Beruflich Dokumente

Kultur Dokumente

Ft. Lauderdale-Q4 2011 Report

Hochgeladen von

Ken RudominerCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Ft. Lauderdale-Q4 2011 Report

Hochgeladen von

Ken RudominerCopyright:

Verfügbare Formate

2424 N.

Federal Highway, Suite 257, Boca Raton, FL 33431

ph 561.394.3399

fax 561.394.3382 www.saxenawhite.com

Firefighters Retirement System

Fort Lauderdale Police and

Prepared for

Select Investor Monitoring Report

Fourth Quarter 2011

2424 N. Federal Highway, Suite 257, Boca Raton, FL 33431

ph 561.394.3399

fax 561.394.3382 www.saxenawhite.com

As a general matter, we must advise you that our calculations are based on the trading records provided to us by your custodial bank, which

date back only to 01/06/2004. In making these calculations, and providing you this information, we have relied on the accuracy and completeness

of those records.

Not Likely - The fund had no activity for an impacted security during the class period.

Possible - The fund had activity other than purchases for an impacted security during the class period.

Likely - The fund had one or more purchase transactions for an impacted security during the class period.

You will notice that we have added an additional column labeled Eligibility in both portions of the report. There

are four possible classifications of the funds eligibility to participate in a new or settled action:

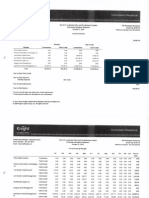

The second chart below contains a list of settled cases in which there are open deadlines for the filing of claims

forms. This chart again contains a column entitled Estimated Gain (Loss), and we have again reviewed your positions in

the securities of the defendant company and calculated any losses your fund may have suffered on a first-in-first-out

basis

Below please find your funds detailed portfolio monitoring report for the fourth financial quarter of 2011. As

always, your report includes two charts. First you will find a chart delineating class action securities fraud lawsuits first

filed during the fourth quarter of 2011, whether by Saxena White or by other law firms. This chart contains a column

entitled Est. Class Period Gain (Loss). This signifies that we have reviewed your positions in the securities of the

defendant company prior to the time the alleged fraud began, reviewed all trading in such securities during the period of

the fraud (the class period), and calculated any losses your fund may have suffered on a first-in-first-out or FIFO

basis.1

SELECT INVESTOR MONITORING REPORT Q4 2011

Fort Lauderdale Police and Firefighters Retirement System

2424 N. Federal Highway, Suite 257, Boca Raton, FL 33431

ph 561.394.3399

fax 561.394.3382 www.saxenawhite.com

Based on the data in our possession, which is limited by the scope of the data available from the current custodial

bank, we sometimes cannot ascertain with complete certainty the funds position in an action. For this reason, the

Eligibility classifications provide the fund with more information than our prior reports in evaluating the probability of

eligibility. Although presented in both the new actions and settled actions charts, this classification is of most value to the

funds in the settled cases context because your custodial bank can search its archives (or that of your prior custodian) to

insure that they file the necessary claim form. To the extent there have been any imminent deadlines for cases in which

your fund has suffered a loss, and which deadlines would have expired before your receipt of this report, we have already

contacted you and/or your custodial bank.

Unknown - There is not enough data for the fund loaded into the monitoring system to determine whether the fund

was impacted by a case or settlement. Please contact your prior custodian to obtain the necessary

data.

01/06/12

01/24/12

03/12/08 - 09/29/11

03/26/10 - 10/19/11

03/02/10 - 09/14/11

08/05/10 - 02/28/11

03/25/10 - 03/17/11

11/26/07 - 12/12/11

11/12/08 - 03/24/10

12/15/10 - 08/03/11

12/09/10 - 11/04/11

FEED (00846L101, B0VTXY0, B28HPC3,

US00846L1017)

AEM (008474108, 2009834, 5821024,

ARDEUT115383, B3TZHPO,

CA0084741085)

CISG (18976M103, B28V2G8,

US18976M10360)

CEDC (153435102, 2286723,

US1534351028)

CAAS (16936R105, 2970662,

US16936R1059)

CMED (169483104, B0G6Q70,

US1694831041)

CNOA (16943A103, B0ZNPS6, B28J433,

US16943A1034)

CBR (17163B102)

DMND (252603105, B081PN2,

US2526031057)

DRYS (262498AB4, B0647S2, B4MXPS7,

MHY2109Q1017, US262498AB44,

12/01/08 - 12/31/10

Y2109Q101)

AgFeed Industries, Inc.

Agnico-Eagle Mines Ltd.

CNinsure Inc.

Central European Distribution Corporation

China Automotive Systems, Inc.

China Medical Technologies, Inc.

China Organic Agriculture, Inc.

Ciber, Inc.

Diamond Foods Inc.

DryShips, Inc.

01/02/12

01/30/12

02/17/12

12/26/11

12/23/11

12/16/11

01/06/12

12/19/11

12/12/11

02/03/11 - 08/03/11

ARO (007865108, 2872092, B1BBX286,

US0078651082)

Aeropostale, Inc.

12/27/11

Lead Plaintiff

Deadline

08/27/10 - 11/06/11

Class Period

OVTI (261134, 682128103,

US682128103)

Ticker (Security ID)

Omnivision Technologies, Inc.

