Beruflich Dokumente

Kultur Dokumente

Price Management & Profit Optimization

Hochgeladen von

firefly_light20068718Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Price Management & Profit Optimization

Hochgeladen von

firefly_light20068718Copyright:

Verfügbare Formate

Price Management & Profit Optimization: From Planning to Execution

By Kosin Huang, Senior Analyst, Business Applications & Commerce, The Yankee Group, khuang@yankeegroup.com One of the most critical drivers of maximizing profit is setting the right price and properly executing it. Yet pricing remains one of the unexplored and untapped levers to managing profit in todays corporations. The pricing challenge is a universal problem that confounds executives across industries. How can companies figure out the optimal price to charge? How do they then deploy their pricing strategies across business units, sales teams, and channels? This Report examines the need for price management technology that addresses the issues and functions required in such a solution set. Reprinted with permission from The Yankee Group. Introduction: The Untapped Pricing Lever Pricing is a fundamental business function that all companies must manage. It has always been and remains a critical profit lever and value driver. Whats at stake? Get pricing wrong and the results can be ruinouslost profits, dwindled market share, and squandered customer opportunities. Get pricing right and it can yield great rewards. Changes in price can drastically improve operating profits and the overall performance of a company so much that the consequences of not managing price appropriately can be similarly devastating. In terms of the previous statement, the reverse is also truea 1% decrease in price can likewise eradicate that same 11% of operating profit dollars. This means that pricing should be the center of attention for many C-level executives. Yet price management today remains an ad hoc process; it is the last lever left not systematized. On the other hand, much investment has gone into automating and optimizing other less influential value drivers, such as inventory reduction. Most companies have committed their IT spending dollars to ERP and supply chain systems, all in an effort to better manage inventories and squeeze savings that contribute to the bottom line. As companies priorities are shifting to focus on software that delivers quick hits yielding significant and concrete returns, pricing optimization solutions are gaining ground. Unlike supply chain software that requires companies to wait for benefits to accrue, pricing software offers a bite-sized approach while employing a powerful profit lever. With such an effective value driver to work with, what have companies been doing today to try to solve the pricing challenge? What are the shortcomings of current pricing processes, and what is the case for price management and profit optimization software as a stand-alone market opportunity? Exhibit 1. The Price Management and Profit Optimization Competitive Landscape Source: the Yankee Group, 2002 The Business Case for Price Management and Optimization Pricing Pressures Intensify What kinds of businesses are more inclined to adopt price management and profit optimization software? Businesses challenged by pricing complexity and marked by the following characteristics have an immediate need for pricing technology: ? Large number of products? Companies that must manage thousands of products, configurations, or SKUs (e.g., retailers and high-tech manufacturers).

? ? ?

? ? ?

Customer price variation? Businesses that have many customers and need to manage a large distribution of prices across that customer base (e.g., in specialty chemicals or distribution businesses). Price change frequency? Managers that deal with a high velocity of price modifications and need to dynamically create new prices, update, and deploy changes. Also, businesses that may need to continually monitor the performance of prices. Negotiation frequency? Companies that are frequently in price discussions with customers or must constantly negotiate contracts and fill RFxs. These companies are often plagued by long response times and need to quickly evaluate deals and make prices decisions, counteroffers, substitutions, and so on. Low operating margins? Businesses in which the impact of price is significantly high (e.g., retailers and distributors). High-margin businesses can also benefit from pricing technology, although businesses with narrow margins have been the first adopters. Demand interdependencies across multiple product sets? Companies with products that synergize and cannibalize each other within and across product lines and product families. Shortened life-cycle management? Companies that need to manage the high velocity with which they must launch and kill their products.

Some business models may readily benefit from pricing optimization software, but as market pressures intensify, the opportunity to leverage pricing tools will be extended to many organizations, across various industries. Compounded by mounting product and channel complexity, multiplying product portfolios, marginalized brands, and numerous other challenges, organizations will require a better way to manage their price processes. In order to remain competitive and on the offensive, companies will need to re-evaluate how they currently create price plans and how effectively they implement or execute on those strategies today. Price Mismanagement and Current Shortcomings These approaches result in missed opportunities, poor customer satisfaction, squandered market share, and other costly consequences that all translate into lost profits. Coupled with a myriad of random pricing tools like price books, custom applications, spreadsheets, databases, and mainframes, information is located in disparate systems; the result is an inefficient set of processes that drain valuable time and resources (see Exhibit 2). Treating pricing like a science and employing tools that support standardized processes will enable pricers to leverage the wealth of data at hand and redefine how they plan and deploy prices. There are two main problems standing between most companies and efficient price management: Pricing complexity, and Inadequate control (for planning, execution, and analysis). Lets examine each challenge. Exhibit 2. Inefficient Tools and Processes Hinder Price Management Source: the Yankee Group, 2002 Pricing Complexity: Creating Insight from a Sea of Data Current pricing systems are disconnected and seldom account for all of the relevant data needed to inform an optimized price, including supply constraints and demand relationships, company objectives, competitor moves, product interactions and life cycles, channel interactions, and configurations. In-house systems and current techniques or formulas have their limitations and cannot factor in all these variables for price optimization. Each of the following approaches fails to capture key data that can greatly influence robust modeling and analysis:

? ? ?

Cost-plus pricingNot cognizant of supply constraints; does not incorporate changing market conditions. Competitor-based pricingReactionary and too static for managing market factors and product life-cycle variables. Market-based pricingStatic assumptions that do not analyze or keep up with changing market dynamics (a great number of companies still base prices on outdated market conditions).

Inadequate Control: Systematizing Disparate Processes The need for improved price process control spans the three functional areas of price management? planning, execution, and analysis. Planning: ? Insufficient decision analysis tools. Organizations have access to a significant amount of data on demand, supply, market segments, channel prices, competitive prices, and so on, but are not equipped with the decision analysis tools necessary to conduct rigorous pricing optimization that continually adjusts prices to respond to changing market conditions. Many tools currently used dont help managers price smarter. A survey conducted by the Professional Pricing Society that included 250 respondents consisting of price analysts, marketing personnel, and top management personnel, reveals that more than half of these pricers still use spreadsheets, while 28% rely on ERP -based software or custom inhouse solutions. These tools are not rigorous or intelligent enough to incorporate and analyze the wealth of information that goes into determining an optimal price. For instance, spreadsheets do not reflect changes in market conditions, product elasticities, supply and demand factors, or channel issues. Only advanced statistical and mathematical models are suited to perform pricing optimization. Pricing professionals equipped with the right optimization analytic tools can price smarter and faster. Yet only 9% of survey respondents reported using new price optimization and revenue management technology. ? Price leaks. Pricing often hides differences in the cost of serving customers, which does not reflect the true revenue a company actually pockets. The final price of a good is usually not the price for which a company originally thought it was selling the good. For each transaction that a company makes, it rarely considers the volume purchasing incentives, prompt payment discounts, and other promotional terms extended to customers, all of which affect the final price of the transactionand the final income pocketed. Most companies only monitor and report on average prices and end up losing out on pricing opportunities, leaking revenue transaction by transaction. More control is needed to plug this revenue leak by tracking and analyzing all deals and contracts, their discounts, promotions, and other costs that affect price. ? Multiple stakeholders contribute to disjointed decision-making; no one owns the pricing process. Multiple constituentsfinance, marketing, and salesare involved in price planning, and each has its own interests and goals in mind. Finance owns the payment terms and must meet certain financial objectives. Marketing owns promotions and rebates, and manages the product portfolio while determining the overall marketing strategy. Other management executives may have market share goals in mind or supply and demand considerations they want to factor in. Each functional team plays a role in determining price; each is armed with valuable information that should be combined to inform the overall price creation process. Todays organizations, however, are limited by the lack of tools to support a systematic and standardized process and hence suffer from disjointed decision-making. Current processes are not rigorous enough to incorporate and account for all the pricing perspectives from various stakeholders. The result is that stakeholders often resort to ad hoc pricing practices because they have a difficult time combining their expertise to contribute to and improve upon pricing decisions.

Pricing optimization is analogous to the supply chain management market back in the early 1990s. Companies understood that supply chain inefficiencies plagued their operations. The challenge at that time was figuring out who owned the problem since so many constituents touched supply chain processes. ? Processes and consensus are lengthy and inefficient. Automating the pricing process gives the pricing professional the ability to leverage new tools, but more importantly, it can significantly increase the efficiency of creating price plans, a laborious and time-consuming process. Since price creation is such a lengthy exercise, pricing updates are not performed frequently. The majority of pricers price on a yearly basis. As the frequency of price changes increases and pricing cycles become more and more compressed, turning into quarterly or even weekly events in response to market conditions, companies will need systems that lend more control and efficiency to current processes. Execution: ? Lack of administrative control over prices and pricing policies. Without the tools to support price execution, companies are unable to manage prices on a daily basis. Often, prices are inaccurately reflected on invoices. ? Difficulty of making price changes in static ERP systems. Typically, the price execution systems in place today are ERP systems, which tend to be rigid and inflexible for price management purposes. Once the pricing model is set, it is very difficult and tedious to change prices. IT would have to be called in to make the changes since pricing professionals lack the tools and administrative control to do so themselves. ? Current pricing tools are not integrated with other systems. Homegrown solutions typically cannot access relevant data from enterprise applications and databases. Since current pricing tools are not linked to other systems, they cannot readily leverage the information a company has. Price setting, distribution, and analysis become isolated functions of their own. ? Inadequate deal and contract control. Sales teams and other stakeholders need better tools for deal negotiation. Analysis: ? Inability to monitor performance of and improve upon price policies and plans. Analysis is a critical part of price management success; without it, companies have no way to measure the performance of pricing strategies and how well they were executed. One-off approaches like spreadsheets may be great for reporting but do not provide the ongoing analytics that can intelligently reflect all the various components of pricing; nor are they capable of identifying areas for improvement to setting prices and policies. Case Study:DistributorCo

