Beruflich Dokumente

Kultur Dokumente

KPMG Tax Assemblage 2011

Hochgeladen von

aasgroupOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

KPMG Tax Assemblage 2011

Hochgeladen von

aasgroupCopyright:

Verfügbare Formate

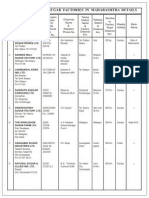

KPMG TAX ASSEMBLAGE - 2011

KPMG IN INDIA

Sr.No. 1

Particulars (Hyperlinked) Limitation on deduction of expenses under Section 44D of the Act cannot be invoked if the consideration received by the foreign company is not Fees for Technical Services as defined in India-USA tax treaty Government of India issues revised guidelines on Conference Visa Payment of Roaming Charges by a telecom company is not rent for the use of telecom equipments Mumbai Tribunal KPMG Flash News Assemblage 2010 Mumbai Tribunal holds that the price of generic APIs can constitute a CUP for import of branded generic drug post the patent expiry period Software industry will the new notifications reignite the controversy?

Citation / Source Cray Research India Ltd v. JCIT [2010-TII-53-ITAT-DEL-INTL]

Sent on 3 January 2011

www.mha.nic.in/

4 January 2011

Vodafone Essar Limited v. DCIT [2011] 45 SOT 82 (Mum) ---------Serdia Pharmaceuticals (India) (P.) Ltd. v. ACIT [2011] 44 SOT 391 (Mum) Notification Nos. 51/2010-ST, 52/2010-ST & 53/2010-ST, No. 126/2010-Customs & No. 35/2010-CE dt.21.12.2010 Notification No. DNBS (PD) 219/CGM(US)-2011 dated 5 January, 2011

4 January 2011

4 5

4 January 2011 5 January 2011

5 January 2011

RBI liberalizes regulatory framework for Core Investment Companies releases Core Investment Companies (Reserve Bank) Directions, 2011

6 January 2011

2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

KPMG FLASH NEWS ASSEMBLAGE - 2011

KPMG IN INDIA 8 Tax credit for tax withheld cannot be denied to the payee upon subsequent refund of the TDS to the deductor The Tribunal holds that overdue accounts receivable balance from associated enterprise is not an international transaction per se, but is a result of an international transaction accordingly no transfer pricing adjustment should be made for non-charging of interest on such overdue balances Amount transferred from the revaluation reserve and set-off against the amount of depreciation debited to P & L Account cannot be reduced for the purpose of calculation of Book Profit in terms of clause (i) of explanation to Section 115JB (2) of the Act Indian taxpayers foreign office which is working as a separate branch and carrying on fullfledged marketing operations would not be eligible for tax holiday as per Section 10A of the Act The tax benefits under Section 10A of the Act in respect of an eligible unit is to be computed without any adjustment or set off of any loss of either an eligible or non-eligible unit The Delhi Tribunal holds that benefit of 5 percent variation shall not be available if there is only one uncontrolled price The Delhi High Court rules on the powers of the Commissioner of Income-tax under Section 263 of the Act while allowing depreciation on Goodwill Outsourced clinical trial expenditure is not eligible for weighted Research and Development deduction Tax deductor is entitled to interest on delayed refund when it is ordered to deduct tax even though no such liability exists Lucent Technologies GRL LLC v. DCIT [2011] 45 SOT 311 (MUM) Nimbus Communications Ltd. v. ACIT [2011] 43 SOT 695 (Mum) 7 January 2011

7 January 2011

10

Indo Ram Synthetics (I) Ltd. v. CIT [2011] 196 TAXMAN 539 (SC)

10 January 2011

11

CIT v. Interra Software India Pvt. Ltd. [2011] 11 taxmann.com 82 (DELHI)

11 January 2011

12

FCI Technology Services Ltd. v. ACIT [2011] 43 SOT 460 (Cochin)

12 January 2011

13

UE Trade Corporation (India) v. ACIT [2011] 44 SOT 457 (DELHI) CIT v. Hindustan Coca Cola Beverages Pvt. Ltd. [2011] 331 ITR 192 (DELHI)

18 January 2011

14

20 January 2011

15

Concept Pharmaceuticals Ltd. v. ACIT [2011] 43 SOT 423 (Mum ) DDIT v. MSM SATELLITE (SINGAPORE) PVT LTD [2011-TII-04-ITAT-Mum-INTL]

20 January 2011

16

27 January 2011

2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

KPMG FLASH NEWS ASSEMBLAGE - 2011

KPMG IN INDIA 17 Method of Accounting regularly followed by the taxpayer which was accepted by the Tax Officer in past cannot be rejected in future years without expressing the dissatisfaction about the correctness or completeness of the accounts of the taxpayer Income from offshore supply of equipment cannot be taxed in India merely because it is interlinked with the satisfactory performance of the onshore contract The Delhi Tribunal holds that supernormal profit making companies should be excluded from the comparable set CIT v. SAS Hotels & Enterprises Limited [2011] 16 taxmann.com 34 (Mad) 28 January 2011

18

DIT v. LG Cable [2011] 197 Taxman 100 (DEL)

28 January 2011

19

ADOBE SYSTEMS INDIA PRIVATE LIMITED v. ACIT NOIDA [2011] 44 SOT 49 (DEL) S.O. 30(E) notification dated 08 January 2011 G.S.R. 25(E) notification dated 15 January 2011 G.S.R. 9(E) notification dated 08 January 2011 ASIA SATELLITE TELECOMMUNICATIONS CO LTD v. DIT [2011] 197 TAXMAN 263 (DEL) Intel Asia Electronics Inc., India, v. ADIT [2011] 46 SOT 48 (BANG) (URO)

31 January 2011

20

Recent Amendments in Provident Fund Act and its related Schemes

1 February 2011

21

Payments to Satellite Operators for broadcasting do not qualify as royalties

2 February 2011

22

The Tribunal has issued directions on the methodology to be adopted for valuing assets in the course of transfer of business as a going concern Tax Residence Certificate issued by the Netherlands tax authorities considering the taxpayer as a beneficial owner of the royalty income is a sufficient proof of beneficial ownership Capital gains arising from transfer of the Development right to attract the provisions Section 50C of the Act Tax Information Exchange Agreement (TIEA) between India and Bermuda In a case involving a taxpayers claim that consideration received upon the transfer of controlling interest was not taxable, the Kolkata

8 February 2011

23

ACIT v. Universal International Music B.V. [2011] 45 SOT 219 (MUM)

8 February 2011

24

Arif Akhatar Hussain v. ITO [2011] 45 SOT 257 (MUM)

9 February 2011

25

Notification No. 5/2011, dated 24 January 2011. ACIT v. RKBK Fiscal Services Ltd. and others (ITA No.770 to 774/ KOL/ 2010)

11 February 2011

26

11 February 2011

2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

KPMG FLASH NEWS ASSEMBLAGE - 2011

KPMG IN INDIA Tribunal held that based on the agreement, and there was no transfer of a controlling interest in the first place 27 Constitutional Amendment Bill on Goods and Service Tax (GST) to be introduced in forthcoming Budget Session Mumbai Tribunal ruled on the applicability of the Limitation of Benefit clause under IndiaSingapore tax treaty Government of India allows conversion of entry (X) visa into employment visa in India Time limit for filing ITR-V form for the Financial Year 2009-10 extended Payments to overseas telecommunication service providers towards provision of International Private Leased Circuit/ dedicated bandwidth to be taxable as Royalty Key judicial pronouncements on credit eligibility of various expenses not directly linked to the provision of output services/ manufacturing activity Delhi High Court rules that additional provision for warranty is revenue expenditure Branch Office set up in India which merely remunerated employees seconded by US group company does not constitute a Permanent Establishment in India Tribunal provides guidance on recovery of precommencement costs under transfer pricing ------------14 February 2011

28

SET Satellite (Singapore) Pte Ltd (M.A. 520/Mum/2011)

16 February 2011

29

http://www.mha.nic.in/

16 February 2011

30

CBDT Press Release dated 10 February 2011 Verizon Communications Singapore Pte. Ltd v. ITO (IT) [2011] 45 SOT 263 (CHENNAI)

16 February 2011

31

17 February 2011

32

-------------

18 February 2011

33

CIT v. Whirlpool of India Ltd. (ITA No. 1154 of 2009) Whirlpool India Holdings Ltd. v. DDIT, NEW DELHI [2011]140 TTJ 155 (Delhi)

18 February 2011

34

21 February 2011

35

36

Highlights of fresh sops announced for exporters

Convergys Information Management (India) (P) Ltd. v. DCIT [2011-TII-23-ITAT-HYD-TP] Public Notice No.21 (RE-2011)/ 2009-2014 dated 10 January 2011; Public Notices No.29/ 2009-14 (RE 2010), 30/ 200914 (RE 2010) 31/2009-14 (RE 2010) dated 14 February 2011; Public Notice No. 33/ 2009-14 (RE 2010) dated 15 February 2011; Policy Circular No.10/ 2009-2014 (RE-2010) dated 31

