Beruflich Dokumente

Kultur Dokumente

New Text Document

Hochgeladen von

Vicky KumarOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

New Text Document

Hochgeladen von

Vicky KumarCopyright:

Verfügbare Formate

Banking in India From Wikipedia, the free encyclopedia Structure of the organised banking sector in India.

Number of banks are in brack ets. Banking in India originated in the last decades of the 18th century. The first b anks were The General Bank of India, which started in 1786, and Bank of Hindusta n, which started in 1790; both are now defunct. The oldest bank in existence in India is the State Bank of India, which originated in the Bank of Calcutta in Ju ne 1806, which almost immediately became the Bank of Bengal. This was one of the three presidency banks, the other two being the Bank of Bombay and the Bank of Madras, all three of which were established under charters from the British East India Company. For many years the Presidency banks acted as quasi-central banks , as did their successors. The three banks merged in 1921 to form the Imperial B ank of India, which, upon India's independence, became the State Bank of India i n 1955. Contents [hide] 1 History 2 Post-Independence 3 Nationalisation 4 Liberalisation 5 Adoption of banking technology 6 Further reading 7 References 8 External links [edit]History Indian merchants in Calcutta established the Union Bank in 1839, but it failed i n 1848 as a consequence of the economic crisis of 1848-49. The Allahabad Bank, e stablished in 1865 and still functioning today, is the oldest Joint Stock bank i n India.(Joint Stock Bank: A company that issues stock and requires shareholders to be held liable for the company's debt) It was not the first though. That hon or belongs to the Bank of Upper India, which was established in 1863, and which survived until 1913, when it failed, with some of its assets and liabilities bei ng transferred to the Alliance Bank of Simla. When the American Civil War stopped the supply of cotton to Lancashire from the Confederate States, promoters opened banks to finance trading in Indian cotton. With large exposure to speculative ventures, most of the banks opened in India d uring that period failed. The depositors lost money and lost interest in keeping deposits with banks. Subsequently, banking in India remained the exclusive doma in of Europeans for next several decades until the beginning of the 20th century . Foreign banks too started to arrive, particularly in Calcutta, in the 1860s. The Comptoire d'Escompte de Paris opened a branch in Calcutta in 1860, and another in Bombay in 1862; branches in Madras and Pondicherry, then a French colony, fol lowed. HSBC established itself in Bengal in 1869. Calcutta was the most active t rading port in India, mainly due to the trade of the British Empire, and so beca me a banking center. The first entirely Indian joint stock bank was the Oudh Commercial Bank, establi shed in 1881 in Faizabad. It failed in 1958. The next was the Punjab National Ba nk, established in Lahore in 1895, which has survived to the present and is now one of the largest banks in India. Around the turn of the 20th Century, the Indian economy was passing through a re lative period of stability. Around five decades had elapsed since the Indian Mut iny, and the social, industrial and other infrastructure had improved. Indians h ad established small banks, most of which served particular ethnic and religious communities. The presidency banks dominated banking in India but there were also some exchang

