Beruflich Dokumente

Kultur Dokumente

Black at Home Ethics)

Hochgeladen von

mahesh_thadani6743Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Black at Home Ethics)

Hochgeladen von

mahesh_thadani6743Copyright:

Verfügbare Formate

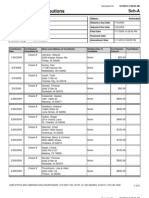

TIMES OF INDIA DATED 31 AUGUST 2009 SECTION:- TIMES NATION 15 PAGE NO.

BLACK, AT HOME

Five ways you and I help the black economy grow

Meenakshi Kumar and Insiya Amir | TNN

Black money thrives. Its not just stashed away in Swiss banks by crorepatis and billionaires, but in ordinary middle-class homes, away from the eyes of the income tax inspector and banking authorities. The black economy is currently estimated to be 50% of Indias gross domestic produce (GDP). Professor Arun Kumar of Jawaharlal Nehru Universitys Centre for Economic Studies and Planning says it could be more. Much more. Kumar should know. He wrote the book, The Black Economy in India. He says: In 1995-96, it was 40% of Indias GDP. Considering that the economy has grown by 8% and more in the last decade, it can be assumed that the black economy, too, has grown roughly by the same amount. Thats a conservative estimate, he adds. It could be much more, somewhere close to 70%. But experts say black money possession and use is only concentrated in a thin slab of 3% of the Indian public. They say it is largely generated in the services sector, which has grown enormously in the last decade. But it may not be as rarefied as that. Arent we all to blame? Arvind Kejriwal, Magsaysay awardee and Right to Information activist, says: Our system forces a person to be corrupt and, at every stage of our life, we end up paying extra for services that should have otherwise been free. That is extortionist corruption. In mutual corruption, greed forces a person to subvert the system for personal gains. Basically, its a combination of these which lead to the generation of black money. Anupama Jha, executive director of Transparency International, India, adds: There is lot of scope for improvement in the government. Also, India has not joined any international effort, like the United Nations Convention Against Corruption, in checking corruption. We need to strengthen our anti-corruption agencies. Last year, Transparency Internationals Corruption Perception Index (CPI) ranked India at 85 in a list of 180 countries. In South Asia, India continues to be at the top of this ugly league table. In effect, we are all guilty, even though none of us would openly admit to being partners in a gross national crime. Here are five ways each of us helps the black economy flourish. No bills | We buy things, say a mobile phone, a music system or even groceries, without asking for or getting bills. We may pay less by avoiding value added tax (VAT) or sales tax, but we are also helping the seller to under-invoice his bills and thus pay less tax. Bank executive Sumedha Kaul confesses to

TOI it never occurred to her that she was helping generate black money every time she bought a mobile phone in the grey market. When the whole world is doing it, then why should I be the only fool around to pay extra money for something which can be bought for less? she remembers thinking. The kirana shop or drug-store owner doesnt give bills unless asked, and the profit margin goes undeclared in income tax returns. The government introduced VAT to ensure businessmen pay the right amount of tax but the loopholes mean it can be bypassed. Even parking attendants in major city centres must be easily making Rs 2-2.5 lakh every month but they would declare perhaps only one-fifth of it. The receipts that they give you are torn up the moment you hand them back, says investment consultant Akash Bhatnagar. Professional herapheri | Many doctors reportedly prescribe unnecessary medical tests from specific laboratories in order to claim commission. Several government doctors run a lucrative and flourishing private practice on the side. And private doctors with their own clinics could be underreporting the number of patients they treat every month. The major bribe-earners are lawyers, doctors, bureaucrats, politicians and businessmen, says Professor Kumar. Government teachers assist the black economy too, he says, when they skip regular classes and devote their time to private, undeclared tuition instead. Consider the number of Indians who hide income from sources other than their salary. Puneet Sethi has rented out his flat in Kolkata but doesnt declare the rent when he files his tax returns. Only cash, no cheques | It may be as simple an act as taking your National Savings Certificate money or post office savings in cash. Surya Bhatia, principal consultant, Assets Managers, says: Its a lot easier not to declare it in income tax returns if you take it in cash. Similarly, most small shop-keepers prefer to pay for and sell wholesale goods in cash. When no receipts are involved, it means black money is generated. And this is happening at every level in the society, says Bhatnagar. Pocket money | The weekly or monthly hafta or bribe charged by policemen; the chai-paani you pay for to get your property file moving in a corporation office or to get your passport on time are just some examples of endemic extortionist corruption. Its the system that is forcing the commoner to become corrupt, says Kejirwal. Delhi resident Somnath Ghosh says: I have a faulty electricity meter. I have complained many times but no one has come to rectify it. So each time the electricity office official comes to take the meter reading, I pay him extra. In return, I get to pay a lower electricity bill every month. Property for sale, in black | At least 40% of a property transaction has to be paid in black. Rahul Sethi, who bought a house in Bangalore, remembers how hard it was for him, a salaried bank official, to arrange ready cash. But there was no other way, he grimaces.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Colombia Building Peace in A Time of WarDokument34 SeitenColombia Building Peace in A Time of Warunnu123Noch keine Bewertungen

