Beruflich Dokumente

Kultur Dokumente

Retirement of A Partner

Hochgeladen von

piyushn_7Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Retirement of A Partner

Hochgeladen von

piyushn_7Copyright:

Verfügbare Formate

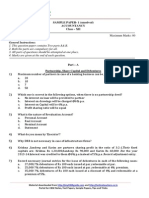

RETIREMENT OF A PARTNER

QUESTION 1: X, Y and Z are the partners sharing profits and losses in the ratio 3:2:1. Their balance sheet as on 31/03/2011 was as under.

LIABILITIES Partners capital: X Y Z General reserve Creditors

AMOUNT

ASSETS Premises

AMOUNT 240000 120000 102000 89000 84000

360000 Machinery 240000 Furniture 120000 Investment in shares 42000 Stock 54000 Debtors Less: provi 96000 (3000)

93000 24000 106000

Bills payable Outstanding exp

36000 Bills receivable 6000 Bank

Additional information: 1) On 1st April 2011, Mr.Y retired. The following adjustments were agreed upon. 2) Goodwill for the purpose of retirement to be valued and raised at Rs. 60000. 3) Investments were sold at a price of Rs. 126000. 4) 40% of the debtors and 60% of bills receivable were collected allowing a discount at 2%. 5) All the receivables are considered good and recoverable. 6) Appreciate property @ 5% and depreciate machinery @ 10%. 7) The account of the retiring partner was settled by a cheque for the necessary amount. In case of need, bank was to grant overdraft. Prepare journal, necessary ledger accounts and balance sheet after Ys retirement. QUESTION 2:

A, B and C are the partners sharing profit and losses in the ratio 5:3:2. On 31st March, 2011 their balance sheet was as under: LIABILITIES Capital Accounts: A B C Current accounts: A B C Profit and loss account 12% bank loan AMOUNT ASSETS Premises 250000 Furniture 150000 Vehicles 100000 Investments Stock 27000 Debtors 65000 62900 17100 2000 AMOUNT

- Less: provi (2100) 13000 Bills receivable 18000 Prepaid insurance 45000 Current a/c: b

7000 28000

Creditors Bills payable Advance from customer

72000 Bank 36000 5000

Additional information: On 1st april2011, Mr.C retired. Thereafter A and B would share profits and losses equally. The following are the adjustments: 1) Maintain provision for doubtful debts at 4% on debtors. 2) Advance from customers was received at 20% of the value of the order placed. This order was executed on 31/03 but the same remains unrecorded. We generally earn a

profit at 30% on selling price and the amount of stock was on basis of accounting entries. 3) Mr. C. agreed to retain Rs.75000 as his loan with the firm and the balance had to be paid to settle the accounts. Mr. C loans shall be entitled to interest of 15% p.a. 4) Goodwill of the firm which is to be raised and written off is valued at Rs.50000. 5) Mr.B shall bring in further capital of Rs.115000. 6) An unrecorded liability of interest payable on bank loan Rs.1500 is to be accounted for. QUESTION 3: P, Q and R are the partners sharing profits and losses in the ratio 4:3:2. Their balance sheet as on 31/03/2011 was as under. LIABILITIES Capital A/C: P Q R Current A/C: P Q General reserve AMOUNT Goodwill 240000 Premises 180000 Machinery 120000 Furniture Vehicles 9000 Investments 6300 Stock 36000 Debtors (less provision @ 10 %) 180000 15% bank loan Creditors Bills payable 108000 Bills receivable 54900 Bank balance 27900 Current a/c: R Outstanding expenses 7200 18000 81000 10800 ASSETS AMOUNT 36000 117000 45000 40500 108000 72000 81000

Additional information:

