Beruflich Dokumente

Kultur Dokumente

Chapter 5 BOOK Outline

Hochgeladen von

gilli1trOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chapter 5 BOOK Outline

Hochgeladen von

gilli1trCopyright:

Verfügbare Formate

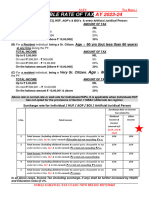

Chapter 5 Outline Gross Income and Exclusions RECALL gross income is income that taxpayers realize and recognize

e (report) on their tax returns for the year. LO1 What Is Included in Gross Income? All-inclusive definition of income (Section 61) includes a list of examples of gross income such as compensation for services, business income, rents, royalties, interest, and dividends. Current view (Form of Receipt) Reg. Section 1.61-(a) definition: Gross income means all income from whatever source derived, unless excluded by law. Gross income includes income realized in any form, whether in money, property, or services. Based on Section 61(a), Reg. 1.61-(a), and various judicial rulings, taxpayers recognize gross income: (1) They receive an economic benefit, (2) They realize the income, and (3) No tax provision allows them to exclude or defer the income from gross income for that year. Judicial Findings: Income is the gain derived from labor and capital (1920) Any increase in wealth that has been realized is income (1955) Economic Benefit Common examples where a taxpayer receives economic benefit include: (1) Being paid for services rendered (typically cash received, but includes property or even services), (2) Proceeds from property sales (typically cash, property, or debt relief), and (3) Income from investments or business activities (such as business income, rents, interest, and dividends). Note: Borrowed funds represent a liability, NOT gross income. Realization Principle Under this principle, income is realized when: (1) A taxpayer engages in a transaction with another party, and (2) The transaction results in a measurable change in property rights. Adopting the realization principle for defining gross income provides two major advantages: (1) Because parties to the transaction must agree to the value of the exchanged property rights, the transaction allows the income to be measured objectively. (2) The transaction often provides the taxpayer with the wherewithal to pay taxes (at least when the taxpayer receives cash in the transaction).

Recognition Realized income is assumed to be recognized absent a deferral or exclusion provision. *Code Section 61: Except as otherwise provided in this subtitle, gross income means all income from whatever source derived, including (but not limited to) the following items: compensation for services, including fees, commissions, fringe benefits, and similar items; gross income derived from business; gains derived from dealings in property; interest; rents; royalties; dividends; alimony and separate maintenance payments; annuities; income from life insurance and endowment contracts; pensions; income from discharge of indebtedness; distributive share of partnership gross income; income in respect of a decedent; and income from an interest in an estate or trust.

Example 5-1 Realization Principle:

In April, Gram used part of the life insurance proceeds she received from Grampss death to purchase 50 shares in Acme Corporation for $30 per share. From April to the end of December, the value of the shares fluctuated between $40 and $25, but on December 31, the shares were worth $35. If Gram does not sell the shares, how much income from her stockholdings in Acme Corporation does she realize for the year? Solution: $0. Unless Gram sells the stock, she does not enter into a transaction resulting in a measurable change of property rights with a second party. Thus, she does not realize income even though she experienced an economic benefit from the appreciation of the stock from $30 per share to $35 per share.

Example All-Inclusive Income (Notes):

After buying food at Meijers, Tom finds a $100 bill in the parking lot. Does Tom have gross income to report? Solution: Yes, $100. Economic benefit Realized No exclusion/deferral

Example All-Inclusive Income (Notes):

Dan is a building contractor. Sue is an accountant. Sue needs remodeling work done in her home. Can needs someone to prepare his tax return. So, Dan agrees to do Sues remodeling work in return for her preparing his tax return. The value of the remodeling work is $750. Preparation of Dans tax return is worth $750. Since cash is not exchanged, how much gross income, if any, must Dan and Sue recognize? Solution: According to Treasury Regulation 1.61-1(a), gross income includes income realized in any form, whether in money, property, or services. In this case, both Dan and Sue would recognize $750 in gross income.