Background An industrial distributor with a large product portfolio needed to better manage its price setting and delivery across its decentralized operations. The company dealt with over 175,000 products in its product catalog and around 100,000 quotes per day. It needed to manage tens of thousands of SKUs, thousands of customer types, and thousands of supplier types. Adding to the complexity were the numerous sales channels that pricing strategies had to reach, including various branches, telesales, Web site sales, and direct sales.

Challenges The company experienced significant pricing pain points across all three areas of planning, execution, and analysis: Planning: ? Simplified pricing: Was practicing cost-plus pricing and often resorted to gut pricing. ? Lengthy processes: Price changes took over a month; quotes took over a week to turn around, resulting in lost customer opportunities. ? Inability to align corporate-wide and division-level goals. Execution:

Unable to track combinations of product, channel, contract, manufacturer promotion, rebate, and so forth (for both corporate and division levels). ? Many price programs were not implemented due to complexity; inability to execute centralized pricing strategy across channels. ? No visibility into price variables at deal and transaction time. Analysis: ? No process for collecting and managing data for insight. Solution ? Optimized prices for price lists: factored in costs, availability, competition, price sensitivity, and demand (evaluated forecast of future demand for each channel-segment combination). ? Set strategic objectives for both corporate and divisions. ? Modeled pricing structures to maintain corporate and local pricing rules. ? Distributed and delivered optimized prices and all elements of terms, freight, and so forth, to sales team, as well as accurate buy lists or job quote invoices that use data directly from the negotiating system. ? Tracked compliance to meet comps, cash and volume discounts, rebates, and so forth. ? Measured expected profit and volume impact of override prices and exceptions. ? Recalibrated pricing model as the conditions changed. ? Developed performance measures that are real-time and consistent. ? Evaluated sales performance against individual, division, and corporate-wide goals. Benefits DistributorCo increased profits 25% by increasing net price just 1%. This does not even include the pricing execution benefits. Other tangible benefits include: ? Reducing the number of people involved in the pricing process. ? Cutting the pricing process time from weeks to hours. ? Adjusting pricing continuously versus once per quarter. ? Informing negotiations with view into pricing structure; enabling quicker turnaround time for deals. ? Eliminating incorrect invoicing. Finding the Right Solution for End-to-End Price Management Pricing as a Closed-Loop Process: Pricing as a complete domain spans price planning (optimizing and setting prices), to price execution (policy and structure administration), to price analysis (proactive reporting and performance monitoring). Price management drives greater value as a closed-loop, integrated set of processes that are closely aligned. The goal is to create the right set of processes so that integrating all the data relevant for price setting, recording all the information on how deals or price calculations were made, and capturing all the information needed for analysis become standard operating procedures. By putting the proper tools in the hands of pricers, sales teams, and executives, companies can make it easier for stakeholders to do the right thing and make more informed decisions. Maverick selling and obsolete pricing techniques can be addressed if price processes are automated and control is placed in the hands of the right people. Exhibit 3 lays out an example of an end-to-end pricing process that is comprehensive enough to be considered as complete price management. Yet companies today cannot follow through on all these steps unless they are given the tools to automate each process. A rigorous and well-defined system for managing price creation, application, and distribution is critical for meeting todays pricing challenges and resolving the shortcomings of current pricing techniques. Exhibit 4 illustrates the three functional business process areas companies should look for when considering a price management and optimization solution.

