Beruflich Dokumente

Kultur Dokumente

To Be Published in The Gazette of India

Hochgeladen von

NAVNEET BAGGAOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

To Be Published in The Gazette of India

Hochgeladen von

NAVNEET BAGGACopyright:

Verfügbare Formate

[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II, SECTION 3, SUB-SECTION (i)]

GOVERNMENT OF INDIA MINISTRY OF FINANCE (DEPARTMENT OF REVENUE) Notification No. 12/2012 Customs (ADD)

th

New Delhi, dated the 8 February, 2012

G.S.R. (E). Whereas, in the matter of imports of Coumarin (hereinafter referred to as the subject goods), falling under Tariff Item 2932 21 00 of the First Schedule to the Customs Tariff Act, 1975 (51 of 1975) (hereinafter referred to as the said Act), originating in, or exported from, the Peoples Republic of China (hereinafter referred to as the subject country) and imported into India, the Designated Authority in its final findings vide Notification No.14/17/2009-DGAD, dated the 7th July, 2010, published in the Gazette of India, Extraordinary, Part I, Section 1, dated the 7th July, 2010, had come to the conclusion that(a) the product under consideration had been exported to India from the subject country below normal values; (b) the domestic industry had suffered material injury on account of imports from subject country; (c) the material injury had been caused by the dumped imports of subject goods from the subject country; and had recommended imposition of definitive anti-dumping duty on the imports of subject goods, originating in, or exported from, the subject country; And whereas, on the basis of the aforesaid findings of the Designated Authority, the Central Government had imposed definitive anti-dumping duty on the subject goods vide Notification of the Government of India in the Ministry of Finance (Department of Revenue), No. 82/2010-Customs, dated th the 20 August, 2010, published in the Gazette of India Extraordinary, Part th II, Section 3, Sub-section (i) vide number G.S.R.695 (E), dated the 20 August, 2010; And whereas, the Designated Authority, pursuant to the order of the th Customs Excise & Service Tax Appellate Tribunal, dated 17 June, 2011, rd vide its final findings Notification No. 14/17/2009-DGAD dated the 23 December, 2011, published in the Gazette of India, Extraordinary, Part I, rd Section 1, dated the 23 December, 2011, had once again come to the conclusion that(a) the subject goods had been exported to India from the subject country below normal values;

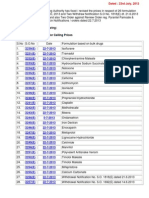

(b) the domestic industry had suffered material injury on account of subject imports from subject country; (c) the material injury had been caused by the dumped imports of subject goods from the subject country; and had recommended the imposition of definitive anti-dumping duty on imports of the subject goods originating in, or exported, from the subject country; Now, therefore, in exercise of the powers conferred by sub-sections (1) and (5) of section 9A of the said Act, read with rules 18 and 20 of the Customs Tariff (Identification, Assessment and Collection of Anti-dumping Duty on Dumped Articles and for Determination of Injury) Rules, 1995, the Central Government, after considering the aforesaid final findings of the Designated Authority, in supersession of Notification of the Government of India in the Ministry of Finance (Department of Revenue), No. 82/2010Customs, dated the 20th August, 2010, published in the Gazette of India Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R.695 (E), th dated the 20 August, 2010, except as respects things done or omitted to be done on such supersession, hereby imposes on the subject goods, the description of which is specified in column (3) of the Table below, falling under the Tariff Item of the First Schedule to the said Act as specified in the corresponding entry in column (2), originating in the country as specified in the corresponding entry in column (4), and produced by the producer as specified in the corresponding entry in column (6), when exported from the country as specified in the corresponding entry in column (5), by the exporter as specified in the corresponding entry in column (7), and imported into India, an anti-dumping duty at a rate which is equivalent to difference between the amount mentioned in the corresponding entry in column (8), in the currency as specified in the corresponding entry in column (10) and as per unit of measurement as specified in the corresponding entry in column (9), of the said Table and the landed value of imported goods in like currency as per like unit of measurement:Table Sl.No. (1) 1 Tariff item (2) 2932 21 00 Description of goods (3) Coumarin of all types Country of origin (4) Peoples Republic of China Country of export (5) Peoples Republic of China Producer (6) Yinghai (Cangzhou) Aroma Aroma chemical Co. Ltd. Chemical Co. Ltd. Any combination of producer and exporter other than at Sl. No. 1 above Exporter Amount Unit of measurement (9) Kg. Currency (10) US Dollar

(7) (8) Yinghai 14.02 (Cangzhou)

2932 21 00

Coumarin of all types

Peoples Republic of China

Peoples Republic of China

14.02

Kg.

