Beruflich Dokumente

Kultur Dokumente

LBTS1

Hochgeladen von

amarsoankar1234Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

LBTS1

Hochgeladen von

amarsoankar1234Copyright:

Verfügbare Formate

MISSION - PCC INCOME TAX AY 2008 - 09

CHAPTER: 1 BASIC CONCEPTS (LECTURE BASED TEST SERIES) LBTS - 1

1. Article _________ empowers the Central Government to levy and to collect the income tax (excluding on an agricultural income). 2. No taxes shall be levied or collected except by the authority of the VALID LAW, i.e. competent legislation Article _________. 3. The Income Tax Laws, means: (a) IT Act 1961, (b) IT Rules 1962, (c) __________________________ & (d)_____________________. 4. Section 294 of the Income Tax Act lays down that _________________________ _________________________________________________________________. 5. A voluntary gathering of natural persons to carry on income generating activities to be called as _________________________. 6. Every _________ is a ________ but every ______ is needs not to be an ______ [use only Section 2 (31) and Section 2(7) to fill up the blanks]. 7. ____________ is the year which precedes the _____________ [use only Section 2 (9) and Section 2 (34) to fill up the blanks) . 8. Match the followings: (a) Section 176 : (i) Income of discontinued business or profession (b) Section 69C : (ii) Unexplained money (c) Section 174 : (iii) Person trying to hide his source of income (d) Section 175 : (iv) Income of person leaving India (e) Section 69A : (v) Unexplained expenditure 9. Section 4 is the ____________________ the Income Tax Act. 10. Income as per the Act has been defined U/s _________, ___________ (Inclusively / Exclusively). 11. A person who fails to comply with the duties imposed upon him under the Act to be called as _____________________________. 12. An assesse commences his business on (a) 1.7.2005, (b) 31.12.2006 and (c) 31.03.04, the AYrs respectively will be (a) _________ (b) ________ and (c) _________. 13. For PY 06-07, the AY will be __________ and the Finance Act related will be _____. 14. For AY 08-09, the PY will be __________ and the Finance Act related will be _____. 15. Finance Bill becomes the Finance Act when it is passed by ____________________ and _________________________.

BONES FOR A BODY, SECTIONS FOR A LAW BUILDS THE PERFECT STRUCTURE.

The LBTS covers the questions specifically based on the previous lecture only.

CHAPTER: 1 BASIC CONCEPTS

All assignment prepared by Mr. Vikas Singh

MISSION - PCC INCOME TAX AY 2008 - 09

CHAPTER: 2 RESIDENTIAL STATUS (LECTURE BASED TEST SERIES) LBTS - 2

1. State whether the following statement is True/False is respect of Marginal Relief. (a) It is available to individual and HUF. (b) It shall be available in respect of education cess. 2. Tax on total income in given cases will be: Assesses Age Total Income Tax Sc. E.C. Total Tax Mr. X 45 Yrs. TI: 2,00,003 Mr. Y 35 Yrs. TI: 1,80,507 Mr. Z 25 Yrs. TI: 4,40,315 Mrs. B 65 Yrs. TI: 2,45,310 Mr. L 40 Yrs. TI: 8,50,000 HUF 20 Yrs. TI: 3,20,000 Firm 10 Yrs. TI: 2,50,000 Co. 5 Yrs. TI: 1,00,025 D. Co. 10Yrs. TI: 37,602 AOP/BO I 5 Yrs. TI: 68,312 3. Surcharge in case of following is payable at the rate and manner: (a) Foreign Company (i) @ 2.5% irrespective of total income (b) Mr. Nirala, 75 Yrs. (ii) @ 10% irrespective of total income (c) Firm (iii) @ 10% if TI exceeds Rs. 10 lacs (d) Local authority & Cooperative Society (iv) @ 2.5% if TI exceeds Rs. 10 lacs (v) Nil 4. Part I of Schedule I of the Finance Act 2006 has given rates of income tax for the: (a) AY - 06 07 (b) AY 07 08 (c) AY 08 09 5. Part III of Schedule I of the Finance Act 2006 has given rates of advance tax & tax to be deducted in case of salary for the: (a) AY - 06 07 (b) AY 07 08 (c) AY 08 09 6. Once a person is resident in a P Yrs. He shall be deemed to be resident for subsequent previous year also state True or False. 7. Mr. Lallan, a citizen of India, left India on 21.10.2004 for employment in abroad. Earlier to this date, he was always in India. During 2005-06 and 2006-07 he came to India for 168 days and 185 days respectively. Determine his residential status for AY 2007-08. 8. Bill Ltd. is an Indian Co. it carries on business in New Delhi and London. The entire control and management of Bill Ltd. is situated outside India. 80% of the total income of the Co. is from the business in London. The residential status of the Co. is . 9. Ms. Manjari, a foreign national visited India during previous year 2006-2007 for 180 days. Earlier to this she never visited India. In this case she shall be

