Beruflich Dokumente

Kultur Dokumente

Financial and Tax Guide 2012

Hochgeladen von

PauldingProgressOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Financial and Tax Guide 2012

Hochgeladen von

PauldingProgressCopyright:

Verfügbare Formate

Tel: 555 555 5555

Business Name

Or g ani z at i on

www.als-cpa.com

117 N Main St., Paulding 1 - - 686

685 Fox Rd., Van Wert 1 - 8- 658

Our professionals are trained to focus on the details of

business. Let us help you feel more confident about your

most important business decisions. We provide tax,

accounting and advisory services to enable success.

419-399-3686

419-238-0658

www.als-cpa.net

A SPECIAL SUPPLEMENT TO

Paulding County Progress February 8, 2012

BANKING

MADE EASY

We make it easy to manage your money all in one

place. Our reliable financial team can handle your

checking, saving and borrowing needs, safely, securely

and conveniently. Talk to us today,

and simplify your financial life.

305 S. Main Street,

Antwerp, Ohio 45813

(419) 258-5351

119 N. Main Street,

Payne, Ohio 45880

(419) 263-2705

Member FDIC

We`re not just bankers, we`re neighbors

The ONLY Number You Need To

Know For Your Tax Return!!

We can Help you save time & money!

ADKINS BOOKKEEPING

& TAX SERVICE

Georgianna Adkins EA

147 E. Main St., Van Wert, OH

Mon.-Fri.: 8am-6pm, Sat.: 9am-2pm

All others by Apppointment

419-238-4253

-Individual

-Business

-Farms

-Federal,

State &

Local Taxes

Electronic

Filing

Included

*Life *Health * Fixed Annuities * Long Term Care

JOHN MANZ, Agent

Waters Insurance LLC

1009 N. Williams St., Paulding OH 45879

419-399-2712

jmanz@windstream.net

Debunking financial

planning myths

(NAPS) These simple tips can help you break

through common misperceptions and achieve

your personal financial goals.

Myth No. 1: Keeping track of everyday spend-

ing is tricky and time consuming.

For many people, the thought of planning for

how to spend money every day is overwhelming,

but it doesnt have to be. Save yourself the

headache by making your plan simple start with

one category of expenses, such as groceries.

Myth No. 2: Once you make a plan, you are all

set.

Once you have a plan, you

should always track it against

your goals. Knowing where you

stand will allow you to identify

any areas of opportunity and

help you learn how you can im-

prove your spending, borrowing

and saving habits to reach your

financial goals.

Myth No. 3: Using a credit

card isnt the same as borrow-

ing money.

You should view using a

credit card and carrying a bal-

ance on that card the same way

you view money you would bor-

row from a bank. And as with

any loan for a car, home or edu-

cation, you should be mindful of

what exactly youre borrowing

money for and always have a

plan for how to pay it back be-

fore you make the purchase.

Myth No. 4: Everyone views fi-

nancial goals the same way.

Research shows that women

tend to focus on the long-term

goal, plan and time frame,

whereas men tend to be focused

on the monthly payment amount.

4 - Paulding County Progress Financial & Tax Guide Wednesday, February 8, 2012

Free E-File

Efficient

Accurate & Reliable

Direct Deposit

Individual

Agriculture

Truck Drivers

Small Business

ALLANCE

TAX 8ERVCE8 LLC

112 E. h|gh 8treet

h|cksv|||e, 0h 4352

(419} 542-9000

www.alliancetaxservices.com

Bookkeeping

Payroll

Tax Preparation 8ervices

Ema|| Us: |nfoa|||ancetaxserv|ces.com

Worried About Your Investments?

Losing sleep over the stock market? Retiring soon?

Call today to schedule a complementary investment review.

Chris R. Johnson

Investment Advisor Representative

(419) 399-5568 or (419) 399-2311

115 North Main Street, Paulding, OH 45879

Securities and investment advisory services

offered through FSC Securities Corporation,

member FINRA/SIPC and a registered

investment advisor.