Exhibit 3. Example of an End-to-End Pricing Process Source: the Yankee Group, 2002

Price Planning How do companies begin to create the best set of prices for their products with the wide array of data available to them? Along with the myriad of in-house tools and formulas in place today, how do companies reconcile these approaches with newer optimization techniques to figure out what works best for them? The way to think about price optimization is to sort through the complexities of pricing and determine what variables affect your business. The ultimate objective of price planning is to take all the variables associated with complex price creation to generate and set optimal prices and promotions for each product, market segment, and channel. What components, then, should be considered in a price-planning package of your price management system? Price Optimization and Creation In order to optimize prices, price-planning solutions should be able to address the price complexity challenge by gathering information that resides in multiple systems and formats and incorporating the relevant data inputs that affect an individual business. Not only is the information located in disparate systems; these variables are tied to many functions of a business. Companies must remember that price optimization is not a black box, nor is it an isolated process; so new technologies should involve all relevant stakeholders across the enterprise. Pricing solutions should be able to provide scenario-planning capabilities, allowing pricers to examine what-if scenarios for events such as competitor price moves or NPIs. Solutions should also be able to use the results of each transaction to update forecasts (of demand, product lifecycle impacts, etc.) and price-sensitivity parameters so as to ensure that recommendations are not outdated. The key types of price optimization solutions are: ? Supply Cognizant Pricing OptimizationRecognizes supply factors and extend them to deal and transaction levels (e.g., capacity, inventory, cost of service). ? Life Cycle Pricing OptimizationOptimizes pricing across product life cycles and manages product transitions. ? Market/Demand Pricing OptimizationConsiders demand forecasts, price and crosselasticities, and customer and market segmentations; and channel interactions. ? Solution/Configuration Pricing OptimizationOptimizes pricing for a product configuration or a product and service bundle/solution. All of these solution types should likewise be able to optimize for corporate goalsmarket share, margins, revenue, profit, and so on (e.g., by projecting units, revenue margin, and market share from price plans). Exhibit 4. Pricing as a Closed-Loop Process Drives Greater Value Source: the Yankee Group, 2002 Policy Setting and Management Policy management aims to set, manage, and distribute price policies and structures. Policy setting requires a company to define its pricing structure and turn strategy into policies that can be implemented. Companies need to develop models for segmenting and analyzing products, channels, geographic data, and other inputs that affect the definition of policies. As for managing and distributing policies, companies need policy management tools for unifying cross-functional pricing methodology, inputs, and approvals from various constituents. Many companies have manual, centralized pricing and price policy approval processes that are lengthy and inefficient, or they have decentralized processes that are very difficult to coordinate. Policy

management sets up and manages policies so that they are reviewed by and distributed to the right individuals. Transaction Execution The primary objective of transaction execution is to manage the price charged for each optimized transaction. Companies require a way to supervise prices on a day-to-day basis so as to ensure that the right price is being deployed for each transaction. Many sales reps freely charge customers at their discretion and may sell goods below cost without even knowing it. Companies also need a better way to automate the input of negotiated prices so that invoices are accurate and consistent with price plans and policies. As for price distribution, transaction execution systems allow companies to rapidly distribute prices so that businesses can capture short -term market opportunities they otherwise may lose out on because of slow reaction time. Deal Management and Execution Deal management automates the dynamic execution of optimized deals for each opportunity. It defines and creates customer price agreements, supporting the negotiation and set-up of customer specific pricing. Deal management and execution tools also manage sales discretion, defining limits for individual constituents.

Price Analysis Analytics is critical for understanding whether price strategies are successful and where there are areas in planning and execution that can be improved. Price analysis solutions track and analyze price and policy results for continuous performance improvement and refinement. They include the following capabilities: ? Performance analysis and reporting. Evaluates and measures price and policy decisions, sales performance, and goal achievement. Enables reconciliation (i.e., reports on rationale to support consensus for pricing decisions). ? Recalibrates and self-tunes pricing model. Solutions should have the ability to recalibrate the pricing model as conditions change through a closed-loop process (e.g., refreshing parameters by updating elasticities as new data arrives and adapting to market shocks and demand volatility). ? Identifies pricing opportunities (e.g., through alerts). Analytics can also be used to help companies become more responsive to market opportunities, identifying opportunities to leverage pricing strategies. With the right analytics, companies can build intelligence into supplier response by tracking history and applying that intelligence to future negotiations. The integrated price management solution will enable companies to collect more information for analysis, which allows for continuous improvements in pricing and policies, enhancing profitability over time. The primary benefit of adding analysis to price management is that it enables an enterprise to move beyond the one-time benefit they may accrue from doing manual reporting and analysis to assess areas for improvement. The simple fact is that if these pricing reports are done manually, they will n be done frequently enough to ensure the maximum benefit to the ot enterprise. Competitive Landscape: Assessing Vendors Supply-Cognizant vs. Consumer-Cognizant Companies shopping for new advanced price management technology need to consider the business problem they are trying to solve. Pricing optimization technology weighs factors depending on the type of data relevant to the company (e.g., a retailer considers seasonality while a manufacturer considers capacity constraints). There are two camps of software providers today: those that target enterprises, and those that serve retailers. They take two basic approaches to price optimization: ? Supply-Cognizant. A view of supply constraints is the focus for many companies upstream in the supply chain. It is now possible to optimize selling processes for companies that deal with highly complex goods. Pricing can now take into account realtime constraint -based information about: product capacity, inventory or component