1) On the date of the balance sheet Mr.Q retired for this purpose, goodwill is to be revalued at Rs.63000. It is also decided that the goodwill of the firm shall be written off totally. 2) 10% general reserve is to be utilized for creating works men compensation fund. 3) Maintain provision for doubtful debts at Rs.24500. 4) Depreciate furniture by 10%. 5) Mr.Q could be paid only 40% of the amount due to him and the balance was transferred to his loan account. Loan was to be repaid in 3 equal half yearly installments. The 1st installment shall fall due on 30/9/11. Mr. P and Mr. R introduced further total capital of Rs. 150000 in their new PSR. 6) One of the creditors having a balance of Rs. 18000 was settled by a cheque of Rs.17100. Prepare necessary ledger accounts and balance sheet. DEATH OF A PARTNER QUESTION 1: Jay, Ajay and Vijay are the partners sharing profits and losses in the ratio 3:2:1. Their balance sheet as on 31/03/2011 is as under.

LIABILITIES Capital accounts: Jay Ajay Vijay

AMOUNT Premises 324000 Furniture 240000 Vehicles

ASSETS

AMOUNT 114000 216000 210000

186000 Investments (900 shares) 135000

General reserve Bank loan

24000 Stock 48000 Debtors 105000

66000

Less: provision (6300) 98100 Creditors Less: 96000 Bills receivable Advertisement to the 36000

provisionfor(3000)discount Bills payable

93000 extent not W/O 36000 Bank balance

21000 54300

Additional information: 1) On the date of balance sheet, Vijay died and the following adjustments were carried out. a) Appreciate premises by 5%. b) All debtors are considered good and recoverable. c) Our acceptance of Rs.9000 could not be honored and noting charges amounted to Rs. 450. d) 80% investments were sold at Rs.210 per share. The brokerage is already deducted from the selling price. e) 30% debtors and 70% of bills receivables were collected at face value. f) Another loan was taken from a bank at an interest rate of 18% p.a. of Rs.36000. g) Prepaid insurance of Rs.1800 is to be brought to books of accounts. h) Recently, the business does not earn any discount from the creditors. Therefore it was decided to write off provision for discount on creditors. i) The legal heir of the dead partner shall be entitled to balance of capital, revaluation results and share in goodwill. For this purpose, goodwill of the firm is to be valued at Rs.108000. Raise and write off goodwill. j) Goodwill account should not be used. Prepare necessary ledger accounts assuming that Sanjay, the legal heir of Vijay was paid the amount in full. Also prepare balance sheet. QUESTION 2: Anil, Sunil and Nikhil are the partners sharing profits and losses in the ratio 4:3:2. Their balance sheet as on 31/03/2010 was as under.

LIABILITIES

AMOUNT

ASSETS

AMOUNT

Partners capital: Anil Sunil Nikhil

Freehold premises 227500 Machinery 154600 Furniture 108900 Investments in shares

117000 81000 72900

63000 General reserve 10% bank loan Creditors Bills payable Pre received rent O/S expenses 36900 Stock 45000 Debtors 63000 Bills receivable 36000 Bank balance 9000 4500 81900 198000 31500 40100

Additional information: On 31/03/2010, Sunil expired and the following adjustments were made. 1) According to the partnership deed, legal heir of the dead partner shall be entitled to: a) Capital balance. b) Share in undistributed profits. c) Share in goodwill of the firm. d) Share in revaluation results. e) Share in proportionate profits till the date of death. 2) The following points of revaluations were agreed upon: a) Property to be appreciated to 120% of book value. b) Stock stands undervalued by 10%. c) Create provision for doubtful debts at Rs.4600. d) Depreciate furniture by 5%. e) Goodwill of the firm is to be valued at 3years purchase of average profit of last 5 years. The profits of last 5 years were; 2009-2010 - 117000

