Beruflich Dokumente

Kultur Dokumente

JF Asia New Frontiers: Fund Objective

Hochgeladen von

Md Saiful Islam KhanOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

JF Asia New Frontiers: Fund Objective

Hochgeladen von

Md Saiful Islam KhanCopyright:

Verfügbare Formate

Asset Management Company in Asia - 2009, 2010 & 2011 2)

Morningstar Overall RatingsTM

Risk

1 2 3 4 5

JF Asia New Frontiers

January 2012 Fund objective

To provide investors with long-term capital growth by investing primarily in securities of companies in developing countries in Asia ("Asia New Frontiers"). The Fund may invest in emerging and developing markets in Asia and therefore may have significant exposure to liquidity and the relevant currency risk. The Fund's price movement may go down or up sharply over a short time span. Whilst the Fund invests in multiple markets, investors may be subject to higher price volatility than a more diversified, developed market investment. Investors may be subject to substantial losses. Investors should not solely rely on this document to make any investment decision.

Fund Manager's report

Portfolio Review: The Fund lost around 4% during the month amid continued volatility in global markets. While the Philippines had a relatively strong month, and in an Asian context was a large outperformer, there was less good news from other frontier markets. In the subcontinent, Bangladesh and Pakistan continue to struggle because of political and economic uncertainties. Sri Lanka, the bright star over the last 18 months, has continued to fizzle after a dampening of the initial market euphoria that greeted the end of the country's long and bloody civil war. Vietnam's stock market has gone from darling to outcast within a few years, and inflation and lack of economic momentum has taken the market back to two-year lows. Outlook: The bright side of the poor market action of late is that there will be greater opportunities to find cheap companies that are prevailing and flourishing in their line of business despite the headwinds facing the broader economy. Overall we remain relatively cautious and maintain around 20% of the Fund in cash.

Performance from 08.11.07 to 30.12.11

120 100 80

REBASED

20 0 -20

% CHANGE

JF Asia New Frontiers

60 40 20 0

-40 -60 -80 -100

07

08

09

10

11

Cumulative performance %

1 month Fund -4.1 1 year -21.4 3 years +85.7 5 years Since launch -20.2

Calendar Year performance %

2006 Fund 2007* +1.4 2008 -57.6 2009 +94.4 2010 +21.6 2011YTD -21.4

Portfolio information

Fund manager Launch date Fund size (m) Base currency and NAV per unit 12 month High NAV: Low Charges: Initial Redemption Management fee Administrative fee Management performance fee SEDOL/ISIN codes Bloomberg code Mayur Nallamala/ Rajendra Nair, Hong Kong 08.11.07 USD 13.4 USD 7.98 USD 10.53 (08.02.11) USD 7.70 (04.10.11) 5.0% of NAV Currently 0%

(up to 0.5% of NAV)

Portfolio analysis

By country/region

Philippines Net Liquidity Kazakhstan Others Australia United Kingdom Sri Lanka Korea Canada 24.1% 22.5% 13.4% 12.0% 8.7% 5.7% 5.1% 4.7% 3.9%

By sector

1.1% 3.8% 3.8% 6.2% 10.8% 14.3% 18.7% 18.8% 22.5% Consumer Staples Utilities Telecommunication Services Consumer Discretionary Industrials Materials Financials Energy Net Liquidity

1.5% p.a. Nil

Top ve holdings (as at end November 2011)

Holding KazMunaiGas EP JSC Newcrest Mining Ltd. Security Bank Corp. Alliance Global Group Inc. Bharti Airtel Ltd. Sector Energy Materials Financials Industrials Telecommunication Services Country/region Kazakhstan Australia Philippines Philippines India % 9.3 4.9 4.3 4.2 4.1

15% of the fund return, subject to the Low Tide Mark N/A B413PS8/HK0000055563 JFASNFR HK

Last distribution (xd date)

Statistical analysis

3 years Correlation Alpha % Beta Annual volatility % Sharpe ratio Annual tracking error % Average annual return % 20.58 1.09 22.91 5 years Since launch1) 25.49 -5.30

For more information, please contact your bank, financial adviser or visit www.jpmorganam.com.hk

