Beruflich Dokumente

Kultur Dokumente

Missouri House Bill No. 1637

Hochgeladen von

Carl MullanCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Missouri House Bill No. 1637

Hochgeladen von

Carl MullanCopyright:

Verfügbare Formate

SECOND REGULAR SESSION

HOUSE BILL NO. 1637

96TH GENERAL ASSEMBLY

INTRODUCED BY REPRESENTATIVES CURTMAN (Sponsor), KOENIG, BAHR, HIGDON, SCHATZ, BRATTIN, W YATT, BURLISON, McNARY, KELLEY (126) AND FUHR (Co-sponsors).

5143L.04I D. ADAM CRUMBLISS, Chief Clerk

AN ACT

To repeal sections 143.111 and 408.010, RSMo, and to enact in lieu thereof two new sections relating to legal tender.

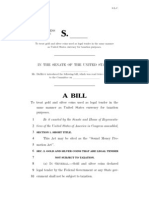

Be it enacted by the General Assembly of the state of Missouri, as follows: Section A. Sections 143.111 and 408.010, RSMo, are repealed and two new sections enacted in lieu thereof, to be known as sections 143.111 and 408.010, to read as follows: 143.111. The Missouri taxable income of a resident shall be such resident's Missouri adjusted gross income less: (1) Either the Missouri standard deduction or the Missouri itemized deduction; (2) The Missouri deduction for personal exemptions; (3) The Missouri deduction for dependency exemptions; (4) The deduction for federal income taxes provided in section 143.171; [and] (5) The deduction for a self-employed individual's health insurance costs provided in section 143.113; and (6) The deduction for any capital gains income included in Missouri adjusted gross income from the exchange of gold or silver under subsection 3 of section 408.010. 408.010. [The silver coins of the United States are hereby declared a legal tender, at their par value, fixed by the laws of the United States, and shall be receivable in payment of all debts, public or private, hereafter contracted in the state of Missouri; provided, however, that no person shall have the right to pay, upon any one debt, dimes and half dimes to an amount exceeding ten dollars, or of twenty and twenty-five cent pieces exceeding twenty dollars.] 1. This section shall be known and may be cited as the "Missouri Sound Money Act of 2012".

EXPLANATION Matter enclosed in bold-faced brackets [thus] in the above bill is not enacted and is intended to be omitted from the law. Matter in bold-face type in the above bill is proposed language.

2 2 3 4 5 6 7 8 9 10 2 3 4 5 6

HB 1637 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42

2. Gold and silver issued by the federal government is legal tender in this state. A person shall not compel any other person to tender or accept gold and silver coins that are issued by the federal government, except for contractual obligations. 3. The exchange of gold and silver coins issued by the federal government for another form of legal tender is exempt from state and local sales and use taxes, as defined in section 32.085, section 238.235, sections 144.010 to 144.525, and sections 144.600 to 144.761, and state individual and corporate income taxes under chapter 143, excluding withholding tax imposed by sections 143.191 to 143.265. 4. (1) This section shall not be used to impair contractual obligations and, except in the case of governmentally assessed taxes, fees, duties, imposts, dues, penalties, or sanctions, neither the government nor any of its branches, agencies, subdivisions, or instrumentalities may compel payment in any particular form of legal tender inconsistent with the express written or verbal agreement of transacting parties, thereby frustrating the parties' manifest intent and impairing their contractual obligations. (2) In furtherance of the inherent rights of privacy and private property, the extent and composition of a person's monetary holdings, including those on deposit with any nonbank depository, shall not be subject to disclosure, search, or seizure except upon strict adherence to due process safeguards, including but not limited to: (a) Issuance of a lawful warrant or writ by a judicial officer sitting in the county within which such holdings exist; (b) Under an adequate showing of probable cause with respect to the particular person or entity in question; and (c) Such warrant or writ being executed only under the authority of the duly elected sheriff of such county. 5. When the federal government requires surrender of gold or silver, the nonbank depository shall return the gold and silver deposits to their owners who will then surrender the gold and silver to the federal government. The depository is not permitted to act without written authority from the owners of the gold and silver. 6. A method of establishing the value of gold and silver to be accepted by the state shall be based on the London PM fix for that day's transaction. 7. Any rule or portion of a rule, as that term is defined in section 536.010, that is created under the authority delegated in this section shall become effective only if it complies with and is subject to all of the provisions of chapter 536 and, if applicable, section 536.028. This section and chapter 536 are nonseverable and if any of the powers vested with the general assembly under chapter 536 to review, to delay the effective date, or to disapprove and annul a rule are subsequently held unconstitutional, then the grant

