Beruflich Dokumente

Kultur Dokumente

Document 14

Hochgeladen von

sammyschwartz08Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Document 14

Hochgeladen von

sammyschwartz08Copyright:

Verfügbare Formate

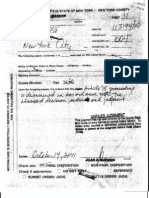

FILED: NEW YORK COUNTY CLERK 01/07/2011

NYSCEF DOC. NO. 1

INDEX NO. 650046/2011 RECEIVED NYSCEF: 01/07/2011

SUPREME COURT OF THE STATE OF NEW YORK COUNTY OF NEW YORK NADER & SONS, LLC and SISKO ENTERPRISES LLC, Plaintiffs, -againstDAN SHAVOLIAN a/k/a, DANNY SHAVOLIAN, and ROBERT FLINK, d/b/a the Law Offices of Robert Flink, Defendants. To the above named Defendants YOU ARE HEREBY SUMMONED to answer the complaint in this action and to serve a copy of your answer, or, if the complaint is not served with this summons, to serve a notice of appearance, on the plaintiffs attorneys within 20 days after the service of this summons, exclusive of the day of service (or within 30 days after the service is complete if this summons is not personally delivered to you within the State of New York); and in case of your failure to appear or answer, judgment will be taken against you by default for the relief demanded in the complaint. Plaintiffs designate New York County as the place of trial. The basis of the venue is plaintiffs and defendants residences. Plaintiff Nader & Sons, LLC resides at181 Madison Avenue, New York, NY 10016, County of New York. Plaintiff Sisko Enterprises LLC resides at 32 Evans Drive, Glen Head, NY 11545, County of Nassau. Defendant Dan Shavolian resides at 501 Fifth Avenue, 14th Floor, New York, NY 10017, County of New York. Defendant Robert Flink, d/b/a The Law Index No. 6___________/2010 Date of Filing with the Clerk of the Court: January 7, 2011

SUMMONS

Offices of Robert Flink, resides at 555 Fifth Avenue, New York, NY 10017, County of New York. Dated: New York, New York January 7, 2011 Defendants addresses: Dan Shavolian 501 Fifth Avenue, 14th Floor New York, NY 10017 Robert Flink, d/b/a The Law Offices of Robert Flink 555 Fifth Avenue New York, NY 10017 WOLF HALDENSTEIN ADLER FREEMAN & HERZ LLP By /s/ Eric B. Levine Eric B. Levine A Member of the Firm Attorneys for Plaintiff 270 Madison Avenue New York, N.Y. 10016 (212) 545-4600

648000

SUPREME COURT OF THE STATE OF NEW YORK COUNTY OF NEW YORK NADER & SONS, LLC and SISKO ENTERPRISES LLC, Plaintiffs, -againstDAN SHAVOLIAN a/k/a, DANNY SHAVOLIAN, and ROBERT FLINK, d/b/a the Law Offices of Robert Flink, Defendants. Plaintiffs Nader & Sons, LLC (Nader) and Sisko Enterprises LLC (Sisko) (collectively, Nader/Sisko), by their attorneys Wolf Haldenstein Adler Freeman & Herz LLP, as and for their complaint, allege as follows: PARTIES TO THIS ACTION 1. Plaintiff Nader is a limited liability company organized under the laws of COMPLAINT Index No. 6___________/2010

the state of New York and having its principal office at 181 Madison Avenue, New York, NY 10016. 2. Plaintiff Sisko is a limited liability company organized under the laws of

the state of New York and having its principal office at 32 Evans Drive, Glen Head, NY 11545. 3. Upon information and belief, defendant Dan Shavolian, a/k/a Danny

Shavolian (Shavolian), is an individual having an address at 501 Fifth Avenue, 14th Floor, New York, NY 10017. 4. Upon information and belief, defendant Robert Flink, d/b/a The Law

Offices of Robert Flink (Flink), is an attorney having an office at 555 Fifth Avenue, New York, NY. Flink is sued herein solely has escrow agent.