availability, configuration and s ubstitution possibilities, and the market life cycle of a product. Supply-cognizant optimization leverages data from existing ERP, SCM, and CRM systems, and factors in supply constraints to dynamically execute optimized pricing strategies and RFP responses. ? Consumer-Cognizant. A view of final end-user demand is the focus for companies at the end of the value chain, namely retailers. This category is often referred to as retail pricing optimization, designed to help retail chains optimize pricing, promotion, product assortment, and shelf-level placement strategies at stores. The demand response crafted by retailers incorporates factors unique to their operational needs such as seasonality and weather-related drivers, price image, and markdown life cycle. The pricing-optimization algorithms used in this environment often employ historical data, not constraint data. The supply-cognizant side does not necessarily just serve manufacturers but rather enterprises in general, which have different pain points than do retailers with an end-consumer point of view. This does not imply that supply-cognizant software fails to incorporate market or customer data, but rather that retail pricing optimization places more of an emphasis on consumer data. This also does not imply that supply-cognizant pricing is the primary pricing challenge software providers in this segment are tackling. Enterprise customers have a wide variety of pricing needs from dynamic pricing to solution/configuration pricing, depending on the vertical orientation and unique needs of a company. Exhibit 5. Key Variables for Optimal Price Creation Source: the Yankee Group, 2002 Implementation Strategies The three key price-management process areasplanning, execution, and analysisprovide a complete solution. However, price management must not always begin with planning; nor must it end with analysis. Many companies may want to start with execution because they want to get their price policies and structures in order before modeling prices and running optimization algorithms. Optimization is useless if it is a black box of algorithms that spits out an optimal set of prices without consideration of current price policies (e.g., promotions, discounts). There are some key success factors to keep in mind, however, once companies do invest the time and resources in implementing a pricing system: ? Create critical sponsorship. Companies must begin by asking: What level of sponsorship is sufficient to drive price management projects? Critical sponsorship from both the top level and lower levels of management is necessary for success. Because price management initiatives are so strategic, senior management must establish the vision and direction for a companys price process restructuring, not only lending their support but also their active involvement. At the same time, buy -in from other managers at lower levels is critical because they are the ones who execute on the new pricing practices. ? Approach as strategic driver, not IT issue. The fact that a company is employing a technology to help automate the pricing process should not relegate price management as an IT issue. Companies cannot view price management as simply an IT upgrade. Price management will become ever more strategic as CEOs and boards of directors are increasingly looking at CIOs to deliver a rapid, concrete return on technology investments. The potential strategic impact is clear and evident when a company can boost its stock price and shareholder value by increasing operating income or converting sales increases to stock price basis points. Such top-line impact will further elevate pricing beyond its traditional lowly marketing mix status to establish price management as a powerful profit lever. ? Devise a realistic, concrete plan. An actionable plan or road map that details how the new price management technology needs to develop should be handed down to the end user. Adoption will be accelerated if a concise plan with measurable objectives for each deployment stage is communicated along with appropriate training for both IT and the business user. The software vendor should play a key part in the restructuring by driving

both cultural and process change. Since price management restructuring affects functional business units across the organization, it is important for the software vendor to assist in developing a plan for how the technology will work for different people and get everyone involved. Provide a user-friendly toolset. It is particularly challenging to achieve acceptance of new tools unless they are both easy to use and can handle the complexity needed. Most existing systems are neither. It is important for business users to easily comprehend the language the toolset employs, and that it be flexible enough for them to want to use the system. Push to collect and develop accurate data. Success begins and ends with good data. End users must recognize that pricing optimization is only as good as the data inputted. Gathering and cleaning up data is crucial for realizing the success of optimization systems as data inconsistencies are bound to occur. The reality is that information is being gathered from disparate systems, and frequent changes in cost and competition information, promotional information, and complex trading relationship information are being managed. As a result, scientific rigor is needed. As end users pilot implementations, they need to integrate existing systems with the new pricing tools and ensure accurate data feeds are done continuously. By understanding the complete data picture, companies can better trust their price optimization engines and get a better understanding of demand while increasing their responsiveness to market changes. Clean data plays a critical role in the reliability of pricing system output, and this becomes quickly apparent in the beginning stages of any price management implementation.