2008-2009 - 135000 2007-2008 - 180000 2006-2007 - 108000 2005-2006 - loss of Rs.45000 3) According to the partnership deed, in case of death during the year, the outgoing partners claim in proportionate profit shall be calculated on the basis of the average profits of the preceding 3years. 4) Prepare necessary ledger accounts and show the working of calculation of goodwill and proportionate share in the profit till the date of death assuming that the claim of the legal heir of Mr.Sunil is to be settled in 4 equal quarterly installments+ interest @ of 12% p.a. starting from 31/03/11. QUESTION NO.3: Vijay, Vinay and Nayan are the partners sharing profits and losses equally. Their partnership deed gives the following details. a) Partners shall be allowed interest on capital at 10% p.a. b) Interest on drawings shall be charged at 10% p.a. c) Vinay shall be allowed salary at Rs.1000/month. d) In case of death or any other circumstances leading to compulsory retirement, the dead partners shall be entitled to salary, interest and share in profit till the completion of the month of the mishappening. In the same situation interest on drawings shall not be charged for the month of mishappening. e) Mr.Nayan died on 13th august, 2010. Balance sheet as on 31/03/2010 was as under:

LIABILITIES Capital accounts: Vijay Vinay Nayan

AMOUNT Goodwill 195000 Premises

ASSETS

AMOUNT 98000 144000 204000 96000

187000 Machinery 203000 Furniture

General reserve Creditors Bills payable

24600 Investments 72900 Stock 48000 Debtors 102000

81000 69000

Less: provi (4500)

97500 O/S expenses Bank O/D 6000 3000

Additional information: 1) For the purpose of amount payable to the dead partner on account of goodwill, goodwill of the firm is valued at Rs. 144000 being 60% of the average annual profit. Goodwill of the firm is written off completely. 2) Revaluation were: a) Premises be appreciated at 20%. b) Depreciate machinery by 10%. c) Entire general reserve is to be utilized for creating works men compensation fund. 3) During the period till the date of death, Vijay Vinay and Nayan withdrew Rs. 3000, Rs. 2000 and Rs. 5000 on the first of every month. 4) The legal heir of the dead partner shall be paid the amount in full immediately. For this a bank loan at 12% was taken to the extent of Rs.150000 and further capital was introduced by Vijay and Vinay at Rs.92000 and Rs.100000 respectively. You are required to prepare revaluation account, dead partners account, partners capital account, also show working in respect of share in goodwill, share in proportional profit till the date of death taking average profit as the base and calculation of amount of P&L account and that would appear in the profit and loss suspense account.

Das könnte Ihnen auch gefallen

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Von EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Bewertung: 4.5 von 5 Sternen4.5/5 (5)

- AccountDokument67 SeitenAccountchamalix100% (1)

- Sale of Partnership To A Limited CompanyDokument5 SeitenSale of Partnership To A Limited CompanyRonel Buhay100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionVon EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNoch keine Bewertungen

- HDFC Bank QuestionnaireDokument25 SeitenHDFC Bank QuestionnaireIesha GuptaNoch keine Bewertungen

- Extra AfaDokument5 SeitenExtra AfaJesmon RajNoch keine Bewertungen

- CBSE Class 12 Accountancy Sample Paper-01 (For 2013)Dokument7 SeitenCBSE Class 12 Accountancy Sample Paper-01 (For 2013)cbsestudymaterialsNoch keine Bewertungen

- Advance AccDokument8 SeitenAdvance AccjayaNoch keine Bewertungen

- 11 CaipccaccountsDokument19 Seiten11 Caipccaccountsapi-206947225Noch keine Bewertungen

- Module-2 Sample Question PaperDokument18 SeitenModule-2 Sample Question PaperRay Ch100% (1)

- AccountancyDokument18 SeitenAccountancyMeena DhimanNoch keine Bewertungen

- c2 Partnership ProblemsDokument6 Seitenc2 Partnership ProblemsSiva SankariNoch keine Bewertungen

- Accountancy June 2008 EngDokument8 SeitenAccountancy June 2008 EngPrasad C MNoch keine Bewertungen

- Class 12 Accountancy Solved Sample Paper 1 - 2012Dokument34 SeitenClass 12 Accountancy Solved Sample Paper 1 - 2012cbsestudymaterialsNoch keine Bewertungen

- Accountancy: Time Allowed: 3 Hours Maximum Marks: 80Dokument58 SeitenAccountancy: Time Allowed: 3 Hours Maximum Marks: 809chand3Noch keine Bewertungen