Company

Not Likely

Not Likely

Not Likely

Not Likely

Not Likely

Not Likely

Not Likely

Not Likely

Not Likely

Not Likely

Not Likely

Likely

Eligibility

$0.00

$0.00

$0.00

($247,602.75)

Est. Class Period

Gain(Loss)

Fort Lauderdale Police and Fire Retirement System

Q4, 2011 Securities Class Action

New Action Eligibility Report

01/10/12

01/17/12

02/02/11 - 11/09/11

12/12/07 - 08/24/09

03/06/11 - 10/28/11

03/24/09 - 10/17/11

02/17/11 - 11/10/11

05/11/10 - 09/21/11

02/14/11 - 04/04/11

08/16/10 - 10/07/11

10/01/08 - 02/27/09

GFG (40108N106, A0M86Q,

US40108N1063)

HCA (40412C101, B3P8247, B4MGBG6,

US40412C1018)

HSP (441060100, B00PWV9,

US4410601003)

HGSI (2429766, 444903108, 444903AJ7,

444903AK4, 444903AL2, 444903AM0,

5386084, B032325, B06BY26, B0G7833,

07/20/09 - 11/11/10

B0PD520, US4449031081,

US444903AJ72, US444903AK46,

US444903AL29, US444903AM02)

02/04/11 - 11/18/11

GMCR (2387596, 393122106,

US3931221069)

IFT (452834104, B4JZOB4,

US4528341047)

IL (46118H104, B4Z5RW8, B557KW2,

US46118H1041)

JKS (47759T100, B64H9N4,

US47759T1007)

KV/A (2487634, 2498410, 482740107,

482740206, 482740305, 482740AB3,

482740AD9, 482740AF4, 48274OAC1,

US4827401070, US4827402060,

US4827403050, US482740AB36,

US482740AC19, US482740AD91,

US482740AF40, USU49067AA65)

KEYP (493722102, B5LG4R6,

US4937221020)

LYG (2544346, 539439109,

US5394391099)

Green Mountain Coffee Roasters, Inc.

Guaranty Financial Group, Inc.

HCA Holdings, Inc.

Hospira, Inc.

Human Genome Sciences, Inc.

Imperial Holdings, Inc.

Intralinks Holdings, Inc.

Jinkosolar Holding Co., Ltd.

K-V Pharmaceutical Company

Keyuan Petrochemicals, Inc.

Lloyds Banking Group, PLC

MF (55276Y106, 55276Y205, 55276YAB2,

01/20/12

02/01/11 - 11/13/11

GLGL (361793201, B1YJJM4,

CA3617932015)

GLG Life Tech Corporation

01/23/12

01/17/12

12/19/11

12/12/11

02/03/12

12/27/11

01/10/12

01/30/12

02/13/12

01/17/12

05/08/11 - 11/14/11

FFN (358453306, B3MNCN4,

US3584533067)

Friendfinder Networks, Inc.

02/13/12

09/25/07 - 11/21/11

FMCN (34415V109, B0CRR96,

US34415V1098)

Focus Media Holding Limited

Not Likely

Not Likely

Not Likely

Not Likely

Not Likely

Not Likely

Not Likely

Likely

Likely

Likely

Not Likely

Not Likely

Not Likely

Not Likely

$0.00

$7,463.61

($107,179.22)

($1,226.21)

01/13/12

01/24/12

01/31/12

11/07/06 - 11/07/11

PACB (69404D108, B4N8MH9, B5KXWC9,

10/24/10 - 10/21/11

US69404D1081)

02/03/11 - 06/23/11

11/01/10 - 08/10/11

05/11/09 - 04/29/11

02/28/11 - 08/09/11

03/12/10 - 08/10/11

02/28/08 - 08/11/11

03/04/11 - 11/15/11

04/27/07 - 08/04/11

OCPNY (2658719, 68163W109,

US68163W1099)

PTIE (2609256, 69562K100,

US69562K1007)

PRMW (74165N105, B5TL6Q6,

US74165N1054)

RZTI (2705530, 754055101,

US7540551014)

STXS (85916J102, B02GMV0,

US85916J1025)

SUBK (2857981, 864739107, B3FHRV6,

US8647391072)

BK (064058100, B1Z77F6,

US0640581007)

COO (216648402, 2222631, 5634233,

US2166484020)

VE (2803597, 92334N103,

US92334N1037)

MF Global Holdings Ltd.

Olympus Corporation

Pacific Biosciences of California, Inc.

Pain Therapeutics, Inc.

Primo Water Corporation

Raser Technologies, Inc.

Stereotaxis, Inc.

Suffolk Bancorp

The Bank of New York Mellon Corporation

The Cooper Companies, Inc.

Veolia Environnement S.A.

02/27/12

01/27/12

02/13/12

12/19/11

12/09/11

01/30/12

01/31/12

01/03/12

55277J108, 55277J306, 55277JAA6,

55277JAB4, 55277JAC2, B235GG3,

B3B36B1, B3B3H41, B3W5GS3, B4PGTT2,

B4VB9X5, B517NK5, B568MS4, B5LQTQ0,

B5VCY96, BMG606421086, EP0357632,

11/05/09 - 10/31/11

G60642108, US55276Y1064,

US55276Y2054, US55276YAB20,

US55277J1088, US55277J3068,

US55277JAA60, US55277JAB44,

US55277JAC27)

Not Likely

Not Likely

Likely

Not Likely

Not Likely

Not Likely

Not Likely

Not Likely

Not Likely

Not Likely

Not Likely

$0.00

($42,602.51)

07/24/07-10/23/07

10/28/99-04/01/05

07/31/09-07/22/10

04/23/08-12/10/08

023177108, 2845845, B1HJRM7, US0231771082

001388AA5, 00138QAA5, 001397AA6, 00139PAA6,

00139RAA2, 00209LAA0, 00209SAA5, 00209WAA6,

0028916, 0029157, 008739AA2, 026351106, 026351AU0,

026351AZ9, 026351BB1, 026351BC9, 02635KAW4,

02635KAX2, 02635KCL6, 02635KCR3, 02635PRA3,

02635PRD7, 02635PRG0, 02635PRK1, 02635PRS4,

02635PRT2, 02635PSA2, 02635PSB0, 02635PSE4,

02635PSF1, 02635PSG9, 02635PSH7, 02635PSJ3,

02635PSK0, 02635PSM6, 02635PSN4, 02635PSP9,

02635PSR5, 02635PSS3, 02635PST1, 02635PSU8,

02637VAA6, 02637XAA2, 02639EAA2, 02639EAF1, ...

