Beruflich Dokumente

Kultur Dokumente

Accounting South Dakota Microbrewery Case

Hochgeladen von

Nỏ MôOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Accounting South Dakota Microbrewery Case

Hochgeladen von

Nỏ MôCopyright:

Verfügbare Formate

Accounting

South Dakota Microbrewery Case

Name: Nguyn Th Mai Anh. Phan Nht Nam Class: FB2-B. Teacher: L Tr My

***2012***

South Dakota Microbrewery Case

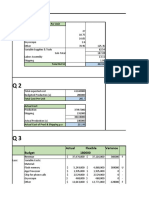

Question 1: a. Plant-wide allocation base system Predetermined overhead rate =

$116,750 7500 direct labor - hours

=$15.57 per direct labor-hours

Product cost estimate

Buffalo Ale Direct material cost (1) Direct labor cost (2) Direct labor hours(3) Predetermined overhead rate (4) Manufacturing Overhead cost (5) = (3) x (4) Total cost (6) = (1)+(2)+(5) Total bottles (7) Cost per bottle (8) = (6) / (7) 280.26 62.60 108.00 18 hrs Bismarck Bock 88.95 72.00 12 hrs $15.57 per DLH 186.84 202.41 Four Heads Stout 89.55 78.00 13 hrs

450.86 528 $0.85

347.79 384 $0.91

369.96 432 $0.86

b. Activity-based cost system The activity rates for the activity cost pools are: Activity Total activity volume (1) 2,910 7,500 82,700 3,740 4,850 229,920 Estimated cost (2) Activity rate (3)=(2)/(1)

Fermentation Days Direct Labor Hours Machine Hours Number of Orders Number of Quality Control Inspections Number of Bottles Produced

38,000 7,500 5,500 31,250 10,500 24,000

$13.06/day $1.00/hour $0.07/hour $8.36/order $2.16/time $0.10/bottle

Unit product cost applied to activity-based cost system:

Buffalo Ale Activity cost pool Activity Volume 3 18 110 2 5 528 Assigned cost 39.18 18.00 7.70 16.72 10.80 52.80 $145.20 Bismarck Bock Activity Volume 14 12 325 18 22 384 Assigned cost 182.84 12.00 22.75 150.48 47.52 38.40 $454.99 Four Heads Stout Activity Volume 4 13 135 9 8 432 Assigned cost 52.24 13.00 9.45 75.24 17.28 43.20 $210.41

Fermentation Days ($13.06/day) Direct Labor Hours ($1.00/hour) Machine Hours ($0.07/hour) Orders ($8.36/order) Quality Control ($2.16/time) Bottle ($0.10/bottle) Total manufacturing overhead cost

Direct material cost (1) Direct labor cost (2) Total Cost Number of bottles Cost per bottle

62.60 108.00 $315.80 528 $0.60

88.95 72.00 $614.94 384 $1.60

89.55 78.00 $377.96

432 $0.88

Question 2: Advantages and disadvantages of each system for SDM: The plant-wide allocationThe activity-based cost system based on direct labor hours Simple The estimated unit price is closely related to the real value Easy to calculate Advantages Applicable to big Applicable to small-sized companies with a smallcompanies with large number of product lines number of product lines Inaccurate becauseComplicated different products havecalculation on unit price different level of resource depreciation the estimated unit price does not reflect exactly the real value

Disadvantages

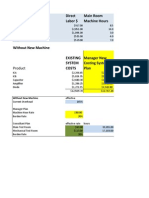

Question 3: 1. Plant-wide allocation base model

Buffalo Ale Expected batches sold (1) Number of Bottles per Batch (2) Expected Bottles sold (3) = (1) x (2) Cost per bottle Selling price per bottle (4) Net income per bottle Net income per product