All assignment prepared by Mr. Vikas Singh

MISSION - PCC INCOME TAX AY 2008 - 09

10. Management & Control of affairs of the business refers to (a) Central Controlling Power (b) Holding of Board Meetings (c) Taking of Crucial decision (d) Day to day trading. ()

THERE IS NO SHORTCUT TO ANYWHERE WORTHGOING.

The LBTS covers the questions specifically based on the previous lecture only. (LECTURE BASED TEST SERIES) LBTS A to Z of GTI Mr. Maya Dolas is in receipt of the following incomes during PY 07 - 08. Compute GTI.

No. Income Details

Res./OR

Not-OR

NR

A B C D E F G H I J K L M N O P Q R S T U V W X Y Z

Income from Prop. situated in India received in UK (Rs. 10,000) Income from Prop. situated in Dubai received over there. (Rs. 20,000) Income from Prop. situated in Canada received in India (Rs. 30,000) Income from Agricultural land in India (Rs. 5,000) Income from Agricultural land in Nepal (Rs. 10,000) Cap. Gains on transfer of property situated in India (Rs. 15,000) Profits from Business in Goa managed from Dubai (Rs. 60,000) Profits from Business in USA controlled from India (Rs. 40,000) Profits from Business in UK controlled from UK (Rs. 60,000) Past untaxed income brought to India (Rs. 70,000) Income from Business of publishing magazine in UK by collecting news in India (Rs. 40,000) Income from purchasing goods in India for exporting it to Kenya (Rs. 10,000) Income from shooting of cinematography films in India Note: (Rs. 60,000) Interest on SB deposit in PNB (Rs. 30,000) Interest on investment in Indonesia received over there but half the amount remitted to India (Rs. 15,000) Interest on Deposit in an Indian Co. received in UK (Rs. 18,000) Interest on investment in USSR received in USA (Rs. 12,0000) Interest on last year RPF balance @ 9.5% (Rs. 9,500) Dividends from Indian Co. received in UK (Rs. 10,000) Dividend from Foreign Co. received in India (Rs. 15,000) Salary from Foreign Co. in London (50% of which relates to service rendered to outside in India. (Rs. 60,000) Allowances and perquisites by the Government of India provided to him outside India (Rs. 10,000) Pension for services rendered in India but received in Iraq (Rs. 40,000) Gifts received from his parents (Rs. 1,00,000) Income from artwork in USA and spend over there (Rs. 15,000) Scholarship from AU to meet cost of education (Rs. 5,000) Gross Total Income All assignment prepared by Mr. Vikas Singh

MISSION - PCC INCOME TAX AY 2008 - 09

Efforts may fail but dont fail to make an effort. The LBTS covers the questions specifically based on the previous lecture only.

CHAPTER 3: EXEMPTED INCOMES (LECTURE BASED TEST SERIES) LBTS 4 Q. 1:Do as directed: (i) (ii) (iii) (iv) (v) (vi) U/s 10(19) U/s 2(1A) U/s 10(34) U/s 10(32) U/s 10(23D) U/s 10(2A) (a) (b) (c) (d) (e) (f) Family pension of armed force personnel killed in action. Income of a notified mutual fund Share of profits of a .. from a .. Fill it Dividends from ..Co. Exemption of Rs. to the parent in whose TI minors income is clubbed.

Q.2: Comment on following incomes and name the particular heads to which they fall: (i) Income from supply of water to an agriculturist (ii) Manufacturing of rubber items (iii) Dividend incomes from an agriculture based company (iv) Profits of M/s Amul Dairy (v) Capital Gains on sale of an Urban Agricultural Land Q. 3: Duration of deduction / exemption u/s 10A is? Ans. Q.4: An exception to the repatriation of sale proceeds in said manner u/s 10A is? Ans. Q. 5: The undertakings u/s 10A should not be formed by employing any second hand P/M at the time of commencement has no exception(s). (T/F, support your answer). Ans. Q. 6: What % of Profits and on fulfillment of which condition, the exemption u/s10A is available for SEZ in last 3 years of 10 consecutive AYrs? Ans. Q.7: Calculate tax on the total income in following cases for AY 07-08: Computed Income 1. Salaries 2. House Property 3. I.O.S. (interest) 4.Income from Horticulture 5. Growing & Manf. of coffee Mr. Big B, 64 Yrs. 1,00,000 40,000 1,10,000 10,000 Nil Mrs. Ash B, 24 Yrs. 60,000 Nil 20,000 Nil 1,30,000 HUF Nil Nil 50,000 4,000 2,00,000

