Beruflich Dokumente

Kultur Dokumente

SFR 20020831 LNG

Hochgeladen von

Vidhu PrabhakarOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

SFR 20020831 LNG

Hochgeladen von

Vidhu PrabhakarCopyright:

Verfügbare Formate

ICRA RATING FEATURE

CREDIT ISSUES IN LNG PROJECTS

Background

Over the past decade or so, natural gas has emerged as a fuel of choice for power generation and also for various industrial applications, most notably the manufacture of fertilizers and petrochemicals. The advantages of natural gas relative to alternative hydrocarbon fuels emanate from its superior environment friendliness, higher thermal efficiencies (in power generation), and higher yields (in the manufacture of fertilizers). As for the power sector, the popularity of gas turbines here is attributable not only to their higher thermal efficiency, but also their lower capital costs, shorter gestation period, and ability to supply peaking power. Significantly, the prices of natural gas in India have been subsidised all along, and this has been one of the key contributors to the growth in demand for natural gas in recent times. However, this demand growth has been inhibited by supply-side limitations following stagnation in the indigenous production levels of natural gas, and this has necessitated a rationing of the existing supplies across different user segments, primarily the power and fertilizer segments. The outlook on indigenous production of natural gas is also not very encouraging in the context of the unmet demand for the fuel, which has spurred initiatives by Petronet LNG, British Gas and Shell towards importing natural gas in its liquid form, that is as liquefied natural gas (LNG). LNG projects involve the low-cost production of gas in countries with large proven reserves, its liquefaction, transportation through specialised LNG carriers, and finally regasification and transmission to the eventual user in the importing country. These projects are highly capital intensive, and are usually financed on a limited-recourse/non-recourse basis. The viability of an LNG project would primarily be dependent on its ability to supply LNG at a competitive price, which in turn would call for suitable structuring of the project to address the various risks that are inherent in any project finance transaction. The objective of this paper is to examine the emerging trends in the global LNG business, and identify the key credit risks that characterise the implementation of LNG projects in India.

Credit Issues in LNG Project

Characteristics of the Global LNG Business

The size of the global LNG market has increased considerably during the past three decades, notching up a compounded annual growth rate (CAGR) of 15% over the period. The growth in this business has largely been driven by the emergence of natural gas as the fuel of choice, and the opportunity the LNG route provides to countries for unlocking the value of large "stranded" gas reserves that are far in excess of their internal requirements. The global LNG business has evolved considerably over the past decade or so, and certain new trends have emerged in this business as discussed in the following sections.

ICRA Rating Feature

Credit Issues in LNG Project

Shortening of Supply Purchase Agreement Tenures During the initial years, the growth in the LNG business was driven by long-tenure (20-25 years) supply purchase agreements (SPAs), usually with price floors which provided stable revenues that supported the financing and construction of large LNG projects. These SPAs were usually characterised by take-or-pay provisions and liquidated damages clauses, which served to mitigate volume risks. The Asian financial crisis in 1998 however marked a turning point for LNG projects, as the economic downturn in the region triggered off a sharp drop in energy consumption, particularly in markets like Korea, which are large consumers of LNG. This event also brought into focus the fact that energy consumption adjusts itself to changes in economic conditions. Consequently, potential buyers of LNG, particularly those that had already built up a base load of LNG supply, started insisting on flexible purchase provisions in the SPAs so as to limit the long-term liabilities that come with 20/25-year SPAs. The development of such flexible contracts is expected to increase the scope of the LNG market. However, the credit implications for sellers of LNG are negative, as they would need to absorb a considerably higher degree of demand and pricing risks, while buyers would also be exposed to greater volatility in prices. Growing Spot Sales Another significant development in the global LNG business in recent times has been the growth of the spot market. The spot market for LNG has been slow to develop, given that most LNG projects were backed by long-term SPAs, and most LNG shipping capacity was associated with specific projects. The fact that the buyers generally owned and/or controlled tankers limited the availability of tankers for LNG spot sales. But the industry has seen a shift in the past few years, with several LNG suppliers having acquired LNG tankers that are being put into service on a short-term basis. Three new projects with excess capacityRasGas, Oman LNG, and Atlantic LNGhave been able to take advantage of favourable conditions in the US, Europe, and Asia to sell spot cargoes. Even traditional buyers of LNG under longterm SPAs, such as Korea, have recently needed spot cargoes during the winter to meet peak season heating needs. In the US, where gas supplies have been inadequate at timeseither because of production limitations or transmission constraintsto meet the growing requirements of the gas-fired power generation market, a spot market for LNG has become viable, especially during periods of high natural gas prices. The implication of this trend is that LNG would gradually become a traded commodity, and this would lead to the pricing being influenced by short-term demand-supply imbalances, and also speculative positions taken by LNG traders. Lower Capital Costs A significant development that augurs well for the development of the domestic LNG business is the progressive reduction in capital costs across the value chain, which has been brought about by changes and improvements in LNG technology. Improvements in refrigerant and liquefaction techniques have lowered the capital costs of these processes, and this is indicated by the fact that since 1988, nominal liquefaction capital costs have fallen from around US$550/tonne to around US$200 per tonne currently (Source: Oil and Gas Journal). Technological improvement has also resulted in an increase in the economic size of these liquefaction facilities from about 2 million tonnes per annum (tpa) to about 3.3 million tpa currently. The growth in LNG demand over the years has also spawned expansion projects of existing facilities such as Atlantic LNG, Oman LNG, and RasGas. These expansions have been achieved at marginal incremental costs and have further lowered the LNG production costs per tonne. Another positive development has been an almost 50% reduction in the capital costs of constructing LNG tankers during the past decade. Since 1997, the cost of constructing a 1,35,000 tonne LNG tanker has dropped from around US$225 million per vessel to around US$175 million. To some extent, this drop occurred during the Asian financial crisis, as Korean shipyards bid aggressively for dollar-denominated tanker construction contracts. The progressive decline in capital costs across the LNG value chain is clearly a major positive for a country like India, which is highly sensitive to energy prices.

