Beruflich Dokumente

Kultur Dokumente

Akbar C.M

Hochgeladen von

Sumon SumOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Akbar C.M

Hochgeladen von

Sumon SumCopyright:

Verfügbare Formate

Loan Classification and Provisioning Rules (from 1989-2005):

In order to strengthen credit discipline and to improve the recovery position of credit of banks, Bangladesh Bank time to time changes loan classification rules through its circular. These loan classification rules are presented in the following tables:

Loan Classification Rules 1989:

In 1989, BB via its circular (BCD Circular No.34 Nov. 16, 1989) set the following rules for classifying loans, for suspending overdue interest and for making provisions against potential load losses. These rules are presented in the table below:

Table# Shows the Loan Classification Rules of BB in 1989 Basis of loan classification 1. Qualitative Criteria: Adverse financial condition, Poor financial performance, insufficient security 2. Overdue Criteria: Overdue six month for private sector and fifteen months for public sector enterprises. 3.Others Criteria Substandard

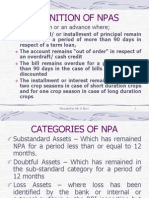

If and advance or any portion of an advance or interest thereon remains overdue for one year or more but less than three years. Limit stands overdrawn by more than 50% for a period of 45 continuous days preceding the reference date for the classification. 1) Renew or reschedule at least three times. 2) Payments were not made within the required period. 3)Qualitative criteria

Doubtful

Any portion of advance or interest thereon remains overdue for three years or more but less than five years.

Bad and Loss

1) Overdue for five years or more. 2) Doubtful and has remained doubtful for two years or more.

Substandard for two years or more.

1) Doubtful and has remained doubtful for two years or more. 2) Legal action initiated. 3) Qualitative Criteria.

a) Legal action has been initiated b)qualitative criteria

Not Applicable.

Source: BCD Circular No.34 Nov. 16, 1989, BB.

Provision against Classified Loans:

Bangladesh Bank has directed all banks to make provision on their classified loans in the following rates: (1) On substandard loans 10% (2) On doubtful loan 50 % and (3) On bad and loss 100 % (Source: BCD Circular No.34 Nov. 16, 1989, BB.)

Loan Classification Rules 1998:

On December 06, 1998 BB via its circular (BCD Circular No. 34/1989 and 20/1994, and BPRD Circular No.16. December 06, 1998) informed all schedule banks that in order to strengthen credit discipline, to make simple the loan classification procedure and to develop the loan classification and provisioning principle to international level, BB has been decided to revise its earlier loan classification standard. The new loan classification standards are exhibit in the following table: Table# Show the Loan Classification Rules in 1998 Types on loan Continuous loans Demand loans Fixed term loans (Up-to five years) Fixed term loans (More than five years) Short-term Agriculture and Micro-Credit Substandard

Nonpayment/Renewal within 3 months or 6 months after expiry date. Nonpayment within 3 months or 6 months after expiry date.

Doubtful

Classified as substandard for 6 to12 months. Classified as substandard for 6 to12 months.

Bad and Loss

Classified as doubtful for 12 months or more. Classified as doubtful for 12 months or more.

Installment default for more than 6 months.

Classified as substandard more than 12 months. Installment default Classified as more than 12 months. substandard more than 18 months. Overdue more than 12 Overdue more than 36 months. months.

Classified as doubtful more than 18 months. Classified as doubtful more than 24 months. Overdue more than 60 months.

Source: BCD Circular No. 34/1989 and 20/1994, and BPRD Circular No.16. December 06, 1998, BB.

Provision against Classified Loans:

Bangladesh Bank has directed all banks to maintain provision in the following rates on their all loans: (1) 1% on non-classified loans, (2) 20% on substandard loans, (3) 50 % on doubtful loans and (3) 100% on bad and loss loans.