23 February 2011

25 February 2011

2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

KPMG FLASH NEWS ASSEMBLAGE - 2011

KPMG IN INDIA December 2011; Policy Circular No.19/ 2009-2014 (RE - 2010) dated 14 February 2011 http://indiabudget.nic.in/

37

Indian Economic Survey 2010-11 Key Highlights Highlights of Comprehensive Economic Partnership Agreement between India and Japan Law empowers Transfer Pricing Officer to determine the arms length price of only referred international transactions. Nonreferred international transactions fall outside the TPOs jurisdiction KPMG Budget Booklet 2011 Tax authorities can determine true character of a transaction. Further, the tax authorities should evaluate a transaction from the point of view of prudent businessman The Delhi High Court holds that merely because a taxpayer is paying royalty for the use of branding & technology, the advertisement expenses cannot be said to be not incurred wholly & exclusively for the purpose of the business of the taxpayer Constitution Bench of the Supreme Court rules on the power of Parliament to enact laws having extra-territorial application Gain on sale of shares to be treated as capital gain and not business income, despite large volume of sales Union Budget 2011 Impact on Infrastructure Sector Merger Combination provisions under Competition Act notified

26 February 2011

38

www.pib.nic.in/

25 February 2011

39

Amadeus India Pvt Ltd v. ACIT [2011] 10 taxmann.com 88 (Del)

2 March 2011

40 41

--------------CIT v. Rockman Cycle Industries Private Limited [2011] 15 taxmann.com 306 (Pun & Har) (FB) CIT v. Adidas India Marketing (P.) Ltd. [2010] 195 Taxman 256 (DELHI)

1 March 2011 3 March 2011

42

3 March 2011

43

GVK Inds. Ltd. & Anr. v. ITO [2011] 332 ITR 130 (SC)

7 March 2011

44

ACIT v. Naishadh V. Vachharajani (I.T.A. No. 6429/Mum/2009) ----------

7 March 2011

45

7 March 2011

46

47

Notional brought forward losses and depreciation of eligible undertaking should be set off in the current year while calculating the quantum of benefit under Section 80-IA of the

The Competition Commission of India (Procedure in regard to the transaction of business relation to combination) Regulations Hyderabad Chemicals Supplies Limited v. ACIT (ITA No. 352/Hyd/2005)

8 March 2011

9 March 2011

2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

KPMG FLASH NEWS ASSEMBLAGE - 2011

KPMG IN INDIA Act even though they have been set off against other income in earlier years 48 Process of incorporation of Companies and establishment of principal place of business in India by Foreign Companies simplified and epayment of MCA fee made compulsory Benefit of weighted deduction on in-house Research and Development expenditure is allowed from the year in which the taxpayer has filed an application and not when it is approved by DSIR Streamlining procedure for scrutiny of Incometax Returns Payments received for leasing of transponder capacity and bandwidth cannot be taxed as royalty under the Section 9(1)(vi) of the Act The Mumbai Tribunal holds that Transfer of undertaking against issue of bonds / shares is not a slump sale and not taxable as capital gains Indian Government increases the interest rate on Employees Provident Funds Scheme Supreme Court rules that receipt of noncompete fee is capital in nature and not chargeable to tax prior to AY 2003-04 Complete diminution in value of investment to be added to the book profits while computing Minimum Alternate Tax Views expressed by smaller bench of a Supreme Court in the case of Azadi Bachao Andolan on tax avoidance are binding on the High Courts because it has interpreted the decision of the larger bench in the case of Mcdowell & Company. Introduction of Constitution Amendment Bill for implementation of GST Losses accruing to FIIs on account of cancellation of foreign exchange forward General Circular No. 6/2011 dated 8 March 2011 15 March 2011

49

CIT v. Sandan Vikas (India) Ltd. [2011-TIOL-133-HC-DEL-IT]

16 March 2011

50

51

Press Note No. 402/92/2006-MC (07 of 2011) dated 14 March 2011 Intelsat Corporation (ITA No.5443/D/2010)

16 March 2011

17 March 2011

52

Bharat Bijlee Limited v. ACIT [2011] 10 taxmann.com 253 (MUM)

17 March 2011

53

MOL No. R-11018/1/2010-SS-II dated 17 March 2011 Guffic Chem Pvt. Ltd. v. CIT [2011] 198 Taxman 78 (SC)

18 March 2011

54

18 March 2011

55

ITO v. TCFC Finance Limited [2011] 131 ITD 103 (MUM)

21 March 2011

56

CIT v. Oberoi Hotels Pvt. Ltd. [2011] 198 taxman 310 (Cal)

22 March 2011

57

--------

22 March 2011

58

Citicorp Banking Corporation, Bahrain v. ADIT

23 March 2011

2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

KPMG FLASH NEWS ASSEMBLAGE - 2011

KPMG IN INDIA contract having direct nexus with investment are capital losses which can be set off against long term capital gains on shares 59 60 Proposed amendments to the Finance Bill, 2011 ---------Delhi High Court rules that taxability in the context of waiver of loan amount would depend upon the purpose for which the loan was taken Revaluation reserve not routed through Profit & Loss Account could not be added to net profit while computing the book profit for the purpose of Minimum Alternate Tax EPFO allows exempt Provident Fund trusts to use surplus reserves for matching the increased interest rate The Delhi Tribunal holds that benefit of set off of brought forward losses could not be denied to the amalgamated company since there was no change in control and management of amalgamated company pre and post merger. Taxpayer holding tax residence certificate is eligible for the India-Mauritius tax treaty benefits Service tax and Cenvat Credit notifications Logitronics Pvt. Ltd and Jubilant Securities Pvt. v. CIT [2011] 333 ITR 386 (DELHI) ITO v. Galaxy Saws P. Ltd. [2011] 132 ITD 236 (MUM) 24 March 2011 [2011-TII-40-ITAT-MUM-INTL]

23 March 2011

61

28 March 2011

62

EPFO Letter dated 17 March 2011

29 March 2011

63

DCIT v. Select Holiday Resorts Pvt. Ltd. (ITA Nos. 1184 & 2460/Del/2008)

30 March 2011

64

D.B.Zwirn Mauritius [2011] 333 ITR 32 (AAR) Notification No. 25/2011 - Service Tax dated 31 March 2011 effective from 1 April 2011 Circular 1 of 2011 dated 31 March 2011

31 March 2011

65

1 April 2011

66

Release of revised third edition of Consolidated Foreign Direct Investment Policy effective 1 April 2011 Social Security Agreement between India and Switzerland comes into effect No income accrues or arises to a Liaison Office if it is engaged only in the purchase of goods for the purpose of exports Bangalore Tribunal confirms the availability of the benefit of 5 percent variation as a standard deduction to the taxpayer (AY 2002-03) Payment made for transfer of comprehensive technical information and know-how which

1 April 2011

67

EPFO Cicular No. IWU/7(5)2008/ Switzerland dated 4 April 2011 ADIT v. Fabrikant & Sons Ltd. [2011] 9 taxmann.com 286 (MUM) TNT India Private Limited v. ACIT [2011] 45 SOT 471 (BANG)

6 April 2011

68

5 April 2011

69

6 April 2011

70

CIT v. DCM Limited [2011] 198 Taxman 391 (DELHI)

7 April 2011

2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

KPMG FLASH NEWS ASSEMBLAGE - 2011

KPMG IN INDIA included all trade secrets and technical information, designs and drawings, etc. cannot be treated as income from royalty under the India-UK tax treaty 71 A Netherland entity is required to file its return of income in India even if the capital gains arising to it from the transfer of shares of an Indian Company to a Swiss entity is not taxable in India under Article 13(5) of the IndiaNetherlands tax treat Mumbai Tribunal holds that royalty received by the taxpayer was in pursuance to agreement entered into before 1976 and therefore not covered under Section 115A of the Act Income tax return forms notified for assessment year 2011-12 Karnataka High Court directs the tax authority if necessary to lift corporate veil to examine real nature of the transaction while dismissing a writ in relation to indirect acquisition of Sesa Goa Ltd Delhi High Court sanctions Vodafone Essars scheme of arrangement involving demerger of the passive infrastructure assets despite opposition by tax department Employee not liable to pay interest for default on the part of employer to deduct tax at source from salary income Exemption under Section 10B is not available to an undertaking taken over on lease Fees received by a Canadian company for providing technical drawings and reports would qualify as Fees for Included Services under India-Canada tax treaty Service tax notifications VNU International B.V. [2011] 334 ITR 56 (AAR) 11 April 2011

72

Siemens Aktiencesellschaft v. DCIT [2011-TII-52-ITAT-MUM-INTL]

19 April 2011

73

Notification No. 18/2011; S.O.693 (E) dated 5 April 2011 Richter Holding Ltd. v. ADIT [2011] 199 TAXMAN 70 (KAR)

20 April 2011

74

20 April 2011

75

Vodafone Essar Ltd. Company Petition No. 334/2009

21 April 2011

76

77

DIT v. Maersk Co. Ltd. [2011] 198 TAXMAN 518 (UTTARAKHAND) (FB) Synergies Casting Ltd. v. DCIT [2011] 47 SOT 82 (HYD) DIT v. SNC Lavalin International Inc [2011] 332 ITR 314 (Del)