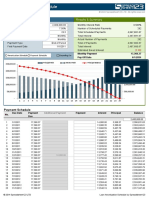

ICRA's Framework for Credit Evaluation of LNG Projects

The LNG business is highly capital intensive, with the value chain including four distinct components: production of natural gas; its liquefaction and storage; transportation; and finally, regasification and transmission. An estimation of the build-up of the capital costs and the estimated LNG delivery cost for a 5 million tpa value chain is presented in the following diagram.

ICRA Rating Services

www.icraindia.com

Page 2 of 7

ICRA Rating Feature

Credit Issues in LNG Project

Production

Liquefaction

Shipping

Regasification (Buyer Country)

Total

(Seller Country) Capital cost (billion) Delivery cost (US$/mBTU)

US$1.5-2

US$0.4

US$0.5

US$2.4-2.9

US$0.7-0.8

US$1.8-2

US$0.3

US$0.6-0.7

US$3.4-3.8

Source: Oil and Gas Journal, ICRA estimates

mBTU: Million British Thermal Units Delivery cost calculated assuming estimated variable costs, and a 12% return on capital investment.

As is evident from the preceding table, liquefaction operations comprise the most capital-intensive component of the overall LNG project. In the Indian context, the transportation of the regasified LNG to the end-user would be undertaken by the Gas Authority of India Limited (GAIL) or other gas distribution companies, although the LNG project may have to take on the responsibility of constructing the feeder pipeline network. Given the magnitude of the capital investment required to implement an LNG project, it is imperative that all elements of the chain be tied up simultaneously so as to ensure that these projects are bankable. India would be an importer of LNG, and hence the investments within the country would be restricted to setting up regasification terminals and the necessary natural gas evacuation infrastructure. Therefore, from here on, this paper focuses primarily on the credit issues related to the establishment of regasification terminals and gas evacuation infrastructure (the phrase "LNG project" would refer to this aspect). ICRAs framework for assessing the credit risk of an LNG project is based on an evaluation of various risks factors, which for analytical convenience, may be grouped under the following heads: Regulatory Risks Demand Risks Pricing Volatility Financial and Operating Strength of Sponsors Nature of Contractual Agreements Financial Structuring of the Project. Regulatory Risks The LNG business is exposed to regulatory risks, which affect the final delivered cost of gas to the endconsumer, and also to issues related to the transmission and distribution of gas. One of the key regulatory risk elements is the continuing uncertainty over the jurisdiction of the State and the Central Governments on various aspects of the gas transmission business. Such aspects include issues related to taxation, licensing of distribution rights, and the appointment of a regulatory body. The gas distribution business has characteristics of a natural monopoly, which has resulted in it being subject to a high degree of regulatory controls in most countries. In India too, the development of an effective gas transmission and distribution infrastructure requires the establishment of a fair and transparent regulatory framework. However, currently, there is considerable uncertainty over the appointment of a regulator, and the nature and extent of control it would exercise on issues related to: access to existing and proposed pipelines; issuance of licences for setting up pipeline projects; and fixing of tariffs for use of these pipelines. LNG projects need to use the gas distribution infrastructure set up by third parties to evacuate its gas and uncertainty over issues related to usage and pricing expose these projects to a certain amount of regulatory risks. The regulatory risks, in ICRAs opinion, would be lower for a project that has been able to enter into contractual arrangements with the existing pipeline owners like GAIL. Such arrangements would ensure that the costs and other terms and conditions of use are known with a fair degree of certainty. Demand Risks Currently, the demand for natural gas far outstrips supply. For instance, the National Thermal Power Corporation (NTPC), which is the largest consumer of natural gas in the country, has a gas linkage of only ICRA Rating Services www.icraindia.com Page 3 of 7