e banks and a number of Indian joint stock banks. All these banks operated in di fferent segments of the economy. The exchange banks, mostly owned by Europeans, concentrated on financing foreign trade. Indian joint stock banks were generally under capitalized and lacked the experience and maturity to compete with the pr esidency and exchange banks. This segmentation let Lord Curzon to observe, "In r espect of banking it seems we are behind the times. We are like some old fashion ed sailing ship, divided by solid wooden bulkheads into separate and cumbersome compartments." The period between 1906 and 1911, saw the establishment of banks inspired by the Swadeshi movement. The Swadeshi movement inspired local businessmen and politic al figures to found banks of and for the Indian community. A number of banks est ablished then have survived to the present such as Bank of India, Corporation Ba nk, Indian Bank, Bank of Baroda, Canara Bank and Central Bank of India. The fervour of Swadeshi movement lead to establishing of many private banks in D akshina Kannada and Udupi district which were unified earlier and known by the n ame South Canara ( South Kanara ) district. Four nationalised banks started in t his district and also a leading private sector bank. Hence undivided Dakshina Ka nnada district is known as "Cradle of Indian Banking". During the First World War (1914 1918) through the end of the Second World War (19 39 1945), and two years thereafter until the independence of India were challengin g for Indian banking. The years of the First World War were turbulent, and it to ok its toll with banks simply collapsing despite the Indian economy gaining indi rect boost due to war-related economic activities. At least 94 banks in India fa iled between 1913 and 1918 as indicated in the following table: Years Number of banks that failed Authorised capital (Rs. Lakhs) Paid-up Capital (Rs. Lakhs) 1913 12 274 35 1914 42 710 109 1915 11 56 5 1916 13 231 4 1917 9 76 25 1918 7 209 1 [edit]Post-Independence The partition of India in 1947 adversely impacted the economies of Punjab and We st Bengal, paralyzing banking activities for months. India's independence marked the end of a regime of the Laissez-faire for the Indian banking. The Government of India initiated measures to play an active role in the economic life of the nation, and the Industrial Policy Resolution adopted by the government in 1948 e nvisaged a mixed economy. This resulted into greater involvement of the state in different segments of the economy including banking and finance. The major step s to regulate banking included: The Reserve Bank of India, India's central banking authority, was established in April 1934, but was nationalized on January 1, 1949 under the terms of the Rese rve Bank of India (Transfer to Public Ownership) Act, 1948 (RBI, 2005b).[Referen ce www.rbi.org.in] In 1949, the Banking Regulation Act was enacted which empowered the Reserve Bank of India (RBI) "to regulate, control, and inspect the banks in India." The Banking Regulation Act also provided that no new bank or branch of an existi ng bank could be opened without a license from the RBI, and no two banks could h ave common directors. [edit]Nationalisation

Banks Nationalisation in India: Newspaper Clipping, Times of India, July 20, 196 9 Despite the provisions, control and regulations of Reserve Bank of India, banks

in India except the State Bank of India or SBI, continued to be owned and operat ed by private persons. By the 1960s, the Indian banking industry had become an i mportant tool to facilitate the development of the Indian economy. At the same t ime, it had emerged as a large employer, and a debate had ensued about the natio nalization of the banking industry. Indira Gandhi, then Prime Minister of India, expressed the intention of the Government of India in the annual conference of the All India Congress Meeting in a paper entitled "Stray thoughts on Bank Natio nalisation." The meeting received the paper with enthusiasm. Thereafter, her move was swift and sudden. The Government of India issued an ord inance and nationalised the 14 largest commercial banks with effect from the mid night of July 19, 1969. Jayaprakash Narayan, a national leader of India, describ ed the step as a "masterstroke of political sagacity." Within two weeks of the i ssue of the ordinance, the Parliament passed the Banking Companies (Acquisition and Transfer of Undertaking) Bill, and it received the presidential approval on 9 August 1969. A second dose of nationalization of 6 more commercial banks followed in 1980. Th e stated reason for the nationalization was to give the government more control of credit delivery. With the second dose of nationalization, the Government of I ndia controlled around 91% of the banking business of India. Later on, in the ye ar 1993, the government merged New Bank of India with Punjab National Bank. It w as the only merger between nationalized banks and resulted in the reduction of t he number of nationalised banks from 20 to 19. After this, until the 1990s, the nationalised banks grew at a pace of around 4%, closer to the average growth rat e of the Indian economy. [edit]Liberalisation In the early 1990s, the then Narasimha Rao government embarked on a policy of li beralization, licensing a small number of private banks. These came to be known as New Generation tech-savvy banks, and included Global Trust Bank (the first of such new generation banks to be set up), which later amalgamated with Oriental Bank of Commerce, Axis Bank(earlier as UTI Bank), ICICI Bank and HDFC Bank. This move, along with the rapid growth in the economy of India, revitalized the bank ing sector in India, which has seen rapid growth with strong contribution from a ll the three sectors of banks, namely, government banks, private banks and forei gn banks. The next stage for the Indian banking has been set up with the proposed relaxati on in the norms for Foreign Direct Investment, where all Foreign Investors in ba nks may be given voting rights which could exceed the present cap of 10%,at pres ent it has gone up to 74% with some restrictions. The new policy shook the Banking sector in India completely. Bankers, till this time, were used to the 4-6-4 method (Borrow at 4%;Lend at 6%;Go home at 4) of fu nctioning. The new wave ushered in a modern outlook and tech-savvy methods of wo rking for traditional banks.All this led to the retail boom in India. People not just demanded more from their banks but also received more. Currently (2010), banking in India is generally fairly mature in terms of supply , product range and reach-even though reach in rural India still remains a chall enge for the private sector and foreign banks. In terms of quality of assets and capital adequacy, Indian banks are considered to have clean, strong and transpa rent balance sheets relative to other banks in comparable economies in its regio n. The Reserve Bank of India is an autonomous body, with minimal pressure from t he government. The stated policy of the Bank on the Indian Rupee is to manage vo latility but without any fixed exchange rate-and this has mostly been true. With the growth in the Indian economy expected to be strong for quite some timeespecially in its services sector-the demand for banking services, especially re tail banking, mortgages and investment services are expected to be strong. One m ay also expect M&As, takeovers, and asset sales. In March 2006, the Reserve Bank of India allowed Warburg Pincus to increase its stake in Kotak Mahindra Bank (a private sector bank) to 10%. This is the first t ime an investor has been allowed to hold more than 5% in a private sector bank s ince the RBI announced norms in 2005 that any stake exceeding 5% in the private