26 April 2011

25 April 2011

78

25 April 2011

79

80

Companies allowed service of documents to its members through electronic mode

Notification Nos. 29 to 37 dated 25 April 2011effective from 1 May 2011 Circular No.17/ 2011

26 April 2011

27 April 2011

2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

KPMG FLASH NEWS ASSEMBLAGE - 2011

KPMG IN INDIA 81 Since the technical services rendered by the non-resident company were not made available, such services cannot be regarded as Fees for Technical Services under Article 13(4)(c) of the India-UK tax treaty Procedure for regulating refund of excess amount of tax deducted and/or paid Informal Guidance involving applicability of second proviso to regulation 11(2) of the SEBI (Substantial Acquisition of Shares & Takeover) Regulations, 1997 Short term capital gains arising from the transfer of depreciable assets held for more than 36 months under Section 50(2) of the Act can be set-off against brought forward loss from other long term capital assets Sharing of management experience and business strategies by a foreign professional in India and payment for testing services cannot be termed as technical or consultancy services under Indo-USA tax treaty Circular on amendments made in Cenvat Credit Rules vide Union Budget 2011 The AAR rules that transfer of shares of an Indian company without consideration in the course of group reorganisation is not liable to tax in India Delhi High Court holds that increase in Authorised Capital is not liable to stamp duty under Indian Stamp Act, 1899 as applicable in Delhi The owners granting the right, authority and power to develop the property in favour of the developers is considered as transfer of the land and building and thus liable to capital gain tax and section 50C of the Act is applicable Employees Provident Fund Organisation issues revised FAQs on International Workers ACIT v. WNS Global Service Private Ltd. [2011] 10 taxmann.com 254 (MUM) 27 April 2011

82

83

Circular No. 2/2011 [F.NO. 385/25/2010-IT(B)], dated 27 April 2011 CFD/DCR/SKM/TO/12446/2011 dated 13 April 2011

28 April 2011

29 April 2011

84

Manali Investments v. ACIT [2011] 139 TTJ 411 (MUM)

02 May 2011

85

Wockhardt Ltd. v. ACIT [2011] 10 TAXMANN.COM 208 (MUM)

03 May 2011

86

Circular No. 943/04/2011-CX dated 29 April 2011 Goodyear Tire and Rubber Company [2011] 334 ITR 69 (AAR)

04 May 2011

87

04 May 2011

88

S.E. Investment Limited (CO. APPL. (M) 38/2011 & CO. APPL. 293/2011)

04 May 2011

89

Chiranjeev Lal Khanna v. ITO [2011] 132 ITD 474 (MUM)

05 May 2011

90

Updated FAQs on IWs dated 6 May 2011

09 May 2011

2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

KPMG FLASH NEWS ASSEMBLAGE - 2011

KPMG IN INDIA 91 Karnataka High Court rules that Liaison Office engaged in certain commercial activities would constitute a Permanent Establishment in India under the India-Korea tax treaty Reserve Bank of India permits opening of Escrow Accounts for Foreign Direct Investment transactions Reserve Bank of India liberalised pledge of shares of an Indian Company by Non-Resident Investors for business purposes Payment made to US companies for developing tooling' and 'validating new process for manufacture' of wheels is taxable as fees for included services as per Article 12 of the IndiaUSA tax treaty Final Combination Regulations on Merger Combination provisions under Competition Act 2002 released Delhi Tribunal holds that when loss making companies were taken out of the comparables set, super profit earning company should also be removed. The Cabinet Committee on Economic Affairs (CCEA) approves the proposal to amend the Policy on allowing Foreign Direct Investments (FDI) in Limited Liability Partnerships (LLPs) Expenses towards advertisement and business promotion incurred on commercial expediency would not be disallowed even if somebody else is benefited Service tax exemption allowed to SEZ under Notification 4/2004 dated 31 March 2004 even if services not fully consumed within SEZ Clarifications on prosecution provisions under Service tax laws Clarification on applicability of Export of Services Rules, 2005 in certain situations Jebon Corporation India v. CIT [2011-TII-15-HC-KAR-INTL] 06 May 2011

92

Reserve Banks A. P. (DIR Series) Circular No. 58 dated 2 May 2011 www.rbi.org.in

06 May 2011

93

06 May 2011

94

Wheels India Ltd. v. ACIT [2011] 11 taxmann.com 68 (Chennai)

09 May 2011

95

The Competition Commission of India Regulations, 2011 (No. 3 of 2011) Sapient Corporation Pvt. Ltd. v. DCIT [2011] 46 SOT 56 (DEL)

11 May 2011

96

11 May 2011

97

Press Release by Press Information Bureau dated 11 may 2011 www.pib.nic.in DCIT v. Maruti Countrywide Auto Financial Services Pvt Ltd. [2011-TIOL-283-ITAT-DEL]

12 May 2011

98

13 May 2011

99

Norasia Container Lines v. CCE (2011-TIOL-574-CESTAT-DEL)

13 May 2011

100

Circular No. 140/9/2011-TRU dated 12 May 2011 Circular No. 141/10/2011-TRU dated 13 May 2011

16 May 2011

101

16 May 2011

2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

KPMG FLASH NEWS ASSEMBLAGE - 2011

KPMG IN INDIA 102 Issue of TDS certificate in Form 16A for taxes deducted at source from payments other than salary Government provides tax exemption on revised interest of 9.5% earned on PF account Mumbai Tribunal rules that payment for data processing at data center in Singapore is not taxable as royalty under India - Singapore tax treaty Special bench of the Mumbai Tribunal rules that Section 50C of the Act applies to transfer of depreciable assets being land and/or building Clarifications on Service tax exemption to SEZ Developer/ Units Foreign Contribution (Regulation) Act, 2010 comes into effect from May 2011 The AAR rules that services rendered by the non-resident company are not make available, and therefore not regarded as Fees for Technical Services under Article 13 of the IndiaUK tax treaty Payment by way of commission, for sales and marketing support outside India, does not constitute income chargeable to tax in India under the Income-tax act, 1961. Interest earned on Income-tax refund from tax department cannot be considered as arising from indebtedness that is effectively connected with Permanent Establishment and is therefore taxable at 15 percent as per Article XI of IndiaAustralia tax treaty Ministry of Corporate Affairs allows Shareholders / Directors to participate in the meetings through video conference facility Taxpayer not eligible to claim short stay exemption under the India- UK Double Taxation Avoidance Agreement (DTAA or the Indo-UK Treaty) as the salary was paid directly by the Indian subsidiary. CBDT Circular No. 3/2011 dated 13 May 2011 17 May 2011

103

104

Notification No. 24/2011 [F.No. 142/14/2010-SO (TPL)], dated 13 May 2011 Standard Chartered Bank v. DDIT [2011] 45 SOT 494 (Mum)

18 May 2011

18 May 2011

105

ITO v. United Marine Academy [2011] 130 ITD 113 (MUM)

18 May 2011

106

Circular No. 142/11/2011-TRU-ST dated 18 May 2011 -----------

19 May 2011

107

19 May 2011

108

R.R. Donnelley India Outsource Private Limited [2011] 199 TAXMAN 255 (AAR)

20 May 2011

109

Eon Technology (P) Ltd. v. DCIT [2011] 46 SOT 323 (DEL)

24 May 2011

110

ACIT v. Clough Engineering Ltd [2011] 130 ITD 137 (DELHI) (SB)

25 May 2011

111

General circular No. 27, 28 & 29 dated 20 May 2011

26 May 2011

112

CIT v R. Rajgopal [ 2011] 199 Taxman 244 (MAD)

31 May 2011

2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

KPMG FLASH NEWS ASSEMBLAGE - 2011

KPMG IN INDIA 113 Delhi Tribunal upheld the determination of arms length price on the basis of only a single comparable Reserve Bank of India liberalises and rationalises Overseas Direct Investment Regulations1 Mumbai Tribunal holds that provisions of Section 50C the Income-tax Act does not apply to transfer of leasehold rights in land New Rules for Preferential Allotment/ Private Placement in unlisted public companies The AAR rules that fees received by nonresident under a composite contract would be taxable as royalty under Article 12 of India-Sri Lanka tax treaty Delhi Tribunal holds that existence of actual cross border transaction and motive to shift profits outside India or evade taxes in India are not necessary pre conditions for Transfer Pricing provisions to apply Amendment in Rules relating to furnishing of Permanent Account Number (PAN) for certain specified transactions Splitting of Minimum Wages for the purpose of PF contribution is not permissible Salary earned by a non resident for services performed outside India on a board of ship does not accrue or arise in India AAR rules that reimbursement made to a foreign company for sending their employees on secondment basis to an Indian Company would be considered as fees for included service under India-USA tax treaty The Delhi High Court rules that once the Transfer Pricing Officer has accepted arms length price of royalty payments, the Assessing Officer could not examine the reasonableness of the said expenditure for disallowance The Mumbai Tribunal rules that the expression liable to tax used in the India-UAE tax treaty Haworth India Private Limited v. DCIT [2011] 131 ITD 215 (DELHI) RBI Circular No. 69 dated 27 May 2011 (www.rbi.org.in) Atul G. Puranik v. ITO [2011] 132 ITD 499 (MUM) 30 May 2011

114

30 May 2011

115

31 May 2011

116

117

Unlisted Public Companies (Preferential Allotment) Rules, 2011 Lanka Hydraulic Institute Ltd. v. DIT [2011] 199 Taxman 232 (AAR) ITO v. Tianjin Tianshi India (P) Limited [2011] 133 ITD 123 (DEL)

31 May 2011

1 June 2011

118

1 June 2011

119

Notification No. 27/2011 [F. No. 149/122/2010-SO(TPL)], dated 26-5-2011 Coord/4(6)2003/Clarification/VolII/ Dated: 23-05-2011 DIT v. Prahlad Vijendra Rao [2011] 198 TAXMAN 551 (Kar.)

