Beruflich Dokumente

Kultur Dokumente

Malta Fees E Gaming 2009 (4) (1) - 1

Hochgeladen von

Silvia ZapucOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Malta Fees E Gaming 2009 (4) (1) - 1

Hochgeladen von

Silvia ZapucCopyright:

Verfügbare Formate

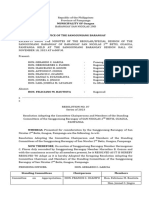

REMOTE GAMING MALTA Costs, Fees & Taxation

(A) Costs

1. LGA Remote Gaming Licence Application Process (costs due to the LGA [Lotteries & Gaming Authority])

[Preparation of the application forms and relative documentation to be attached thereto; the submission of the same; meetings and correspondence with the Lotteries & Gaming Authority; technical advice and other ancillary services] - Processing fee (non-refundable) due to the LGA in respect of each application - The audit fee due to the LGA for the audit of the gaming system during the certification process 2,330 - Annual license fee per class due to the LGA 7,000

2,330

2. MFSA Company Incorporation Process (Costs due to the Registrar of Companies [MFSA])

- The Official Registration Costs payable to the Registrar of Companies (MFSA) for the registration of a company are calculated according to the companys authorised share capital & official copies of the M&A Cost (Minimum Share Capital of 1200) - Minimum Issued Share Capital to be deposited in the companys name with a local bank account -

500

1,200

(N.B. Immediately prior to the issuing of the licence the LGA will request as a condition thereof that the Company increases its issued share in accordance with the business activities to be carried out)

Credinvest International

For info: amangion@credinvestonline.com

(B)

Fees

1. Fee for Remote Gaming Licence Application Process (Fees due to Credinvest International Corporate Finance)

- 1st Stage Fixed Fee - 2nd & 3rd Stage (Provided that the 3rd stage mirrors the 2nd details submitted to the LGA) Fixed Fee 10,000 35,000

stage technical 45,000 to 60,000

2. Fee for Company Formation

- Company Formation Fee Liaising with client for the sourcing of the required information and documentation reservation of company name preparation and registration of a Memorandum and Articles of Association for the company liaising with the Registrar of Companies Income tax registration VAT Registration Opening of operative bank account Fixed Fee -

1,500

3. Fees for Company Maintenance

- Provision of Registered Office (The company's registered office must be located in Malta) - OPTIONAL Annual Fixed Fee - Company Secretary (Acting as company secretary - handling of annual statutory filing at the Registry, including maintaining of the company's official register & annual return submission) - OPTIONAL Annual Fixed Fee -

1,000

3,000

Credinvest International

For info: amangion@credinvestonline.com

Annual Fees for Company Maintenance (cont)

- Statutory Auditing of Accounts of the Start Up Gaming Company Annual Fixed Fee 2,500

- Fiduciary Shareholder Services provided by Intershore Fiduciary Services Limited (Screening screen of the beneficial owners involvement in the company) - OPTIONAL Annual Fixed Fee 2,500 - Appointment Intershore Fiduciary Services Limited as an additional Director on the Board of Directors of the Company - OPTIONAL Annual Fixed Fee 5,000 - Back Office Administration, Legal Advice and ancillary support services following the issuing of the the Letter of Intent by the LGA Hourly Fixed Rate - Key Official Services, including supervision of the gaming operations, supervision of control system and reporting to the LGA following the issuing of the Letter of Intent by the LGA Monthly Fixed Rate -

120

2,000

(C)

Corporate Tax

Company Tax due to the Commissioner of Inland Revenue Under the new tax refund system introduced in January 2007, the company is taxed on profits at the rate of tax of 35%, however a tax refund is applicable upon the distribution of profits through dividends where the tax thereon has not been reduced by double taxation relief. The said tax refund amounts to 6/7ths of the 35% underlying tax payable by the distributing company. Therefore, after receipt of the tax refund the Malta tax burden on dividends received by shareholders of Maltese companies will be 5%. Effective Corporate tax 5% on profits

Credinvest International

For info: amangion@credinvestonline.com

(D)

Gaming Tax

Gaming tax payable to the LGA to the LGA on behalf of the government is differentiated according to the type of betting/gaming operation as follows:On Gaming (Class1) - an amount of 4,600 per month during the first 6 months after issue of the licence and thereafter 7000 per month for the entire duration of the licence Provided that where a casino operator (under Class 1 licence) operates from the host platform (under Class 4 licence): - gaming tax payable by casino operator is 1,200 per month; and - the gaming tax payable by the host platform is as follows: - untaxed for the first 6 months of operation; - 2,300 per month for the following 6 months; and - thereafter 4,600 per month On Betting (Class 2) - an amount equal to 0.5% on the gross amount of stakes/bets accepted On Commission Based Games (Class 3) - an amount equal to 5% on the net income The maximum gaming tax payable per annum by one licensee in respect of Classes 2 & 3 shall not exceed 466,000.