037604105, 037604204, 5396685, US0376041051

075811109, 2087733, 5386181, US0758111092

127387108, 127387AC2, 127387AD0, 127387AE8,

127387AF5, 2302232, 5482205, B1L7ZH8, B1L80B0,

B23X3N3, B2833Q1, US1273871087, US127387AC26,

US127387AD09, US127387AE81, US127387AF56

Ambac Financial Group, Inc.

Ambassadors Group, Inc.

American International Group,

Inc.

Apollo Group, Inc.

Beckman Coulter, Inc.

Cadence Design Systems, Inc.

02/27/04-09/14/04

$33,000,000.00

023139108, 023139504, 023139603, 023139AA6,

023139AB4, 023139AE8, 023139AF5, 023139AG3, 2023737,

2440400, 2525396, 5684603, 784786204, B00SX59,

B0SKV20, B1RBJD8, B24HTN6, B3CWFP4, US0231391089, 10/19/05-07/18/09

US0231395049, US0231396039, US023139AA61,

US023139AB45, US023139AE83, US023139AF58,

US7847862049

$38,000,000.00

$5,500,000.00

$145,000,000.00

$725,000,000.00

$7,500,000.00

$4,770,000.00

12/26/07-03/13/08

009720103, B1CL591, B1Q3TQ8, US0097201034

$1,500,000.00

Settlement

Amount

Akeena Solar, Inc.

02/21/06-04/22/10

Class Period

00509L109, 00509L703, 2405904, B0153G0,

US00509L1098, US00509L7038

Security ID

Acura Pharmaceuticals, Inc.

Company

03/01/12

04/12/12

05/02/12

01/23/12

11/19/11

10/24/11

12/19/11

03/19/12

Claims

Deadline

Not Likely

Not Likely

Likely

Likely

Not Likely

Likely

Not Likely

Not Likely

Eligibility

$0.00

$0.00

($157,748.89)

NC

($10,688.95)

Estimated

Gain(Loss)

Q4, 2011 Securities Class Action

Settlement Eligibility Report - Fort Lauderdale Police

and Fire Retirement System

$1,375,000.00

02/06/99-02/04/04

10/30/07-11/19/07

07/22/08-07/24/08

04/25/07-08/07/07

03/13/00-07/19/04

34415V109, B0CRR96, US34415V1098

352518104, 352518203, 352518302, 352518401,

352519102, 352519201, 352519300, 352519409,

352519508, 35251D103, 35251D202, 35251D301,

353496201, 353496300, 353496409, 353496508,

353496607, 353496698, 353496706, 353496714,

353496722, 353496730, 353496755, 353496763,

353496771, 353496789, 353496797, 353496805,

353496813, 353496821, 353496839, 353496847,

353496854, 353496862, 353496870, 353496888,

353516107, 353516206, 353516305, 353516404,

353516503, 353518103, 353519101, 353519200,

353519309, ...

374511103, B28RPV2, US3745111035

3623E0209, B1G3M36, B1YXK12, B3BX7R4,

US3623E02092, USU382961063

2411202, 413216300, US4132163001

2559975, 45662N103, BO1DKJ6, D35415104,

DE0006231004, US45662N1037

44925A107, 45927F101, 45928H106, B03WWH3, B0R3TM6,

04/28/05-06/06/06

B0S0249, US44925A1079, US45927F1012, US45928H1068

2462244, 4238777, 461142101, US4611421011

2547044, 55262C100, 5788475, US55262C1009

2576510, 4448532, 584690309, US5846903095

586499AA3, 586499AB1, US586499AA38, US586499AB11

589962CR8, 589962CS6, 589962CT4, 589962CU1,

589962CV9, 589962CW7, 589962CX5

Focus Media Holding Limited

Franklin Funds

Giant Interactive Group, Inc.

GT Solar International, Inc

Harmony Gold Mining Company

Limited

Infineon Technologies AG

International Coal Group, Inc.

InterVoice-Brite, Inc.

MBIA, Inc.

Medicis Pharmaceutical Corp.

Menasha Steam Utility

Merit Securities Corp.

Collateralized Bonds Series 13

59020U3V5, 59020U3W3, 59020U3X1, 59020U3Y9,

59020U3Z6, 59020U4A0, 59020U4B8, 59020U4C6,

$6,200,000.00

09/27/07-11/19/07

31617K808, US31617K8080

Fidelity Ultra-Short Bond Fund

02/07/00-05/13/04

02/01/05-09/01/09

10/30/03-09/23/08

07/02/07-01/09/08

10/12/99-06/06/00

06/06/05-06/05/08

02/16/10-08/29/10

23326R109, B15TOR5, US23326R1095

DG FastChannel, Inc.

