Beruflich Dokumente

Kultur Dokumente

Case 1

Hochgeladen von

Md ThoufeekOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Case 1

Hochgeladen von

Md ThoufeekCopyright:

Verfügbare Formate

Case1: Abstract: Bajaj Auto Limited is one of India's largest two-wheeler manufacturers.

As the dominant player until the early 1990s, Bajaj's market share declined from 49.3% in 1994, to 38.9% in 1999 with the entry of major competitors like Hero Honda. Bajaj has initiated several measures to regain its market share and strengthen its competitive position. The case discusses the financial strategy pursued by Bajaj. Introduction In 2003, Bajaj Auto Limited (Bajaj) was one of India's largest manufacturers of both two and three-wheelers. The three-wheelers, also known as autorickshaws, were unique to the South Asian region. The company recorded revenue of Rs.5125.73 crores representing a 13% increase over the previous year2. Once the unchallenged market leader, Bajaj trailed Hero Honda in the late 1990s. Bajaj's market share declined from 49.3% in 1994, to 38.9% in 1999.3 Thereafter, Bajaj had initiated several measures to regain its market share and strengthened its competitive position. In 2003, Bajaj had a workforce of 12,000 employees and a network of 422 dealers and over 1,300 authorised service centers.

The Indian Two-wheeler Industry Two-wheelers had become the standard mode of transportation in many of India's large urban centers. Use of two-wheelers in the rural areas had also increased significantly in the 1990s. The birth of the Indian two-wheeler industry could be traced to the early 1950s, when Automobile Products of India (API) started manufacturing scooters in the country. While API initially dominated the scooter market with its Lambrettas, it was Bajaj which rapidly emerged as the unchallenged leader in the scooter industry. A number of government and private enterprises who entered the scooter segment, had disappeared from the market by the turn of the century. The License Raj that existed prior to economic liberalization (1940s-1980s) in India, did not allow foreign players to enter the market, making it an ideal breeding ground for local players.

Case2:

LIC under Siege

Ravi Bhargava (Bhargava), Assistant Marketing Manager, Life Insurance Corporation of India (LIC) was disconcerted by the full-page advertisement in the newspaper. The advertisement, by an Indian company in alliance with a US insurance company declared, 'Till now we were all buying insurance blindfolded, wake up. Experience the new phenomenon, one giving shape to all your dreams and driving away all your fears.' On the next page was another advertisement by an Indian bank, inviting applications from agency managers, promising a very good work atmosphere and 'best in the industry' remuneration. Bhargava had been Marketing Manager at LIC for the past eighteen months and eight of his best performing agents had submitted their resignations. He feared more would follow suit. The new players in the life insurance market were already affecting LIC. The Monitor Group, a Boston-based strategy consulting firm, which studied the trends in the Indian insurance market after it was thrown open to private players, predicted that LIC would find the going tough. But Prakash Sharma, (GM, Marketing Division) was more optimistic: "It is obvious they will look for the best of our people, but we are not unduly worried. LIC offers a commission of 35% of the premiums for the first year and 7.5% for the next two years, and 5% for the rest of the period for which the sum is assured. At the most, the new players will be able to offer 40% - not good enough to attract our people. These are all new players and none can beat our 44 years of experience." But Bhargava and Sharma knew that the issues involved were not that simple.

Background Note

In 1956, there were 154 Indian insurers, 16 foreign insurers and 75 provident societies in the life insurance1 sector in the country. The life insurance business was concentrated in urban areas and served only the wealthy sections. In January 1956, the management of the 245 Indian and foreign insurers and provident societies was taken over by the Central Government. Life Insurance Corporation was formed as a government regulated monopoly in September 1956 by an Act of Parliament, (LIC Act 1956) with a capital contribution of Rs 50 million. Over the years, LIC built a strong distribution and agent network. By 2000, LIC had 2048 branches and 500,000 agents across the country. With income from premiums totalling Rs 6,262 crore and a Rs 1,60,935 crore asset base for fiscal 2001, LIC was a financial powerhouse, with a presence in mutual funds and housing loans besides life insurance (Refer Table I for LIC's growth statistics). The company had insured more than 11.5 crore people in the country through its individual and group schemes. Of the 60-80 million life insurance policies outstanding, 48% were from the rural and semi urban areas. This was very impressive since no company in any other industry had been able to tap the rural market to this extent. LIC's annual revenue growth rate was 8.8% during 1993-2000.