2 June 2011

120

2 June 2011

121

6 June 2011

122

Verizon Data Services India Private Limited v. CIT [2011] 337 ITR 192 (AAR)

7 June 2011

123

CIT v. Oracle India Pvt. Ltd. [2011] 199 TAXMAN 181 (DELHI)(MAG)

8 June 2011

124

ITO v. Mahavirchand Mehta [2011] 45 SOT 137(MUM)

8 June 2011

2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

KPMG FLASH NEWS ASSEMBLAGE - 2011

KPMG IN INDIA does not necessarily imply that person should actually be liable to tax in UAE 125 Transfer of intangible assets with right to carry on business is taxable as capital gains and not as business income Delhi High Court rules on reasonableness of expenditure on Royalty and its allowability Mumbai Tribunal rules that mere inactivity for a limited period does not mean that business ceased to exist. Accordingly, expenditure is allowable even though no business income is earned during such period Reserve Bank of India (RBI) liberalizes the regulations pertaining to maintaining of a bank account in India and remittance of assets by foreign nationals AAR rules that income earned from bill discounting by a foreign company would not be treated as interest under India-USA tax treaty New Rules for Passing of the Resolution through Postal Ballot Suggestions on the Constitution Amendment Bill, 2011 to enable introduction of GST in India SEBI Informal Guidance holds Call / Put Option in private agreement amongst shareholders as invalid Income earned by a Foreign Institutional Investor from derivative transactions shall be taxable as capital gains and not speculative business income in India Draft Rules for mandatory dematerialisation of share certificate by Public Companies Delhi Tribunal holds that Arms length price of royalty payments cannot be determined to be NIL merely because the taxpayer incurs losses Withdrawal of 1937 Stamp Duty notification in Delhi CIT v. Mediworld Publications Pvt. Ltd [2011] 200 TAXMAN 1 (DEL) CIT v. Nestle India Ltd. [2011] 337 ITR 178 (DELHI) Bechtel International Inc., USA v. ADIT [2011-TII-149-ITAT-MUM-INTL] 10 June 2011

126

10 June 2011

127

10 June 2011

128

Reserve Banks A.P. (DIR Series) Circular No. 70 dated 9 June 2011

10 June 2011

129

ABC International Inc [2011] 199 TAXMAN 211 (AAR DEL) Notification dated 30 May 2011 of Govt. of India (Ministry of Corporate Affairs) ----------

13 June 2011

130

14 June 2011

131

17 June 2011

132

Informal Guidance Letter No. CFD/DCR/16403/11 dated 23 May 2011 LG Asian Plus Ltd v. ACIT [2011] 46 SOT 159 (MUM)

16 June 2011

133

16 June 2011

134

135

Draft Companies (Dematerialisation of Certificates) Rules, 2011 DCIT v. Ekla Appliances [2011] 45 SOT 7 (DEL) (URO)

17 June 2011

20 June 2011

136

Notification F 1 (423)/Regn. Br./HQ/Div. Com/10 dated 1 June

21 June 2011

2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

KPMG FLASH NEWS ASSEMBLAGE - 2011

KPMG IN INDIA 2011) Brintons Carpets Asia Private Limited v. DCIT [2011] 46 SOT 289 (PUNE) (URO)

137

The Pune Tribunal upholds that the rule of consistency is to be honoured by the revenue in case there is no change in the facts of two years. Further, there is need to make necessary adjustments under TNMM to remove and minimise the differences between Marketing and reservation fees received from franchisee hotels with a corresponding obligation to use it for an agreed purpose, are not regarded as income Commission received by a foreign company for assistance in arranging cargo transportation was taxable in India on account of 'business connection' Salaried tax payers are not required to file India tax return for the Financial Year (FY) 2010-11 on fulfillment of certain conditions and where the total income does not exceed prescribed limit The Delhi Tribunal holds that foreign exchange fluctuation gain arising on external commercial borrowings for meeting working capital requirements, is not entitled to deduction under Section 10A of the Income-tax Act Delhi Tribunal held that the amendment in the transfer pricing provision with respect to +/- 5 percent variation does not apply retrospectively Madhya Pradesh High Court held that conveyance allowance and special allowance have to be considered for determination of provident fund liability The Chennai Tribunal held that where the taxpayer had extended loan to its Associated Enterprise in foreign currency, LIBOR must be considered while determining arms length interest rate Mumbai Tribunal held that the taxpayer following the project completion method as per AS 7 may set-off receipts from sale of TDR against work-in-progress and such receipt is not taxable in the year of receipt

22 June 2011

138

Six Continents Hotels Inc. v. DCIT [2011] 46 SOT 97 (MUM) (URO)

23 June 2011

139

ADIT v. ACM Shipping India Ltd [2011] 46 SOT 94 (MUM)

23 June 2011

140

Notification No. 36/2011 [ F. NO. 142/09/2011 (TPL)], dated 23 June 2011

27 June 2011

141

Convergys India Services Pvt. Ltd v. CIT (ITA No.5085 & 5087/MUM/2009)

24 June 2011

142

iPolicy Network Pvt. Ltd. v. ITO [2011] 46 SOT 38 (DEL) (URO)

28 June 2011

143

Montage Enterprises Pvt. Ltd v. Employees Provident Fund

29 June 2011

144

Siva Industries & Holdings Ltd v. ACIT, Chennai [2011] 46 SOT 112 (CHE)

30 June 2011

145

ACIT v. Skylark Build [2011] 48 SOT 306 (MUM)

30 June 2011

2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

KPMG FLASH NEWS ASSEMBLAGE - 2011

KPMG IN INDIA 146 KPMG Thought Leadership: Advance Pricing Agreement Considerations for India Social Security Agreements with France and Luxembourg come into effect ---------04 July 2011

147

148

The Mumbai Tribunal held that the arms length price in case of interest on extended credit period granted to an Associated Enterprise shall be determined on the basis of USD LIBOR and not on any other currency denominated loan rate The Bangalore Tribunal held that lease rentals earned by a developer of Software Technology Park should be treated as business income Payment made for online banner advertisement on the portal of a foreign company is not taxable as royalty Delhi Tribunal held that loss making companies cannot be rejected as comparables simplicitor on ground of losses but can be excluded on other comparability aspects The Supreme Court cites the relevance of General Rule of Interpretation outlined in the Vienna Convention on the law of treaties Madras High Court ruling on the applicability of Provident Fund contributions on certain allowances The Pune Tribunal held that continuing debit balance in the account of the Associated Enterprises (AEs) is not an international transaction per se, but is a result of an international transaction The Hyderabad Tribunal held that sale contract falls within purview of right to manufacture, produce or process an article or thing RBI liberalises Disinvestment of Overseas Direct Investment with / without write off

No. IWU/7(5) 2006 / France / 14721 dated 4 July 2011 and IWU /7(8) 2008 / Luxembourg / 14741 dated 5 July 2011 Tech Mahindra Limited v. DCIT [2011] 46 SOT 141 (MUM) (URO)

06 July 2011

06 July 2011

149

DCIT v. Golflink Software Park P Ltd (ITA No. 40 & 41/Bang/10) Yahoo India P. Ltd v. DCIT [2011] 46 SOT 105 (MUM) (URO)

06 July 2011

150

07 July 2011

151

Yum Restaurants India Pvt. Ltd. v. ACIT (ITA No. 3796/Rel/2006)

08 July 2011

152

Ram Jethmalani & Ors v. Union of India & Ors. [2011] 200 Taxman 171 (SC) Reynolds Pens India Pvt Ltd & Ors. v. RPFC [Writ Petition No. 15823 of 2010] Patni Computer System v. DCIT (ITA No 426 & 1131/PN/06)

11 July 2011

153

11 July 2011

154

13 July 2011

155

Prajna Technologies & Services Pvt. Ltd v. DCIT [2011] 47 SOT 71 (HYD) RBIs Master Circular No. 11 dated 1 July 2011 (www.rbi.org.in)