- Accountancy EngDokument8 SeitenAccountancy EngBettappa Patil100% (1)

- 9 Partnership Question 21Dokument11 Seiten9 Partnership Question 21kautiNoch keine Bewertungen

- Pccquestionpapers (2008)Dokument20 SeitenPccquestionpapers (2008)Samenew77Noch keine Bewertungen

- Monthly Test - Acc. Aug 2020Dokument5 SeitenMonthly Test - Acc. Aug 2020akash debbarmaNoch keine Bewertungen

- Class 12 Cbse Accountancy Sample Paper 2012 Model 2Dokument20 SeitenClass 12 Cbse Accountancy Sample Paper 2012 Model 2Sunaina RawatNoch keine Bewertungen

- TtryuiopDokument6 SeitenTtryuiopNAVEENNoch keine Bewertungen

- Accountancy (Accountancy (Accountancy (Accountancy (Delhi) Delhi) Delhi) Delhi)Dokument7 SeitenAccountancy (Accountancy (Accountancy (Accountancy (Delhi) Delhi) Delhi) Delhi)Bhoj SinghNoch keine Bewertungen

- Accountancy March 2008 EngDokument8 SeitenAccountancy March 2008 EngPrasad C M100% (2)

- Advanced Corporate AccountingDokument6 SeitenAdvanced Corporate Accountingamensinkai3133Noch keine Bewertungen

- Accountancy For Class XII Full Question PaperDokument35 SeitenAccountancy For Class XII Full Question PaperSubhasis Kumar DasNoch keine Bewertungen

- Accountancy Set 3 QPDokument6 SeitenAccountancy Set 3 QPKunal Gaurav100% (2)

- Advanced AccountancyDokument4 SeitenAdvanced AccountancyAbdul Lathif50% (2)

- CBSE Class 12 Accountancy Sample Paper-02 (For 2012)Dokument20 SeitenCBSE Class 12 Accountancy Sample Paper-02 (For 2012)cbsesamplepaperNoch keine Bewertungen

- Class 12 AccountsDokument5 SeitenClass 12 AccountsVishal AgarwalNoch keine Bewertungen

- Accounting ProblemsDokument9 SeitenAccounting ProblemsMukta MattaNoch keine Bewertungen

- SAMPLE PAPER-1 (Unsolved) Accountancy Class - XII: Time Allowed: 3 Hours Maximum Marks: 80Dokument6 SeitenSAMPLE PAPER-1 (Unsolved) Accountancy Class - XII: Time Allowed: 3 Hours Maximum Marks: 80AcHu TanNoch keine Bewertungen

- XII - Accy. QP - Revision-15.2.14Dokument6 SeitenXII - Accy. QP - Revision-15.2.14devipreethiNoch keine Bewertungen

- Worksheet - Retirement & DissolutionDokument4 SeitenWorksheet - Retirement & DissolutionYogesh AdhikariNoch keine Bewertungen

- 3hr Paper 4feb 2010Dokument3 Seiten3hr Paper 4feb 2010Bhawna BhardwajNoch keine Bewertungen

- Corporate Accounting QUESTIONSDokument4 SeitenCorporate Accounting QUESTIONSsubba1995333333100% (1)

- TRDokument15 SeitenTRBhaskar BhaskiNoch keine Bewertungen

- SUMMER HOLILDAYS HomeworkDokument33 SeitenSUMMER HOLILDAYS HomeworkLorem LoremNoch keine Bewertungen

- Acc Sample Paper 4 Typed by DhairyaDokument6 SeitenAcc Sample Paper 4 Typed by DhairyaMaulik ThakkarNoch keine Bewertungen

- Accounts..std 12Dokument3 SeitenAccounts..std 12Abhishek SharmaNoch keine Bewertungen

- Accountancy 12th SPSDokument4 SeitenAccountancy 12th SPSMahesh TandonNoch keine Bewertungen