GILL TAX SERVICE

$65

Rates Include:

Federal,

State, City, School

Free

e-filing

419-258-2294

22c2

17196 SR 613

Paulding, OH 45879

O(419)399-2420

F(419)399-9253

24c3

COUNTRY HAVEN

TAXES

CHANGE ON THE HORIZON

By Appointment

or Drop-offs

Talk to your partner and put achieving goals such

as succeeding in finishing a payment plan at the top

of the list of things to discuss.

Myth No. 5: Financial planning should be limited

to regular expenses.

While it is always important to have a good finan-

cial plan, major life events like weddings, having a

baby and raising children elevate the importance of

personal finances. Be proactive and take a few min-

utes to think about any expected or unexpected

events and fit them into your plan.

117 N Main St., Paulding

685 Fox Rd., Van Wert

Dianne T. Jones

Vice President

Paulding Sales Manager

419.399.2028

Dianne.Jones@thebank-sbt.com

Karen A. Varner

Assistant Vice President

Mortgage Loan Ofcer

419.785.3676

Karen.Varner@thebank-sbt.com

Oakwood Banking Center

218 N. First Street

Oakwood, OH 45873

419.594.3333

Financial Success Starts Here

Paulding Banking Center

220 N. Main Street

Paulding, OH 45879

419.399.5270

www.thebank-sbt.com 877.867.4218 Member FDIC Equal Housing Lender

Call us today!

$imple mean$ to $aving money

If the ongoing recession has

taught people anything, its the

need for saving money. Many peo-

ple were caught off guard by the re-

cession, and studies have shown

just how little men and women had

saved before the bottom fell out on

the economy.

In a 2011 poll from the National

Foundation for Credit Counseling,

64 percent of respondents admitted

they would not be able to rely on

their savings account if a $1,000

unplanned expense suddenly

popped up. And the problem of not

saving enough is not exclusive to

Americans. A 2011 survey from the

Canadian Payroll Association indi-

cated that 57 percent of the nearly

2,100 respondents admitted they

would be in financial trouble if their

pay was delayed by just one week,

while 40 percent expect to delay

their retirement due to lack of sav-

ings.

Such figures should be enough to

motivate men and women to start

saving, not only for retirement but

for an unforeseen event like a layoff

that could put finances in serious

jeopardy. There are ways men and

women can save money that dont

require too much sacrifice.

Pay extra each month on

loans. If paying extra money

each month sounds like an odd

way to save money, keep in

mind that paying ahead on

loans can substantially reduce

the amount of interest that ac-

crues over the course of the

loan. Some loan agreements

include prepayment penalties

that actually penalize cus-

tomers for paying ahead. But if

the loan agreement has no such

penalties, sending a little extra

each month reduces the loans

principle faster, meaning bor-

rowers will pay less in interest

and pay off their loans faster.

Shop sales. Shopping sales

is a simple way to save, yet

many people still dont take

advantage of sales. Whether

grocery shopping, shopping

for home furnishings or adding

on to your wardrobe, shopping

sales is a great way to save

substantial amounts of money.

When visiting the grocery

store, sign up for the stores

club membership, which in

many cases automatically

earns you sale prices as long as

you remember to swipe the

club card before paying. When

shopping for clothes, peruse the

clearance racks, especially at the

end of the season, when stores sim-

ply want to get rid of items and, as

a result, mark them down heavily.

The items will still be wearable next

season, and you will have saved a

lot of money without doing much

work.

Re-examine existing insurance

policies. An insurance company is

not liable to call you and offer lower

rates. However, a consumer often

finds his or her company is willing

to lower rates for those who initiate

the conversation. For example, mo-

torists who have gone a significant

amount of time since their last

speeding ticket or traffic accident

can often renegotiate their auto in-

surance policies and earn a lower

rate. Some companies will automat-

ically lower these rates, while others

need some prodding. Oftentimes,

the threat of cancellation is enough

to motivate a company to reduce in-

surance costs. But policy holders

wont know unless they try. If the

company claims theres no wiggle

room, start shopping around for a

new company, and dont hesitate to

jump on a more affordable policy,

even if it can be a hassle to change

companies and policies.