ICRA Rating Feature

Credit Issues in LNG Project

about 13 million standard cubic metres per day (mscmd) against an existing requirement of 17 mscmd, with the actual supplies being even lower. In the long run, estimates suggest that domestic production of natural gas is likely to level off at around 85 mscmd while the actual demand for the same would be in excess of 200 mscmd. The balance would necessarily have to be met through imports of LNG and transportation of piped gas from countries like Bangladesh. However, the primary issue is the price at which the projects would be able to deliver the product, and hence, the most important part of the risk assessment would involve a study of the price competitiveness of LNG vis--vis alternative fuels and its volatility Price competitiveness is also critical in view of the weak credit quality of most entities in the power sector and the increasing importance of variable costs of power generation under the Merit Order Dispatch system prescribed by the Electricity Regulatory Commissions. It is expected that coal will continue to be the most competitive fuel for power generation for plants located close to the pit-heads. In recent times, coal prices have also shown a fair degree of stability, with the annual rise limited to less than 5%. ICRA would, therefore, evaluate the competitiveness of LNG vis--vis coal, other liquid hydrocarbons like naphtha and low sulphur heavy stock (LSHS), and most importantly, natural gas in the long term. Natural gas and LNG are fuels that provide similar economic value to their end-consumers, and hence the pricing of these two would need to be correlated from the consumer's point of view. Natural gas prices are currently subsidised in India, unlike internationally, where natural gas and LNG command a price premium (on a British Thermal Unit, or BTU, basis) on the strength of superior emission characteristics and higher thermal efficiencies. The economics of LNG use, on a relative scale, would improve quite significantly as and when natural gas prices get aligned with international fuel oil prices, following which the price differential between natural gas and LNG would decrease substantially. The pricing of LNG would, however, need to take into consideration the cascading nature of State and Central Government taxes, and the charges for transportation from the importing facility to the endconsumer. All this would have a material bearing on the final delivery cost to the end-user. Pricing Volatility Various models are used for pricing LNG contracts, and these vary along a continuum from fixed pricing to one where the price floats in relation to the price of a basket of traded hydrocarbons, including crude oil. A completely floating price structure could however introduce a fairly high degree of volatility in LNG prices, and consequently, create instability in the cost structures for the primary user segments. An illustration of the impact of crude oil price volatility on LNG prices, urea production costs, and power tariffs for a freely floating price structure is presented in the following table. International Crude Price (US$/bbl) LNG price (US$/mmbtu) LNG price (Rs./000 SCM)Basic LNG price (Rs./000 SCM) Adjusted LNG price (Rs./tonne) LNG cost in power (Rs./unit) Existing coal cost (Rs./KWH) Natural gas cost in urea (Rs/tonne) Existing 1.5 2846 3623 4963 1.04 0.97 1449 14 2.3 4340 5495 7528 1.58 0.97 2198 18 3.0 5580 7049 9656 2.03 0.97 2820 22 3.7 6820 8602 11784 2.47 0.97 3441 26 4.3 8060 10156 13912 2.92 0.97 4062 30 5.0 9300 11709 16040 3.37 0.97 4684

Calculations do not include transportation charges within the country. The adjusted prices take into account existing royalty rates and a 16% sales tax. SCM: Standard Cubic Metres

The volatility could be further accentuated by rupee versus US dollar fluctuations. As mentioned earlier, the growth in demand for LNG would essentially be driven by the power sector, which faces severe constraints in passing on sharp fluctuations in variable costs to its end-users. Therefore, this sector would require a certain degree of stability in prices, irrespective of the movement of international hydrocarbon prices, so as to be able to use this fuel on a sustained basis. Accordingly, project sponsors would need to consider longterm fixed price structures, or floating structures with a floor and a cap, which would be designed to provide stability to the user's cost structure and also a minimum cash flow support to the project for meeting debt service obligations. Financial and Operating Strength of Sponsors Despite LNG projects in India being implemented on a non-recourse/limited recourse basis, the financial strength of the sponsors would have a significant bearing on the viability and credit worthiness of these projects. The LNG business is highly capital intensive, and one of the biggest barriers to entry is the raising of the capital needed to execute the project. Delays in raising resources or the inability to do so could lead to cost and time overruns, which could seriously impair the viability of the project. In such cases, the financial strength of the sponsor would be an important risk mitigant, as a strong parent may be able to ICRA Rating Services www.icraindia.com Page 4 of 7