Table I LIC'S Growth over the Years 1974- 1979- 19961957 75 80 97 Individuals (Rs 14.7 118.52 192.43 344.62 billion) Group (Rs 0.05 14.57 61.37 64.61 billion) No. of policies in 5.69 18.8 22.09 77.75 force (million) Group business n.a. 2.33 5.84 24.45 (million) Life fund (Rs 4.1 30.34 58.18 877.59 billion) The opening up of the insurance sector had been the subject of debate for many years2. The Insurance Regulatory and Development Authority (IRDA) bill, which was tabled in Parliament, contained detailed guidelines for inviting private players into the insurance sector. In December 1999, the Government approved the IRDA Act, making IRDA the authority to protect the interests of policyholders, and to regulate, promote and ensure the systematic growth of insurance industry. After August 2000, private licenses were given to HDFC-Standard Life, ICICI Prudential and Max New York. International companies that entered the sector included Lombard, Zurich, Allianz, Royal & Sun Alliance, Chubb Insurance, AIG, ING and CGNU, while ICICI, Hero Honda, Dabur, the Tatas, the Birlas, SBI, HDFC and Reliance were the major Indian players. With the opening up of the insurance sector, media reports predicted tough times ahead for LIC. A report revealed that LIC was 70% over-staffed, which meant that its competitors would have substantial labor-cost advantages. The report also predicted that LIC might find it difficult to retain and protect its extensive agent network and, in particular, to ensure that the most talented and influential agents stayed with it. LIC was also expected to face fierce competition on the new product development front.

LIC - After IRDA

In November 1999, even as the IRDA Act was being debated in Parliament, LIC begun preparations for meeting the threat posed by private players. The company appointed consultants Booz, Allen and Hamilton to do a scenario-building exercise, suggest areas for process re-engineering, and recommend ways to sharpen customer focus. LIC gave top priority to introducing over-the-counter (OTC) facilities that would help it serve its customers better. By 2000 it had computerized and locally networked all its 2,048 branches. The speed of service delivery, particularly in the case of claimssettlement, had also improved. The total outstanding claims were brought down to 2.74% in 2000 from 3.47% in 1995. LIC realized that to be able to retain its position, it would have to be match the technological sophistication of the multinationals. LIC extended its Metropolitan Area Network (MAN) system from Mumbai, Delhi and Bangalore to Ahmedabad, Pune, Hyderabad, and Calcutta. This enabled LIC customers to pay premiums and get status reports from any of its branches in these cities. LIC planned to eventually connect upto 27 cities in a Wide Area Network (WAN). E-mail and Internet facility were introduced at over 600 additional branches. A mechanism was put in place to facilitate insurance premium

payment over the Internet in cities that were covered by the WAN. Over 98% of LIC's branches had begun providing software assistance that helped the policyholders track premium payments, loans and claims positions. Information kiosks were set up in over 50 places across the country. The company also started an Interactive Voice Response System, to help customers get details of various policies over the telephone. LIC planned to tie up with corporate agents to enable customers to buy insurance products at banks or financial services companies or while buying a consumer durable. LIC also intended to use the services of brokers once brokerage concerns were allowed to operate in India. LIC initiated measures to revamp its service network and to open 600 new training centers. The new centers were to have a new training modules in the curriculum which focused on marketing. It intensified its research activities in order to get market feedback and tailor its products according to customer needs. LIC also planned to offer new products and schemes and enter new markets, especially in the global arena. LIC began exploring the possibility of entering the Nepalese, African, Middle-East, Mauritius, US and UK markets. Under Section 27 A of the Insurance Act, 50% of LIC's investments had to be in central and state government securities and 25% in the social sector (comprising power, telecom, ports, roads, bridges, housing etc.) LIC was free to invest the remaining 25% wherever it wanted. LIC was hoping that the 25% mandatory investment in social sector would be waived in the near future. LIC also decided to leverage its brand value to increase its presence into more lucrative areas like the equity markets. A major area of concern was retaining employees and strengthening the agency system, which was the backbone of the life insurance business. LIC had 8.5 lakh agents outside its payrolls who reported to its development officers in branch offices. As 80% of the business was brought in by just 30% of the agents, the private competitors were likely to make an attempt to poach the good agents. LIC, however, believed that there was no danger of its agents leaving, as it had a more competitive commission structure. Moreover, since IRDA had prohibited agents from working for more than one insurance firm, LIC could afford to relax a bit. The issue of loss of actuaries3 was another issue to be addressed. Of the 40,000 qualified actuaries worldwide, only 150 were in India. Since, the IRDA had stipulated that insurance companies could only use actuaries who were of Indian nationality, a fight for actuaries would be inevitable. LIC had recruited 65 actuarial assistants, and planned to create 200 such jobs each year.