Another thing to consider when

examining insurance policies if the

level coverage is still necessary. For

instance, men and women who

opened an auto policy when their

car was brand new might not want

full coverage now that the car has

gotten older. Reducing coverage can

save significant amounts of money.

Contact your credit card

provider. Credit card holders in

good standing almost always have

the means to saving money at their

disposal. Thats because the credit

card company will likely be willing

to lower your interest rate if you are

a customer in good standing. Low-

ering the interest rate can save card

holders significant amounts of

money, but its still ideal for card

holders to pay off their balances

each month and avoid interest ac-

cruing in the first place.

When speaking with a represen-

tative of your credit card company,

discuss any additional benefits the

company might provide. For exam-

ple, some cards have an incentive

program that provides cash back on

qualifying purchases, which might

include groceries or airline tickets.

If your card offers such incentives,

take full advantage of them, just be

sure to pay off the balance in full

each month.

Saving money is something

many people insist they will start

doing tomorrow. But its the little

changes you make today that can

add up to significant savings down

the road.

2 - Paulding County Progress Financial & Tax Guide Wednesday, February 8, 2012

Its likely that your retirement income may come from

many sources, such as Social Security, pension distributions,

a 401(k) or IRA withdrawals. Thats why, if taxes are a

concern for you, its important to choose the right investments

for your portfolio. At Edward Jones, we have many options

that can give you more control over your taxes, so you can

enjoy what youve worked so hard to achieve.

Edward Jones, its employees and fnancial advisors cannot provide tax advice. You should

consult with a qualifed tax specialist for professional advice on your specifc situation.

SO MUCH PLANNING

GOES INTO RETIREMENT.

HAVE YOU THOUGHT ABOUT TAXES AS WELL?

Call today to see how our unique, face-to-face approach

makes us best-suited to help long-term investors meet their

current needs and future fnancial goals.

www.edwardjones.com Member SIPC

Philip J Recker, AAMS

Financial Advisor

.

121 N Main St

Paulding, OH 45879

419-399-3767

Renegotiating existing insurance policies is one way men and women can

save substantial amounts of money each month.

Changes impacting your tax return this year

(NAPS) Three out of four taxpayers re-

ceived a refund from Uncle Sam last year,

averaging $2,805. This years amount should

be about the same, thanks to a few major tax

law changes expiring or added during 2011.

Although your bottom line may change lit-

tle, there are changes you should be aware of

for this years tax return.

Unless lawmakers extend them, this will

be the last year to claim several well-known

tax breaks, according to TaxACT

spokesperson Jessi Dolmage. Take advan-

tage of them while you still can. With 2012

being an election year, its anyones guess as

to what changes could be in store for next

years return.

Before you do your taxes, read this sum-

mary of the more notable changes that may

affect your federal return this year.

The filing deadline is Tuesday, April 17,

2012, because April 15 is a Sunday and

Washington, D.C., is recognizing Emancipa-

tion Day on April 16. Dont use the later

deadline as an excuse to procrastinate,

though. When you rush, youre more likely

to make mistakes that could cost you money

and time. Furthermore, filing, paying or pro-

viding information late will result in IRS

penalties that have increased this year.

Your 2011 tax return could be your last

chance to claim one of the credits for energy-

efficient home improvements as well as de-

ductions for tuition and fees, educator

expenses, mortgage insurance premiums,

and the option to include your state and local

sales taxes paid as an itemized deduction (in

lieu of state and local income taxes paid).

The Making Work Pay Tax Credit and

Alternative Motor Vehicle Credit (unless it

was a new fuel-cell vehicle) that you could

claim last year have expired. The Making

Work Pay Tax Credit was essentially re-

placed by the payroll tax holiday for 2011,

which employees and the self-employed al-

ready received in 2011 paychecks through a

reduction in FICA-OASDI Social Security

taxes. Unlike the Making Work Pay Tax

Credit, employees who benefited from the

payroll tax holiday dont need to claim it on

this years tax return.