HB 1637

43 of rulemaking authority and any rule proposed or adopted after August 28, 2012, shall be 44 invalid and void. T

Das könnte Ihnen auch gefallen

- Williams v. Hagood, 98 U.S. 72 (1878)Dokument4 SeitenWilliams v. Hagood, 98 U.S. 72 (1878)Scribd Government DocsNoch keine Bewertungen

- Be It Enacted by The General Assembly of The State of ColoradoDokument5 SeitenBe It Enacted by The General Assembly of The State of ColoradoGreenpoint Insurance Advisors, LLCNoch keine Bewertungen

- Government of The District of Columbia Office of The Attorney GeneralDokument9 SeitenGovernment of The District of Columbia Office of The Attorney GeneralSusie CambriaNoch keine Bewertungen

- Special Provisions Relating To Certificate For The Recovery of Certain DuesDokument3 SeitenSpecial Provisions Relating To Certificate For The Recovery of Certain DuesAbdullah Al MasumNoch keine Bewertungen

- Affidavit of EFT (January 28, 2013)Dokument7 SeitenAffidavit of EFT (January 28, 2013)Carla DiCapri100% (10)

- Jakim Bey, All Debt Discharge To CIBC-BankDokument6 SeitenJakim Bey, All Debt Discharge To CIBC-Bankjakim el bey100% (3)

- Recovery of Certain DuesDokument4 SeitenRecovery of Certain DuesAbdullah Al MasumNoch keine Bewertungen

- Jakim Bey All Debt Discharge 1121 Dundas Street East Whitby, ON. Bill of Exchange To Samuel Soriano 2Dokument6 SeitenJakim Bey All Debt Discharge 1121 Dundas Street East Whitby, ON. Bill of Exchange To Samuel Soriano 2jakim el bey100% (5)

- Jakim Bey All Debt Discharge To Utility Finance, 605 Rossland RD, East Whitby, ON, L1N 6A3Dokument6 SeitenJakim Bey All Debt Discharge To Utility Finance, 605 Rossland RD, East Whitby, ON, L1N 6A3jakim el bey67% (3)

- Memorandum of LawDokument2 SeitenMemorandum of LawYarod Yisrael100% (1)

- (Day 49) (Final) The Local Authorities Loans Act, 1914Dokument4 Seiten(Day 49) (Final) The Local Authorities Loans Act, 1914Deb DasNoch keine Bewertungen

- HRJ 192 Declared Void by CongressDokument7 SeitenHRJ 192 Declared Void by CongressLuis Ewing100% (10)

- Oryahtajel Bill of Exchange Freedom MobileDokument7 SeitenOryahtajel Bill of Exchange Freedom Mobileoryah ElNoch keine Bewertungen

- Oryahtajel Bill of Exchange Freedom MobileDokument7 SeitenOryahtajel Bill of Exchange Freedom Mobileoryah El100% (2)

- Memorandum of Law On Offer To Pay (July 5, 2013)Dokument15 SeitenMemorandum of Law On Offer To Pay (July 5, 2013)Keith Muhammad: Bey100% (7)

- Affidavit of Fact: Moorish AmericansDokument7 SeitenAffidavit of Fact: Moorish Americansoryah El100% (2)