The Future

Soon after the IRDA announcements, there were a number of breakups in the private sector joint ventures. This was largely due to IRDA rules and regulations, which stipulated that the partners to a joint venture could not disinvest from the venture for a period of seven years after the license was granted. This meant that no there was no exit route for companies that wanted to opt out. Also, foreign insurers were allowed only 26% equity participation. With the majority stake being with the domestic partner, foreign insurers would have little say in the management of the company and important decisions could be easily considered without them. This led to the break up of several partnerships: AXACholamandalam, Hindustan Times-CGU, Alpic-Allianz, Dabur Finance-Allstate, CGNUBombay Dyeing, Chubb-Kotak Mahindra, Eaglestar-ITC, Cigna-Ranbaxy, Manulife-UTI etc. The companies that did stay back found the going tougher than expected as they had the added burden of having to build credibility in the marketplace and to build infrastructure.

The average business LIC got per active agent was Rs 1.26 million - a figure hard to achieve over a short period of time. The services offered by the new players were found to be quite similar to the ones offered by LIC, with differences only in the presentation and packaging of the policies. Reacting to media reports about LIC being adversely affected by the entry of MNCs, an LIC agent said, "The entry of the private players will not make any difference to LIC. The private players will concentrate more on the higher income groups while LIC will maintain its goodwill among the masses." A policyholder added, "LIC has already been offering all the frills that the private players are now banking on and the only differentiating factor could be the quality of service." Apprehensions of the MNCs 'taking over' the Indian insurance sector were gradually put to rest as various reports revealed that LIC would easily continue to be the market leader. A Monitor Group study predicted that LIC would continue to have 7580% market share even in 2010. A report by consultants KPMG revealed that the threat of new players taking over the market had been overplayed and that the nationalized players would continue to hold strong market share positions. At the same time, there would be enough business for new entrants. A look at the developments in other countries which opened up their insurance sector to global players reveals that new companies seldom displace the existing players. In China, Malaysia, Indonesia and Thailand, the foreign companies accounted for only 10% of the market share. In South Korea, the opening up of the sector saw the six biggest domestic players, who initially controlled the entire market, increase their business substantially. The foreign companies were not able to capture more than 0.4% of the domestic market. What LIC does to retain its competitive strength will determine its success in the future. For now, LIC seems to be taking a Business Wire report very seriously. This report aptly summed up the whole issue: "Over the years, LIC has made money the easy way. Hereafter, it must sweat for it."

Questions for Discussion

1. Write a brief note on LIC's reaction to the entry of foreign players. Critically examine the steps taken by LIC to face the competition from MNCs. 2. Do you agree with Bajpai's statement that service would not be a key feature to success in the post-IRDA era? If you were a new entrant in the Indian insurance market, what are the issues you would focus on? 3. Do you think LIC will be able to remain the market leader in the insurance business in the long run? Give reasons for your answer.