Example 5-2 Recognition:

During March, Gram paid no rent to her neighbor (also her landlord). Although the neighbor typically charges $350 per month for rent, he allowed Gram to live rent free in exchange for babysitting his infant son. What income must Gram and Grams neighbor realize and recognize on this exchange? Solution: $350. Gram and the neighbor each must recognize $350 of income for March. The neighbor recognizes $350 of rental receipts because this is the value of the babysitting services the neighbor received in lieu of a cash payment for rent from Gram (an economic benefit the neighbor realized through the exchange). Gram recognizes $350 of babysitting income, because this is the value of the services provided to her neighbor (an economic benefit was realized because Gram was not required to pay rent).

Return of Capital Principle refers to exclusion of the tax basis from realized income. Cost of an asset is called tax basis. Gain or loss from the sale or disposition of an asset is included in realized income, NOT the selling price. o Portion of the proceeds that represents tax basis is excluded from realized income, because it does not represent an economic benefit to the seller.

Example Capital Recovery (Notes):

Natalie sold 100 shares of common stock for $5,000. She paid a sales commission of $500 on the sale and had purchased the shares three years ago for $3,000. What amount of gross income must she recognize? Solution: $1,500. [($5,000 $500) - $3,000]

Recovery of Amounts Previously Deducted A refund is not typically included in gross income because it usually represents a return of capital. Expenditures are typically deducted in the year paid. Tax Benefit Rule: However, if the refund is made for an expenditure deducted in a previous year, then under the tax benefit rule the refund is included in gross income to the extent that the prior deduction produced a tax benefit. A previous years deductions may be reimbursed or refunded in a following year. Referred to as recovery of a previous years deduction. Tax Benefit Rule determines how much, if any, of the recovery/refund is included in gross income and when. In the year a previous years expenditure is recovered/refunded, taxpayer must include in gross income an amount equal to the tax benefit received from the deduction. Tax benefit = amount that previous years taxable income was reduced by the deduction. o Previous years excess deduction

Das könnte Ihnen auch gefallen

- Chapter 12 - Check Figures To 24-53Dokument4 SeitenChapter 12 - Check Figures To 24-53gilli1trNoch keine Bewertungen

- Financial Accounting 7th EditionDokument8 SeitenFinancial Accounting 7th Editiongilli1trNoch keine Bewertungen

- Financial Accounting 7th EditionDokument9 SeitenFinancial Accounting 7th Editiongilli1trNoch keine Bewertungen

- Managerial AccountingDokument17 SeitenManagerial Accountinggilli1tr100% (1)

- Chm1 PPT SlidesDokument15 SeitenChm1 PPT Slidesgilli1tr100% (1)

- Chap08 Extra Challenge ExercisesDokument7 SeitenChap08 Extra Challenge Exercisesgilli1trNoch keine Bewertungen

- Financial Accounting 7th EditionDokument4 SeitenFinancial Accounting 7th Editiongilli1trNoch keine Bewertungen

- Financial Accounting 7th EditionDokument3 SeitenFinancial Accounting 7th Editiongilli1trNoch keine Bewertungen

- Financial Accounting 7th EditionDokument9 SeitenFinancial Accounting 7th Editiongilli1trNoch keine Bewertungen

- Chap06 Extra Challange ExercisesDokument8 SeitenChap06 Extra Challange Exercisesgilli1trNoch keine Bewertungen

- Financial Accounting 7th EditionDokument6 SeitenFinancial Accounting 7th Editiongilli1trNoch keine Bewertungen

- Financial Accounting 7th EditionDokument5 SeitenFinancial Accounting 7th Editiongilli1tr100% (1)

- Financial Accounting 7th EditionDokument7 SeitenFinancial Accounting 7th Editiongilli1tr100% (1)

- Global Investments PPT PresentationDokument48 SeitenGlobal Investments PPT Presentationgilli1trNoch keine Bewertungen

