Beruflich Dokumente

Kultur Dokumente

DTC Agreement Between Argentina and Malaysia

Hochgeladen von

OECD: Organisation for Economic Co-operation and DevelopmentOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

DTC Agreement Between Argentina and Malaysia

Hochgeladen von

OECD: Organisation for Economic Co-operation and DevelopmentCopyright:

Verfügbare Formate

P.U.

(A) 61 Signed: 3 October 1997 (Buenos Aires) Effective Date: 1 January 1994 (see Article 8)

AGREEMENT BETWEEN THE GOVERNMENT OF MALAYSIA AND THE GOVERNMENT OF THE ARGENTINE REPUBLIC FOR RECIPROCAL EXEMPTION WITH RESPECT TO TAXES ON INCOME FROM THE OPERATION OF SHIPS AND AIRCRAFT IN INTERNATIONAL TRAFFIC

THE GOVERNMENT OF MALAYSIA AND THE GOVERNMENT OF THE ARGENTINE REPUBLIC

Article 1 PERSONAL SCOPE This Agreement shall apply to persons who are residents of one or both of the Contracting States. Article 2 TAXES COVERED 1. This Agreement shall apply to taxes on income imposed by a Contracting State, irrespective of the manner in which they are levied. 2. The existing taxes to which this Agreement shall apply are in particular: (i) in the case of Argentina, the income tax; and (ii) in the case of Malaysia, the income tax. 3. This Agreement shall apply also to any identical or substantially similar taxes which are imposed by a Contracting State after the date of signature of this Agreement in addition to, or in place of, the existing taxes. Article 3 DEFINITIONS 1. In this Agreement, unless the context otherwise requires: (a) the term "person" includes an individual, a partnership, a company and any other body of persons which is treated as a person for tax purposes;

DTA MALAYSIA ARGENTINA

(b) the term "company" means any body corporate or any entity which is treated as a body corporate for tax purposes; (c) the term "a Contracting State" and "the other Contracting State" mean Malaysia or Argentina as the context requires; (d) the term "enterprise of a Contracting State" means an enterprise carried on by a resident of a Contracting State; (e) the term "international traffic" means any transport by a ship or aircraft operated by an enterprise of a Contracting State, except when the ship or aircraft is operated solely between places in the other Contracting State; (f) the term "competent authority" means: (i) in the case of Argentina, the Ministry of Economy and Works and Public Services, Secretariat of Finance (Ministerio de Economia y Obras y Servicios Publicos, Secretaria de Hacienda); and (ii) in the case of Malaysia, the Minister of Finance or his authorised representative. 2. As regards the application of this Agreement by a Contracting State, any term not defined therein shall, unless the context otherwise requires, have the meaning which it has under the laws of that State concerning the taxes to which this Agreement applies. Article 4 RESIDENT 1. For the purposes of this Agreement, the term "resident of a Contracting State" means: (a) in the case of Argentina, a person who is resident in Argentina for the purposes of Argentine tax; and (b) in the case of Malaysia, a person who is resident in Malaysia for the purposes of Malaysian tax. 2. Where by reason of the provisions of paragraph 1 an individual is a resident of both Contracting States then his status shall be determined as follows: (a) he shall be deemed to be a resident of the State in which he has a permanent home available to him, if he has a permanent home available to him in both States, he shall be deemed to be a resident of the State

2.

DTA MALAYSIA ARGENTINA

with which his personal and economic relations are closer (centre of vital interests); (b) if the State in which he has his centre of vital interests cannot be determined, or if he has not a permanent home available to him in either State, he shall be deemed to be a resident of the State in which he has an habitual abode; (c) if he has an habitual abode in both States or in neither of them, he shall be deemed to be a resident of the State of which he is a national; (d) if he is a national of both States or of neither of them, the competent authorities of the Contracting States shall settle the question by mutual agreement. 3. Where by reason of the provision of paragraph 1 a person other than an individual is a resident of both Contracting States, then it shall be deemed to be a resident of the State in which its place of effective management is situated. Article 5 SHIPPING AND AIR TRANSPORT 1. Profits derived by an enterprise of a Contracting State from the operation of ships and aircraft in international traffic shall be exempted from tax in the other Contracting State. 2. The provision of paragraph 1 shall also apply to the share of the profits derived by a resident of a Contracting State from its participation in a pool, a joint business or an international operating agency. 3. For the purposes of this Article, profits derived by a resident of a Contracting State from the operation of ships and aircraft in international traffic shall also include profits derived from: (a) the rental on a full or bare boat (time or voyage) basis of ships or aircraft used in international traffic; (b) the use or rental of containers (including trailers, barges and related equipment for the transport of containers); if such profits are incidental to the profits to which the provisions of paragraphs 1 and 2 apply. 4. Remuneration in respect of an employment exercised aboard a ship or aircraft operated in international traffic by an enterprise of a Contracting State

3.