Classification Rules in 2001:

Bangladesh Bank again revises its loan classification rules and provision rates on 2001 via its BRPD Circular No. 09 on May 14, 2001. Revise loan classification rules are present in the table below:

Credit Information Bureau (CIB) It is necessary to know the credit status of a loan applicant for credit analysis. But in Bangladesh, before 1993, there was no established bureau to provide information about credit status of borrowers. To meet this deficiency, Bangladesh Bank (BB) established Credit Information Bureau (CIB) and made mandatory for all schedule banks to collect information about borrowers credit status before sanctioning, renewals and rescheduling of loans from 1st January 1993. On 17-06-1995, BB via its circular (BCD circular No. 07), again directed all schedule banks to collect information about borrowers before sanctioning new loan, renewal and rescheduling of loan up to Tk. 10.00 lakhs or more. On 29-06-1995, BB extended this ceiling to Tk. 50.00 lakhs (BCD circular No. 09). On 26-10-2000, BB made it mandatory for all schedule banks to collect information from CIB for sanctioning new loans, renewals and rescheduling, issuing bank guarantee and opening letter of credit (LC) via its circular BRPD Circular No. 13.

Guidelines on Managing Core Risks on in Banking Deregulation along with globalization of business warrants better risk management practices around the world. Failure to adequate manage of risks exposes banks not only to business losses but also to threat of not to survive in the business. To look into the practices of management in home and abroad and to produce a best model to deal with risk management, Bangladesh Bank formed a Focus Group consisting of members from NCBs, PCBS, and FCBs. Members from

Bangladesh Bank acted as team coordinator. This focus group identified five core risks in banking business and these are: 1. Credit risks; 2. Asset and Liability/Balance Sheet risks; 3. Foreign exchange risks; 4. Internal control and compliance risks; and 5. Money laundering risks. Bangladesh Bank by its circular ( BRPD Circular no.17 October 07, 2003) advised all schedule banks in Bangladesh to put in place an effective risk management system by December 2003. Focus group also supplied a CD-ROM to all banks which contain possible guidelines to handle each risk separately. Risk Credit Grading Manual The LRA was faced various problem and it made no attempts to introduce a Risk Grading System (RGS) for unclassified loans. After realizing it, in January 2004, BIBM was introduced by Governor of Bangladesh Bank to produce a Credit Grading Manual (CRGM) based on the Core Risks Management Guidelines (CRMG). BIBM constituted a Focus Group for this purpose. The Focus Group completed its task and submitted it to Bangladesh Bank in September 2004. This was received by an Industry Review Group (IRG) consists of the representatives from NCBs, PCBS, and FCBs specifically involved in the credit approval and corporate business functions. The IRG met a number of times in August and September 2005 and gave their recommendations. These were discussed and suitable amendments were made in the guidelines. The CRGM is a mandatory replacement of the LRA and it will be applicable for all exposures (irrespective of amount) other than those covered under Consumer and Small Enterprise Financing under Prudential Guidelines and also under Short Term Agriculture and Micro Credit (Source: Credit Risk Grading Manual, November 2005). Legal Environment and Non-Performing Loans Legal action against borrower is the last weapon bank uses to recover dues .But in most cases; legal environment in Bangladesh becomes a barrier instead of being helpful to recover bank dues. The commercial law dealing with loan recovery overwhelmingly favors the delinquent customers. The legal system makes its difficult for the NCBs to repossess and sell many securities [LRA Manual, 1-2] The borrower are confident that they would not be touched for at least 10-12 year due to cumbersome , inefficient and time consuming procedural low ,over burdened judges and most of all , ingenuity of their lawyers in adopting dilatory tactics . Bangladesh legal system provides an elaborate system of appeals, reference, reviews and revisions, which causes abnormal delays in the legal process. Present scenarios of environment will the following subsections 1. Present Status of Low Relating to Recovery of Loans

Bank lends money to borrowers in hope that it will be repaid at the end of its tenure. If borrowers fail to repay the loans as agreement, bank takes recovery drive. When bank recovery drives fail, bank file case against borrowers as the last weapon. At present, bank can take legal actions under the following laws1. Filing certificate cases under the public demand recovery act, 1913 2. Filing bankruptcy cases under the Bankruptcy Act, 1997; 3. Filing money suit/title suit under the Artha Rin Adalat 2003; and 4. Other legal actions.