Bismarck Bock

Four heads Stout

250

120

120

528

384

432

132,000 $0.85 1.05 0.20 $26,400

46,080 $0.91 1.50 0.59 $27,187

51,840 $0.86 1.40 0.54 $27,994

Total net income = $26,400 + $27,187 + $27,994 = $81,514

2. ABC model Buffalo Ale Expected batches sold (1) Number of Bottles per Batch (2) Expected Bottles sold (3) = (1) x (2) Cost per bottle Selling price per bottle (4) Net income per bottle Product margin Bismarck Bock Four heads Stout

250

120

120

528

384

432

132,000 $0.60 1.05 0.45 $59,400

46,080 $1.60 1.50 (0.1) $(4,608)

51,840 $0.88 1.40 0.52 $26,957

Total net income = $59,400 $4,608 + $26,957 = 81,749 Question 4: What price should South Dakota Microbrewery charge for each of its three products? Justify your answer with supporting arguments and analysis. 1. Current situation Following the situation accordance with the information mentioned in the case, we have collected the data and the suggested solutions below - Buffalo Ale is sold primarily to bars in college town that quite large shipment and some beers prices are fluctuating substantially. Moreover, Ale prices have been decreased throughout the market. Therefore, $1.05 is a good price to the market. - When it comes to the second product, Bismarck Bock, we have found that there was no apparent market response to 10% increase in price of this beer. In addition, the selling price is lower than the cost. Hence, we might set a new price which is 15 or 20% higher

than former one. It should be

$1. 5 x120 % = = $1.64 per bottle. However, we have to 110 %

keep an eye on feedbacks from the market. We should make no change in the price of Four Heads Stout due to no related significant data and the price is in the practical and profitable level.

Question 5:

Product cost estimate using ABC model

Buffalo Ale Cost per bottle Selling price per bottle Product margin $0.60 $1.05 $0.45 Bismarck Bock $1.60 $1.50 ($0.1) Four heads Stout $0.88 $1.40 $0.52

- The given table shows the problem in pricing strategy of SDM that the selling price of Bismarck Bock is lower than the cost. Therefore, we should raise the price in order to prevent negative responses from the market. . - We should consider in reducing the quantity of Bismarck Bock produced. If there is no increase in demand from upscale restaurants and hotel, we may either reduce or maintain the current production capacity. Another reason is that the product margin of Bismarck Bock is quite low. . - It should be considered that there is a need to raise the Buffalo Ale quantity produced due to the following reasons: + There is a great demand from the bars with reasonable price in compliance with the majority of people. + Computed cost per bottle by using ABC model is lower than traditional one. Additionally, it has the lowest cost compared with the two others. - We must not reduce the fund for the activities such as quality control, fermentation day because it can affect the quality of the product.

Das könnte Ihnen auch gefallen

- South Dakota Microbrewery CaseDokument6 SeitenSouth Dakota Microbrewery Casecuruaxitin60% (5)

- Case Study South Dakota MicrobreweryDokument1 SeiteCase Study South Dakota Microbreweryjman02120Noch keine Bewertungen

- Costing Systems Reveal True Product MarginsDokument1 SeiteCosting Systems Reveal True Product Marginsfelipevwa100% (1)

- Economic Impact of Oakland Athletics Ballpark at Howard TerminalDokument13 SeitenEconomic Impact of Oakland Athletics Ballpark at Howard TerminalZennie AbrahamNoch keine Bewertungen

- Case ReichardDokument23 SeitenCase ReichardDesiSelviaNoch keine Bewertungen

- Seligram Summary DetailsDokument6 SeitenSeligram Summary DetailsSachin MailareNoch keine Bewertungen

- Case Case:: Colorscope, Colorscope, Inc. IncDokument4 SeitenCase Case:: Colorscope, Colorscope, Inc. IncBalvinder SinghNoch keine Bewertungen

- Group 7 - Excel - Destin BrassDokument9 SeitenGroup 7 - Excel - Destin BrassSaumya SahaNoch keine Bewertungen