Das könnte Ihnen auch gefallen

- Lic Under SiegeDokument4 SeitenLic Under SiegeAjay Narang0% (1)

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsVon EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNoch keine Bewertungen

- Case Study of LicDokument21 SeitenCase Study of LicfrazfarooquiNoch keine Bewertungen

- Trial Balance: Private Sector Financing for Road Projects in IndiaVon EverandTrial Balance: Private Sector Financing for Road Projects in IndiaNoch keine Bewertungen

- Globlization and Its Impact of Insurance Industry in IndiaDokument29 SeitenGloblization and Its Impact of Insurance Industry in IndiaPranav ViraNoch keine Bewertungen

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume III: Thematic Chapter—Fintech Loans to Tricycle Drivers in the PhilippinesVon EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume III: Thematic Chapter—Fintech Loans to Tricycle Drivers in the PhilippinesNoch keine Bewertungen

- Globlization and Its Impact of Insurance Industry in IndiaDokument15 SeitenGloblization and Its Impact of Insurance Industry in Indiatores123Noch keine Bewertungen

- Financial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeVon EverandFinancial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeNoch keine Bewertungen

- LIC Case StudyDokument6 SeitenLIC Case StudymayuriNoch keine Bewertungen

- The Enabling Environment for Disaster Risk Financing in Sri Lanka: Country Diagnostics AssessmentVon EverandThe Enabling Environment for Disaster Risk Financing in Sri Lanka: Country Diagnostics AssessmentNoch keine Bewertungen

- Analysis of Life Insurance SectorLife Insurance CorporationDokument38 SeitenAnalysis of Life Insurance SectorLife Insurance Corporationmayur9664501232Noch keine Bewertungen

- Emerging FinTech: Understanding and Maximizing Their BenefitsVon EverandEmerging FinTech: Understanding and Maximizing Their BenefitsNoch keine Bewertungen

- FINAL InsuranceDokument76 SeitenFINAL InsuranceAkash RajpurohitNoch keine Bewertungen

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Von EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Noch keine Bewertungen

- Chapter IDokument43 SeitenChapter IDr.P. Siva RamakrishnaNoch keine Bewertungen

- A.1 About The Insurance Sector in IndiaDokument9 SeitenA.1 About The Insurance Sector in Indiapurusottam_asianpacificNoch keine Bewertungen

- Term Paper ON Life Insurance Corporation of India: Department of Business Administration University of LucknowDokument13 SeitenTerm Paper ON Life Insurance Corporation of India: Department of Business Administration University of LucknowAmansinghmailgNoch keine Bewertungen

- Customer Satisfaction IndexDokument25 SeitenCustomer Satisfaction IndexPrateek DeepNoch keine Bewertungen

- Insurance Sector and GlobalizationDokument10 SeitenInsurance Sector and GlobalizationJatin Arora50% (2)

- Objectives of Lic: Growth of Private Life Insurance Companies in The Last 5yearsDokument19 SeitenObjectives of Lic: Growth of Private Life Insurance Companies in The Last 5yearsRohit BundelaNoch keine Bewertungen

- Insurance Sector PPTDokument19 SeitenInsurance Sector PPTpdabhaadeNoch keine Bewertungen

- Review of LiteratureDokument6 SeitenReview of LiteraturePraveen SehgalNoch keine Bewertungen

- Corporate Finance & Financial Services Emerging TrendsDokument74 SeitenCorporate Finance & Financial Services Emerging TrendsSridher BashattyNoch keine Bewertungen

- A Comparative Study: Lic and Icici PrudentialDokument56 SeitenA Comparative Study: Lic and Icici PrudentialKristoff FinchNoch keine Bewertungen

- Insurance Awareness in India MainDokument34 SeitenInsurance Awareness in India Maintejaskamble45Noch keine Bewertungen

- Awareness and Impact of Globalization of Life Insurance in IndiaDokument8 SeitenAwareness and Impact of Globalization of Life Insurance in IndiaInternational Journal of Application or Innovation in Engineering & ManagementNoch keine Bewertungen

- Project On Insurance SectorDokument63 SeitenProject On Insurance Sectormayur9664501232Noch keine Bewertungen

- History: Life Insurance India Government of IndiaDokument5 SeitenHistory: Life Insurance India Government of IndiadhairyaNoch keine Bewertungen

- Indian Service SectorDokument7 SeitenIndian Service SectorAshish SharmaNoch keine Bewertungen

- LIC Swot AnalysisDokument3 SeitenLIC Swot AnalysisGOVIND JANGIDNoch keine Bewertungen