The amount of the Health Coverage Tax

Credit decreased to 72.5 percent for qualified

health insurance coverage received between

March and December 2011.

If you converted a traditional IRA to a

designated Roth IRA in 2010 or rolled over

a qualified retirement plan to a Roth IRA, but

did not report the taxable amount on your

2010 tax return (due April 2011), you must

report half the amount on this years return

and the other half on your 2012 return. De-

tails are available in IRS Publication 575 at

www.irs.gov

Amounts for standard mileage, standard

deductions, personal exemptions and the Al-

ternative Minimum Tax have increased. Note

that there are different standard mileage rates

for miles driven before July 1 and after June

30. Details about all increases and other tax

law changes can be found in IRS Publication

17.

Online and downloadable tax preparation

programs make navigating tax law changes

easy. When choosing your software, Dol-

mage reminds you to carefully weigh your

options, especially if youre using a free so-

lution. Make sure it covers your tax situa-

tion. Many free federal products only cover

simple returns, like Form 1040EZ returns.

Most taxpayers need forms and schedules

that are only included in overpriced solu-

tions.

Wednesday, February 8, 2012 Paulding County Progress Financial & Tax Guide - 3

We find money others

miss. FREE Second

Look Review.

If you didnt use H&R Block, bring in your return for a FREE Second Look Review.

We usually find a different result which can mean more money for our clients.

Well also certify whether or not your original return is accurate. Join the thousands

of clients who have received more money with an H&R Block Second Look Review.

Based on Second Look Reviews conducted 2009-2011. Fees apply if you have us prepare a corrected or amended return. Results will

vary. If H&R Block makes an error on your return, well pay resulting penalties and interest. If you are audited, well explain your

audit notice and the documentation you should provide to the auditor. Participating locations only. Expires April 30, 2012.

2011 HRB Tax Group, Inc.

H&R Block

141 E HIgh Street

Hicksville, OH 43526

Phone: 419-542-6929

Mon-Fri 9:00 am to 6:00 pm

Saturday 9:00 am to 5:00 pm

H&R Block

833 N Williams Street

Paulding, OH 45879

Phone: 419-399-5283

Mon-Fri 9:00 am to 6:00 pm

Saturday 9:00 am to 5:00 pm

The filing deadline isnt the only notable

change that may affect your federal tax return

this year.

Das könnte Ihnen auch gefallen

- Paulding Progress June 29, 2016Dokument28 SeitenPaulding Progress June 29, 2016PauldingProgressNoch keine Bewertungen

- Weekly Reminder July 4, 2016Dokument6 SeitenWeekly Reminder July 4, 2016PauldingProgressNoch keine Bewertungen

- Fair SectionDokument12 SeitenFair SectionPauldingProgressNoch keine Bewertungen

- Weekly Reminder JUne 13, 2016 PDFDokument4 SeitenWeekly Reminder JUne 13, 2016 PDFPauldingProgressNoch keine Bewertungen

- Weekly Reminder June 6, 2016Dokument6 SeitenWeekly Reminder June 6, 2016PauldingProgressNoch keine Bewertungen

- Weekly Reminder June 27, 2016 PDFDokument4 SeitenWeekly Reminder June 27, 2016 PDFPauldingProgressNoch keine Bewertungen

- Paulding Progress June 22, 2015Dokument18 SeitenPaulding Progress June 22, 2015PauldingProgressNoch keine Bewertungen

- Paulding Progress June 15, 2016Dokument16 SeitenPaulding Progress June 15, 2016PauldingProgressNoch keine Bewertungen

- BCD 1 20 PDFDokument20 SeitenBCD 1 20 PDFPauldingProgressNoch keine Bewertungen

- Weekly Reminder June 20, 2016 PDFDokument4 SeitenWeekly Reminder June 20, 2016 PDFPauldingProgressNoch keine Bewertungen

- Weekly Reminder June 20, 2016 PDFDokument4 SeitenWeekly Reminder June 20, 2016 PDFPauldingProgressNoch keine Bewertungen

