Beruflich Dokumente

Kultur Dokumente

House Foreclosure Bills Press Release

Hochgeladen von

Georgette Takushi DeemerCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

House Foreclosure Bills Press Release

Hochgeladen von

Georgette Takushi DeemerCopyright:

Verfügbare Formate

News Release Hawaii House of Representatives

March 8, 2012 - For immediate release

Contact: Rep. Robert Herkes 808-586-8400 Media Contact: Georgette Deemer 808-341-5043

House passes Mortgage Foreclosure bills

Honolulu, Hawaii. To complement the 2011 Legislature's reform of Hawaii's foreclosure laws in Act 48, the House of Representatives has transmitted to the Senate several measures that would further offset the negative effects of the national foreclosure crisis in Hawaii. HB1875 HD2: Over the interim, the legislatively-created Mortgage Foreclosure Task Force convened for its second year, focusing its efforts on reviewing and refining the provisions of Act 48. Their recommendations are included in HB1875 HD2 with some amendments. Everett Kaneshige, formerly the Deputy Director of the Department of Commerce and Consumer Affairs and Chair of the task force, explained in his testimony that the task force "focused on streamlining the process enacted by the Legislature" and tried "to bring to the Legislatures vision of a functional and fair non-judicial foreclosure process to fruition." The task force's recommendations predominantly concentrated on the non-judicial foreclosure process for condominium and homeowner associations. They also suggested some revisions to the Mortgage Foreclosure Dispute Resolution Program to: protect borrower's personal information; simplify and clarify some definitions and terminology; and refine certain procedural issues. The task force also suggested that an owner-occupants ability to convert her or his non-judicial foreclosure to one overseen by the courts would be made permanent. Under Act 48, this option would be repealed at the end of 2012. Perhaps the task force's most potentially impactful recommendation is to amend Act 48's Unfair and Deceptive Act or Practice (UDAP) provision, which has been cited as the primary reason why lenders have since decided to pursue all their foreclosures in court. The various stakeholders on the task force reached a compromise by majority vote to support this recommendation, which seeks to retain strong protections for consumers while also providing lenders and title insurers more specific guidance as to what actions may constitute UDAP violations. The compromise recommendation includes a 6 month time-frame on a borrower's ability to challenge the transfer of title of a home after such a foreclosure. -more-

Page 2 Mortgage foreclosure bills March 8, 2012

The current draft of this measure further limits the application of UDAP so that lenders need not fear committing an automatic UDAP violation while the dispute resolution program is operative. This amendment was adopted to encourage use of the program so that more foreclosure actions may be resolved with the help of a trained third-party neutral. In 2014, when the program ends, the task force's recommendations would then take effect. HB1875 HD2 also permanently repeals the non-judicial foreclosure law from 1874, which was used to conduct the majority of foreclosures before Act 48 and is currently under moratorium until July 1, 2012. If this bill is enacted, there would be just one non-judicial foreclosure process with numerous consumer protections built in. Also included in this bill is a requirement that a foreclosing lender's attorney sign an affirmation in judicial foreclosures indicating that they had reviewed and verified the accuracy of the lender's paperwork and legal authority to foreclose. The bill is 158-pages and predominantly deals with condominium and planned community association liens and foreclosures. A number of these provisions are still being discussed by various stakeholders. These stakeholders have been encouraged by lawmakers to continue working toward consensus so that the final draft's provisions are agreeable to all.

HB2018: Like HB1875 HD2, this measure adopts the mortgage foreclosure task force's recommendations to temper Act 48's UDAP provision; however, HB2018 limits this recommendation until after the dispute resolution program is no longer operative in 2014. While the dispute resolution program is in effect, Act 48's UDAP provision would be repealed to encourage use of the program so that more foreclosure actions may be resolved with the help of a trained third-party neutral.