All assignment prepared by Mr. Vikas Singh

MISSION - PCC INCOME TAX AY 2008 - 09

Ans. Q.8: Calculate exemption u/s 10A of a Firm for AY 07-08: Total turnover 12,50,000(80% Export, 60% repatriated in India) 20% of Export is with the bank in abroad, approved by RBI, still to be brought in India. Total Profits 2,50,000. Ans. Q.9: What will be your answer to the above question in respect of exemption if the firm is in SEZ commenced just before a year? Ans. Q.10: Match the following: (1) Exempted Incomes (2) General Deductions (3) Rebate (4) Relief (a) u/s 10 (b) u/s 88E (c) u/s 89(1) (d) u/s 80C to 80U (i) Before surcharge (ii) Income which do not form part in TI (iii) After SC & EC (iv) Before calculating TI

WINNERS NEVER QUIT n QUITTERS NEVER WIN. The LBTS covers the questions specifically based on the previous lecture only.

All assignment prepared by Mr. Vikas Singh

MISSION - PCC INCOME TAX AY 2008 - 09

CHAPTER 3: EXEMPTED INCOMES (LECTURE BASED TEST SERIES) LBTS 5 Q.1. Compute tax on TI of Mr. Kissan, 45 Yrs. for the AY 07- 08: 1. Growing and manufacturing of rubber Rs. 10,00,000 2. Growing and manufacturing of tea Rs. 5,00,000 3. Growing and manufacturing of coffee Rs. 4,00,000 4. Income from horticulture Rs. 2,00,000 5. Income from nursery Rs. 1,00,000 Q. 2. Compute tax on the TI of M/s RIC, a newly established 100% EOU for the AY 07 - 08: Total turnover (of 4th consecutive AY) Rs. 20,00,000 Total Profit Rs. 5,00,000 Repatriate Export turnover 80% of total turnover Q.3a. Compute tax on TI of M/s Sindhi Dharamshala, a charitable trust for the AY 07 - 08: Income from property used for charitable purposes Rs. 20,00,000 Amount utilized for the purpose during the year Rs. 12,00,000 Q. 3b. The trust has applied to AO for the extension u/s 11(1) in the above case (Q.3a.) and the permission has been granted for its utilization upto next PY on the ground that 20% of the amount in not yet realized. Calculate TI. Q. 4. Compute TI of M/s Jain Dharamshala, a charitable trust for the AY 07 08: Income from property Rs. 3,00,000 Voluntary contribution (forming part of corpus) Rs. 1,50,000 Voluntary contribution (not forming part of corpus) Rs. 2,00,000 Anonymous donation Rs. 50,000 Amount utilized Rs. 2,50,000 Amount unrealized for which extension granted u/s 11(1) Rs. 1,00,000 Note: Amendment Finance Act, 2006: u/s 115 BBC Q. 5. The books of accounts National Janta Party registered under the Representation of the Peoples Act 1951 shows the following details for the PY 06 07. Compute TI. 1. CG on transfer of Land Rs. 4,00,000 2. Interest on Fund Deposited Rs. 2,00,000 3. Rental income form property let out to a Hospital Rs. 1,00,000 4. Voluntary contribution Rs. 5,000 each from 1,000 members 5. Voluntary contribution of Rs. 35,000 from 500 members (Out of which names of 100 members were undisclosed) Q. 6. Mr. B grows sugarcane and uses the same for the purpose of manufacturing sugar in his factory. 30% of sugarcane produce is sold for Rs. 10 lacs, and the cost of cultivation of such sugarcane is Rs. 5 lacs. The cost of cultivation of the balance sugarcane (70%) is Rs. 14 lacs and the market value of the same is Rs. 22 lacs. After incurring Rs. 1.5 lacs in the manufacturing All assignment prepared by Mr. Vikas Singh

MISSION - PCC INCOME TAX AY 2008 - 09

process on the balance sugarcane, the sugar was sold for Rs. 25 lacs. Compute Bs business income and agricultural income as per Rule 7. Excellence has always been achieved by those who dared to believed that some thing inside them is superior to circumstances. The LBTS covers the questions specifically based on the previous lecture only.