$7,500,000.00

$17,500,000.00

$18,000,000.00

$68,000,000.00

$4,750,000.00

$9,000,000.00

$10,500,000.00

$13,000,000.00

$4,437,368.00

$2,000,000.00

$7,500,000.00

$2,000,000.00

$10,500,000.00

04/18/07-08/06/09

195493101, 195493200, 195493309, 195493408,

195493AA9, 195493AD3, 195493AE1, 195493AF8

Colonial BancGroup, Inc.

$5,200,000.00

01/14/08-02/17/09

136644101, 2981813, B1L3HL4, CA1366441014

Canadian Superior Energy, Inc.

06/04/12

10/31/11

02/18/12

02/09/12

10/07/11

11/15/11

10/24/11

01/09/12

11/09/11

12/15/11

12/12/11

03/16/12

04/27/12

10/24/11

02/29/12

12/07/11

Unknown

Not Likely

Likely

Possible

Unknown

Not Likely

Unknown

Not Likely

Not Likely

Not Likely

Unknown

Not Likely

Not Likely

Possible

Not Likely

Not Likely

$3,449.99

$0.00

$0.00

$0.00

$4,000,000.00

$52,500,000.00

03/13/07-05/19/08

01/24/08-02/19/09

06/21/08-03/12/09

05/09/08-12/14/09

06/16/08-11/06/08

04/30/08-09/25/08

2086655, 5407112, 640933107, US6409331070

2504492, 5808889, 653351106, US6533511068

2501051, 683944102, 683944201, 683944300, 683944409,

US6839441028, US6839444097, US6839445086,

01/01/06-12/31/08

US6839942018, US6839943008

03/28/07-08/15/07

635405103

683969109, 683969208, 683969307, 683969604,

683969703

2788070, 69325N102, US69325N1028

73316NAA3, 73316PDL1, 73316PGE4, 73316PKF6,

73316QAA6, 73316TAA0, 733174106, 733174304,

733174403, 73317H206, 73317W203, 73318EAJ2,

73318EAK9, 73318EAL7, 73318EAQ6, PR7331741061

744320508, B3BCFN3, US7443205080

2750756, 5949261, 760112102, 760112AA0, B3FHLM5,

US7601121020, US760112AA02

74957T104, B3B1518, B3B9K84, US74957T1043

270607906, 2765095, 786326108, BRSDIAACNPR1,

LB2706078, LB2765090

81662W108, US81663W1080

879455103, B44D370, US8794551031

Motorola, Inc.

National City Corporation

NetBank, Inc.

NexCen Brands, Inc.

Oppenheimer Champion Income

Fund

Oppenheimer Funds, Inc. (Core

Bond Fund)

PCS Edventures!.com Inc.

Popular, Inc.

Prudential Financial Inc.

Rentech, Inc.

RHI Entertainment, Inc.

Sadia S.A.

SemGroup Energy Partners, L.P.

Telenav Inc.

05/13/10-09/02/10

07/17/07-07/17/08

04/30/07-12/31/08

03/16/05-05/21/07

04/30/07-04/21/08

10/25/07-01/22/08

009705708, 2606600, 4591748, 4591748, 620076109,

6606963, B0CRGR7, B10RVQ0, B1SNWM3, US6200761095

MF Global Ltd.

$3,800,000.00

$28,000,000.00

$27,000,000.00

$2,500,000.00

$1,800,000.00

$16,500,000.00

$37,500,000.00

$665,000.00

$47,500,000.00

$12,500,000.00

$168,000,000.00

$3,150,000.00

$90,000,000.00

07/16/07-02/28/08

55276Y106, 55277J108, B235GG3, B3B3H41, B568MS4,

B5VCY96, BMG606421086, G60642108, US55276Y1064,

US55277J1088

Merrill Lynch & Co. Inc.

$315,000,000.00

12/21/05-02/17/09

59020U4D4, 59020U4E2, 59020U4F9, 59020U4G7,

59020U4H5, 59020U4J1, 59020U4K8, 59020U4L6,

59020U4M4, 59020U4N2, 59020U4Q5, 59020U5U5,

59020U5V3, 59020U5W1, 59020U5X9, 59020U5Y7,

59020U5Z4, 59020U6A8, 59020U6C4, 59020U6D2,

59020U6E0, 59020U6F7, 59020U6H3, 59020U6J9,

59020U6K6, 59020U6L4, 59020U6M2, 59020U6N0,

59020U6P5, 59020U6Q3, 59020U6R1, 59020U6S9,

59020U6T7, 59020U6U4, 59020U6V2, 59020U6W0,

59020U6X8, ...

02/27/12

10/15/11

02/10/12

11/21/11

10/22/11

12/23/11

10/11/11

01/03/12

10/30/11

10/30/11

01/31/12

12/10/11

03/09/12

11/25/11

12/27/11

04/25/12

Not Likely

Not Likely

Not Likely

Not Likely

Not Likely

Not Likely

Not Likely

Not Likely

Not Likely

Not Likely

Not Likely

Not Likely

Possible

Possible

Not Likely

Not Likely

$0.00

$0.00

$208,500,000.00

$125,000,000.00

2145103, 2168683, 2455879, 2608554, 2788423, 2942188,

7299522, 939322103, 939322111, 939322202, 939322301,

939322400, 939322509, 939322608, 939322707,

939322756, 939322764, 939322772, 939322780,

939322798, 939322806, 939322814, 939322822,

939322830, 939322848, 939322855, 939322863,

10/19/05-07/23/08

939322871, 939322889, 939322AB9, 939322AC7,

939322AD5, 939322AE3, 939322AF0, 939322AG8,

939322AH6, 939322AL7, 939322AN3, 939322AP8,

939322AQ6, 939322AR4, 939322AS2, 939322AT0,

939322AU7, 939322AV5, 939322AW3, ...