- BANK HOLIDAY Under Executive Order of President Issued April 5 1933Dokument18 SeitenBANK HOLIDAY Under Executive Order of President Issued April 5 1933in1or100% (3)

- Jakim Bey All Debt Discharge To OSHAWA TAX DEPARTMENTDokument6 SeitenJakim Bey All Debt Discharge To OSHAWA TAX DEPARTMENTjakim el beyNoch keine Bewertungen

- H.R. 5278Dokument161 SeitenH.R. 5278Circa NewsNoch keine Bewertungen

- April Judgements (1) - 1Dokument19 SeitenApril Judgements (1) - 1AbhijitNoch keine Bewertungen

- Chit Funds ActDokument47 SeitenChit Funds Actrkaran22Noch keine Bewertungen

- Foreclosure Reform Law - Nevada Ab284 Is Now in Effect - Oct 1 2011 - Affidavit of Authority RequiredDokument20 SeitenForeclosure Reform Law - Nevada Ab284 Is Now in Effect - Oct 1 2011 - Affidavit of Authority Required83jjmackNoch keine Bewertungen

- Jakim Bey All Debt Discharge To GRAHAM LINTON, GREG MANBECK, AND JOSEPH AGUCCIDokument8 SeitenJakim Bey All Debt Discharge To GRAHAM LINTON, GREG MANBECK, AND JOSEPH AGUCCIjakim el bey100% (1)

- MRL3701 - May - June 2022 ExaminationDokument7 SeitenMRL3701 - May - June 2022 ExaminationXOLANINoch keine Bewertungen

- Village of Roca Ordinance Book 2014Dokument231 SeitenVillage of Roca Ordinance Book 2014sethjbrNoch keine Bewertungen

- IRS Rev Rul 90-110Dokument2 SeitenIRS Rev Rul 90-110Jeffrey GilesNoch keine Bewertungen

- hb14 1125 3-27-14Dokument3 Seitenhb14 1125 3-27-14api-249149330Noch keine Bewertungen

- State Secrets New Central Bank Act (RA 7653)Dokument3 SeitenState Secrets New Central Bank Act (RA 7653)jmclacasNoch keine Bewertungen

- HJR 192Dokument2 SeitenHJR 192Sue Rhoades100% (14)

- HB342 Motor Vehicle Title Loan ActDokument46 SeitenHB342 Motor Vehicle Title Loan ActLindsey BasyeNoch keine Bewertungen

- Chit Funds Act, 1982Dokument20 SeitenChit Funds Act, 1982Latest Laws TeamNoch keine Bewertungen

- Syrian Support Group OFAC LicenseDokument2 SeitenSyrian Support Group OFAC LicensePatrick PooleNoch keine Bewertungen

- Linda Wall Wins Over IRSDokument12 SeitenLinda Wall Wins Over IRSJeff Anderson89% (9)

- Tender Payment SCDokument3 SeitenTender Payment SCsolution4theinnocent100% (1)

- STATCONNNNNDokument21 SeitenSTATCONNNNNJoy S FernandezNoch keine Bewertungen

- Affidavit of Fact: Moorish AmericansDokument7 SeitenAffidavit of Fact: Moorish Americansoryah El100% (1)

- Affidavit of Fact: Moorish AmericansDokument7 SeitenAffidavit of Fact: Moorish Americansoryah El100% (1)

- Vent v. Brown Final Amended WritDokument50 SeitenVent v. Brown Final Amended WritJon OrtizNoch keine Bewertungen

- Florida Senate 2013 SB 1666C1Dokument42 SeitenFlorida Senate 2013 SB 1666C1vdoitnowNoch keine Bewertungen

- 0814 DoneDokument2 Seiten0814 DonenoahNoch keine Bewertungen

- InsolvencyDokument5 SeitenInsolvencyArmand Patiño AlforqueNoch keine Bewertungen