FACTS A. Background: The Loan to Namco 5. In or about June 2008, Nader loaned to a non-party to this action, Namco

Capital Group, Inc. (Namco), a California corporation, the sum of $7.5 million. The terms of that loan were initially set forth in a certain Loan Pledge and Security Agreement, dated as of June 12, 2008 (the Loan and Pledge Agreement). 6. As is set forth in the Loan and Pledge Agreement, Ezri Namvar

guaranteed the payment of the loan. Ezri Namvar was at all relevant times a principal of Namco. 7. The loan was initially evidenced by a promissory note (the Namco

Note) from Namco to Nader. 8. On or about July 16, 2008, the loan was amended and modified in

accordance with the terms of a certain First Amendment to Loan, Pledge and Security Agreement, entered into as of July 16, 2008 (the First Amendment and, together with the Loan and Pledge Agreement, the Amended Loan and Pledge Agreement). 9. At the time of that amendment, Sisko became an additional Lender, and

Nader/Sisko loaned Namco an additional $5 million. Thus, as of July 16, 2008, the total principal amount that Nader/Sisko had loaned to Namco was $12.5 million. 10. The loan as amended (the Loan) was evidenced by an Amended and

Restated Secured Promissory Note, dated July 14, 2008, in the principal amount of $12.5 million. The Loan bore interest at the rate of eight percent per annum. At the maturity date, September 1, 2008, the Loan was due, and full payment was required. 11. As reflected in the Amended Loan and Pledge Agreement, Nader and

Sisko received from non-party affiliates of Ezri Namvar, including N.Y. 18, LLC (NY 18), certain collateral to secure the Loan. 2

12.

As is set forth in the Amended Loan and Pledge Agreement, NY 18

collateralized the Loan with what NY 18 represented to be certain interests it had in or relating to 127 West 25th LLC (25 LLC), a limited liability company that owned and operated, and still owns and operates, a commercial office building located at 127 West 25th Street, New York, New York. 13. NY 18 represented that it owned and was pledging, among other things, a

35 percent membership interest in 25 LLC.NY 18 represented further that the remaining 65 percent of the membership interest was owned by DHD 127, LLC (DHD), which was a New York limited liability company owned entirely by defendant Shavolian. B. The Termination Agreement 14. Almost immediately after Namco signed the First Amendment and

obtained an additional $5 million from Nader/Sisko, NY 18 and its principal, Ezri Namvar, entered into an agreement with DHD for the purpose of defeating Nader/Siskos security interest. 15. DHD, NY 18 and Ezri Namvar entered into a Termination Agreement,

dated as of July 31, 2008 (the Termination Agreement). In the Termination Agreement, NY 18, DHD and Ezri expressly referred to Nader/Sisko as a third party. The Termination Agreement purported to declare as null and void and of no further force and effect the operating agreement for 25 LLC, dated as of May 2, 2008 (the 25 Operating Agreement), which the Termination Agreement described as conditional. 16. The Termination Agreement stated further that NY 18 hereby agrees that

it has no right, title or interest in or to [25 LLC]. C. The Shavolian Note 17. Contemporaneously with the execution and delivery of the Termination

agreement, NY 18, Ezri Namvar, DHD and defendant Shavolian agreed among themselves that 3

DHD and or defendant Shavolian would pay to NY 18 and/or Ezri Namvar $5.2 million (the Shavolian Debt), representing payments NY 18 had made as a capital contribution into 25 LLC, in the amount of $4.4 million, plus an accumulated, 11 percent preferred return thereon. 18. Of the $5.2 million Shavolian Debt, DHD, Shavolian and NY 18

evidenced the sum of $2.6 million by a promissory note from defendant Shavolian to NY 18 (the Shavolian Note). 19. To secure the Shavolian Note, Shavolian and/or DHD executed and

delivered in escrow a collateral assignment (the Shavolian Assignment) to NY 18 of, upon information and belief, a 40 percent membership interest in 25 LLC (the Security). Defendant Flink is the escrow agent with respect to the Shavolian Assignment. D. Namcos Default 20. Namco defaulted on the Loan to Nader/Sisko. Namco failed to make any

monthly interest payments timely as required under the Loan. Namco also failed to repay the principal of the Loan, including accrued interest thereon or any portion of that principal or interest, on or before the September 1, 2008 maturity date. 21. 22. Nader/Sisko duly gave notice of Namcos default. After the maturity date of the Loan, Nader/Sisko was paid approximately