ICRA Rating Feature

Credit Issues in LNG Project

bring in additional equity or subordinated debt to ensure that the project gets implemented according to schedule. The financial and operating strengths of the sponsors are also very important in mitigating some of the market risks, which the project may be exposed to. For instance, in certain cases a sponsor may extend its balance sheet to provide credit support to the operations if LNG prices fall to levels that cannot sustain servicing of debt. A case in point is the RasGas project at Qatar, where Exxon-Mobil, the primary sponsor, supported the project with a revolving US$200 million line of credit to be used if LNG prices drop too low to support debt servicing. Alternatively, in certain projects being implemented currently, the sponsors have underwritten the entire off-take from the project, thereby absorbing the full market risk. In such cases, if the construction risks can be suitably addressed through fixed-time, fixed-price contracts and the proper selection of an engineering, procurement and construction (EPC) contractor, the credit strength of the project could be positively impacted by the credit quality of its sponsors. Nature of Contractual Agreements The regasification component of the LNG value chain procures liquefied gas from the LNG seller, processes it and eventually sells it to the end-consumer, either directly or through certain intermediaries, like gas distribution companies. The nature of the SPA, which the LNG project signs with the seller, and the off-take agreement, which it signs with different end-users, determine its exposure to commodity price and volume risks. Usually, the SPAs are structured in a way so as to pass these risks to the buyer through takeor-pay provisions, liquidated damages, and price floors. This would however result in the buyer project taking on a disproportionately high level of price risk, which could be partially mitigated through the incorporation of suitable price cap provisions in the SPA. These projects would also enter into off-take agreements, either with end-users like the NTPC or with gas distribution intermediaries like GAIL. The credit quality of these counter-parties and the ability of the LNG project to pass on the volume, price and exchange rate risks through suitable covenants in the off-take or supply agreement would be a critical determinant of the credit risk profile of these projects. However, given the sensitivity of the end-users to LNG prices, these projects may not be able to transfer the complete price risk to the end-user although some credit enhancement may be available from the sponsors through off-take guarantees for absorbing a part of this risk. Another issue affecting the risk profile of these LNG projects is the nature of the shipping contract and the reliability and cost of the shipping arrangements. In most cases, LNG carriers are associated with individual LNG projects for long periods of time, and the shipping cost is a function of the distance between the buyer and the seller, the capital costs of the carrier, and the utilisation rate for the vessel. The project sponsors would need to specify in the shipping contract the key operating parameters and the penalties for deviations from the norms specified so as to mitigate some of the risks associated with the transportation operation. Financial Structuring of LNG Projects LNG projects, being capital intensive in nature, usually have highly leveraged capital structures. Further, given the adverse experience of institutional lenders in funding projects of this magnitude on a nonrecourse/limited recourse basis, the ability of these projects to achieve financial closure on a stand-alone basis would be limited. Therefore, these LNG projects would need to be suitably structured so as to transfer the risks embedded within themsuch as commodity pricing and volume risksto entities that may be better equipped to handle them. Some of the financial risks can be addressed by proper designing of the capital structure by creating senior-subordinated debt structures, having flexible debt amortisation schedules, and securing partial guarantees from highly-rated entities. Single-location projects such as these are also exposed to a number of force majeure risks, which can be partially mitigated through suitable property and casualty insurance contracts with financially strong insurance and reinsurance companies. ICRA believes that suitable structuring, using appropriate risk-management techniques, could partially mitigate some of the funding risks associated with LNG projects and increase their bankability.

Summing up

The emergence of natural gas as the preferred fuel for power generation and as a feedstock for industrial applications, together with the supply constraints, points towards considerable opportunities for appropriately structured LNG projects in India. The key credit risks characterising such projects arise from the capital-intensive nature of the LNG value chain, the sensitivity of prices to international hydrocarbon prices and exchange rate movements, the price-sensitive nature of demand, and counter-party credit risks. The demand for LNG would primarily be driven by the power sector, and thus, the fundamental viability of an LNG project would depend on its ability to create a pricing structure that would ensure a reasonable variable cost for power generation, relative to natural gas and other fuels. Further, the pricing formula would also need to ensure minimal variability because of fluctuations in the exchange rate (through suitable hedging techniques) and international crude prices. Cost competitiveness is all the more critical since LNG ICRA Rating Services www.icraindia.com Page 5 of 7

ICRA Rating Feature

Credit Issues in LNG Project

is a feedstock for a consumer sector with poor credit quality. A positive feature of the global LNG business has been the trend of declining capital costs, which has lowered the break-even price for the entire LNG value chain. Despite being funded on a non-recourse/limited recourse basis, an important credit issue for LNG projects would be the credit and operating strength of the sponsors, which could mitigate some of the key operating, financial and market risks that characterise the LNG business. The financial strength of the off-taker, and the terms of the off-take agreements in terms of take-or-pay provisions, price floors, and liquidated damages would also have a material impact on the eventual credit quality of LNG projects.