- State Liabilities Act (Chapter 8-14)Dokument3 SeitenState Liabilities Act (Chapter 8-14)Franco DurantNoch keine Bewertungen

- 2010 Re Petition For Recognition of The Exe 220906 065107Dokument11 Seiten2010 Re Petition For Recognition of The Exe 220906 065107Winter SNoch keine Bewertungen

- September 8 - ConstiDokument19 SeitenSeptember 8 - ConstiMonica Margarette Feril100% (2)

- National Life Ins. Co. v. United States, 277 U.S. 508 (1928)Dokument18 SeitenNational Life Ins. Co. v. United States, 277 U.S. 508 (1928)Scribd Government DocsNoch keine Bewertungen

- Sec. 10, Art. III ConstiDokument7 SeitenSec. 10, Art. III ConstiSFar AbasNoch keine Bewertungen

- State of Colorado: IntroducedDokument18 SeitenState of Colorado: IntroducedCircuit MediaNoch keine Bewertungen

- Goudie OpinionDokument15 SeitenGoudie OpinionCentre4JusticeNoch keine Bewertungen

- Missouri Senate Bill 613 For 2014Dokument35 SeitenMissouri Senate Bill 613 For 2014USA TODAYNoch keine Bewertungen

- Brenda L. Nazareth vs. Hon. Reynaldo A. Villar G.R. No. 188635 January 29, 2013Dokument3 SeitenBrenda L. Nazareth vs. Hon. Reynaldo A. Villar G.R. No. 188635 January 29, 2013Dawn Jessa GoNoch keine Bewertungen

- Philippine Constitutional Provisions Related To TaxDokument2 SeitenPhilippine Constitutional Provisions Related To TaxWithDoctorWu100% (1)

- Final Convention Report COS 2016Dokument3 SeitenFinal Convention Report COS 2016Ken IvoryNoch keine Bewertungen

- Engrossed Senate Joint Resolution 8221: Certification of EnrollmentDokument6 SeitenEngrossed Senate Joint Resolution 8221: Certification of EnrollmentKathy E. GillNoch keine Bewertungen

- Detroit EM Order No 18 CombinedDokument118 SeitenDetroit EM Order No 18 CombinedStephen BoyleNoch keine Bewertungen

- The Prohibition Affects Only State LawsDokument16 SeitenThe Prohibition Affects Only State LawsMarione John SetoNoch keine Bewertungen

- 1-12 Legislature DigestDokument22 Seiten1-12 Legislature DigestLauraNoch keine Bewertungen

- Constitution of the State of Minnesota — 1974 VersionVon EverandConstitution of the State of Minnesota — 1974 VersionNoch keine Bewertungen

- Foreign Exchange Transactions ActVon EverandForeign Exchange Transactions ActNoch keine Bewertungen

- Hunter Biden Prescott Police Report 2016Dokument23 SeitenHunter Biden Prescott Police Report 2016Carl MullanNoch keine Bewertungen

- PETITION FOR WRIT OF ERROR CORAM NOBIS. Criminal Action No. 07-109Dokument62 SeitenPETITION FOR WRIT OF ERROR CORAM NOBIS. Criminal Action No. 07-109Carl Mullan100% (1)

- 2020.09.28 Government Response E-Gold CaseDokument26 Seiten2020.09.28 Government Response E-Gold CaseCarl MullanNoch keine Bewertungen

- Digital Laundry An Analysis of Online Currencies, and Their Use in CybercrimeDokument17 SeitenDigital Laundry An Analysis of Online Currencies, and Their Use in CybercrimeCarl MullanNoch keine Bewertungen

- Central Bank Issued Digital CurrencyDokument7 SeitenCentral Bank Issued Digital CurrencyCarl Mullan0% (1)

- Digital Gold Magazine Jan 2016Dokument49 SeitenDigital Gold Magazine Jan 2016Carl MullanNoch keine Bewertungen