949789AA9, 949789AB7, 949789AC5, 949789AD3,

949789AE1, 949789AF8, 949789AG6, 949789AH4,

949789AJ0, 949789AK7, 949789AL5, 949789AM3,

949789AN1, 949789AP6, 949789AQ4, 949789AR2,

94982XAA0, 94982XAB8, 94982XAC6, 94982XAD4,

94982XAE2, 94982XAF9, 94982XAG7, 94982XAH5,

94982XAJ1, 94982XAK8, 94982XAL6, 94982XAM4,

94982XAN2, 94982XAP7, 94982XAQ5, 94982XAR3,

94982XAS1, 94982XAT9, 949837AA6, 949837AB4,

949837AC2, 949837AD0, 949837AE8, 949837AF5,

949837AG3, 949837AH1, 949837AJ7, 949837AK4,

949837AL2, ...

Wachovia (Preferred Stock and

Bond/Notes)

Washington Mutual, Inc.

Wells Fargo (Pass-Through

Certificates)

* The loss calculation for this class action may be incorrect due to incomplete transactional data.

NC indicates the gain/loss could not be computed.

07/29/05-09/27/06

$627,000,000.00

07/31/06-02/27/09

929403243, 92976WBA3, 92976WBA3, 92976WBB1,

92976WBC9, 92976WBD7, 92976WBG0, 92976WBH8,

92976WBJ4, 92976WBK1, 92978U207, 92978X201,

92979K208, 929903219, 929903276, 929903CF7,

929903CG5, 929903CH3, 929903CJ9, 929903DF6,

929903DT6, 929903DT6, 929903DU3, 929903EC2,

929903EF5, B19NHG1, B19NHG1, B19RSG0, B1G54Y7,

B1G5500, B1G5K61, B1RFSC2, B1W7FD3, B1X7MT7,

B1YLRV5, B1YLRV5, B1YW4V7, B29FB17, B2PCZM1,

B2PF6B6, B2R46Y4, B2R4TZ6, B3V8XT3, US92976WBA36,

US92976WBA36, US92976WBB19, US92976WBC91, ...

12/07/11

12/08/11

12/28/11

Likely

Likely

Likely

($94,425.12)

($36,371.67)

($41,890.00)

Das könnte Ihnen auch gefallen

- How To Request Ssa Program Data For ResearchDokument5 SeitenHow To Request Ssa Program Data For ResearchShashwat Vaid100% (1)

- Letter of AdviceDokument2 SeitenLetter of AdviceAndrew100% (6)

- LPX 10K 2010 - Balance Sheet Case-StudyDokument116 SeitenLPX 10K 2010 - Balance Sheet Case-StudyJohn Aldridge ChewNoch keine Bewertungen

- CFPB List Consumer-reporting-AgenciesDokument17 SeitenCFPB List Consumer-reporting-Agenciesdbush2778Noch keine Bewertungen

- Verizon Financial Analysis Draft (Finall)Dokument22 SeitenVerizon Financial Analysis Draft (Finall)MadfloridaNoch keine Bewertungen

- Quickbooks Practice MCQ'sDokument5 SeitenQuickbooks Practice MCQ'sdiastye75% (4)

- R05 Time Value of Money IFT Notes PDFDokument28 SeitenR05 Time Value of Money IFT Notes PDFAbbas0% (1)

- Yau Chu Vs CADokument1 SeiteYau Chu Vs CAcmv mendozaNoch keine Bewertungen

- Financial Statement Fraud: Strategies for Detection and InvestigationVon EverandFinancial Statement Fraud: Strategies for Detection and InvestigationNoch keine Bewertungen

- Export Documentation For Garment HouseDokument88 SeitenExport Documentation For Garment HouseRon Bhuyan0% (1)

- Ncnda Imfpa Jp54 2016 Ty ScottDokument8 SeitenNcnda Imfpa Jp54 2016 Ty ScottIvan EastmanNoch keine Bewertungen

- Billing Reference ArchitectureDokument37 SeitenBilling Reference ArchitectureAnandhababuS100% (1)

- Ft. Lauderdale-Q2 ReportDokument9 SeitenFt. Lauderdale-Q2 ReportKen RudominerNoch keine Bewertungen

- Figure 2.1. Actual and Reported Result of Currency OptionsDokument4 SeitenFigure 2.1. Actual and Reported Result of Currency OptionsSarah DanaNoch keine Bewertungen

- Er 20130507 Bull Phat DragonDokument3 SeitenEr 20130507 Bull Phat DragonBelinda WinkelmanNoch keine Bewertungen

- FLO Newsletter July 5 2012Dokument7 SeitenFLO Newsletter July 5 2012Andrew Charles HendricksNoch keine Bewertungen

- Institutional Risk Analytics: Proposed Guidance On Stress TestingDokument11 SeitenInstitutional Risk Analytics: Proposed Guidance On Stress TestingrkasukuNoch keine Bewertungen

- Senate Hearing, 111TH Congress - Nomination of Daniel I. WerfelDokument77 SeitenSenate Hearing, 111TH Congress - Nomination of Daniel I. WerfelScribd Government DocsNoch keine Bewertungen