HB2375: One burgeoning enterprise that has emerged during this foreclosure crisis is the mortgage foreclosure rescue industry. These operations often defraud borrowers, taking their money and/or persuading homeowners to transfer to them title on their homes while falsely promising to prevent foreclosure. Homeowners often default on their mortgages to pay for these "services" and end up losing their property anyway. Their practices are dangerous and objectionable to borrowers and lenders alike. -more-

Page 3 Mortgage foreclosure bills March 8, 2012

This bill makes these practices criminal felonies subject to $10,000 fines. A special fund would be created from these and other fines to further enforce Hawaii's mortgage rescue fraud law and to educate the public on how to identify violators and avoid their traps.

HB2019: Act 48 ensured that owner-occupants would not be subject to deficiency judgments in nonjudicial foreclosures should the sale of their property fail to satisfy the full amount of their indebtedness on a mortgage loan. Since lenders have filed all their foreclosures in the courts since the passage of Act 48, this bill would extend these protections to owner-occupants in judicial foreclosures, short sales, and in transactions transferring deeds-in-lieu of foreclosure. Similar anti-deficiency legislation has been enacted in various other states. This measure would prevent double recovery for many lenders who often sell foreclosed homes on the open market at a profit, and then subsequently collect deficiencies from troubled borrowers. This would also reduce the amount of bankruptcy filings by borrowers seeking to discharge these debts giving them a chance at a fresh start. Sometimes these deficiency judgments are sold at a great discount on the secondary market, inviting abusive third party debt collection activities.

###

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- AGR NECEC FERC 206 Complaint Against NEE (10-13-2020) PDFDokument110 SeitenAGR NECEC FERC 206 Complaint Against NEE (10-13-2020) PDFPress Clean Energy MattersNoch keine Bewertungen

- 15562711-ad97-4f6d-9325-e852a0c8add9Dokument7 Seiten15562711-ad97-4f6d-9325-e852a0c8add9Julia FairNoch keine Bewertungen

- Laws Effective July 1, 2012Dokument12 SeitenLaws Effective July 1, 2012Georgette Takushi DeemerNoch keine Bewertungen

- Rep. Derek Kawakami Selected For NCSL Emerging Leaders Symposium NRDokument1 SeiteRep. Derek Kawakami Selected For NCSL Emerging Leaders Symposium NRGeorgette Takushi DeemerNoch keine Bewertungen

- Tax Review Final ReportDokument154 SeitenTax Review Final ReportGeorgette Takushi DeemerNoch keine Bewertungen

- House Members Oppose Tax Review Commission Recommendations NR 2012Dokument1 SeiteHouse Members Oppose Tax Review Commission Recommendations NR 2012Georgette Takushi DeemerNoch keine Bewertungen

- Marilyn Lee School Bus Cuts NRDokument1 SeiteMarilyn Lee School Bus Cuts NRGeorgette Takushi DeemerNoch keine Bewertungen

- Rep Isaac Choy TestimonyDokument4 SeitenRep Isaac Choy TestimonyGeorgette Takushi DeemerNoch keine Bewertungen

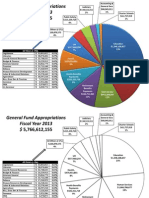

- Pie Chart 2013 GF AppropriationsDokument2 SeitenPie Chart 2013 GF AppropriationsGeorgette Takushi DeemerNoch keine Bewertungen

- Rep Denny Coffman Legislative Energy Horizon Institute CertificateDokument1 SeiteRep Denny Coffman Legislative Energy Horizon Institute CertificateGeorgette Takushi DeemerNoch keine Bewertungen

- Rep Denny Coffman Legislative Energy Horizon Institute CertificateDokument1 SeiteRep Denny Coffman Legislative Energy Horizon Institute CertificateGeorgette Takushi DeemerNoch keine Bewertungen

- Rep. Jerry Chang To Retire From Elected Office NRDokument1 SeiteRep. Jerry Chang To Retire From Elected Office NRGeorgette Takushi DeemerNoch keine Bewertungen