- Siemens Electric Motor WorksAQ PDFDokument3 SeitenSiemens Electric Motor WorksAQ PDFHashirama SenjuNoch keine Bewertungen

- Danshui PlantDokument2 SeitenDanshui PlantYAKSH DODIANoch keine Bewertungen

- Destin BrassDokument5 SeitenDestin Brassdamanfromiran100% (1)

- Hallstead Jewelers Breakeven AnalysisDokument7 SeitenHallstead Jewelers Breakeven Analysisanon_839867152Noch keine Bewertungen

- Color ScopeDokument10 SeitenColor Scopedharti_thakare100% (1)

- Cost Accounting ReportDokument12 SeitenCost Accounting ReportSYED WAFINoch keine Bewertungen

- Davey Brothers Watch Co. and Classic Pen Company Case AnalysisDokument4 SeitenDavey Brothers Watch Co. and Classic Pen Company Case Analysisabhishek pattanayakNoch keine Bewertungen

- Accounting Seligram CaseDokument2 SeitenAccounting Seligram CaseNadia Iqbal100% (1)

- Dentin Brass Case Study3Dokument13 SeitenDentin Brass Case Study3Hosein Rahmati100% (2)

- Bridgeton HWDokument3 SeitenBridgeton HWravNoch keine Bewertungen

- Boston Creamery Variance Analysis Reveals $71K Profit GainDokument9 SeitenBoston Creamery Variance Analysis Reveals $71K Profit GainwahyuNoch keine Bewertungen

- 29 Purity Steel Compensation Plan AnalysisDokument7 Seiten29 Purity Steel Compensation Plan Analysisfajarina ambarasariNoch keine Bewertungen

- Seligram, IncDokument5 SeitenSeligram, IncAto SumartoNoch keine Bewertungen

- Stuart DawDokument3 SeitenStuart DawHarsh SoniNoch keine Bewertungen

- HKUST ACCT 521 Assignment 2 Activity Based CostingDokument4 SeitenHKUST ACCT 521 Assignment 2 Activity Based CostingSilvia WongNoch keine Bewertungen

- Group 3 - Canonical (Eldorado Electronics)Dokument5 SeitenGroup 3 - Canonical (Eldorado Electronics)chelsea1989Noch keine Bewertungen

- Cafe Monte BiancoDokument21 SeitenCafe Monte BiancoWilliam Torrez OrozcoNoch keine Bewertungen

- Dave BrothersDokument6 SeitenDave BrothersSangtani PareshNoch keine Bewertungen

- Prestige Telephone Company SlidesDokument13 SeitenPrestige Telephone Company SlidesHarsh MaheshwariNoch keine Bewertungen

- Colorscope 1Dokument6 SeitenColorscope 1Andrew NeuberNoch keine Bewertungen

- MA Session 5 PDFDokument35 SeitenMA Session 5 PDFArkaprabha GhoshNoch keine Bewertungen

- Classic Pen CompanyDokument9 SeitenClassic Pen Companyabhay_prakash_ranjanNoch keine Bewertungen

- Variable Cost Structure and Budget AnalysisTITLECost Variance Analysis for Phone ProductionTITLECalculation of Material and Labor VariancesDokument6 SeitenVariable Cost Structure and Budget AnalysisTITLECost Variance Analysis for Phone ProductionTITLECalculation of Material and Labor VariancesArindam MandalNoch keine Bewertungen

- Destin Brass Costing ProjectDokument2 SeitenDestin Brass Costing ProjectNitish Bhardwaj100% (1)

- Wilkerson Company Break Even Analysis for Multi-product SituationDokument5 SeitenWilkerson Company Break Even Analysis for Multi-product SituationYAKSH DODIANoch keine Bewertungen

- ACCY 302 Danshui Plant Budget AnalysisDokument1 SeiteACCY 302 Danshui Plant Budget Analysisptanoy8Noch keine Bewertungen

- Balakrishnan MGRL Solutions Ch14Dokument36 SeitenBalakrishnan MGRL Solutions Ch14Aditya Krishna100% (1)