DTA MALAYSIA ARGENTINA

shall be taxable only in the Contracting State in which the enterprise operating the ship or aircraft is a resident. 5. Gains from the alienation of ships or aircraft operated in international traffic or movable or immovable property pertaining exclusively to the operation of such ships or aircraft, shall be taxable only in the Contracting State in which the enterprise operating the ships or aircraft is a resident. Article 6 MUTUAL AGREEMENT PROCEDURE The competent authorities of the Contracting States may consult each other if appropriate for the purpose of assuring the reciprocal implementation of and compliance with the principles and provisions of this Agreement. Article 7 EXCHANGE OF INFORMATION 1. The competent authorities of the Contracting States shall exchange such information as is necessary for carrying out the provisions of this Agreement or for the prevention or detection of evasion or avoidance of taxes covered by this Agreement. Any information so exchange[d] shall be treated as secret and shall be disclosed only to persons or authorities (including a court or reviewing authority) concerned with the assessment, collection, enforcement or prosecution in respect of, or the determination of appeals in relation to, the taxes which are the subject of this Agreement. 2. In no case shall the provisions of paragraph 1 be construed so as to impose on a Contracting State the obligation: (a) to carry out administrative measures at variance with the laws or the administrative practice of that or of the other Contracting State; (b) to supply particulars which are not obtainable under the laws or in the normal course of the administration of that or of the other Contracting State; (c) to supply information which would disclose any trade, business, industrial, commercial or professional secret or trade process, or information the disclosure of which would be contrary to public policy.

4.

DTA MALAYSIA ARGENTINA

Article 8 ENTRY INTO FORCE 1. The Governments of the Contracting States shall notify each other that the requirements according to their laws for entry into force of this Agreement have been complied with. 2. This Agreement shall enter into force on the thirtieth day after the date of the latter of the notifications referred to in paragraph 1 and its provisions shall have effect: (a) in the case of Argentina, with respect to taxable years beginning on or after the first day of January 1994; (b) in the case of Malaysia, with respect to basis periods beginning on or after the first day of January 1994. Article 9 TERMINATION This Agreement shall remain in effect indefinitely, but either Contracting State may terminate the Agreement through diplomatic channels, by giving to the other Contracting State written notice of termination on or before June 30th in any calendar year after the period of five years from the date on which this Agreement enters into force. In such an event the Agreement shall cease to have effect: (a) in the case of Argentina, with respect to taxable years beginning on or after the first day of January following the year in which the notice is given; (b) in the case of Malaysia, with respect to basis period beginning on or after the first day of January following the year in which the notice is given. IN WITNESS whereof the undersigned, duly authorised thereto, by their respective Governments, have signed this Agreement. DONE in duplicate at Buenos Aires this 3rd day of October 1997 each in Bahasa Melayu, Spanish and the English Languages, the three texts being equally authentic. In the event of there being a dispute in the interpretation and the application of this Agreement, the English text shall prevail.

5.

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- United States Second Round Peer ReviewDokument148 SeitenUnited States Second Round Peer ReviewOECD: Organisation for Economic Co-operation and DevelopmentNoch keine Bewertungen

- San Marino Second Round Peer ReviewDokument104 SeitenSan Marino Second Round Peer ReviewOECD: Organisation for Economic Co-operation and DevelopmentNoch keine Bewertungen

- Guernsey Second Round Peer Review ReportDokument148 SeitenGuernsey Second Round Peer Review ReportOECD: Organisation for Economic Co-operation and DevelopmentNoch keine Bewertungen

- Cayman Islands Second Round Review (2017)Dokument130 SeitenCayman Islands Second Round Review (2017)OECD: Organisation for Economic Co-operation and DevelopmentNoch keine Bewertungen

- Bermuda Second Round Review (2017)Dokument146 SeitenBermuda Second Round Review (2017)OECD: Organisation for Economic Co-operation and DevelopmentNoch keine Bewertungen

- Australia Second Round Review (2017)Dokument130 SeitenAustralia Second Round Review (2017)OECD: Organisation for Economic Co-operation and DevelopmentNoch keine Bewertungen

- DTC Agreement Between Indonesia and IndiaDokument19 SeitenDTC Agreement Between Indonesia and IndiaOECD: Organisation for Economic Co-operation and DevelopmentNoch keine Bewertungen

- DTC Agreement Between India and Former Yugoslav Republic of MacedoniaDokument18 SeitenDTC Agreement Between India and Former Yugoslav Republic of MacedoniaOECD: Organisation for Economic Co-operation and DevelopmentNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Rev. Fr. Anthony v. Almadrones, MADokument2 SeitenRev. Fr. Anthony v. Almadrones, MAGlenn Binasahan ParcoNoch keine Bewertungen