- Er 20130404 Bull Phat DragonDokument3 SeitenEr 20130404 Bull Phat DragonBelinda WinkelmanNoch keine Bewertungen

- FLO Newsletter May 16 2012Dokument8 SeitenFLO Newsletter May 16 2012Andrew Charles HendricksNoch keine Bewertungen

- June 14 2010-Dept of Treasury - Regulatory Bulletin Fraud & Insider Abuse (Revised)Dokument41 SeitenJune 14 2010-Dept of Treasury - Regulatory Bulletin Fraud & Insider Abuse (Revised)83jjmackNoch keine Bewertungen

- Liquidity Coverage RatioDokument102 SeitenLiquidity Coverage Ratioed_nycNoch keine Bewertungen

- er20130624BullPhatDragon PDFDokument3 Seitener20130624BullPhatDragon PDFJesse BarnesNoch keine Bewertungen

- Bank United, FSB Form 10 K (Mar 31 2011)Dokument367 SeitenBank United, FSB Form 10 K (Mar 31 2011)Melike84Noch keine Bewertungen

- Broadview Networks Holdings, Inc 10 QDokument43 SeitenBroadview Networks Holdings, Inc 10 QChapter 11 DocketsNoch keine Bewertungen

- er20130411BullPhatDragon PDFDokument3 Seitener20130411BullPhatDragon PDFJennifer PerezNoch keine Bewertungen

- Facebook, Inc.: United States Securities and Exchange Commission Washington, D.C. 20549 FORM 10-KDokument105 SeitenFacebook, Inc.: United States Securities and Exchange Commission Washington, D.C. 20549 FORM 10-KSapta BintangNoch keine Bewertungen

- The Financial System Is A Farce:: Part ThreeDokument4 SeitenThe Financial System Is A Farce:: Part ThreeVALUEWALK LLCNoch keine Bewertungen

- er20130322BullPhatDragon PDFDokument3 Seitener20130322BullPhatDragon PDFHeidi TaylorNoch keine Bewertungen

- I2 Presentation Money Trail v3Dokument42 SeitenI2 Presentation Money Trail v3772748_nareshNoch keine Bewertungen

- Notice of Data EventDokument4 SeitenNotice of Data Eventnoobb64Noch keine Bewertungen

- PDFDokument2 SeitenPDFEl Nuevo DíaNoch keine Bewertungen

- Gerald Young v. GrowLife, Inc. Et Al Doc 1 Filed 25 Apr 14Dokument34 SeitenGerald Young v. GrowLife, Inc. Et Al Doc 1 Filed 25 Apr 14scion.scionNoch keine Bewertungen

- 2011-32244 Federal Register 12-19-2011transparency Reports and Reporting of PhysicianDokument33 Seiten2011-32244 Federal Register 12-19-2011transparency Reports and Reporting of PhysicianJames LindonNoch keine Bewertungen

- FT Lauderdale-Q3 2010 ReportDokument11 SeitenFT Lauderdale-Q3 2010 ReportKen RudominerNoch keine Bewertungen

- Phat Dragons (Westpac) Weekly Chronicle of The Chinese Economy 16.01.2013Dokument2 SeitenPhat Dragons (Westpac) Weekly Chronicle of The Chinese Economy 16.01.2013leithvanonselenNoch keine Bewertungen

- The NoticeDokument5 SeitenThe NoticeMayra ParrillaNoch keine Bewertungen

- TSA SecOpsProcedTOCs 2007 2008Dokument12 SeitenTSA SecOpsProcedTOCs 2007 2008dpi435Noch keine Bewertungen

- Under Secretary of DefenseDokument9 SeitenUnder Secretary of DefenseSunlight FoundationNoch keine Bewertungen

- Senate Hearing, 109TH Congress - From Factory To Foxhole: Improving Dod LogisticsDokument62 SeitenSenate Hearing, 109TH Congress - From Factory To Foxhole: Improving Dod LogisticsScribd Government DocsNoch keine Bewertungen

- Er 20130620 Bull Phat DragonDokument3 SeitenEr 20130620 Bull Phat DragonDavid SmithNoch keine Bewertungen

- Er 20130612 Bull Phat DragonDokument3 SeitenEr 20130612 Bull Phat DragonDavid SmithNoch keine Bewertungen

- Bank Failure Research PaperDokument8 SeitenBank Failure Research Paperwihefik1t0j3100% (1)

- House Hearing, 113TH Congress - Who Is Too Big To Fail: Does Dodd-Frank Authorize The Government To Break Up Financial Institutions?Dokument77 SeitenHouse Hearing, 113TH Congress - Who Is Too Big To Fail: Does Dodd-Frank Authorize The Government To Break Up Financial Institutions?Scribd Government DocsNoch keine Bewertungen

- Er 20130702 Bull Phat DragonDokument3 SeitenEr 20130702 Bull Phat DragonDavid SmithNoch keine Bewertungen

- Web Page SCIP IntroDokument43 SeitenWeb Page SCIP IntrobcfunkNoch keine Bewertungen

- Aol 10KDokument62 SeitenAol 10KScottyw18Noch keine Bewertungen

- Senate Hearing, 112TH Congress - Securities Lending in Retirement Plans: Why The Banks Win, Even When You LoseDokument191 SeitenSenate Hearing, 112TH Congress - Securities Lending in Retirement Plans: Why The Banks Win, Even When You LoseScribd Government DocsNoch keine Bewertungen

- Estudios BiblicosDokument6 SeitenEstudios Biblicosa munizNoch keine Bewertungen