Present Status of Law Relating to Recovery of Loan Bank lend money to borrowers in the hope that it will be repaid at the end of its tenure. If borrowers fail to repay the loans as agreement, bank takes recovery drive. When bank recovery drives fail, bank file case against borrowers as the last weapon. At present, bank can take legal actions under the following laws:1.filling certificate cases under the Public Demand Recovery Act,1913; 2. filling bankruptcy cases under Bankruptcy Act,1997; 3. Filling money suit/title suit under the Artha Rin Adalat 2003; and 4. Other legal action. Performance of Artha Rin Adalat : After failing to recover the loan from borrowers, banks have the legal option to file case in the Artha Rin Adalat. Table given below shows the performance of Artha Rin Adalat as on June 2004. Shows the performance of Artha Rin Adalat as on June 2004 Tape of banks Suits filed No. of suits 5274 8 2124 5 1445 Amount claimed 1057268. 3 236516.3 584183.2 Suits Settled (Cumulative) No. of suits Amount claimed 97207.3 62971.1 129541.9 Amount No. recovered of suits 82995.6 3204 3 13038.3 1080 9 54509.0 7965 Suits under trail Amount claimed 965191.5 173725.3 454419.8 Amount recovered 47055.0 2711.o 67180.4

NCBs DFIs PCBs

21721 10436 6493

8 FCBs 296 23865.7 206 8668.6 Total 8974 1901834. 38856 298028.8 7 1 Source: Bangladesh Economic Review 2004

5845.7 15688.6

90 5090 7

15197.1 1608533. 6

1210.2 118156.7

The above table presents the performance of Artha Rin Adalat 2003 as on June, 2004. It is revealed from the table that as on June, 2004, out of the total 89747 cases, 38856 cases were settled and tk. 156288.60 crores was recovered. It is also clears from the table that average claim of the case is tk. 21.19 crores (amount claimed /no. of suits i.e 1901834.1/89747). Average claim of the settled case is Tk. 7.67 crores (298208.8/38856) and average amount recovered from each suit is Tk. 4.02 crores(156388.6/38856). It is 52 percent (4.02/7.67=52%) of the claim .Table also shows that average amount claimed per case under trial is Tk. 31.60 crores (1608533.6/50907).From this table it is concluded that small defaulters case takes short and big defaulters case takes longer time to settle.

Das könnte Ihnen auch gefallen

- SARFAESI Act Management of NPADokument4 SeitenSARFAESI Act Management of NPAsuchethatiaNoch keine Bewertungen

- BB Loan Classification and ProvisioningDokument16 SeitenBB Loan Classification and ProvisioningMuhammad Ali Jinnah100% (1)

- Loan ProvisioningDokument16 SeitenLoan ProvisioningrajmirakshanNoch keine Bewertungen

- BRPD Circular No. 14-2012 - Master Circular On Loan Classification and ProvisioningDokument16 SeitenBRPD Circular No. 14-2012 - Master Circular On Loan Classification and ProvisioningRifat Hasan Rathi100% (4)

- CCP - RBI - July-Dec 22Dokument19 SeitenCCP - RBI - July-Dec 22P N rajuNoch keine Bewertungen

- 503acf260214f PDFDokument16 Seiten503acf260214f PDFSiddhi KudalkarNoch keine Bewertungen

- Assignment: Export Financing System of BangladeshDokument8 SeitenAssignment: Export Financing System of BangladeshNafiz ImtiazNoch keine Bewertungen

- Understanding Non-Performing Assets in BanksDokument35 SeitenUnderstanding Non-Performing Assets in BanksMaridasrajanNoch keine Bewertungen

- Credit Management Overview and Principles of LendingDokument44 SeitenCredit Management Overview and Principles of LendingTavneet Singh100% (2)

- BRPD Circular No 05Dokument14 SeitenBRPD Circular No 05Iftekhar Ifte100% (1)

- Unit-2 Financial Crdit Risk AnalyticsDokument25 SeitenUnit-2 Financial Crdit Risk AnalyticsAkshitNoch keine Bewertungen

- NPAkjhhkjhkjhjhjDokument54 SeitenNPAkjhhkjhkjhjhjRintu AbrahamNoch keine Bewertungen

- Non Performing AssetsDokument11 SeitenNon Performing AssetssudheerNoch keine Bewertungen