- Comparative Police System - REVIEWERDokument48 SeitenComparative Police System - REVIEWERMitchiko KarimaguNoch keine Bewertungen

- Mackinac Center Exposed: Who's Running Michigan?Dokument19 SeitenMackinac Center Exposed: Who's Running Michigan?progressmichiganNoch keine Bewertungen

- Gurpreet DissertationDokument167 SeitenGurpreet DissertationKarishma WadhwaNoch keine Bewertungen

- CadburyDokument7 SeitenCadburymahesh_thadani6743Noch keine Bewertungen

- Internet Retailer Top 500 Guide United Kingdom Global E-CommerceDokument9 SeitenInternet Retailer Top 500 Guide United Kingdom Global E-Commercemahesh_thadani6743Noch keine Bewertungen

- Corporate Governance and Globalisation: .Debate - Summer.02Dokument14 SeitenCorporate Governance and Globalisation: .Debate - Summer.02mahesh_thadani6743Noch keine Bewertungen

- ResourcesDokument25 SeitenResourcesLokendra Pratap SinghNoch keine Bewertungen

- Black at Home Ethics)Dokument3 SeitenBlack at Home Ethics)mahesh_thadani6743Noch keine Bewertungen

- Brand Management Question BankDokument3 SeitenBrand Management Question Bankmahesh_thadani6743Noch keine Bewertungen

- Brand Management Question BankDokument3 SeitenBrand Management Question Bankmahesh_thadani6743Noch keine Bewertungen

- Brand Management Question BankDokument3 SeitenBrand Management Question Bankmahesh_thadani6743Noch keine Bewertungen

- Black at Home Ethics)Dokument3 SeitenBlack at Home Ethics)mahesh_thadani6743Noch keine Bewertungen

- RailwaysDokument36 SeitenRailwaysmahesh_thadani6743Noch keine Bewertungen

- GGDokument8 SeitenGGmahesh_thadani6743Noch keine Bewertungen

- RailwaysDokument36 SeitenRailwaysmahesh_thadani6743Noch keine Bewertungen

- RailwaysDokument36 SeitenRailwaysmahesh_thadani6743Noch keine Bewertungen

- Antonio Palomino-Herrera, A205 765 691 (BIA May 24, 2016)Dokument8 SeitenAntonio Palomino-Herrera, A205 765 691 (BIA May 24, 2016)Immigrant & Refugee Appellate Center, LLCNoch keine Bewertungen

- Fortson v. Elbert County Detention Center and Administration Et Al - Document No. 8Dokument4 SeitenFortson v. Elbert County Detention Center and Administration Et Al - Document No. 8Justia.comNoch keine Bewertungen

- Philippine Journalist Vs Journal EMPLOYEES UNION (G.R. NO. 192601 JUNE 3, 2013)Dokument1 SeitePhilippine Journalist Vs Journal EMPLOYEES UNION (G.R. NO. 192601 JUNE 3, 2013)RobertNoch keine Bewertungen

- SSC BP-2Dokument1 SeiteSSC BP-2Yug “Kapoor”Noch keine Bewertungen

- Alejandro V PepitoDokument3 SeitenAlejandro V PepitotrishortizNoch keine Bewertungen

- (Routledge Contemporary South Asia Series, 20) Mahendra Lawoti and Anup K. Pahari - The Maoist Insurgency in Nepal - Revolution in The Twenty-First Century-Routledge (2010)Dokument375 Seiten(Routledge Contemporary South Asia Series, 20) Mahendra Lawoti and Anup K. Pahari - The Maoist Insurgency in Nepal - Revolution in The Twenty-First Century-Routledge (2010)Aparajita RoyNoch keine Bewertungen