- WALTHAMDokument2 SeitenWALTHAMSam SkfNoch keine Bewertungen

- Des Tin BrassDokument7 SeitenDes Tin Brassfundu123100% (9)

- Johnson Beverage Implements Activity-Based CostingDokument4 SeitenJohnson Beverage Implements Activity-Based CostingShouib MehreyarNoch keine Bewertungen

- Seligram Case QuestionsDokument2 SeitenSeligram Case QuestionsZain Bharwani100% (1)

- Seligram Case Cost AccountingDokument3 SeitenSeligram Case Cost Accountingsharkss521Noch keine Bewertungen

- Analysis of PolysarDokument84 SeitenAnalysis of PolysarParthMairNoch keine Bewertungen

- Hospital SupplyDokument3 SeitenHospital SupplyKate BurgosNoch keine Bewertungen

- Outsourcing Manifold ProductionDokument8 SeitenOutsourcing Manifold Productionaliraza100% (2)

- Chapter 14 SolutionsDokument35 SeitenChapter 14 SolutionsAnik Kumar MallickNoch keine Bewertungen

- Anagene Case StudyDokument1 SeiteAnagene Case StudySam Man0% (3)

- 05 Wilkerson Company Solution - StudentsDokument9 Seiten05 Wilkerson Company Solution - StudentsVinyabhooshan Bajpai PGP 2022-24 Batch100% (1)

- Berkshire Toy CompanyDokument25 SeitenBerkshire Toy CompanyrodriguezlavNoch keine Bewertungen

- Ajax Manufacturing Cost AnalysisDokument7 SeitenAjax Manufacturing Cost Analysisreva_radhakrish1834Noch keine Bewertungen

- Seligram 2Dokument4 SeitenSeligram 2Yvette YuanNoch keine Bewertungen

- Colorscope IncDokument14 SeitenColorscope IncShashi ShekharNoch keine Bewertungen

- Sharing Sheet Hallstead JewelersDokument11 SeitenSharing Sheet Hallstead JewelersHarpreet SinghNoch keine Bewertungen

- Dakota Office ProductsDokument10 SeitenDakota Office ProductsMithun KarthikeyanNoch keine Bewertungen

- Unitron CorporationDokument7 SeitenUnitron CorporationERika PratiwiNoch keine Bewertungen

- Davey Brothers Case ScenariosDokument6 SeitenDavey Brothers Case ScenariosBhavik LodhaNoch keine Bewertungen

- South Dakota Microbrewery Pricing StrategyDokument6 SeitenSouth Dakota Microbrewery Pricing StrategySana Khan100% (1)

- Kunci Jawaban Bab 5 Manajemen BiayaDokument10 SeitenKunci Jawaban Bab 5 Manajemen BiayaMuhammad Faggih Tjanaba100% (4)

- TUTORIAL 7 Answers Questions PDFDokument8 SeitenTUTORIAL 7 Answers Questions PDFGareth Tan Jiawen0% (1)

- Blanchard Importing PPC CaseDokument24 SeitenBlanchard Importing PPC CaseJo James100% (1)

- All But 7Dokument6 SeitenAll But 7bestmoosena100% (2)

- Briefly Speaking IncDokument21 SeitenBriefly Speaking IncdavidNoch keine Bewertungen

- Introduction To Operations and Supply Chain ManagementDokument42 SeitenIntroduction To Operations and Supply Chain Managementdiyaalkhazraji1290% (1)

- TLE 6 First Quarter Summative With TOSDokument9 SeitenTLE 6 First Quarter Summative With TOSjuvy0% (1)

- Seamless Fully Fashioned Clothing Their Advantages DisadvantagesDokument2 SeitenSeamless Fully Fashioned Clothing Their Advantages DisadvantagesHarleen Kaur100% (1)

- MIGMax 140 WelderDokument32 SeitenMIGMax 140 WelderVooDooJake100% (1)