- Paulding Progress June 8, 2016Dokument30 SeitenPaulding Progress June 8, 2016PauldingProgressNoch keine Bewertungen

- Weekly Reminder May 16, 2016Dokument6 SeitenWeekly Reminder May 16, 2016PauldingProgressNoch keine Bewertungen

- Weekly Reminder May 30, 2016 PDFDokument6 SeitenWeekly Reminder May 30, 2016 PDFPauldingProgressNoch keine Bewertungen

- Weekly Reminder June 6, 2016Dokument6 SeitenWeekly Reminder June 6, 2016PauldingProgressNoch keine Bewertungen

- Weekly Reminder April 25, 2016 PDFDokument6 SeitenWeekly Reminder April 25, 2016 PDFPauldingProgressNoch keine Bewertungen

- Paulding Progress June 1, 2016Dokument18 SeitenPaulding Progress June 1, 2016PauldingProgressNoch keine Bewertungen

- Paulding Progress May 25, 2016Dokument44 SeitenPaulding Progress May 25, 2016PauldingProgressNoch keine Bewertungen

- Paulding Progress April 27, 2016 RDDokument20 SeitenPaulding Progress April 27, 2016 RDPauldingProgressNoch keine Bewertungen

- Paulding Progress May 18, 2016Dokument28 SeitenPaulding Progress May 18, 2016PauldingProgressNoch keine Bewertungen

- Paulding Progress May 11, 2016Dokument18 SeitenPaulding Progress May 11, 2016PauldingProgressNoch keine Bewertungen

- Weekly Reminder May 9, 2016Dokument8 SeitenWeekly Reminder May 9, 2016PauldingProgressNoch keine Bewertungen

- Paulding Progress April 27, 2016 RDDokument20 SeitenPaulding Progress April 27, 2016 RDPauldingProgressNoch keine Bewertungen

- Paulding Progress May 4, 2016Dokument20 SeitenPaulding Progress May 4, 2016PauldingProgressNoch keine Bewertungen

- Weekly Reminder April 18, 2016 PDFDokument4 SeitenWeekly Reminder April 18, 2016 PDFPauldingProgressNoch keine Bewertungen

- Weekly Reminder May 4, 2016Dokument8 SeitenWeekly Reminder May 4, 2016PauldingProgressNoch keine Bewertungen

- Paulding Progress April 13, 2016Dokument16 SeitenPaulding Progress April 13, 2016PauldingProgressNoch keine Bewertungen

- Paulding Progress April 20, 2016Dokument18 SeitenPaulding Progress April 20, 2016PauldingProgressNoch keine Bewertungen

- Weekly Reminder April 11, 2016 PDFDokument4 SeitenWeekly Reminder April 11, 2016 PDFPauldingProgressNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Ibps RRB Po 2019 Mains Solved PaperDokument40 SeitenIbps RRB Po 2019 Mains Solved PaperMohd TauqeerNoch keine Bewertungen

- Municipal Tax SystemDokument194 SeitenMunicipal Tax SystemSrini VasuluNoch keine Bewertungen

- Assistant Property Manager in Falls Church VA Resume Kathryn Jane RipleyDokument2 SeitenAssistant Property Manager in Falls Church VA Resume Kathryn Jane RipleyKathrynJaneRipleyNoch keine Bewertungen

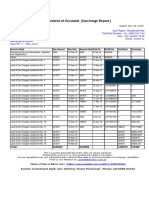

- Surcharge Report BTKSC-P05164Dokument1 SeiteSurcharge Report BTKSC-P05164Nasir Badshah AfridiNoch keine Bewertungen

- Loan Disbursement and Recovery Procedures of BKBDokument10 SeitenLoan Disbursement and Recovery Procedures of BKBFarhanChowdhuryMehdiNoch keine Bewertungen

- ACCT 6331 Final Exam Review QuestionsDokument5 SeitenACCT 6331 Final Exam Review QuestionsMisha KolosovNoch keine Bewertungen