Credinvest International

For info: amangion@credinvestonline.com

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Salient Features of RA 7610Dokument28 SeitenSalient Features of RA 7610Pevi Mae Jalipa83% (12)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- SC examines validity of Maratha reservation and 102nd Constitution AmendmentDokument569 SeitenSC examines validity of Maratha reservation and 102nd Constitution AmendmentKrushna PanchalNoch keine Bewertungen

- Dgt-1 Form - Per 10 - 2017Dokument12 SeitenDgt-1 Form - Per 10 - 2017Adanbungaran PangribNoch keine Bewertungen

- Jide Taiwo & Co Sample - KORPDokument2 SeitenJide Taiwo & Co Sample - KORPKennyNoch keine Bewertungen

- CHB Aprjun08 RosieDokument21 SeitenCHB Aprjun08 RosieLoriNoch keine Bewertungen

- PCLL Examiner Comments on Business Associations ExamDokument3 SeitenPCLL Examiner Comments on Business Associations ExamDenis PoonNoch keine Bewertungen

- Republic of The Philippines v. Sandiganbayan, Major General Josephus Q. Ramas and Elizabeth DimaanoDokument5 SeitenRepublic of The Philippines v. Sandiganbayan, Major General Josephus Q. Ramas and Elizabeth DimaanozacNoch keine Bewertungen

- Attack The Debt CollectorDokument3 SeitenAttack The Debt CollectorGabe Perazzo100% (1)

- CIR V Reyes - DigestDokument1 SeiteCIR V Reyes - DigestVillar John EzraNoch keine Bewertungen

- Sensa Verogna v. Twitter, Inc., Docket 9 - Defendant Motion Pro Hac ViceDokument4 SeitenSensa Verogna v. Twitter, Inc., Docket 9 - Defendant Motion Pro Hac ViceSensa VerognaNoch keine Bewertungen

- Republic vs. Drugmaker's Laboratories, Inc. and Terramedic, Inc., G.R. No. 190837, March 05, 2014Dokument2 SeitenRepublic vs. Drugmaker's Laboratories, Inc. and Terramedic, Inc., G.R. No. 190837, March 05, 2014Elaine Belle OgayonNoch keine Bewertungen

- Ubi Jus Ibi RemediumDokument9 SeitenUbi Jus Ibi RemediumUtkarsh JaniNoch keine Bewertungen

- Annexure - E: Legal Security ReportDokument7 SeitenAnnexure - E: Legal Security Reportadv Balasaheb vaidyaNoch keine Bewertungen

- District Court - Online Public Records - Remote TerminalDokument5 SeitenDistrict Court - Online Public Records - Remote TerminalSELA - Human Rights Alert - IsraelNoch keine Bewertungen

- Incrementnotes PDFDokument6 SeitenIncrementnotes PDFnagalaxmi manchalaNoch keine Bewertungen

- Resolution On Standing Committee ChairmanshipDokument3 SeitenResolution On Standing Committee ChairmanshipNikki BautistaNoch keine Bewertungen

- Docshare - Tips - Special Proceedings Compilation Case Digestsdocx PDFDokument135 SeitenDocshare - Tips - Special Proceedings Compilation Case Digestsdocx PDFKresnie Anne BautistaNoch keine Bewertungen

- Letter From ElectedsDokument2 SeitenLetter From ElectedsJon RalstonNoch keine Bewertungen

- OSHA Complaint Regarding Oakdale Federal Correctional ComplexDokument4 SeitenOSHA Complaint Regarding Oakdale Federal Correctional ComplexmcooperkplcNoch keine Bewertungen

- Written Task 1 - Child Pornography in CartoonsDokument4 SeitenWritten Task 1 - Child Pornography in CartoonsMauri CastilloNoch keine Bewertungen

- Statement of AccountDokument1 SeiteStatement of AccountMary MacLellanNoch keine Bewertungen

- Application To The Local Court: Notice of ListingDokument3 SeitenApplication To The Local Court: Notice of ListingRoopeshaNoch keine Bewertungen

- Heirs of Hilario Ruiz Vs Edmond RuizDokument2 SeitenHeirs of Hilario Ruiz Vs Edmond RuizParis Valencia100% (1)

- Writing Case Notes: A Very Brief Guide: Kent Law School Skills HubDokument1 SeiteWriting Case Notes: A Very Brief Guide: Kent Law School Skills HubAngel StephensNoch keine Bewertungen

- PwC Webinar on the Extractive Sector Transparency Measures Act (ESTMADokument40 SeitenPwC Webinar on the Extractive Sector Transparency Measures Act (ESTMAShravan EtikalaNoch keine Bewertungen

- The Alexandra Condominium Corporation VsDokument3 SeitenThe Alexandra Condominium Corporation VsPinky De Castro AbarquezNoch keine Bewertungen

- Supreme Court Appeal on Murder ConvictionDokument43 SeitenSupreme Court Appeal on Murder ConvictionVinita Ritwik100% (1)

- QatarDokument5 SeitenQatarRuth BehailuNoch keine Bewertungen

- Evidence-Hierarchy of CourtsDokument4 SeitenEvidence-Hierarchy of CourtsShasharu Fei-fei LimNoch keine Bewertungen

- Chapter 18 Section 3Dokument8 SeitenChapter 18 Section 3api-206809924Noch keine Bewertungen