- Sample Paper (Cbse) - 2009 Accountancy - XiiDokument5 SeitenSample Paper (Cbse) - 2009 Accountancy - XiiJanine AnzanoNoch keine Bewertungen

- Accounts Worksheet Ch-1 To 3Dokument3 SeitenAccounts Worksheet Ch-1 To 3Preetsahib SinghNoch keine Bewertungen

- 19696ipcc Acc Vol2 Chapter14Dokument41 Seiten19696ipcc Acc Vol2 Chapter14Shivam TripathiNoch keine Bewertungen

- MKGM Accounts Question Papers ModelDokument101 SeitenMKGM Accounts Question Papers ModelSantvana ChaturvediNoch keine Bewertungen

- CA Exam Preparatory Question AnswersDokument4 SeitenCA Exam Preparatory Question AnswersBhavye GuptaNoch keine Bewertungen

- Practice Paper 5 Class Xii AccountancyDokument8 SeitenPractice Paper 5 Class Xii AccountancyDinesh KumarNoch keine Bewertungen

- Accountancy Previous QuestionsDokument4 SeitenAccountancy Previous QuestionsmurthyNoch keine Bewertungen

- Prati AccountancyDokument2 SeitenPrati AccountancyMohan NjNoch keine Bewertungen

- ACCOUNTANCY - II MID - Quastion PaperDokument6 SeitenACCOUNTANCY - II MID - Quastion PaperveenaNoch keine Bewertungen

- Accountancy: Time Allowed: 3 Hours Maximum Marks: 80Dokument50 SeitenAccountancy: Time Allowed: 3 Hours Maximum Marks: 80Sidharth NahataNoch keine Bewertungen

- Bcom Semester Iii Accounts Mega Revision Cum Suggestion PDFDokument6 SeitenBcom Semester Iii Accounts Mega Revision Cum Suggestion PDFAvirup ChakrabortyNoch keine Bewertungen

- AccountDokument3 SeitenAccountSk SinghNoch keine Bewertungen

- 12th Accounts Partnership Test 15 Sept.Dokument6 Seiten12th Accounts Partnership Test 15 Sept.SGEVirtualNoch keine Bewertungen

- 12 Accountancy SQP 5Dokument13 Seiten12 Accountancy SQP 5KandaroliNoch keine Bewertungen

- Introduction To Partnership AccountsDokument20 SeitenIntroduction To Partnership Accountsanon_672065362100% (1)

- Questions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingDokument27 SeitenQuestions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingcasarokarNoch keine Bewertungen

- Kendriya Vidyalaya Sangathan, Delhi Region Pre-Board Examination 2020-21 Class XII - AccountancyDokument9 SeitenKendriya Vidyalaya Sangathan, Delhi Region Pre-Board Examination 2020-21 Class XII - Accountancyraghu monnappaNoch keine Bewertungen

- Cluster Centre MGM HSS: Prepared byDokument6 SeitenCluster Centre MGM HSS: Prepared bysharathk916Noch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNoch keine Bewertungen

- Zero Emission VehiclesDokument1 SeiteZero Emission Vehiclespiyushn_7Noch keine Bewertungen

- WPR MbaDokument1 SeiteWPR Mbapiyushn_7Noch keine Bewertungen

- Research Mobile Buying BEhaviour IRS - MBA GenDokument48 SeitenResearch Mobile Buying BEhaviour IRS - MBA Genpiyushn_7100% (1)

- Verbal Communication: Group 4: Submitted ToDokument13 SeitenVerbal Communication: Group 4: Submitted Topiyushn_7Noch keine Bewertungen

- Tri MeDokument2 SeitenTri Mepiyushn_7Noch keine Bewertungen

- 02.10, TST Prep Test 10, The Listening SectionDokument40 Seiten02.10, TST Prep Test 10, The Listening SectionAlejandro RuizNoch keine Bewertungen

- VP-DC-009 - e Way BillDokument1 SeiteVP-DC-009 - e Way BillTechnetNoch keine Bewertungen