- Indian Banks Cut NPAs to Lowest Since 2016Dokument44 SeitenIndian Banks Cut NPAs to Lowest Since 2016ParthNoch keine Bewertungen

- Non Performing AssetsDokument24 SeitenNon Performing AssetsAmarjeet DhobiNoch keine Bewertungen

- Credit Management Overview and Principles of LendingDokument55 SeitenCredit Management Overview and Principles of LendingShilpa Grover100% (4)

- RBI Guidelines on Joint Lenders' Forum and Corrective Action PlanDokument16 SeitenRBI Guidelines on Joint Lenders' Forum and Corrective Action Planonlynishank1934Noch keine Bewertungen

- Credit Team Report 1Dokument18 SeitenCredit Team Report 1Saugat DangalNoch keine Bewertungen

- Various Recovery Measures Adopted by Banks and Financial InstitutionsDokument19 SeitenVarious Recovery Measures Adopted by Banks and Financial InstitutionsjasmeetNoch keine Bewertungen

- Assignment of Management of Working Capital On Chore CommitteeDokument4 SeitenAssignment of Management of Working Capital On Chore CommitteeShubhamNoch keine Bewertungen

- Semester-III Comprehensive Examinations Class of 2009 SLBK605 - Overview of Banking Part-ADokument22 SeitenSemester-III Comprehensive Examinations Class of 2009 SLBK605 - Overview of Banking Part-AChandni BhargavaNoch keine Bewertungen

- BANKING ISSUESDokument17 SeitenBANKING ISSUESbhavyaNoch keine Bewertungen

- Presentation On NPA Problem: by Anshika AditiDokument18 SeitenPresentation On NPA Problem: by Anshika AditiAnshika SharmaNoch keine Bewertungen

- Impact of nationalisation on Indian banking sectorDokument4 SeitenImpact of nationalisation on Indian banking sectorAryan DevNoch keine Bewertungen

- Bank Assurance and Letter of CreditDokument4 SeitenBank Assurance and Letter of CreditRahul Kumar TantwarNoch keine Bewertungen

- Cbi So Model Paper 2022Dokument37 SeitenCbi So Model Paper 2022himanshu agrawalNoch keine Bewertungen

- Definition of Npas: A NPA Is A Loan or An Advance WhereDokument30 SeitenDefinition of Npas: A NPA Is A Loan or An Advance WheremulchandranaNoch keine Bewertungen

- Management of Non-Performing Assets: Presentation by Mr. S. RaviDokument29 SeitenManagement of Non-Performing Assets: Presentation by Mr. S. RaviRajesh MaddiNoch keine Bewertungen

- NPADokument6 SeitenNPA76-Gunika MahindraNoch keine Bewertungen

- Banking policy and structural changes e-magazineDokument22 SeitenBanking policy and structural changes e-magazineApurva JhaNoch keine Bewertungen

- File BRPD Circular No 05Dokument3 SeitenFile BRPD Circular No 05Arifur RahmanNoch keine Bewertungen

- Study on Factors Driving Non-Performing Assets in Indian BanksDokument85 SeitenStudy on Factors Driving Non-Performing Assets in Indian BanksAbhishek EraiahNoch keine Bewertungen

- RBI Master Circular Lending To Micro Small Medium Enterprises MSME Sector 2nd July 2012KALE LAW OFFICE CORPORATE LAWYER LAW FIR TAX CONSULTANTS COMPANY LAWYER 1Dokument7 SeitenRBI Master Circular Lending To Micro Small Medium Enterprises MSME Sector 2nd July 2012KALE LAW OFFICE CORPORATE LAWYER LAW FIR TAX CONSULTANTS COMPANY LAWYER 1Divya MewaraNoch keine Bewertungen

- RBI Governor On IBCDokument15 SeitenRBI Governor On IBCyashs-pgdm-2022-24Noch keine Bewertungen

- At Last Asset Management CompanyDokument3 SeitenAt Last Asset Management CompanyMohammad Shahjahan SiddiquiNoch keine Bewertungen

- Plutus Ias Current Affairs Eng Med 25 Sep 2023Dokument7 SeitenPlutus Ias Current Affairs Eng Med 25 Sep 2023VikasNoch keine Bewertungen