Unless stated otherwise, all information as at the last valuation date of the previous month. Source: JPMAM/Thomson Reuters Datastream (NAV to NAV in USD with income reinvested). Source of star rating: Morningstar, Inc. Risk ratings (if any) are based on JPMAM's assessment of relative risk by asset class and is subject to change. This is for reference only. Any overweight in any investment holding exceeding the limit set out in the Investment Restrictions was due to market movements and will be rectified shortly. Top ten holdings is available upon request. *Since launch to end of year. It should be noted that due to the difference of the fund domiciles the valuation points used by the JF funds and JPMorgan series of funds for fair valuation (where applied) may vary. For details please refer to the respective offering document(s). 1)With the exception of the "Average annual return" figure, all data are calculated from the month end after inception. 2)The Asset Triple A Investment Awards. For 2011, the award is 'Asset Management Company of the Year, Asia Retail'. 125

Investment involves risk. Past performance is not indicative of future performance. Please refer to the offering document(s) for details, including the risk factors. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.

Das könnte Ihnen auch gefallen

- UBS HandbookDokument152 SeitenUBS HandbookcarecaNoch keine Bewertungen

- 02 Oct 2013 Fact SheetDokument1 Seite02 Oct 2013 Fact SheetfaisaladeemNoch keine Bewertungen

- CFO Job Description DRAFTDokument3 SeitenCFO Job Description DRAFTpatrickNoch keine Bewertungen

- AFP Final AssignmentDokument12 SeitenAFP Final AssignmentDanTanNoch keine Bewertungen

- 2009 CFA Level 1 Mock Exam MorningDokument38 Seiten2009 CFA Level 1 Mock Exam MorningForrest100% (1)

- Jpmorgan Investment Funds - Income Opportunity Fund: August 2013Dokument4 SeitenJpmorgan Investment Funds - Income Opportunity Fund: August 2013james.dharmawanNoch keine Bewertungen

- Fact Sheet MT PR UscDokument2 SeitenFact Sheet MT PR Uscdonut258Noch keine Bewertungen

- Allan Gray Equity Fund: BenchmarkDokument2 SeitenAllan Gray Equity Fund: Benchmarkapi-217792169Noch keine Bewertungen

- Security Bank - UITF Investment ReportDokument2 SeitenSecurity Bank - UITF Investment ReportgwapongkabayoNoch keine Bewertungen

- AMANX FactSheetDokument2 SeitenAMANX FactSheetMayukh RoyNoch keine Bewertungen

- Maverick Capital Q1 2011Dokument13 SeitenMaverick Capital Q1 2011Yingluq100% (1)

- Osku Ob Kid Save June 2013 FactsheetDokument3 SeitenOsku Ob Kid Save June 2013 FactsheetRaymond Chan Chun LimNoch keine Bewertungen

- ALFM Money Market FundDokument3 SeitenALFM Money Market Fundippon_osotoNoch keine Bewertungen

- Power of 3 JPMAMDokument28 SeitenPower of 3 JPMAMAnup Jacob JoseNoch keine Bewertungen

- Equity Strategy: The 5 Top Picks For FebruaryDokument26 SeitenEquity Strategy: The 5 Top Picks For Februarymwrolim_01Noch keine Bewertungen

- JANUARY 2016: Bond FundDokument2 SeitenJANUARY 2016: Bond FundFaiq FuatNoch keine Bewertungen

- Performance Data in Philippine Peso (PHP)Dokument1 SeitePerformance Data in Philippine Peso (PHP)Teresa Dumangas BuladacoNoch keine Bewertungen

- 36ONE Fact Sheets SeptemberDokument3 Seiten36ONE Fact Sheets Septemberrdixit2Noch keine Bewertungen

- Ing Philippine Equity Fund A Unit Investment Trust Fund of ING Bank N.V. Philippine Branch (Trust Department)Dokument1 SeiteIng Philippine Equity Fund A Unit Investment Trust Fund of ING Bank N.V. Philippine Branch (Trust Department)sunjun79Noch keine Bewertungen

- Value Partners Classic Fund Q1 2015 CommentaryDokument8 SeitenValue Partners Classic Fund Q1 2015 CommentaryCharlie TianNoch keine Bewertungen