$6.7 million in reduction of Namcos obligations under the Loan. 23. The unpaid outstanding balance of the Loan is in excess of $5.8 million,

no part of which has been paid. 24. Namco filed for bankruptcy in the United States Bankruptcy Court for the

Central District of California. Its bankruptcy case is pending there under Bankruptcy Case No. 2:08-bk-32333-BR.

25.

Ezri Namvar filed for bankruptcy in the United States Bankruptcy Court

for the Central District of California. His bankruptcy case is pending there under Bankruptcy Case No. 2:08-bk-32349-BR. Upon information and belief, his case involves very serious allegations of fraud. 26. NY 18 did not file for bankruptcy. However, at or around the time of the

Namvar and Namco bankruptcies, Ezri Namvar surrendered control over NY 18 to Louis A. Cicalese, for the purpose of permitting Mr. Cicalese to wind up the affairs of NY 18 for the benefit of its creditors, including Nader/Sisko. E. The Prior Litigation 27. These and related transactions and occurrences are the subject of prior

litigation between the parties. 28. In an action captioned 127 West 25th LLC v. N.Y.18 LLC, etc., Index No.

101755/2009 (Sup. Ct. N.Y. Co.) (the Prior Action), the court has granted partial summary judgment to 25 LLC, to the extent of determining that, because of a failure to obtain the consent of 25 LLCs lender, NY 18 was not in fact a member of 25 LLC when it purported to pledge its membership interest to Nader/Sisko. While Nader/Sisko does not agree with that ruling, that issue is not involved in the present action. Other issues between the parties in the Prior Action have not been decided, and that action is still pending. F. Nader/Siskos Acquisition of the Shavolian Note Directly from NY 18. 29. Nader/Sisko contends in the Prior Action that, regardless of whether NY

18 was a member of 25 LLC, the Shavolian Note for $2.6 million was and is part of Nader/Sisko collateral. 30. Upon information and belief, Shavolian disagrees and contends that NY

18 is the owner of the Shavolian Note. 5

31.

NY 18 and Ezri Namvar have agreed that Nader/Sisko owns the Shavolian

Note. NY 18 and Ezri Namvar delivered physical possession of the Shavolian Note to Nader/Sisko. Since that time and to the present date, Nader/Sisko had and has of the original Shavolian Note. 32. On or about January 18, 2010, Nader/Sisko entered into an agreement (the

Assignment Agreement) with NY 18 (which, as noted above, was no longer under the control of Ezri Namvar but which was owned by Mr. Cicalese for the purpose of winding up its affairs), as well as with the bankruptcy trustees for Ezri Namvar and Namco. 33. Under the Assignment Agreement, all of the other parties, including NY

18, assigned and transferred to Nader/Sisko, among other things, their entire right, title and interest in the Shavolian Note. 34. The Assignment Agreement (with an amendment not relevant here) was

approved by the Bankruptcy Court in the bankruptcy cases of Ezri Namvar and Namco. 35. Under the Assignment Agreement, and without regard to any other

disputes relating to this matter, Nader/Sisko is now indisputably the sole owner of the Shavolian Note. G. Nader/Sisko Has Fulfilled All Conditions to the Shavolian Note. 36. payment obligations. 37. Nader/Sisko satisfied all of the conditions to the Shavolian Note by The Shavolian Note contains certain conditions to defendant Shavolians

tendering, under cover of its letter of August 10, 2010 to Shavolian, all documents required by the Shavolian Note, including: a. a termination statement for Nader/Siskos pledge interest in NY

18s membership interest in 127 LLC; and 6

b.