sector banks would need to be vetted by them. In recent years critics have charged that the non-government owned banks are too aggressive in their loan recovery efforts in connection with housing, vehicle a nd personal loans. There are press reports that the banks' loan recovery efforts have driven defaulting borrowers to suicide.[1][2][3] [edit]Adoption of banking technology The IT revolution had a great impact in the Indian banking system. The use of co mputers had led to introduction of online banking in India. The use of the moder n innovation and computerisation of the banking sector of India has increased ma ny fold after the economic liberalisation of 1991 as the country's banking secto r has been exposed to the world's market. The Indian banks were finding it diffi cult to compete with the international banks in terms of the customer service wi thout the use of the information technology and computers. Number of branche of scheduled banks of India as of March 2005 The RBI in 1984 formed Committee on Mechanisation in the Banking Industry (1984) [4] whose chairman was Dr C Rangarajan, Deputy Governor, Reserve Bank of India. The major recommendations of this committee was introducing MICR[5] Technology i n the all the banks in the metropolis in India.This provided use of standardized cheque forms and encoders. In 1988, the RBI set up Committee on Computerisation in Banks (1988)[6] headed b y Dr. C.R. Rangarajan which emphasized that settlement operation must be compute rized in the clearing houses of RBI in Bhubaneshwar, Guwahati, Jaipur, Patna and Thiruvananthapuram.It further stated that there should be National Clearing of inter-city cheques at Kolkata,Mumbai,Delhi,Chennai and MICR should be made Opera tional.It also focused on computerisation of branches and increasing connectivit y among branches through computers.It also suggested modalities for implementing on-line banking.The committee submitted its reports in 1989 and computerisation began form 1993 with the settlement between IBA and bank employees' association .[7] IN 1994, Committee on Technology Issues relating to Payments System, Cheque Clea ring and Securities Settlement in the Banking Industry (1994)[8] was set up with chairman Shri WS Saraf, Executive Director, Reserve Bank of India. It emphasize d on Electronic Funds Transfer (EFT) system, with the BANKNET communications net work as its carrier. It also said that MICR clearing should be set up in all bra nches of all banks with more than 100 branches. Committee for proposing Legislation On Electronic Funds Transfer and other Elect ronic Payments (1995)[9] emphasized on EFT system. Electronic banking refers to DOING BANKING by using technologies like computers, internet and networking,MICR ,EFT so as to increase efficiency, quick service,productivity and transparency i n the transaction. Number of ATMs of different Scheduled Commercial Banks Of India as on end March 2005 [7] Apart from the above mentioned innovations the banks have been selling the third party products like Mutual Funds, insurances to its clients.Total numbers of AT Ms installed in India by various banks as on end March 2005 is 17,642.[10]The Ne w Private Sector Banks in India is having the largest numbers of ATMs which is f ollowed by SBI Group, Nationalized banks, Old private banks and Foreign banks.[7 ]The total off site ATM is highest for the SBI and its subsidiaries and then it is followed by New Private Banks, Nationalised banks and Foreign banks. While on site is highest for the Nationalised banks of India.[7] BANK GROUP NUMBER OF BRANCHES ON SITE ATM OFF SITE ATM TOTAL AT M NATIONALISED BANKS 33627 3205 1567 4772 STATE BANK OF INDIA 13661 1548 3672 5220