- Roberto Tuazon Vs Del Rosario-SuarezDokument2 SeitenRoberto Tuazon Vs Del Rosario-SuarezJaysonNoch keine Bewertungen

- Chapter 2 - FI-ADokument43 SeitenChapter 2 - FI-AQuỳnh Anh NguyễnNoch keine Bewertungen

- CRES2015 Module1 Mocknov302015Dokument29 SeitenCRES2015 Module1 Mocknov302015Law_PortalNoch keine Bewertungen

- Commercial Law DigestsDokument4 SeitenCommercial Law DigestsAnn SCNoch keine Bewertungen

- 10 Basic Rights of Workers in The Philippines Under The Applicable LawsDokument2 Seiten10 Basic Rights of Workers in The Philippines Under The Applicable Lawsrosa4rosata1Noch keine Bewertungen

- Stronghold Insurance VS Republic PDFDokument15 SeitenStronghold Insurance VS Republic PDFJohn Dy Castro FlautaNoch keine Bewertungen

- Life Insurance Policy SampleDokument16 SeitenLife Insurance Policy SampleSittie AinNoch keine Bewertungen

- Full Download Solution Manual For Principles of Marketing 14 e 14th Edition 0133130983 PDF Full ChapterDokument12 SeitenFull Download Solution Manual For Principles of Marketing 14 e 14th Edition 0133130983 PDF Full Chapterlacktipcatg306fh100% (20)

- Contracts ProjectDokument20 SeitenContracts ProjectvinayaNoch keine Bewertungen

- Business Without Bribery - Analyzing The Future of Enforcement For TheDokument21 SeitenBusiness Without Bribery - Analyzing The Future of Enforcement For ThesaraNoch keine Bewertungen

- E ContractsDokument18 SeitenE ContractsayushNoch keine Bewertungen

- Intellectual PropertyDokument24 SeitenIntellectual PropertyMff DeadsparkNoch keine Bewertungen

- 13 Municipality of San Fernando Vs Judge FerminDokument2 Seiten13 Municipality of San Fernando Vs Judge FerminPresion CoreccionalNoch keine Bewertungen

- 8 Santiago v. DionisioDokument2 Seiten8 Santiago v. DionisiokdescallarNoch keine Bewertungen

- LLB AssignmentsDokument15 SeitenLLB Assignmentsoo7 BondNoch keine Bewertungen

- Concept Map IIDokument1 SeiteConcept Map IISuri LeeNoch keine Bewertungen

- Contrato Civil de Prestación de Servicios Profesionales en InglesDokument3 SeitenContrato Civil de Prestación de Servicios Profesionales en InglesDom DomNoch keine Bewertungen

- 正租sampleDokument7 Seiten正租sampleDixon Luk100% (6)

- NullDokument4 SeitenNullapi-25425285Noch keine Bewertungen

- CHAPTER 4 - InsuranceDokument182 SeitenCHAPTER 4 - Insuranceanis abdNoch keine Bewertungen

- Real Estate: (Regulation & Development)Dokument17 SeitenReal Estate: (Regulation & Development)Vivek KumarNoch keine Bewertungen

- VL SL FormDokument2 SeitenVL SL FormAldo TVNoch keine Bewertungen

- TenderDokument10 SeitenTenderNavi RengarajanNoch keine Bewertungen

- Atienza v. PhilimareDokument1 SeiteAtienza v. PhilimarecinfloNoch keine Bewertungen

- All Property Law Reports 2009 2017Dokument237 SeitenAll Property Law Reports 2009 2017Saydul Imran100% (1)

- Torts Finals ReviewerDokument14 SeitenTorts Finals ReviewerFlorence RoseteNoch keine Bewertungen

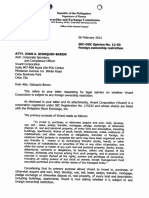

- Securities and Exchange Commission: SEC-OGC Opinion No. 12-03 Foreign Ownership Restriction Atty. Joan A. Giduquio-BaronDokument3 SeitenSecurities and Exchange Commission: SEC-OGC Opinion No. 12-03 Foreign Ownership Restriction Atty. Joan A. Giduquio-BaronsarNoch keine Bewertungen

- Wilson Go V. Estate of Late Felisa Tamio de Buenaventura GR No. 211972, Jul 22, 2015Dokument2 SeitenWilson Go V. Estate of Late Felisa Tamio de Buenaventura GR No. 211972, Jul 22, 2015Alvin Ryan KipliNoch keine Bewertungen

- Bagayao HandoutDokument42 SeitenBagayao HandoutChris Jackson100% (1)