Beruflich Dokumente

Kultur Dokumente

Rlic App Ecommunication Pdfrecieptgenerator Mail PDF Files TDSC STMT 2011-12 q3 Ablpi5301a Form16a 2012-13 q3

Hochgeladen von

143688Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Rlic App Ecommunication Pdfrecieptgenerator Mail PDF Files TDSC STMT 2011-12 q3 Ablpi5301a Form16a 2012-13 q3

Hochgeladen von

143688Copyright:

Verfügbare Formate

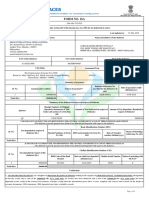

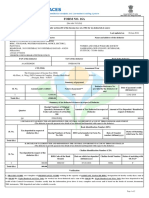

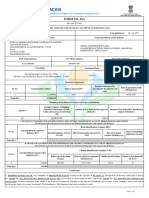

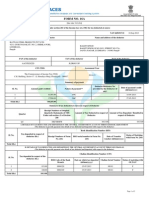

Tax Information Network of Income Tax Department

Certificate No.: SETQGI Last Updated 11/01/2012

FORM NO.16A

[See rule 31(1)(b)] Certificate under section 203 of the Income-tax Act, 1961 for Tax deducted at source Name and address of the Deductor RELIANCE LIFE INSURANCE COMPANY LIMITED 9TH & 10TH FLOOR R TECH PARK BUILDING NO 2, OFF W E HIGHWAY NIRLON COM GOREGAON E, MUMBAI MAHARASHTRA 400063 Name and address of the Deductee INSAN VARUN KUMAR VPO RANIA, SIRSA HARYANA 125076 Note : Name and address is as present in Income Tax PAN database. Apply for PAN change request to update details. PAN of the Deductor AADCA1410E CIT (TDS) The Commissioner of Income Tax (TDS) Room No. 900A 9th Floor K.G. Mittal Ayurvedic Hospital Building Charni Road Mumbai 400002 Summary of Payment Amount paid/credited ( ) 1,648.65 3,941.69 181.00 Nature of payment 194D - Insurance commission 194D - Insurance commission 194D - Insurance commission Date of payment/credit (dd/mm/yyyy) 25/10/2011 12/11/2011 28/12/2011 Status of Booking MATCHED MATCHED MATCHED TAN of the Deductor MUMR22066C Assessment Year From 2012-13 01/10/2011 31/12/2011 PAN of the Deductee ABLPI5301A Period To

Summary of tax deducted at source in respect of deductee Quarter Receipt Numbers of original quarterly statements of TDS under sub-section (3) of section 200 KKSXCZQG Amount of tax deducted in respect of the deductee ( ) 579.00 Amount of tax deposited/ remitted in respect of the deductee ( ) 579.00

Q3

I. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee) S. No. Tax Deposited in respect of the deductee ( ) ) N.A. Book Identification number (BIN) Receipt numbers of Form No. 24G DDO sequence Number in the Book Adjustment Mini Statement N.A. Date on which tax deposited (dd/mm/yyyy) Status of Booking

Total (

II. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN (The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee S. No. Tax Deposited in respect of the deductee ( ) 165.00 395.00 Challan Identification number (CIN) BSR Code of the Bank Branch 0510308 0510308 Date on which tax deposited (dd/mm/yyyy) 05/11/2011 07/12/2011 Challan Serial Number 1212 5773 Status of Booking

1 2

MATCHED MATCHED

Page 1 of 2

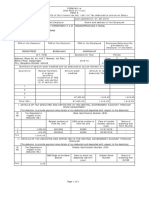

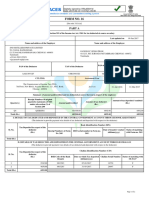

Tax Information Network of Income Tax Department

TAN of the Deductor MUMR22066C PAN of the Deductee ABLPI5301A Assessment Year 2012-13 Quarter Q3

Certificate No.: SETQGI

Last Updated 11/01/2012

II. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN (The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee S. No. Tax Deposited in respect of the deductee ( ) 19.00 ) 579.00 Verification I, VAIBHAV KABRA, son/daughter of RADHESHYAM KABRA working in the capacity of AVP (designation) do hereby certify that a sum of ( ) 579.00 [Rupees Five Hundred Seventy Nine only] has been deducted and a sum of ( ) 579.00 [Rupees Five Hundred Seventy Nine only] has been deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the books of account, documents, TDS statements, TDS deposited and other available records. Place Date MUMBAI 12/01/2012 Signature of person responsible for deduction of tax Challan Identification number (CIN) BSR Code of the Bank Branch 0510308 Date on which tax deposited (dd/mm/yyyy) 07/01/2012 Challan Serial Number 2211 Status of Booking

3 Total (

MATCHED

Notes: 1.Form 16A is generated on the basis of the details provided in the quarterly TDS statement filed by deductor in TIN. 2.To update PAN details in Income Tax Department database, apply for 'PAN change request' through NSDL or UTITSL.