- Cumulative Performance (%) : NAVPU Graph Investment ObjectiveDokument1 SeiteCumulative Performance (%) : NAVPU Graph Investment ObjectivescionchoNoch keine Bewertungen

- Fidelity South-East Asia Fund, A Sub-Fund of Fidelity Investment Funds, A Accumulation Shares (ISIN: GB0003879185)Dokument2 SeitenFidelity South-East Asia Fund, A Sub-Fund of Fidelity Investment Funds, A Accumulation Shares (ISIN: GB0003879185)Nais BNoch keine Bewertungen

- JF - India 31 01 07 PDFDokument3 SeitenJF - India 31 01 07 PDFstavros7Noch keine Bewertungen

- FPA Crescent Fund: 2019 Year-End CommentaryDokument22 SeitenFPA Crescent Fund: 2019 Year-End CommentaryKan ZhouNoch keine Bewertungen

- Element Global Value - 3Q13Dokument4 SeitenElement Global Value - 3Q13FilipeNoch keine Bewertungen

- Group 24Dokument23 SeitenGroup 24dineomokoena327Noch keine Bewertungen

- Sgreits 020911Dokument18 SeitenSgreits 020911Royston Tan Keng SanNoch keine Bewertungen

- Strategic Analysis of SBIMFDokument19 SeitenStrategic Analysis of SBIMF26amitNoch keine Bewertungen

- Fid MoneybuilderDokument2 SeitenFid Moneybuildersnake1977Noch keine Bewertungen

- JPM Weekly MKT Recap 8-13-12Dokument2 SeitenJPM Weekly MKT Recap 8-13-12Flat Fee PortfoliosNoch keine Bewertungen

- Fpa Capital Fund Commentary 2017 q1Dokument12 SeitenFpa Capital Fund Commentary 2017 q1superinvestorbulletiNoch keine Bewertungen

- Pitchbook StrategyDokument25 SeitenPitchbook Strategydfk1111Noch keine Bewertungen

- FT Global Total ReturnDokument2 SeitenFT Global Total ReturnxninesNoch keine Bewertungen

- File 1Dokument10 SeitenFile 1Alberto VillalpandoNoch keine Bewertungen

- Cusip Rfo 5221392Dokument12 SeitenCusip Rfo 5221392Chemtrails Equals Treason100% (2)

- Philippine Stocks Index Fund CorpDokument1 SeitePhilippine Stocks Index Fund CorptimothymaderazoNoch keine Bewertungen

- PRUlink Dana Urudana Urus 2 2011Dokument7 SeitenPRUlink Dana Urudana Urus 2 2011shadowz123456Noch keine Bewertungen

- QMU Underperformance in Fixed Income Markets IFS FINAL 3.22.12 ADADokument3 SeitenQMU Underperformance in Fixed Income Markets IFS FINAL 3.22.12 ADAPaulo AraujoNoch keine Bewertungen

- Liquid Money Guide For Banks, Corporates and SMEsDokument9 SeitenLiquid Money Guide For Banks, Corporates and SMEsSameer RastogiNoch keine Bewertungen

- JPM Weekly MKT Recap 5-14-12Dokument2 SeitenJPM Weekly MKT Recap 5-14-12Flat Fee PortfoliosNoch keine Bewertungen

- PLTVF Factsheet February 2014Dokument4 SeitenPLTVF Factsheet February 2014randeepsNoch keine Bewertungen

- Portfolio Management ReportDokument35 SeitenPortfolio Management Reportfarah_hhrrNoch keine Bewertungen

- 02 Jan 2014 Fact Sheet1Dokument1 Seite02 Jan 2014 Fact Sheet1faisaladeemNoch keine Bewertungen

- Jif - Final Report - Af07Dokument27 SeitenJif - Final Report - Af07Thu ThuNoch keine Bewertungen

- Muni Rally May Continue, But Must Navigate Policy RisksDokument3 SeitenMuni Rally May Continue, But Must Navigate Policy RisksPutnam InvestmentsNoch keine Bewertungen

- Conf Call TranscriptDokument28 SeitenConf Call Transcriptsandy_caponeNoch keine Bewertungen

- CCR Arbitrage Volatilité 150: Volatility StrategyDokument3 SeitenCCR Arbitrage Volatilité 150: Volatility StrategysandeepvempatiNoch keine Bewertungen