- WWW - Sec.gov Archives Edgar Data 1372375 000104746912002246 A2207233zs-1aDokument221 SeitenWWW - Sec.gov Archives Edgar Data 1372375 000104746912002246 A2207233zs-1aAnonymous Feglbx5Noch keine Bewertungen

- The Discovery and Reporting of Internal Control Deficiencies Prior To SOX-mandated AuditsDokument27 SeitenThe Discovery and Reporting of Internal Control Deficiencies Prior To SOX-mandated AuditsAndronache RazvanNoch keine Bewertungen

- Fil 06081Dokument2 SeitenFil 06081Miguel BenedettoNoch keine Bewertungen

- Data Breach Reports 2015Dokument33 SeitenData Breach Reports 2015lovemytoolNoch keine Bewertungen

- United States Securities and Exchange Commission: Washington, D.C. 20549Dokument46 SeitenUnited States Securities and Exchange Commission: Washington, D.C. 20549budice4ever6315Noch keine Bewertungen

- William HenleyDokument3 SeitenWilliam HenleyMarketsWikiNoch keine Bewertungen

- See 76 Fed. Reg. 8068 (Feb. 11, 2011) (The "Joint Proposing Release")Dokument9 SeitenSee 76 Fed. Reg. 8068 (Feb. 11, 2011) (The "Joint Proposing Release")MarketsWikiNoch keine Bewertungen

- Twitter Form S 1Dokument181 SeitenTwitter Form S 1Rahul AmrikNoch keine Bewertungen

- Senate Hearing, 111TH Congress - Taking Stock: Independent Views On Tarp's EffectivenessDokument107 SeitenSenate Hearing, 111TH Congress - Taking Stock: Independent Views On Tarp's EffectivenessScribd Government DocsNoch keine Bewertungen

- U.S. Food & Drug Administration: 10903 New Hampshire Avenue Silver Spring, MD 20993Dokument9 SeitenU.S. Food & Drug Administration: 10903 New Hampshire Avenue Silver Spring, MD 20993FarbodNoch keine Bewertungen

- OGE Response To Letter From Ranking Member Patty MurrayDokument4 SeitenOGE Response To Letter From Ranking Member Patty Murrayemma brownNoch keine Bewertungen

- House Hearing, 112TH Congress - Social Security's Payment AccuracyDokument110 SeitenHouse Hearing, 112TH Congress - Social Security's Payment AccuracyScribd Government DocsNoch keine Bewertungen

- ACOSS To Senator Scott - OverPayments - 12-06-2023-FINALwithSignatureREVDokument3 SeitenACOSS To Senator Scott - OverPayments - 12-06-2023-FINALwithSignatureREVWZZM NewsNoch keine Bewertungen

- Federal Register / Vol. 76, No. 245 / Wednesday, December 21, 2011 / Proposed RulesDokument28 SeitenFederal Register / Vol. 76, No. 245 / Wednesday, December 21, 2011 / Proposed RulesMarketsWikiNoch keine Bewertungen

- Link PDFDokument175 SeitenLink PDFAbhimanyun MandhyanNoch keine Bewertungen

- US Internal Revenue Service: n-02-20Dokument6 SeitenUS Internal Revenue Service: n-02-20IRSNoch keine Bewertungen

- Hack NoticeDokument3 SeitenHack NoticegekkoNoch keine Bewertungen

- Commission Recaptre 5-12011Dokument10 SeitenCommission Recaptre 5-12011Ken RudominerNoch keine Bewertungen

- Ftpol Vote Report 120710Dokument1.188 SeitenFtpol Vote Report 120710Ken RudominerNoch keine Bewertungen

- 1st QTR 12 City of Ft. Lauderdale Full ReportDokument151 Seiten1st QTR 12 City of Ft. Lauderdale Full ReportKen RudominerNoch keine Bewertungen

- COLA HistoryDokument18 SeitenCOLA HistoryKen RudominerNoch keine Bewertungen

- Pension Reform DestructionDokument40 SeitenPension Reform DestructionKen RudominerNoch keine Bewertungen

- Ft. Lauderdale-Q2 2012 ReportDokument14 SeitenFt. Lauderdale-Q2 2012 ReportKen RudominerNoch keine Bewertungen

- 2011 Customer Service Results 037Dokument21 Seiten2011 Customer Service Results 037Ken RudominerNoch keine Bewertungen

- Ft. Lauderdale 4th QTR 11 Full ReportDokument142 SeitenFt. Lauderdale 4th QTR 11 Full ReportKen RudominerNoch keine Bewertungen

- DMS Financial Rating PlanDokument18 SeitenDMS Financial Rating PlanKen RudominerNoch keine Bewertungen

- 2011 - Florida Mortality StudyDokument13 Seiten2011 - Florida Mortality StudyKen RudominerNoch keine Bewertungen

- Fort Lauderdale Police and Fire Pension Proxy Voting RecordDokument109 SeitenFort Lauderdale Police and Fire Pension Proxy Voting RecordKen RudominerNoch keine Bewertungen

- Year End Recapture 20010Dokument6 SeitenYear End Recapture 20010Ken RudominerNoch keine Bewertungen

- January GTS029Dokument7 SeitenJanuary GTS029Ken RudominerNoch keine Bewertungen

- Disability Presumptions - Task Force ReportDokument30 SeitenDisability Presumptions - Task Force ReportKen RudominerNoch keine Bewertungen

- Understanding Unfunded LiabilityDokument10 SeitenUnderstanding Unfunded LiabilityKen RudominerNoch keine Bewertungen