- Project ReportDokument63 SeitenProject ReportAnil BatraNoch keine Bewertungen

- Lic Case StudyDokument21 SeitenLic Case StudyAkshayNoch keine Bewertungen

- Lic 2 PDFDokument29 SeitenLic 2 PDFDipti MaheriyaNoch keine Bewertungen

- T&D at MaxDokument29 SeitenT&D at MaxPriyanka SarafNoch keine Bewertungen

- A Summer Training Report ON: "Designing A Strategy For Servicing Customers"Dokument66 SeitenA Summer Training Report ON: "Designing A Strategy For Servicing Customers"Shubham BhattNoch keine Bewertungen

- Insurance SectorDokument40 SeitenInsurance SectorRaunak ChaurasiaNoch keine Bewertungen

- Name: Akshit. H. Gada Roll No: 10 SEAT NO: 15-8810 STD: Ty. Bms Sub: Business Ethics Topic: CSR On Life Insurance Coperation of India (Lic)Dokument13 SeitenName: Akshit. H. Gada Roll No: 10 SEAT NO: 15-8810 STD: Ty. Bms Sub: Business Ethics Topic: CSR On Life Insurance Coperation of India (Lic)Dhruvi GadaNoch keine Bewertungen

- Introduction of Company: The History of Indian Insurance IndustryDokument14 SeitenIntroduction of Company: The History of Indian Insurance IndustryMaria BoalerNoch keine Bewertungen

- Symbiosis Institute of Management Studies: Submitted By: NAME: Shilpa Parmar Section: E Roll No: 49Dokument7 SeitenSymbiosis Institute of Management Studies: Submitted By: NAME: Shilpa Parmar Section: E Roll No: 49Shilpa ParmarNoch keine Bewertungen

- PRINCIPLES OF MARKETING Da 4Dokument7 SeitenPRINCIPLES OF MARKETING Da 4Jayagokul SaravananNoch keine Bewertungen

- Industrial Training Project ReportDokument11 SeitenIndustrial Training Project ReportmanishNoch keine Bewertungen

- Datta Sai AssisgnDokument11 SeitenDatta Sai Assisgnm_dattaiasNoch keine Bewertungen

- Scope of Banking & Insurance Sectors in IndiaDokument9 SeitenScope of Banking & Insurance Sectors in IndiaMilind ZalaNoch keine Bewertungen

- Preface: Acknowledgement Objective of The Project Methodology Finding Project Analysis Conclusion LiDokument83 SeitenPreface: Acknowledgement Objective of The Project Methodology Finding Project Analysis Conclusion LiHarsh HariaNoch keine Bewertungen

- Insurance Awareness in India MainDokument39 SeitenInsurance Awareness in India Maintejaskamble4575% (4)

- Exploring Rural Market For Private Life Insurence Players in IndiaDokument18 SeitenExploring Rural Market For Private Life Insurence Players in IndiaLakshmish GopalNoch keine Bewertungen

- Life Insurance Industry in India:current ScenarioDokument9 SeitenLife Insurance Industry in India:current ScenarioChirag KhandelwalNoch keine Bewertungen

- SBI Life SWOT AnalysisDokument12 SeitenSBI Life SWOT AnalysisSantosh ReddyNoch keine Bewertungen

- Swot Analysis OF SBI Life Insurance Co: Presented By.... Siva Rama Krishna, Sanchita, Sukamal, Smita, Soumya, VivekDokument12 SeitenSwot Analysis OF SBI Life Insurance Co: Presented By.... Siva Rama Krishna, Sanchita, Sukamal, Smita, Soumya, Vivekamar635Noch keine Bewertungen

- Indian Insurance Sector: Group 4 Section A Mba Ii Financial Service Course Instructor: Prof. S.B.MishraDokument20 SeitenIndian Insurance Sector: Group 4 Section A Mba Ii Financial Service Course Instructor: Prof. S.B.Mishrasl400Noch keine Bewertungen

- IciciDokument8 SeitenIcicidhanushNoch keine Bewertungen

- SIP FinalDokument38 SeitenSIP FinalOMKAR WARANGNoch keine Bewertungen

- Industry Profile: Meaning of Life InsuranceDokument72 SeitenIndustry Profile: Meaning of Life InsuranceArchana AdavihallimathNoch keine Bewertungen