- Mrunal Sir Latest 2020 Handout 3 PDFDokument19 SeitenMrunal Sir Latest 2020 Handout 3 PDFdaljit singhNoch keine Bewertungen

- 3EF1B - HDT - RBI3 - Burning - Issues - Banking - 2020B @ PDFDokument19 Seiten3EF1B - HDT - RBI3 - Burning - Issues - Banking - 2020B @ PDFMohan DNoch keine Bewertungen

- Summer Project Report: Loan AppraisalDokument36 SeitenSummer Project Report: Loan Appraisalchirag_ismNoch keine Bewertungen

- CCP Rbi Jul-Dec'23Dokument21 SeitenCCP Rbi Jul-Dec'23RaviTuduNoch keine Bewertungen

- Module-III Banking Regulation: Course OutlineDokument36 SeitenModule-III Banking Regulation: Course OutlineSanjay ParidaNoch keine Bewertungen

- Credit Report On MCBDokument16 SeitenCredit Report On MCBuzmabhatti34Noch keine Bewertungen

- What Are Non Performing Assets?Dokument9 SeitenWhat Are Non Performing Assets?Rizul96 GuptaNoch keine Bewertungen

- Dec 242015 FSD 01 eDokument3 SeitenDec 242015 FSD 01 eRaquibul HasanNoch keine Bewertungen

- Short Term LoansDokument4 SeitenShort Term LoansHarsh MehtaNoch keine Bewertungen

- Common Guidelines For Priority Sector AdvancesDokument43 SeitenCommon Guidelines For Priority Sector AdvancesKeval PatelNoch keine Bewertungen

- NPA Recovery ManagementDokument31 SeitenNPA Recovery ManagementSantoshi AravindNoch keine Bewertungen

- Bangladesh's Financial System and Central Banking PoliciesDokument10 SeitenBangladesh's Financial System and Central Banking PoliciesMohammad ShoaibNoch keine Bewertungen

- Sap Id: Roll No: Open Book - Through Blackboard Learning Management SystemDokument4 SeitenSap Id: Roll No: Open Book - Through Blackboard Learning Management SystemAkshita ShrivastavaNoch keine Bewertungen

- Guidelines for settling bank dues through Lok AdalatsDokument3 SeitenGuidelines for settling bank dues through Lok AdalatsMahesh Prasad PandeyNoch keine Bewertungen

- CMPCir1656 12Dokument95 SeitenCMPCir1656 12sunilNoch keine Bewertungen

- Financial Statements-2021Dokument137 SeitenFinancial Statements-2021Fakhrul AlamNoch keine Bewertungen

- Banking RegulationsDokument44 SeitenBanking RegulationsAnkith BNoch keine Bewertungen

- Weekly Economic Round Up 37Dokument11 SeitenWeekly Economic Round Up 37Mana PlanetNoch keine Bewertungen

- 2631IIBF Vision January 2013Dokument8 Seiten2631IIBF Vision January 2013Sukanta DasNoch keine Bewertungen

- 22MC894E2203DDDF4E0ABCA714DCE21F8F6CDokument63 Seiten22MC894E2203DDDF4E0ABCA714DCE21F8F6Caspimpale1999Noch keine Bewertungen

- Bank Promotion Interview - 2023Dokument79 SeitenBank Promotion Interview - 2023kumar Raushan RatneshNoch keine Bewertungen

- Public Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesVon EverandPublic Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesNoch keine Bewertungen

- Financing Small and Medium-Sized Enterprises in Asia and the Pacific: Credit Guarantee SchemesVon EverandFinancing Small and Medium-Sized Enterprises in Asia and the Pacific: Credit Guarantee SchemesNoch keine Bewertungen

- WSO 2022 IB Working Conditions SurveyDokument42 SeitenWSO 2022 IB Working Conditions SurveyPhạm Hồng HuếNoch keine Bewertungen

- Poverty and Crime PDFDokument17 SeitenPoverty and Crime PDFLudwigNoch keine Bewertungen