15 July 2011

156

15 July 2011

2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

KPMG FLASH NEWS ASSEMBLAGE - 2011

KPMG IN INDIA 157 Regularisation of Liaison / Branch Offices of Foreign Entities established during the preFEMA period without Reserve Bank of India approval Customs Clarification on Import of used Electrical and Electronic Assemblies into India Ruling of Bombay High Court on taxation of sale of shares involving India-Mauritius tax treaty and a transaction resulting in indirect transfer of shares in an Indian company The Delhi Tribunal held that revenues from turnkey contract with Airport Authority of India for Air Traffic System were taxable in India Advisory and opinion related services provided by a foreign company could not be treated as Fees for Included Services under India-USA tax treaty In respect of shares held as investments, even gains on shares held for 30 days or less to be treated as short term capital gains and not business profits Discount offered by cellular companies to distributors on SIM cards and recharge coupons is in the nature of commission on which tax is required to be withheld Chennai Tribunal held that the taxpayer cannot question the credibility of the price assigned by customs authorities to the imported goods based on scientifically formulated methods used by the Transfer Pricing Officer SEBI Informal Guidance on inter-se transfer of shares among promoters Meaning of term Turnover for the purpose of Section 47(xiiib) of the Income-tax Act in the context of conversion of Company into LLP While sanctioning the scheme of amalgamation, the High Court can stipulate that the scheme will come into effect upon receipt of other statutory and contractual permissions Reserve Banks A. P. (DIR Series) Circular No. 02 dated 15 July 2011 18 July 2011

158

F.No.401/130/2011-Cus III dated 4 July 2011 Aditya Birla Nuvo Limited v. DDIT and Union of India [2011] 200 Taxman 437 (BOM)

19 July 2011

159

19 July 2011

160

Raytheon Company v. DDIT [2011-TII-98-ITAT-DEL/INTL]

19 July 2011

161

ACIT v. Viceroy Hotels Ltd [2011] 46 SOT 4 (HYD)

21 July 2011

162

Hitesh Satishchandra Doshi v. JCIT [2011] 46 SOT 336 (MUM)

22 July 2011

163

Bharti Cellular Ltd. v. ACIT [2011] 200 TAXMAN 254 (CAL)

22 July 2011

164

Coastal Energy Pvt Ltd v. ACIT [2011] 46 SOT 286 (CHE)(URO)

25 July 2011

165

CFD/DCR/SKS/SG/OW/17827/11 dated 2 June 2011 CBDT Circular No. 01/2011 dated 6 April 2011

27 July 2011

166

27 July 2011

167

Spice Communications Ltd. [2011] 12 taxmann.com 134 (Del)

28 July 2011

2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

KPMG FLASH NEWS ASSEMBLAGE - 2011

KPMG IN INDIA 168 Competition Commission of India approves the acquisition by Reliance Industries of Bharti Enterprises stake in Bharti-AXA Insurance joint venture SEBI accepts recommendations of Takeover Regulations Advisory Committee A Joint Venture partner executing infrastructure development work is eligible for deduction under Section 80-IA(4) of the Income-tax Act even if contract is awarded to a Joint Venture The Pune Tribunal held that no Transfer pricing adjustment is necessary when period and basis of computation of royalty is different from comparable transactions Draft SEBI (Alternative Investment Funds) Regulations, 2011 CCI order dated 26 July 2011 28 July 2011

169

SEBI Press Release dated 28 July 2011 Transstory (India) Ltd v. ITO [2011] 16 taxmann.com 24 (VISAKHAPATNAM)

29 July 2011

170

29 July 2011

171

Kirloskar Ebara Pumps Ltd. v. DCIT [2011] 138 TTJ 211 (Pune)

01 August 2011

172

173

MCA issues guidelines to Regional Directors / Registrar of Companies in relation arrangement / amalgamations under the Companies Act, 1956 Commission paid to employees in lieu of dividend is neither allowed under Section 36(1)(ii) nor under Section 37(1) of the Incometax Act Bonus shares received on shares acquired out of foreign currency are foreign exchange asset and eligible for capital gains tax exemption Expenditure incurred on in-house scientific research and development activity are deductible under Section 35(1)(i) or under Section 37(1) of the Income-tax Act Amount received by foreign company from offshore supply of equipments and materials is not taxable in India A Committee of Secretaries (CoS) in its meeting held on 22 July 2011 has recommended 51 percent Foreign Direct Investment (FDI) in multibrand retail. The recommendation however is

Concept paper on proposed Alternative Investment Funds Regulation for public comments dated 1 August 2011 General Circular No. 53/2011 (F.No. 51/16/2011-CL.III)

03 August 2011

05 August 2011

174

Dalal Broacha Stock Broking (P.) Ltd. v. ACIT [2011] 131 ITD 36 (MUM) (SB)

06 August 2011

175

Sanjay Gala v. ITO [2011] 46 SOT 482 (MUM)

08 August 2011

176

ACIT v. Parablic Drugs Ltd [2011-TIOL-403-ITAT-DEL]

10 August 2011

177

LS Cable Ltd. [2011-TII-20-ARA-INTL]

11 August 2011

178

Committee of Secretaries meeting held on 22 July 2011

11 August 2011

2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

KPMG FLASH NEWS ASSEMBLAGE - 2011

KPMG IN INDIA likely to be subject to some stiff conditions 179 Authorised dealer is not liable to withhold tax while making remittance to a non-resident on account of sale proceeds representing short term capital gain Fees paid to a foreign company for rendering testing and certification services could not be treated as income deemed to accrue or arise in India under Section 9(1)(vii) of the Income-tax Act Reference to Special Bench of Tribunal cannot be withdrawn merely because High Court has admitted identical question of law in another case Fees received by KPMG for assisting an Indian Company in acquisition of Sugar mills in Brazil is not Fees for Technical Services under the Income-tax Act Scope of DRP is restricted only to adjustments proposed in the draft assessment order and not beyond Activities of Liaison Office were not confined to the purchase of goods in India and therefore there is Business Connection and Permanent Establishment in India The Supreme Court held that the tax department can reopen the assessment relating to Section 14A of the Income-tax Act, 1961 (the Act) inspite of specific relief provided under Section 14A of the Act Authorised Economic Operator (AEO) Scheme has been notified Amounts received on redemption of preference shares cannot be taxed as deemed dividend Abu Dhabi Commercial Bank v. ITO [2011-TII-103-ITAT-MUM-INTL] 11 August 2011

180

Havells India Ltd v. ACIT [2011] 47 SOT 61 (DEL)

17 August 2011

181

DCIT v. Summit Securities Limited [2011] 132 ITD 1 (MUM) (SB)

17 August 2011

182

ITO v. Bajaj Hindustan Ltd. [2011] 47 SOT 74 (MUM)

19 August 2011

183

GE India Technology Centre Pvt. Ltd. v. DRP and ACIT [2011] 338 ITR 416 (KAR) Columbia Sportswear Company [2011] 337 ITR 407 (AAR)

18 August 2011

184

18 August 2011

185

Honda Siel Power Products Ltd v. DCIT [2011-TIOL-72-SC/IT]

19 August 2011

186

Circular No 37/ 2011 Customs dated 23 August 2011 Parle Biscuits Pvt. Ltd. v. ACIT (ITA Nos 5318 & 5319/ Mum//2006 & 447/Mum/2009) and (ITA Nos 5540 & 5541/Mum/2006 & 663/Mum/2009) ----------

24 August 2011

187

25 August 2011

188

KPMGs 2011 edition of Thinking Beyond Borders Management of Extended Business

26 August 2011

2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

KPMG FLASH NEWS ASSEMBLAGE - 2011

KPMG IN INDIA Travelers 189 Competition Commission of India approves the proposed acquisition of UTV Software Communications by Walt Disney (South East Asia) E-filing of Service tax returns made compulsory for all taxpayers with effect from 1 October 2011 Concept paper for public debate on taxation of services based on a negative list of services Indian Government issues internal circular for effective compliance of International Workers provisions Mumbai Tribunal held in favour of the taxpayer certain core issues in Transfer Pricing Indian Government issues guidelines on visa endorsement Transfer pricing provisions would be applicable to a transaction entered with an unrelated entity which is deemed associated enterprise Allocation of common expenditure using employee head-count ratio is a more appropriate method instead of a hybrid method A certificate issued by a Chartered Accountant has no decisive impact on taxability of income in the hands of a non-resident but it is only primafacie evidence about the taxability Mere canvassing of cruise packages business does not establish a business connection in India If part of the income attributable to permanent establishment of non-resident is taxable in India as business income then the balance income shall not be taxable as FTS Actual date of completion certificate issued by local authority is not relevant to claim deduction under Section 80-IB of the Income-tax Act, where a project is completed within time and Diageo India Private Limited v. ACIT [2011] 47 SOT 252 (MUM) CIT v. S.T.Micro Electronics Pvt. Ltd. [2011-TIOL-449-HC-DEC-INTL] DCIT v. Rediff.com India Limited [2011] 47 SOT 310 (MUM) Combination Registration No. C2011/08/02 dated 25 August 2011 26 August 2011