- Prevailing Winds Vol 4 Issue 4 May-June 2012Dokument2 SeitenPrevailing Winds Vol 4 Issue 4 May-June 2012Georgette Takushi DeemerNoch keine Bewertungen

- Pulse Summer 2011Dokument4 SeitenPulse Summer 2011Georgette Takushi DeemerNoch keine Bewertungen

- Rep Denny Coffman Legislative Energy Horizon Institute CertificateDokument1 SeiteRep Denny Coffman Legislative Energy Horizon Institute CertificateGeorgette Takushi DeemerNoch keine Bewertungen

- Ommunity Ewsletter: O R J JDokument4 SeitenOmmunity Ewsletter: O R J JGeorgette Takushi DeemerNoch keine Bewertungen

- 2011 Flyer Kauai WorkshopsDokument1 Seite2011 Flyer Kauai WorkshopsGeorgette Takushi DeemerNoch keine Bewertungen

- HB608 Organ Transplant FacilityDokument1 SeiteHB608 Organ Transplant FacilityGeorgette Takushi DeemerNoch keine Bewertungen

- Samuel Lee NRDokument1 SeiteSamuel Lee NRGeorgette Takushi DeemerNoch keine Bewertungen

- Project Interchange State Elected Officials ReleaseDokument3 SeitenProject Interchange State Elected Officials ReleaseGeorgette Takushi DeemerNoch keine Bewertungen

- Puuhulu Stream CleanupDokument2 SeitenPuuhulu Stream CleanupGeorgette Takushi DeemerNoch keine Bewertungen

- 2012 Session CalendarDokument2 Seiten2012 Session CalendarGeorgette Takushi DeemerNoch keine Bewertungen

- 2012 Classified AdDokument1 Seite2012 Classified AdGeorgette Takushi DeemerNoch keine Bewertungen

- Infrastructure Improvement Projects For Our Community Total Over $15 MillionDokument4 SeitenInfrastructure Improvement Projects For Our Community Total Over $15 MillionGeorgette Takushi DeemerNoch keine Bewertungen

- 2011 Flyer Big Island WorkshopsDokument1 Seite2011 Flyer Big Island WorkshopsGeorgette Takushi DeemerNoch keine Bewertungen

- 2012 Conference Room ScheduleDokument1 Seite2012 Conference Room ScheduleGeorgette Takushi DeemerNoch keine Bewertungen

- WLN Board Officer Press Release 2011-2012Dokument3 SeitenWLN Board Officer Press Release 2011-2012Georgette Takushi DeemerNoch keine Bewertungen

- NR NCSL Exec RepChongDokument2 SeitenNR NCSL Exec RepChongGeorgette Takushi DeemerNoch keine Bewertungen

- Reps Aquino and Cullen Hold Disaster Preparedness MeetingDokument1 SeiteReps Aquino and Cullen Hold Disaster Preparedness MeetingGeorgette Takushi DeemerNoch keine Bewertungen

- Mililani Community Report August 2011Dokument2 SeitenMililani Community Report August 2011Georgette Takushi DeemerNoch keine Bewertungen

- Purchase Order: Your Company Name Phone: XXX-XXX-XXXX Fax: XXX-XXX-XXXX Address, City, State, Zip CodeDokument12 SeitenPurchase Order: Your Company Name Phone: XXX-XXX-XXXX Fax: XXX-XXX-XXXX Address, City, State, Zip CodeBALAJINoch keine Bewertungen

- Ias Our Dram Gs NotesDokument129 SeitenIas Our Dram Gs Notesbalu56kvNoch keine Bewertungen

- NFLPA 2010 LM-2 Schedules 19 - 20Dokument13 SeitenNFLPA 2010 LM-2 Schedules 19 - 20Robert LeeNoch keine Bewertungen

- Asia Traders Insurance Corporation vs. Court of Appeals: Supreme Court Reports AnnotatedDokument7 SeitenAsia Traders Insurance Corporation vs. Court of Appeals: Supreme Court Reports AnnotatedKimmy DomingoNoch keine Bewertungen