- Pension History 018Dokument16 SeitenPension History 018Ken RudominerNoch keine Bewertungen

- FT - Lauderdale 3rd QTR 11 Full ReportDokument140 SeitenFT - Lauderdale 3rd QTR 11 Full ReportKen RudominerNoch keine Bewertungen

- Fort Lauderdale Police and Fire Pension Securities MonitoringDokument11 SeitenFort Lauderdale Police and Fire Pension Securities MonitoringKen RudominerNoch keine Bewertungen

- Fort Lauderdale Police and Fire Pension 1st Quarter 2011 Investment ReviewDokument131 SeitenFort Lauderdale Police and Fire Pension 1st Quarter 2011 Investment ReviewKen RudominerNoch keine Bewertungen

- 2011 Pension Reform Update Re HB303 1!24!11Dokument3 Seiten2011 Pension Reform Update Re HB303 1!24!11Ken RudominerNoch keine Bewertungen

- Ft. Lauderdale-Q4 2010 ReportDokument11 SeitenFt. Lauderdale-Q4 2010 ReportKen RudominerNoch keine Bewertungen

- Kinght01 11015Dokument4 SeitenKinght01 11015Ken RudominerNoch keine Bewertungen

- Recapture09 11021Dokument5 SeitenRecapture09 11021Ken RudominerNoch keine Bewertungen

- Knight: /ommjssion RecaptureDokument6 SeitenKnight: /ommjssion RecaptureKen RudominerNoch keine Bewertungen

- Recapture11 10Dokument5 SeitenRecapture11 10Ken RudominerNoch keine Bewertungen

- Ftpol Vote Report 101011Dokument55 SeitenFtpol Vote Report 101011Ken RudominerNoch keine Bewertungen

- Knight8 31005Dokument3 SeitenKnight8 31005Ken RudominerNoch keine Bewertungen

- FT Lauderdale-Q3 2010 ReportDokument11 SeitenFT Lauderdale-Q3 2010 ReportKen RudominerNoch keine Bewertungen

- AcknowledgementDokument9 SeitenAcknowledgementDeepika DedhiaNoch keine Bewertungen

- KYC Master Directions 2016 - Presentations For RefDokument15 SeitenKYC Master Directions 2016 - Presentations For RefAnagha LokhandeNoch keine Bewertungen

- International Bank For Reconstruction and DevelopmentDokument14 SeitenInternational Bank For Reconstruction and DevelopmentBhavesh JoliyaNoch keine Bewertungen

- Module 1 and 3 AssignmentDokument12 SeitenModule 1 and 3 AssignmentPrincess Maeca OngNoch keine Bewertungen

- FIN80004 Lecture1Dokument28 SeitenFIN80004 Lecture1visha183240Noch keine Bewertungen

- 111 c150042 CarlsonDokument33 Seiten111 c150042 CarlsonAbrar HussainNoch keine Bewertungen

- Challan PDFDokument1 SeiteChallan PDFRAJESH KUMAR YADAVNoch keine Bewertungen

- Sbi Focused Equity Fund Factsheet (May-2019!25!1)Dokument1 SeiteSbi Focused Equity Fund Factsheet (May-2019!25!1)Chandrasekar Attayampatty TamilarasanNoch keine Bewertungen

- Performance Appraisal in Banks A Study. 2Dokument8 SeitenPerformance Appraisal in Banks A Study. 2Asma Malik100% (1)

- Chapter 5Dokument30 SeitenChapter 5Jyoti Prakash BarikNoch keine Bewertungen

- Advance Portfolio ManagementDokument7 SeitenAdvance Portfolio ManagementKinza ZaheerNoch keine Bewertungen

- Banking Performance Management: Rajesh Shewani Presales Leader, BA Software IBM India/SADokument20 SeitenBanking Performance Management: Rajesh Shewani Presales Leader, BA Software IBM India/SARajesh Kumar100% (1)

- Johor Corp 2008Dokument209 SeitenJohor Corp 2008khairulkamarudinNoch keine Bewertungen

- Difference Between LC and SBLC - LC Vs SBLCDokument8 SeitenDifference Between LC and SBLC - LC Vs SBLCAnonymous sMqylHNoch keine Bewertungen

- HyundaiDokument17 SeitenHyundaikumraashuNoch keine Bewertungen

- 489 FDokument18 Seiten489 Fasgharkhankakar100% (2)

- 201272163237draft Prospectus - Jointeca Education Solutions Limited - FinalDokument220 Seiten201272163237draft Prospectus - Jointeca Education Solutions Limited - FinalNimalanNoch keine Bewertungen

- Detailed StatementDokument2 SeitenDetailed Statementnisha.yusuf.infNoch keine Bewertungen

- JMGS1 - Recollected Questions of Exam Held in Feb-2016Dokument4 SeitenJMGS1 - Recollected Questions of Exam Held in Feb-2016Anonymous Ey8uMU5nNoch keine Bewertungen

- Islamic Banking User Manual-Bai SalamDokument21 SeitenIslamic Banking User Manual-Bai SalamPranay SahuNoch keine Bewertungen

- Financial Statement Analysis of Habib BankDokument87 SeitenFinancial Statement Analysis of Habib Bankhelperforeu56% (9)

- 10 - List of Banks PDFDokument3 Seiten10 - List of Banks PDFAyush ParakhNoch keine Bewertungen

- Employee Selection - Structure ExerciseDokument10 SeitenEmployee Selection - Structure ExerciseKaushik HazarikaNoch keine Bewertungen