OLD PRIVATE SECTOR BANKS NEW PRIVATE SECTOR BANKS FOREIGN BANKS 242 218 [edit]Further reading

4511 1685 579

800 1883 797

441 3729

1241 5612

The Evolution of the State Bank of India (The Era of the Imperial Bank of India, 1921-1955) (Volume III) Banking Frontiers - a monthly magazine, published by Mumbai based Glocal Infomar t. Editor [edit]References ^ "ICICI personal loan customer commits suicide after alleged harassment by reco very agents". Parinda.com. Retrieved 2010-07-28. ^ "Karnataka / Mysore News : ICICI Bank returns tractor to farmer s mother". Chenn ai, India: The Hindu. 2008-06-30. Retrieved 2010-07-28. ^ "ICICI s third eye : It s Indiatime". Indiatime.com. Retrieved 2010-07-28.[dead li nk] ^ "Computerisation of banking sector". ^ "MICR technology". ^ "Committee on Computerisation in Banks (1988)". ^ a b c d e INDIAN BANKING SYSTEM. I.K INTERNATIONAL PUBLISHING HOUSE PVT. LTD.. 2006. ISBN 81-88237-88-4. ^ "Reforms in banking system". ^ "Reforms of banking sector". ^ Indian banking system. I.K. International. 2006. ISBN i81-88237-88-4. [edit]External links IndianBanks.org, All India Banking Information Private banks score over public sector banks The importance of public banking Brief profiles, 2008-09 performance, and 2009-10 outlook on 10 leading Indian ba nks Indian Banks Logos Reserve Bank of India [show] v t e Banking in India [show] v t e Banking in Asia View page ratings Rate this page What's this? Trustworthy Objective Complete Well-written I am highly knowledgeable about this topic (optional) Submit ratings Categories: Banking in India Log in / create accountArticleTalkReadEditView history Main page Contents Featured content Current events Random article Donate to Wikipedia Interaction Help About Wikipedia

Community portal Recent changes Contact Wikipedia Toolbox Print/export Languages ????? ?????? Norsk (bokml) Svenska ????? This page was last modified on 26 February 2012 at 07:08. Text is available under the Creative Commons Attribution-ShareAlike License; add itional terms may apply. See Terms of use for details. Wikipedia is a registered trademark of the Wikimedia Foundation, Inc., a non-prof it organization. Contact us Privacy policyAbout WikipediaDisclaimersMobile view