- Chapter7f EmarketingDokument57 SeitenChapter7f EmarketingNishant Sharma100% (1)

- Handicap Clothing ConversionDokument5 SeitenHandicap Clothing Conversionaccessaudio100% (4)

- MaheshwariDokument1 SeiteMaheshwarisrajendr200Noch keine Bewertungen

- CA6000Dokument195 SeitenCA6000juan_cvb848326Noch keine Bewertungen

- Stock Sled ReportDokument744 SeitenStock Sled ReportGeorge OsumanNoch keine Bewertungen

- My Tesco ThesisDokument3 SeitenMy Tesco Thesisirfan sNoch keine Bewertungen

- Goods and Services Tax (GST) in India: A Presentation by KRISHNA SHUKLADokument30 SeitenGoods and Services Tax (GST) in India: A Presentation by KRISHNA SHUKLAKrishna ShuklaNoch keine Bewertungen

- Business PlanDokument16 SeitenBusiness PlanHamid Asghar100% (1)

- HRM Issues in RetailDokument34 SeitenHRM Issues in RetailJoginder Singh ChandnaniNoch keine Bewertungen

- ITC's Diversified Business Model and Global ContributionDokument7 SeitenITC's Diversified Business Model and Global ContributionabhipankajNoch keine Bewertungen

- CrusherDokument22 SeitenCrusherRandom House TeensNoch keine Bewertungen

- AC V For Fast Food RestaurantsDokument4 SeitenAC V For Fast Food Restaurantselijah namomoNoch keine Bewertungen

- Trade Magazine PDFDokument5 SeitenTrade Magazine PDFTejaswi BandlamudiNoch keine Bewertungen

- Cooking Methods BrochureDokument2 SeitenCooking Methods Brochureapi-392216729Noch keine Bewertungen

- Walmart Case Study On Strategic ManagementDokument4 SeitenWalmart Case Study On Strategic ManagementSwati Goyal Sethi50% (4)

- MY23PG Microwave OvenDokument20 SeitenMY23PG Microwave OvenAhmed MostafaNoch keine Bewertungen

- Company Profile DMA UpdateDokument8 SeitenCompany Profile DMA UpdateYandi RaifaNoch keine Bewertungen

- 64 L 00.00-34 Method Pesticides PCBsDokument62 Seiten64 L 00.00-34 Method Pesticides PCBsRojison Koshy100% (1)

- A Presentation By: Prof. Thadeus Abilla, CPADokument52 SeitenA Presentation By: Prof. Thadeus Abilla, CPApamela_pardo_3Noch keine Bewertungen

- Zara AnalyticsDokument9 SeitenZara AnalyticsNiti Modi ShahNoch keine Bewertungen

- Ripcords Tennis Ball TrebuchetDokument0 SeitenRipcords Tennis Ball TrebuchetEduardo HirtNoch keine Bewertungen

- Physical Distribution SystemDokument6 SeitenPhysical Distribution Systemhinasaxena100% (1)

- Associate Director Customer Operations in San Diego CA Resume Laura LairdDokument3 SeitenAssociate Director Customer Operations in San Diego CA Resume Laura LairdLauraLaird2Noch keine Bewertungen

- Jerry Bickell Race Cars 2002 - Catalog - Part - 1Dokument42 SeitenJerry Bickell Race Cars 2002 - Catalog - Part - 1wordpower777Noch keine Bewertungen

- Polar Adidas Case Study The Most ImportantDokument5 SeitenPolar Adidas Case Study The Most ImportantBlabla100% (1)

- Wc565176@ssu - Edu: Bob & Dorie Sheldon 420 Walker Road Great Falls, VA 22066 703-819-7515 Cell/textDokument3 SeitenWc565176@ssu - Edu: Bob & Dorie Sheldon 420 Walker Road Great Falls, VA 22066 703-819-7515 Cell/textDaniel FioreNoch keine Bewertungen