- DigixGlobal Proof of AssetDokument5 SeitenDigixGlobal Proof of AssetCarl MullanNoch keine Bewertungen

- Douglas Jackson Interview 2012 E-GoldDokument8 SeitenDouglas Jackson Interview 2012 E-GoldCarl MullanNoch keine Bewertungen

- E-Bullion Remission FundDokument3 SeitenE-Bullion Remission FundCarl MullanNoch keine Bewertungen

- Voucher Safe Open Source Voucher Payment ProjectDokument3 SeitenVoucher Safe Open Source Voucher Payment ProjectCarl MullanNoch keine Bewertungen

- Jon Matonis Interview: DGC Magazine Person of The YearDokument6 SeitenJon Matonis Interview: DGC Magazine Person of The YearCarl MullanNoch keine Bewertungen

- Kens Artisan Bakery BrochureDokument2 SeitenKens Artisan Bakery BrochureCarl MullanNoch keine Bewertungen

- Digital Gold Currency Magazine November 2011Dokument59 SeitenDigital Gold Currency Magazine November 2011Carl MullanNoch keine Bewertungen

- FinCEN Form 105, Currency and Monetary Instrument Report (CMIR)Dokument2 SeitenFinCEN Form 105, Currency and Monetary Instrument Report (CMIR)Carl Mullan100% (1)

- Digital Gold Currency Magazine July 2011Dokument45 SeitenDigital Gold Currency Magazine July 2011Carl MullanNoch keine Bewertungen

- FAQ Electronically Filing Your Registration of Money Services Business (RMSB) FormDokument3 SeitenFAQ Electronically Filing Your Registration of Money Services Business (RMSB) FormCarl MullanNoch keine Bewertungen

- Sound Money Promotion Act 2011Dokument2 SeitenSound Money Promotion Act 2011Carl MullanNoch keine Bewertungen

- Client Briefing Fatca Usa Imposes New Global Withholding and Information Obligations For Non American Financial Institutions 6011359Dokument2 SeitenClient Briefing Fatca Usa Imposes New Global Withholding and Information Obligations For Non American Financial Institutions 6011359Carl MullanNoch keine Bewertungen

- Digital Gold Currency Magazine June 2011Dokument50 SeitenDigital Gold Currency Magazine June 2011Carl MullanNoch keine Bewertungen

- Silver Viral Project Official GuidebookDokument14 SeitenSilver Viral Project Official GuidebookCarl MullanNoch keine Bewertungen

- Index Newspapers v. City of Portland: Stipulated Preliminary InjunctionDokument4 SeitenIndex Newspapers v. City of Portland: Stipulated Preliminary InjunctionAthul AcharyaNoch keine Bewertungen

- Jesus Loves You: Law Notes, Past Questions and Answers atDokument40 SeitenJesus Loves You: Law Notes, Past Questions and Answers atVite Researchers75% (4)

- Extradition ContiguousandForeignCountries Act Cap76Dokument64 SeitenExtradition ContiguousandForeignCountries Act Cap76danielNoch keine Bewertungen

- Tactical Explosive BreachingDokument15 SeitenTactical Explosive BreachingEaglethedesertLove Avila100% (1)

- People v. TudtudDokument34 SeitenPeople v. TudtudlabellejolieNoch keine Bewertungen

- People Vs SalanguitDokument23 SeitenPeople Vs SalanguitKirsten Denise B. Habawel-VegaNoch keine Bewertungen

- Basic Concepts in Criminal LawDokument39 SeitenBasic Concepts in Criminal LawPrecylyn Garcia Buñao100% (1)

- Constitutional Law Jedd Refreshener NotesDokument4 SeitenConstitutional Law Jedd Refreshener NotesLoreto Alipio IIINoch keine Bewertungen

- Carroll v. United States: HeldDokument15 SeitenCarroll v. United States: HeldKatrina Anne Layson YeenNoch keine Bewertungen