Das könnte Ihnen auch gefallen

- Mortgage Lending: Product & Pricing Engines - Strategic Uses For Compliance, Competitiveness & ProfitDokument7 SeitenMortgage Lending: Product & Pricing Engines - Strategic Uses For Compliance, Competitiveness & ProfitAndrew ArmstrongNoch keine Bewertungen

- Dell Notes StrategyDokument3 SeitenDell Notes Strategyjack stoNoch keine Bewertungen

- Hard Discounters & Soft Discounters OverviewDokument7 SeitenHard Discounters & Soft Discounters OverviewAaron Chio100% (1)

- Model BussinesDokument8 SeitenModel BussinesGabriela BarbozaNoch keine Bewertungen

- EconomicsDokument348 SeitenEconomicsSrv Solitario BiswasNoch keine Bewertungen

- Strategy and InternetDokument6 SeitenStrategy and Internetlilywhite786Noch keine Bewertungen

- 11 Hotel Digital Marketing StrategiesDokument5 Seiten11 Hotel Digital Marketing StrategiesReservations A5HotelNoch keine Bewertungen

- Marketing Strategy: The Case of BarcoDokument5 SeitenMarketing Strategy: The Case of BarcoParvinder KumarNoch keine Bewertungen

- BookingDokument30 SeitenBookingstephen simangunsongNoch keine Bewertungen

- EY Retail Operations - Six Success Factors For A Tough MarketDokument16 SeitenEY Retail Operations - Six Success Factors For A Tough MarketKomal PriyaNoch keine Bewertungen

- Developing Business ModelDokument31 SeitenDeveloping Business ModelCheska LimsonNoch keine Bewertungen

- 1.5.2 Strategy As Position: Why Strategy Execution FailsDokument12 Seiten1.5.2 Strategy As Position: Why Strategy Execution Failsmpweb20Noch keine Bewertungen

- 10 Business Models For This DecadeDokument83 Seiten10 Business Models For This DecadeDewita SoeharjonoNoch keine Bewertungen

- Advertisement and SalesDokument20 SeitenAdvertisement and Salessayyed munirNoch keine Bewertungen

- Introduction To Performance AppraisalDokument20 SeitenIntroduction To Performance AppraisalKimberley Allison Fernandez100% (3)

- Group5 - Neimen Marcus Case - Quest For The Best - Death of EleganceDokument8 SeitenGroup5 - Neimen Marcus Case - Quest For The Best - Death of EleganceambujsinhaNoch keine Bewertungen

- Financial Leasing: Leasing Is A Significant Industry. in The Year 2004, It Accounted For OverDokument41 SeitenFinancial Leasing: Leasing Is A Significant Industry. in The Year 2004, It Accounted For OverSouliman MuhammadNoch keine Bewertungen

- Lecture 22Dokument14 SeitenLecture 22lc_surjeetNoch keine Bewertungen

- Pricing Strategy: Models of Pricing Absorption PricingDokument28 SeitenPricing Strategy: Models of Pricing Absorption PricingNarsingh Das AgarwalNoch keine Bewertungen

- My StockmannDokument27 SeitenMy StockmannCollaborative and Industrial design Master programmeNoch keine Bewertungen

- Retail CompendiumDokument10 SeitenRetail CompendiumRahul Garg100% (1)

- Customer Experience Checklist PDFDokument1 SeiteCustomer Experience Checklist PDFGhassan QutobNoch keine Bewertungen

- Final PPT TMDokument61 SeitenFinal PPT TMAditya Roy Munka100% (1)

- Director Manager Merchandising Supermarket in NYC Resume Bobbie MalatestaDokument2 SeitenDirector Manager Merchandising Supermarket in NYC Resume Bobbie MalatestaBobbieMalatestaNoch keine Bewertungen

- List of Case Studies On Strategy (Catalogue IV)Dokument53 SeitenList of Case Studies On Strategy (Catalogue IV)Sushil Agrawal0% (1)

- Trader Joe's Case StudyDokument4 SeitenTrader Joe's Case Studyjanelle100% (1)

- Corporate - Level StrategiesDokument27 SeitenCorporate - Level Strategiescoolth2Noch keine Bewertungen

- ManagementDokument12 SeitenManagementaakanksha_rinni0% (1)