190

Notification No 43/ 2011 Service tax dated 25 August 2011 ----------

29 August 2011

191

31 August 2011

192

Circular No.IWU/7(11)/2011/ Compliance 10235

02 September 2011

193

Emersons Process Management India Pvt Ltd v. ACIT (ITA No. 8118/Mum/2010)

05 September 2011 05 September 2011 10 September 2011

194

195

196

08 September 2011

197

12 September 2011

198

ADIT v. Star Cruise India Travel Services (P.) Ltd [2011] 46 SOT 173 (MUM) (URO) Nippon Kaiji Kyokoi v. ITO [2011] 47 SOT 41 (MUM) (URO)

13 September 2011

199

13 September 2011

200

ACIT v. North City Developers [2011-TIOL-672-ITAT-KOL]

14 September 2011

2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

KPMG FLASH NEWS ASSEMBLAGE - 2011

KPMG IN INDIA certified by architect 201 Liability of Dividend Distribution Tax does not depend upon eventual taxability of dividend income Payment received for supply of software not to be treated as Royalty as per India-Israel tax treaty as it was neither for the use of a copyright nor process Corporate guarantee provided to associated enterprises is not an international transaction Roadside amenities cannot be treated as 'infrastructure facility' for the purposes of claiming deduction under Section 80-IA of the Income-tax Act Landmark decision of the Mumbai Tribunal on core issues relating to Intra-Group Services / Headquarter Cost allocations Payment for license to use shrink wrapped computer software constitutes 'royalty' The Delhi Tribunal held that a Project Office of a foreign company constitutes a Permanent Establishment in India Competition Commission of India approves the acquisition of nutrition business of Wockhardt by Danone Group Deduction under Section 10A is available once RBI approval under FEMA is obtained in respect of delay in remittance of export proceeds Compensation paid for settlement of patent infringement dispute in the USA is deductible expenditure Interest received on income tax refund can be set-off against the interest paid on delayed payment of income tax New Takeover Regulations notified Provident Fund (PF) office negotiating banking arrangement for payment of social security The Tata Power Company Limited v. ACIT (ITA No. 4497/M/2008) ADIT v. TII Team Telecom International Pvt. Ltd. [2011] 47 SOT 76 (MUM) 15 September 2011 15 September 2011

202

203

Four Soft Ltd v. DCIT (ITA No. 1495/HYD/2010) L&T Transportation Infrastructure Limited v. ITO [2011] 47 SOT 105 (CHE)

16 September 2011 16 September 2011

204

205

Dresser-Rand India Private Limited v. ACIT [2011] 47 SOT 423 (MUM) ING Vysya Bank Ltd v. DDIT [2011-TII/136-ITAT-BANG-INTL] Samsung Heavy Industries Co. Ltd. v. ADIT [2011] 133 ITD 413 (DEL) CCI Order dated 15 September 2011

16 September 2011

206

17 September 2011 20 September 2011

207

208

21 September 2011

209

210

CIT v. Morgan Stanley Advantage Services Pvt. Ltd. [2011] 13 taxmann.com 166 (BOM) CIT v. Desiccant Rotors International (P.) Ltd. [2011] 201 TAXMAN 144 (DEL) DCIT v. Bank of America NT & SA [2011-TII-ITAT-MUM-INTL] SEBI Release dated 23 September 2011 Circular No. IWU/8(2) Bnkg Arrangement/2009/28871 dated

21 September 2011

21 September 2011

211

23 September 2011

212 213

24 September 2011 27 September 2011

2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

KPMG FLASH NEWS ASSEMBLAGE - 2011

KPMG IN INDIA benefits to International Workers (IWs) 214 Activities relating to installation of pipe lines by a marine vessel are treated as construction and assembly and results into Permanent Establishment if carried on for more than nine months under the India Mauritius tax-treaty Supreme Court stays recovery of Service tax on Renting of Immovable Property KPMGs Individual Income Tax and Social Security Rate Survey 2011 External Commercial Borrowings: Rationalisation and Liberalisation 23 September 2011 GIL Mauritius Holdings Ltd v. ADIT [2011] 48 SOT 17 (DEL) 29 September 2011

215

------------

01 October 2011

216

------------

03 October 2011

217

218

Consolidated Foreign Direct Investment (FDI) policy fourth edition Interest paid on delayed payment of income tax cannot be set off against the interest received on income tax refund Reduction of Equity share capital without variation of shareholders rights and without payment of any consideration to the shareholder is not subject to capital gain provisions There is no time limit for initiating withholding tax proceedings during the relevant period. Further the Limitation Act, 1963 does not apply to income tax Act Central Board of Excise and Customs (CBEC) formally notifies On-Site Post Clearance Audit at the Premises of Importers and Exporters Regulations, 2011 (the Regulations) AAR held that the payment received for right to use copyright in the software is taxable as royalty Right to exercise an option to sell stock allotted under the Employee Stock Option Plan (held through a Trust) to be considered as a capital asset

A.P. (DIR Series) Circular No.2529 dated 26 September 2011; and A.P. (DIR Series) Circular No.30 dated 27 September 2011 Circular 2 of 2011

03 October 2011

04 October 2011

219

Sandvik Asia Ltd v. DCIT [2011-TIOL-625-ITAT-PUNE-TM]

04 October 2011

220

Bennett Coleman & Co. Ltd v. ACIT [2011] 133 ITD 1 (MUM)(SB)

05 October 2011

221

Bhura Exports Ltd v. ITO [2011] 13 TAXMANN.COM 162 (CAL)

10 October 2011

222

Notification No. 72/2011-Cus (NT) dated 4 October 2011

10 October 2011

223

Millennium IT Software Ltd [2011] 338 ITR 391 (AAR)

11 October 2011

224

Abhiram Seth v. JCIT [ITA No. 2302/Del/2010]

14 October 2011

2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

KPMG FLASH NEWS ASSEMBLAGE - 2011

KPMG IN INDIA 225 Date from which liability to pay Service tax under reverse charge mechanism attains finality Income of non-resident from production of television signals for broadcasting of cricket matches in India is taxable as fees for technical services on gross basis. In the absence of a Permanent Establishment, advertisement revenues from the Indian advertisers for matches held outside India and telecasted internationally are not taxable in India India signs a comprehensive Social Security Agreement (SSA) with Germany to provide additional benefits For the purpose of Section 2(22)(e) of the Income- tax Act, a partnership firm is to be considered as the shareholder even though the shares are held in the name of its partners The time period of independent installation and assembly projects cannot be aggregated in order to determine the constitution of a Permanent Establishment under Article 5(3) of India-Singapore tax treaty Markup on costs incurred is not an arms length remuneration for sourcing support service and the taxpayer should be compensated on the basis of value of the goods sourced through it The Ministry of Finance issued a discussion paper on Tax Accounting Standards (TAS) on Construction Contracts and Government Grants Due date for electronic filing of half yearly Service Tax Returns extended to 26 December 2011 Supply of goods to offshore installations i.e. Exclusive Economic Zone (EEZ) will not be subject to sales tax, especially Central Sales Tax, since EEZ does not form part of the territory of India Highlights of additional sops announced for exporters under Foreign Trade Policy 2009-14 Circular No. 276/8/2009-CX8A dated 26 September 2011 Nimbus Sport International Pte Ltd v. DDIT [2011-TII-178-ITAT-DEL-INTL] 14 October 2011

226

14 October 2011

227

PIB press release dated 13 October 2011

17 October 2011

228

CIT v. National Travel Services (ITA 219, 223, 1204 of 2010 & 309 of 2011)

17 October 2011

229

Tiong Woon Project & Contracting Pte Ltd [2011] 338 ITR 386 (AAR)

17 October 2011

230

Li & Fung (India) Pvt. Ltd. v. DCIT [2011] 16 taxmann.com 192 (Del)

19 October 2011

231

Discussion paper on Tax Accounting Standard

20 October 2011

232

Order No. 1/2011-Service Tax

21 October 2011

233

Larsen & Toubro Ltd v. UOI [2011-VIL-46-GUJ)

24 October 2011

234

----------

24 October 2011

2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

KPMG FLASH NEWS ASSEMBLAGE - 2011

KPMG IN INDIA 235 Karnataka High Court held that for computation of tax holiday benefit, what is excluded from export turnover must necessarily be excluded from total turnover as well Competition Commission of India approves the proposed amalgamation of ALSTOM Group companies in India Synopsis of Vodafone proceedings before the Supreme Court Government issues additional clarifications on the grant of employment visa New Permanent Account Number Form 49AA introduced for Individuals not being a citizen of India, LLP, Companies, Firm, Trust, AOP, BOI, formed or registered outside India Draft Circular on Service tax refund scheme for exporters Social Security Agreement between India and Denmark comes into effect Payment made for supply of software is not royalty since it is copyrighted software and not copyright in the software Reserve Bank of India (RBI) issues clarification on repatriation of income and sale proceeds of assets (i) held abroad by Non Resident of India (NRIs) who have returned to India for permanent settlement and (ii) acquired abroad under the Liberalised Remittance Scheme Delhi High Court upheld CBDT circular requiring Third Party Administrators to withhold tax under Section 194J of the Income-tax Act while making payment to hospital CBDT amended Income-tax rules for grant of withholding tax credit to person other than deductees Brought forward business loss and unabsorbed depreciation shall not be adjusted while computing the profit eligible for relief under CIT v. Dell International Services India Private Limited and Ors. (ITA No. 70/2009) 28 October 2011