ICRA Rating Services

www.icraindia.com

Page 6 of 7

ICRA Rating Feature

Credit Issues in LNG Project

ICRA Rating Services

A Division of ICRA Limited

CORPORATE & REGISTERED OFFICE

NEW DELHI Kailash Building, 4th Floor 26, Kasturba Gandhi Marg, New Delhi 110001 Tel. : +(91 11) 335 7940-50 Fax : +(91 11) 335 7014, 3355293 Email : icrainfo@icraindia.com Website : www.icraindia.com Branches: Mumbai: Tel.: + (91 22) 4331046/53/62/74/86/87, Fax: + (91 22) 433 1390 Chennai: Tel + (91 44) 434 0043/9659/8080, 433 0724/ 3293/3294, Fax + (91 44) 434 3663 Kolkata: Tel + (91 33) 287 0450, 240 6617/8839, 280 0008, Fax + (91 33) 247 0728 Bangalore: Tel + (91 80) 559 7401/4049 Fax + (91 80) 559 4065 Ahmedabad: Tel + (91 79) 658 4924/5049/2008, Fax + (91 79) 658 4924 Hyderabad: Tel +(91 40) 373 5061/7251, Fax + (91 40) 373 5152 Chandigarh: Tel + (91 172) 743 776 882, Fax + (91 172) 746 068 Pune: Tel + (91 20) 552 0194/95/96, Fax + (91 20) 553 9231 Email: icrainfo@icraindia.com Website: www.icraindia.com

Copyright, ICRA Limited, 26 Kasturba Gandhi Marg, New Delhi - 110001 None of the Information contained in the publication may be copied or otherwise reproduced, repackaged, further transmitted, disseminated, redistributed, or resold, or stored for subsequent use for any such purpose, in whole or in part, in any form or manner or by means whatsoever, by any person without ICRA's prior written permission.

ICRA Rating Services

www.icraindia.com

Page 7 of 7

Das könnte Ihnen auch gefallen

- Key Credit Risks of Project FinanceDokument12 SeitenKey Credit Risks of Project FinanceDavid FreundNoch keine Bewertungen

- Ascots Ascots Ascots Ascots: UnderstandingDokument24 SeitenAscots Ascots Ascots Ascots: UnderstandingPratik GiteNoch keine Bewertungen

- HFS Overview - Activist Investing ResearchDokument11 SeitenHFS Overview - Activist Investing ResearchDamien Park0% (1)

- Loan Amortization Calculator BestDokument11 SeitenLoan Amortization Calculator BestHenok mekuriaNoch keine Bewertungen

- NX CAD CAM AutomationDokument12 SeitenNX CAD CAM AutomationfalexgcNoch keine Bewertungen

- Uncharted Waters LNG Supply Transforming Industry v2Dokument16 SeitenUncharted Waters LNG Supply Transforming Industry v2Anonymous iMq2HDvVqNoch keine Bewertungen

- Global - LNG - New - Pricing - Ahead - Ernst & YoungDokument20 SeitenGlobal - LNG - New - Pricing - Ahead - Ernst & YoungUJJWALNoch keine Bewertungen

- Future Trends in LNG Project Finance - M FilippichDokument36 SeitenFuture Trends in LNG Project Finance - M Filippichmichael_filippich2Noch keine Bewertungen

- Hoegh-LNG-presentation For VietnamDokument18 SeitenHoegh-LNG-presentation For VietnamJeffryNoch keine Bewertungen

- New Mechanisms of LNG Pricing in Asia: KeywordsDokument15 SeitenNew Mechanisms of LNG Pricing in Asia: KeywordsMonica MardiNoch keine Bewertungen

- NG 184 A New Global Gas Order Part 1Dokument36 SeitenNG 184 A New Global Gas Order Part 1Bernie Pimentel SalinasNoch keine Bewertungen

- Content Handbook of Energy and Economic Statistics of Indonesia 2022Dokument111 SeitenContent Handbook of Energy and Economic Statistics of Indonesia 2022kktahunanNoch keine Bewertungen

- Financing LNG Projects: 17 World Petroleum Congress Rio de Janeiro, BrazilDokument26 SeitenFinancing LNG Projects: 17 World Petroleum Congress Rio de Janeiro, BrazilMarcelo Varejão CasarinNoch keine Bewertungen