- Legal Ethics Case on NegligenceDokument3 SeitenLegal Ethics Case on NegligenceChesza MarieNoch keine Bewertungen

- Child Marriage in Equatorial GuineaDokument8 SeitenChild Marriage in Equatorial GuineaHannah AmitNoch keine Bewertungen

- Types of Companies in RomaniaDokument7 SeitenTypes of Companies in RomaniaGabrielAlexandruNoch keine Bewertungen

- Maliwalo Budget Process - Marianne Castaneda BSA-3BDokument1 SeiteMaliwalo Budget Process - Marianne Castaneda BSA-3BJerico ManaloNoch keine Bewertungen

- Seminar 1Dokument47 SeitenSeminar 1farheen haiderNoch keine Bewertungen

- VL Order Judge Mary Ann Grilli - Santa Clara County Superior Court - Dong v. Garbe Vexatious Litigant Proceeding Santa Clara Superior Court - Attorney Brad Baugh - Presiding Judge Rise Jones PichonDokument6 SeitenVL Order Judge Mary Ann Grilli - Santa Clara County Superior Court - Dong v. Garbe Vexatious Litigant Proceeding Santa Clara Superior Court - Attorney Brad Baugh - Presiding Judge Rise Jones PichonCalifornia Judicial Branch News Service - Investigative Reporting Source Material & Story IdeasNoch keine Bewertungen

- Prof - Ranbir Singh Brief BiodataDokument2 SeitenProf - Ranbir Singh Brief BiodataSteffi WaltersNoch keine Bewertungen

- LetterDokument3 SeitenLetterBonjen BoniteNoch keine Bewertungen

- IR Q.3 - AnswerDokument3 SeitenIR Q.3 - AnswerGeorgia OsborneNoch keine Bewertungen

- IWDA PAC - 9761 - A - ContributionsDokument2 SeitenIWDA PAC - 9761 - A - ContributionsZach EdwardsNoch keine Bewertungen

- James Walter P. Capili, Petitioner, vs. People of The Philippines and Shirley Tismo Capili, RespondentsDokument10 SeitenJames Walter P. Capili, Petitioner, vs. People of The Philippines and Shirley Tismo Capili, RespondentsMoniqueLeeNoch keine Bewertungen

- (A) Civic KnowledgeDokument9 Seiten(A) Civic KnowledgepodderNoch keine Bewertungen

- Reserved On: November 03, 2015 Pronounced On: November 06, 2015Dokument11 SeitenReserved On: November 03, 2015 Pronounced On: November 06, 2015SatyaKamNoch keine Bewertungen

- Course Title: Issues in Peace and Conflict Course Code: GSP 202 Continuous Assessment Questions Answer All The QuestionsDokument10 SeitenCourse Title: Issues in Peace and Conflict Course Code: GSP 202 Continuous Assessment Questions Answer All The QuestionsHenry OssaiNoch keine Bewertungen

- Inya Trust Sample Paper SolutionsDokument42 SeitenInya Trust Sample Paper SolutionsRavi BadriNoch keine Bewertungen

- Bangladesh Vs Noor ChowdhuryDokument13 SeitenBangladesh Vs Noor ChowdhuryPalash Chandra SarkarNoch keine Bewertungen

- Balance Billing After Olszewski, The Law Surrounding Balance-Billing Law Is Rapidly EvolvingDokument4 SeitenBalance Billing After Olszewski, The Law Surrounding Balance-Billing Law Is Rapidly EvolvingWilliam A. DanielsNoch keine Bewertungen

- Summaries of Writ of Amparo, Habeas data, and KalikasanDokument15 SeitenSummaries of Writ of Amparo, Habeas data, and KalikasanPhillip Joshua GonzalesNoch keine Bewertungen

- Foundations of American Democracy (GoPo Unit 1)Dokument170 SeitenFoundations of American Democracy (GoPo Unit 1)Yuvika ShendgeNoch keine Bewertungen

- A Very Big Branch - Teacher GuideDokument5 SeitenA Very Big Branch - Teacher Guidebumass213Noch keine Bewertungen