- Fundamental Financial Analysis and ReportingDokument6 SeitenFundamental Financial Analysis and Reportinggilli1trNoch keine Bewertungen

- Auditing and Assurance ServicesDokument69 SeitenAuditing and Assurance Servicesgilli1tr100% (1)

- Southwest Airlines Case - Chap. 06Dokument11 SeitenSouthwest Airlines Case - Chap. 06gilli1trNoch keine Bewertungen

- Auditing and Assurance ServicesDokument65 SeitenAuditing and Assurance Servicesgilli1tr67% (3)

- Fundamental Financial Analysis and ReportingDokument4 SeitenFundamental Financial Analysis and Reportinggilli1trNoch keine Bewertungen

- Governmental and Nonprofit Accounting Theory and PracticeDokument68 SeitenGovernmental and Nonprofit Accounting Theory and Practicegilli1tr100% (2)

- Governmental and Nonprofit Accounting Theory and PracticeDokument68 SeitenGovernmental and Nonprofit Accounting Theory and Practicegilli1tr100% (2)

- Auditing and Assurance Services - Ch02Dokument43 SeitenAuditing and Assurance Services - Ch02gilli1tr33% (3)

- CH 11 TBDokument57 SeitenCH 11 TBgilli1tr100% (1)

- Auditing and Assurance Services TBDokument65 SeitenAuditing and Assurance Services TBgilli1tr100% (2)

- Auditing and Assurance ServicesDokument49 SeitenAuditing and Assurance Servicesgilli1tr100% (1)

- Auditing and Assurance Services Chapter 13 TBDokument51 SeitenAuditing and Assurance Services Chapter 13 TBgilli1tr67% (3)

- Auditing and Assurance Chapter 14 MC QuestionsDokument9 SeitenAuditing and Assurance Chapter 14 MC Questionsgilli1tr0% (1)

- Auditing and Assurance Chapter 7 MC QuestionsDokument7 SeitenAuditing and Assurance Chapter 7 MC Questionsgilli1trNoch keine Bewertungen

- Auditing and Assurance Services Chapter 8 MC QuestionsDokument6 SeitenAuditing and Assurance Services Chapter 8 MC Questionsgilli1trNoch keine Bewertungen

- Chapter 8 - Debt Service Funds Solutions ManualDokument30 SeitenChapter 8 - Debt Service Funds Solutions Manualgilli1trNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Iceland TaxDokument16 SeitenIceland TaxRaja Ahmed HassanNoch keine Bewertungen

- Form 1607022022 205546Dokument2 SeitenForm 1607022022 205546Mahesh VayiboyinaNoch keine Bewertungen

- Amendments To Chapter I of Finance Act (Chapter 23:04) : SectionDokument17 SeitenAmendments To Chapter I of Finance Act (Chapter 23:04) : SectionTsitsi AbigailNoch keine Bewertungen

- C.M. Hoskins & Co., Inc. vs. Commissioner of Internal RevenueDokument1 SeiteC.M. Hoskins & Co., Inc. vs. Commissioner of Internal RevenueAlljun SerenadoNoch keine Bewertungen

- TX 201 PDFDokument5 SeitenTX 201 PDFFriedeagle OilNoch keine Bewertungen

- 1h DT Revision Short Notes Selected Chapters Cma Inter Dec 2023Dokument109 Seiten1h DT Revision Short Notes Selected Chapters Cma Inter Dec 2023Vaheed AliNoch keine Bewertungen

- TAX - Quiz 1Dokument6 SeitenTAX - Quiz 1KriztleKateMontealtoGelogo100% (1)

- Math 10-3 Unit 2.3 - 2.4 Worksheet - Additional Earnings - Pay 2018-19 STUDENTDokument5 SeitenMath 10-3 Unit 2.3 - 2.4 Worksheet - Additional Earnings - Pay 2018-19 STUDENTBob SmynameNoch keine Bewertungen