Signature Not Verified

Digitally signed by VAIBHAV RADHESHYAM KABRA Date: 2012.01.12 10:08:39 IST

Page 2 of 2

Das könnte Ihnen auch gefallen

- Form16Dokument5 SeitenForm16er_ved06Noch keine Bewertungen

- Proposed Record On Appeal-Pre Stipulation PDFDokument421 SeitenProposed Record On Appeal-Pre Stipulation PDFKenNoch keine Bewertungen

- Case Digest: Atty Ricafort V Atty BansilDokument3 SeitenCase Digest: Atty Ricafort V Atty BansilmavslastimozaNoch keine Bewertungen

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionVon EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNoch keine Bewertungen

- Form 16Dokument6 SeitenForm 16anon_825378560Noch keine Bewertungen

- UCSP Quarter Examination (2nd Quarter)Dokument9 SeitenUCSP Quarter Examination (2nd Quarter)GIO JASMINNoch keine Bewertungen

- Form 16Dokument2 SeitenForm 16SIVA100% (1)

- Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDokument2 SeitenForm No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceAnonymous glyBR9Noch keine Bewertungen

- Form 16 FormatDokument2 SeitenForm 16 FormatParthVanjaraNoch keine Bewertungen

- PNB vs. Independent Planters Assoc. Inc.Dokument2 SeitenPNB vs. Independent Planters Assoc. Inc.Dave UmeranNoch keine Bewertungen

- Samsung India Electronics Pvt. LTD.: Signature Not VerifiedDokument7 SeitenSamsung India Electronics Pvt. LTD.: Signature Not VerifiedGajendra Singh RaghavNoch keine Bewertungen

- The Mindanao Peace ProcessDokument81 SeitenThe Mindanao Peace ProcessRam Toledo100% (1)

- Legal Ethics Case Digest HWDokument7 SeitenLegal Ethics Case Digest HWGuia Jade BautistaNoch keine Bewertungen

- PP v. FontanillaDokument2 SeitenPP v. FontanillamenforeverNoch keine Bewertungen

- 038 - Spouses Perez v. HermanoDokument4 Seiten038 - Spouses Perez v. HermanoIhna Alyssa Marie Santos100% (1)

- Form No. 16: Part ADokument5 SeitenForm No. 16: Part APunitBeriNoch keine Bewertungen

- Form No.16A: Tax Information Network of Income Tax Department Certificate No.: GVVIPLDokument2 SeitenForm No.16A: Tax Information Network of Income Tax Department Certificate No.: GVVIPLcool_rdNoch keine Bewertungen

- Aaaco1111l Form16a 2011-12 Q3Dokument1 SeiteAaaco1111l Form16a 2011-12 Q3Pradnesh KulkarniNoch keine Bewertungen

- TdsDokument4 SeitenTdsSahil SheikhNoch keine Bewertungen

- Form 16A: Summary of Tax Deducted at Source in Respect of DeducteeDokument1 SeiteForm 16A: Summary of Tax Deducted at Source in Respect of DeducteeVinayak BadagiNoch keine Bewertungen

- Form 16A NewDokument2 SeitenForm 16A NewKovidh GoyalNoch keine Bewertungen

- Tax Applicable (Tick One) 2 8 1Dokument7 SeitenTax Applicable (Tick One) 2 8 1Gaurav BajajNoch keine Bewertungen

- Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDokument2 SeitenForm No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceAkshay DhawanNoch keine Bewertungen

- Form 16: Wipro LimitedDokument5 SeitenForm 16: Wipro Limiteddeepak9976Noch keine Bewertungen

- I. Details of Tax Deducted and Deposited in The Central Government Account Through Book EntryDokument34 SeitenI. Details of Tax Deducted and Deposited in The Central Government Account Through Book EntryAjay PandeyNoch keine Bewertungen

- Form 16Dokument22 SeitenForm 16Ajay Chowdary Ajay ChowdaryNoch keine Bewertungen