a release of any and all written claims, actions, judgments or

causes of action arising out of actions taken by NY 18 or its affiliates or Ezri Namvar in connection with 127 LLC and in existence before the date of the letter by Nader/Sisko against defendant Shavolian, DHD and 127 LLC. 38. As set forth in the letter, these documents were all placed in escrow and

tendered to defendant Shavolian. 39. Accordingly, under the Shavolian Note, Shavolian was required to pay

$600,000 of the principal balance, plus interest accrued thereon to the date of such payment within 90 days of August 10, 2010. 40. the required payment. 41. Accordingly, the entire unpaid principal balance of the Shavolian Note, The ninety-day period has expired. Shavolian failed and refused to make

i.e., $2.6 million, together with all accrued and unpaid interest thereon, and all other amounts and payments due under the Note, are immediately due and payable. 42. defendant Shavolian. 43. Shavolian has failed to make any payment under the Shavolian Note. FIRST CAUSE OF ACTION (Breach of the Shavolian Note) 44. Nader/Sisko repeat and reallege each and every allegation contained in While no further notice was required, written notice was given to

paragraphs 1 through 43 hereof. 45. The Shavolian Note is due and payable, and defendant Shavolian is liable

to Nader/Sisko for the full principal balance and all accrued interest thereon.

46.

By failing to pay the Shavolian Note to Nader/Sisko, defendant Shavolian

has breached and defaulted on the Shavolian Note. SECOND CAUSE OF ACTION (Foreclosure on the Collateral Securing the Shavolian Note) 47. Nader/Sisko repeat and reallege each and every allegation contained in

paragraphs 1 through 46 hereof. 48. By the Shavolian Assignment referred to above, Shavolian secured the

Shavolian Note with the Security, i.e., a 40 percent membership interest in 25 LLC. 49. Pursuant to the Assignment Agreement, Nader/Sisko acquired the Security

from NY 18 and have a valid, first priority and perfected security interest in the 40 percent membership interest in 25 LLC, securing the Shavolian Note. 50. 51. As alleged above, the Shavolian Note is in default. Under the escrow agreement, Nader/Sisko is entitled to have the Shavolian

Assignment delivered to it out of escrow upon such default. Nader/Sisko has notified Flink, as escrow agent, of the default. Flink has not delivered the Shavolian Assignment out of escrow. 52. Accordingly, Nader/Sisko is entitled to delivery of the Shavolian

assignment out of escrow and to judicial foreclosure on, and sale of, the Security. THIRD CAUSE OF ACTION (In the Alternative, for Declaratory Judgment) 53. Nader/Sisko repeat and reallege each and every allegation contained in

paragraphs 1 through 52 hereof. 54. causes of action. This cause of action is asserted in the alternative to the first and second

55.

As set forth in the first and second causes of action above, Nader/Sisko

contend that they have satisfied all of the conditions to the Shavolian Note and that, accordingly, defendant Shavolian is currently liable to Nader/Sisko for full payment of the Shavolian Note. 56. Upon information and belief, defendant Shavolian denies liability under

the Shavolian Note and denies that Nader/Sisko has fully satisfied all of the conditions to the Shavolian Note. 57. If, contrary to Nader/Siskos position, there is any question as to the

satisfaction of the conditions, then there is a live and ripe controversy between the parties as to the satisfaction of the conditions. 58. In that event, and in the alternative to the first and second causes of action

set forth above, Nader/Sisko demands and is entitled to a declaratory judgment setting forth the steps required for the complete satisfaction of the conditions. WHEREFORE, Nader/Sisko demand judgment granting them the following: a. on the first cause of action, a money judgment against defendant

Shavolian in the principal amount of $2.6 million, plus all interest thereon; b. on the second cause of action, delivery of the Shavolian

Assignment out of escrow and judicial foreclosure on, and sale of, the Security; c. on the third cause of action, a declaration setting forth the steps

required for the complete satisfaction of the conditions to the Shavolian Note; d. on all causes of action, interest according to law; and

e.