- Case 2Dokument2 SeitenCase 2Hajra ArifNoch keine Bewertungen

- Life Insurance Industry in India - Current Scenario: Dr. Sonika Chaudhary, Priti KiranDokument5 SeitenLife Insurance Industry in India - Current Scenario: Dr. Sonika Chaudhary, Priti Kiranrajanityagi23Noch keine Bewertungen

- Financial Services: Jyothish P 4 SemesterDokument57 SeitenFinancial Services: Jyothish P 4 SemesterJyothish Punathil PNoch keine Bewertungen

- 3rd Sem Finance ProjectDokument81 Seiten3rd Sem Finance Projectsai vishnuNoch keine Bewertungen

- HR Project in HDFCDokument69 SeitenHR Project in HDFCJdahiya90Noch keine Bewertungen

- Project On Life Insurance CorporationDokument62 SeitenProject On Life Insurance CorporationMD Rishad100% (1)

- Ulotka Face Master 2.5NVDRDokument2 SeitenUlotka Face Master 2.5NVDRlorenzo henerNoch keine Bewertungen

- Hero Honda Passport ProgramDokument5 SeitenHero Honda Passport ProgramShona KatochNoch keine Bewertungen

- CII Best KaizensDokument104 SeitenCII Best Kaizensterhex100% (2)

- Customer Satisfaction Sonalika TractorDokument41 SeitenCustomer Satisfaction Sonalika TractorShobhit GoswamiNoch keine Bewertungen

- Fleet Management System: Prospective Business ImplicationsDokument28 SeitenFleet Management System: Prospective Business ImplicationsSantanu DasNoch keine Bewertungen

- Pressure Sensor HistoryDokument38 SeitenPressure Sensor HistoryBrian McMorris100% (3)

- Six-Wheeled Aatvs: Edit Source EditDokument2 SeitenSix-Wheeled Aatvs: Edit Source EditprabhjotbhangalNoch keine Bewertungen

- Automotive-Report-2020 TecAlliance v2.1.8 PDFDokument64 SeitenAutomotive-Report-2020 TecAlliance v2.1.8 PDFAndresNoch keine Bewertungen

- Lexus - GS300 - GS430 - Service - Manual 6Dokument23 SeitenLexus - GS300 - GS430 - Service - Manual 6seregap84100% (4)

- The Competitive Status of The UK Automotive IndustryDokument137 SeitenThe Competitive Status of The UK Automotive Industrymlucian73Noch keine Bewertungen

- Company Profile of PT. Suryaraya Rubberindo IndustriesDokument8 SeitenCompany Profile of PT. Suryaraya Rubberindo IndustriesZubair KhanNoch keine Bewertungen

- A Study On "Analysis of Consumer Buying Behavior of Luxury Cars of Maruti Suzuki in Balasore"Dokument7 SeitenA Study On "Analysis of Consumer Buying Behavior of Luxury Cars of Maruti Suzuki in Balasore"Preetam DandpatNoch keine Bewertungen

- Petsafe Do-It-Yourself Dog Kennel: Step-By-Step Assembly InstructionsDokument12 SeitenPetsafe Do-It-Yourself Dog Kennel: Step-By-Step Assembly InstructionsurbandragNoch keine Bewertungen

- CD-SR90: Warning Advertencia Warnung Avertissement Avvertimento WaarschuwingDokument4 SeitenCD-SR90: Warning Advertencia Warnung Avertissement Avvertimento WaarschuwingcaimanaterNoch keine Bewertungen

- Electric VehiclesDokument13 SeitenElectric VehiclesMario ManciaNoch keine Bewertungen

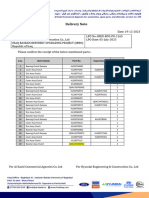

- Delivery Note - IBRU-BOC-PU-1165Dokument1 SeiteDelivery Note - IBRU-BOC-PU-1165Santosh SridharNoch keine Bewertungen

- Senna TelemetryDokument7 SeitenSenna Telemetry6ylinderNoch keine Bewertungen

- 33611B SUV & Light Truck Manufacturing in The US Industry ReportDokument38 Seiten33611B SUV & Light Truck Manufacturing in The US Industry ReportSubhash BabuNoch keine Bewertungen