- Gas Business Opportunity - South East AsiaDokument18 SeitenGas Business Opportunity - South East AsiaMuhammad Syaiful ArifinNoch keine Bewertungen

- LNG MethodologyDokument21 SeitenLNG MethodologyCarlos SierraNoch keine Bewertungen

- Tariff Calculating Model For Natural Gas Transport PDFDokument7 SeitenTariff Calculating Model For Natural Gas Transport PDFUJJWALNoch keine Bewertungen

- Banpu Analytical Disclosure Workshop Jun 2012Dokument45 SeitenBanpu Analytical Disclosure Workshop Jun 2012Vishan SharmaNoch keine Bewertungen

- Reading 31 - Private Company ValuationDokument15 SeitenReading 31 - Private Company ValuationJuan MatiasNoch keine Bewertungen

- Executive Summary Report Phase One Legal and Regulatory Framework For LNG To Power DevelopmentDokument43 SeitenExecutive Summary Report Phase One Legal and Regulatory Framework For LNG To Power DevelopmentChaitanya Sood100% (1)

- Fuel Gas SkidsDokument2 SeitenFuel Gas SkidsjiokoijikoNoch keine Bewertungen

- Carbon Negative: A Primer On Vertical Integration of CCUS / DAC With Oil & GasDokument47 SeitenCarbon Negative: A Primer On Vertical Integration of CCUS / DAC With Oil & GasDanielNoch keine Bewertungen

- Recent Developments of Shipping FinanceDokument17 SeitenRecent Developments of Shipping Financesasa gdafsa fNoch keine Bewertungen

- Energy Industry Conversions LRGDokument2 SeitenEnergy Industry Conversions LRGmaxrobnsonNoch keine Bewertungen

- LNG Standard Form Charters March 2013 PDFDokument10 SeitenLNG Standard Form Charters March 2013 PDFFabián BischoffNoch keine Bewertungen

- DNV Maritime Forecast 2050 2023-ReportDokument74 SeitenDNV Maritime Forecast 2050 2023-ReportNandakrishnan S L Assistant Professor Mechanical Engineering IMU MPCNoch keine Bewertungen

- Top Ten Natural Gas Producing Fields in AfricaDokument6 SeitenTop Ten Natural Gas Producing Fields in AfricaSalah ElbakkoushNoch keine Bewertungen

- Avista Management Inc V Wausau Underwriters Ins CoDokument1 SeiteAvista Management Inc V Wausau Underwriters Ins CoHRNoch keine Bewertungen

- Energy Recovery From The LNG Regasification ProcessDokument25 SeitenEnergy Recovery From The LNG Regasification ProcessAn TrNoch keine Bewertungen

- Global LNG Outlook - February 2023Dokument42 SeitenGlobal LNG Outlook - February 2023AllisonNoch keine Bewertungen

- Powerpoint Embedded Layouts: Look & Feel 2010Dokument30 SeitenPowerpoint Embedded Layouts: Look & Feel 2010Chandan_RicharyaaNoch keine Bewertungen

- BM410-16 Equity Valuation 2 - Intrinsic Value 19oct05Dokument35 SeitenBM410-16 Equity Valuation 2 - Intrinsic Value 19oct05muhammadanasmustafaNoch keine Bewertungen

- Asean Gas PricingDokument37 SeitenAsean Gas PricingEriansa SoganiNoch keine Bewertungen

- Danish Ship Finance Shipping Market Review November 2022Dokument56 SeitenDanish Ship Finance Shipping Market Review November 2022ngo ngoc haNoch keine Bewertungen

- Vietnam Country Risk ReportDokument66 SeitenVietnam Country Risk ReportK59 Tran Kha VyNoch keine Bewertungen

- 2014-7 Equity Yield Curve FinalDokument16 Seiten2014-7 Equity Yield Curve FinalLuke ConstableNoch keine Bewertungen

- CNG Alternative To LNGDokument7 SeitenCNG Alternative To LNGSundar Kumar Vasantha GovindarajuluNoch keine Bewertungen

- Integration of CCGT Plant and LNG TerminalDokument28 SeitenIntegration of CCGT Plant and LNG Terminalcicko45100% (1)

- PASH Pakistan Strategy (21588)Dokument21 SeitenPASH Pakistan Strategy (21588)Junaid ArsahdNoch keine Bewertungen

- LNG Versus CNG Versus HSDDokument7 SeitenLNG Versus CNG Versus HSDUJJWALNoch keine Bewertungen

- Star Lite LNGDokument16 SeitenStar Lite LNGelton100% (1)