236

----------

31 October 2011

237

----------

01 November 2011 02 November 2011 02 November 2011

238

----------

239

Notification No. 56/2011 dated 17 October 2011

240

Draft Circular dated 31 October 2011 www.epfindia.com

02 November 2011 03 November 2011 04 November 2011

241

242

DCIT v. ABAQUS Engineering Pvt Ltd [2011-TII-143-ITAT-MAD-INTL] RBI/2011-12/226 A.P. (DIR Series) Circular No. 37, dated 19 October 2011

243

07 November 2011

244

Vipul Medcorp TPA Pvt Ltd & Ors v. CBDT [2011-TIOL-641-HC-DEL-IT]

07 November 2011

245

Notification No. 57/2011 dated 24 October 2011

08 November 2011

246

CIT v. Yokogawa India Ltd [2011-TIOL-711-HC-KAR-IT]

08 November 2011

2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

KPMG FLASH NEWS ASSEMBLAGE - 2011

KPMG IN INDIA Section 10A of the Income-tax Act 247 The Reserve Bank of India liberalises and rationalises the Foreign Direct Investment Transfer of Shares guidelines Payment for transfer of right to broadcast live cricket matches is not royalty Expenditure incurred on application software is allowable as revenue expenditure Residential status of the individual who leaves India for the purpose of employment outside India as a member of the crew of an Indian ship Deduction under Section 80HHE of the Act shall be computed on the basis of adjusted book profit while computing Minimum Alternate Tax under Section 115JA of the Act Transaction charges paid to the Stock Exchange constitutes Fees for Technical Services. Since there was a bonafide belief for a decade that tax was not deductible at source, no disallowance can be made under Section 40(a)(ia) of the Income-tax Act Highlights of India - Georgia tax treaty RBI A.P. (DIR Series) Circular No. 43 ADIT v. Neo Sports Broadcast Private Limited [2011-TII-185-ITAT-MUM-INTL] CIT v. Asahi India Safety Glass Ltd [2011-TIOL-705-HC-DEL-IT] Madhukar Vinayak Dhavale v. ITO 08 November 2011 12 November 2011 14 November 2011 14 November 2011

248

249

250

251

CIT v. Bhari Information Tech Systems Pvt Ltd (2011-TIOL-107-SC-IT)

15 November 2011

252

CIT v. Kotak Securities Ltd. [ITA No. 3111 of 2009 dated 21 October 2011]

15 November 2011

253

254

Capital gains on transfer of shares in Indian company by Mauritian subsidiary of UK entity is not chargeable to tax in India Payment made by taxpayer towards noncompete fee to its employees in US, treated as salary income not taxable in India under IndiaUS Double Taxation Avoidance Agreement. Consequently, taxpayer was not liable to deduct tax at source while making the said Findings from subsequent year's assessment constitute sufficient tangible material to reopen assessment beyond four years Reserve Bank of India liberalises procedure for Set-off of export receivables against import

CBDT Press Release (Ministry of Finance) No.402/92/2006 MC (20 of 2011) , dated 24 August 2011 Ardex Investments Mauritius Ltd. [2011] 203 Taxman 402 (AAR)

15 November 2011 16 November 2011

255

Sasken Communication Technologies Ltd. v. Income- tax Officer [2011] 15 taxmann.com 36 (Ban)

16 November 2011

256

257

Indo European Breweries Ltd. v. ITO (Writ Petition No. 2000 of 2011, Judgement dated 20 October 2011) RBI A. P. (DIR Series) Circular No. 47, dated 17 November 2011

18 November 2011

21 November 2011

2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

KPMG FLASH NEWS ASSEMBLAGE - 2011

KPMG IN INDIA payables 258 Commission paid to a foreign agent without deduction of tax for services rendered outside India cannot be disallowed under the Incometax Act Revised concept paper for public debate on taxation of services based on negative list Interest paid on borrowed funds invested in shares of operating companies for acquiring a controlling stake is disallowed under Section 14A of the Act Payments for rendering healthcare services cannot be treated as Fees for included services or Royalty under the India-USA tax treaty A 100 percent export oriented unit which has already availed the tax benefit under the old regime is eligible for the balance unexpired period out of 10 years by virtue of amendment to Section 10B of the Income-tax Act from AY 1999-2000 Mumbai Tribunal held that where the TPO fails to show expressly as to how all or any of the comparables selected by the taxpayer are not comparable, then a presumption has to be drawn that those cases are comparable Key changes under Customs Regulations, 2011 DCIT v. Divis Laboratories Ltd [2011] 131 ITD 271 (HYD) 22 November 2011

259

----------

22 November 2011 26 November 2011

260

Maxopp Investment Ltd v. CIT [2011] 203 Taxman 364 (Del)

261

JDIT v. Harward Medical International USA [ITA No.1558/ 1559(Mum)/07, dated 15 November 2011] CIT & ACIT v. DSL Software Ltd [2011-TIOL-787-HC-KAR-IT]

28 November 2011

262

28 November 2011

263

-----------

29 November 2011

264

265

Payment for shrink wrapped software/ off-theshelf software amounts to royalty Concept of Self Assessment in Customs clearances was implemented with Finance Act, 2011. As a trade facilitation measure, Government has issued a Customs Manual on Self Assessment 2011 to serve as a guide/ advisory to the importer/ exporter Full exemption available under Section 54F of the Income-tax Act, 1961 even if the investment

266

Notification Nos 79/ 2011 Customs (NT), 80/ 2011Customs (NT) and 81/2011Customs (NT) dated 25 August 2011 CIT v. Samsung Electronics Co Ltd and others [2011-TII-43-HC-KAR-INTL] http://www.cbec.gov.in

30 November 2011

30 November 2011 30 November 2011

267

CIT v. Ravindra Kumar Arora (ITA No. 1106 of 2011)

30 November 2011

2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

KPMG FLASH NEWS ASSEMBLAGE - 2011

KPMG IN INDIA is made under joint name with spouse 268 Foreign Direct Investment in Multi Brand Retail Press Release dated 25 November 2011 issued by the GoI, Ministry of Commerce and Industry CIT v. Wipro Ltd. [2011-TII-45-HC-KAR-INTL] ITO v. Shri Sanjay Singh [ITA No. 2021/Del/2008, dated 18 November 2011] 30 November 2011

269

Payment for right to access database of a foreign publisher amounts to royalty Benefit under Section 47(xiv) of the Income-tax Act cannot be denied in case there is a delay in allotment of shares to the proprietor on conversion of a proprietary concern into a company Since transmission and wheeling charges paid by power trading companies are not rent, the taxpayer was not required to deduct tax at source Social Security Agreement between India and Republic of Korea comes into effect Payments received by a non-resident for Value Added Services (VAS) is partly treated as Royalty and partly as Fees for Technical Services under India-UK tax treaty The role of Transfer Pricing Officer (TPO) is limited to determination of the Arms Length Price (ALP) in relation to the international transactions referred to him by the Assessing Officer (AO) Sale of Software without granting right to duplicate, amounts to sale of copyrighted article and not the transfer of copyright and therefore not taxable as Royalty Expenditure can be disallowed only in the event of non-deduction of tax at source, and not in the cases involving short deduction Interest payable to French resident on loan insured by specified French corporation is not taxable in India in view of Most Favoured Nation clause under India-France tax treaty

01 December 2011 05 December 2011

270

271

Gridco Limited v. ACIT (ITA No. 404/CTK/2011)

05 December 2011

272

http://epfindia.com

05 December 2011 08 December 2011

273

De Beers UK Limited v. DCIT [ITA No.8831/Mum/2010 (AY 2007-08)

274

Amadeus India Pvt. Ltd. v. CIT [ITA No. 938/2011, dated 28 November 2011]

08 December 2011

275

Novell Inc. v. DDIT [2011-TII-200-ITAT-MUM-INTL]

08 December 2011

276

Sandvik Asia Ltd. v. JCIT (ITA No. 758/PN/99 & CO No. 58/PN/05) Poonawalla Aviation Private Limited (AAR No. 953 of 2010)

08 December 2011

277

09 December 2011

2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

KPMG FLASH NEWS ASSEMBLAGE - 2011

KPMG IN INDIA 278 Indexation benefit on gifted asset to apply from the year in which the asset was acquired by the previous owner Passive increase in shareholding / voting rights does not attract provisions of regulation 11 (1) of SEBI (Substantial Acquisition of Shares and Takeovers) Regulation, 1997 Services rendered to Indian Insurance Company in the process of re-insurance of risk cannot be treated as Fees for Technical Services under India-UK tax treaty Social Security Agreement between India and Netherlands comes into effect Payments for operational and support services are Fees for Technical Services under Article 12 of India-Netherland tax treaty The Companies Bill, 2011 has been presented before the lower house of Parliament (Lok Sabha) The Reserve Bank of India delegates Compounding powers to its Regional Offices and prescribes format for submission of details / information Change of employer by a foreign national in India Government issues detailed guidelines Interest for shortfall in payment of advance tax is leviable while computing book profit under the existing provisions of Minimum Alternate Tax Delhi High Court upheld the employee head count method for cost allocation towards STP unit Payment for import of software amounts to royalty under the Income-tax Act Unlisted Public Companies (Preferential Allotment) Amendment Rules, 2011 issued by MCA for amendment of Unlisted Public Companies (Preferential Allotment) Rules, 2003 CIT v. Manjula J Shah [2011TIOL-808-HC-Mum-IT] 09 December 2011