- Bond Market PerspectivesDokument5 SeitenBond Market PerspectivesdpbasicNoch keine Bewertungen

- Empower July 2011Dokument74 SeitenEmpower July 2011Priyanka AroraNoch keine Bewertungen

- 10YR Examination of Active Investment in Emerging Markets CA PDFDokument10 Seiten10YR Examination of Active Investment in Emerging Markets CA PDFTylerSVNoch keine Bewertungen

- 209652CIMB Islamic DALI Equity Growth FundDokument2 Seiten209652CIMB Islamic DALI Equity Growth FundazmimdaliNoch keine Bewertungen

- JSC Liberty Finance Factsheet - April 2014Dokument2 SeitenJSC Liberty Finance Factsheet - April 2014LibertySecuritiesNoch keine Bewertungen

- Rs. 1 Crore Rs. 4.5 Crores: NAFA Stock FundDokument23 SeitenRs. 1 Crore Rs. 4.5 Crores: NAFA Stock FundSohail HanifNoch keine Bewertungen

- Am Pan EPEDokument1 SeiteAm Pan EPEYeong Leong LimNoch keine Bewertungen

- Artko Capital 2018 Q4 LetterDokument9 SeitenArtko Capital 2018 Q4 LetterSmitty WNoch keine Bewertungen

- 2015 q1 Ivf Webcast With WatermarkDokument10 Seiten2015 q1 Ivf Webcast With WatermarkCanadianValue0% (1)

- CIMB Islamic Sukuk Fund MYR FFSDokument2 SeitenCIMB Islamic Sukuk Fund MYR FFSAbdul-Wahab Abdul-HamidNoch keine Bewertungen

- C O M P A N Y P R O F I L E: Achal Gupta Managing Director & Chief Executive OfficerDokument61 SeitenC O M P A N Y P R O F I L E: Achal Gupta Managing Director & Chief Executive OfficervipinkathpalNoch keine Bewertungen

- 29 Jan 2014 Fact Sheet1Dokument1 Seite29 Jan 2014 Fact Sheet1faisaladeemNoch keine Bewertungen

- Fund Period Dividend (RS.) Per Unit % of Par Value of Rs. 50/-FYTD Return Meezan Cash Fund (MCF)Dokument12 SeitenFund Period Dividend (RS.) Per Unit % of Par Value of Rs. 50/-FYTD Return Meezan Cash Fund (MCF)faisaladeemNoch keine Bewertungen

- Weekly Market Commentary: The One Big RiskDokument4 SeitenWeekly Market Commentary: The One Big Riskapi-234126528Noch keine Bewertungen

- 2012.07 RAM-Score Trending RecapDokument4 Seiten2012.07 RAM-Score Trending Recapdiane_estes937Noch keine Bewertungen

- 21 Aug 2013 Fact Sheet (Bisb)Dokument1 Seite21 Aug 2013 Fact Sheet (Bisb)faisaladeemNoch keine Bewertungen

- The Real Economy: Table 2.1 Sectoral GDP GrowthDokument4 SeitenThe Real Economy: Table 2.1 Sectoral GDP GrowthMd Saiful Islam KhanNoch keine Bewertungen

- 1476783934daily Market Commentary - October 18 2016Dokument2 Seiten1476783934daily Market Commentary - October 18 2016Md Saiful Islam KhanNoch keine Bewertungen

- Equity Note - Padma Oil Company LTDDokument2 SeitenEquity Note - Padma Oil Company LTDMd Saiful Islam KhanNoch keine Bewertungen

- Beximco Hy2014Dokument2 SeitenBeximco Hy2014Md Saiful Islam KhanNoch keine Bewertungen

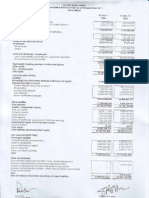

- 3rd Quarter Financial Statements 2011Dokument8 Seiten3rd Quarter Financial Statements 2011Md Saiful Islam KhanNoch keine Bewertungen

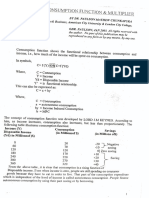

- Fundamental 1Dokument2 SeitenFundamental 1Md Saiful Islam KhanNoch keine Bewertungen