- LDES 2021 Report HighresDokument76 SeitenLDES 2021 Report HighresPedro SousaNoch keine Bewertungen

- The IB Business of EquitiesDokument79 SeitenThe IB Business of EquitiesNgọc Phan Thị BíchNoch keine Bewertungen

- LNG Pricing All ChangeDokument3 SeitenLNG Pricing All ChangeĐức Vũ NguyễnNoch keine Bewertungen

- Presentation MD NGC Developent of Gas Infrastrucure26March2008Dokument20 SeitenPresentation MD NGC Developent of Gas Infrastrucure26March2008emodeye kennethNoch keine Bewertungen

- Surging Liquefied Natural Gas TradeDokument28 SeitenSurging Liquefied Natural Gas TradeThe Atlantic CouncilNoch keine Bewertungen

- Shipping Market Review May 2020Dokument80 SeitenShipping Market Review May 2020stanleyNoch keine Bewertungen

- 2020 - Vietnams EVN Faces The Future - September 2020Dokument27 Seiten2020 - Vietnams EVN Faces The Future - September 2020Luong Thu HaNoch keine Bewertungen

- Brochure MicroLNGDokument2 SeitenBrochure MicroLNGbaanglore345Noch keine Bewertungen

- Equity Shares Stock Portfolio Management Presentation PowerPoint TemplateDokument67 SeitenEquity Shares Stock Portfolio Management Presentation PowerPoint TemplateSlideTeamNoch keine Bewertungen

- Course On LNG Business-Session11Dokument19 SeitenCourse On LNG Business-Session11Rahul AtodariaNoch keine Bewertungen

- Vault Fund Venture Studio Structure AnalysisDokument6 SeitenVault Fund Venture Studio Structure AnalysisKleber Bastos Gomes JuniorNoch keine Bewertungen

- Economic Evaluation of Propulsion Systems For LNG Carriers - A Comparative Life Cycle Cost ApproachDokument28 SeitenEconomic Evaluation of Propulsion Systems For LNG Carriers - A Comparative Life Cycle Cost ApproachIro Gidakou GeorgiouNoch keine Bewertungen

- Maritime Economics - Costs Revenue and CashflowDokument45 SeitenMaritime Economics - Costs Revenue and CashflowTeshaleNoch keine Bewertungen

- The LNG Shipping Forecast Costs Rebounding Outlook Uncertain Insight 27Dokument18 SeitenThe LNG Shipping Forecast Costs Rebounding Outlook Uncertain Insight 27123habib123fikri100% (1)

- Energy Scenario: Presented By-Kratika Agarwal BE/25007/2016Dokument21 SeitenEnergy Scenario: Presented By-Kratika Agarwal BE/25007/2016Stream MarkusNoch keine Bewertungen

- M&A Resource Collection For StartupsDokument3 SeitenM&A Resource Collection For StartupsmamaNoch keine Bewertungen

- Bnef-Cif Fi Project 2030 Roadmap Slide Deck IndonesiaDokument41 SeitenBnef-Cif Fi Project 2030 Roadmap Slide Deck Indonesianita SNoch keine Bewertungen

- Financing LNG Projects - Excellent Presentation Goldman SachDokument11 SeitenFinancing LNG Projects - Excellent Presentation Goldman SachUJJWALNoch keine Bewertungen

- Isdb Group Aml & Kyc Questionnaire (Non-Financial Institutions)Dokument4 SeitenIsdb Group Aml & Kyc Questionnaire (Non-Financial Institutions)DineshKumarNoch keine Bewertungen

- LNG Fundamentals Presentation 2019Dokument26 SeitenLNG Fundamentals Presentation 2019endosporaNoch keine Bewertungen

- Global Status of CCSpdfDokument69 SeitenGlobal Status of CCSpdfVidhu PrabhakarNoch keine Bewertungen

- DocumentDokument1 SeiteDocumentVidhu PrabhakarNoch keine Bewertungen

- Oil and Gas Industry Overview SsDokument2 SeitenOil and Gas Industry Overview SsVidhu PrabhakarNoch keine Bewertungen

- DILIGENT CONSULTING JVA Best Practice Solution Consist ofDokument2 SeitenDILIGENT CONSULTING JVA Best Practice Solution Consist ofVidhu PrabhakarNoch keine Bewertungen

- Short and Mid-Term Trends On The Global LNG Market: Jean-Luc COLONNA Senior Vice President, LNGDokument15 SeitenShort and Mid-Term Trends On The Global LNG Market: Jean-Luc COLONNA Senior Vice President, LNGVidhu PrabhakarNoch keine Bewertungen

- Admin BorkersReports EnergyDokument6 SeitenAdmin BorkersReports EnergyVidhu PrabhakarNoch keine Bewertungen