US Dollar

2932 21 00

Coumarin of all types

Peoples Republic of China

2932 21 00

Coumarin of all types

Any country other than Peoples Republic of China

Any country other than Peoples Republic of China Peoples Republic of China

Any

Any

14.02

Kg.

US Dollar

Any

Any

14.02

Kg.

US Dollar

2. The anti-dumping duty imposed shall be levied for a period of five years (unless revoked, superseded or amended earlier) from the date of rd imposition of the provisional anti-dumping duty, that is, 23 March, 2010 and shall be payable in Indian currency. Explanation. - For the purposes of this notification,(a) landed value means the assessable value as determined under the Customs Act, 1962 (52 of 1962) and includes all duties of customs except duties levied under sections 3,3A, 8B, 9 and 9A of the Customs Tariff Act, 1975; (b) rate of exchange applicable for the purposes of calculation of antidumping duty shall be the rate which is specified in the notification of the Government of India, in the Ministry of Finance (Department of Revenue), in exercise of the powers conferred by section 14 of the Customs Act, 1962 (52 of 1962) and the relevant date for determination of the rate of exchange shall be the date of presentation of the bill of entry under section 46 of the Customs Act, 1962 ( 52 of 1062) . [F.No.354/22/2010 TRU (Pt-I)]

(Sanjeev Kumar Singh) Under Secretary to the Government of India.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Dpco Norms 2012.Dokument8 SeitenDpco Norms 2012.NAVNEET BAGGA100% (2)

- Admissibility of Electronic Evidence in CourtsDokument22 SeitenAdmissibility of Electronic Evidence in CourtsNasir ZamanNoch keine Bewertungen

- Approved FDC List by DCG (I) Upto Sept 2013Dokument85 SeitenApproved FDC List by DCG (I) Upto Sept 2013NAVNEET BAGGANoch keine Bewertungen

- Calender by N. BaggaDokument134 SeitenCalender by N. BaggaNAVNEET BAGGANoch keine Bewertungen

- Tea CalculationDokument2 SeitenTea CalculationNAVNEET BAGGANoch keine Bewertungen

- NPPA UPDATED Ceiling Prices Upto 24.5.14 Under DPCO 2013Dokument70 SeitenNPPA UPDATED Ceiling Prices Upto 24.5.14 Under DPCO 2013NAVNEET BAGGA100% (1)

- Nursing Homes at DelhiDokument38 SeitenNursing Homes at DelhiNAVNEET BAGGANoch keine Bewertungen

- InDokument135 SeitenInNAVNEET BAGGANoch keine Bewertungen

- Early FDA LaboratoryDokument1 SeiteEarly FDA LaboratoryNAVNEET BAGGANoch keine Bewertungen

- Indian National Policy For Containment of Antimicrobial Resiatance 2011Dokument55 SeitenIndian National Policy For Containment of Antimicrobial Resiatance 2011antibio_resistanceNoch keine Bewertungen

- The Bureau of Indian Standards Act 1986Dokument14 SeitenThe Bureau of Indian Standards Act 1986vasudeva yasasNoch keine Bewertungen

- BIS CreamsDokument13 SeitenBIS CreamsNAVNEET BAGGA100% (2)

- 425 Glycerin: S.No S.O.No Date Formulation Based On Bulk Drugs CategoryDokument30 Seiten425 Glycerin: S.No S.O.No Date Formulation Based On Bulk Drugs CategoryNAVNEET BAGGANoch keine Bewertungen

- Nppa SeminarDokument2 SeitenNppa SeminarNAVNEET BAGGANoch keine Bewertungen

- Indian PatentsDokument459 SeitenIndian PatentsNAVNEET BAGGA100% (1)

- US Mass ShootingsDokument1 SeiteUS Mass ShootingsNAVNEET BAGGANoch keine Bewertungen

- Mat Calculation Navbagga Nppa13Dokument163 SeitenMat Calculation Navbagga Nppa13NAVNEET BAGGANoch keine Bewertungen

- For Details Please Click The Following: Copies of Gazette Notifications For Ceiling PricesDokument2 SeitenFor Details Please Click The Following: Copies of Gazette Notifications For Ceiling PricesNAVNEET BAGGANoch keine Bewertungen