All assignment prepared by Mr. Vikas Singh

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- 2016 04 1420161336unit3Dokument8 Seiten2016 04 1420161336unit3Matías E. PhilippNoch keine Bewertungen

- Cash Budget Model Cash Budget Model - Case Study: InflowsDokument1 SeiteCash Budget Model Cash Budget Model - Case Study: Inflowsayu nailil kiromahNoch keine Bewertungen

- Project Budget WBSDokument4 SeitenProject Budget WBSpooliglotaNoch keine Bewertungen

- COMP2230 Introduction To Algorithmics: A/Prof Ljiljana BrankovicDokument18 SeitenCOMP2230 Introduction To Algorithmics: A/Prof Ljiljana BrankovicMrZaggyNoch keine Bewertungen

- SpmeDokument27 SeitenSpmeRajiv RanjanNoch keine Bewertungen

- Dolly Madison Zingers (Devil's Food)Dokument2 SeitenDolly Madison Zingers (Devil's Food)StuffNoch keine Bewertungen

- 3 Competitive EnvironmentDokument5 Seiten3 Competitive EnvironmentAlksgrtzNoch keine Bewertungen

- Groen BPP-40E Tilt SkilletDokument2 SeitenGroen BPP-40E Tilt Skilletwsfc-ebayNoch keine Bewertungen

- Managenet AC - Question Bank SSDokument18 SeitenManagenet AC - Question Bank SSDharshanNoch keine Bewertungen

- 环球时报11月14日第一版Dokument1 Seite环球时报11月14日第一版poundsassonNoch keine Bewertungen

- (84650977) Variance Accounting Case Study - PD1Dokument24 Seiten(84650977) Variance Accounting Case Study - PD1Mukesh ManwaniNoch keine Bewertungen

- CH 12Dokument27 SeitenCH 12DewiRatihYunusNoch keine Bewertungen

- Problem Set3Dokument4 SeitenProblem Set3Jack JacintoNoch keine Bewertungen

- Ananda KrishnanDokument4 SeitenAnanda KrishnanKheng How LimNoch keine Bewertungen

- Betma Cluster RevisedDokument5 SeitenBetma Cluster RevisedSanjay KaithwasNoch keine Bewertungen

- CA FirmsDokument5 SeitenCA FirmsbobbydebNoch keine Bewertungen

- Godrej Presentation FinalDokument21 SeitenGodrej Presentation FinalAkshay MunotNoch keine Bewertungen

- Purchase Order-Orders Monitoring & Analysis ToolDokument5 SeitenPurchase Order-Orders Monitoring & Analysis ToolSukriti BabbarNoch keine Bewertungen

- Ivy LeagueDokument2 SeitenIvy LeagueDr Amit RangnekarNoch keine Bewertungen

- TFG Manuel Feito Dominguez 2015Dokument117 SeitenTFG Manuel Feito Dominguez 2015Yenisel AguilarNoch keine Bewertungen

- Roll of Entrepreneurs in Indian EconomyDokument14 SeitenRoll of Entrepreneurs in Indian EconomySāĦılKukrējāNoch keine Bewertungen

- 18e Key Question Answers CH 4Dokument2 Seiten18e Key Question Answers CH 4AbdullahMughal100% (1)

- Continue or Eliminate AnalysisDokument3 SeitenContinue or Eliminate AnalysisMaryNoch keine Bewertungen

- Grove RT870 PDFDokument22 SeitenGrove RT870 PDFjcpullupaxi50% (2)

- AUD THEO BSA 51 Mr. LIMHEYADokument137 SeitenAUD THEO BSA 51 Mr. LIMHEYAMarie AzaresNoch keine Bewertungen

- Product Life CycleDokument19 SeitenProduct Life CycleTamana Gupta100% (2)

- Cows and ChickensDokument9 SeitenCows and Chickensapi-298565250Noch keine Bewertungen

- 8C PDFDokument16 Seiten8C PDFReinaNoch keine Bewertungen

- Month To Go Moving ChecklistDokument9 SeitenMonth To Go Moving ChecklistTJ MehanNoch keine Bewertungen

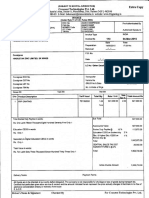

- HZL 4100070676 Inv Pay Slip PDFDokument12 SeitenHZL 4100070676 Inv Pay Slip PDFRakshit KeswaniNoch keine Bewertungen