- Chefs Choice Knife Sharpener and Your Kitchen KnifeDokument10 SeitenChefs Choice Knife Sharpener and Your Kitchen KnifeJoe HitchNoch keine Bewertungen

- Pricing Decisions Policies & PracticesDokument7 SeitenPricing Decisions Policies & PracticesHarty Robert0% (1)

- ShuptiDokument2 SeitenShuptiMd Borhan Uddin 2035097660Noch keine Bewertungen

- Audit Committee Attributes andDokument14 SeitenAudit Committee Attributes andnurul hanifah nathasyaNoch keine Bewertungen

- Business Week Magazine July 03.2006 Economist Joseph Stiglitz Makes The Case Against Unfettered GlobalizationDokument82 SeitenBusiness Week Magazine July 03.2006 Economist Joseph Stiglitz Makes The Case Against Unfettered Globalizationrambo_style19Noch keine Bewertungen

- The Economics of Tourism Chapter 4Dokument17 SeitenThe Economics of Tourism Chapter 4Roy CabarlesNoch keine Bewertungen

- Summary Good To GreatDokument5 SeitenSummary Good To GreatAziz ur RehmanNoch keine Bewertungen

- Bus251 Case Study 2Dokument4 SeitenBus251 Case Study 2Md Tanzeelul Hoque Meraj 1831671630Noch keine Bewertungen

- The Case For A Planogramming Pilot ProjectDokument40 SeitenThe Case For A Planogramming Pilot Projectmayank_astroNoch keine Bewertungen

- Leasing FurnitureDokument30 SeitenLeasing FurnitureMaria Alejandra AminNoch keine Bewertungen

- HRM: Performance Related PayDokument12 SeitenHRM: Performance Related Payseowsheng100% (6)

- The Hour GlassDokument1 SeiteThe Hour GlassTip TaptwoNoch keine Bewertungen

- The Execution Premium SummaryDokument7 SeitenThe Execution Premium SummaryRitfan Wisesa100% (1)

- Retail Loyalty Programs Ebook ComarchDokument16 SeitenRetail Loyalty Programs Ebook ComarchGreat Idea Business Solutions CorporationNoch keine Bewertungen

- Report On Relex SupermarketDokument44 SeitenReport On Relex SupermarketDeepesh PathakNoch keine Bewertungen

- Are You Sure You Have A StrategyDokument9 SeitenAre You Sure You Have A Strategysaurabh_kumbhareNoch keine Bewertungen

- 5 Life Lessons From CEOsDokument5 Seiten5 Life Lessons From CEOsKarishma KoulNoch keine Bewertungen

- AdRoll Case Study - GymsharkDokument1 SeiteAdRoll Case Study - GymsharkRandy Uriel MéndezNoch keine Bewertungen

- Organisational Buying Behaviour HBRDokument7 SeitenOrganisational Buying Behaviour HBRGracelin PrathabanNoch keine Bewertungen

- Marketing StrategyDokument12 SeitenMarketing Strategybadri_1220009218100% (3)

- Zero To One - Peter Thiel - Book SummaryDokument46 SeitenZero To One - Peter Thiel - Book Summaryraj RajNoch keine Bewertungen

- BaumolDokument9 SeitenBaumolJoshua Capa FrondaNoch keine Bewertungen

- Digital StrategyDokument4 SeitenDigital StrategyPETERNoch keine Bewertungen

- Dynamic PricingDokument9 SeitenDynamic PricingkoolboyankitNoch keine Bewertungen

- How To Create A Sales Plan - Template + ExamplesDokument26 SeitenHow To Create A Sales Plan - Template + ExamplesLuNoch keine Bewertungen

- Small Business EnterprisesDokument3 SeitenSmall Business EnterprisesAnilkumar GopalanNoch keine Bewertungen

- Successful EntrepreneureDokument16 SeitenSuccessful EntrepreneureBhushan BariNoch keine Bewertungen

- Account Planning ChecklistDokument1 SeiteAccount Planning ChecklistGhassan QutobNoch keine Bewertungen

- Strategic MGMT NotesDokument48 SeitenStrategic MGMT NotesjtpmlNoch keine Bewertungen

- Business Model DesignDokument20 SeitenBusiness Model DesignBashar Shagari UmarNoch keine Bewertungen

- Literature ReviewDokument9 SeitenLiterature ReviewRaheema Abdul Gafoor100% (1)

- Why Management History MattersDokument4 SeitenWhy Management History MattersPablo Perez VilarNoch keine Bewertungen