- People v. Mengote, G.R. No. 87059, June 22, 1992 People of The Philippines., Petitioner VS., RespondentDokument2 SeitenPeople v. Mengote, G.R. No. 87059, June 22, 1992 People of The Philippines., Petitioner VS., RespondentAntonio Ines Jr.Noch keine Bewertungen

- WA's DPP Files On Methy-Lamphetamine CasesDokument60 SeitenWA's DPP Files On Methy-Lamphetamine CasesMichael SmithNoch keine Bewertungen

- Bill of RightsDokument57 SeitenBill of RightsBJ Ambat100% (1)

- Hazlet Brothers File Federal Lawsuit Against State, Township and Monmouth County Prosecutor's Office For $50M in Damages For Online Child Porn Case (3:18-cv-03069-FLW-LHG)Dokument77 SeitenHazlet Brothers File Federal Lawsuit Against State, Township and Monmouth County Prosecutor's Office For $50M in Damages For Online Child Porn Case (3:18-cv-03069-FLW-LHG)resorbNoch keine Bewertungen

- Riley v. CaliforniaDokument5 SeitenRiley v. CaliforniaEileen Eika Dela Cruz-LeeNoch keine Bewertungen

- Case Digest Pestilos Vs Generoso and People - G.R. No. 182601Dokument2 SeitenCase Digest Pestilos Vs Generoso and People - G.R. No. 182601JamesHarvey25% (4)

- June 23 Letter To The U.S. Department of JusticeDokument22 SeitenJune 23 Letter To The U.S. Department of JusticeIan CummingsNoch keine Bewertungen

- Anti Evasion ManualDokument205 SeitenAnti Evasion ManualgrizscribdNoch keine Bewertungen

- Case Digest CompendiumDokument157 SeitenCase Digest Compendiumdodong123Noch keine Bewertungen

- 12 Tips On Search Warrants Patrick LathamDokument12 Seiten12 Tips On Search Warrants Patrick LathamuisunupurabowoNoch keine Bewertungen

- Warrant 652Dokument16 SeitenWarrant 652Scott JohnsonNoch keine Bewertungen

- Columbia Pictures, Inc. Et. Al. v. CA, Et. Al. (1996)Dokument2 SeitenColumbia Pictures, Inc. Et. Al. v. CA, Et. Al. (1996)RNicolo BallesterosNoch keine Bewertungen

- Consti II Session 2Dokument185 SeitenConsti II Session 2Kim Muzika PerezNoch keine Bewertungen

- People vs. Huang Zhen Hua, 439 SCRA 351, September 29, 2004Dokument41 SeitenPeople vs. Huang Zhen Hua, 439 SCRA 351, September 29, 2004Niezel SabridoNoch keine Bewertungen

- GO vs. CA Case DigestDokument1 SeiteGO vs. CA Case Digestunbeatable38100% (4)

- Shannon Gooden Search WarrantDokument9 SeitenShannon Gooden Search WarrantPatch MinnesotaNoch keine Bewertungen

- Sy Tan Vs Sy TiongDokument2 SeitenSy Tan Vs Sy TiongKate CalansinginNoch keine Bewertungen

- People vs. Veloso, G.R. No. 23051, October 20, 1925Dokument6 SeitenPeople vs. Veloso, G.R. No. 23051, October 20, 1925Abby PerezNoch keine Bewertungen

- CIV-2017-404-3103 Dotcom V A-G & OrsDokument63 SeitenCIV-2017-404-3103 Dotcom V A-G & Ors_2020Noch keine Bewertungen

- New Rules On Issuance of Cybercrime Warrants and Filing Cybercrime CasesDokument3 SeitenNew Rules On Issuance of Cybercrime Warrants and Filing Cybercrime Casesmaxx villaNoch keine Bewertungen

- 80 - People v. Damaso, 212 SCRA 457Dokument4 Seiten80 - People v. Damaso, 212 SCRA 457gerlie22Noch keine Bewertungen