- FFFFDokument45 SeitenFFFFĐào Quỳnh AnhNoch keine Bewertungen

- NCERT Solutions For Class 11th: CH 1 Introduction To Accounting AccountancyDokument36 SeitenNCERT Solutions For Class 11th: CH 1 Introduction To Accounting Accountancydinesh100% (1)

- Cfs NumericalsDokument12 SeitenCfs NumericalsNeelu AhluwaliaNoch keine Bewertungen

- Various Stages of Venture Capital FinancingDokument19 SeitenVarious Stages of Venture Capital Financingjoy9crasto100% (2)

- The Guardian UK - 14.03.2023?Dokument64 SeitenThe Guardian UK - 14.03.2023?Karla RibeiroNoch keine Bewertungen

- 4.1accruals Prepayments Lecture Notes Student Versio4nDokument6 Seiten4.1accruals Prepayments Lecture Notes Student Versio4nDarshna KumariNoch keine Bewertungen

- Cimb PaymentDokument2 SeitenCimb Payment振霖Noch keine Bewertungen

- Statement Bank MBBDokument13 SeitenStatement Bank MBBminyak bidara01Noch keine Bewertungen

- Sample Chapter5Dokument5 SeitenSample Chapter5zoltan2014Noch keine Bewertungen

- Abm Acctg2 Reading Materials 2019Dokument27 SeitenAbm Acctg2 Reading Materials 2019Nardsdel RiveraNoch keine Bewertungen

- Naveed Shahzad: ObjectiveDokument2 SeitenNaveed Shahzad: ObjectiveNaveed ShahzadNoch keine Bewertungen

- Test 1 Ma2Dokument15 SeitenTest 1 Ma2Waseem Ahmad Qurashi63% (8)

- SA2 SolvencyII 2016Dokument16 SeitenSA2 SolvencyII 2016ChidoNoch keine Bewertungen

- Prospect Theory - Bounded RationalityDokument57 SeitenProspect Theory - Bounded RationalityalishehzadNoch keine Bewertungen

- Maruti Suzuki 1Dokument55 SeitenMaruti Suzuki 1Saikat PaulNoch keine Bewertungen

- Company Name Changes As of May 302023Dokument256 SeitenCompany Name Changes As of May 302023krish659Noch keine Bewertungen

- Z XEb RUG5 R REHu 5 XyDokument89 SeitenZ XEb RUG5 R REHu 5 XysvkrocksNoch keine Bewertungen

- Memo On Turnover - SK PDFDokument2 SeitenMemo On Turnover - SK PDFFatima Mercado Alon50% (2)

- Case 2Dokument4 SeitenCase 2Chris WongNoch keine Bewertungen

- Inflation AssignmentDokument18 SeitenInflation AssignmentAmul Shrestha25% (4)

- Republic Act No. 3765 Truth in Lending ActDokument6 SeitenRepublic Act No. 3765 Truth in Lending ActMarc Geoffrey HababNoch keine Bewertungen

- HDFC Customer Preference & Attributes Towards Saving-AccountDokument50 SeitenHDFC Customer Preference & Attributes Towards Saving-Accountpmcmbharat264Noch keine Bewertungen

- MiniScribe Corporation - FSDokument5 SeitenMiniScribe Corporation - FSNinaMartirezNoch keine Bewertungen

- 24 Standard Costing and Variance AnalysisDokument12 Seiten24 Standard Costing and Variance AnalysisSafwan mansuriNoch keine Bewertungen

- Interim Order in Respect of Nirmal Infrahome Corporation LTDDokument24 SeitenInterim Order in Respect of Nirmal Infrahome Corporation LTDShyam SunderNoch keine Bewertungen

- Chapter 27: The Theory of Active Portfolio Management: Problem SetsDokument1 SeiteChapter 27: The Theory of Active Portfolio Management: Problem SetsMehrab Jami Aumit 1812818630Noch keine Bewertungen

- The Statutory Audit Report of ITC LTDDokument8 SeitenThe Statutory Audit Report of ITC LTDsvrbchaudhariNoch keine Bewertungen