- Tax 2 Outline (Consolidated)Dokument24 SeitenTax 2 Outline (Consolidated)MRNoch keine Bewertungen

- CA Tax NotesDokument616 SeitenCA Tax NotesvijayNoch keine Bewertungen

- Kanga & Palkhivala IT Act 10th Ed Vol I CH 4 Part IDokument119 SeitenKanga & Palkhivala IT Act 10th Ed Vol I CH 4 Part IlokeshNoch keine Bewertungen

- Income Tax Deductions Under Section 80C PDFDokument2 SeitenIncome Tax Deductions Under Section 80C PDFArunDanielNoch keine Bewertungen

- Nfjpia Nmbe Taxation 2017 AnsDokument9 SeitenNfjpia Nmbe Taxation 2017 AnsJeric RebandaNoch keine Bewertungen

- S4Q0000023905 1 PDFDokument16 SeitenS4Q0000023905 1 PDFAli Azhar KhanNoch keine Bewertungen

- Corporate Tax in SingaporeDokument23 SeitenCorporate Tax in SingaporeMaria Bulgaru100% (1)

- Cir Vs Central LuzonDokument1 SeiteCir Vs Central LuzonJf ManejaNoch keine Bewertungen

- Guidelines and Instructions For BIR Form No. 1701Q Quarterly Income Tax Return For Individuals, Estates and TrustsDokument1 SeiteGuidelines and Instructions For BIR Form No. 1701Q Quarterly Income Tax Return For Individuals, Estates and TrustsAlyssa Hallasgo-Lopez AtabeloNoch keine Bewertungen

- Computation Format For Individual Tax Liability For The Year of Assessment 20XXDokument4 SeitenComputation Format For Individual Tax Liability For The Year of Assessment 20XXannastasia luyah100% (1)

- Mathematical Literacy Formula SheetDokument2 SeitenMathematical Literacy Formula SheetSaiyuri GirdhariNoch keine Bewertungen

- 20.CIR Vs Central Luzon DrugDokument12 Seiten20.CIR Vs Central Luzon DrugClyde KitongNoch keine Bewertungen

- Rev Syllabus RAEDokument14 SeitenRev Syllabus RAEsmarttalksaurabhNoch keine Bewertungen

- Presentation For Viva: Miss. Akshata Anil MasurkarDokument64 SeitenPresentation For Viva: Miss. Akshata Anil MasurkarAkshata MasurkarNoch keine Bewertungen

- Different Types of Provident Fund and Tax Benefit Related To Investment in Provident Fund - FinhealthDokument3 SeitenDifferent Types of Provident Fund and Tax Benefit Related To Investment in Provident Fund - Finhealthyasin shahNoch keine Bewertungen

- Invalidating Tax Assessment January 2024 2Dokument68 SeitenInvalidating Tax Assessment January 2024 2arnulfojr hicoNoch keine Bewertungen

- Tax DigestDokument42 SeitenTax DigestybunNoch keine Bewertungen

- 09.19.22 TaxationDokument3 Seiten09.19.22 TaxationLeizzamar BayadogNoch keine Bewertungen

- St. Vincent'S College Incorporated College of Accounting EducationDokument8 SeitenSt. Vincent'S College Incorporated College of Accounting Educationrey mark hamacNoch keine Bewertungen

- Tally Erp 9 0 Material Payroll Accounting Amp Compliance in Tally Erp 9 0Dokument228 SeitenTally Erp 9 0 Material Payroll Accounting Amp Compliance in Tally Erp 9 0barakkat72100% (1)

- Accounting For Income Taxes Accounting For Income TaxesDokument41 SeitenAccounting For Income Taxes Accounting For Income TaxesankitmogheNoch keine Bewertungen

- Income Tax Planning in India With Respect To Individual AssesseeDokument96 SeitenIncome Tax Planning in India With Respect To Individual AssesseeSyed Murthza57% (7)