the costs and disbursements of this action and such other and

further relief as shall be just and proper. Dated: New York, New York January 7, 2011 WOLF HALDENSTEIN ADLER FREEMAN & HERZ LLP /s/ Eric B. Levine Eric B. Levine A Member of the Firm Attorneys for Plaintiffs Nader & Sons LLC and Sisko Enterprises LLC 270 Madison Avenue New York, NY 10016 (212) 545-4600 By:

647870.2

10

Das könnte Ihnen auch gefallen

- Greg FleeslerDokument1 SeiteGreg Fleeslersammyschwartz08Noch keine Bewertungen

- Greg FleeslerDokument1 SeiteGreg Fleeslersammyschwartz08Noch keine Bewertungen

- Greg FleeslerDokument1 SeiteGreg Fleeslersammyschwartz08Noch keine Bewertungen

- Greg FleeslerDokument1 SeiteGreg Fleeslersammyschwartz08Noch keine Bewertungen

- Greg FleeslerDokument1 SeiteGreg Fleeslersammyschwartz08Noch keine Bewertungen

- Greg FleeslerDokument1 SeiteGreg Fleeslersammyschwartz08Noch keine Bewertungen

- Greg FleeslerDokument1 SeiteGreg Fleeslersammyschwartz08Noch keine Bewertungen

- Greg FleeslerDokument1 SeiteGreg Fleeslersammyschwartz08Noch keine Bewertungen

- Mary ChangDokument1 SeiteMary Changsammyschwartz08Noch keine Bewertungen

- Greg FleeslerDokument1 SeiteGreg Fleeslersammyschwartz08Noch keine Bewertungen

- Greg FleeslerDokument1 SeiteGreg Fleeslersammyschwartz08Noch keine Bewertungen

- Greg FleeslerDokument1 SeiteGreg Fleeslersammyschwartz08Noch keine Bewertungen

- Greg FleeslerDokument1 SeiteGreg Fleeslersammyschwartz08Noch keine Bewertungen

- Ira DizengoffDokument1 SeiteIra Dizengoffsammyschwartz08Noch keine Bewertungen

- Greg FleeslerDokument1 SeiteGreg Fleeslersammyschwartz08Noch keine Bewertungen

- Greg FleeslerDokument1 SeiteGreg Fleeslersammyschwartz08Noch keine Bewertungen

- Greg FleeslerDokument1 SeiteGreg Fleeslersammyschwartz08Noch keine Bewertungen

- Greg FleeslerDokument1 SeiteGreg Fleeslersammyschwartz08Noch keine Bewertungen

- Greg FleeslerDokument1 SeiteGreg Fleeslersammyschwartz08Noch keine Bewertungen

- Alyson WeissDokument1 SeiteAlyson Weisssammyschwartz08Noch keine Bewertungen

- Greg FleeslerDokument1 SeiteGreg Fleeslersammyschwartz08Noch keine Bewertungen

- Greg FleeslerDokument1 SeiteGreg Fleeslersammyschwartz08Noch keine Bewertungen

- Greg FleeslerDokument1 SeiteGreg Fleeslersammyschwartz08Noch keine Bewertungen

- Allison Lambert LutnickDokument1 SeiteAllison Lambert Lutnicksammyschwartz08Noch keine Bewertungen

- Otda Foil Request 2Dokument4 SeitenOtda Foil Request 2sammyschwartz08Noch keine Bewertungen

- Rosenblatt Reply AffDokument7 SeitenRosenblatt Reply Affsammyschwartz08Noch keine Bewertungen

- Nashak Exhibit B - (# Legal 2897311)Dokument1 SeiteNashak Exhibit B - (# Legal 2897311)sammyschwartz08Noch keine Bewertungen

- October 14, 2011 DecisionDokument35 SeitenOctober 14, 2011 Decisionsammyschwartz08Noch keine Bewertungen

- Oasas Foil RequestDokument2 SeitenOasas Foil Requestsammyschwartz08Noch keine Bewertungen

- Omb Foil RequestDokument2 SeitenOmb Foil Requestsammyschwartz08Noch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)