- Kellogg's Initial Marketing Mix-4PDokument3 SeitenKellogg's Initial Marketing Mix-4PswatiNoch keine Bewertungen

- (2022년 예상) 애월고등학교 (제주 제주시) 1-2 중간 영어Dokument19 Seiten(2022년 예상) 애월고등학교 (제주 제주시) 1-2 중간 영어Charile JangNoch keine Bewertungen

- What Value Does: Group 2 Group 2 Group 2 Group 2Dokument6 SeitenWhat Value Does: Group 2 Group 2 Group 2 Group 2DI NGUYỄN NGỌC TÂMNoch keine Bewertungen

- Industry Insights The D2C Brands Guide To Fashion WholesaleDokument15 SeitenIndustry Insights The D2C Brands Guide To Fashion WholesaleLalithusfNoch keine Bewertungen

- Determinants of Online Shopping Intention PDFDokument6 SeitenDeterminants of Online Shopping Intention PDFtarekmn1Noch keine Bewertungen

- 09 - Chapter 2-5 PDFDokument34 Seiten09 - Chapter 2-5 PDFMiko100% (2)

- Channel Distribution Ultratech 2019Dokument14 SeitenChannel Distribution Ultratech 2019MohmmedKhayyumNoch keine Bewertungen

- BIRA DistributionDokument2 SeitenBIRA Distributionsoopreo50% (2)

- Marketing An Introduction Assignment 1 (02000539)Dokument22 SeitenMarketing An Introduction Assignment 1 (02000539)Aarkash Kannangara0% (1)

- Rotenberg, The Metropolis and Everyday LifeDokument9 SeitenRotenberg, The Metropolis and Everyday LifeAngie Tatiana Camelo BautistaNoch keine Bewertungen

- Simply You Living - Autumn 2016Dokument196 SeitenSimply You Living - Autumn 2016zmajcotajcoNoch keine Bewertungen

- Design GalleryDokument100 SeitenDesign GalleryAlexsandra Silva100% (1)

- Shopping VocabularyDokument2 SeitenShopping VocabularyEmily CalvoNoch keine Bewertungen

- CLB Obe Syl Prof SalesmanshipDokument7 SeitenCLB Obe Syl Prof SalesmanshipANNALENE OLITNoch keine Bewertungen

- JOJO Assessment - BSBPMG517Dokument39 SeitenJOJO Assessment - BSBPMG517Marina Khan100% (1)

- Banister &hogg, (2004) Negative Symbolic Consumption and Consumers - Drive For Self - EsteemDokument25 SeitenBanister &hogg, (2004) Negative Symbolic Consumption and Consumers - Drive For Self - EsteemLuiza ElenaNoch keine Bewertungen

- Business Mschem 2Dokument7 SeitenBusiness Mschem 2Okoth Ronald OumaNoch keine Bewertungen

- Research PaperDokument37 SeitenResearch PaperprasenjitjuprodNoch keine Bewertungen

- Sop ParsonsDokument2 SeitenSop ParsonsRicha Uppal67% (3)

- Coffee Value ChainDokument3 SeitenCoffee Value ChainFill Niu100% (1)

- Retail Marketing WriteupDokument5 SeitenRetail Marketing WriteupPrince PrinceNoch keine Bewertungen

- Marketing PlanDokument2 SeitenMarketing PlanDys MatiasNoch keine Bewertungen

- Cumberland Maryland Strategic Economic Development Plan - Executive SummaryDokument18 SeitenCumberland Maryland Strategic Economic Development Plan - Executive SummaryMarc Nelson Jr.Noch keine Bewertungen

- Lolo Tinongs Marketing ProgramDokument17 SeitenLolo Tinongs Marketing Programlikha piaoNoch keine Bewertungen

- E-Commerce Challenges, Solutions and Effectiveness Perspective BangladeshDokument9 SeitenE-Commerce Challenges, Solutions and Effectiveness Perspective BangladeshnaimenimNoch keine Bewertungen

- EyeQ PresentationDokument10 SeitenEyeQ PresentationPawni GoyalNoch keine Bewertungen

- Plans For The Family's Animal Raising Project: Learning Activity Sheet Tle 6 - AgricultureDokument5 SeitenPlans For The Family's Animal Raising Project: Learning Activity Sheet Tle 6 - AgricultureTwinkle Ferrancol Santos100% (2)

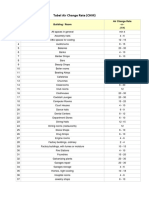

- Tabel Air Change RateDokument3 SeitenTabel Air Change Ratefaiz budiNoch keine Bewertungen