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Sip Project ReportDokument29 SeitenSip Project ReportAAKIB HAMDANINoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- List of Largest Banks in The United States - WikipediaDokument5 SeitenList of Largest Banks in The United States - WikipedialdNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Pakistan's Major Banks and Financial InstitutionsDokument24 SeitenPakistan's Major Banks and Financial Institutionskhizrajamal000Noch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- PassbookDokument128 SeitenPassbookArvind MalviyaNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Expenses Tracker 2022 Peter WafulaDokument50 SeitenExpenses Tracker 2022 Peter Wafulafrank obimoNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Statement 028201000028352Dokument6 SeitenStatement 028201000028352Saravanan 75Noch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Vinayak Pandla Nbs (Bank of Baroda)Dokument19 SeitenVinayak Pandla Nbs (Bank of Baroda)Vinayak PandlaNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Banking Financial Institutions By: Jessica Ong: 1. Define Central BankDokument5 SeitenBanking Financial Institutions By: Jessica Ong: 1. Define Central BankJessica Cabanting OngNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Bank Statement SummaryDokument24 SeitenBank Statement SummaryRanjith Kumar ANoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- Commercial BanksDokument8 SeitenCommercial BanksEdwin NyamohNoch keine Bewertungen

- Evolution of Central Banking in IndiaDokument15 SeitenEvolution of Central Banking in Indiapaisa321Noch keine Bewertungen

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDokument17 SeitenStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancePrasanta BarmanNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- BFSI Sector ReportDokument33 SeitenBFSI Sector ReportSAGAR VAZIRANINoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Oblicon CasesDokument1 SeiteOblicon CasesRenzo JamerNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Complete Banking, Financial & Economic Awareness PDFDokument86 SeitenComplete Banking, Financial & Economic Awareness PDFAbhishek RawatNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Routing CodesDokument14 SeitenRouting CodesParag PenkerNoch keine Bewertungen

- Payment ConfirmationDokument1 SeitePayment ConfirmationsipkatNoch keine Bewertungen

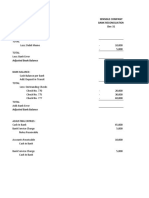

- Sensible Company Bank Reconciliation Dec-31Dokument8 SeitenSensible Company Bank Reconciliation Dec-31OwO OwONoch keine Bewertungen

- Plan Contable EmpresarialDokument432 SeitenPlan Contable EmpresarialJhamil Nirek PascasioNoch keine Bewertungen

- VIJAYA BANK ACCOUNT STATEMENT FOR TECHOPTIONS INFOSOLUTIONS PVT. LTDDokument7 SeitenVIJAYA BANK ACCOUNT STATEMENT FOR TECHOPTIONS INFOSOLUTIONS PVT. LTDVivek PatilNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Allahabad Bank Headquarters and HistoryDokument4 SeitenAllahabad Bank Headquarters and HistoryAmit RanjanNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- 1503XXXXXXXXX006412 12 2022Dokument5 Seiten1503XXXXXXXXX006412 12 2022Prem PanigrahiNoch keine Bewertungen

- Suku Bunga DepositoDokument3 SeitenSuku Bunga DepositoStfs Itu AkuNoch keine Bewertungen

- UAE Banks Swift CodesDokument10 SeitenUAE Banks Swift CodesakatariyaNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- 1542447415479Dokument7 Seiten1542447415479LogeshNoch keine Bewertungen

- Imp Key Indicators of RRBs 2013Dokument6 SeitenImp Key Indicators of RRBs 2013Pankaj SharmaNoch keine Bewertungen

- Nefteft MICR CodesDokument1.192 SeitenNefteft MICR CodesDeepesh DivakaranNoch keine Bewertungen

- Stipulation and Order of Discontinuance by KBC Investments Cayman Islands V Ltd.Dokument5 SeitenStipulation and Order of Discontinuance by KBC Investments Cayman Islands V Ltd.Thierry DebelsNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- N LOcsjr 27 NYUUCobDokument11 SeitenN LOcsjr 27 NYUUCobSANTOSH TRAVELSNoch keine Bewertungen

- Read The Following News Report and Answer Q. 1-4 On The Basis of The Same: (Case Based Question)Dokument4 SeitenRead The Following News Report and Answer Q. 1-4 On The Basis of The Same: (Case Based Question)Aditya BangreNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)