279

Raghu Hari Dalmia v. SEBI [2011] 16 Taxmann.com 100 (SAT)

13 December 2011

280

Guy Carpenter & Co. Ltd v. ADIT [2011-TII-190-ITAT-DEL-INTL]

13 December 2011

281

http://epfindia.com

14 December 2011 16 December 2011

282

Perfetti Van Melle Holding B.V. [AAR No 869 of 2010, dated 9 December 2011] ------------

283

19 December 2011

284

Circular No. 57 dated 13 December 2011

19 December 2011

285

http://www.mha.nic.in/

20 December 2011 21 December 2011

286

287

DCIT v. Bharat Aluminium Company Ltd [ITA No.2825/Del/ 2010 (AY 2007-08), dated 9 December 2011] CIT v. EHPT India P. Ltd. (ITA 1172/2008)

22 December 2011

288

289

CIT v. Lucent Technologies (ITA No. 168 of 2004 and ITA No. 170 of 2004) Notification No. No. F. 2/21/2011CL V dated 14 December 2011

22 December 2011 22 December 2011

2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

KPMG FLASH NEWS ASSEMBLAGE - 2011

KPMG IN INDIA 290 Competition Commission of India approves the acquisition of 10 percent FII stake in Magma Fincorp Limited Application filed before the AAR to seek the advance ruling cannot be admitted if the applicant has already filed the income-tax return Non-prospecting related expenditure incurred prior to commencement of mining is deductible under Section 37 of the Income-tax Act The Delhi High Court rules favourably on taxability of offshore supply of equipment comprising hardware and software CCI Order dated 13 December 2011 26 December 2011

291

292

293

294

AAR held that payments for Business Support Services are not Fees for Technical Services under the India-Netherlands tax treaty The tax department cannot rely on the negative order passed by the Dispute Resolution Panel for not staying the demand where issues are covered by the order of the Commissioner (Appeals) or the Tribunal. Hyderabad Tribunal rules on the timing of taxability of development agreements

SEPCOIII Electric Power Construction Corporation, In re [2011] 16 taxmann.com 195 (AAR) De Beers India Prospecting Pvt. Ltd v. ITO (ITA No. 40/Mum/2006 and ITA Nos.6193 & 86/Mum/2007) DIT v. Ericsson A.B., Ericsson Radio Systems A.B. and M/s Metapath Software International Ltd ( ITA 504,507, 508, 511 & 397 of 2007) Shell Technology India Private Limited [AAR No 850 of 2009, dated 21 December 2011] Maruti Suzuki India Limited v. DCIT [Writ Petition (Civil) No. 2252/2011, dated 25 November 2011]

26 December 2011

28 December 2011

28 December 2011

28 December 2011

295

28 December 2011

296

297

In the absence of principal-agent relationship, discount offered by laboratory to the collection centre is not in the nature of commission Taxability of import of International Private Leased Circuit services The Government of India signed a Protocol with the Government of Australia amending the India-Australia tax treaty KPMG Tax Highlights for 2011

Shri Suresh Kumar D. Shah v. DCIT (ITA no. 420, 421, 422, 423, 425 & 426 / Hyd / 2011) SRL Ranbaxy Ltd. v. ACIT (ITA No. 434/Del/2011)

29 December 2011

29 December 2011

298

Letter No. F. No. 137/21/2011 S.T dated 19 December 2011 -----------

29 December 2011 29 December 2011

299

300

------------

30 December 2011

2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

KPMG FLASH NEWS ASSEMBLAGE - 2011

www.kpmg.com/in

Ahmedabad Safal Profitaire B4 3rd Floor,`Corporate Road, Opp. Auda Garden, Prahlad Nagar Ahmedabad 380 015 Tel: +91 79 4040 2200 Fax: +91 79 4040 2244 Bangalore Maruthi Info-Tech Centre 11-12/1, Inner Ring Road Koramangala, Bangalore 560 071 Tel: +91 80 3980 6000 Fax: +91 80 3980 6999 Chandigarh SCO 22-23 (Ist Floor) Sector 8C, Madhya Marg Chandigarh 160 009 Tel: +91 172 393 5777/781 Fax: +91 172 393 5780 Chennai No.10, Mahatma Gandhi Road Nungambakkam Chennai 600 034 Tel: +91 44 3914 5000 Fax: +91 44 3914 5999 Delhi Building No.10, 8th Floor DLF Cyber City, Phase II Gurgaon, Haryana 122 002 Tel: +91 124 307 4000 Fax: +91 124 254 9101 Hyderabad 8-2-618/2 Reliance Humsafar, 4th Floor Road No.11, Banjara Hills Hyderabad 500 034 Tel: +91 40 3046 5000 Fax: +91 40 3046 5299 Kochi 4/F, Palal Towers M. G. Road, Ravipuram, Kochi 682 016 Tel: +91 484 302 7000 Fax: +91 484 302 7001

KPMG IN INDIA

Kolkata Infinity Benchmark, Plot No. G-1 10th Floor, Block EP & GP, Sector V Salt Lake City, Kolkata 700 091 Tel: +91 33 44034000 Fax: +91 33 44034199 Mumbai Lodha Excelus, Apollo Mills N. M. Joshi Marg Mahalaxmi, Mumbai 400 011 Tel: +91 22 3989 6000 Fax: +91 22 3983 6000 Pune 703, Godrej Castlemaine Bund Garden Pune 411 001 Tel: +91 20 3050 4000 Fax: +91 20 3050 4010

The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.

2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

The KPMG name, logo and cutting through complexity are registered trademarks of KPMG International Cooperative (KPMG International), a Swiss entity.

Das könnte Ihnen auch gefallen

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisVon EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNoch keine Bewertungen

- Tax Glimpses 2012Dokument92 SeitenTax Glimpses 2012CharuJagwaniNoch keine Bewertungen

- November 2020Dokument36 SeitenNovember 2020ABC 123Noch keine Bewertungen

- Ernst & Young Merchant Banking Services LLPDokument11 SeitenErnst & Young Merchant Banking Services LLPManishNoch keine Bewertungen

- Digest Case Laws January 2011Dokument15 SeitenDigest Case Laws January 2011Umang SangalNoch keine Bewertungen

- (A Bharti Enterprise) T.: +91-124-4222222, F.: +91-124-4248063, Email Id: Compliance - Officer@bharti - InDokument13 Seiten(A Bharti Enterprise) T.: +91-124-4222222, F.: +91-124-4248063, Email Id: Compliance - Officer@bharti - InShweta ChaudharyNoch keine Bewertungen

- Legal Roundup - July 08Dokument10 SeitenLegal Roundup - July 08api-3730218Noch keine Bewertungen

- Indian IT Outlook 2012Dokument2 SeitenIndian IT Outlook 2012SidRoy84Noch keine Bewertungen

- 3M India - MF Case Law - Bang ITATDokument16 Seiten3M India - MF Case Law - Bang ITATbharath289Noch keine Bewertungen

- Announces Q2 Results, Results Press Release & Auditors Report For September 30, 2015 (Result)Dokument15 SeitenAnnounces Q2 Results, Results Press Release & Auditors Report For September 30, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Deloitte Tax Alert - Tax Is Deductible at Source On Year-End Provisions Created For Ascertained LiabilitiesDokument4 SeitenDeloitte Tax Alert - Tax Is Deductible at Source On Year-End Provisions Created For Ascertained LiabilitiesRajuNoch keine Bewertungen

- MTNL Annual Report 2009-10Dokument157 SeitenMTNL Annual Report 2009-10Mohammad ShoaibNoch keine Bewertungen

- India Budget Statement 2011: Mgb&coDokument39 SeitenIndia Budget Statement 2011: Mgb&coAnsal HaneefaNoch keine Bewertungen

- CENVAT: A Fresh Perspective: Vivek Kohli, Ashwani Sharma, Anuj KakkarDokument8 SeitenCENVAT: A Fresh Perspective: Vivek Kohli, Ashwani Sharma, Anuj Kakkarraju7971Noch keine Bewertungen

- Company Profile AirtelDokument3 SeitenCompany Profile Airtelcharacter2407100% (1)

- PTL - Case AnalysisDokument6 SeitenPTL - Case AnalysisTanya JainNoch keine Bewertungen

- EoDB Intiatives 11december2015Dokument5 SeitenEoDB Intiatives 11december2015Shabir TrambooNoch keine Bewertungen