- ISO 554-1976 ScanDokument4 SeitenISO 554-1976 ScanrezaeibehrouzNoch keine Bewertungen

- Knights Inn LawsuitDokument9 SeitenKnights Inn LawsuitTom JohanningmeierNoch keine Bewertungen

- COURSE SYLLABUS Book II Article 114 133Dokument5 SeitenCOURSE SYLLABUS Book II Article 114 133Honey Anjelyn M. MontecalboNoch keine Bewertungen

- Panes Vs Visayas State College of AgricultureDokument10 SeitenPanes Vs Visayas State College of Agriculturejimart10100% (1)

- Tamil Nadu Industrial Establishments (Conferment of Permanent Status To Workman Act, 1981Dokument12 SeitenTamil Nadu Industrial Establishments (Conferment of Permanent Status To Workman Act, 1981Latest Laws TeamNoch keine Bewertungen

- Section 9Dokument12 SeitenSection 9Ashish RajNoch keine Bewertungen

- JurisprudenceDokument2 SeitenJurisprudencextinemaniegoNoch keine Bewertungen

- SSRN Id2758033Dokument13 SeitenSSRN Id2758033Kumar Kaustubh Batch 2027Noch keine Bewertungen

- Chapter 7 Vocabulary DefinitionsDokument2 SeitenChapter 7 Vocabulary Definitionsapi-245168163Noch keine Bewertungen

- Morales v. Harbour Centre Port Terminal, G.R. No. 174208, Jan. 25, 2012Dokument9 SeitenMorales v. Harbour Centre Port Terminal, G.R. No. 174208, Jan. 25, 2012Martin SNoch keine Bewertungen

- Executive ReviewerDokument15 SeitenExecutive ReviewerJanica AngelesNoch keine Bewertungen

- TK 4001설명서2015Dokument11 SeitenTK 4001설명서2015geetha raniNoch keine Bewertungen

- 70 Policies That Shaped India PDFDokument212 Seiten70 Policies That Shaped India PDFKCNoch keine Bewertungen

- Contentio Writers NDA Kavita AdhikariDokument2 SeitenContentio Writers NDA Kavita Adhikarikavita adhikariNoch keine Bewertungen

- Constitution SummaryDokument4 SeitenConstitution SummaryBoy ToyNoch keine Bewertungen

- European Purchase Terms - EnglishDokument21 SeitenEuropean Purchase Terms - EnglishgheNoch keine Bewertungen

- Credit Card Application Form: Applicant'S InformationDokument4 SeitenCredit Card Application Form: Applicant'S InformationStacy BeckNoch keine Bewertungen

- Writs in Article 199 of The Constitution of PakistanDokument3 SeitenWrits in Article 199 of The Constitution of PakistanAwais KhanNoch keine Bewertungen

- Chihuly Inc Et Al v. LaCount Et Al - Document No. 7Dokument6 SeitenChihuly Inc Et Al v. LaCount Et Al - Document No. 7Justia.comNoch keine Bewertungen

- Norma AtexDokument4 SeitenNorma AtexV_VicNoch keine Bewertungen

- Lodha Park-2Dokument50 SeitenLodha Park-2Rohan BagadiyaNoch keine Bewertungen

- G.R. No. 78239 February 9, 1989 SALVACION A. MONSANTO, Petitioner, Vs - FULGENCIO S. FACTORAN, JR., RespondentDokument4 SeitenG.R. No. 78239 February 9, 1989 SALVACION A. MONSANTO, Petitioner, Vs - FULGENCIO S. FACTORAN, JR., RespondentI.F.S. VillanuevaNoch keine Bewertungen

- Attn: Rachel Olmogues Senior Sales RepresentativeDokument2 SeitenAttn: Rachel Olmogues Senior Sales RepresentativeShine BillonesNoch keine Bewertungen

- CPD FormDokument2 SeitenCPD FormAlex Olivar, Jr.Noch keine Bewertungen