- Insurance Law: Beneficiary: Effects: Irrevocable Beneficiary (2005)Dokument32 SeitenInsurance Law: Beneficiary: Effects: Irrevocable Beneficiary (2005)alyza burdeosNoch keine Bewertungen

- Project ON Low Oil Pressure Problem Found at Engine of Mahindra JeetoDokument32 SeitenProject ON Low Oil Pressure Problem Found at Engine of Mahindra JeetoAnindya Sekhar DasNoch keine Bewertungen

- Fortuner Brochure 2014Dokument13 SeitenFortuner Brochure 2014451mktgNoch keine Bewertungen

- Og 20 1101 1805 00000881 PDFDokument4 SeitenOg 20 1101 1805 00000881 PDFIshu BishtNoch keine Bewertungen

- Roush Performance SolutionDokument6 SeitenRoush Performance SolutionUTKARSH JOSHINoch keine Bewertungen

- This Study Resource Was: ContentDokument9 SeitenThis Study Resource Was: ContentLakshani AkalankaNoch keine Bewertungen

- 1 Ton Gran Max: The Ideal WorkhorseDokument12 Seiten1 Ton Gran Max: The Ideal WorkhorseagungNoch keine Bewertungen

- Chief Operating Officer VP in San Diego CA Resume Mitchell WhiteDokument4 SeitenChief Operating Officer VP in San Diego CA Resume Mitchell WhiteMitchellWhiteNoch keine Bewertungen

- Inventory ManagementDokument77 SeitenInventory ManagementNavin Jain80% (5)

- Hre14-41-p011-En FD Fde GK JM El MC NF TGDokument7 SeitenHre14-41-p011-En FD Fde GK JM El MC NF TGRodos96Noch keine Bewertungen

- BFC 32302 Tutorial 1 - SolutionDokument5 SeitenBFC 32302 Tutorial 1 - SolutionLebya UminNoch keine Bewertungen

- Honda Atlas MotorsDokument132 SeitenHonda Atlas MotorsIgnorant Human0% (1)

- Summary of Noah Kagan's Million Dollar WeekendVon EverandSummary of Noah Kagan's Million Dollar WeekendBewertung: 5 von 5 Sternen5/5 (2)

- High Road Leadership: Bringing People Together in a World That DividesVon EverandHigh Road Leadership: Bringing People Together in a World That DividesNoch keine Bewertungen

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeVon EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeBewertung: 4.5 von 5 Sternen4.5/5 (91)

- $100M Offers: How to Make Offers So Good People Feel Stupid Saying NoVon Everand$100M Offers: How to Make Offers So Good People Feel Stupid Saying NoBewertung: 5 von 5 Sternen5/5 (26)

- $100M Leads: How to Get Strangers to Want to Buy Your StuffVon Everand$100M Leads: How to Get Strangers to Want to Buy Your StuffBewertung: 5 von 5 Sternen5/5 (19)

- The Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverVon EverandThe Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverBewertung: 4.5 von 5 Sternen4.5/5 (186)

- Summary of Thinking, Fast and Slow: by Daniel KahnemanVon EverandSummary of Thinking, Fast and Slow: by Daniel KahnemanBewertung: 4 von 5 Sternen4/5 (117)

- Critical Thinking: How to Effectively Reason, Understand Irrationality, and Make Better DecisionsVon EverandCritical Thinking: How to Effectively Reason, Understand Irrationality, and Make Better DecisionsBewertung: 4.5 von 5 Sternen4.5/5 (39)

- The Leader Habit: Master the Skills You Need to Lead--in Just Minutes a DayVon EverandThe Leader Habit: Master the Skills You Need to Lead--in Just Minutes a DayBewertung: 4 von 5 Sternen4/5 (5)

- Broken Money: Why Our Financial System Is Failing Us and How We Can Make It BetterVon EverandBroken Money: Why Our Financial System Is Failing Us and How We Can Make It BetterBewertung: 5 von 5 Sternen5/5 (4)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurVon Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurBewertung: 4.5 von 5 Sternen4.5/5 (3)