- Econ 1006 Summary Notes 1Dokument24 SeitenEcon 1006 Summary Notes 1KulehNoch keine Bewertungen

- Tenancy Law ReviewerDokument19 SeitenTenancy Law ReviewerSef KimNoch keine Bewertungen

- Matrix of Consumer Agencies and Areas of Concern: Specific Concern Agency ConcernedDokument4 SeitenMatrix of Consumer Agencies and Areas of Concern: Specific Concern Agency ConcernedAJ SantosNoch keine Bewertungen

- Sealant Solutions: Nitoseal Thioflex FlamexDokument16 SeitenSealant Solutions: Nitoseal Thioflex FlamexBhagwat PatilNoch keine Bewertungen

- KV Tripple Eccentric Butterfly Valve-LinDokument12 SeitenKV Tripple Eccentric Butterfly Valve-LinWelma JohnsonNoch keine Bewertungen

- Starkville Dispatch Eedition 12-9-18Dokument28 SeitenStarkville Dispatch Eedition 12-9-18The DispatchNoch keine Bewertungen

- Different Software Life Cycle Models: Mini Project OnDokument11 SeitenDifferent Software Life Cycle Models: Mini Project OnSagar MurtyNoch keine Bewertungen

- Amel Forms & Logging SheetsDokument4 SeitenAmel Forms & Logging SheetsisaacNoch keine Bewertungen

- Binder 1Dokument107 SeitenBinder 1Ana Maria Gálvez Velasquez0% (1)

- XI STD Economics Vol-1 EM Combined 12.10.18 PDFDokument288 SeitenXI STD Economics Vol-1 EM Combined 12.10.18 PDFFebin Kurian Francis0% (1)

- Safety Data Sheet: Fumaric AcidDokument9 SeitenSafety Data Sheet: Fumaric AcidStephen StantonNoch keine Bewertungen

- Napoleon RXT425SIBPK Owner's ManualDokument48 SeitenNapoleon RXT425SIBPK Owner's ManualFaraaz DamjiNoch keine Bewertungen

- CH 2 Nature of ConflictDokument45 SeitenCH 2 Nature of ConflictAbdullahAlNoman100% (2)

- Lecture 1Dokument11 SeitenLecture 1Taniah Mahmuda Tinni100% (1)

- ML7999A Universal Parallel-Positioning Actuator: FeaturesDokument8 SeitenML7999A Universal Parallel-Positioning Actuator: Featuresfrank torresNoch keine Bewertungen

- Shopnil Tower 45KVA EicherDokument4 SeitenShopnil Tower 45KVA EicherBrown builderNoch keine Bewertungen

- Certification and LettersDokument6 SeitenCertification and LettersReimar FerrarenNoch keine Bewertungen

- Methods of Teaching Syllabus - FinalDokument6 SeitenMethods of Teaching Syllabus - FinalVanessa L. VinluanNoch keine Bewertungen

- Soneri Bank Compensation PolicyDokument20 SeitenSoneri Bank Compensation PolicySapii MandhanNoch keine Bewertungen

- Bea Form 7 - Natg6 PMDokument2 SeitenBea Form 7 - Natg6 PMgoeb72100% (1)

- EASY DMS ConfigurationDokument6 SeitenEASY DMS ConfigurationRahul KumarNoch keine Bewertungen

- Brief Curriculum Vitae: Specialisation: (P Ea 1. 2. 3. Statistical AnalysisDokument67 SeitenBrief Curriculum Vitae: Specialisation: (P Ea 1. 2. 3. Statistical Analysisanon_136103548Noch keine Bewertungen

- Bba Colleges in IndiaDokument7 SeitenBba Colleges in IndiaSumit GuptaNoch keine Bewertungen

- COGELSA Food Industry Catalogue LDDokument9 SeitenCOGELSA Food Industry Catalogue LDandriyanto.wisnuNoch keine Bewertungen

- UCAT SJT Cheat SheetDokument3 SeitenUCAT SJT Cheat Sheetmatthewgao78Noch keine Bewertungen

- Cds13041 Yamaha PWC Plug-In EcuDokument1 SeiteCds13041 Yamaha PWC Plug-In EcuGérôme ZélateurNoch keine Bewertungen

- Codex Standard EnglishDokument4 SeitenCodex Standard EnglishTriyaniNoch keine Bewertungen

- The Concept of Crisis PDFDokument10 SeitenThe Concept of Crisis PDFJohann RestrepoNoch keine Bewertungen

- Study of Risk Perception and Potfolio Management of Equity InvestorsDokument58 SeitenStudy of Risk Perception and Potfolio Management of Equity InvestorsAqshay Bachhav100% (1)