- Notice: Use of Segways® and Similar Devices by Individuals With A Mobility Impairment in GSA-Controlled Federal FacilitiesDokument2 SeitenNotice: Use of Segways® and Similar Devices by Individuals With A Mobility Impairment in GSA-Controlled Federal FacilitiesJustia.comNoch keine Bewertungen

- Immune System Quiz ResultsDokument6 SeitenImmune System Quiz ResultsShafeeq ZamanNoch keine Bewertungen

- HVDC BasicDokument36 SeitenHVDC BasicAshok KumarNoch keine Bewertungen

- SVIMS-No Que-2Dokument1 SeiteSVIMS-No Que-2LikhithaReddy100% (1)

- Workplace Hazard Analysis ProcedureDokument12 SeitenWorkplace Hazard Analysis ProcedureKent Nabz60% (5)

- Chemical and Physical Properties of Refined Petroleum ProductsDokument36 SeitenChemical and Physical Properties of Refined Petroleum Productskanakarao1Noch keine Bewertungen

- Perforamance Based AssessmentDokument2 SeitenPerforamance Based AssessmentJocelyn Acog Bisas MestizoNoch keine Bewertungen

- Abortion and UtilitarianismDokument4 SeitenAbortion and UtilitarianismBrent Harvey Soriano JimenezNoch keine Bewertungen

- SCE Research Paper PDFDokument12 SeitenSCE Research Paper PDFmuoi2002Noch keine Bewertungen

- Material Handling EquipmentsDokument12 SeitenMaterial Handling EquipmentsRahul SheelavantarNoch keine Bewertungen

- Space Analysis in Orthodontic: University of GlasgowDokument16 SeitenSpace Analysis in Orthodontic: University of GlasgowNizam Muhamad100% (1)

- LPBP HPSU Document PDFDokument131 SeitenLPBP HPSU Document PDFGanga PrasadNoch keine Bewertungen

- EP Series User Manual PDFDokument40 SeitenEP Series User Manual PDFa.elwahabNoch keine Bewertungen

- Model Fs CatalogDokument4 SeitenModel Fs CatalogThomas StempienNoch keine Bewertungen

- Life Overseas 7 ThesisDokument20 SeitenLife Overseas 7 ThesisRene Jr MalangNoch keine Bewertungen

- Philippines implements external quality assessment for clinical labsDokument2 SeitenPhilippines implements external quality assessment for clinical labsKimberly PeranteNoch keine Bewertungen

- Request For Review FormDokument11 SeitenRequest For Review FormJoel MillerNoch keine Bewertungen

- Formularium ApotekDokument12 SeitenFormularium ApotekNurul Evi kurniatiNoch keine Bewertungen

- Chapter 5Dokument16 SeitenChapter 5Ankit GuptaNoch keine Bewertungen

- Stress and FilipinosDokument28 SeitenStress and FilipinosDaniel John Arboleda100% (2)

- TS4-F - Fire SafetyDokument2 SeitenTS4-F - Fire SafetyDominic SantiagoNoch keine Bewertungen

- Week 6 Blood and Tissue FlagellatesDokument7 SeitenWeek 6 Blood and Tissue FlagellatesaemancarpioNoch keine Bewertungen

- Health and Safety Awareness For Flower Farm WorkersDokument1 SeiteHealth and Safety Awareness For Flower Farm WorkersGerald GwambaNoch keine Bewertungen

- Cellular Basis of HeredityDokument12 SeitenCellular Basis of HeredityLadyvirdi CarbonellNoch keine Bewertungen

- C. Drug Action 1Dokument28 SeitenC. Drug Action 1Jay Eamon Reyes MendrosNoch keine Bewertungen

- Insects, Stings and BitesDokument5 SeitenInsects, Stings and BitesHans Alfonso ThioritzNoch keine Bewertungen

- HTM 2025 2 (New) Ventilation in HospitalsDokument123 SeitenHTM 2025 2 (New) Ventilation in HospitalsArvish RamseebaluckNoch keine Bewertungen

- 2.assessment of Dental Crowding in Mandibular Anterior Region by Three Different MethodsDokument3 Seiten2.assessment of Dental Crowding in Mandibular Anterior Region by Three Different MethodsJennifer Abella Brown0% (1)