- FKMPS9021Q Q3 2016-17Dokument2 SeitenFKMPS9021Q Q3 2016-17Hannan SatopayNoch keine Bewertungen

- Form No. 16A: From ToDokument2 SeitenForm No. 16A: From ToMohammed MohieNoch keine Bewertungen

- Form 16 ADokument2 SeitenForm 16 Asatyampandey7986659533Noch keine Bewertungen

- (See Rule 37D) : Cit (TDS) Address City Pin Code . .Dokument2 Seiten(See Rule 37D) : Cit (TDS) Address City Pin Code . .Akshay RuikarNoch keine Bewertungen

- N/A AMRS16666G CGAPS6779N: Certificate Under Section 203 of The Income Tax-Act, 1961 For Tax Deducted at Source On SalaryDokument2 SeitenN/A AMRS16666G CGAPS6779N: Certificate Under Section 203 of The Income Tax-Act, 1961 For Tax Deducted at Source On SalaryZUHAIB ASHFAQNoch keine Bewertungen

- Form27d Applicable From 01.04Dokument2 SeitenForm27d Applicable From 01.04sudhrengeNoch keine Bewertungen

- Ahrpv0731f 2013-14Dokument2 SeitenAhrpv0731f 2013-14Shiva KumarNoch keine Bewertungen

- (See Rule 31 (1) (B) )Dokument2 Seiten(See Rule 31 (1) (B) )B RNoch keine Bewertungen

- Certificate No.:: Tax Deduction Account No. of The DeductorDokument8 SeitenCertificate No.:: Tax Deduction Account No. of The DeductorcmtssikarNoch keine Bewertungen

- ViewDokument2 SeitenViewVenkat JvsraoNoch keine Bewertungen

- "FORM NO.16B: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDokument1 Seite"FORM NO.16B: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceKKumar SantoshNoch keine Bewertungen

- 0.00 Verification: TotalDokument4 Seiten0.00 Verification: TotalKesava KesNoch keine Bewertungen

- Form 16a New FormatDokument2 SeitenForm 16a New FormatJayNoch keine Bewertungen

- BOHPxxxx5E Q3 2019-20Dokument2 SeitenBOHPxxxx5E Q3 2019-20Tamziul IslamNoch keine Bewertungen

- Form 16Dokument3 SeitenForm 16Bijay TiwariNoch keine Bewertungen

- Aayush JainDokument3 SeitenAayush Jaindingle2Noch keine Bewertungen

- FORM16Dokument5 SeitenFORM16sunnyjain19900% (1)

- Abdfa2602a Q2 2019-20 PDFDokument2 SeitenAbdfa2602a Q2 2019-20 PDFTarun AgarwalNoch keine Bewertungen

- ITR62 Form 15 CADokument5 SeitenITR62 Form 15 CAMohit47Noch keine Bewertungen

- Form No. 16A: From ToDokument2 SeitenForm No. 16A: From ToRajesh AntonyNoch keine Bewertungen

- Anspg5953f 2018-19Dokument3 SeitenAnspg5953f 2018-19virajv1Noch keine Bewertungen

- T D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19Dokument2 SeitenT D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19MinatiBindhaniNoch keine Bewertungen

- 14374752Dokument2 Seiten14374752Anshul MehtaNoch keine Bewertungen

- Form No. 16A: From ToDokument2 SeitenForm No. 16A: From ToNanu PatelNoch keine Bewertungen

- 2307 For EBS Private Individual Percenateg TaxDokument4 Seiten2307 For EBS Private Individual Percenateg TaxAGrace MercadoNoch keine Bewertungen

- Form 16 Excel FormatDokument4 SeitenForm 16 Excel FormatAUTHENTIC SURSEZNoch keine Bewertungen

- TDS CertificateDokument2 SeitenTDS CertificateJyoti MeenaNoch keine Bewertungen

- BIR PaymentDokument2 SeitenBIR Paymentachilles_0367% (15)

- Aaacl4159l Q3 2024-25Dokument3 SeitenAaacl4159l Q3 2024-25vbgrandvizagNoch keine Bewertungen

- (See Rule 31 (1) (B) ) : Printed From WWW - Incometaxindia.gov - in Page 1 of 2Dokument2 Seiten(See Rule 31 (1) (B) ) : Printed From WWW - Incometaxindia.gov - in Page 1 of 2Anonymous SMqp9rZuNoch keine Bewertungen

- Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDokument3 SeitenCertificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalarySvsSridharNoch keine Bewertungen