- Amending Standard Form ContractsDokument10 SeitenAmending Standard Form ContractsHoang Vien DuNoch keine Bewertungen

- Public International Law - OutlineDokument5 SeitenPublic International Law - OutlineLJ W SantosNoch keine Bewertungen

- Legal Notice To Arbitration Syed Kamran Ali, AdvocateDokument3 SeitenLegal Notice To Arbitration Syed Kamran Ali, AdvocateSyed Kamran AliNoch keine Bewertungen

- Background Guide - Commonwealth of NationsDokument13 SeitenBackground Guide - Commonwealth of NationsBBPSMUNNoch keine Bewertungen

- CA Mediation Form - CalluengDokument2 SeitenCA Mediation Form - CalluengJerome FlojoNoch keine Bewertungen

- Republic Vs Zurbaran Realty and Development Corp. (Bersamin) FactsDokument5 SeitenRepublic Vs Zurbaran Realty and Development Corp. (Bersamin) FactsKatrina Vianca DecapiaNoch keine Bewertungen

- SummonDokument10 SeitenSummonMusab Hafeez LOrajaNoch keine Bewertungen

- Fill The Form Below:: Sonia SharmaDokument1 SeiteFill The Form Below:: Sonia SharmaDr BalakrishnaNoch keine Bewertungen

- Political Law Compilation of Case Digests - Sec. 8 and 10, Art. III, 1987 ConstitutionDokument42 SeitenPolitical Law Compilation of Case Digests - Sec. 8 and 10, Art. III, 1987 ConstitutionSherlyn Paran Paquit-SeldaNoch keine Bewertungen

- 0 Glossary For HRBA-RBM WorkshopDokument9 Seiten0 Glossary For HRBA-RBM WorkshopTaxo HaNoch keine Bewertungen

- Metalliferous Mines Regulation, 1961-1Dokument1 SeiteMetalliferous Mines Regulation, 1961-1KP S0% (1)

- Module 4Dokument22 SeitenModule 4Vanessa CorpuzNoch keine Bewertungen

- Non Judicial Stamp Paper: Rs.10 Rs.10Dokument3 SeitenNon Judicial Stamp Paper: Rs.10 Rs.10MunaNoch keine Bewertungen

- Comments On FIDIC 2017Dokument2 SeitenComments On FIDIC 2017Magdy El-GhobashyNoch keine Bewertungen

- Banking Regulation Act, 1949: Zafrin MemonDokument26 SeitenBanking Regulation Act, 1949: Zafrin Memonzafrinmemon100% (1)

- Sales of Goods ActDokument56 SeitenSales of Goods ActCharu ModiNoch keine Bewertungen

- Nonn V Cotati-Rohnert Park Unified School CASE HISTORYDokument5 SeitenNonn V Cotati-Rohnert Park Unified School CASE HISTORYPaul Charles D.Noch keine Bewertungen

- Searches and Seizures Case NotesDokument8 SeitenSearches and Seizures Case NotesKen MarcaidaNoch keine Bewertungen

- Article On Henry VIII ClausesDokument17 SeitenArticle On Henry VIII ClausesSandeep GolaniNoch keine Bewertungen

- UgcnDokument1 SeiteUgcnlamba5Noch keine Bewertungen

- Viudez II V CA (2009)Dokument10 SeitenViudez II V CA (2009)attyrmlfNoch keine Bewertungen

- Malaysian Legal SystemDokument3 SeitenMalaysian Legal Systemحازيق فاتيحينNoch keine Bewertungen

- Manila International Airport Authority Vs CA FactsDokument3 SeitenManila International Airport Authority Vs CA FactsAnonymous bOncqbp8yi100% (1)

- Withrawal of Appearance Galope Case at NLRCDokument3 SeitenWithrawal of Appearance Galope Case at NLRCBaphomet JuniorNoch keine Bewertungen

- Bail PDFDokument2 SeitenBail PDFSahidul IslamNoch keine Bewertungen

- Cmo 22 2007editedDokument2 SeitenCmo 22 2007editedKylene Nichole EvaNoch keine Bewertungen

- Evidence PowerpointDokument18 SeitenEvidence Powerpointpete malinaoNoch keine Bewertungen

- Revised Penal Code RecapDokument6 SeitenRevised Penal Code RecapPaulaNoch keine Bewertungen

- Rajasthan High Court, Jaipur Bench, JaipurDokument3 SeitenRajasthan High Court, Jaipur Bench, JaipurAnkur SrivastavaNoch keine Bewertungen