- ACKNOWLEDGMENT RECEIPT With UndertakingDokument1 SeiteACKNOWLEDGMENT RECEIPT With UndertakingwengmenciasNoch keine Bewertungen

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDokument2 SeitenForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryKrishna Chaitanya JonnalagaddaNoch keine Bewertungen

- ZTBL Annual ReportDokument64 SeitenZTBL Annual ReportHaris NaseemNoch keine Bewertungen

- Chapter 8 W13Dokument28 SeitenChapter 8 W13Joe JoyNoch keine Bewertungen

- Capricorn 30: A Secret Business ConferenceDokument2 SeitenCapricorn 30: A Secret Business ConferenceStarlingNoch keine Bewertungen

- H HJ KJHKJDokument15 SeitenH HJ KJHKJEmmanuel BatinganNoch keine Bewertungen

- A Project Report On: "Money & Banking"Dokument57 SeitenA Project Report On: "Money & Banking"Tasmay EnterprisesNoch keine Bewertungen

- Deposit Confirmation/Renewal AdviceDokument1 SeiteDeposit Confirmation/Renewal Adviceekta rajoriaNoch keine Bewertungen

- Psak 72 10 Minutes PDFDokument2 SeitenPsak 72 10 Minutes PDFMentari AndiniNoch keine Bewertungen

- Hire Purchase For Bcom and Nepal CADokument14 SeitenHire Purchase For Bcom and Nepal CANandani BurnwalNoch keine Bewertungen

- 1.what Is SAP Finance? What Business Requirement Is Fulfilled in This Module?Dokument163 Seiten1.what Is SAP Finance? What Business Requirement Is Fulfilled in This Module?sudhakarNoch keine Bewertungen

- Firma Solok Indah: DECEMBER, 2016 Debit Credit Vat-In Freight in Invoice NO Merchandise Inventory Account PayableDokument45 SeitenFirma Solok Indah: DECEMBER, 2016 Debit Credit Vat-In Freight in Invoice NO Merchandise Inventory Account PayableBento HartonoNoch keine Bewertungen

- Chapter 03Dokument13 SeitenChapter 03ClaraNoch keine Bewertungen

- Form 16 Part BDokument4 SeitenForm 16 Part BDharmendraNoch keine Bewertungen

- Jurnalratna Haryo Soni2016Dokument14 SeitenJurnalratna Haryo Soni2016hafizhmmNoch keine Bewertungen

- Federal RetirementDokument50 SeitenFederal RetirementFedSmith Inc.100% (1)

- Madhuban Bapudham SchemeDokument3 SeitenMadhuban Bapudham SchemerahulNoch keine Bewertungen

- A Case Study of Luntian Multi-Purpose Cooperative in Barangay Lalaig, Tiaong, Quezon, Philippines: A Vertical Integration ApproachDokument8 SeitenA Case Study of Luntian Multi-Purpose Cooperative in Barangay Lalaig, Tiaong, Quezon, Philippines: A Vertical Integration ApproachJedd Virgo100% (2)

- Types of StrategiesDokument15 SeitenTypes of Strategiesmayaverma123pNoch keine Bewertungen

- Difference Types of Insurance Companies by Baqir SiddiqueDokument2 SeitenDifference Types of Insurance Companies by Baqir Siddiquem.bqairNoch keine Bewertungen

- Silabus Cgc. FixDokument5 SeitenSilabus Cgc. FixTeguh PurnamaNoch keine Bewertungen

- Inflation Instruments OpenGammaDokument4 SeitenInflation Instruments OpenGammadondan123Noch keine Bewertungen

- FICA Configuration Step by Step - SAP Expertise Consulting PDFDokument35 SeitenFICA Configuration Step by Step - SAP Expertise Consulting PDFsrinivaspanchakarla50% (6)

- Tax RatesDokument6 SeitenTax RatesStephany PolinarNoch keine Bewertungen

- Chapter 13Dokument67 SeitenChapter 13HugooNoch keine Bewertungen

- Principles of Macro Economics Part 4Dokument6 SeitenPrinciples of Macro Economics Part 4Duaa WajidNoch keine Bewertungen