- Awareness About Cash Less Economy Among Students: K. Girija & M. NandhiniDokument8 SeitenAwareness About Cash Less Economy Among Students: K. Girija & M. NandhiniTJPRC PublicationsNoch keine Bewertungen

- How Many Mutual Funds Constitute A Diversified Mutual Fund PortfolioDokument10 SeitenHow Many Mutual Funds Constitute A Diversified Mutual Fund PortfolioKris SzczerbinskiNoch keine Bewertungen

- Ifrs 16 Leases MiningDokument48 SeitenIfrs 16 Leases MiningBill LiNoch keine Bewertungen

- EVN Jahresfinanzbericht 2011 12 deDokument95 SeitenEVN Jahresfinanzbericht 2011 12 deLiv MariaNoch keine Bewertungen

- Unit-1 Investment and Competition Law E-NotesDokument33 SeitenUnit-1 Investment and Competition Law E-NotesSoumil RawatNoch keine Bewertungen

- How Temporal Focus Shapes The Influence of Executive Compensation On Risk TakingDokument29 SeitenHow Temporal Focus Shapes The Influence of Executive Compensation On Risk TakingFatikchhari USONoch keine Bewertungen

- Peng - FM 1.Dokument28 SeitenPeng - FM 1.Aliya JamesNoch keine Bewertungen

- Personal Budget Guide with Examples and ChartsDokument20 SeitenPersonal Budget Guide with Examples and ChartsMayur Bn70% (10)

- Pitfalls Tips of Dealing With Subcontract Nomination Under Fidic Uaecivil LawDokument36 SeitenPitfalls Tips of Dealing With Subcontract Nomination Under Fidic Uaecivil LawWael LotfyNoch keine Bewertungen

- Capital Profile Weekly Report - 10.october.2014Dokument7 SeitenCapital Profile Weekly Report - 10.october.2014Anita KarlinaNoch keine Bewertungen

- Types of Credit BSBA 3B, GROUP 2Dokument20 SeitenTypes of Credit BSBA 3B, GROUP 2Rizzle RabadillaNoch keine Bewertungen

- Bop Internship ReportDokument70 SeitenBop Internship Reportiqarah100% (4)

- AC Milan v. UEFA Europa League BanDokument48 SeitenAC Milan v. UEFA Europa League BanRahasia_NegaraNoch keine Bewertungen

- one+din+L6315-DSP55+MB+VER 1.4+20201224Dokument10 Seitenone+din+L6315-DSP55+MB+VER 1.4+20201224Eliecer RdguezNoch keine Bewertungen

- DAIICHI SANKYO ACQUIRES RANBAXY IN $4.5B DEALDokument25 SeitenDAIICHI SANKYO ACQUIRES RANBAXY IN $4.5B DEALSaurav HanswalNoch keine Bewertungen

- FilipinoSariSariStore Draft HMalapitDokument25 SeitenFilipinoSariSariStore Draft HMalapitRomy Wacas100% (2)

- Solutions BD3 SM14 GEDokument9 SeitenSolutions BD3 SM14 GEAgnes Chew100% (1)

- Leanmap SEE Cost of Quality CalculatorDokument1 SeiteLeanmap SEE Cost of Quality CalculatorWixi MundoNoch keine Bewertungen

- Stock Markets TrainingDokument7 SeitenStock Markets TrainingCornelius MasikiniNoch keine Bewertungen

- Chap 008Dokument69 SeitenChap 008jjseven22100% (1)

- PJSC National Bank Trust and Anor V Boris Mints and OrsDokument33 SeitenPJSC National Bank Trust and Anor V Boris Mints and OrshyenadogNoch keine Bewertungen

- Advanced ExcelDokument6 SeitenAdvanced ExcelKeith Parker100% (4)

- Carter's LBO ModelDokument1 SeiteCarter's LBO ModelNoah100% (1)

- Equity HandoutDokument14 SeitenEquity HandoutJohn Vicente BalanquitNoch keine Bewertungen