,000, and Anup

Rs.2,00,000. Ashok paid Rs. 10,000 as architect fees, Kishor brought in the venture

mixture of Rs. 25,000 and Anup brought in motor truck of Rs. 55,000. The following

transactions were made from Joint bank A/c. Purchase of material Rs. 4, 50,000, Plant

Rs. 30,000 and freight and wages Rs. 1, 50,000. At the close of the venture, Ashok took

away the unused material worth Rs. 8,000. Kishor took away the mixture worth Rs.

H.S.C OMTEX CLASSES 9

TH

YEAR

28

BOOK KEEPING & ACCOUNTANCY

15,000 and Anup took away the truck worth Rs. 35,000. The scrap value realised of the

plant was Rs. 6,000. The Contract price was received in full and Kishor took over the

shares for Rs. 4,10,000. Prepare Joint Venture A/c, Joint Bank A/c & co ventures A/c.

Pass journal entries.

5. Sanjay, Ajay and Vijay entered into a Joint venture for construction of a building for

contract price of Rs. 6, 00,000. Payable in cash Rs. 4,00,000 and Rs. 2,00,000 in

debentures. They decided to share profits and losses in the ratio of their initial

contributions. They opened Joint Bank A/c. where Sanjay deposited Rs. 3,00,000 Ajay

Deposited Rs. 2,00,000 and Vijay deposited Rs. 1,00,000. The following payments are

made out through Joint Bank A/c . Purchase of material Rs. 2,50,000, Plant Rs. 45,000,

Wages Rs. 77,000 and other charges Rs. 11,000. Sanjay brings truck of Rs. 40,000. Ajay

brings materials of Rs. 55,000 and Vijay brings mixture of Rs. 10,000. At the end of the

venture unused material was taken over by Sanjay for Rs. 5,000. Ajay took over mixture

for Rs. 15,000 and Vijay took over Plant for Rs. 12,000. The truck was sold in the market

for Rs. 22,000. Contract price was received and debentures were taken over by Vijay for

Rs. 1,90,000. Prepare Joint Venture A/c., Joint Bank A/c., Co ventures A/c and also

passes journal entries.

6. Harish, Iqbal and Joseph undertook to construct a building for Prabhu & Co. at a

contract price of Rs. 2, 50,000. The price was to be paid as follows: Rs. 2,00,000 in cash

and balance in preference shares of the company. Profit was agreed to be divided in the

ratio of 2:2:1. The participants contributed cash as follows. Harish Rs. 30,000 Iqbal Rs.

25,000 and Joseph Rs. 20,000. These amount were credited to a joint bank A/c. Iqbal was

to be paid a remuneration of Rs. 1,500 for managing the business. Harish prepared the

plats and paid Rs. 3,500 for them. Iqbal brought a concrete mixture for Rs. 12,000 and

Joseph brought a truck for Rs. 25,000. They brought Plant for Rs. 15,000 Material for Rs.

1,20,000 and paid wages Rs. 1,05,000. When the contract was completed Harish took over

unused material for Rs. 10,000. Iqbal took back the concrete mixture for Rs. 11,000 and

Joseph agreed to take back the truck for Rs. 18,000. The plant was sold as scrap for Rs.

6,000. When the contract price was received, Harish agreed to take over preference shares

at a discount of 20%. All the accounts were closed. Prepare Joint venture A/c, Joint Bank

Account and the Co venturers account also pass journal entries.

7. X, Y and Z entered into a joint venture to construct a premises and the contract price

was Rs. 4,00,000. Payable Rs. 2,00,000 in cash and Rs. 2,00,000 in shares. X,Y and Z

contributed Rs. 1,00,000 each. The following payments were made through bank: Raw

materials Rs. 75,000; Transportation charges Rs. 25,000; Machinery Rs. 50,000;

Insurance Rs. 25,000. Besides this X paid other expenses Rs. 20,000. Y paid for mixture

worth Rs. 20,000 and Z brought in materials of Rs. 20,000. After completion X and Z took

over unused materials of Rs. 5,000 each and Y took over the mixture for Rs. 10,000. The

scrap of plant was sold for Rs. 8,000. Due to a certain defect, contract price was reduced

by Rs. 10,000 and shares were taken over by X at a premium of 5%. Prepare Joint Venture

A/c. Joint Bank A/c and Co venturers.

8. X,Y and Z entered into a Joint Venture to sell a certain plot of land. They contributed

Rs. 25,000 each. They purchased land of 5,000 sq. m. at Rs. 10 per sq. m. 1/5

th

of the land

H.S.C OMTEX CLASSES 9

TH

YEAR

29

BOOK KEEPING & ACCOUNTANCY

was left over for public roads and the balance was divided into 8 plots of equal size. A plan

was got prepared for Rs. 2,000 and other expenses were Rs. 3,500. 5 plots were sold @ Rs,

15 per sq. m. and 3 plots were sold @ Rs. 14 per sq. m. Prepare joint venture A/c Joint

Bank A/c and Co Venturers A/c. Pass journal entries.

9. A, B & C entered into a joint venture sharing profits and losses in the ratio of their initial

contributions. They opened a Joint Bank A/c. wherein they deposited Rs. 1,00,000 Rs.

1,50,000 and Rs. 2,00,000 respectively. Expenses made through Joint Bank were as

follows. Purchase of Raw material Rs. 50,000. Paid architect fees Rs. 10,000, Plant Rs.

25,000 Besides this, A brought in mixture of Rs. 20,000, B paid insurance charges Rs.,

5,000 and C brought in machinery worth RS. 12,000. At the end of the venture, A took

back the mixture worth Rs. 5,000, B took back the unused materials for Rs. 4,000 and C

took back the machinery for Rs. 8,000. Scrap of plat realized Rs. 2,000. On completion

they received the contract price Rs. 1,00,000 in cash and Rs. 1,00,000 in debenture which

where taken over by A at a loss of Rs. 10,000. Prepare Joint Venture A/c Joint Bank A/c

and Co venture A/c. Pass Journal entries.

10. Ram and Rajiv entered into a Joint venture to construct a conference hall at a contract

price of Rs. 3,00,000. Ram contributed Rs. 1,00,000 and Rajiv contributed Rs. 1,50,000.

Ram brought in material worth Rs. 2,000 and Rajiv Paid transportation charges worth Rs.

6,000 Plant was purchased for Rs. 50,000 and material worth Rs. 2,00,000 were also

purchased. On completion, plant was sold for Rs. 20,000. Due to certain defect, one bill of

Rs. 20,000 was not recovered and the balance was received in cash. Venturers share

profits in the ratio of their initial contributions. Prepare Joint Venture A/c, Joint Bank A/c

and Co venturers A/c and pass Journal entries.

11. A and B entered into a Joint venture. They contributed Rs. 75,000 each and

purchases a plot of 6,000 sq. m. @ Rs. 20 per sq. m. Besides this A got the plan prepared