- Form 15CADokument4 SeitenForm 15CAManoj MahimkarNoch keine Bewertungen

- Form No 16Dokument2 SeitenForm No 16scorpio.vinodNoch keine Bewertungen

- A SimDokument4 SeitenA Simsana_rautNoch keine Bewertungen

- Form No. 16A: From ToDokument2 SeitenForm No. 16A: From ToAstro Shalleneder GoyalNoch keine Bewertungen

- 1 SdsdsdsdsDokument2 Seiten1 Sdsdsdsdsachilles_03Noch keine Bewertungen

- PrintTax14 PDFDokument2 SeitenPrintTax14 PDFarnieanuNoch keine Bewertungen

- Form16fy10 11Dokument3 SeitenForm16fy10 11atishroyNoch keine Bewertungen

- Form No 16Dokument3 SeitenForm No 16rsharma09170Noch keine Bewertungen

- 2551QDokument2 Seiten2551QCris David Moreno79% (14)

- Itr 62 Form 16Dokument4 SeitenItr 62 Form 16Hardik ShahNoch keine Bewertungen

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesVon EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNoch keine Bewertungen

- FULL TEXT - People vs. BongcarawanDokument9 SeitenFULL TEXT - People vs. BongcarawanSSNoch keine Bewertungen

- Contoh Case ReviewDokument6 SeitenContoh Case ReviewAqilahAzmi100% (1)

- Elliot Currie Su Left RealismDokument15 SeitenElliot Currie Su Left RealismFranklinBarrientosRamirezNoch keine Bewertungen

- Rosales vs. vs. New a.N.J.H. EnterprisesDokument19 SeitenRosales vs. vs. New a.N.J.H. EnterprisesJerome ArañezNoch keine Bewertungen

- Polity Study PlanDokument8 SeitenPolity Study Plansarwat fatmaNoch keine Bewertungen

- Sabitsana, Jr. vs. Villamor: VOL. 202, OCTOBER 4, 1991 435Dokument7 SeitenSabitsana, Jr. vs. Villamor: VOL. 202, OCTOBER 4, 1991 435Angelie FloresNoch keine Bewertungen

- Flynote: HeadnoteDokument6 SeitenFlynote: HeadnoteFrancis Phiri100% (1)

- Ais Sarbanes Oxley Act of 2002wfaDokument19 SeitenAis Sarbanes Oxley Act of 2002wfaLeslie Ann ArguellesNoch keine Bewertungen

- Assignment BelDokument5 SeitenAssignment Belpandya rajendraNoch keine Bewertungen

- Framing of SuitDokument2 SeitenFraming of SuitmonekaNoch keine Bewertungen

- 10%-CS005 - Kimolongit Box Culvert-Tender DocumentDokument124 Seiten10%-CS005 - Kimolongit Box Culvert-Tender Documentbest essaysNoch keine Bewertungen

- 10000022228Dokument302 Seiten10000022228Chapter 11 DocketsNoch keine Bewertungen

- P L D 1991 KARACHI (Different Cases)Dokument11 SeitenP L D 1991 KARACHI (Different Cases)Anonymous 16w0dovNoch keine Bewertungen

- Sarbananda SonowalDokument9 SeitenSarbananda SonowalHumanyu KabeerNoch keine Bewertungen

- The Insular LifeDokument12 SeitenThe Insular LifeAngelie BaccayNoch keine Bewertungen

- Contracts 2 1030LAW Week 2 OutlineDokument2 SeitenContracts 2 1030LAW Week 2 OutlineBrookeNoch keine Bewertungen

- What Is A Common Seal: ObjectivesDokument7 SeitenWhat Is A Common Seal: ObjectivesSakshiNoch keine Bewertungen

- Why The United Nations Is A Useless FailureDokument3 SeitenWhy The United Nations Is A Useless FailurevenuNoch keine Bewertungen

- OLC Equal Rights OpinionDokument38 SeitenOLC Equal Rights OpinionLaw&CrimeNoch keine Bewertungen

- Nellie Ohr - 8.13.2019 PDFDokument332 SeitenNellie Ohr - 8.13.2019 PDFWashington ExaminerNoch keine Bewertungen

- Please Tick As ApplicableDokument4 SeitenPlease Tick As ApplicableAnand ThackerNoch keine Bewertungen

- Title Iii Rights and Obligations Between Husband and WifeDokument4 SeitenTitle Iii Rights and Obligations Between Husband and WifeKim YvesNoch keine Bewertungen